Introduction

Navigating the complexities of tax forms can feel like an uphill battle. We understand that when it comes to the Schedule R tax form, the stakes are high. This form is crucial for claiming the Credit for the Elderly or Disabled, which offers much-needed financial relief to eligible individuals. Yet, many people remain unaware of the specific requirements or the documentation needed to file successfully.

It's common to feel overwhelmed by the process. What if you miss out on potential benefits? This guide is here to help. We aim to demystify the Schedule R tax form, offering step-by-step instructions and troubleshooting tips. You are not alone in this journey; we’re here to empower you in your pursuit of financial support.

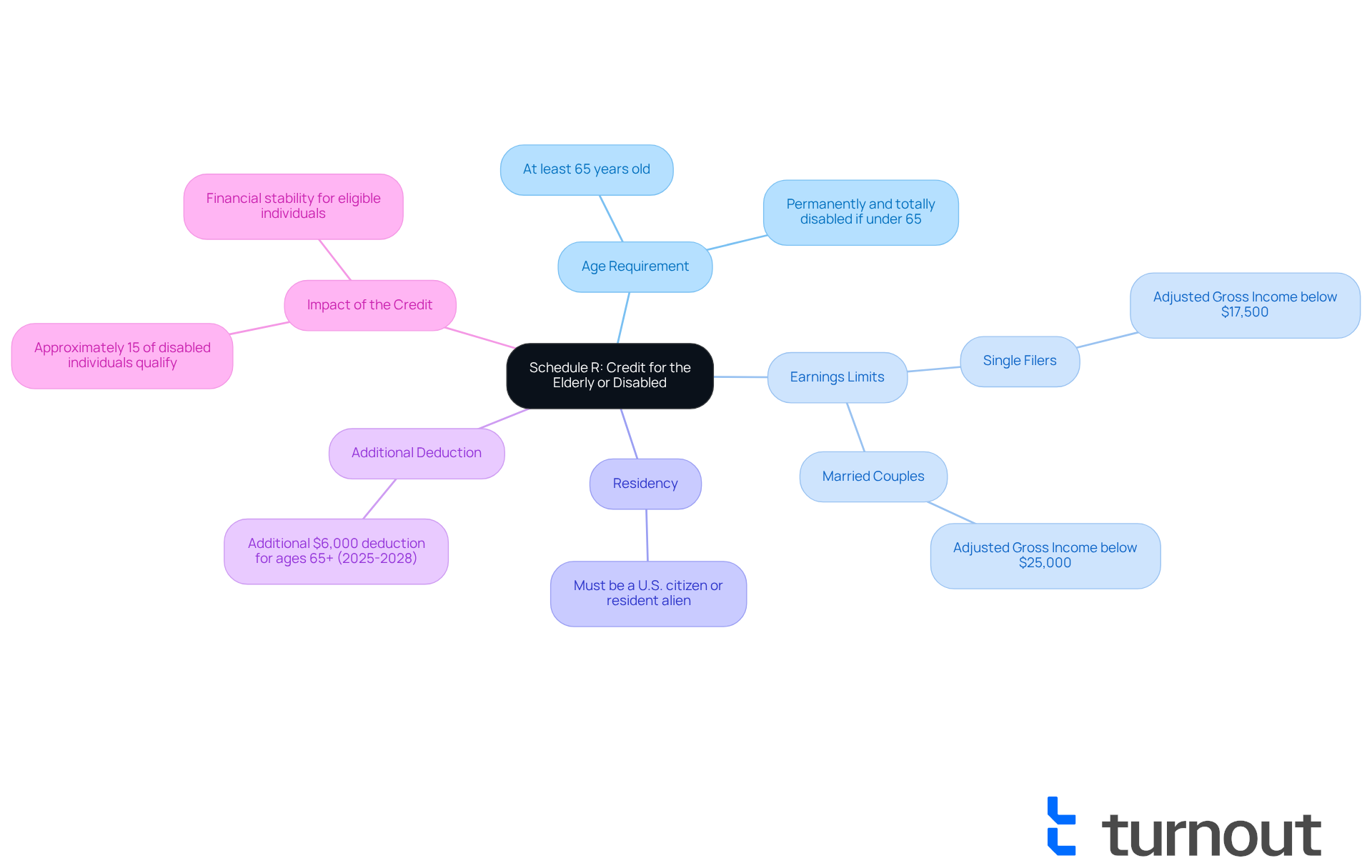

Understand Schedule R: Purpose and Eligibility Criteria

The schedule R tax form is essential for helping you claim the Credit for the Elderly or Disabled. This credit is designed to provide financial relief to those who truly need it. We understand that navigating tax forms can be overwhelming, but knowing the eligibility criteria can make a significant difference.

To qualify for this credit, you need to meet a few specific requirements:

- Age Requirement: You must be at least 65 years old by the end of the tax year. If you’re under 65, you should be permanently and totally disabled.

- Earnings Limits: Your earnings must be below certain thresholds, which vary depending on your filing status. For 2025, single filers need an adjusted gross income below $17,500, while married couples filing jointly must stay under $25,000. These limits are set to ensure that those who need assistance can access it.

- Residency: You must be a U.S. citizen or resident alien.

From 2025 through 2028, individuals aged 65 and older can also claim an additional deduction of $6,000. This can provide even more support for those eligible for the benefit.

Did you know that approximately 15% of disabled individuals qualify for the Credit for the Elderly or Disabled? This highlights how crucial this credit is in providing support. Turnout offers tools and services, including trained non-lawyer advocates, to help you navigate these processes. We’re here to ensure you can access the benefits you deserve without needing legal representation. Many consumers have successfully obtained this benefit, significantly impacting their financial stability. One individual shared that claiming the benefit allowed them to cover essential medical costs, showcasing its potential advantages.

Understanding these eligibility criteria is essential before gathering your documentation and completing the form. This knowledge can help you avoid unnecessary work if you don’t qualify for the credit. Tax specialists emphasize that being informed about the schedule R tax form can lead to better financial outcomes for those who qualify. Remember, you are not alone in this journey; Turnout is here to help ease the process.

Gather Required Documentation for Schedule R Filing

To successfully complete the schedule R tax form, it is important to have your documentation organized and ready. We understand that gathering these documents can feel overwhelming, but we’re here to help you through it.

- Personal Information: Make sure you have your Social Security number handy, along with your spouse's if applicable.

- Proof of Age or Disability: Acceptable documents include a birth certificate, Social Security card, or a physician's letter confirming your disability status. It’s common to feel challenged when collecting these documents; approximately 30% of disabled individuals report difficulties in this area. Careful preparation can make a big difference.

- Income Statements: Gather your W-2 forms, 1099 forms, and any other income documentation to verify your total income for the year.

- Tax Returns: Previous year’s tax returns can provide valuable context for your current filing.

- Other Relevant Documents: Don’t forget to include any additional documentation that supports your claim for the credit, such as proof of disability benefits received.

Arranging these documents not only simplifies the completion of the schedule R tax form but also aligns with IRS updates for 2025, ensuring that you meet all filing requirements. Expert advice suggests maintaining a digital folder for these documents to avoid last-minute scrambles during tax season. This proactive approach can significantly reduce stress and improve accuracy in your filing process. Remember, you are not alone in this journey; we’re here to support you every step of the way.

Complete the Schedule R Form: Step-by-Step Instructions

Completing the schedule r tax form can feel overwhelming, but we're here to assist you through the process. By following these steps, you can navigate the process with confidence and ease:

-

Download the schedule r tax form: Start by obtaining the latest version from the IRS website. This is your first step toward securing the benefits you deserve.

-

Fill Out Personal Information: At the top of the form, enter your name, address, and Social Security number. This information is essential for processing your claim.

-

Determine Eligibility: In Part I, check the box that applies to you-whether you’re claiming the benefit based on age or disability. Remember, to qualify, you need to be at least 65 years old by the end of the tax year or permanently disabled, as certified by a physician. It’s common to have questions about this, so don’t hesitate to reach out for clarification if needed.

-

Determine Your Funds: Use the worksheet included in the guidelines to assess your funds based on your earnings and filing status. This involves:

- Listing your total income, including any taxable disability income.

- Checking if you meet the income thresholds for the benefit, which can significantly affect the amount you might request.

-

Complete Part II: If you’re claiming based on disability, fill out Part II. This section may require additional information about your disability status. Make sure you have the necessary documentation, like a physician's statement, to support your claim. We understand that gathering this information can be daunting, but it’s crucial for your application.

-

Review and Sign: Take a moment to double-check all entries for accuracy. Mistakes can lead to delays or penalties, and tax professionals emphasize the importance of precision here. You’re not alone in this; many people find this step challenging, but it’s vital for a smooth process.

-

Attach to Your Tax Return: Finally, include Form R with your Form 1040 or 1040-SR when you submit your tax return. This ensures that your request for reimbursement is handled accurately.

By following these steps carefully, you can enhance your chances of successfully obtaining the credit available through the schedule r tax form. This credit can provide substantial financial assistance for those who qualify, and we want you to feel empowered in this journey.

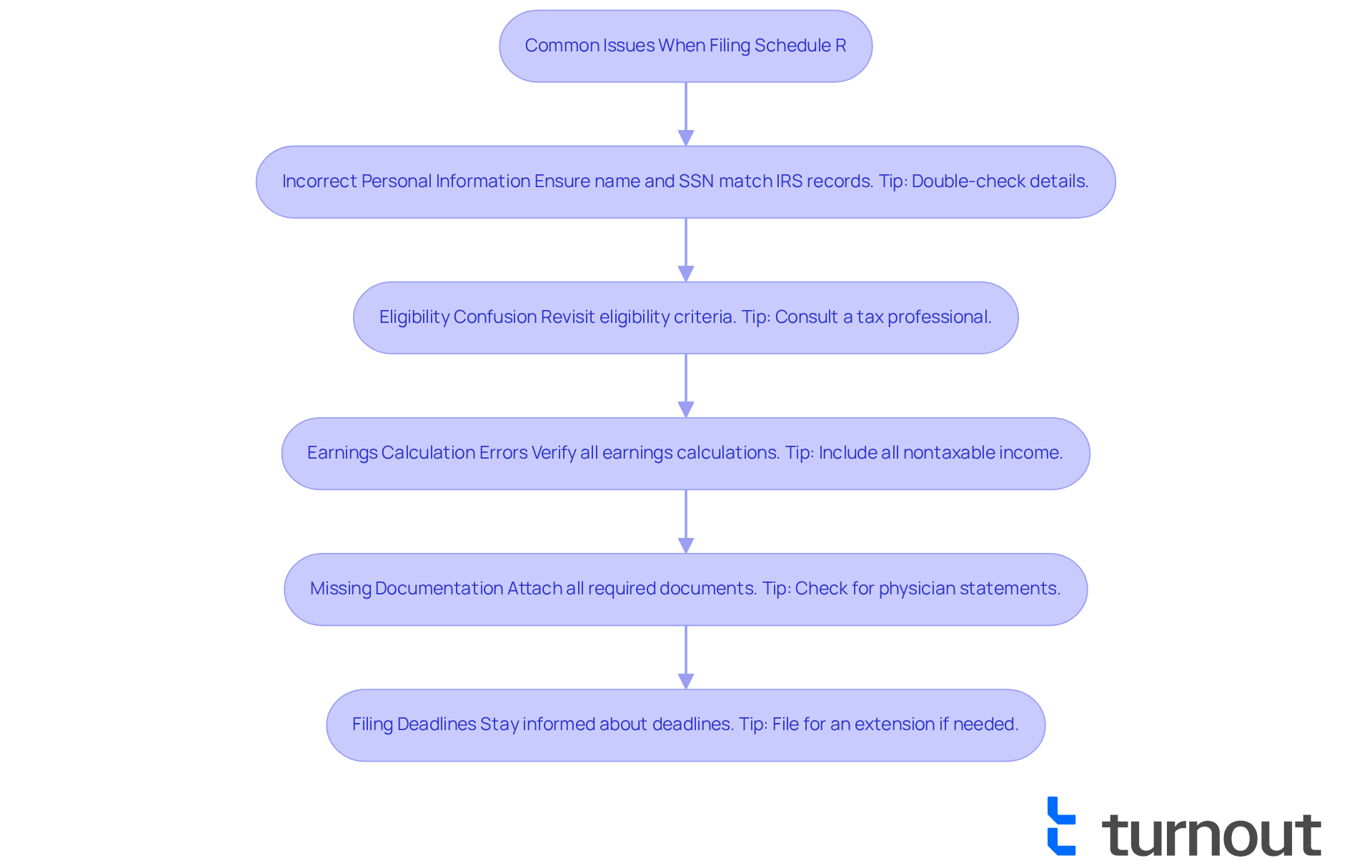

Troubleshoot Common Issues When Filing Schedule R

Filing the Schedule R tax form can feel overwhelming, and it's common to encounter a few bumps along the way. Here are some common issues that may arise:

-

Incorrect Personal Information: It’s crucial to ensure that your name and Social Security number match exactly with IRS records. Discrepancies can lead to significant processing delays. In fact, studies show that nearly 30% of Schedule R tax form claims are delayed due to incorrect personal information. Remember, accuracy in your personal details is vital for timely processing.

-

Eligibility Confusion: If you’re unsure about your eligibility, take a moment to revisit the criteria outlined in the initial sections. Consulting a tax professional can provide clarity and help you avoid unnecessary mistakes. As Senior Tax Advisor Marylyn wisely notes, "Understanding the eligibility requirements is key to successfully claiming benefits."

-

Earnings Calculation Errors: Carefully verify your earnings calculations. Omitting revenue sources or miscalculating totals can jeopardize your eligibility for the benefit. Tax professionals emphasize the importance of accurate reporting on the Schedule R tax form to maximize your potential benefits. A common mistake is failing to include all nontaxable income, which can impact your overall credit.

-

Missing Documentation: Make sure all required documents are attached to your filing. Missing documentation can lead to claim denials, so double-check that you’ve included everything necessary, such as physician statements for disability claims. This is a frequent oversight that can easily be avoided.

-

Filing Deadlines: Staying informed about filing deadlines is essential to avoid late penalties. If you miss the deadline, you may need to file for an extension, which can complicate your situation further.

If you encounter any issues, please don’t hesitate to reach out to a tax professional or the IRS for assistance. We understand that navigating these common problems can be stressful, but being proactive can save you time and reduce anxiety during tax season. Remember, you are not alone in this journey; we're here to help!

Conclusion

Mastering the Schedule R tax form is essential for those eligible to claim the Credit for the Elderly or Disabled. This form can provide crucial financial support, and we understand that navigating it can feel overwhelming. By understanding the eligibility criteria, gathering the necessary documentation, and following a structured approach, you can tackle this process with confidence.

Let’s break it down. First, it’s important to know the specific age and income requirements for eligibility. Organizing your personal and financial documents is key. We’ve outlined step-by-step instructions for accurately filling out the form, ensuring you have everything you need at your fingertips.

However, it’s common to encounter pitfalls, such as incorrect personal information or missing documentation. This highlights the importance of careful attention to detail. Remember, you’re not alone in this journey; many have faced similar challenges.

Ultimately, being well-informed about the Schedule R tax form not only makes filing smoother but also maximizes your potential benefits. If you meet the criteria, taking the time to understand and properly complete this form can lead to significant financial relief. We encourage you to seek assistance when needed and to utilize available resources effectively. You deserve this support, and we’re here to help.

Frequently Asked Questions

What is the purpose of the Schedule R tax form?

The Schedule R tax form is used to claim the Credit for the Elderly or Disabled, providing financial relief to those who need it.

What are the eligibility criteria for claiming the Credit for the Elderly or Disabled?

To qualify for the credit, you must meet the following criteria: be at least 65 years old by the end of the tax year or be permanently and totally disabled if under 65; have earnings below specific thresholds based on your filing status; and be a U.S. citizen or resident alien.

What are the earnings limits for the Credit for the Elderly or Disabled in 2025?

For 2025, single filers must have an adjusted gross income below $17,500, while married couples filing jointly must have an income under $25,000.

Is there an additional deduction available for individuals aged 65 and older?

Yes, from 2025 through 2028, individuals aged 65 and older can claim an additional deduction of $6,000.

What percentage of disabled individuals qualify for the Credit for the Elderly or Disabled?

Approximately 15% of disabled individuals qualify for the Credit for the Elderly or Disabled.

How can Turnout assist individuals in navigating the Schedule R tax form process?

Turnout offers tools and services, including trained non-lawyer advocates, to help individuals navigate the process of claiming the benefit without needing legal representation.

Why is it important to understand the eligibility criteria before completing the Schedule R form?

Understanding the eligibility criteria can help you avoid unnecessary work if you do not qualify for the credit, leading to better financial outcomes for those who are eligible.