Introduction

Navigating the complexities of tax forms can feel overwhelming, especially for our elderly and disabled loved ones who may be seeking additional financial support. Schedule R is a vital resource that offers potential tax benefits, which can significantly ease financial burdens. We understand that understanding eligibility requirements and the filing process is crucial. What happens when common pitfalls lead to missed opportunities?

This guide is here to break down the essentials of Schedule R. We’ll provide step-by-step instructions and troubleshooting tips to ensure that eligible taxpayers can maximize their benefits and avoid costly mistakes. Remember, you are not alone in this journey - we're here to help.

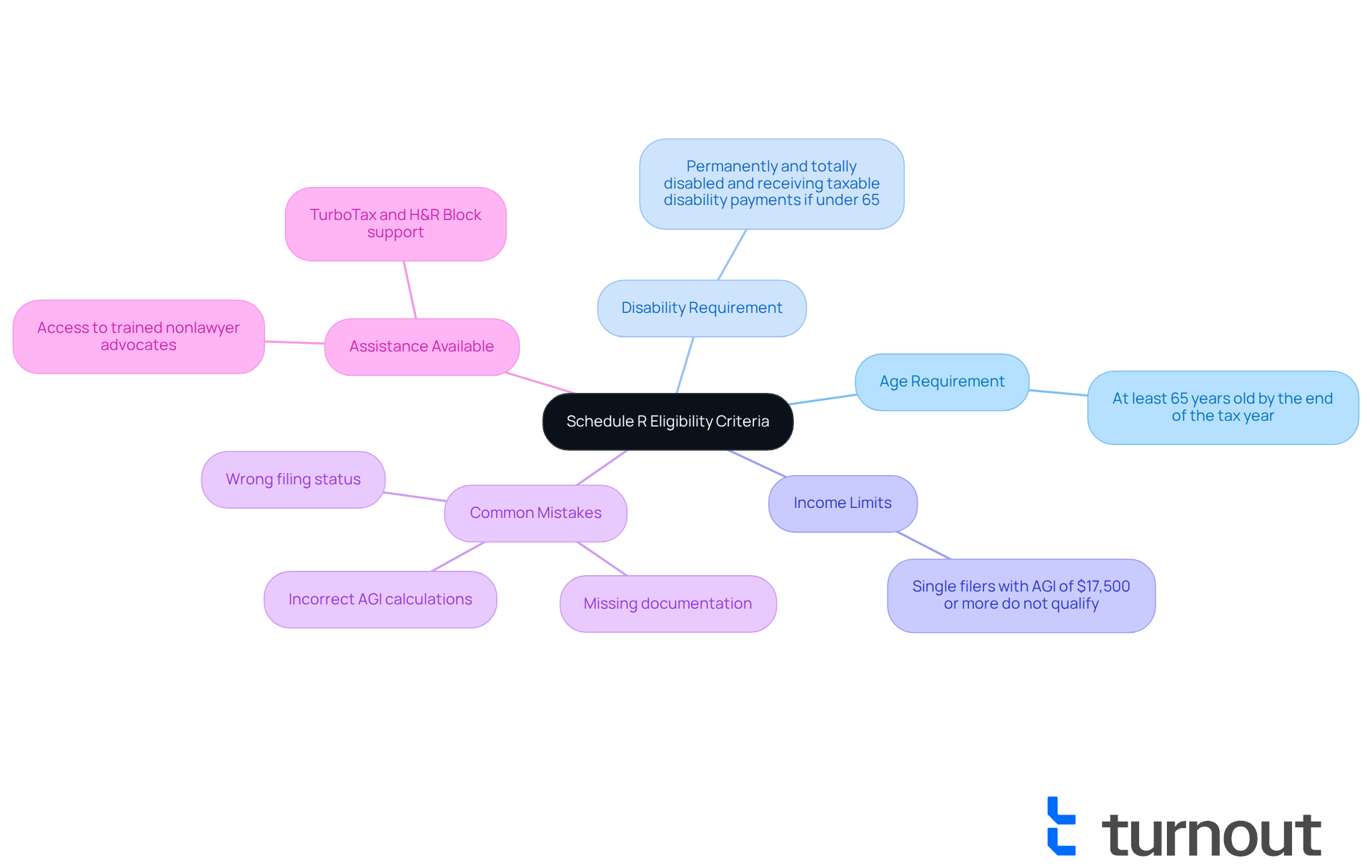

Understand Schedule R: Purpose and Eligibility Criteria

Tax form schedule R (Form 1040) is an important resource for those who may need a little extra support, especially for our elderly and disabled community members. If you’re wondering whether you qualify for this tax benefit, let’s take a closer look at the criteria:

- Age Requirement: You need to be at least 65 years old by the end of the tax year.

- Disability Requirement: If you’re under 65, you must be permanently and totally disabled and receiving taxable disability payments.

It’s also essential to keep in mind that your earnings must stay below certain limits, which can affect the amount of assistance you can request. For instance, if you’re a single filer with an adjusted gross income (AGI) of $17,500 or more, you won’t qualify for this benefit. Recent statistics indicate that about 37% of Americans are eligible for the R tax benefit based on age and disability status, underscoring its significance as a financial resource.

Understanding these eligibility criteria is crucial before you gather your documentation and fill out the tax form schedule R. We understand that navigating this process can be overwhelming, but there are tools and services available to help. Turnout offers access to trained nonlawyer advocates who can assist you in claiming the R benefit. Tax experts emphasize that this benefit can significantly ease financial burdens for those who qualify, making it vital to fully grasp the requirements.

Before claiming the credit, ensure that you meet all the requirements to avoid any delays or inspections. Remember to submit the tax form schedule R along with your tax return. Common mistakes include incorrect AGI calculations and missing documentation, so paying close attention to detail is key.

You are not alone in this journey; we’re here to help you every step of the way.

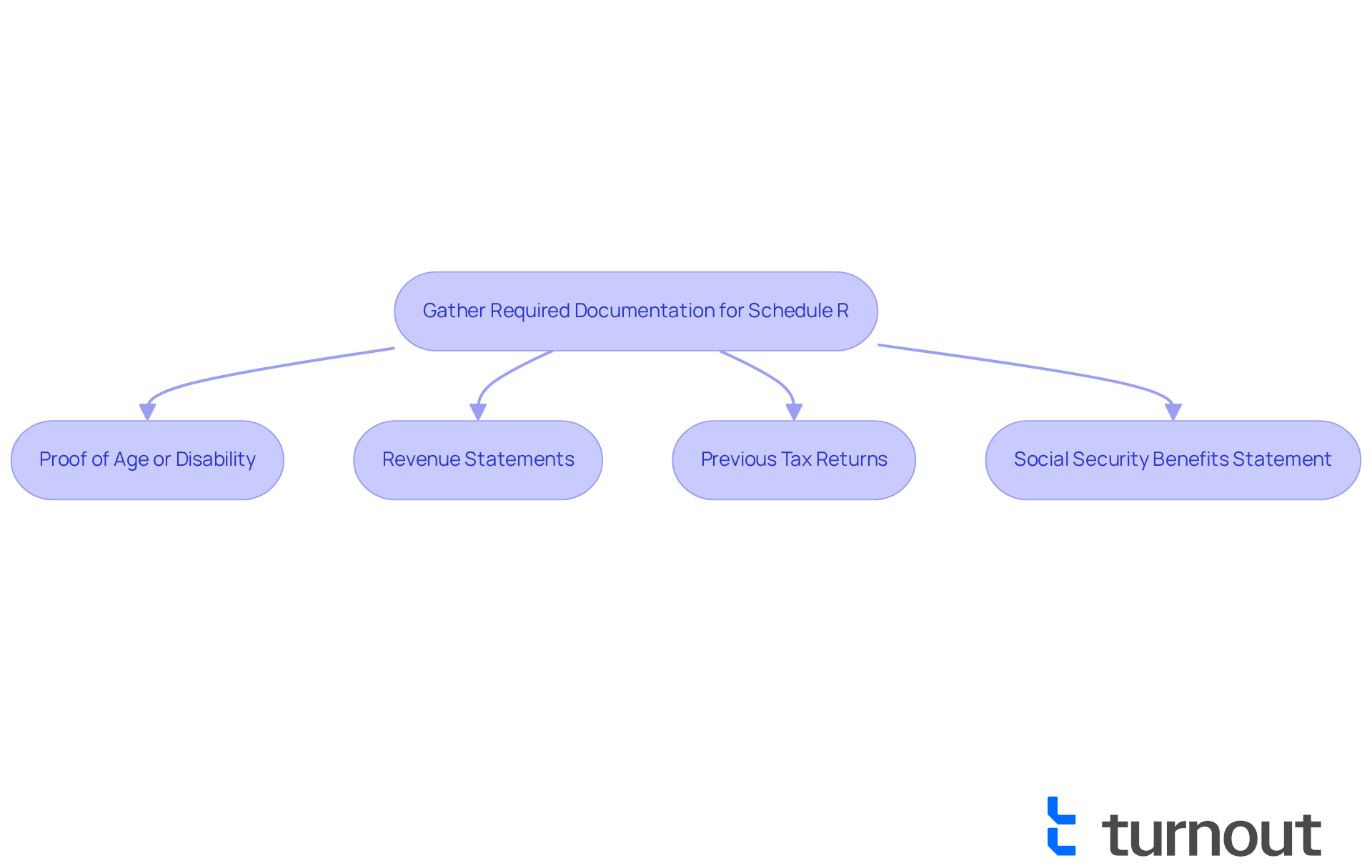

Gather Required Documentation for Schedule R

Before you fill out the tax form schedule R, it’s important to gather some key documents to ensure the filing process is smoother. We understand that this can feel overwhelming, but having everything ready can really help.

- Proof of Age or Disability: This could be your birth certificate or a statement from your doctor confirming your disability. It’s crucial to have accurate documentation here, as mistakes can lead to delays or even denials of your claims.

- Revenue Statements: Make sure to collect all your earnings documents, like W-2s, 1099s, and any other forms that report your income. Incomplete or incorrect reporting is a common issue that can affect your eligibility for benefits.

- Previous Tax Returns: Having last year’s tax return handy can give you a clearer picture of your financial situation and help ensure consistency in your reporting. It can also help you spot any discrepancies that might come up this year.

- Social Security Benefits Statement: If you receive Social Security benefits, include documentation of these payments. Remember, most Social Security and VA disability payments are non-taxable and do not count as taxable disability income on the tax form schedule R, so clarity here is really important.

Make sure all your documents are current and accurately reflect your financial situation. This preparation can help you avoid complications during the filing process. Statistics show that documentation errors are a leading cause of issues in tax credit claims for disabled individuals. By preparing thoroughly, you’re taking a vital step toward maximizing your benefits. Remember, you’re not alone in this journey; we’re here to help.

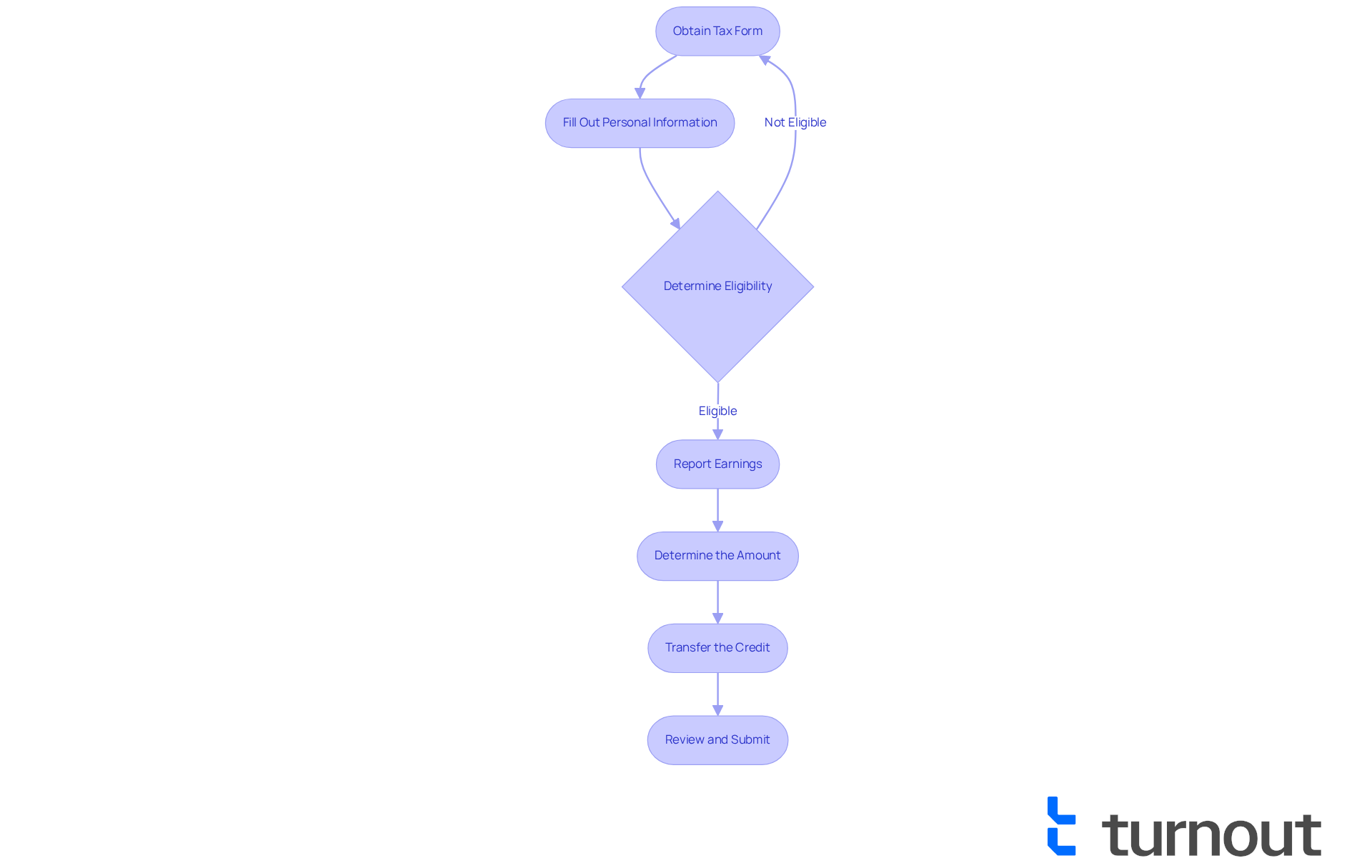

Complete Schedule R: Step-by-Step Instructions

Completing the tax form schedule R can feel overwhelming, but we're here to help you through it. Follow these detailed steps to make the process smoother:

- Obtain the tax form schedule R by downloading it from the IRS website or using tax preparation software that includes it.

- Fill Out Personal Information: At the top of the form, enter your name, address, and Social Security number. This is your first step toward claiming your benefits.

- Determine Eligibility: In Part I, check the box that applies to you-whether you’re claiming based on age (65 or older) or disability status. If you’re claiming due to disability, remember to provide proof of your benefits from Social Security or private insurers.

- Report Earnings: In Part II, list all relevant sources of income, including pensions and taxable disability earnings. Make sure to report only taxable earnings, as non-taxable benefits don’t qualify.

- Determine the Amount: Use the worksheet included in the Schedule R guidelines to assess your amount based on your reported earnings and eligibility criteria. The loan amount can range from $3,750 to $7,500, depending on your earnings and family size. This step is crucial; common mistakes include misreporting income or forgetting to attach necessary documentation.

- Transfer the Credit: After calculating your credit, move the amount to Section 3 of Form 1040.

- Review and Submit: Take a moment to double-check all entries for accuracy. Attach the tax form schedule R to your Form 1040 and ensure you submit your tax return by the filing deadline.

It’s common to feel anxious about these details, but tax professionals emphasize that many individuals overlook critical aspects, like ensuring all income is accurately reported and selecting the correct filing status. For instance, a single filer earning $20,000 annually with $5,000 in Social Security benefits might be eligible for up to $750. This highlights the potential benefits of careful filing. On average, completing Form R takes about 30 minutes, and the typical refund amount for taxpayers in the 2024 filing season was $3,207. This underscores the importance of precise filing. Real-world examples show that individuals who diligently follow these steps often successfully claim their credits, significantly easing their financial burdens. Remember, you are not alone in this journey.

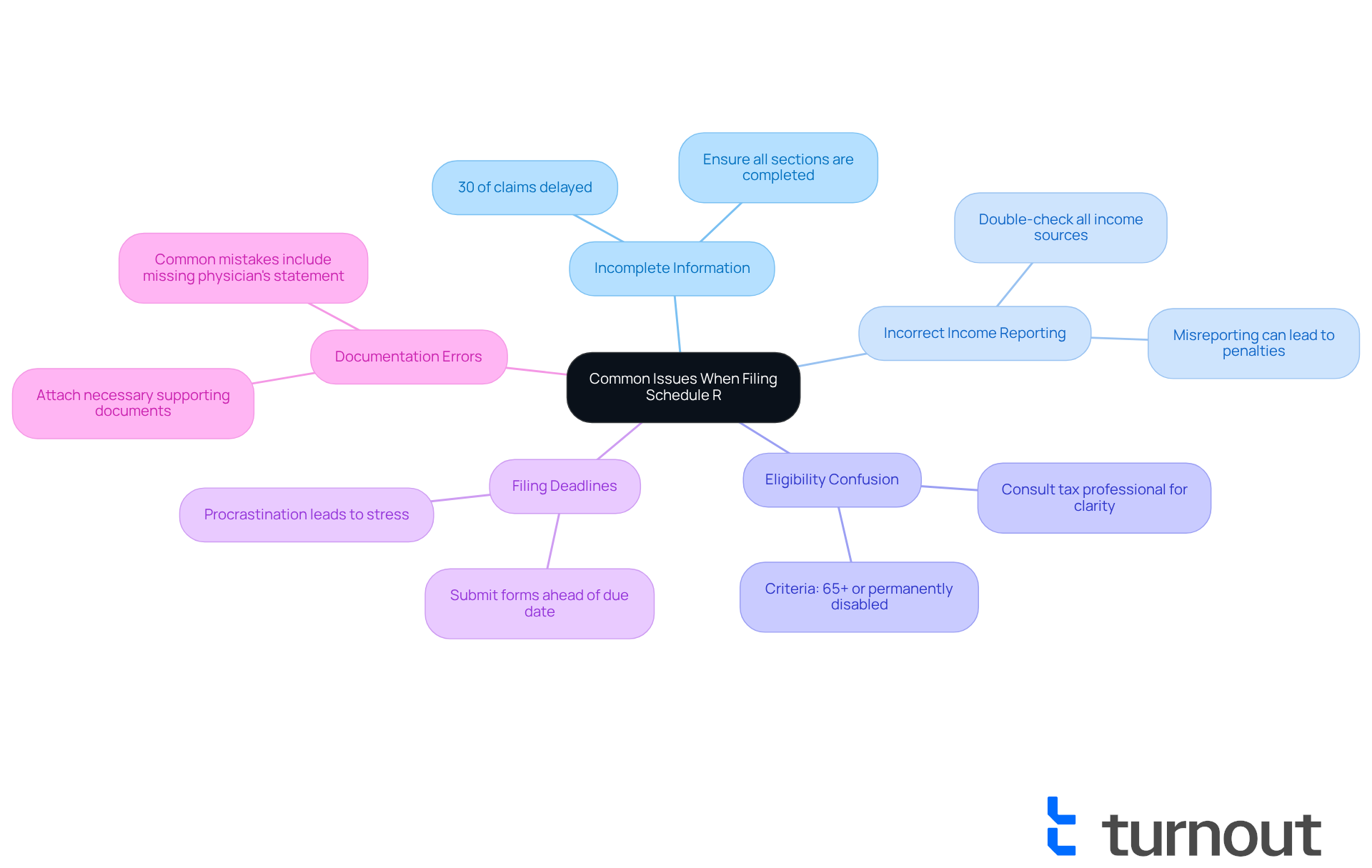

Troubleshoot Common Issues When Filing Schedule R

When filing the tax form schedule R, we understand that it can feel overwhelming. Here are some common issues to watch out for:

-

Incomplete Information: It’s crucial to ensure that every section of the form is fully completed. Missing details can lead to significant processing delays. In fact, studies show that about 30% of claims related to tax form schedule R are delayed due to incomplete information. With the IRS having lost about one-quarter of its workforce since January, processing times may be further impacted.

-

Incorrect Income Reporting: Accurately reporting all sources of income is essential. Misreporting can not only reduce your credits but may also result in penalties. Tax advisors often emphasize the importance of double-checking figures to avoid costly mistakes. As Arian wisely notes, "R may seem daunting at first glance, but it’s straightforward when broken down."

-

Eligibility Confusion: If you’re unsure about your eligibility, it’s a good idea to revisit the criteria outlined in the guidelines. Consulting a tax professional can provide clarity and help you navigate complex situations. Arian advises, 'To qualify for the tax form schedule R, you must either: be 65 years or older by the end of the tax year or be permanently disabled, as certified by a physician.'

-

Filing Deadlines: Staying aware of tax deadlines is vital to prevent late penalties. Submitting your forms well ahead of the due date is advisable. Procrastination can lead to unnecessary stress and complications.

-

Documentation Errors: Make sure to attach all necessary supporting documents, including a physician's statement for disability claims, and ensure they are correctly labeled. Inaccuracies in documentation can lead to claims being denied, so thoroughness is key. Remember, common mistakes include incorrectly reporting income or forgetting to attach necessary documentation.

If you encounter issues, please don’t hesitate to reach out to a tax professional or the IRS for assistance. Their expertise can help resolve problems efficiently and ensure your filing process is smooth. Remember, you are not alone in this journey.

Conclusion

Mastering the tax form Schedule R is essential for those seeking to maximize their benefits, especially for the elderly and disabled. We understand that navigating tax forms can be overwhelming. Knowing the eligibility criteria, gathering the necessary documentation, and following a clear step-by-step process are vital components in successfully claiming these tax credits. This form serves as a lifeline for many, providing crucial financial support when it is most needed.

Throughout this guide, we’ve highlighted key arguments that emphasize the importance of understanding eligibility requirements and preparing the right documents. It’s common to feel anxious about completing forms, but we’ve also pointed out common pitfalls, such as:

- Incomplete information

- Incorrect income reporting

Along with practical solutions to avoid these issues. By carefully following these steps and seeking assistance when needed, you can navigate the complexities of Schedule R with confidence.

Ultimately, the significance of Schedule R extends beyond mere paperwork; it represents an opportunity for financial relief and improved quality of life for those who qualify. Taking the time to understand and properly complete this form can lead to substantial benefits. We encourage you to engage with tax professionals or advocacy services to ensure a smooth filing process. Remember, empowerment through knowledge and preparation can make a profound difference in securing the benefits that are rightfully owed. You are not alone in this journey.

Frequently Asked Questions

What is Schedule R and who is it for?

Schedule R (Form 1040) is a tax form designed to provide financial support to elderly and disabled individuals. It is particularly beneficial for those who may need extra assistance during tax season.

What are the age requirements to qualify for Schedule R?

To qualify for Schedule R, you must be at least 65 years old by the end of the tax year.

What are the disability requirements for those under 65?

If you are under 65, you must be permanently and totally disabled and receiving taxable disability payments to qualify for Schedule R.

Are there income limits to qualify for Schedule R?

Yes, your earnings must stay below certain limits. For example, single filers with an adjusted gross income (AGI) of $17,500 or more do not qualify for this benefit.

How many Americans are estimated to be eligible for Schedule R?

Recent statistics indicate that about 37% of Americans are eligible for the Schedule R tax benefit based on age and disability status.

What should I do before filling out Schedule R?

It is crucial to understand the eligibility criteria before gathering your documentation and filling out Schedule R to avoid any issues.

What resources are available to help with claiming Schedule R?

Turnout offers access to trained nonlawyer advocates who can assist individuals in claiming the R benefit.

What common mistakes should I avoid when claiming Schedule R?

Common mistakes include incorrect AGI calculations and missing documentation, so it is important to pay close attention to detail when submitting the form.

When should I submit Schedule R?

You should submit Schedule R along with your tax return to ensure that your claim is processed correctly.