Introduction

Navigating the complexities of financial support after losing a spouse can feel overwhelming. We understand that understanding widow's payments is crucial during this challenging time. This vital assistance is designed to help you maintain financial stability, and it’s expected to benefit millions in the coming years.

However, the application process can be daunting. From determining eligibility to gathering the necessary documentation, it’s common to feel lost. How can you ensure you successfully navigate this intricate journey? You deserve the support you need during such a difficult time, and we’re here to help.

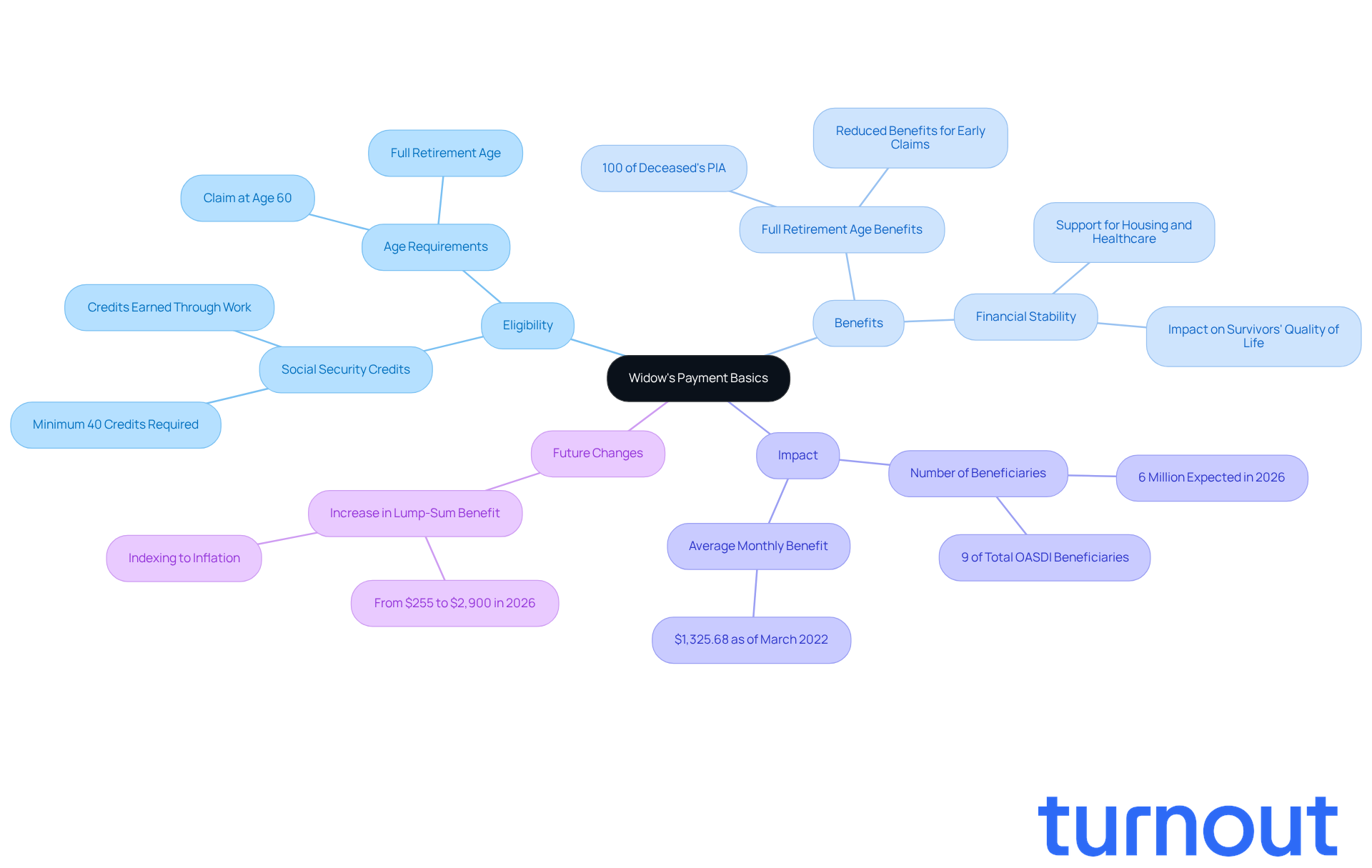

Understand Widow's Payment Basics

Widows payment, often referred to as survivor assistance, provides crucial financial support for surviving spouses of workers who were covered by Social Security. These widows payments are designed to help widows maintain financial stability after the loss of their partner. In 2026, around 6 million individuals are expected to receive this vital support, highlighting its significance during such a challenging time.

We understand that navigating this process can feel overwhelming. To be eligible for these benefits, individuals must have accumulated enough Social Security credits through their work history. Typically, a worker needs to earn a minimum of 40 credits, which is about 10 years of work. The amount of compensation varies based on the deceased's earnings history and the age at which the widow applies. For example, a widow can request assistance as early as age 60, but claiming before full retirement age may result in lower monthly payments.

Real-world examples show just how impactful survivor support can be on financial stability. Widows who apply for assistance at full retirement age receive 100% of the deceased worker's Primary Insurance Amount (PIA), which can significantly ease financial burdens. Financial advisors emphasize that these benefits are essential for widows, especially when it comes to managing costs like housing and healthcare, highlighting the importance of widows payment.

In 2026, there will be updates to survivor benefits, including an increase in the lump-sum death benefit from $255 to $2,900. This change reflects the rising costs associated with funerals and burials, aiming to provide more substantial assistance during a difficult time. We want to ensure that financial worries do not overshadow the grieving experience.

Understanding these basics is vital for effectively navigating the application process and securing the financial assistance you need during this challenging period. Remember, you are not alone in this journey; we're here to help.

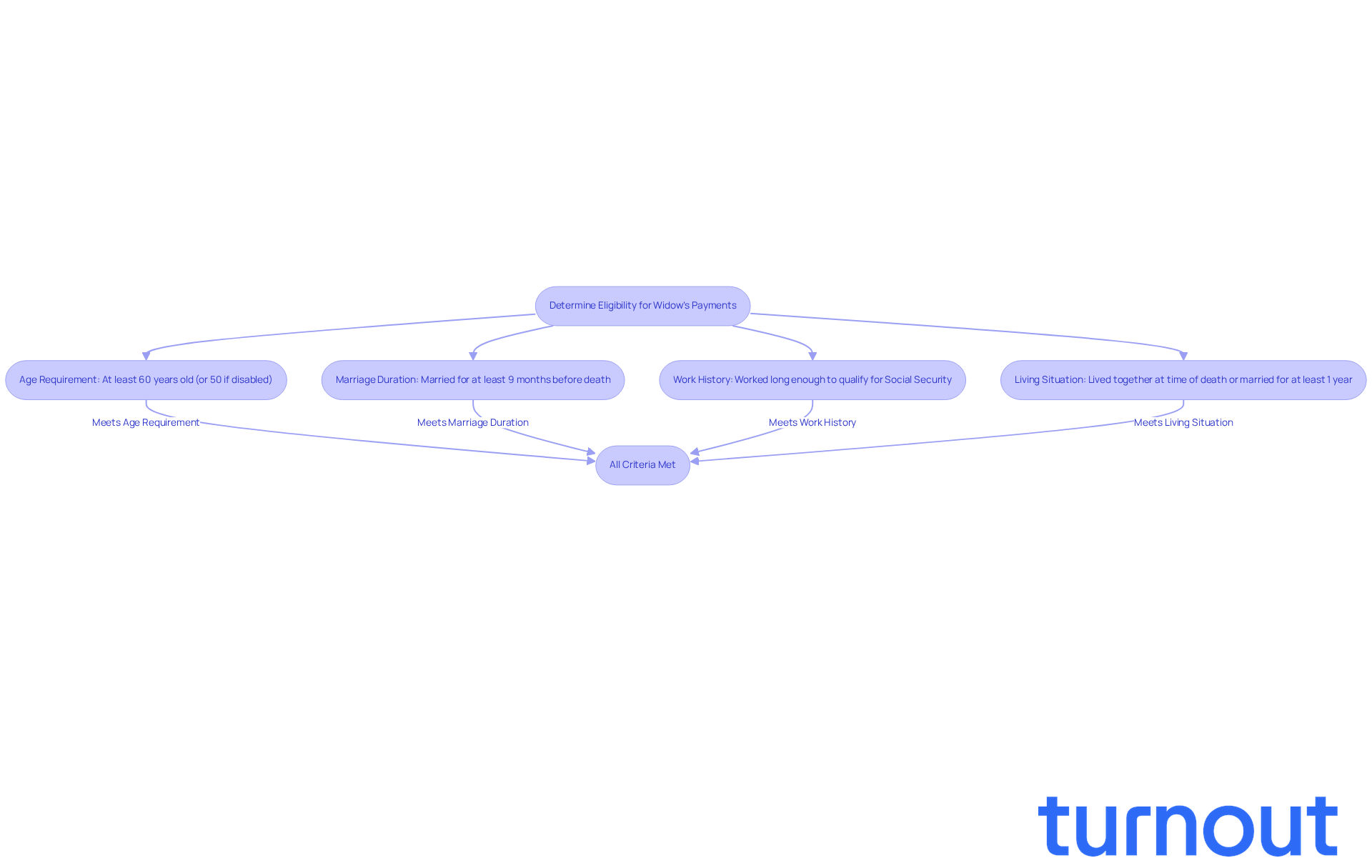

Determine Eligibility for Widow's Payments

To qualify for Widow's Payments, it's important to understand the specific criteria that can help you navigate this process:

- Age Requirement: You need to be at least 60 years old (or 50 if you are disabled).

- Marriage Duration: You must have been married to the individual who passed away for at least nine months before their death.

- The individual’s work history indicates they should have worked long enough to qualify for Social Security benefits.

- Living Situation: You should have been living with the deceased at the time of their death or have been married to them for at least a year if you weren’t living together.

We understand that this can be a challenging time, and verifying your eligibility can provide peace of mind as you move forward with your submission. Turnout is here to support you in navigating these procedures, ensuring you comprehend your rights and options without needing legal representation. Remember, Turnout offers assistance through trained nonlawyer advocates and IRS-licensed enrolled agents, and our services do not constitute legal advice. You are not alone in this journey; we’re here to help.

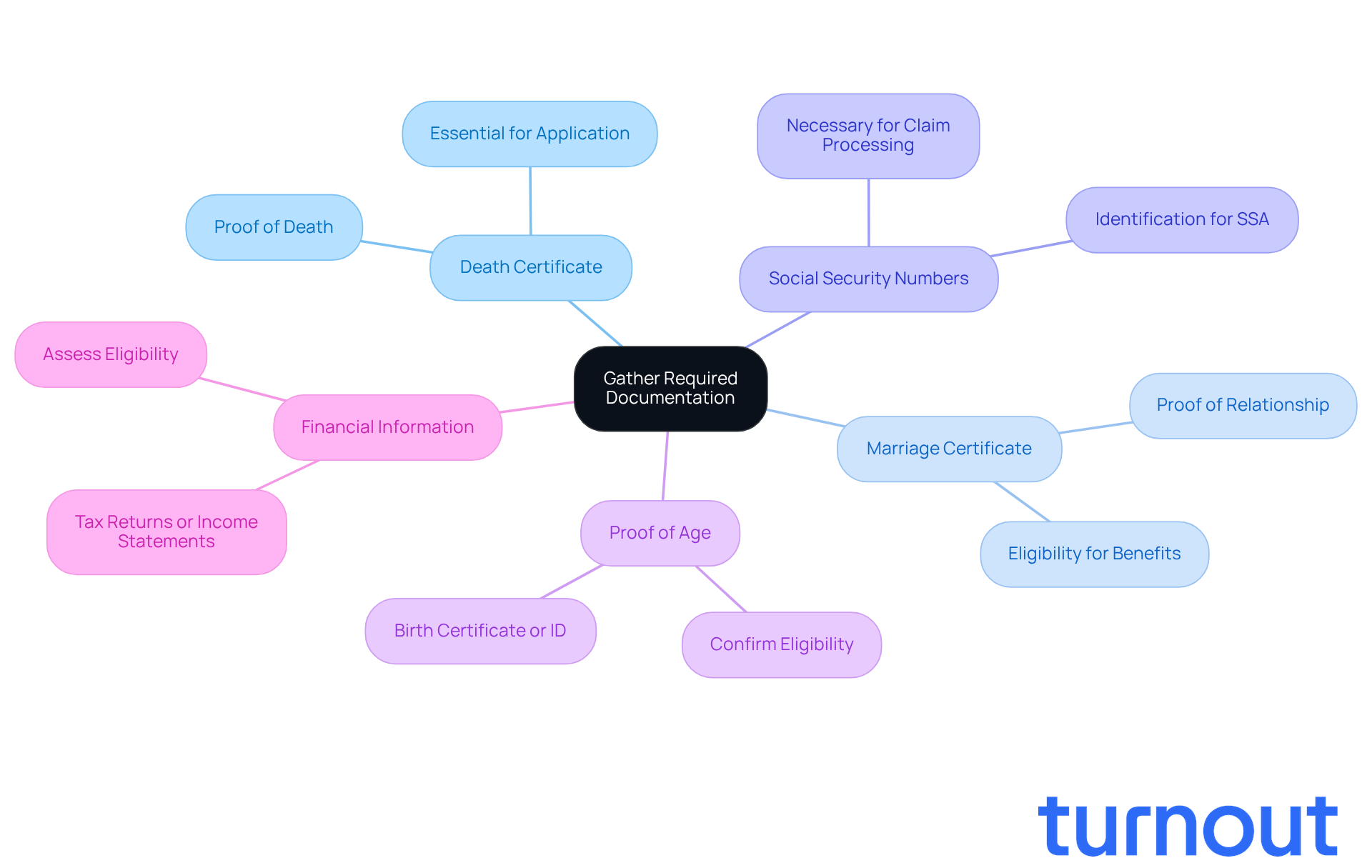

Gather Required Documentation

Before you apply for widows payment, it's important to have a few key documents ready. We understand that this can be a challenging time, and being prepared can help ease some of the stress.

-

Death Certificate: You'll need an original or certified copy of your spouse's death certificate. This document serves as the main proof of death and is essential for your application. Having it ready can really speed up the process, making it a crucial step.

-

Marriage Certificate: Proof of your marriage to the deceased is necessary to establish your eligibility for survivor benefits. This document is a vital part of your application.

-

Social Security Numbers: Don’t forget to include your Social Security number and that of your late spouse. This information is crucial for the Social Security Administration (SSA) to process your claim effectively.

-

Proof of Age: A birth certificate or another document that verifies your age is required to confirm your eligibility based on age criteria. This step is important to ensure everything is in order.

-

Financial Information: Gather any relevant financial documents that may be needed to assess your eligibility. This could include tax returns or other income statements.

It's common to feel overwhelmed by paperwork, but remember that incomplete or missing documents can lead to delays in your application. Advocates emphasize that submitting all required documents correctly is key to avoiding unnecessary complications and speeding up the approval of widows payment. As of August 2024, the average monthly survivor's benefit is $1,509. This highlights the importance of having your request in order to secure these vital funds. We're here to help you through this process, and you are not alone in this journey.

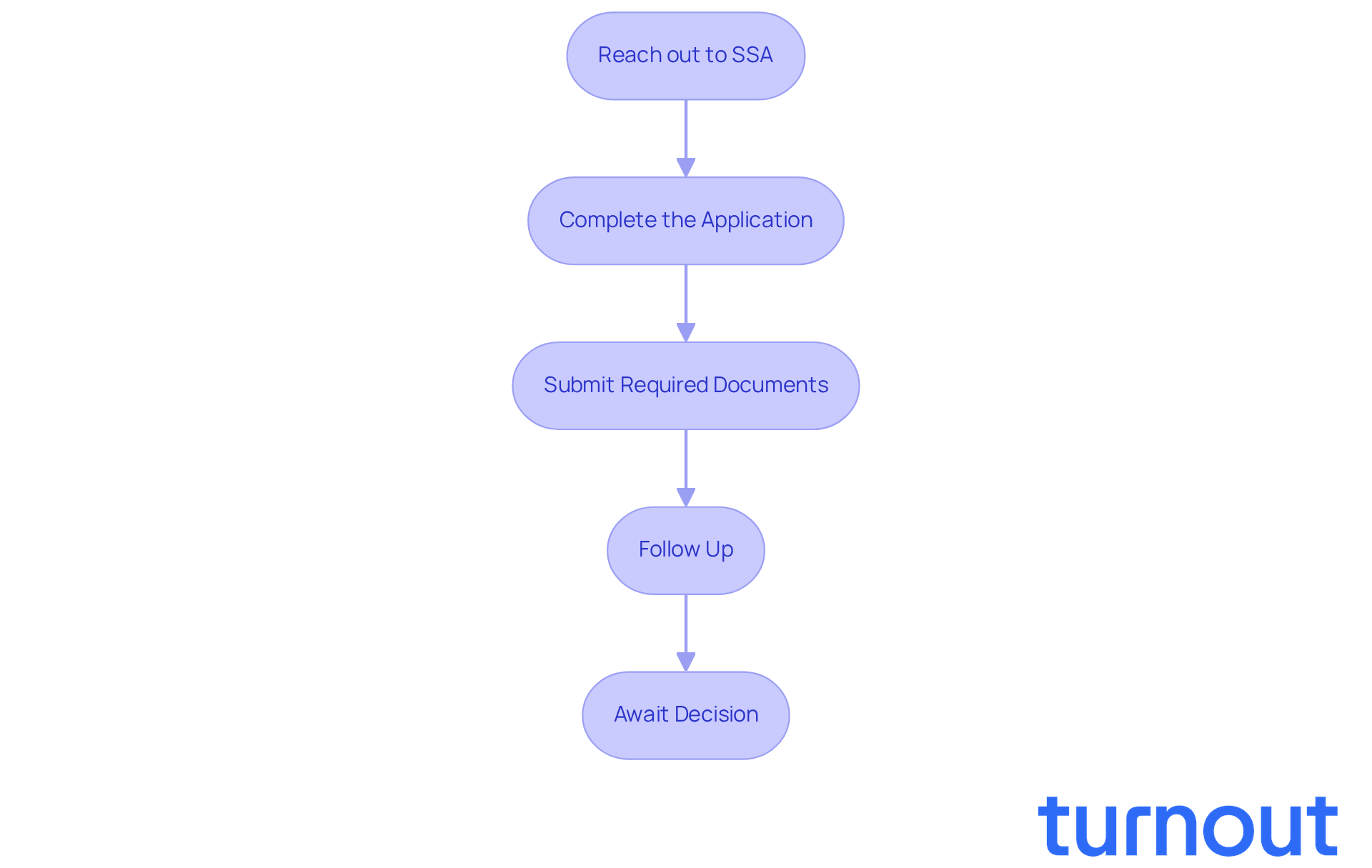

Follow the Application Process

Applying for widows payment can feel overwhelming, but we're here to help you through it. Follow these steps to ensure a smoother process:

-

Reach out to the Social Security Administration (SSA): Start by calling the SSA at 1-800-772-1213 or visiting your local SSA office. This is your first step toward enrollment, and the staff is ready to assist you.

-

Complete the Application: Fill out Form SSA-10, specifically designed for Widow's or Widower's Insurance Benefits. Make sure all information is accurate and matches your Social Security records. This attention to detail can help avoid delays.

-

Submit Required Documents: Gather and submit necessary documentation, including the deceased's Social Security number, marriage certificate, and death certificate. Having these documents ready can really streamline the process and ease your mind.

-

Follow Up: After submitting your request, it’s important to check in with the SSA regularly. This proactive approach can help ensure your case is being processed correctly and address any issues early on.

-

Await Decision: The SSA will review your submission and notify you of their decision. Be prepared to provide additional information if asked; this can help speed up the review.

We understand that recent changes in the submission process may affect how quickly requests are handled. For example, as of January 2025, the average monthly survivor benefit for non-disabled widows was $1,835.82, while disabled widows received an average of $951.26. Processing times for widows payment requests in 2026 are expected to be around 3 to 6 months. However, prompt follow-up can assist in ensuring a smoother experience.

As a Social Security official noted, "Maintaining your documentation in order and checking in frequently can greatly minimize delays in handling your request." Remember, you are not alone in this journey; we’re here to support you every step of the way.

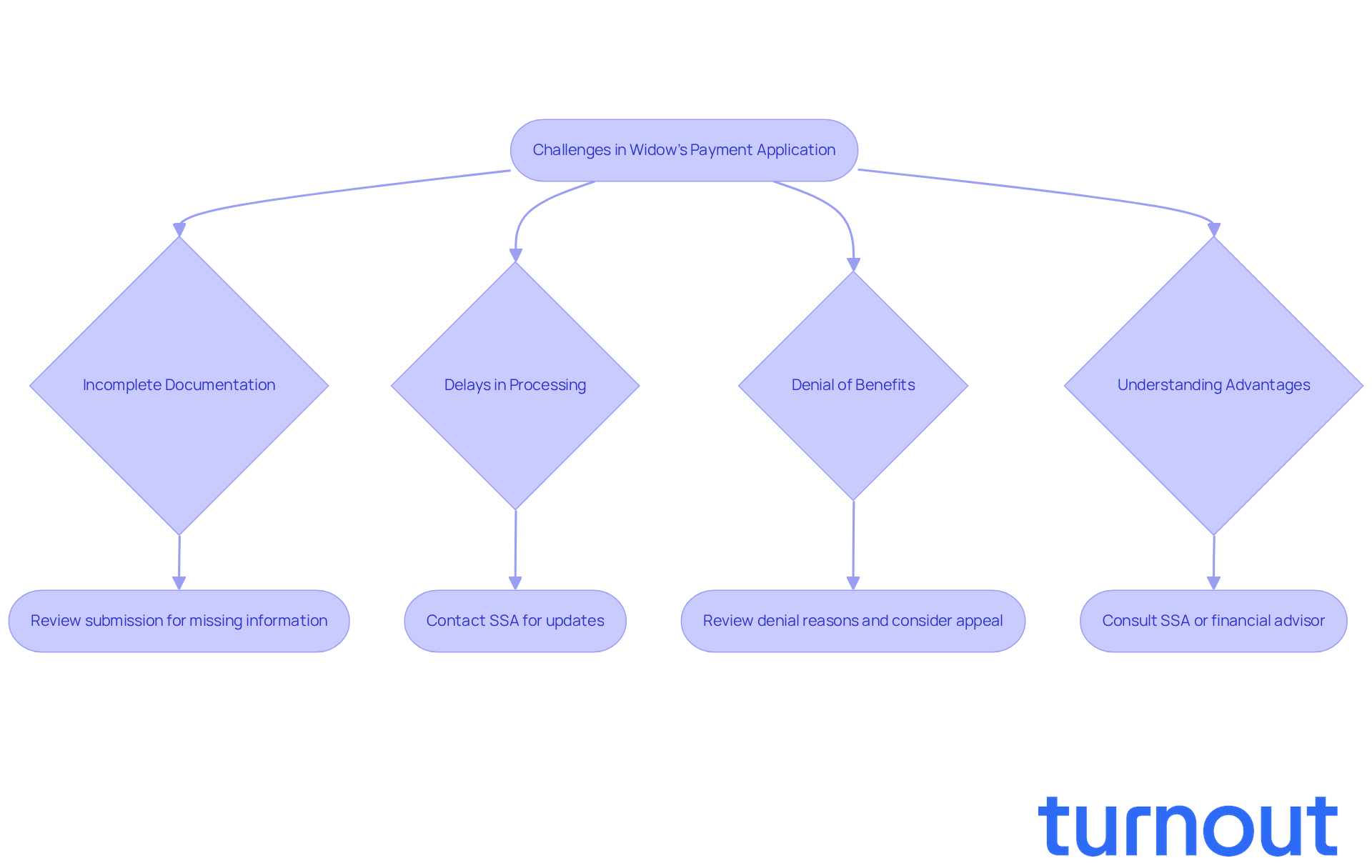

Navigate Common Challenges in the Application

Applying for widows payment can be a challenging journey, and we understand that you may feel overwhelmed. Here are some key issues you might encounter, along with strategies to help you navigate them:

-

Incomplete Documentation: It's crucial to ensure that all required documents are submitted. Take a moment to carefully review your submission for any missing information. Incomplete entries can lead to delays or denials. For example, if the deceased had children, you’ll need to provide details about each child, including their relationship to the deceased and any relevant dates.

-

Delays in Processing: If your request is taking longer than expected, don’t hesitate to reach out to the Social Security Administration (SSA) for updates. Delays often arise from missing information, so staying in touch can help speed up the process.

-

Denial of Benefits: If your request is denied, take the time to thoroughly review the reasons provided. Many applications are denied due to insufficient documentation or not meeting eligibility criteria. Consider appealing the decision regarding the widows payment, and remember, you’re not alone - seeking assistance from a qualified advocate or attorney can make a difference in navigating the appeals process.

-

Understanding Advantages: If you have questions about the amount you may receive or how allowances are calculated, consulting the SSA or a financial advisor can provide clarity. Understanding the nuances of your benefits is essential for making informed decisions.

By being proactive and informed, you can navigate these challenges more effectively. Remember, you deserve the support you need, and we’re here to help you every step of the way.

Conclusion

Navigating the complexities of Widow's Payment can feel overwhelming. We understand that this process is not just about paperwork; it’s about securing the financial support you need during a challenging time. This guide has illuminated the essential aspects of the application process, from eligibility requirements to necessary documentation, ensuring that you feel equipped to tackle this journey.

Key insights discussed include:

- The importance of age and marriage duration in determining eligibility.

- Gathering required documents, like death and marriage certificates, is crucial.

- We’ve outlined a step-by-step approach to submitting your application, making it easier for you to follow.

- It’s common to encounter challenges, such as incomplete documentation and processing delays, but addressing these can significantly improve your experience.

Ultimately, securing Widow's Payment is not just about financial assistance; it’s about restoring stability when you need it most. By understanding the process and being proactive, you can navigate this journey with confidence. Remember, you are not alone in this. Seek support when needed, and know that assistance is available to help ensure that financial concerns do not overshadow your healing process.

Frequently Asked Questions

What is widow's payment?

Widow's payment, also known as survivor assistance, provides financial support to surviving spouses of workers covered by Social Security, helping them maintain financial stability after the loss of their partner.

How many individuals are expected to receive widow's payments in 2026?

In 2026, around 6 million individuals are expected to receive widow's payments.

What are the eligibility requirements for widow's payments?

To qualify for widow's payments, you must be at least 60 years old (or 50 if disabled), have been married to the deceased for at least nine months, the deceased must have worked long enough to qualify for Social Security benefits, and you should have been living with the deceased at the time of their death or married for at least a year if not living together.

How many Social Security credits are needed to qualify for widow's payments?

Typically, a worker needs to earn a minimum of 40 Social Security credits, which is about 10 years of work.

When can a widow apply for assistance?

A widow can request assistance as early as age 60, but claiming before full retirement age may result in lower monthly payments.

What percentage of the deceased worker's Primary Insurance Amount (PIA) do widows receive if they apply at full retirement age?

Widows who apply for assistance at full retirement age receive 100% of the deceased worker's Primary Insurance Amount (PIA).

What changes to survivor benefits are expected in 2026?

In 2026, the lump-sum death benefit is expected to increase from $255 to $2,900 to reflect rising funeral and burial costs.

How can individuals get help with the application process for widow's payments?

Individuals can receive assistance from trained nonlawyer advocates and IRS-licensed enrolled agents through Turnout, which helps navigate the application process and understand rights and options.