Introduction

Navigating the complexities of Social Security Disability Insurance (SSDI) back pay can feel overwhelming. We understand that these retroactive benefits are more than just financial support; they’re a lifeline during tough times, helping to cover essential expenses that pile up while you wait for approval.

This guide is here to help you master the SSDI back pay tax calculator. We’ll walk you through a clear, step-by-step approach, empowering you to estimate your entitlements accurately and prepare for any potential tax implications.

Yet, with so much at stake, it’s common to wonder: how can you ensure you’re making the right calculations and avoiding common pitfalls? Remember, you’re not alone in this journey. We’re here to help.

Understand SSDI Back Pay

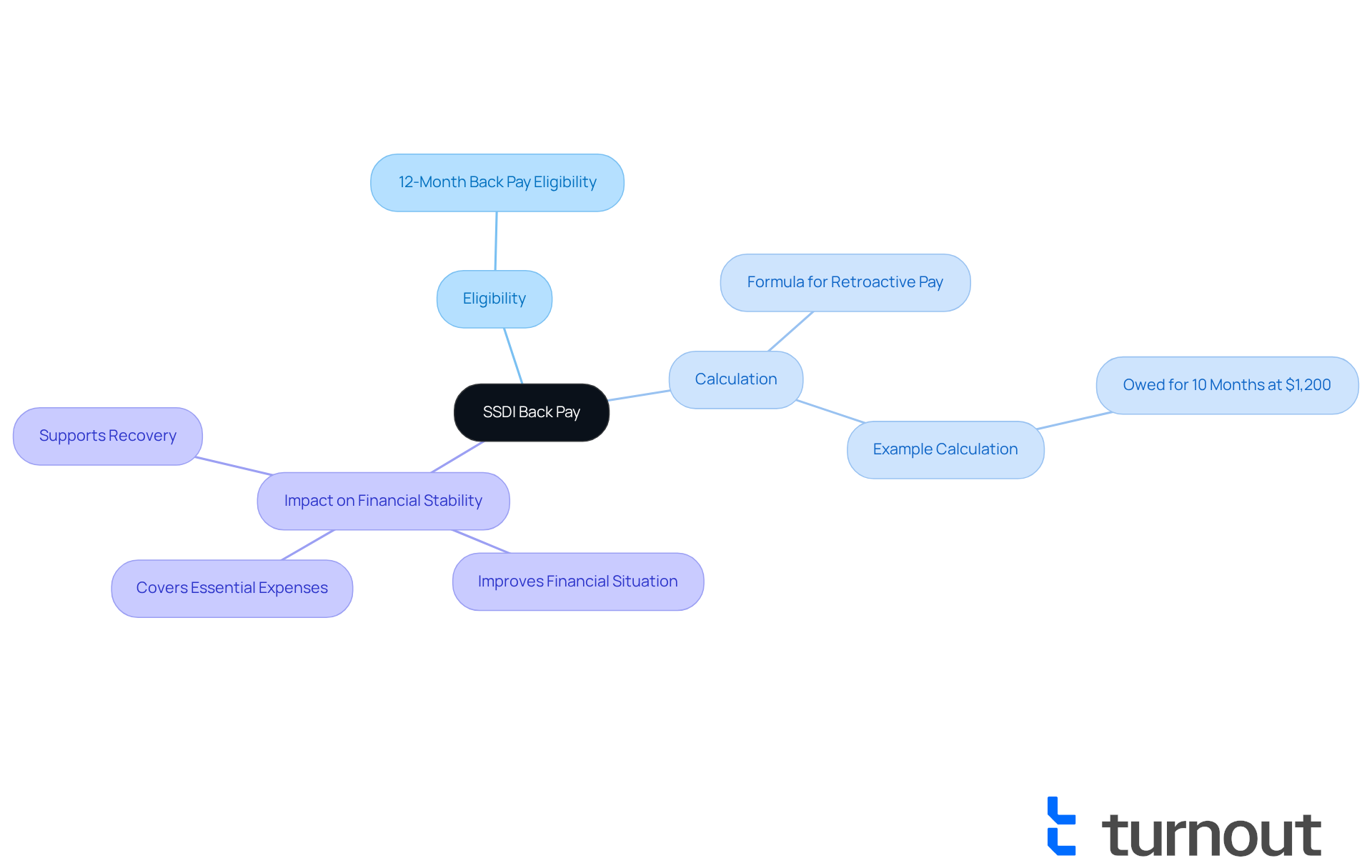

Disability benefits owed retroactively are crucial payments that individuals deserve from the moment their condition begins until their claim is approved. This compensation covers the months when they were eligible for benefits but didn’t receive them. Let’s explore some important aspects of SSDI back pay:

- Eligibility: You may qualify for back pay for up to 12 months before your application date, depending on when your disability started. For many, this can mean receiving significant funds that reflect their needs during a tough time.

- Calculation: The amount of retroactive pay is calculated by multiplying your monthly benefit by the number of months owed, while considering any waiting periods. For instance, if you’re owed benefits for 10 months at a monthly rate of $1,200, you can use an ssdi back pay tax calculator to determine that your retroactive pay would total $12,000, minus any deductions for waiting periods.

- Impact on Financial Stability: Receiving retroactive pay can greatly improve your financial situation, especially if you’re unable to work due to your disability. This lump sum can help cover essential expenses like medical bills and living costs, which can feel overwhelming without support. Each year, many recipients rely on these retroactive payments, underscoring their vital role in financial recovery.

At Turnout, we understand that navigating the SSD claims process can be daunting. That’s why we offer access to trained nonlawyer advocates and various tools designed to assist you. We’re here to empower you with the knowledge and resources you need to secure the financial assistance you deserve, without the complexities of legal representation. Remember, you are not alone in this journey.

Explore the SSDI Back Pay Tax Calculator

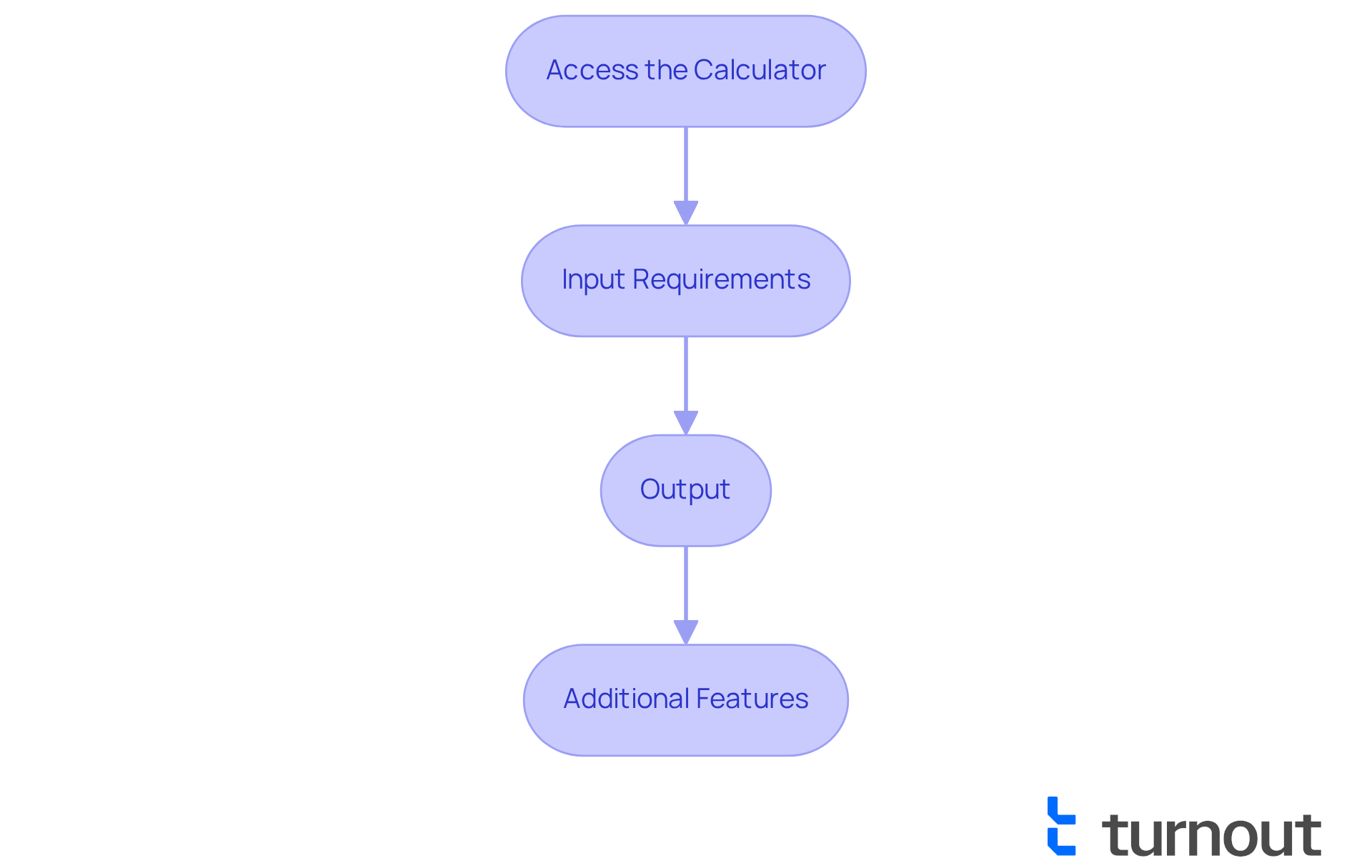

The Disability Insurance Back Pay Tax Calculator is an essential tool for estimating the compensation you may be eligible to receive. We understand that navigating this process can be overwhelming, but we’re here to help you every step of the way. Here’s how to effectively use this valuable resource:

-

Accessing the Calculator: You can find the SSDI back pay calculator on various platforms, including the Social Security Administration's official website and many advocacy organizations dedicated to supporting consumers. Turnout also offers resources to help you better understand the process.

-

Input Requirements: To use the calculator, you typically need to provide your disability onset date, the date you applied for SSDI, and your approved monthly benefit amount. This information is crucial for accurate calculations, and we know it can feel daunting to gather.

-

Output: Once you enter the required information, the calculator will produce an estimate of your overall pay. This estimate is invaluable for understanding what to expect when your claim is approved, allowing for better financial planning. It’s common to feel uncertain about your financial future, but this tool can provide clarity.

-

Additional Features: Some calculators also offer insights into the potential tax consequences of your retroactive pay, which is essential for managing your finances efficiently. SSDI retroactive payments can be considered taxable income, so understanding these implications can help you prepare for any tax obligations that may arise. We recommend consulting a tax professional to navigate these complexities.

Turnout is not a law firm and does not provide legal advice; instead, we utilize trained nonlawyer advocates to assist clients with SSD claims, ensuring you have the support you need throughout the process. Many users have shared how the SSDI back pay tax calculator helped clarify their anticipated back pay amounts, enabling them to make informed decisions about their financial futures. Financial advisors often suggest using these tools to ensure individuals are fully informed about their entitlements and any related tax obligations. In fact, a significant number of disability applicants rely on these calculators to navigate the complexities of their benefits, highlighting their importance in the claims process. Remember, you are not alone in this journey.

Follow Steps to Use the Calculator

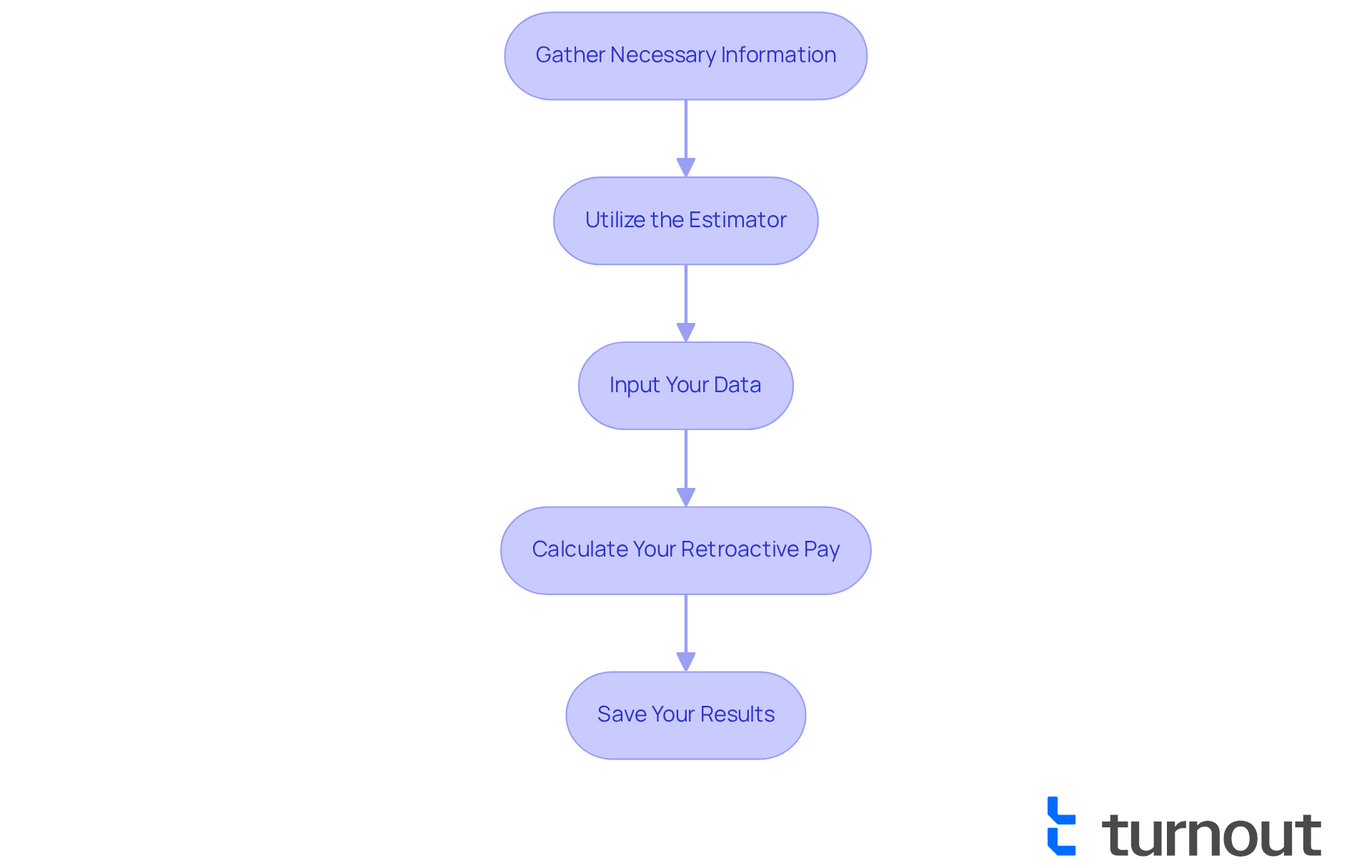

To effectively use the SSDI Back Pay Tax Calculator, follow these essential steps:

-

Gather Necessary Information: Start by collecting your disability onset date, application date, and the approved monthly benefit amount. This information is crucial for making precise calculations using the ssdi back pay tax calculator. Even slight discrepancies can lead to significant differences in your projected compensation.

-

Utilize the Estimator: Look for a trustworthy SSDI retroactive payment estimator online. It’s important to choose one from a reputable source, like the Social Security Administration or a trusted advocacy organization. This ensures the accuracy of the tool you’re using.

-

Input Your Data: Carefully enter the required information into the calculator. Double-check all dates and amounts to avoid common errors that could skew your results. Many users have faced issues due to incorrect entries of the disability onset date or application submission date, which can drastically affect the outcome.

-

Calculate Your Retroactive Pay: After entering your data, click the calculate button to receive your estimated retroactive pay amount. Take a moment to examine the output closely, especially any remarks about possible tax consequences when using the ssdi back pay tax calculator. Remember, disability compensation may be subject to federal income tax depending on your overall earnings for the year.

-

Save Your Results: It’s wise to save or print the results for your records. This information can be invaluable for future reference or discussions with financial advisors, especially as you navigate the complexities of managing your benefits.

Real-life examples show that precise calculations can lead to significant financial relief. For instance, someone with a monthly disability benefit of $1,580 could potentially receive around $9,600 in back pay for an eight-month duration. Consulting with advocates can further enhance your understanding of the calculation process and help you avoid common pitfalls.

We understand that this process can feel overwhelming, but you are not alone in this journey. We're here to help you every step of the way.

Troubleshoot Common Issues

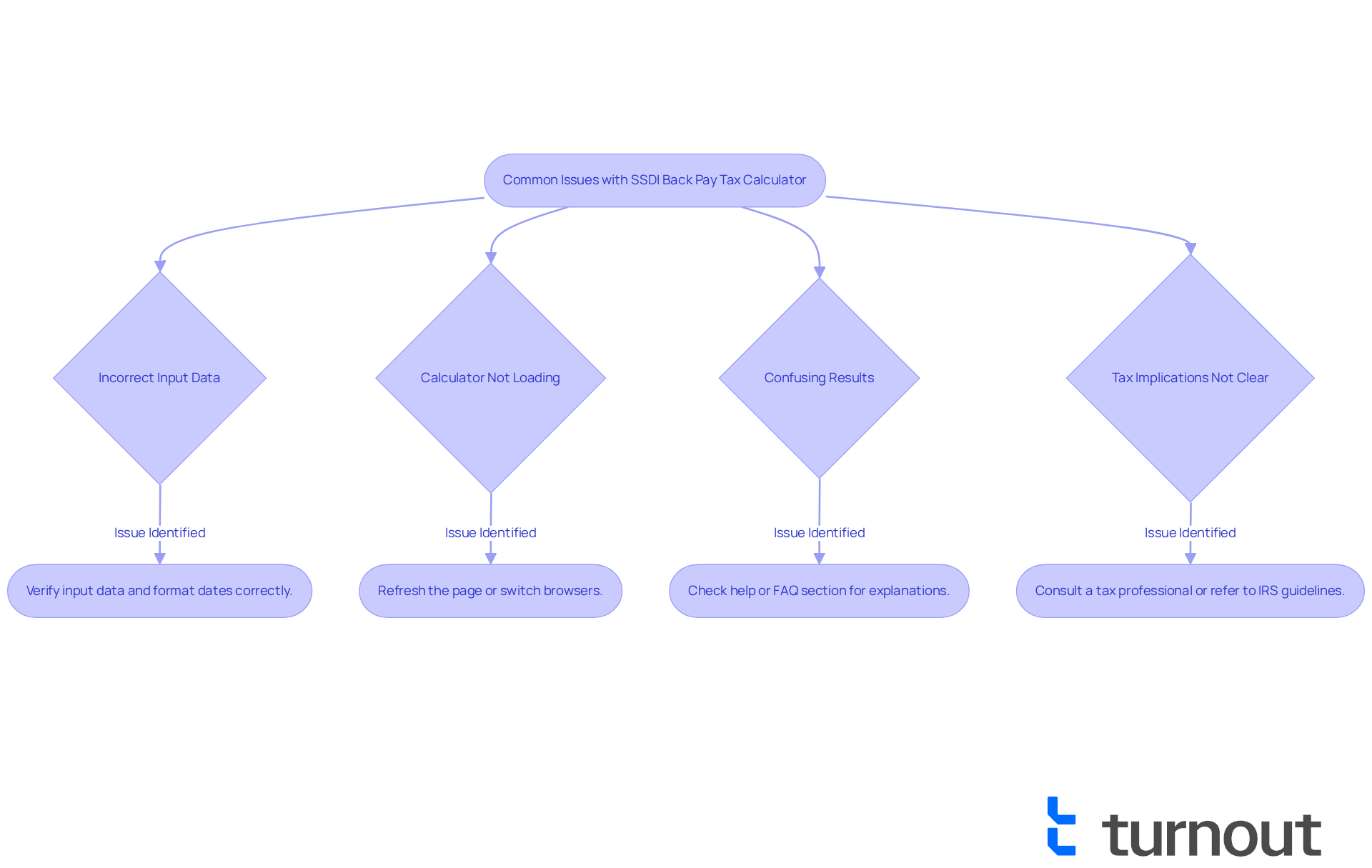

Navigating the ssdi back pay tax calculator can sometimes feel overwhelming. We understand that you might encounter a few common issues along the way. Here’s how to troubleshoot them effectively, ensuring you feel supported throughout the process:

- Incorrect Input Data: If the calculator gives you unexpected results, take a moment to verify the information you entered. It’s crucial to ensure that your disability onset date and application date are accurate and formatted correctly. Even small errors in these dates can significantly affect your calculations.

- Calculator Not Loading: If the tool isn’t loading, don’t worry! Try refreshing the page or switching to a different web browser. Technical issues often arise from browser compatibility, and a simple change can resolve the problem.

- Confusing Results: If the output leaves you puzzled, look for a help or FAQ section on the tool's website. Many calculators provide explanations for their calculations and clarify any assumptions made, which can help demystify the results.

- Tax Implications Not Clear: If you’re uncertain about the tax consequences of your previous pay, it’s wise to consult a tax professional or refer to IRS guidelines regarding SSDI benefits. Understanding how retroactive pay may influence your tax situation is essential for effective financial planning. Remember, tax professionals often highlight that back pay can complicate your tax return, so seeking expert advice is a smart move.

By following these troubleshooting steps, you can confidently address common issues related to the SSDI back pay tax calculator. Remember, you’re not alone in this journey, and we’re here to help you receive accurate estimates for your benefits.

Conclusion

Understanding the complexities of SSDI back pay is crucial for anyone facing the challenges of disability benefits. We know that navigating this process can feel overwhelming, but this guide is here to help you. It highlights the significance of retroactive payments, the eligibility criteria, and how to effectively use the SSDI back pay tax calculator. By mastering these elements, you can ensure you receive the financial assistance you deserve during tough times.

Key insights include:

- How retroactive pay is calculated

- The substantial impact these payments can have on your financial stability

It’s important to utilize reliable tools to estimate your potential compensation. Our step-by-step approach to using the calculator, along with solutions for common issues, empowers you to take control of your financial future with confidence.

Ultimately, being informed about SSDI back pay and its tax implications is vital for effective financial planning. We encourage you to leverage available resources and seek guidance when needed. Remember, you’re not alone in this journey. Embracing the knowledge shared here can lead to better financial outcomes, ensuring that those eligible for SSDI benefits are fully prepared to manage their entitlements and any related tax obligations.

You deserve support and clarity as you navigate this process. Let’s take these steps together.

Frequently Asked Questions

What is SSDI back pay?

SSDI back pay refers to disability benefits owed retroactively to individuals from the moment their condition began until their claim is approved. It compensates for the months when they were eligible for benefits but did not receive them.

Who is eligible for SSDI back pay?

Individuals may qualify for SSDI back pay for up to 12 months before their application date, depending on when their disability started.

How is SSDI back pay calculated?

The amount of retroactive pay is calculated by multiplying your monthly benefit by the number of months owed, while considering any waiting periods. For example, if you are owed benefits for 10 months at a monthly rate of $1,200, your retroactive pay would total $12,000, minus any deductions for waiting periods.

How does receiving SSDI back pay impact financial stability?

Receiving retroactive pay can significantly improve financial situations for those unable to work due to their disability. This lump sum can help cover essential expenses such as medical bills and living costs, providing crucial support during difficult times.

What resources are available for navigating the SSD claims process?

Turnout offers access to trained nonlawyer advocates and various tools designed to assist individuals in the SSD claims process, empowering them with knowledge and resources to secure the financial assistance they deserve.