Overview

This article addresses a crucial aspect of financial support for many individuals: calculating Supplemental Security Income (SSI) benefits. We understand that navigating this process can be overwhelming, but we're here to help you through it.

To effectively determine your SSI benefits, it's essential to follow specific steps and understand the eligibility criteria. This article provides a clear and detailed process for:

- Assessing countable earnings and assets

- Utilizing the Federal Benefit Rate

- Considering state supplements

It's common to feel uncertain about these calculations, but accurate assessments are vital to ensure you receive the financial support you deserve.

We encourage you to take your time with these calculations. Understanding your benefits can provide peace of mind during challenging times. Remember, you are not alone in this journey; many resources are available to assist you.

Introduction

Understanding Supplemental Security Income (SSI) benefits can often feel like navigating a complex maze. For individuals with disabilities, seniors, and those with limited resources, this journey can be particularly challenging. This federal program aims to provide crucial financial support, yet many find themselves struggling with the nuances of eligibility criteria and benefit calculations.

We understand that the process can be overwhelming. By breaking down the steps to calculate SSI benefits, this guide offers you the opportunity to demystify the process and maximize your potential support. However, it's common to feel uncertain about how to accurately assess your benefits. With various state regulations and common pitfalls, how can you ensure you're not falling into traps that lead to miscalculations?

You're not alone in this journey. Together, we can navigate these complexities and help you find the support you need.

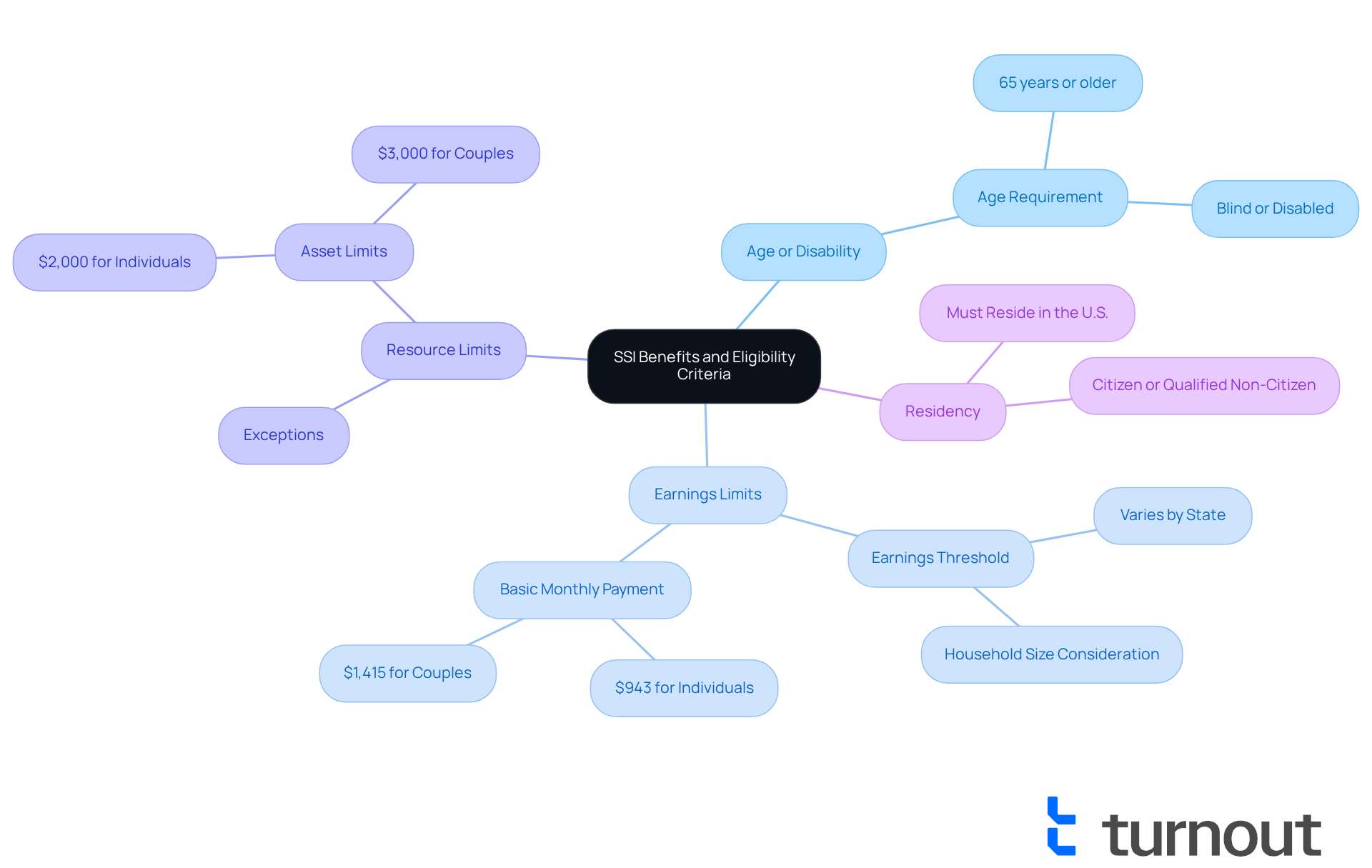

Understand SSI Benefits and Eligibility Criteria

Supplemental Security Income (SSI) is a federal program designed to provide financial support to individuals with disabilities, seniors, and those with limited resources. We understand that navigating financial assistance can be overwhelming, so it's important to know the specific eligibility criteria for SSI benefits:

- Age or Disability: You must be aged 65 or older, blind, or disabled.

- Earnings Limits: Your earnings should be below a certain threshold, which varies by state and household size. In 2024, the basic monthly SSI payment is $943 for individuals and $1,415 for couples, but these amounts may decrease based on other income sources.

- Resource Limits: You must have limited resources, typically not exceeding $2,000 for individuals or $3,000 for couples, with some exceptions.

- Residency: You must reside in the United States and be a citizen or a qualified non-citizen.

Understanding these criteria is essential, as they directly affect how you calculate SSI benefits. To enhance your application, gather all necessary documentation, such as proof of earnings, bank statements, and medical records. Remember, you are not alone in this journey. Turnout offers assistance through trained nonlawyer advocates who can help you navigate the complexities of the SSI application process. They provide the guidance you need to maximize your chances of approval. It's important to note that Turnout is not a law firm and does not provide legal advice.

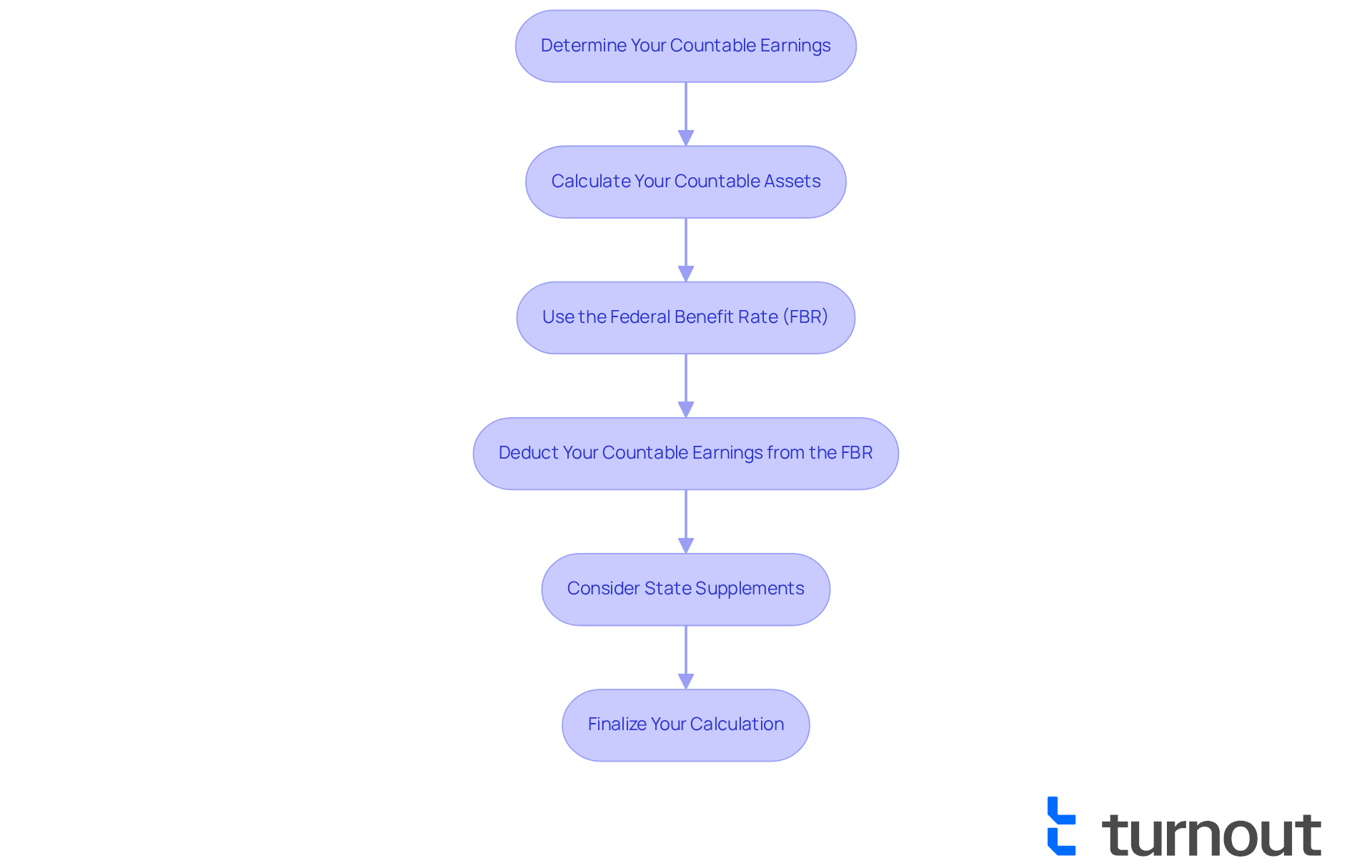

Follow the Step-by-Step Calculation Process for SSI Benefits

To calculate your SSI benefits, follow these steps:

-

Determine Your Countable Earnings: Begin by identifying all sources of revenue, including wages, pensions, and Social Security benefits. Remember to deduct any permissible exclusions, such as the first $20 of monthly earnings and any earned compensation exclusions. It's important to note that gifts, child support, and certain economic impact payments from the IRS due to COVID-19 are not counted as income.

-

Calculate Your Countable Assets: Next, evaluate your assets, which include cash, bank accounts, and property. Keep in mind that certain resources, like your primary home and one vehicle, may not count against the limit. If you own two cars, you can exclude the one with the highest equity value if it is used for transportation.

-

Use the Federal Benefit Rate (FBR): For 2025, the FBR is set at $914 for individuals and $1,371 for couples. This figure represents the highest monthly aid amount available to you.

-

Deduct Your Countable Earnings from the FBR: Now, take the FBR and subtract your countable earnings. This calculation will help you to calculate SSI benefits and determine your potential compensation amount. For instance, if your countable income is $500, your possible assistance would be $414.

-

Consider State Supplements: Some states provide extra assistance on top of the federal SSI amount. It's worth examining your state’s program to see if you qualify for any additional support, which can enhance your overall monthly allowance.

-

Finalize Your Calculation: Finally, add any state supplements to your calculated SSI payment to determine your total monthly payment amount. This last step ensures you have a complete understanding of your financial support.

By following these steps, you can accurately calculate SSI benefits and assess your potential advantages. Remember, you are not alone in this journey, and we are here to help you navigate the system with confidence.

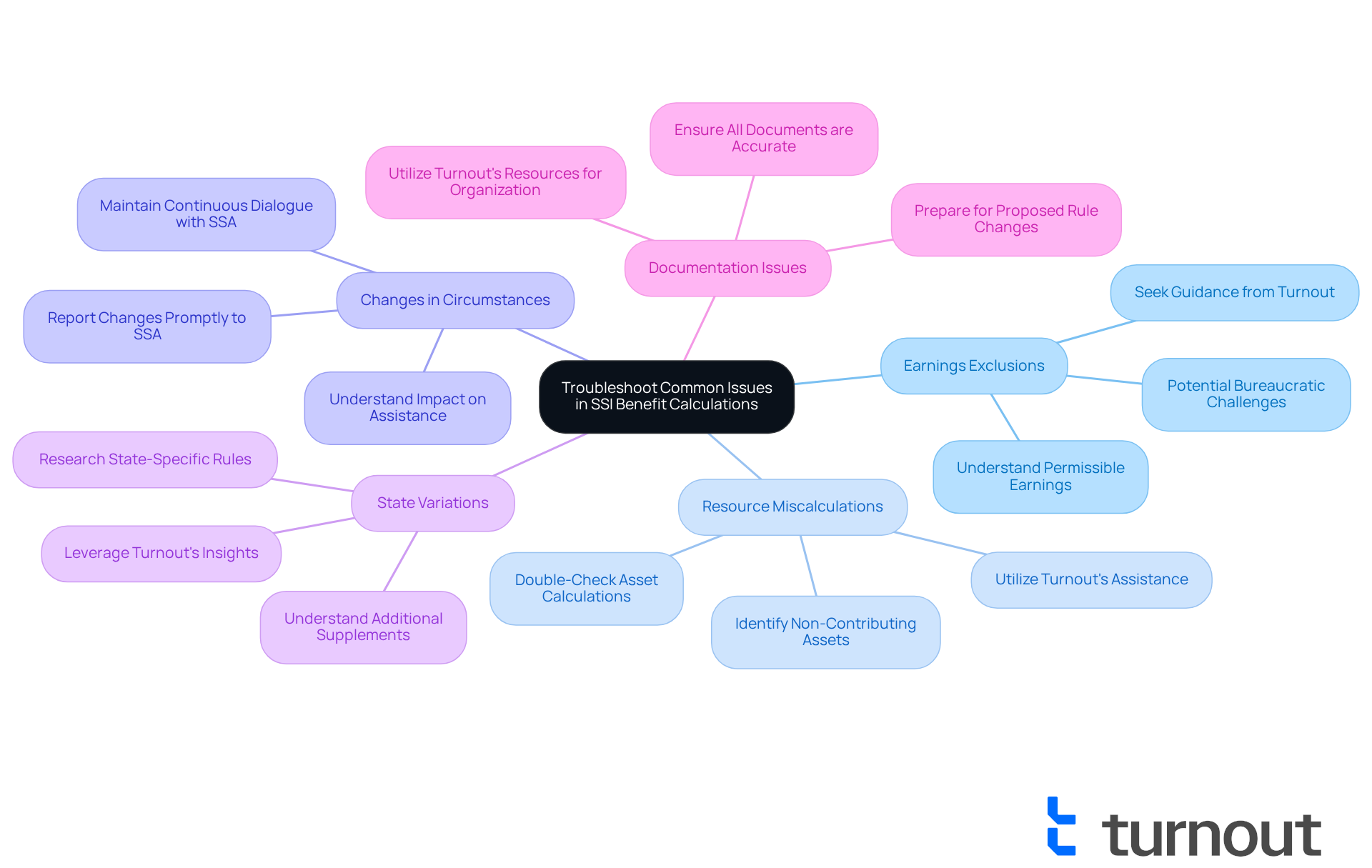

Troubleshoot Common Issues in SSI Benefit Calculations

While calculating SSI benefits, you may encounter several common issues that can feel overwhelming:

-

Misunderstanding Earnings Exclusions: Many applicants often overlook permissible earnings exclusions. It's crucial to understand what qualifies as earnings in order to calculate SSI benefits and what can be excluded. As Kathleen Romig observes, suggested rule modifications could create additional bureaucracy for beneficiaries, making it harder for them to grasp exclusions related to earnings. We understand that this can be confusing, but Turnout can help simplify this process by providing guidance on what income can be excluded, ensuring you maximize your benefits.

-

Resource Miscalculations: It's essential to double-check your calculations of assets. It’s easy to miss certain assets or misclassify them, which can lead to unnecessary stress. Remember, not everything contributes to the limit. The administrative burden of SSI regulations can place considerable financial pressure on low-income families who rely on these supports to calculate SSI benefits. Turnout's trained non-legal advocates are here to assist you in accurately evaluating your assets, so you don’t have to navigate this alone.

-

Changes in Circumstances: If your income or resources change after submitting your application, it can impact your assistance. Always report these changes to the Social Security Administration (SSA) promptly. We recognize that the anticipated rule changes could affect an estimated 386,000 SSI beneficiaries, highlighting the importance of timely reporting. Turnout emphasizes the necessity for continuous dialogue with the SSA to calculate SSI benefits that align with your current situation, because you deserve the support you need.

-

State Variations: Be aware that when you calculate SSI benefits, they can vary by state due to additional supplements. Researching your state’s specific rules is vital to calculate SSI benefits accurately. Understanding these variations is essential for precise advantage calculations, and Turnout can offer insights into state-specific regulations that may affect how you calculate SSI benefits. Remember, knowledge is power, and we're here to help you navigate this complexity.

-

Documentation Issues: Ensure you have all necessary documentation ready and accurate. Missing or incorrect documents can delay your application and make it difficult to calculate SSI benefits. The complexities introduced by proposed rule changes may lead to increased administrative costs and improper payments, further complicating the documentation process. Turnout's resources can help you gather and organize the required documentation efficiently, so you can focus on what matters most.

If you encounter issues, consider reaching out to Turnout or a qualified professional for assistance. Miscalculations can lead to significant financial strain, especially for low-income households relying on these benefits. We emphasize the importance of understanding these common pitfalls to ensure that beneficiaries receive the support they need. Remember, you are not alone in this journey; we’re here to help.

Conclusion

Calculating Supplemental Security Income (SSI) benefits can feel overwhelming, and we understand that. However, grasping this process is vital for those seeking financial support. This article offers a compassionate approach to mastering SSI calculations, highlighting the importance of knowing eligibility criteria and following a step-by-step method to determine potential benefits.

It's essential to discern countable earnings and assess assets accurately. Additionally, being aware of state-specific variations can influence benefit amounts significantly. We also address common pitfalls, such as misunderstandings regarding earnings exclusions, documentation issues, and the importance of timely reporting changes in circumstances. With the right guidance and resources, you can navigate these complexities more effectively.

Ultimately, the ability to calculate SSI benefits accurately can profoundly impact your financial stability. This article serves as a valuable resource for understanding the intricacies of SSI benefits. We encourage you to seek assistance from organizations like Turnout, which can provide the necessary support to ensure that all eligible individuals receive the benefits they deserve. Remember, empowerment through knowledge is key; take the steps today to secure the financial assistance that can truly make a difference in your life.

Frequently Asked Questions

What is Supplemental Security Income (SSI)?

Supplemental Security Income (SSI) is a federal program that provides financial support to individuals with disabilities, seniors, and those with limited resources.

What are the eligibility criteria for SSI benefits?

The eligibility criteria for SSI benefits include being aged 65 or older, blind, or disabled; having earnings below a certain threshold; having limited resources (not exceeding $2,000 for individuals or $3,000 for couples); and residing in the United States as a citizen or qualified non-citizen.

What are the earnings limits for SSI in 2024?

In 2024, the basic monthly SSI payment is $943 for individuals and $1,415 for couples, but these amounts may decrease based on other income sources.

What documentation is needed to apply for SSI?

To enhance your SSI application, you should gather necessary documentation such as proof of earnings, bank statements, and medical records.

How can Turnout assist with the SSI application process?

Turnout offers assistance through trained nonlawyer advocates who help navigate the complexities of the SSI application process and provide guidance to maximize chances of approval.

Is Turnout a law firm?

No, Turnout is not a law firm and does not provide legal advice.