Introduction

Navigating the complexities of tax forms can feel overwhelming, especially when you're trying to access the Credit for the Elderly or Disabled through Schedule R Form 1040. We understand that this essential form not only offers significant financial relief but also requires a clear grasp of eligibility criteria and documentation needs. It’s common to feel daunted by the process, particularly when the stakes are high.

This guide is here to help you master Schedule R, step by step. We want to ensure that you can confidently access the benefits you deserve while steering clear of common pitfalls along the way. Remember, you are not alone in this journey; we’re here to support you.

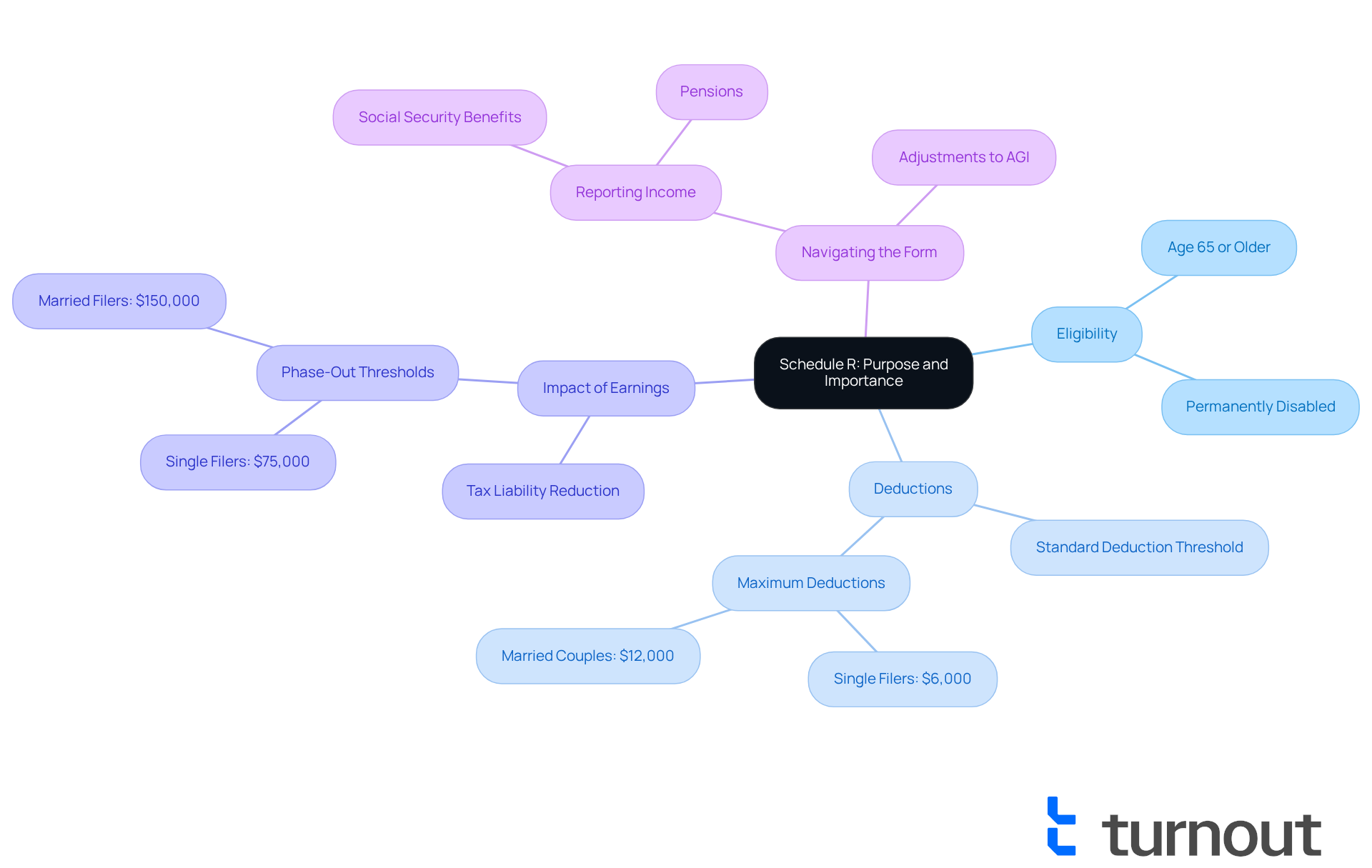

Understand Schedule R: Purpose and Importance

Schedule R Form 1040 is an essential resource for eligible taxpayers looking to calculate the Credit for the Elderly or Disabled. This credit can significantly reduce your tax liability and provide much-needed financial support. If you’re 65 or older, or if you’re under 65 and permanently and totally disabled, this benefit is for you.

We understand that navigating tax forms can be overwhelming. For example, consider Avery, who has total earnings of $48,000. Unfortunately, they may not qualify for the additional $12,000 deduction for seniors because their earnings fall below the standard deduction threshold. However, in 2025, the credit will still offer vital relief, allowing for a maximum deduction of $6,000 for qualifying individuals, and up to $12,000 for married couples where both spouses qualify.

It's common to feel uncertain about how these deductions work, especially since they phase out for taxpayers with modified adjusted gross earnings above $75,000. This modification can be particularly beneficial for those with limited earnings or high medical expenses, potentially leading to larger refunds or lower taxes owed.

Form R includes sections for reporting earnings and adjustments to help determine your adjusted gross income (AGI). By mastering the schedule r form 1040, you can confidently navigate the complexities involved in tax preparation. Remember, you’re not alone in this journey; we’re here to help you maximize your financial benefits.

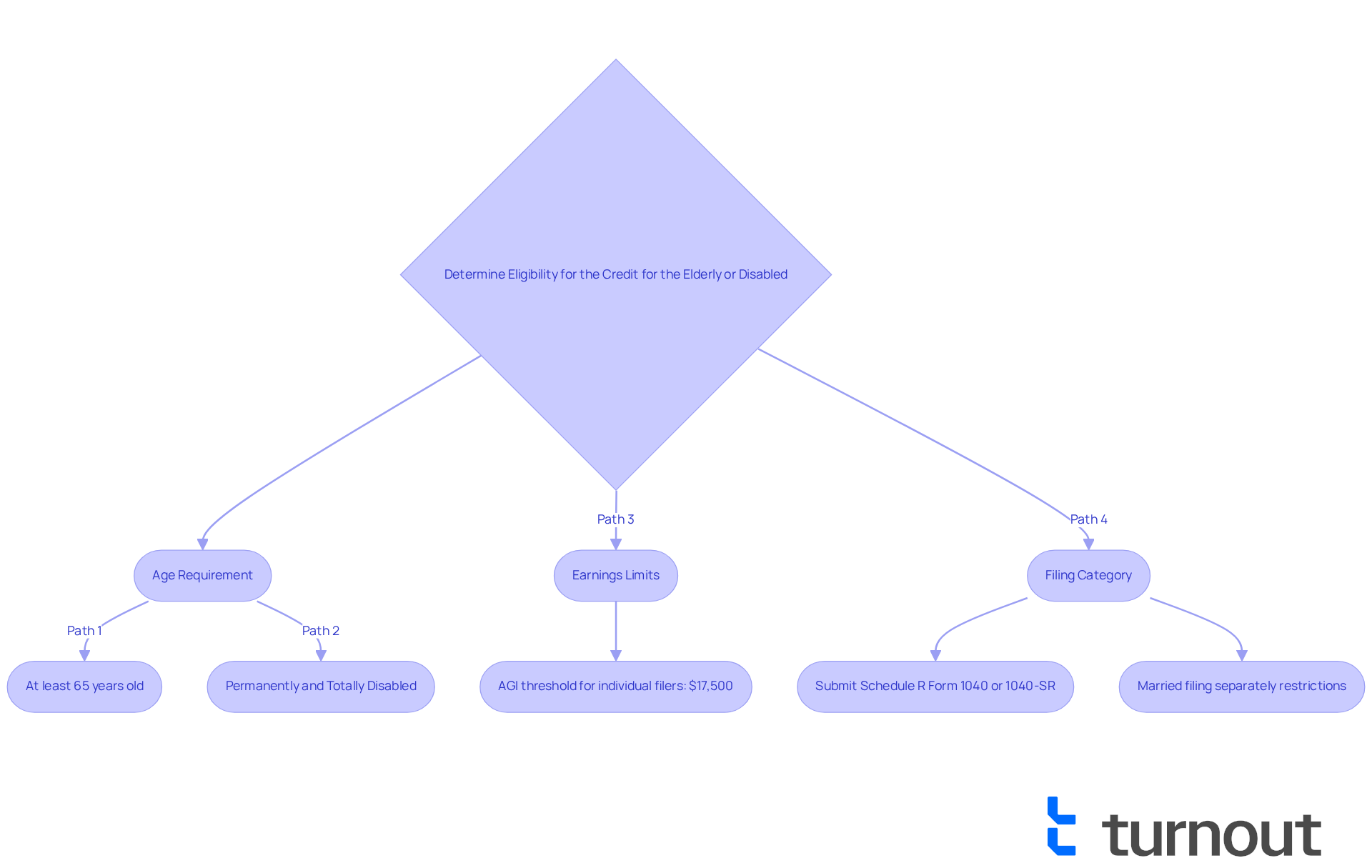

Determine Eligibility for the Credit for the Elderly or Disabled

Navigating the requirements for the Credit for the Elderly or Disabled can feel overwhelming, but we're here to help you through it. To qualify, you need to meet specific criteria:

-

Age Requirement: You must be at least 65 years old by the end of the tax year. If you're under 65, you need to be permanently and totally disabled. This means you can't engage in any significant gainful activity due to your disability and must have received taxable disability payments during the year.

-

Earnings Limits: Your adjusted gross income (AGI) must be below certain thresholds, which vary based on your filing status. For instance, individual filers can't claim the benefit if their AGI is $17,500 or more. Additionally, nontaxable income limits apply. The loan amount can range from $3,750 to $7,500, providing significant financial assistance with your tax responsibilities.

-

Filing Category: It's essential to submit the Schedule R Form 1040 or 1040-SR, as Form R cannot be used with other documents. If you're married and filing separately, you won't be able to claim the credit if you lived with your spouse at any time during the tax year.

We understand that this process can be confusing, but Turnout is here to simplify it for you. Our trained nonlawyer advocates are ready to provide guidance tailored to your situation, ensuring you understand your eligibility and the steps needed to access the financial support you deserve. Remember, Turnout is not a law firm and does not provide legal advice. For more information, you can refer to IRS Publication 524, which offers additional insights on the Credit for the Elderly or Disabled.

By confirming your eligibility based on these criteria, you can move forward with confidence in claiming your benefits. You're not alone in this journey; we're here to support you every step of the way.

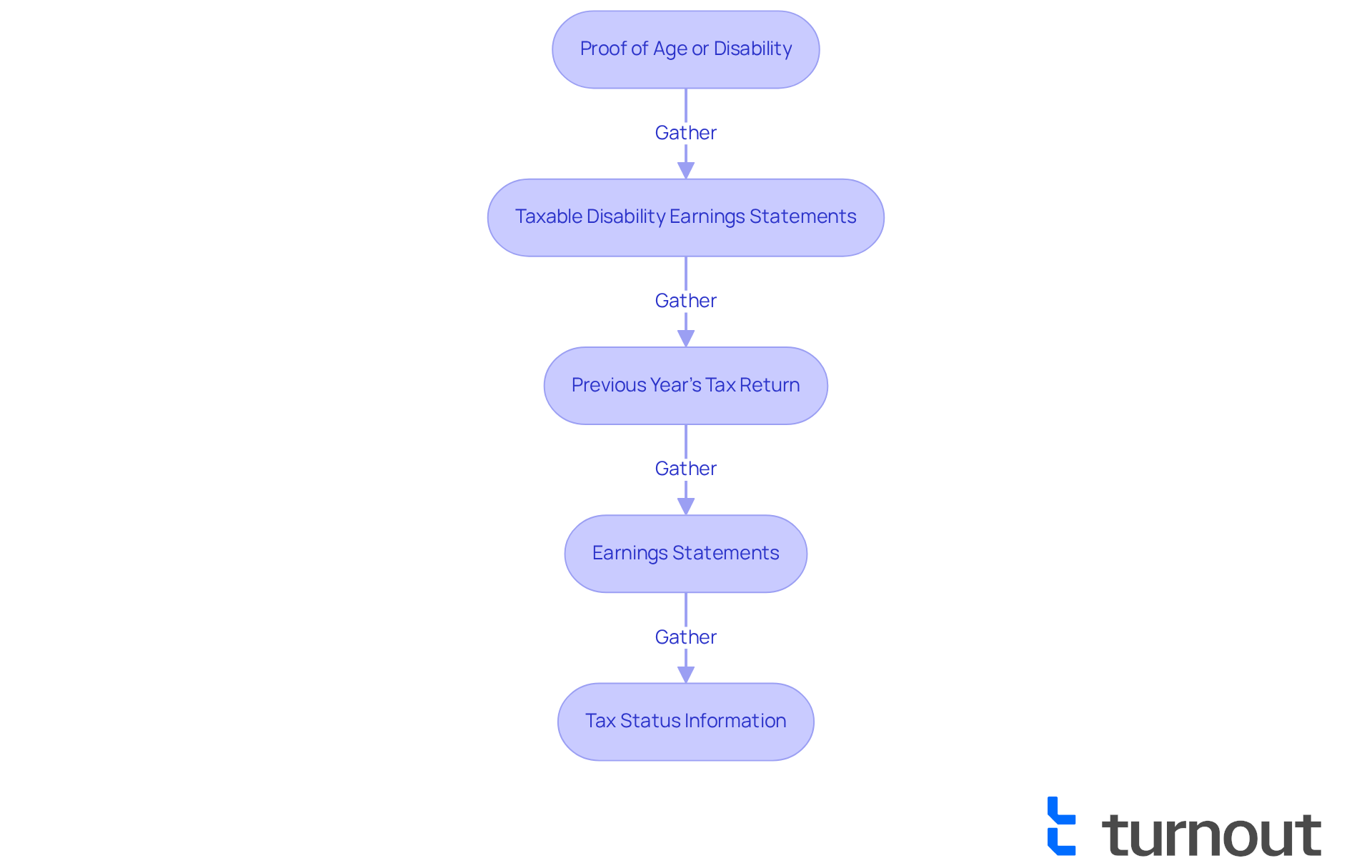

Gather Required Documentation for Schedule R

Before you start filling out the schedule r form 1040, it’s important to gather some key documents to ensure the filing process is smoother. We understand that this can feel overwhelming, but having everything ready can really help.

-

Proof of Age or Disability: This could be a birth certificate or a letter from your doctor confirming your disability status. Accurate documentation is crucial, as many taxpayers face challenges in providing this proof, which can delay their claims. If you’re unsure what counts as acceptable proof, Turnout's trained nonlawyer advocates are here to help you understand and guide you through the process.

-

Taxable Disability Earnings Statements: Make sure to collect any forms or statements that outline your taxable disability earnings for the year. This information is vital for determining your eligibility for the credit. If you have questions about your financial statements, Turnout's supporters are available to clarify any concerns you may have.

-

Previous Year’s Tax Return: Keeping last year's return handy can assist you in referencing your earnings and filing status, making it easier to complete this year's form. Turnout provides resources to help you locate and interpret this information.

-

Earnings Statements: Gather your W-2s, 1099s, or any other documentation of earnings to ensure accurate reporting of your income. Understanding your adjusted gross income (AGI) is essential, as it directly influences your eligibility for the benefit. Turnout's expert guidance simplifies this process, ensuring you report your income correctly.

-

Tax Status Information: Be aware of your tax status—whether single, married, or another category—as this influences your eligibility and the amount of benefit you may receive. Turnout can help you determine the best filing status for your situation.

As Naveed Lodhi, a Tax Analyst, emphasizes, "Understanding these requirements is crucial to determining whether you qualify for the credit and can receive the financial relief it offers." Having these documents prepared will simplify the process of completing the schedule r form 1040 and enhance your chances of successfully obtaining the Credit for the Elderly or Disabled. Proper documentation has proven to be a significant factor in helping individuals secure their benefits, as shown by case studies where thorough preparation led to successful claims. Remember, you are not alone in this journey; we’re here to help.

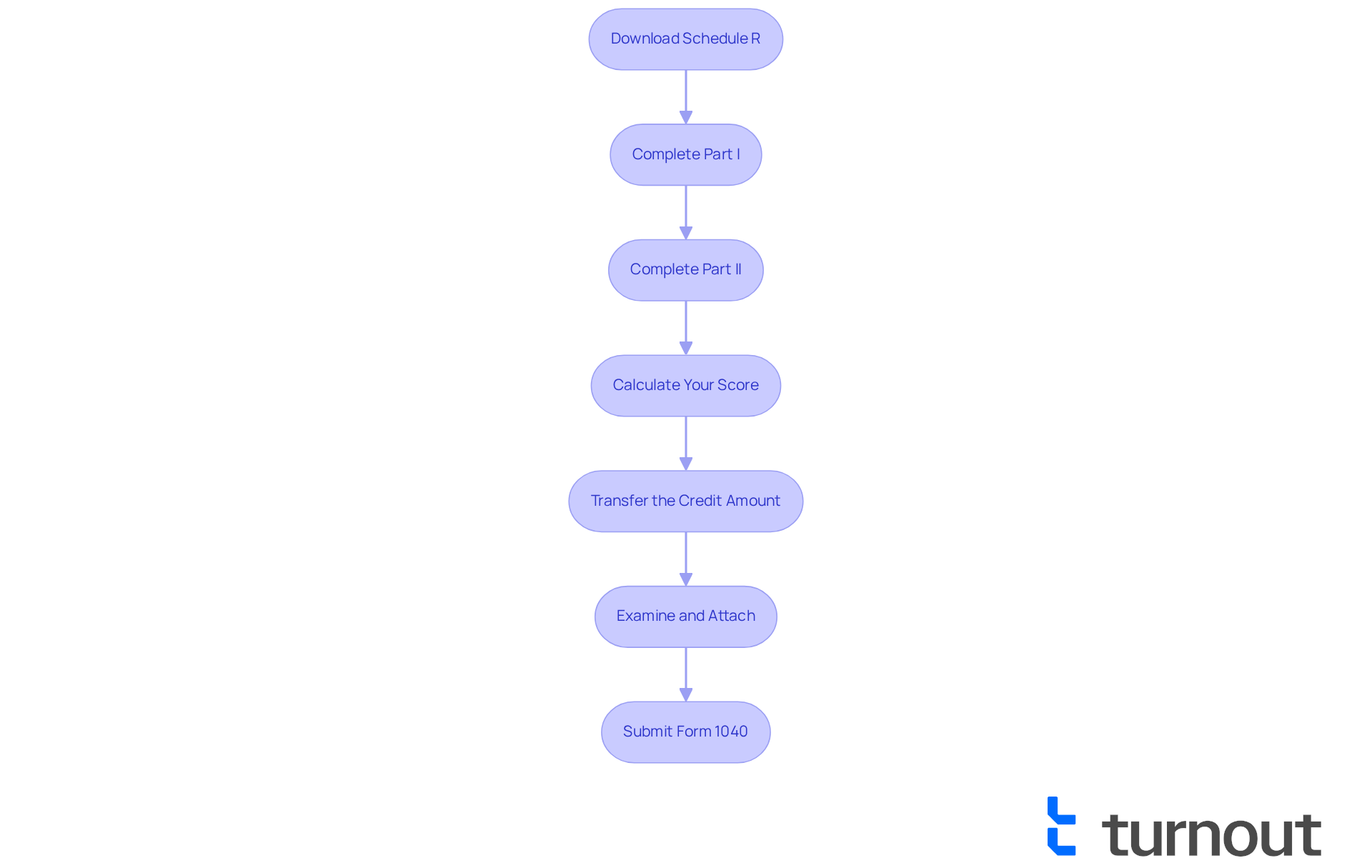

Complete Schedule R: Step-by-Step Instructions

Completing the Schedule R Form 1040 can feel overwhelming, but we're here to help you through it. By following these essential steps, you can ensure a smooth process:

- Download Schedule R: Start by accessing the latest version of Schedule R from the IRS website. This is your first step toward getting the assistance you deserve.

- Complete Part I: Indicate your status and age. Make sure to check the box confirming if you qualify as elderly or disabled. It’s important to be accurate here.

- Complete Part II: If you’re under 65 and claiming disability, provide details about your disability compensation. Don’t forget to include any necessary documentation; it can make a difference.

- Calculate Your Score: Use the worksheet included in the form to determine your score based on your income and filing status. Remember, the maximum allowance can range from $375 to $7,500, depending on your situation. This could significantly impact your tax relief.

- Transfer the Credit Amount: After calculating, move the credit amount to Section 3 of Form 1040. This step is crucial for ensuring you receive your benefits.

- Examine and Attach: Take a moment to thoroughly check all entries for accuracy. It’s common to make mistakes, like incorrect status or missing documentation. Finally, attach the Schedule R Form 1040 to your Form 1040 or 1040-SR before submission.

By carefully following these steps, you can confidently complete your Schedule R Form 1040 and submit it by the tax filing deadline, typically April 15. This diligence not only maximizes your potential tax relief but also minimizes the risk of errors that could delay your benefits. Remember, you’re not alone in this journey; we’re here to support you every step of the way.

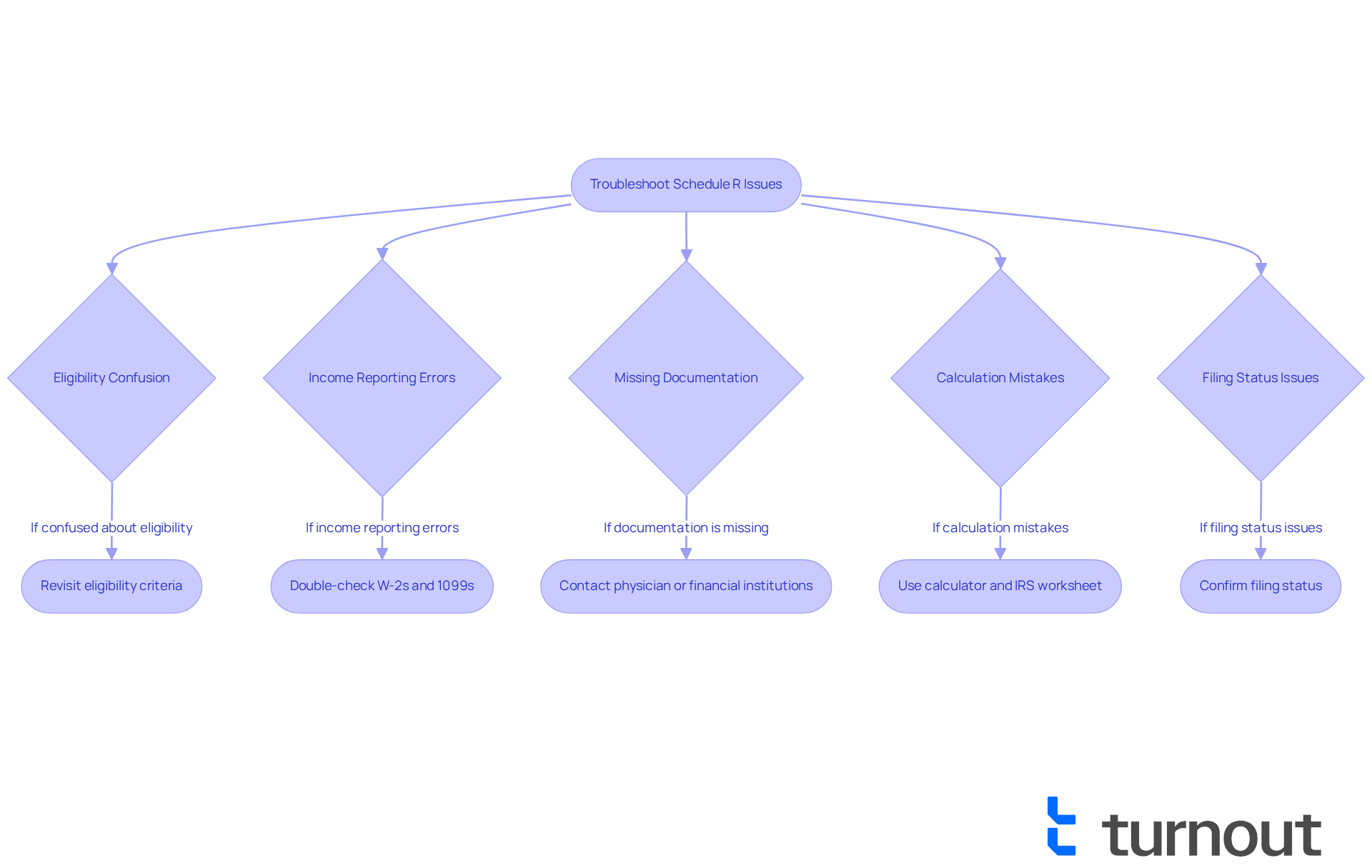

Troubleshoot Common Issues When Filling Out Schedule R

When filling out the schedule R form 1040, it’s common to encounter a few bumps along the way. We understand that this can be a bit overwhelming, but don’t worry—here’s how to troubleshoot effectively:

-

Eligibility Confusion: If you’re feeling uncertain about your eligibility, take a moment to revisit the criteria outlined earlier. The IRS eligibility tool can be a helpful resource to clarify your status and ease your mind.

-

Income Reporting Errors: It’s crucial to report all income accurately. Double-check your W-2s and 1099s for any discrepancies that might affect your submission. Remember, accuracy is key!

-

Missing Documentation: If you find yourself lacking necessary documents, don’t hesitate to reach out to your physician or financial institutions. They can help you obtain the required paperwork quickly.

-

Calculation Mistakes: To ensure your financial calculations are spot on, use a calculator and carefully review the worksheet provided by the IRS. This can help you avoid common errors. Just remember, "Double-check your math to avoid errors and delays in processing your return."

-

Filing Status Issues: Confirming your filing status is essential, as it significantly impacts both your eligibility and the amount of credit you may receive. If you’re married, typically you’ll need to submit together to claim R unless you’ve lived separately for the entire year.

Statistics show that the error rate for paper submissions is 21%, compared to under 1% for e-filed returns. This highlights the importance of seeking help with completing the schedule R form 1040. By being aware of these potential pitfalls and their solutions, you can navigate the completion of the schedule R form 1040 more smoothly and confidently. Remember, you’re not alone in this journey—we’re here to help!

Conclusion

Mastering Schedule R Form 1040 is a crucial step for eligible taxpayers seeking financial relief through the Credit for the Elderly or Disabled. This form not only helps reduce tax liabilities but also provides essential support for those who qualify. Understanding its purpose, eligibility criteria, and the steps required for completion can significantly enhance your chances of receiving these benefits.

We understand that determining eligibility based on age and income limits can feel overwhelming. Gathering accurate documentation to support your claims is essential. By following the step-by-step instructions provided, you can navigate the complexities of the form with confidence. Additionally, troubleshooting common issues ensures a smoother filing experience, minimizing the risk of errors that could delay your benefits.

Ultimately, taking the time to master Schedule R Form 1040 can lead to substantial financial benefits for those who qualify. It’s important to approach this process with diligence and awareness of the available resources. Remember, you are not alone in this journey. Engaging with knowledgeable support can further ease the process, empowering you to secure the credits you deserve and enhance your financial well-being.

Frequently Asked Questions

What is Schedule R Form 1040 used for?

Schedule R Form 1040 is used by eligible taxpayers to calculate the Credit for the Elderly or Disabled, which can significantly reduce tax liability and provide financial support.

Who is eligible for the Credit for the Elderly or Disabled?

To qualify, you must be at least 65 years old by the end of the tax year, or if you’re under 65, you must be permanently and totally disabled and have received taxable disability payments during the year.

What are the earnings limits for qualifying for the Credit for the Elderly or Disabled?

Your adjusted gross income (AGI) must be below certain thresholds. For individual filers, the AGI limit is $17,500 or more, and there are also nontaxable income limits that apply.

How much financial assistance can the Credit for the Elderly or Disabled provide?

The credit can provide a loan amount ranging from $3,750 to $7,500, depending on eligibility, which can significantly help with tax responsibilities.

What forms must be submitted to claim the Credit for the Elderly or Disabled?

You must submit the Schedule R Form 1040 or 1040-SR, as Form R cannot be used with other documents. If you are married and filing separately, you cannot claim the credit if you lived with your spouse at any time during the tax year.

What should I do if I need help understanding my eligibility for the Credit for the Elderly or Disabled?

You can seek guidance from trained nonlawyer advocates, such as those from Turnout, who can provide tailored assistance. For more information, refer to IRS Publication 524 for additional insights.

How does the Credit for the Elderly or Disabled phase out?

The credit phases out for taxpayers with modified adjusted gross earnings above $75,000, which can be beneficial for those with limited earnings or high medical expenses.

What sections does the Schedule R Form 1040 include?

The Schedule R Form 1040 includes sections for reporting earnings and adjustments to help determine your adjusted gross income (AGI).