Overview

Navigating financial challenges can be tough, especially for elderly individuals and those with disabilities. The IRS Schedule R offers a valuable tax credit that can provide much-needed relief, ranging from $3,750 to $7,500 based on your eligibility.

To claim this credit, it’s essential to understand the requirements, including age, disability status, and income limits. We know that gathering the right documentation can feel overwhelming, but it’s crucial for maximizing your benefits.

You might be wondering, "Am I eligible?" or "What do I need to do?" These questions are common, and we’re here to help you through the process. By ensuring you have accurate information and understanding the application steps, you can take full advantage of this opportunity.

Remember, you’re not alone in this journey. Many have successfully navigated these waters, and with the right support, you can too. Take the first step today by reviewing your eligibility and preparing your documents. Your financial relief is within reach!

Introduction

Navigating the complexities of tax credits can often feel like an uphill battle. We understand that for senior citizens and individuals with disabilities, these benefits are crucial for financial relief. The IRS Schedule R offers a lifeline, providing eligible taxpayers with a nonrefundable tax credit that can significantly reduce their tax burden—ranging from $3,750 to $7,500.

However, understanding the eligibility criteria and the intricacies of the application process can be challenging. It’s common to feel overwhelmed. What steps can you take to ensure you successfully claim this vital support? How can you avoid common pitfalls along the way? We're here to help you navigate this journey.

Understand the Schedule R Tax Credit for the Elderly and Disabled

The R Tax Incentive offers vital financial support for senior citizens and individuals with disabilities. This nonrefundable benefit can significantly lessen your tax burden, providing relief when it’s needed most. For eligible taxpayers, the benefit can range from $3,750 to $7,500, depending on your filing status and income level.

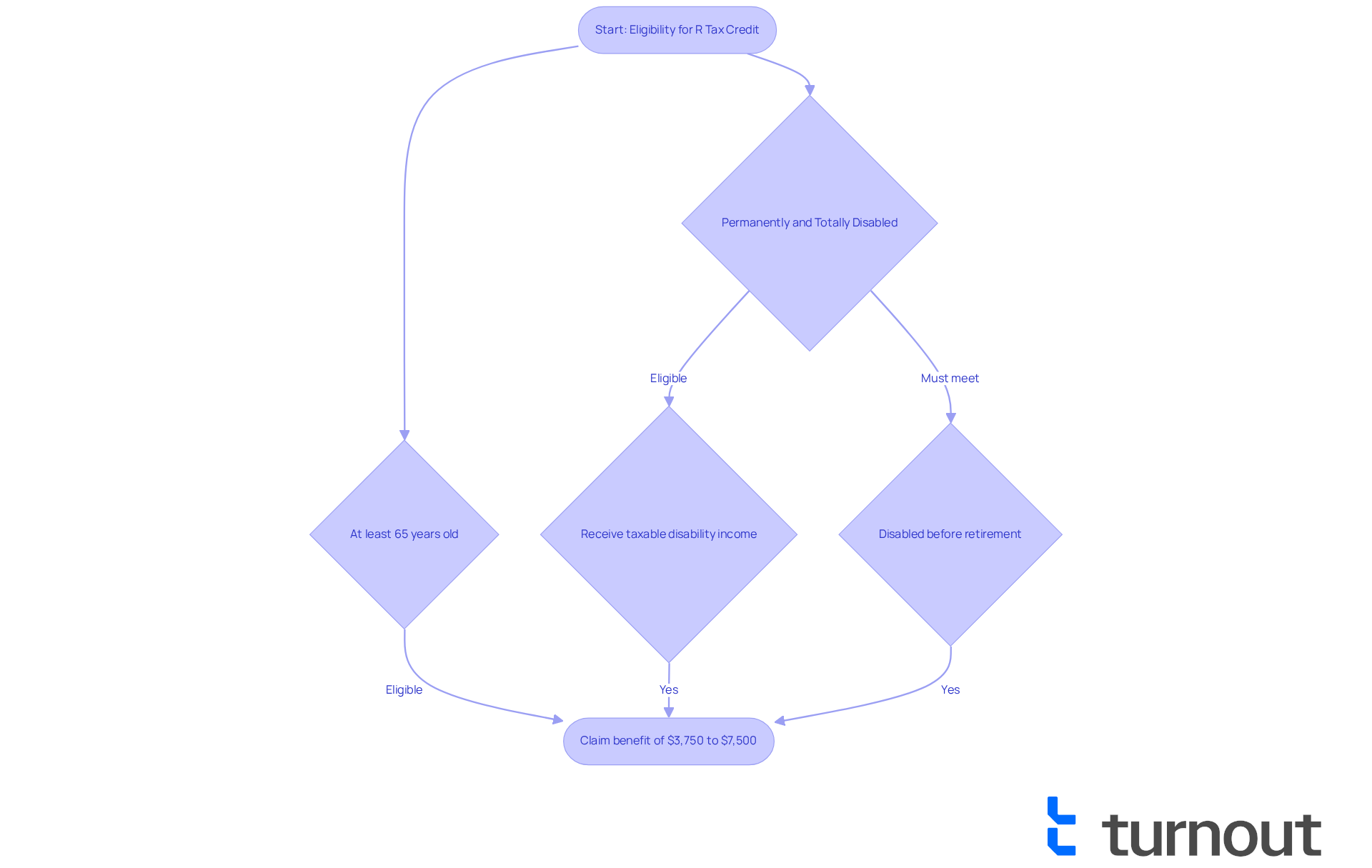

We understand that navigating tax benefits can be overwhelming. To qualify, you need to be at least 65 years old by the end of the tax year or be permanently and totally disabled. Currently, millions of taxpayers benefit from the IRS Schedule R, a tax credit designed to ease the financial pressure on those with limited earnings and resources.

For instance, if you meet the criteria outlined in IRS Publication 524, you could potentially lower your tax obligations, offering much-needed relief. Recent updates clarify that to qualify for this benefit, you must receive taxable disability income during the year and have been permanently and totally disabled before retirement. This ensures that the assistance reaches those who truly need it.

Real-world examples show the positive impact of this credit: many disabled taxpayers have successfully claimed it, leading to reduced tax liabilities and greater financial stability. By understanding the eligibility criteria and benefits of the R Tax Credit, you can make informed choices during your tax filing process. Remember, you are not alone in this journey; we’re here to help you every step of the way.

Determine Your Eligibility for the Credit

Are you wondering if you qualify for the IRS Schedule R? Let’s explore some important criteria together:

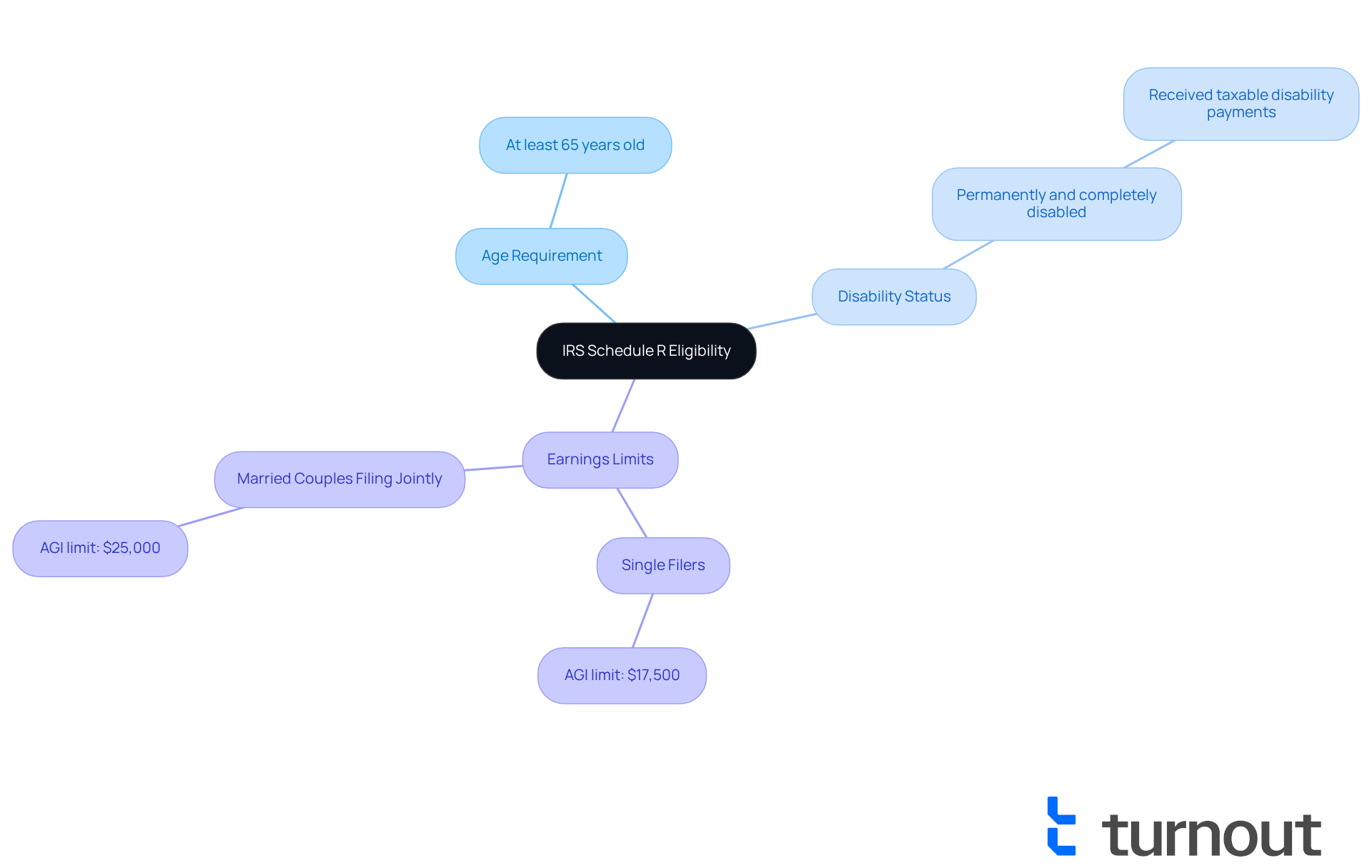

- Age Requirement: You need to be at least 65 years old by the end of the tax year.

- Disability Status: If you’re under 65, you must be permanently and completely disabled, having received taxable disability payments during the year.

- Earnings Limits: Your adjusted gross earnings (AGI) should be below certain thresholds. For single filers, the limit is typically $17,500, while for married couples filing jointly, it’s $25,000. It’s crucial to check your earnings against these limits to confirm your eligibility.

We understand that navigating these requirements can feel overwhelming. Recent data shows that many disabled individuals qualify for the IRS Schedule R, highlighting its significance as a source of financial relief. Tax professionals stress that grasping these criteria is vital for maximizing your benefits. If you meet the age or disability requirements and stay within the financial limits, you could receive anywhere from $3,750 to $7,500. This assistance can be a lifeline for those facing financial challenges, especially with rising medical costs.

You’re not alone in this journey. Many have successfully accessed this benefit, easing the burden of limited income and high expenses. Turnout is dedicated to simplifying access to government benefits and financial support, including tax debt relief services. Our trained nonlawyer advocates are here to guide you through these processes.

Remember, even if your earnings are below the required filing limit, you still need to submit a federal tax return and include the IRS Schedule R to request the credit. We’re here to help you every step of the way.

Complete the Schedule R Form Accurately

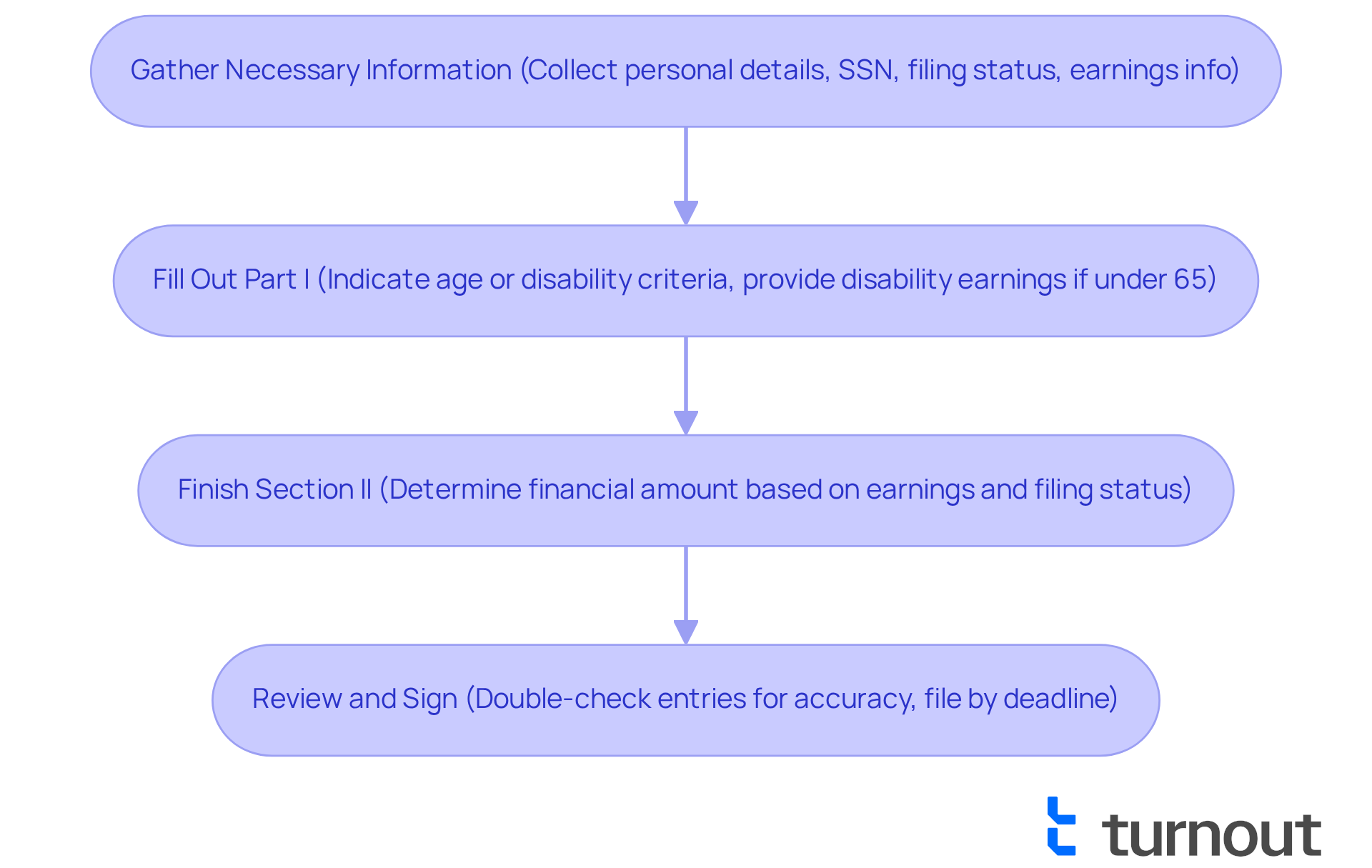

Completing the IRS Schedule R form can feel overwhelming, but we're here to assist you through the process. Just follow these simple steps:

-

Gather Necessary Information: Start by collecting your personal details, like your Social Security number, filing status, and earnings information. If you're under 65, make sure you have documentation of any disability earnings. This is an important first step.

-

Fill Out Part I: Here, you'll indicate whether you meet the age or disability criteria. If you're under 65, it's crucial to provide details about your taxable disability earnings, as this impacts your eligibility.

-

Finish Section II: Next, determine your financial amount based on your earnings and filing status. Utilize the worksheets provided in the IRS Schedule R instructions to ensure your calculations are precise. Remember, the funding can vary from $3,750 to $7,500, depending on your earnings and household size. For 2025, if you're married and filing jointly with a qualifying spouse, your adjusted gross income (AGI) must be below $20,000 to qualify for the benefit.

-

Review and Sign: Before you sign the form, double-check all entries for accuracy and completeness. Common mistakes include misreporting income or forgetting to include IRS Schedule R with your Form 1040 or 1040-SR. It's essential to file by the tax deadline, but don't worry—you can amend your return within three years if your eligibility changes. Just keep in mind that the credit is nonrefundable, meaning it can reduce your tax liability but won't result in a tax refund.

By following these steps, you can effectively navigate the IRS Schedule R process and potentially reduce your tax obligation, leading to significant financial relief. Remember, you're not alone in this journey, and taking these steps can make a real difference.

Troubleshoot Common Issues When Claiming the Credit

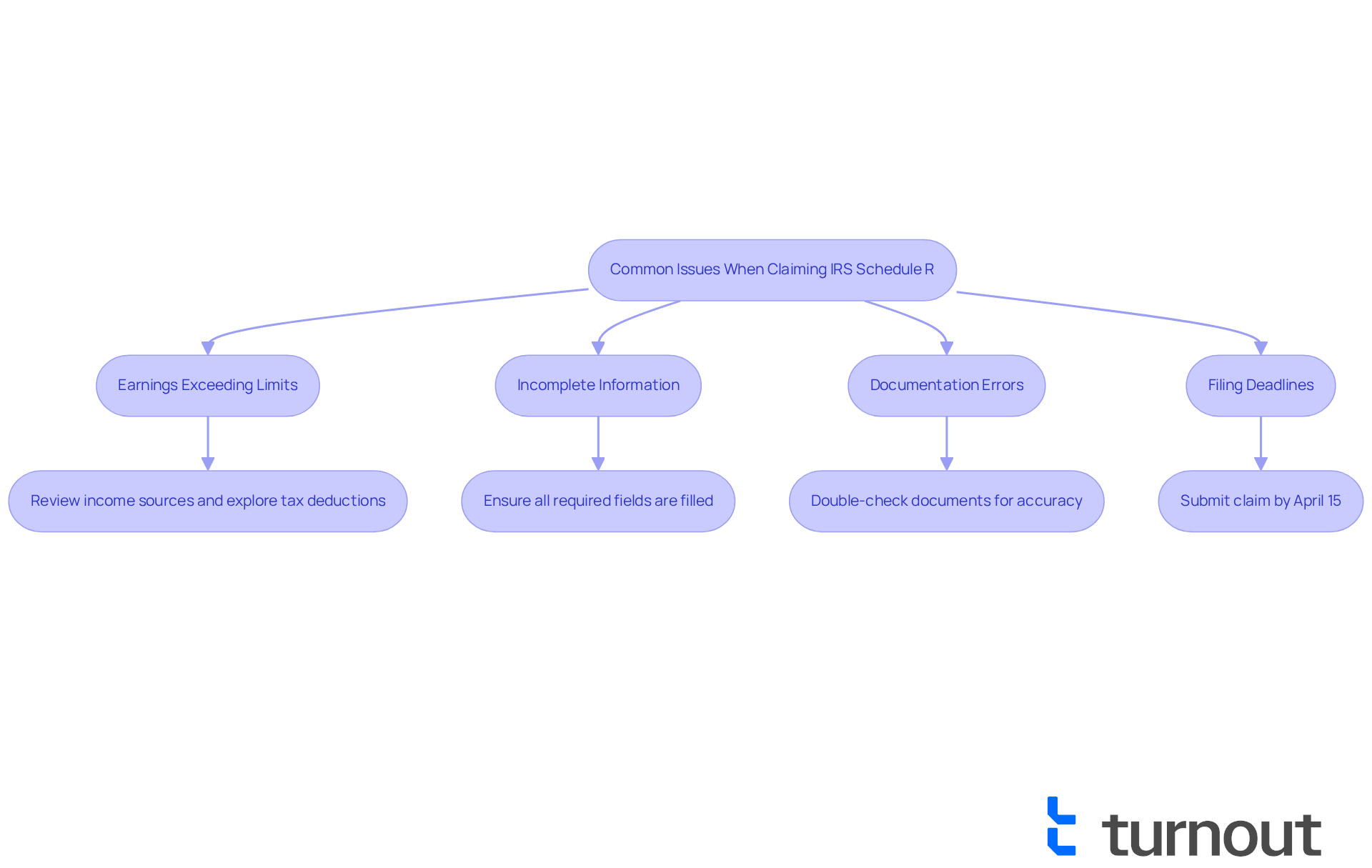

Navigating the IRS Schedule R can be challenging, and we understand that many taxpayers face common hurdles. Here are some key issues you might encounter:

-

Earnings Exceeding Limits: It’s not uncommon for taxpayers to struggle with the earnings thresholds for Form R. If your adjusted gross income (AGI) exceeds $17,500 for individual filers or $25,000 for married couples filing jointly, you won’t qualify for the credit. Additionally, if you’re married and filing separately, an AGI of $12,500 or more makes you ineligible. To tackle this, take a moment to review your income sources and explore tax deductions that could help lower your AGI.

-

Incomplete Information: Make sure every required field on the IRS Schedule R is filled out completely. Incomplete information can lead to processing delays, which may hinder your ability to receive the reimbursement you deserve.

-

Documentation Errors: Common pitfalls include not attaching necessary supporting documents, like proof of disability income. Errors in documentation can result in rejection of your claim. It’s essential to double-check that all documents are accurate and included with your tax return. Remember, keeping records for at least three years can support your eligibility claims.

-

Filing Deadlines: Be aware of tax filing deadlines, typically April 15. Missing these deadlines can complicate your ability to claim the benefit. To avoid penalties, it’s crucial to submit your claim by this date. Planning ahead and setting reminders can help ensure you file on time.

By addressing these issues proactively, you can navigate the claiming process related to IRS Schedule R more effectively. Remember, you’re not alone in this journey, and we’re here to help you maximize your benefits from the IRS Schedule R.

Conclusion

Navigating the complexities of the IRS Schedule R can feel overwhelming, especially for elderly individuals and those with disabilities seeking financial relief through tax credits. We understand that this process can be daunting, but it’s crucial to grasp the eligibility criteria, potential benefits, and the steps for accurately completing the Schedule R form. By equipping yourself with the right knowledge, you can effectively claim the tax credit and ease some of your financial burdens.

Key insights include:

- Specific age and disability requirements

- Income limits that dictate eligibility

- The necessary steps to fill out the Schedule R form correctly

It’s common to encounter pitfalls, such as incomplete information and documentation errors, but recognizing these can significantly enhance your chances of a successful claim. The potential financial benefits, ranging from $3,750 to $7,500, can truly make a substantial difference for those facing economic challenges.

Ultimately, the significance of the IRS Schedule R tax credit cannot be overstated. It serves as a vital resource for eligible taxpayers, providing much-needed support during challenging times. By taking proactive steps to understand eligibility and navigate the claiming process, you can secure the financial assistance you deserve. Remember, you are not alone in this journey; staying informed and seeking guidance when needed is essential to fully benefit from this critical tax relief opportunity.

Frequently Asked Questions

What is the Schedule R Tax Credit?

The Schedule R Tax Credit is a nonrefundable tax benefit that provides financial support to senior citizens and individuals with disabilities, helping to reduce their tax burden.

Who is eligible for the Schedule R Tax Credit?

To qualify, you must be at least 65 years old by the end of the tax year or be permanently and totally disabled.

How much can eligible taxpayers receive from the Schedule R Tax Credit?

The benefit can range from $3,750 to $7,500, depending on your filing status and income level.

What are the requirements for receiving the Schedule R Tax Credit?

You must receive taxable disability income during the year and have been permanently and totally disabled before retirement to qualify for this benefit.

How does the Schedule R Tax Credit help taxpayers?

The credit helps reduce tax liabilities for eligible taxpayers, providing much-needed financial relief and stability.

Where can I find more information about the eligibility criteria for the Schedule R Tax Credit?

More information can be found in IRS Publication 524, which outlines the criteria for eligibility.