Introduction

Navigating tax obligations can often feel like a daunting labyrinth, especially for those facing financial hardships. We understand that this journey can be overwhelming. The Offer in Compromise (OIC) program shines as a beacon of hope, allowing eligible taxpayers to settle their debts for less than the total owed. This guide will walk you through the essential steps to master the OIC process, revealing how you can secure much-needed relief and regain control over your financial future.

Yet, with a national acceptance rate hovering around 40%, it’s common to wonder: what strategies can ensure a successful application amidst this competitive landscape? Let’s explore how you can increase your chances of success.

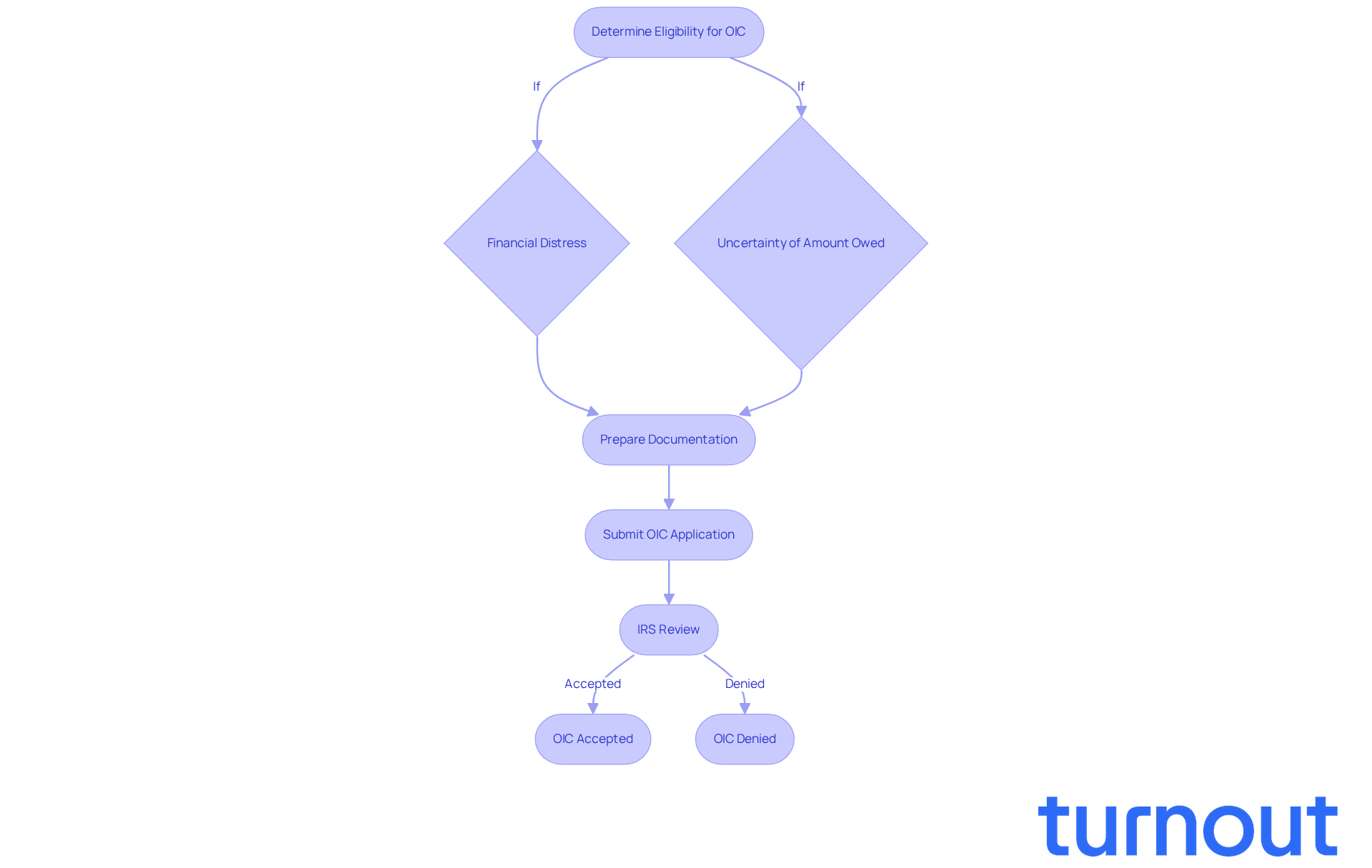

Understand the Offer in Compromise: What It Is and Who It Helps

A tax offer in compromise (OIC) is a strategic agreement between you and the IRS, allowing you to settle your tax debt for less than what you owe. If you're facing economic difficulties and can't pay your tax obligations in full, this program could be a lifeline. To qualify, you need to show that paying the full amount would cause you financial distress or that there’s uncertainty about the amount owed. Did you know that around 21% of OIC submissions were accepted in the 2024 filing year? This highlights just how competitive this program can be.

Tax professionals often emphasize the benefits of the OIC, noting that it can provide significant relief for those overwhelmed by debt. Many individuals have successfully used the OIC to reduce their tax obligations, helping them regain their financial footing. The IRS carefully reviews each submission, considering factors like income, expenses, and your overall economic situation. This underscores the importance of thorough documentation and accurate disclosures.

Understanding the tax offer in compromise process is vital for determining if it meets your tax relief needs. We encourage you to check out the IRS's Offer in Compromise Booklet for detailed guidance on eligibility and application procedures, including the current application fee of $205. By taking advantage of this program, you could resolve your debts for a fraction of what you owe, paving the way for a more manageable financial future. Remember, you’re not alone in this journey, and we’re here to help.

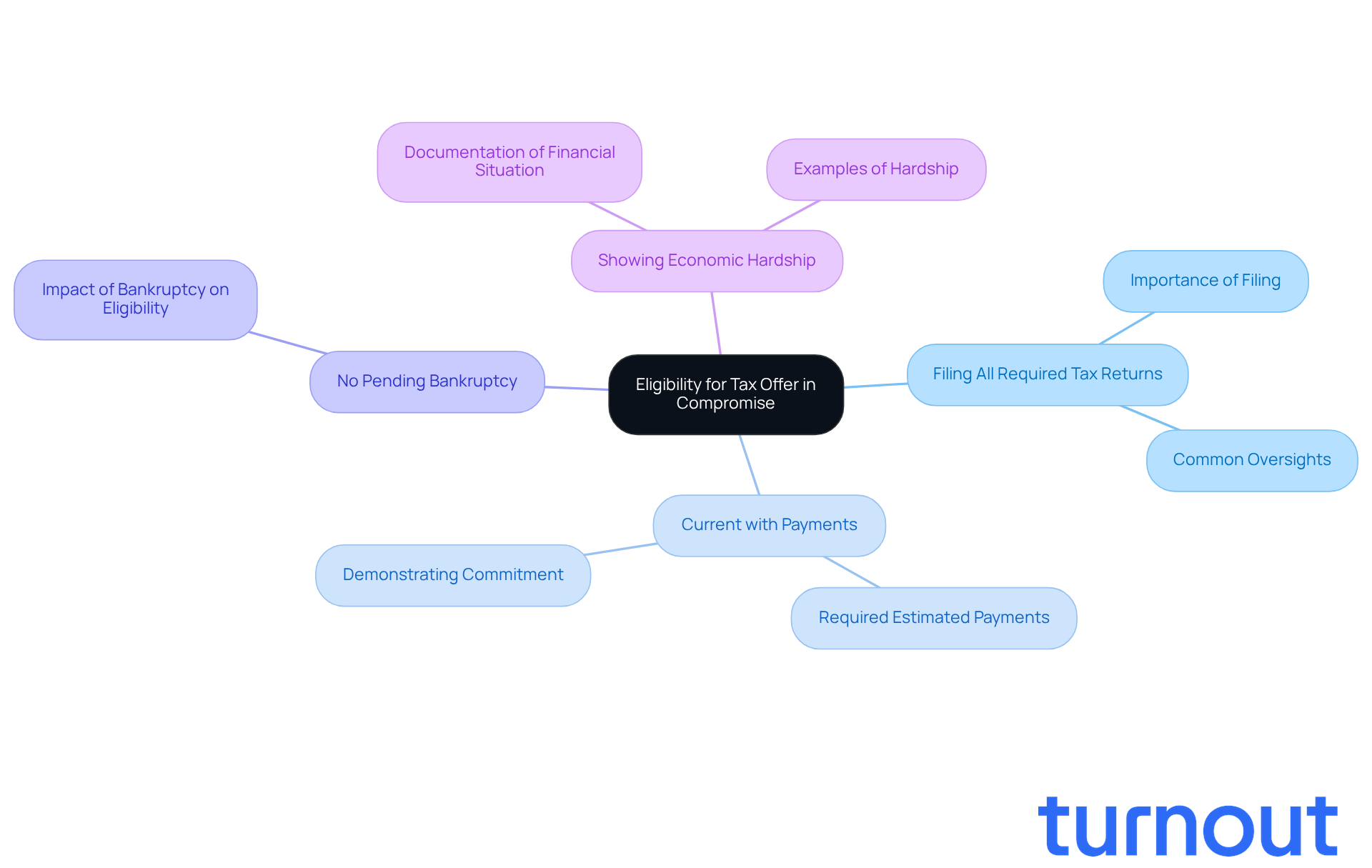

Determine Your Eligibility: Who Can Apply for an Offer in Compromise

To qualify for a tax offer in compromise (OIC), taxpayers must meet specific eligibility criteria set by the IRS. We understand that navigating these requirements can feel overwhelming, but knowing what to expect can make a significant difference. Here are the key criteria:

- Filing all required tax returns: It’s crucial to have filed all tax returns for the past five years. Surprisingly, many applicants overlook this step, which can hinder their chances of acceptance.

- Current with payments: Being current on all required estimated tax payments for the current year is essential before applying. This demonstrates your commitment to resolving your tax obligations with a tax offer in compromise.

- No pending bankruptcy: If you’re involved in an open bankruptcy proceeding, unfortunately, this disqualifies you from the tax offer in compromise program.

- Showing economic hardship: You’ll need to provide evidence that paying your tax debt in full would cause significant financial difficulty. This often involves detailed documentation of your income, expenses, and assets.

Real-life examples highlight the importance of these criteria. For instance, an Amazon FBA seller successfully reduced a $156K obligation to $38K by submitting their tax returns correctly and demonstrating economic hardship. This led to a feasible payment plan that worked for them.

To assess your eligibility, consider using the IRS Offer in Compromise Pre-Qualifier tool available on the IRS website. This tool can help you gauge your standing based on the outlined requirements. Proper preparation and understanding of these criteria can significantly enhance your chances of a favorable outcome in the tax offer in compromise process.

It’s important to recognize that the national average success rate for OIC submissions hovers around 40%. This highlights the competitive nature of the program. As noted by 20/20 Tax Resolution, 'the risk of rejection is another significant downside' of the tax offer in compromise process, emphasizing the need for meticulous adherence to eligibility requirements. Furthermore, the IRS evaluates your economic condition to establish the 'reasonable collection potential' (RCP), which is essential for determining the viability of your OIC request. Remember, you are not alone in this journey, and we’re here to help you navigate these challenges.

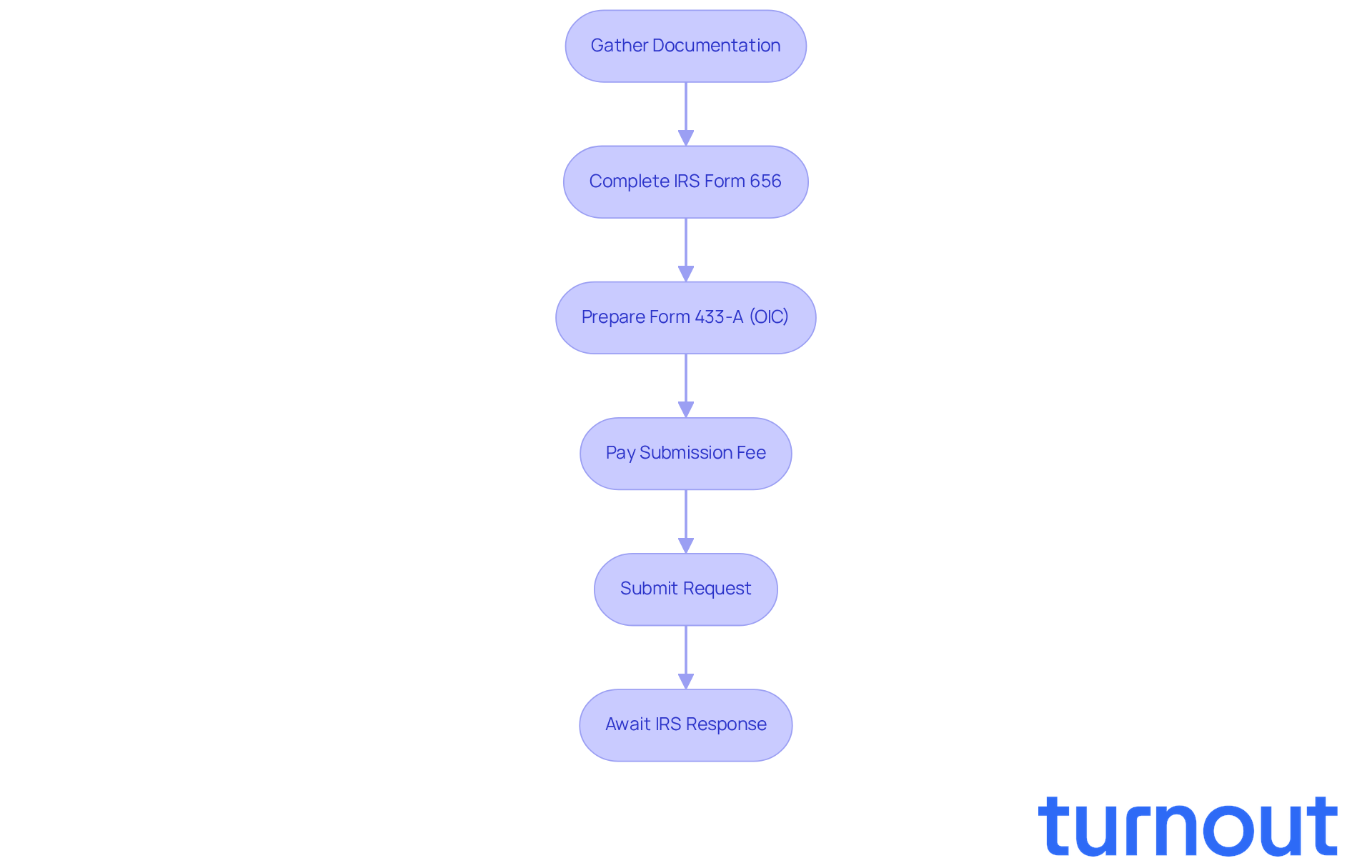

Follow the Application Process: Steps to Submit Your Offer in Compromise

Submitting your tax offer in compromise can feel overwhelming, but we're here to help you through it. Follow these steps to make the process smoother:

-

Gather necessary documentation: Start by collecting all the important financial documents you’ll need, like income statements, expenses, and details about your assets. This will give you a clearer picture of your situation.

-

Complete IRS Form 656, which is your official request for a tax offer in compromise. Make sure all the information is accurate and complete - this is crucial for your application.

-

Prepare Form 433-A (OIC): This form related to the tax offer in compromise provides the IRS with detailed financial information. If you’re representing a business, don’t forget to use Form 433-B instead.

-

Pay the submission fee: Include the $205 fee with your submission, unless you qualify for a fee waiver. It’s important to check this to avoid any delays.

-

Submit your request: Once everything is ready, send your completed forms and documentation to the appropriate IRS address. Remember to keep copies for your records - this is your safety net.

-

Await IRS response: After you submit, the IRS will review your request. They might reach out for more information, so be prepared to respond promptly. It’s common to feel anxious during this waiting period, but know that you’re taking important steps toward relief.

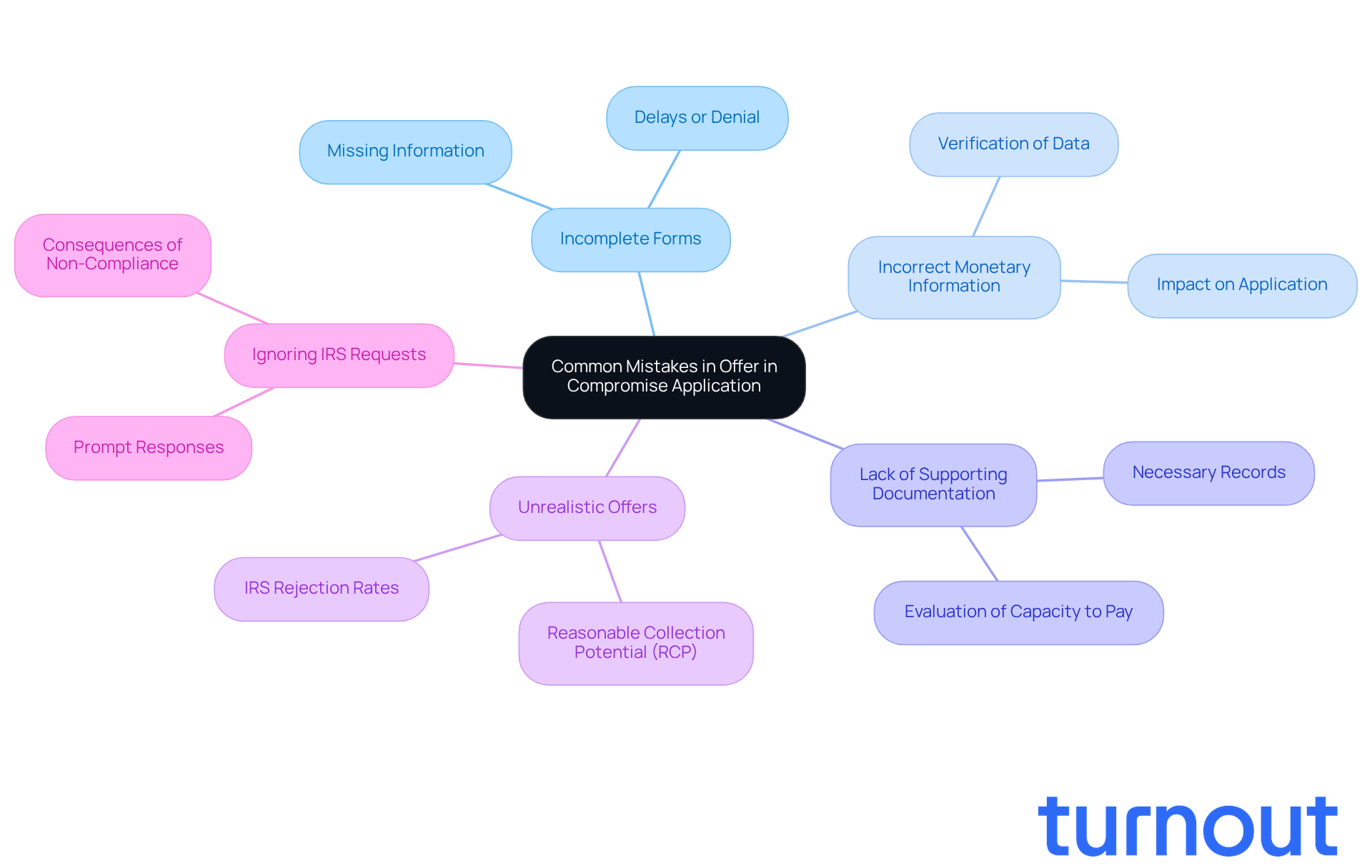

Avoid Common Mistakes: Troubleshooting Your Offer in Compromise Application

When applying for a tax offer in compromise, we understand that it can be a daunting process. It's crucial to avoid common pitfalls that can lead to rejection. Here are some key mistakes to watch out for:

-

Incomplete Forms: Make sure all forms are fully completed and signed. Missing information can lead to delays or outright denial. In fact, the IRS dismisses a substantial percentage of requests due to incomplete submissions.

-

Incorrect Monetary Information: Carefully verify all monetary data provided in Form 433-A or 433-B. Mistakes in your monetary disclosures can undermine your application and result in rejection. As Parham Khorsandi observes, the IRS assesses your financial situation by reviewing your assets, income, expenses, and capacity to pay.

-

Lack of Supporting Documentation: Include all necessary documentation to substantiate your monetary claims. The IRS requires thorough records to evaluate your capacity to pay, and missing documents can jeopardize your application.

-

Unrealistic Offers: Your offer amount should reflect your economic situation. The IRS typically rejects offers that are significantly below your Reasonable Collection Potential (RCP), which is calculated based on your financial circumstances. In 2023, the IRS accepted 12,711 offers out of 30,163 submitted, resulting in an acceptance rate of approximately 42.1%.

-

Ignoring IRS Requests: If the IRS reaches out for additional information, respond promptly. Failing to provide requested documentation can complicate your case and lead to rejection. Additionally, missing even one payment during the OIC review period results in automatic rejection.

By being mindful of these common mistakes, you can enhance your submission for a tax offer in compromise and significantly improve your chances of acceptance. Remember, the IRS accepted approximately 30 to 40 percent of OIC requests in recent years, highlighting the importance of a well-prepared submission. Also, keep in mind that there is a $205 application fee unless you qualify for Low-Income Certification, which is an important consideration in the application process. We're here to help you navigate this journey.

Conclusion

Navigating the complexities of a tax offer in compromise (OIC) can feel overwhelming, especially for those grappling with tax debt. This strategic agreement with the IRS offers a chance to settle obligations for less than what you owe, providing a vital opportunity for financial relief. By understanding the eligibility requirements, the application process, and common pitfalls, you can significantly enhance your chances of securing this essential tax relief.

We understand that filing all necessary tax returns and demonstrating economic hardship can be daunting. It's crucial to complete the required forms meticulously. Avoiding common mistakes, like incomplete submissions or unrealistic offers, is equally important. With an acceptance rate hovering around 40%, thorough preparation and accurate documentation are key to achieving a favorable outcome.

Ultimately, the offer in compromise program stands as a beacon of hope for those facing overwhelming tax burdens. By taking proactive steps and grasping the intricacies of the application process, you can pave the way toward a more manageable financial future. Embracing this opportunity not only alleviates immediate financial stress but also empowers you to regain control of your financial life.

If you're considering this route, remember: the time to act is now. Explore the resources available and take that first step toward securing the relief you deserve. You're not alone in this journey, and we're here to help.

Frequently Asked Questions

What is a tax offer in compromise (OIC)?

A tax offer in compromise (OIC) is a strategic agreement between you and the IRS that allows you to settle your tax debt for less than the total amount owed.

Who can benefit from an offer in compromise?

Individuals facing economic difficulties who cannot pay their tax obligations in full may benefit from an OIC. It is particularly helpful for those who can demonstrate that paying the full amount would cause financial distress or if there is uncertainty about the amount owed.

What percentage of OIC submissions were accepted in the 2024 filing year?

Approximately 21% of OIC submissions were accepted in the 2024 filing year, indicating the competitiveness of the program.

What factors does the IRS consider when reviewing an OIC submission?

The IRS reviews factors such as income, expenses, and the overall economic situation of the applicant when evaluating an OIC submission.

What is the current application fee for an offer in compromise?

The current application fee for an offer in compromise is $205.

Where can I find more information about the offer in compromise process?

For detailed guidance on eligibility and application procedures for an OIC, you can refer to the IRS's Offer in Compromise Booklet.

How can an OIC help individuals with tax debt?

An OIC can significantly reduce tax obligations, helping individuals regain their financial footing by allowing them to resolve their debts for a fraction of what they owe.