Overview

This article serves as a comprehensive guide on how to effectively use the SSDI back pay calculator. We understand that estimating the compensation owed to you from Social Security Disability Insurance (SSDI) can be overwhelming. It is crucial to enter key details accurately, such as the onset of your disability and the dates you submitted your application. By doing so, you can gain a clearer picture of what to expect.

We provide supportive examples and statistics that illustrate potential back pay amounts. These insights can significantly impact your financial planning. Remember, precise calculations can make a difference in your financial security. You're not alone in this journey; we're here to help you navigate through it.

Introduction

Navigating the complexities of Social Security Disability Insurance (SSDI) can feel overwhelming. Many individuals face challenges in understanding the financial support available through back pay. The SSDI back pay calculator is here to help. It serves as a vital tool, allowing applicants to estimate the compensation owed from the onset of their disability until their application is approved.

However, we understand that while this calculator provides clarity, many potential beneficiaries may still grapple with its intricacies and the various factors influencing their back pay amount. It's common to feel uncertain about how to maximize benefits and accurately navigate this essential resource. Remember, you are not alone in this journey. We’re here to help you every step of the way.

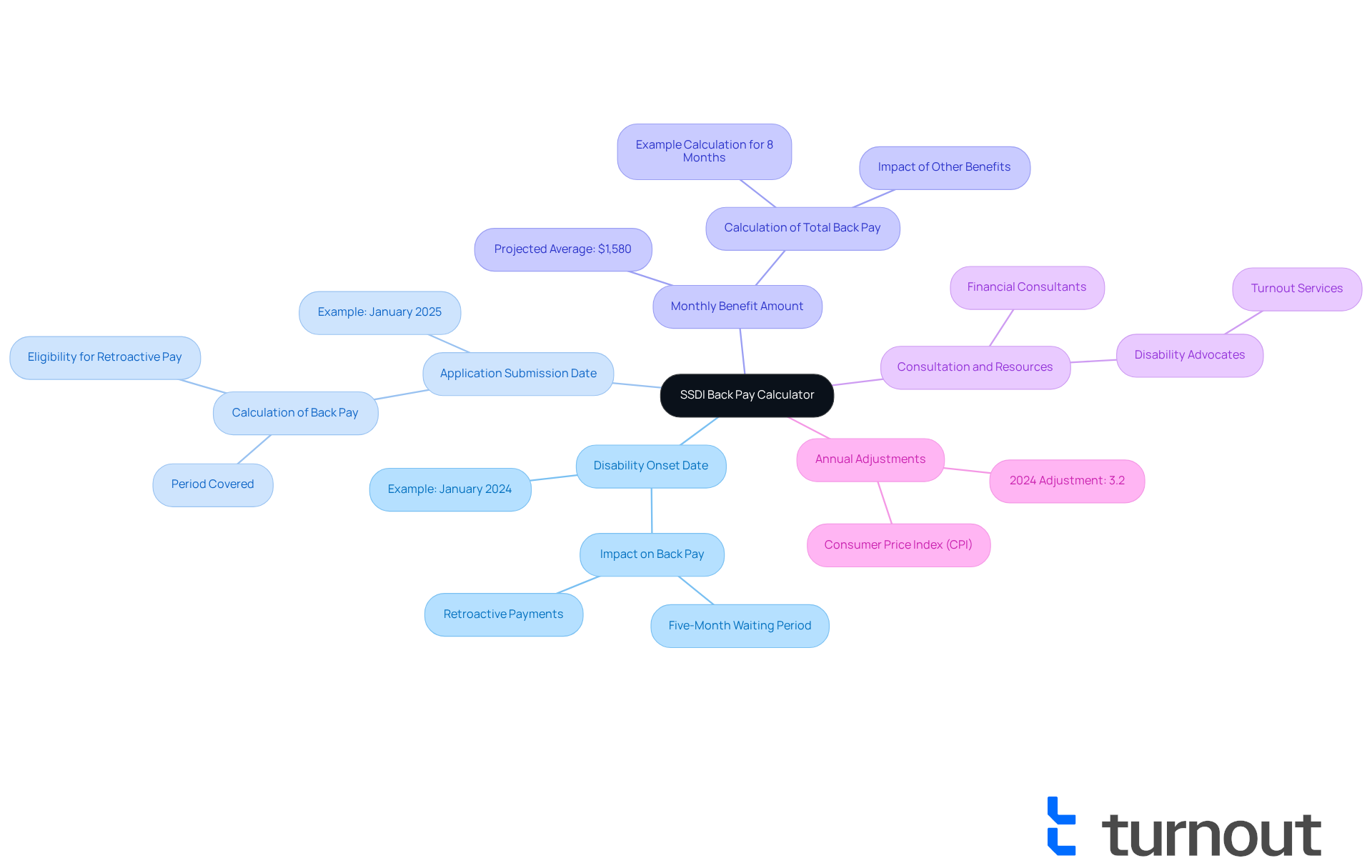

Understand the SSDI Back Pay Calculator

The is an essential tool for individuals estimating the compensation they may receive from Insurance (SSDI). Back pay represents the compensation owed from the onset of your disability until your application is approved. Understanding how to use the ssdi back pay calculator is vital for SSDI applicants, as it highlights the financial support they can expect.

This calculator considers several key factors, including:

- When your disability began

- When you submitted your application

- The monthly benefit amount you qualify for

For example, if your disability onset date is January 2024 and your application is approved in January 2025, you could receive back pay for the months leading up to your approval.

In 2025, the average disability payment is projected to be around $1,580 per month, translating to approximately $9,600 in back pay for an eight-month period. This figure underscores the importance of accurately determining your eligibility and .

the value of using the SSDI back pay calculator to gain a clearer understanding of potential benefits. They encourage applicants to familiarize themselves with the components involved in the calculation to enhance their understanding and preparedness. Consulting with a , such as those provided by Turnout, can also help with , offering valuable guidance throughout the process. Turnout's trained nonlegal advocates are here to assist clients in navigating the , ensuring they understand their rights and the benefits available to them.

Recent updates indicate that disability payments are recalculated annually based on the Consumer Price Index (CPI), which can affect the amount of retroactive payments granted. For instance, in 2024, disability assistance increased by 3.2%, highlighting the ongoing adjustments to adequately support recipients. Additionally, it’s important to remember that there is a before benefits can begin, which does not count towards back pay.

By staying informed and utilizing the ssdi back pay calculator, applicants can better navigate the complexities of the disability support system and secure the financial assistance they need.

Please remember that Turnout is not a law firm, and the services provided do not constitute legal advice. Using our services does not establish an attorney-client relationship.

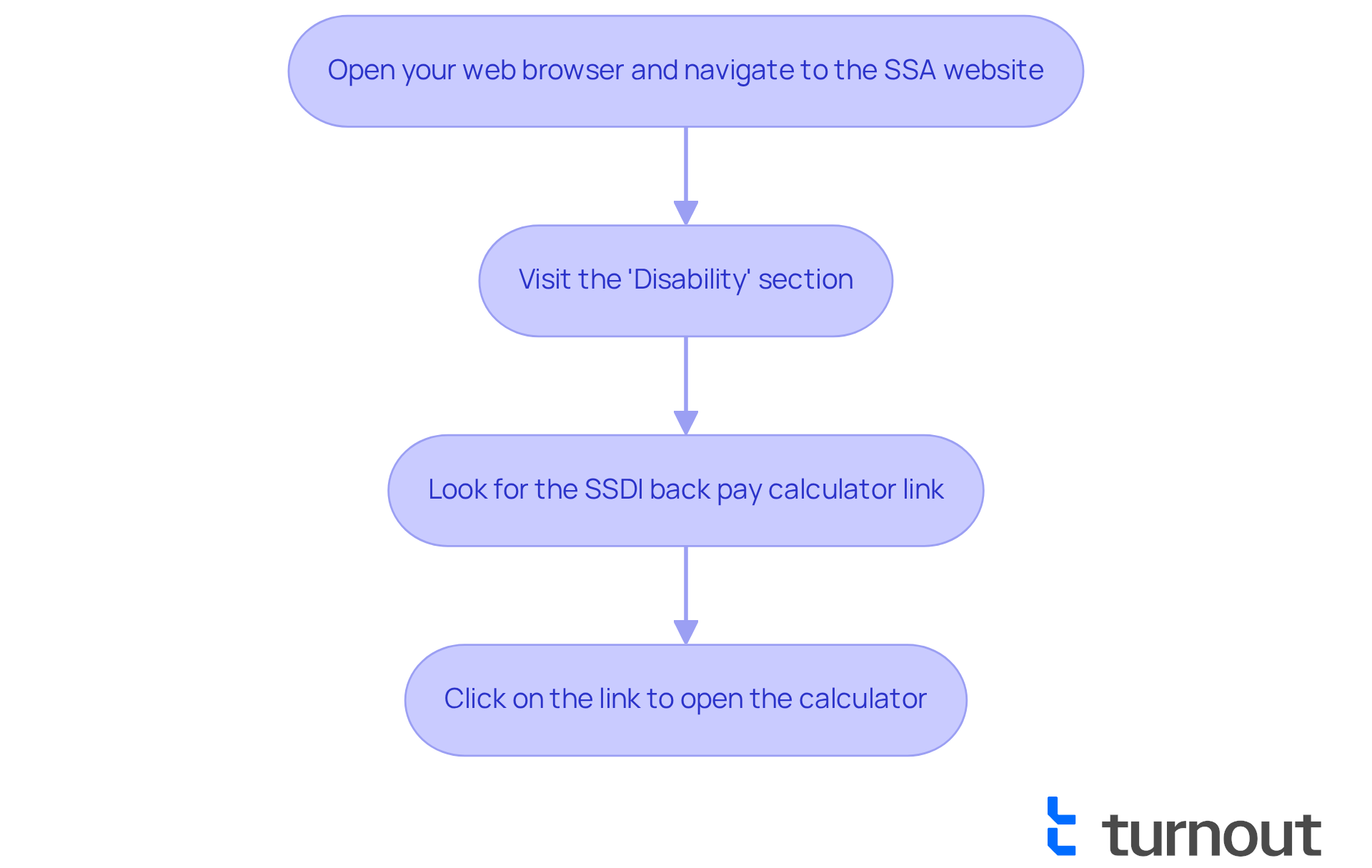

Access the SSDI Back Pay Calculator

We understand that navigating the process of can be overwhelming. To assist you, we’ve outlined the steps to access the calculator for Insurance.

- Open your web browser and navigate to the .

- Visit the 'Disability' section, where you will find various resources related to .

- Look for the link to the [SSDI back pay calculator](https://impactdisabilitylaw.com/ssdi-back-pay-calculator), which is typically found under the tools or resources section for applicants.

- Click on the link to open the calculator.

It's important to ensure you have a stable internet connection for a smooth experience. Once you access the SSDI back pay calculator, you can input your information to start the calculation process. Remember, we're here to help you through this journey.

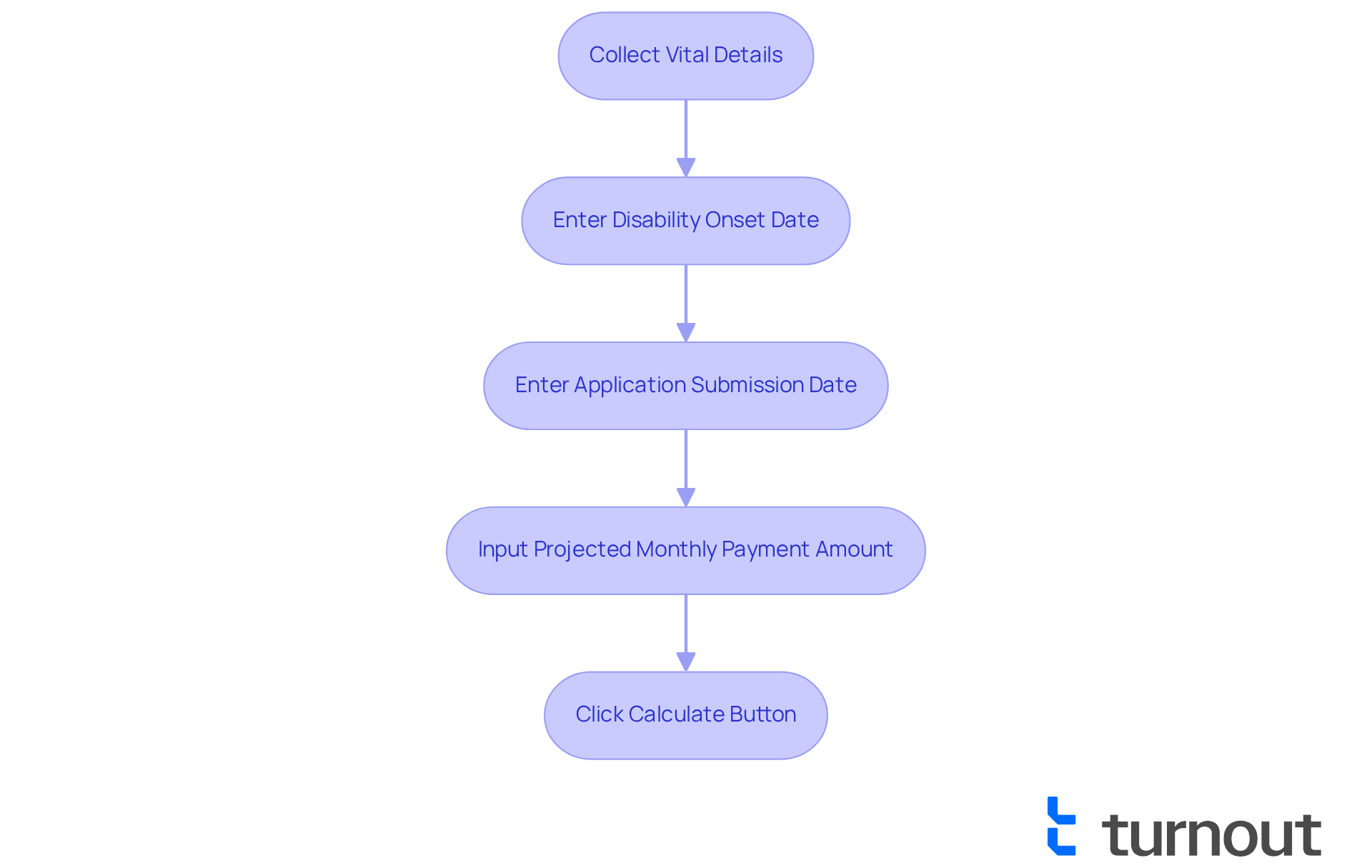

Calculate Your SSDI Back Pay Amount

Determining your back pay amount can feel overwhelming, but using an can help. Follow these simple steps to make the process easier for you:

- Start by collecting vital details, such as your , the date you submitted your SSDI application, and your . These details are essential for using the SSDI back pay calculator accurately.

- Enter your moment of disability onset into the designated field on the calculator. This moment is significant, as it indicates when you became qualified for assistance.

- Next, enter the date you submitted your . This information helps the calculator determine how long you are owed back pay.

- Finally, input your projected monthly payment amount, which you can usually find in your Social Security Disability Insurance award letter or by using the SSA's payment estimator.

- Once all the information is entered, click the 'Calculate' button. The SSDI back pay calculator will give you an estimate of your amount, helping you plan your finances accordingly.

Precise data is essential in disability benefit calculations. Small mistakes can lead to significant differences in back pay sums calculated by an SSDI back pay calculator. For instance, the (SSA) allows a maximum of 80% of your average earnings prior to disability from SSDI and other public disability assistance combined. Therefore, ensuring that your earnings history is correct is crucial for the accuracy of the SSDI back pay calculator.

Real-world examples illustrate the importance of precise calculations. If your established onset period (EOP) is January 1, 2023, and your application submission is January 1, 2024, the total back pay calculated amounts to 19 months, accounting for the five-month waiting period. This highlights the necessity of keeping and application dates to maximize your entitled benefits when using an SSDI back pay calculator.

As Lorraine Netter notes, "How much back pay you're owed depends on several different factors, including the type of disability benefits you'll receive, when you became disabled, and how long you waited for a decision." Remember, you are not alone in this journey, and taking these steps can bring you closer to the support you need.

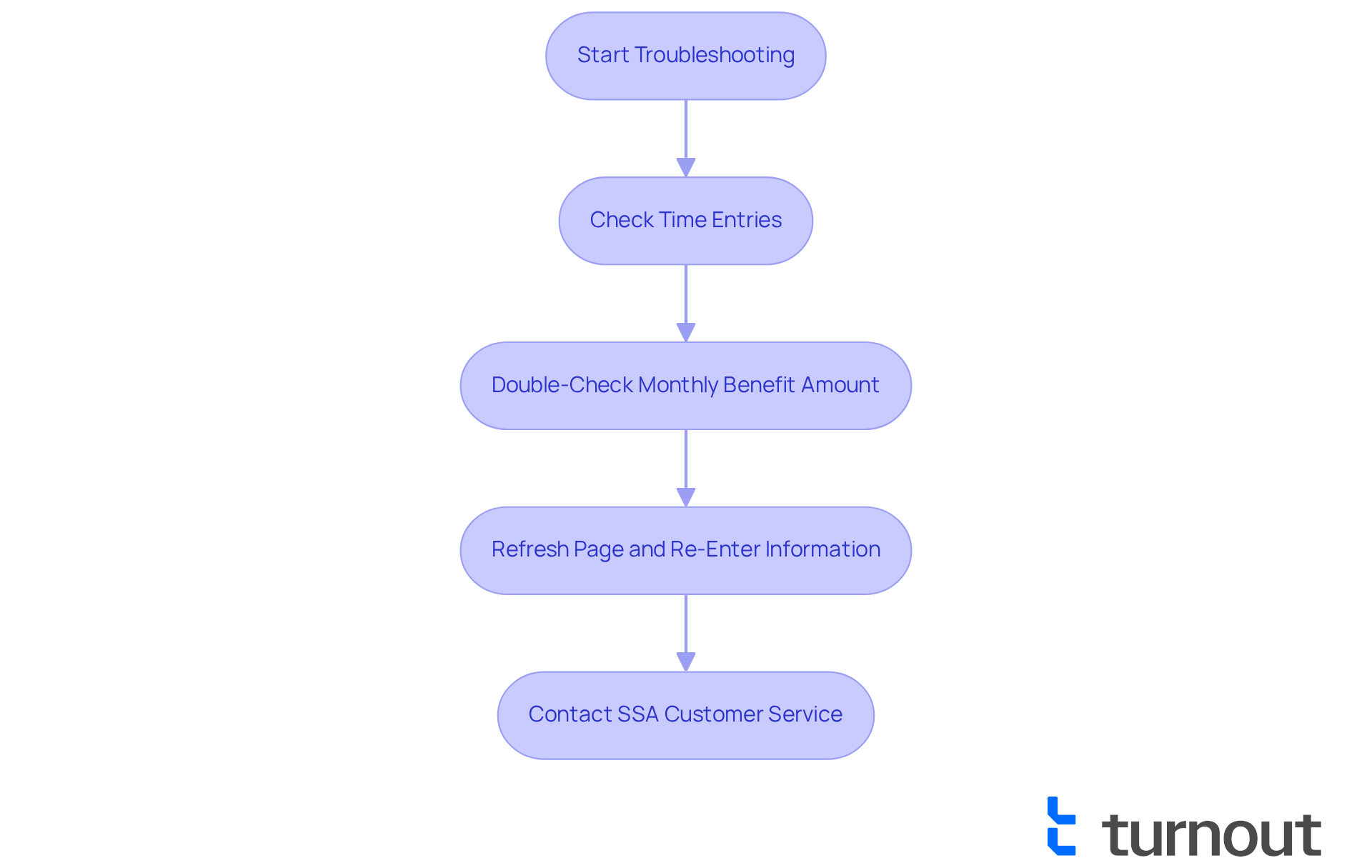

Troubleshoot Common Calculation Issues

We understand how frustrating it can be if you encounter issues while using the . Here are some to help you navigate these challenges:

- Ensure that all entries for time are precise and in the appropriate format. Incorrect dates can lead to erroneous calculations, which can be disheartening.

- Double-check your ; if you are unsure, refer to your or the SSA's benefit estimator. Knowing your benefits is crucial for .

- If the calculator does not seem to provide results, try refreshing the page and re-entering your information. can occur, and a simple refresh may resolve the issue.

- If problems persist, please reach out to the SSA's at 1-800-772-1213 for assistance. They are there to provide guidance and help resolve any issues you may face.

Statistics indicate that over $7.5 billion has been paid in through March 4, 2025, with an average retroactive payment of $6,710. This highlights the importance of and system reliability. Many individuals have successfully resolved their calculator problems by following these steps, which helps them accurately use the ssdi back pay calculator to estimate their back pay. Remember, you are not alone in this journey, and we’re here to help you every step of the way.

Conclusion

Understanding the SSDI back pay calculator is essential for anyone applying for Social Security Disability Insurance benefits. This tool not only helps estimate the financial support owed from the onset of a disability until the approval of an application, but it also empowers you to navigate the complexities of the disability support system with confidence. By grasping how the calculator works, you can gain a clearer picture of what to expect in terms of back pay compensation.

We recognize that navigating this process can be overwhelming. Key factors influencing the back pay calculation include:

- The date of disability onset

- The application submission date

- The monthly benefit amount

Real-world examples illustrate how precise data entry can significantly affect the total back pay amount, emphasizing the importance of keeping accurate records. Furthermore, we offer troubleshooting tips to help you overcome common issues encountered while using the calculator, ensuring a smoother experience.

In conclusion, utilizing the SSDI back pay calculator is not merely a step in the application process; it is a vital tool for securing the financial assistance you need during challenging times. By staying informed and proactive, you can maximize your benefits and effectively plan for your future. Engaging with resources such as disability advocates can further enhance your understanding and support throughout this journey. Remember, accurate calculations and informed decisions are key to accessing the benefits you deserve. You are not alone in this journey; we’re here to help.

Frequently Asked Questions

What is the SSDI back pay calculator?

The SSDI back pay calculator is a tool that helps individuals estimate the compensation they may receive from Social Security Disability Insurance (SSDI) for the time between the onset of their disability and the approval of their application.

What factors does the SSDI back pay calculator consider?

The calculator considers the following key factors: the date when your disability began, the date you submitted your application, and the monthly benefit amount you qualify for.

How is back pay calculated?

Back pay is calculated based on the number of months between the onset of your disability and the approval of your application, multiplied by the monthly benefit amount. For example, if your disability began in January 2024 and your application was approved in January 2025, you could receive back pay for the months leading up to your approval.

What is the average disability payment amount?

In 2025, the average disability payment is projected to be around $1,580 per month, which could result in approximately $9,600 in back pay for an eight-month period.

Why is it important to use the SSDI back pay calculator?

Using the SSDI back pay calculator helps applicants understand their potential benefits, ensuring they are aware of the financial support they can expect and enhancing their preparedness for the application process.

How can applicants get assistance with back pay calculations?

Applicants can consult with disability advocates, such as those provided by Turnout, who can offer guidance and support throughout the process of calculating back pay and navigating the disability support system.

Are there any recent updates regarding disability payments?

Yes, disability payments are recalculated annually based on the Consumer Price Index (CPI), which can affect retroactive payments. For instance, in 2024, disability assistance increased by 3.2%.

Is there a waiting period for SSDI benefits to begin?

Yes, there is a five-month waiting period before SSDI benefits can begin, and this waiting period does not count towards back pay.

Does Turnout provide legal advice regarding SSDI applications?

No, Turnout is not a law firm, and the services provided do not constitute legal advice. Using their services does not establish an attorney-client relationship.