Introduction

Navigating the world of Social Security Disability Insurance (SSDI) can feel overwhelming. We understand that the intricate rules surrounding work credits can add to your stress. That’s where the SSDI work credit calculator comes in. This vital tool empowers you to assess your eligibility based on your employment history, providing clarity in a confusing process.

By understanding how these credits accumulate and the specific requirements for 2025, you can gain insight into your potential benefits. But what if the numbers don’t align with your expectations? It’s common to feel uncertain in these situations. This guide will walk you through the step-by-step process of using the SSDI work credit calculator, ensuring that you’re not alone on this journey.

Understand the SSDI Work Credit Calculator

Are you feeling overwhelmed by the complexities of Social Security Disability Insurance? You're not alone. The SSDI work credit calculator is designed to help you assess your eligibility based on your employment history, making this journey a little easier.

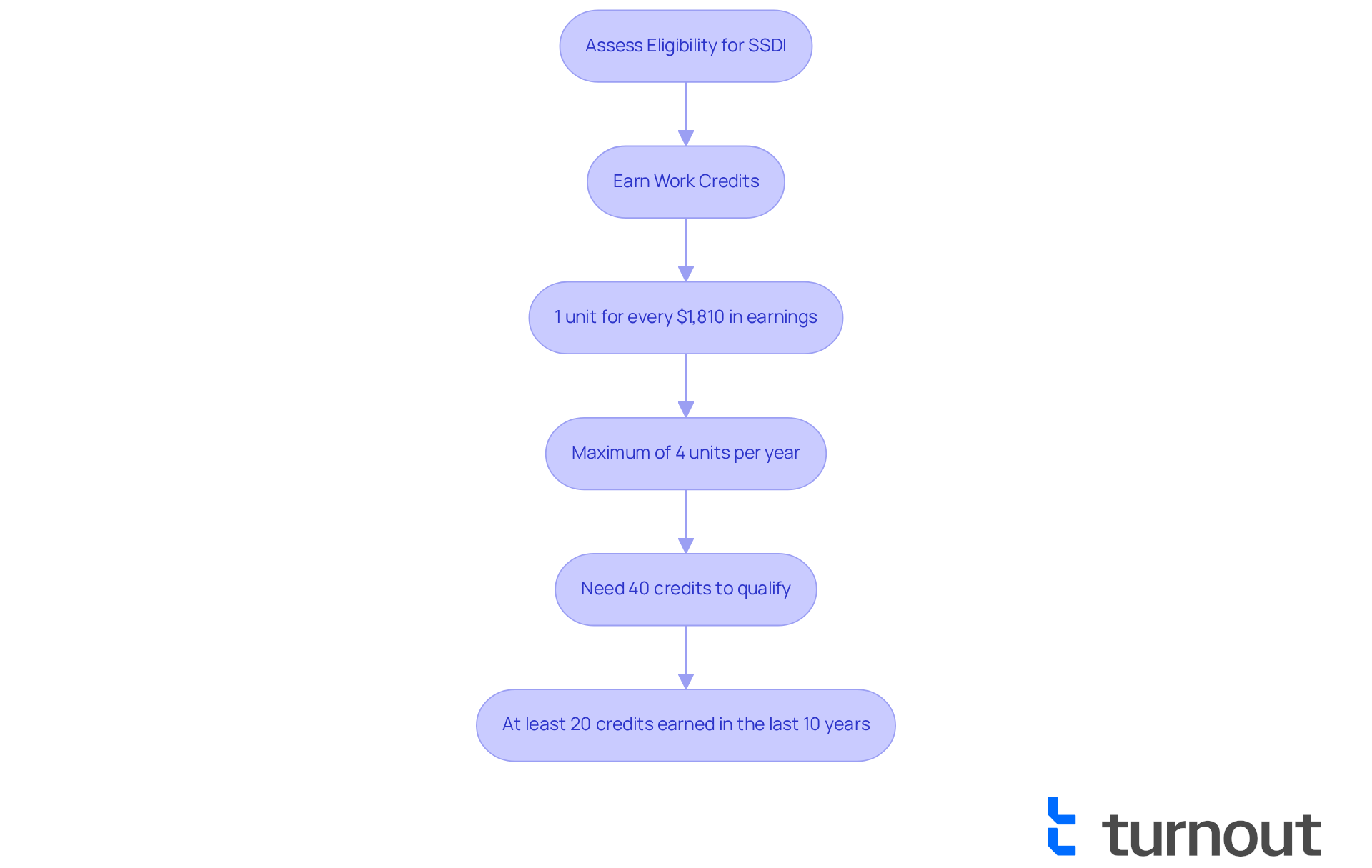

To qualify for SSDI, you need to earn a specific number of work points, which are determined by your total earnings. In 2025, you’ll earn one unit for every $1,810 in wages or self-employment income, with a maximum of four units per year. Understanding how these credits accumulate is vital. Typically, you need 40 credits to qualify for benefits, with at least 20 of those earned in the last 10 years before your disability began.

Familiarizing yourself with the SSDI work credit calculator can help you assess your eligibility and effectively plan your next steps. Remember, we're here to help you navigate this process. You are not alone in this journey.

Access the SSDI Work Credit Calculator

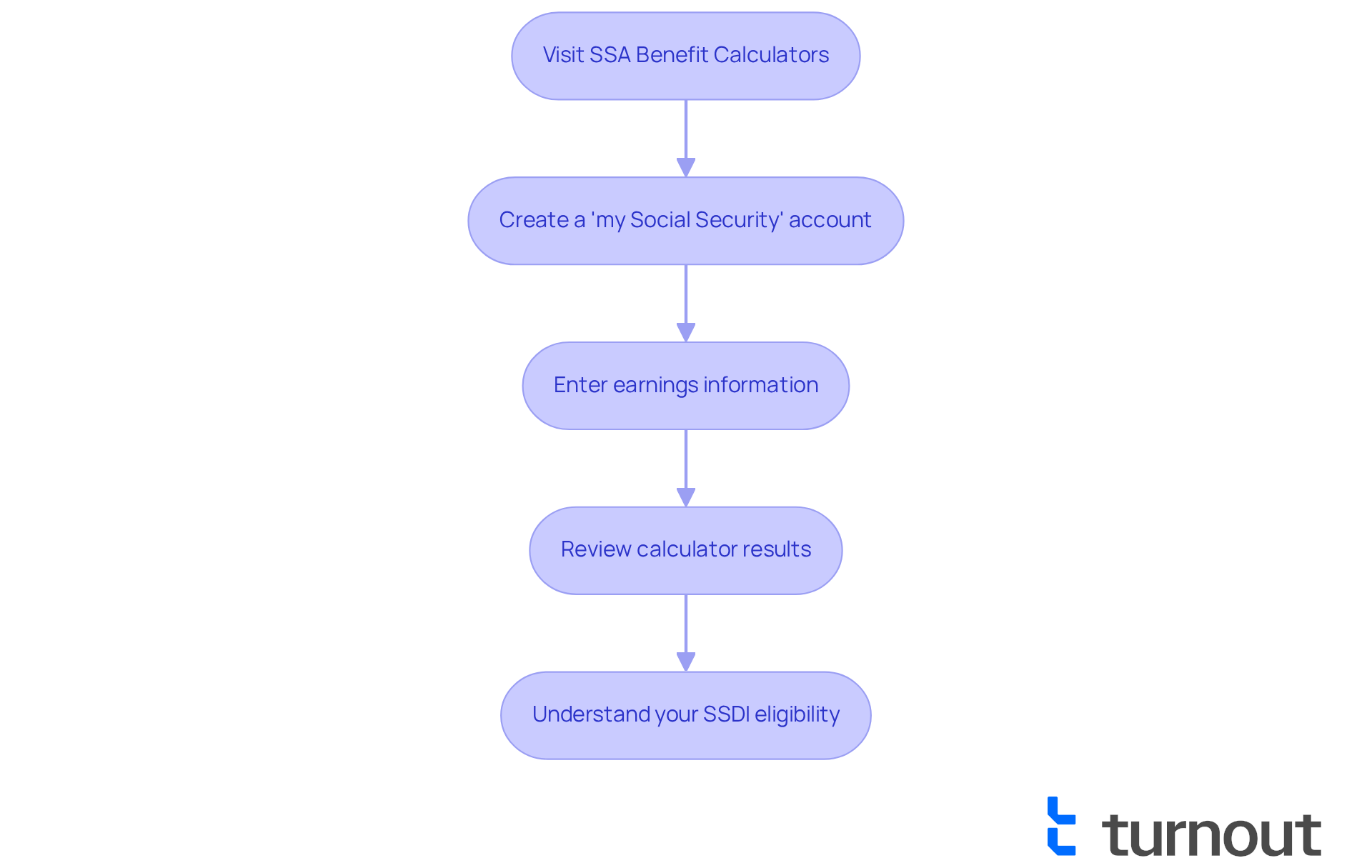

If you're looking to understand your Social Security Disability Insurance benefits better, we’re here to help. To access the ssdi work credit calculator, simply visit the Social Security Administration's official website at SSA Benefit Calculators. Here, you’ll find a variety of calculators, including the one you need. Just click on the appropriate link to open it.

You might need to create a 'my Social Security' account to unlock some features. Once you have access, follow the prompts to enter your earnings information accurately. This step is crucial, as it allows the calculator to provide you with an approximation of your work contributions and potential eligibility for disability benefits.

As of 2025, the minimum earnings required to earn one credit have increased to $1,810, with a total of $7,240 needed for four credits. Additionally, keep in mind that your monthly earnings must not exceed $1,690 to qualify for SSDI. The recent 2.5% COLA increase for 2025 reflects the ongoing economic challenges many beneficiaries face.

Using the ssdi work credit calculator can significantly enhance your understanding of your benefits. When paired with the support from Turnout's trained nonlawyer advocates, you can navigate the SSD claims process with greater confidence. Remember, as the Social Security Administration emphasizes, "Using benefit calculators is essential for planning your financial future and understanding your eligibility."

It’s important to be aware that many disability applications are denied, so thorough preparation is key. You are not alone in this journey; Turnout is here to guide you through these complexities.

Interpret Your Results

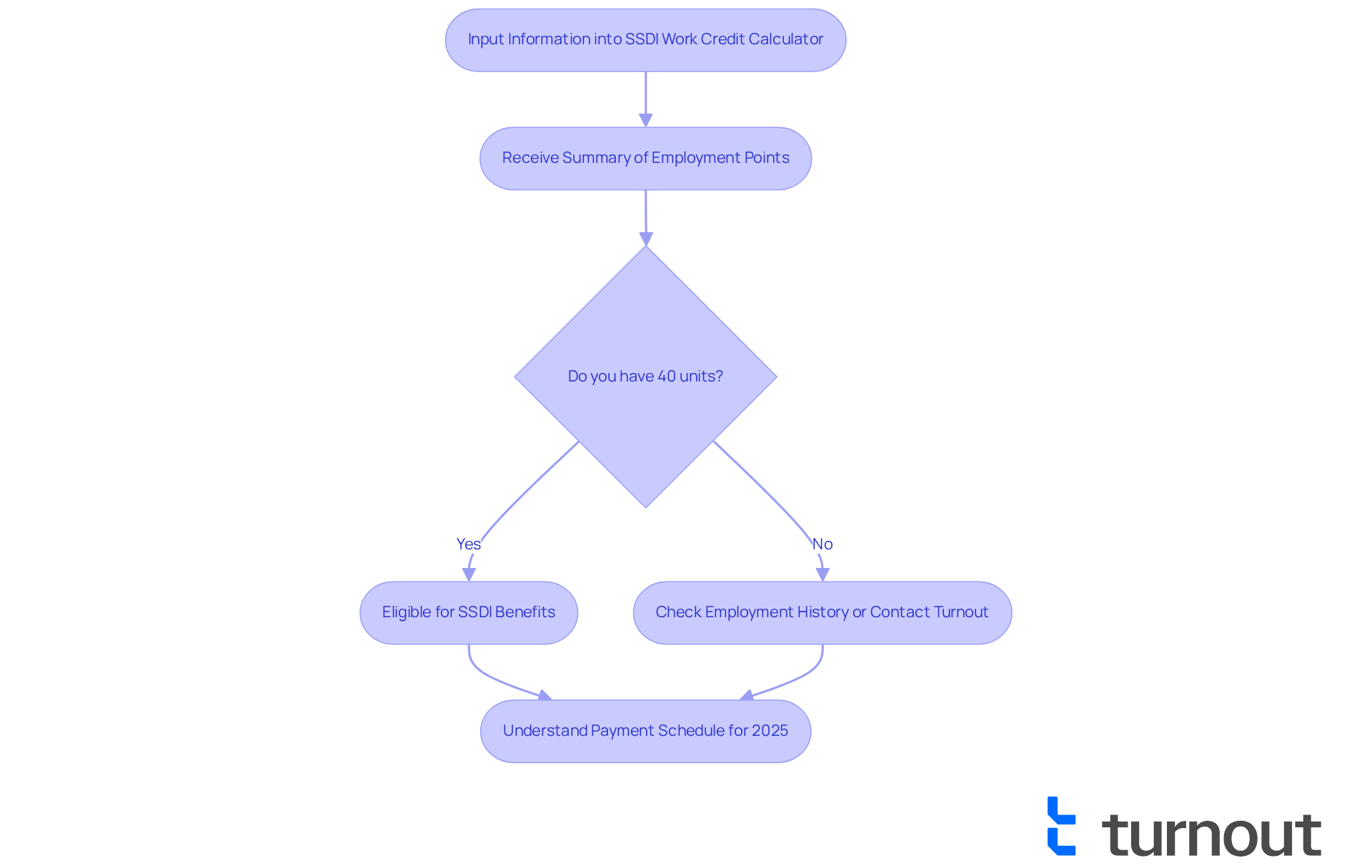

After you input your information into the ssdi work credit calculator, you will receive a summary of your accumulated employment points. Obtaining the full 40 units usually signifies eligibility for SSDI benefits, as long as you also meet the necessary medical standards, which can be assessed using an ssdi work credit calculator.

In 2025, one earning unit is valued at $1,810, meaning you’ll need a total of $7,240 to acquire the maximum of four units each year. If your total falls below this threshold, the ssdi work credit calculator will indicate how many additional units you need.

It’s crucial to note the date of your disability onset, as this can significantly affect your eligibility. If you discover that you don’t have enough points, consider reviewing your employment history for any inconsistencies or reaching out to a Turnout representative. Remember, Turnout isn’t a law firm; they’re here to help you navigate the complex Social Security Disability Insurance application process.

Many applicants - about 20% - struggle with insufficient work credits, which often leads them to utilize the ssdi work credit calculator to explore alternative options or seek assistance. Understanding the payment schedule for 2025, determined by birth dates, can also help you predict when your benefits might start if you qualify.

We understand that this process can feel overwhelming, but you are not alone in this journey. We’re here to help you every step of the way.

Take Action Based on Your Results

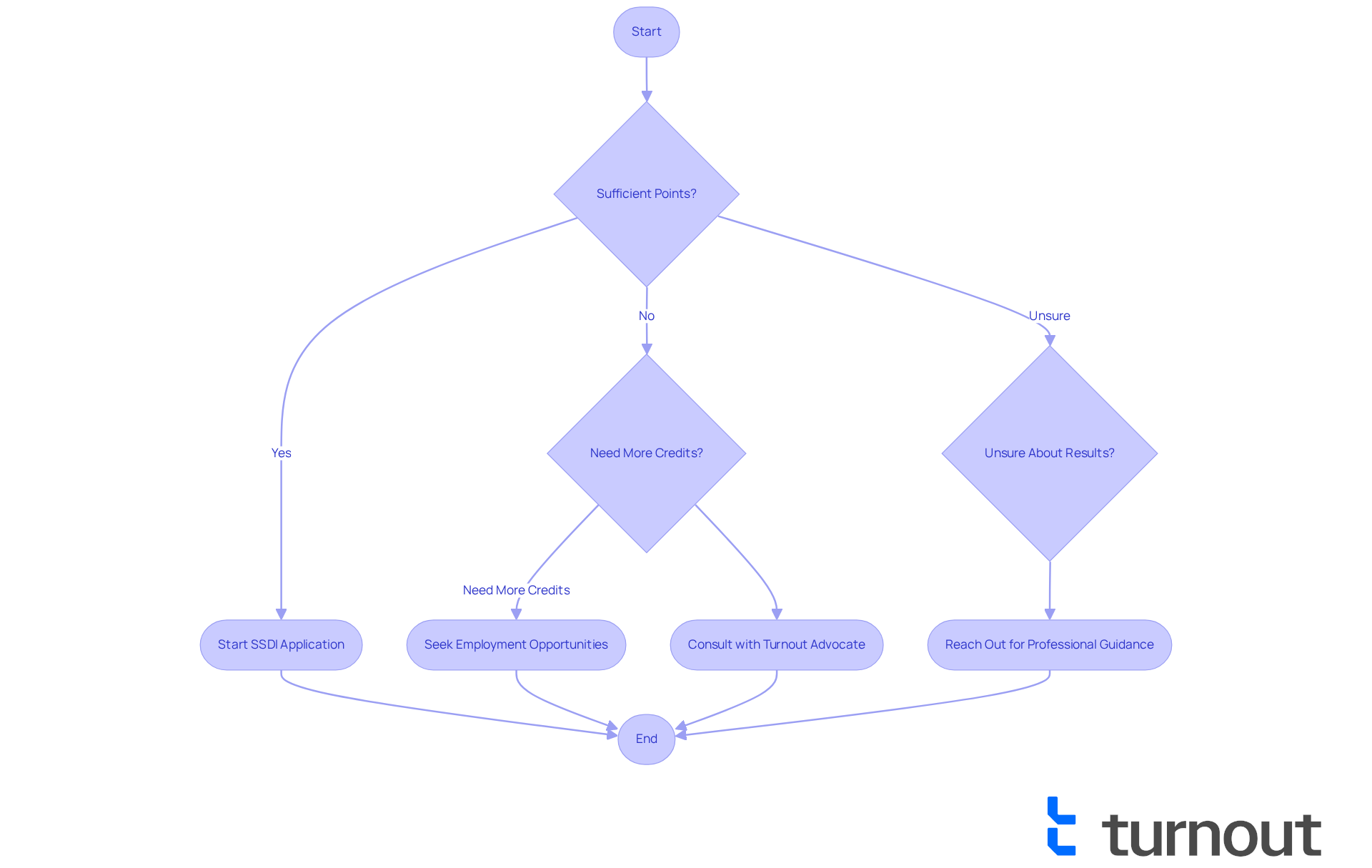

Based on the results from the ssdi work credit calculator, we understand that navigating this process can feel overwhelming. Here are some steps you can take:

-

If you possess sufficient points: Start the SSDI application process. You can apply online through the SSA website, over the phone, or in person at your local SSA office. Remember to gather necessary documentation, including your employment history and medical records.

-

If you need more credits: Consider strategies to increase your work credits. This might involve seeking employment opportunities that allow you to earn the required income. Alternatively, you can consult with a Turnout disability benefits advocate to explore other options or benefits you may qualify for. Their trained nonlawyer advocates can provide tailored advice, helping you navigate the complexities of the disability benefits system. Just a reminder, Turnout is not a law firm and does not provide legal representation.

-

If you are unsure about your results: Don’t hesitate to reach out to a professional for guidance. A knowledgeable representative from Turnout can help clarify your situation and assist you in navigating the intricacies of the disability benefits system. Additionally, if you’re facing tax debt relief issues, Turnout collaborates with IRS-licensed enrolled agents who can offer further assistance.

In 2025, the average duration to process disability applications has improved. The Appeals Council now provides a quicker review procedure, reducing average wait times by about 30%. Real-world examples show that candidates who effectively manage their qualifications and seek help often experience smoother application processes. Remember, understanding the nuances of your work credits and using the SSDI work credit calculator in the application process is crucial for maximizing your benefits. We're here to help you every step of the way.

Conclusion

Mastering the SSDI Work Credit Calculator is a crucial step for anyone seeking Social Security Disability Insurance benefits. We understand that this process can feel overwhelming, but this tool simplifies the complex eligibility assessment, allowing you to evaluate your work history and see your potential for receiving benefits. By grasping how work credits accumulate and the requirements for SSDI, you can navigate your journey with greater confidence and clarity.

In this guide, we’ve shared key insights, including:

- How to access the SSDI Work Credit Calculator

- The importance of accurately entering your earnings information

- What your results mean for you

It’s essential to recognize that achieving the necessary work credits is vital for eligibility. Knowing how to interpret these results can significantly impact your next steps in the application process. Remember, you’re not alone; support from trained advocates can enhance your experience and provide guidance along the way.

Ultimately, understanding the SSDI Work Credit Calculator is invaluable. It serves as a vital resource for planning your financial future and making informed decisions about your disability benefits. Taking action based on your results-whether that means applying for benefits or seeking additional guidance-is crucial. Embrace this process with the right tools and support, and you’ll find a smoother path toward securing the benefits you need for a more stable future.

Frequently Asked Questions

What is the SSDI work credit calculator?

The SSDI work credit calculator is a tool designed to help individuals assess their eligibility for Social Security Disability Insurance (SSDI) based on their employment history.

How do I qualify for SSDI?

To qualify for SSDI, you need to earn a specific number of work credits, which are determined by your total earnings. Typically, you need 40 credits to qualify, with at least 20 of those earned in the last 10 years before your disability began.

How are work credits earned?

In 2025, you will earn one work credit for every $1,810 in wages or self-employment income, with a maximum of four credits that can be earned in a year.

Why is it important to understand how work credits accumulate?

Understanding how work credits accumulate is vital because it helps you assess your eligibility for SSDI benefits and plan your next steps effectively.

Can the SSDI work credit calculator help me with my SSDI application?

Yes, familiarizing yourself with the SSDI work credit calculator can assist you in assessing your eligibility and navigating the SSDI application process.