Introduction

Navigating the complexities of income tax can often feel like traversing a maze. We understand that in a state with a progressive tax system like Virginia, this can be especially daunting. With rates ranging from 2% to 5.75% based on earnings, grasping the intricacies of Virginia's income tax is crucial for taxpayers who want to optimize their financial situation.

This guide is here to help you master the Virginia income tax payment process. We’ll walk you through essential forms, deadlines, convenient payment options, and even troubleshoot common issues. You’re not alone in this journey - many taxpayers share your concerns. How can you ensure you meet your obligations while minimizing stress and maximizing efficiency? Let’s explore this together.

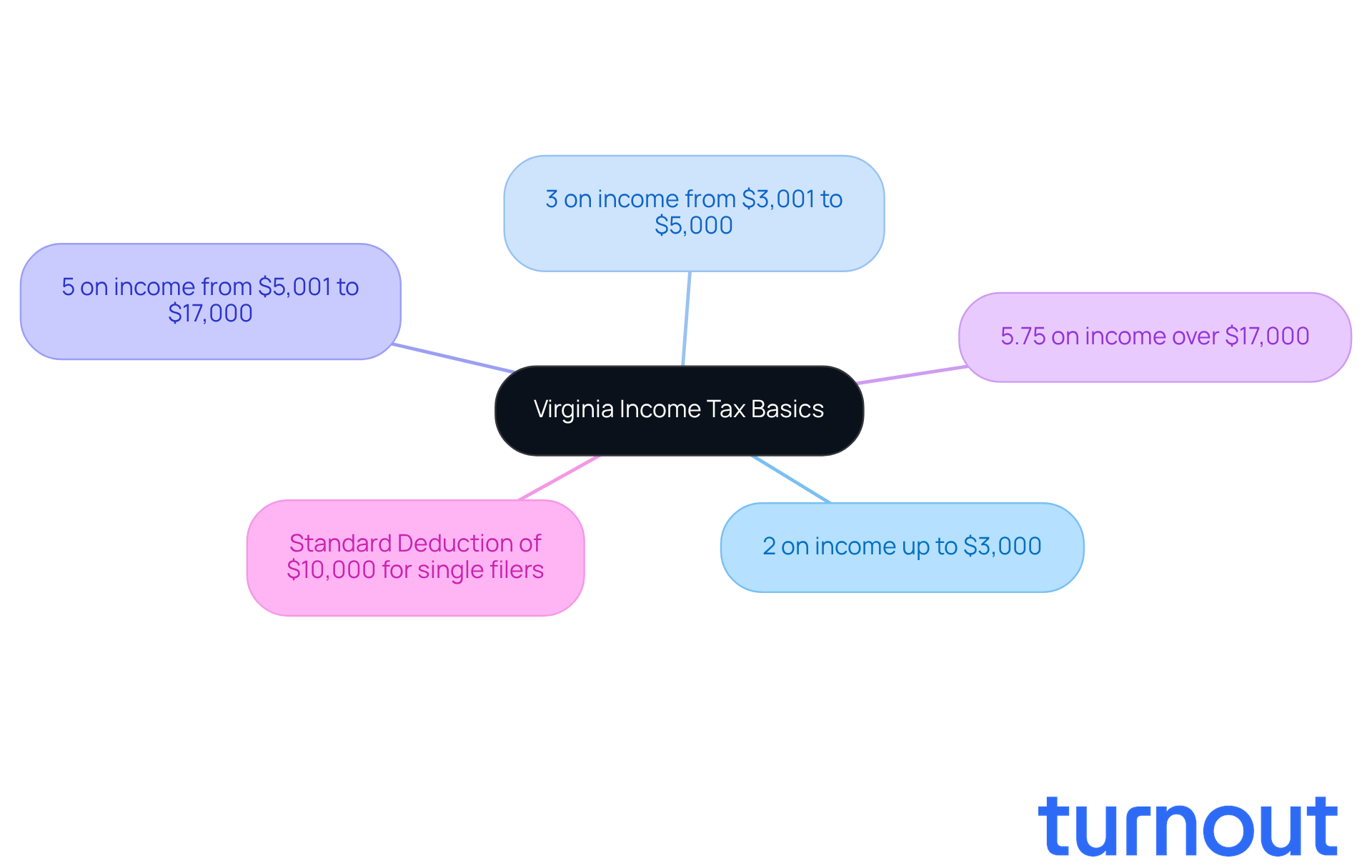

Understand Virginia Income Tax Basics

Navigating taxes can feel overwhelming, but understanding your state's progressive tax system can make a significant difference. The rates for Virginia income tax payment range from 2% to 5.75%, depending on your earnings. Here’s a quick look at the current tax brackets for 2026:

- 2% on income up to $3,000

- 3% on income from $3,001 to $5,000

- 5% on income from $5,001 to $17,000

- 5.75% on income over $17,000

In addition to these rates, Virginia offers a standard deduction of $10,000 for single filers starting in 2026. This deduction can significantly impact your overall tax liability, and we understand how important it is to be aware of these details.

Familiarity with these brackets and deductions is crucial for accurately calculating your Virginia income tax payment. It’s common to feel uncertain about how to navigate these tax brackets, but understanding them can empower you to optimize your tax situation effectively. Remember, you’re not alone in this journey; we’re here to help you make informed financial decisions.

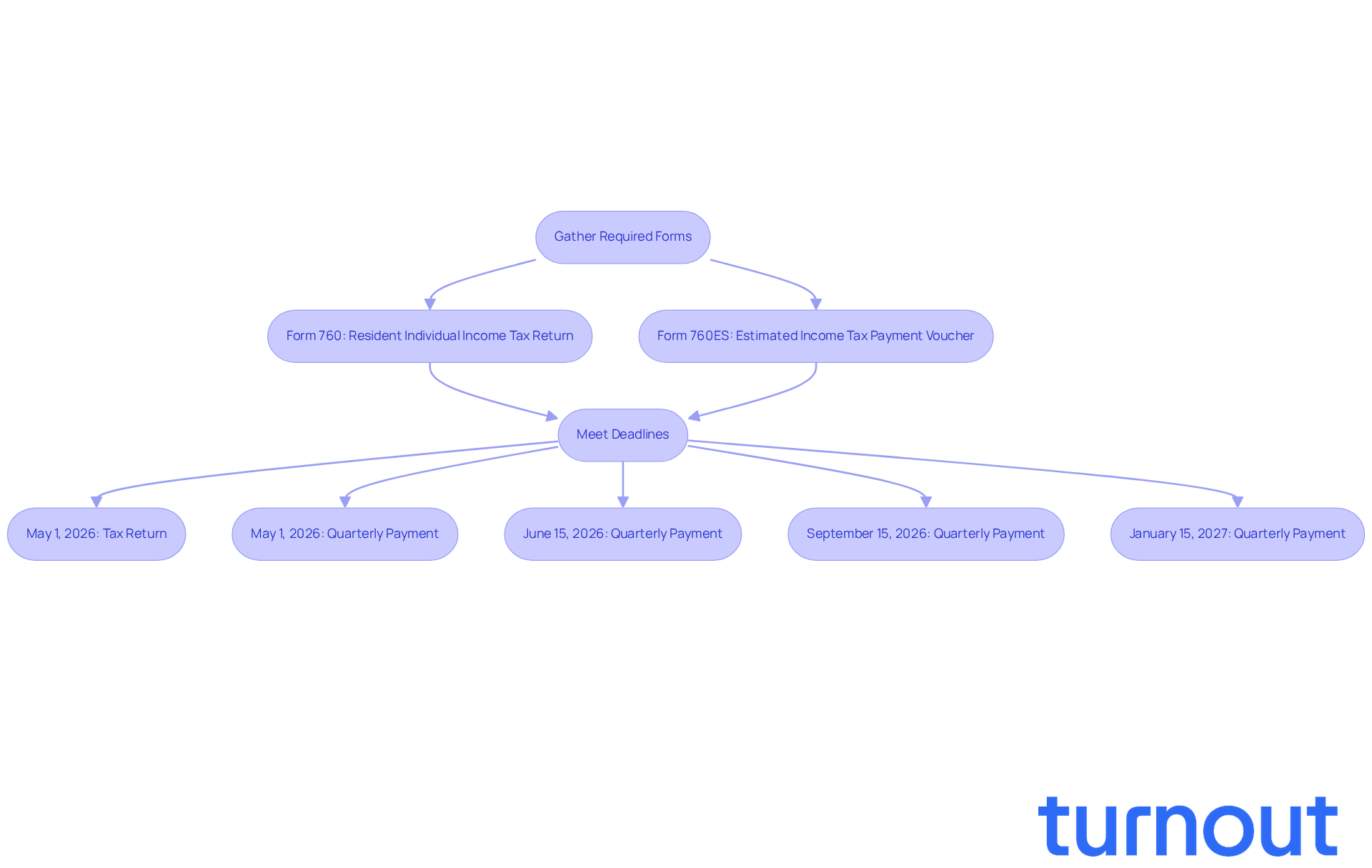

Gather Required Forms and Meet Deadlines

While paying your Virginia income tax payment can feel overwhelming, we’re here to help you through it. To get started, gather these essential forms:

- Form 760: Resident Individual Income Tax Return

- Form 760ES: Estimated Income Tax Payment Voucher

It’s important to be aware of the deadlines to avoid any last-minute stress:

- May 1, 2026: Deadline for filing your 2025 tax return.

- Quarterly estimated payments are due on:

- May 1, 2026

- June 15, 2026

- September 15, 2026

- January 15, 2027

We understand that keeping track of these dates can be challenging. You can find all the necessary forms on the Virginia Department of Taxation website. Make sure you have all your documentation ready to avoid any delays. Remember, you’re not alone in this journey; we’re here to support you every step of the way.

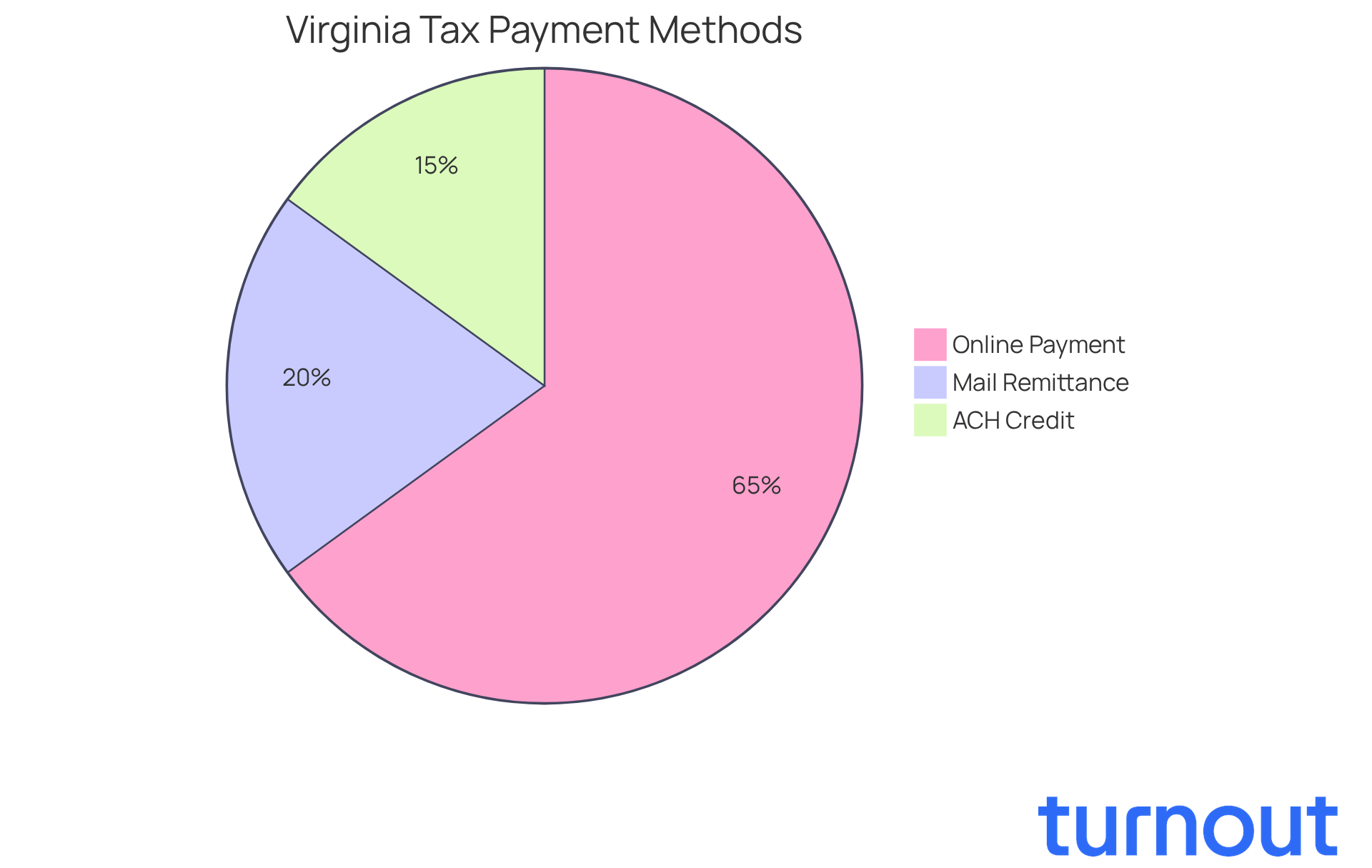

Explore Payment Options and Strategies

Virginia understands that the Virginia income tax payment can be a daunting task, but we’re here to help. You have several convenient options to make this process easier:

- Online Payment: Many taxpayers are finding it simpler to pay directly from their bank accounts or via credit/debit cards through Virginia Tax Online Services. In fact, around 65% of Virginians opted for online transactions in 2025, showing a growing trend towards digital exchanges. You can also use QuickPay or Paymentus for a smooth transaction experience.

- Mail Remittance: If you prefer traditional methods, you can send your payment via check or money order along with the appropriate remittance voucher to the Department of Taxation.

- ACH Credit: Another secure option is to initiate transfers directly from your bank account to the Virginia Tax bank account. This method is efficient and helps you manage your Virginia income tax payment with ease.

We understand that keeping track of payments can be overwhelming. That’s why establishing automatic transactions is a great idea for those making estimated contributions. It helps ensure you meet deadlines without the worry of missing a payment. Tax specialists emphasize that using online transaction strategies can simplify the Virginia income tax payment process and enhance compliance, making it easier for you to manage your obligations effectively. Just keep in mind that a $35 fee may apply if a financial institution does not honor a transaction.

You’re not alone in this journey, and we’re here to support you every step of the way.

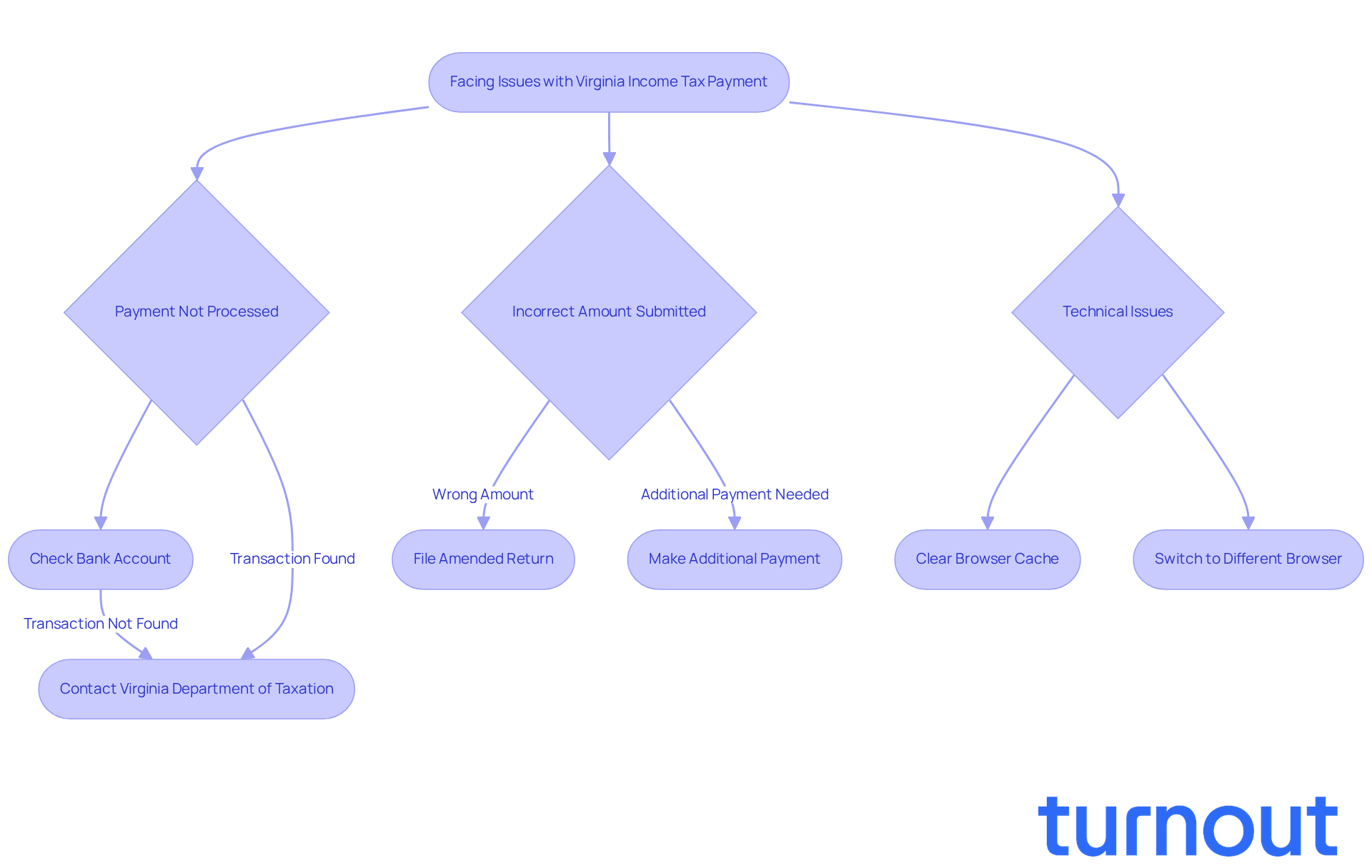

Troubleshoot Common Issues and Seek Help

When you're facing issues with your Virginia income tax payment, it’s completely understandable to feel overwhelmed. Here are some steps to help you resolve common problems:

- Payment Not Processed: First, take a moment to check your bank account. Has the transaction gone through? If you don’t see the fee related to your Virginia income tax payment, don’t hesitate to reach out to the Virginia Department of Taxation for assistance. They’re there to help you.

- Incorrect Amount Submitted: If you realize that you submitted the wrong amount, you might need to file an amended return or make an additional payment to correct the discrepancy. It’s okay; mistakes happen, and there are ways to fix them.

- Technical Issues: Encountering difficulties with the online payment system can be frustrating. If that’s the case, try clearing your browser cache or switching to a different browser. Sometimes, a simple change can make all the difference.

Statistics show that in 2025, about 15% of electronically filed returns faced processing errors. This highlights how important it is to double-check your submission. As tax expert Jane Doe wisely points out, timely communication with the state Department of Taxation regarding Virginia income tax payment can prevent further complications and ensure a smoother resolution process.

For additional support, remember that you’re not alone in this journey. You can contact the Virginia Department of Taxation at 804-367-2486 or visit their help page for comprehensive resources. We’re here to help you navigate through this.

Conclusion

Navigating Virginia's income tax payment system can feel overwhelming, and we understand that. But with a little knowledge about its structure and processes, you can ease that burden significantly. By familiarizing yourself with the state's progressive tax rates, essential forms, payment options, and troubleshooting strategies, you can confidently manage your tax obligations and improve your financial outcomes.

It's important to know the tax brackets and deductions that apply to you. Gather the necessary forms before deadlines, and explore various payment methods, whether online or through traditional mail. Addressing common issues promptly and seeking help when needed can prevent complications and lead to a smoother tax experience.

Taking proactive steps to understand and manage your Virginia income tax payments is vital for your financial well-being. By utilizing available resources and staying informed about deadlines and payment options, you can simplify the process and reduce stress. Remember, you are not alone in this journey. Embracing these strategies not only fosters compliance but also empowers you to take charge of your financial responsibilities effectively. We're here to help you every step of the way.

Frequently Asked Questions

What is the range of Virginia income tax rates?

Virginia income tax rates range from 2% to 5.75%, depending on your earnings.

What are the current tax brackets for Virginia in 2026?

The tax brackets for Virginia in 2026 are as follows:

- 2% on income up to $3,000

- 3% on income from $3,001 to $5,000

- 5% on income from $5,001 to $17,000

- 5.75% on income over $17,000

Is there a standard deduction for Virginia income tax filers?

Yes, Virginia offers a standard deduction of $10,000 for single filers starting in 2026.

How can understanding tax brackets and deductions impact my tax liability?

Familiarity with tax brackets and deductions can significantly impact your overall tax liability, allowing you to optimize your tax situation effectively.

What should I do if I feel uncertain about navigating Virginia's tax system?

It's common to feel uncertain about navigating tax brackets, but understanding them can empower you. Seeking assistance can help you make informed financial decisions.