Introduction

Navigating tax obligations can feel overwhelming, especially when financial challenges arise. We understand that facing the IRS can be daunting, but there’s hope. The IRS payment plan for taxes owed offers a lifeline, allowing you to pay your debts in manageable installments instead of facing a hefty lump sum all at once.

This guide will walk you through the essential steps and considerations for mastering these payment plans. But what happens when unexpected obstacles threaten to derail your progress? It’s common to feel anxious about the intricacies of eligibility, documentation, and potential pitfalls. Understanding these elements can empower you to regain control over your financial future while minimizing stress and penalties.

Remember, you are not alone in this journey. We're here to help you navigate these challenges with confidence.

Understand IRS Payment Plans and Their Importance

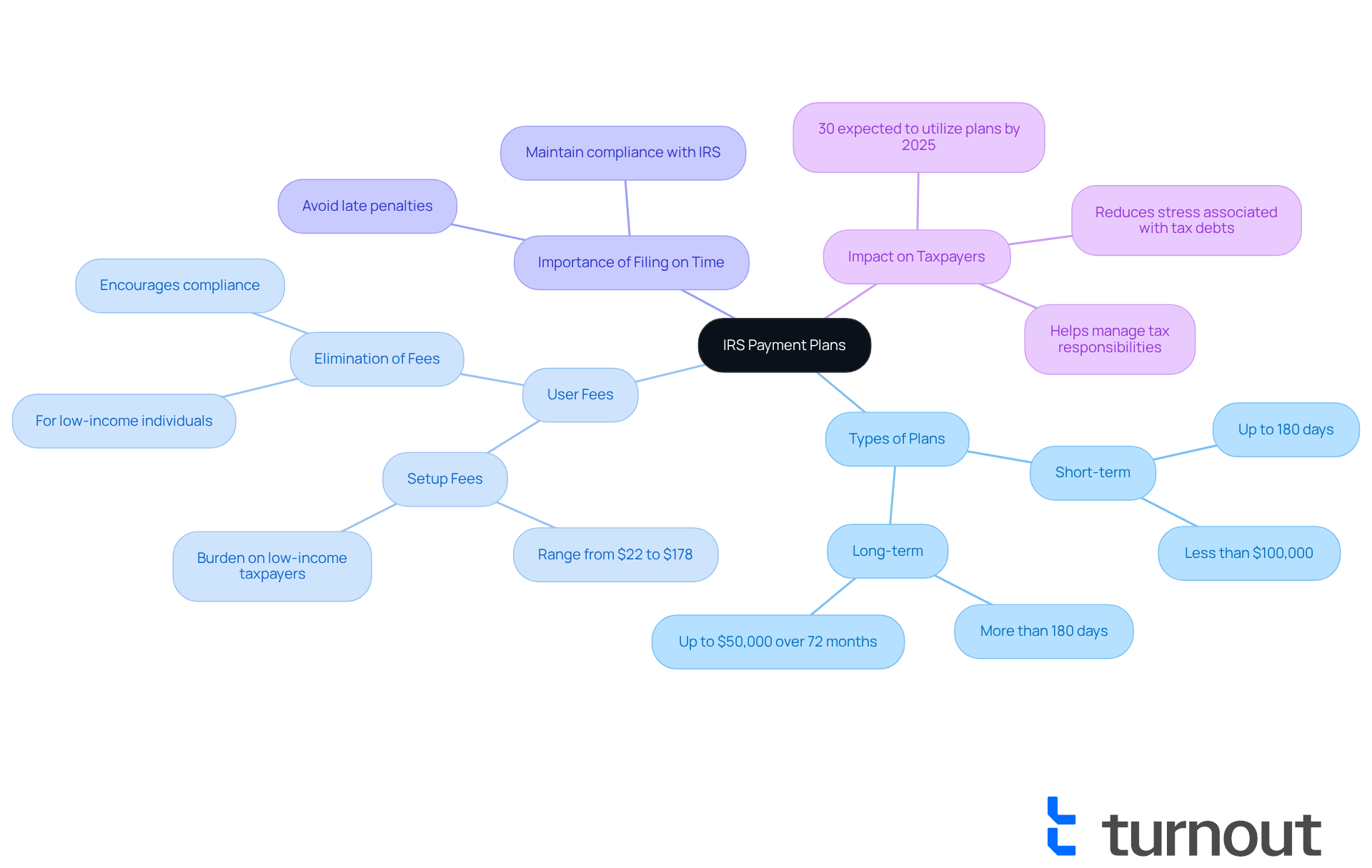

The IRS payment plan for taxes owed, often known as installment agreements, allows taxpayers to pay off their tax debts gradually rather than all at once. We understand that this flexibility is crucial for individuals facing financial challenges, as it helps them avoid severe penalties and collection actions. Knowing the types of financing options available - short-term (up to 180 days) and long-term (more than 180 days) - is essential for selecting the right choice based on your financial situation. These payment arrangements can significantly ease the stress associated with tax debts, making it easier for taxpayers to regain control of their finances.

In 2025, around 30% of taxpayers are expected to utilize these installment agreements, highlighting their growing importance in managing tax debt. However, it’s important to be aware of the user fees tied to setting up and maintaining these agreements, which can add extra financial pressure on low-income taxpayers. Thankfully, recent changes in IRS regulations, including the removal of installment agreement user fees for low-income individuals, provide a vital update that could encourage more taxpayers to consider these options.

Additionally, filing tax returns on time is crucial for effectively managing tax debt, as it helps maintain compliance with IRS requirements. The IRS typically reaches out to taxpayers regarding unpaid taxes through mail, sending a series of notices that explain what is owed and how to address it. Overall, the IRS payment plan for taxes owed serves as an essential resource for taxpayers, empowering them to manage their tax responsibilities with greater confidence and reduced stress.

Determine Your Eligibility for an IRS Payment Plan

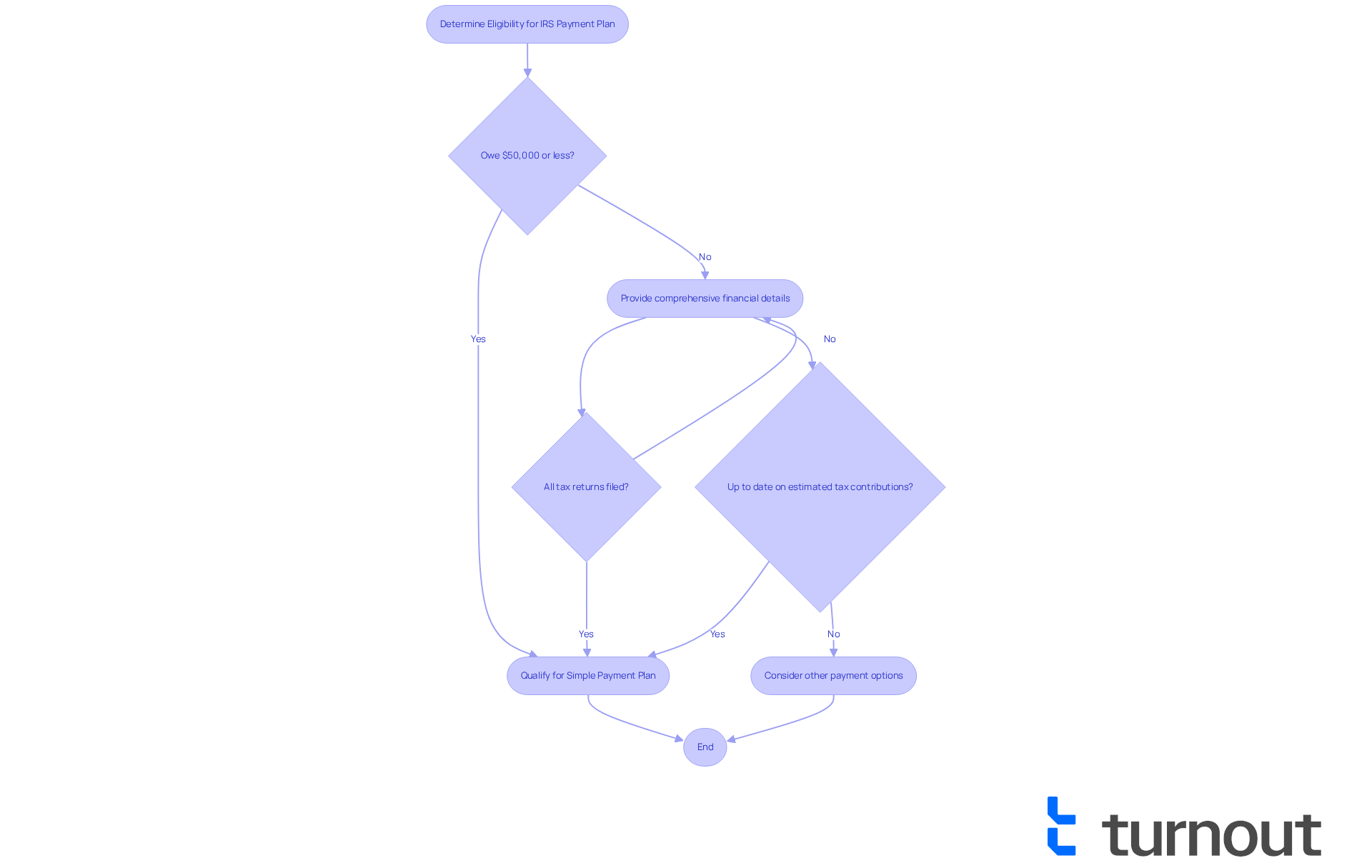

We understand that dealing with tax obligations can be overwhelming. To qualify for the IRS payment plan for taxes owed, you need to meet specific criteria. Generally, you should owe $50,000 or less in total tax, penalties, and interest, and all required tax returns must be filed. It’s also essential to be up to date on your estimated tax contributions.

If your tax obligation exceeds $50,000, don’t worry-you may still qualify for an installment arrangement. However, you will need to provide more comprehensive financial details. It’s important to take a moment to review your financial situation to ensure you meet these requirements before applying.

Did you know that over 90% of individual taxpayers with a balance due qualify for a Simple Payment Plan? This makes it a viable option for many. For those with balances under $100,000, there are short-term financing options available, allowing you up to 180 days to settle your debt in full.

If you find yourself unable to pay your tax debt, the IRS payment plan for taxes owed may provide a delay in collection until your financial condition improves. Keep in mind that penalties and interest will continue to accrue during this time. Financial situations that may lead to eligibility include unexpected medical expenses, job loss, or other hardships that impact your ability to pay taxes in full.

Understanding these criteria can help you navigate this process more effectively. Remember, you are not alone in this journey, and we’re here to help.

Gather Required Documentation for Your Application

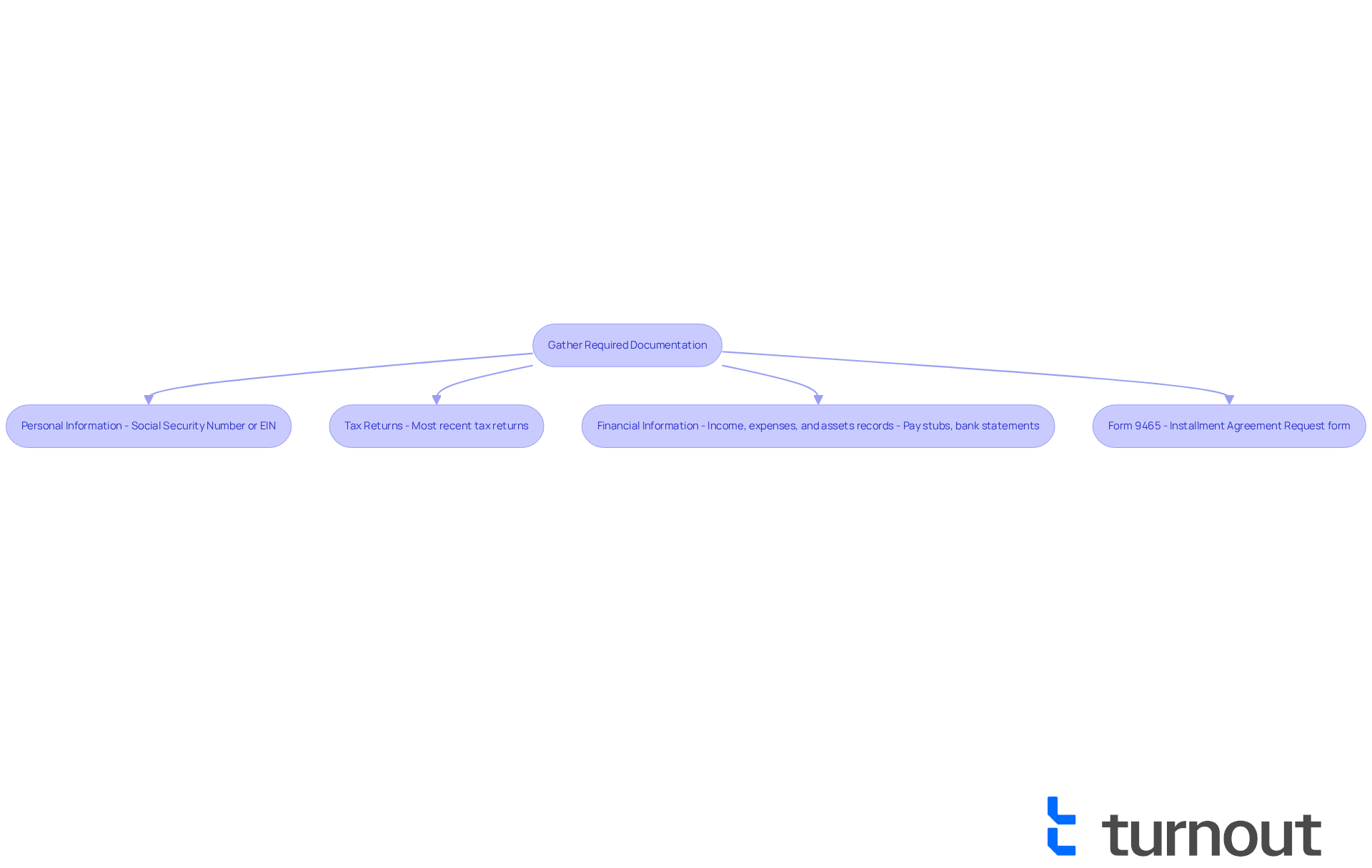

If you're looking to request an IRS payment plan for taxes owed, we understand that it can feel overwhelming. But don’t worry; with a little preparation, you can make this process smoother and less stressful. Collecting the necessary documentation ahead of time is crucial. Studies show that about 30% of applicants face delays due to incomplete submissions. Here’s what you need to gather:

- Personal Information: Make sure to include your Social Security number or Employer Identification Number (EIN).

- Tax Returns: Have copies of your most recent tax returns ready for submission.

- Financial Information: Prepare detailed records of your income, expenses, and assets. This may include pay stubs, bank statements, and any other relevant financial documents.

- Form 9465: Complete the Installment Agreement Request form, which is essential for your application.

Financial experts emphasize that having these documents organized not only streamlines the application process but also boosts your chances of approval. Many individuals who take the time to prepare their documentation report smoother experiences with their applications.

It's also important to understand the setup costs associated with IRS arrangements, which can range from $0 to $178 depending on the type. This knowledge is vital for your financial planning. By ensuring all necessary materials are in order and following the conditions of the financial agreement, you can avoid common pitfalls and expedite your journey toward setting up an IRS payment plan for taxes owed. Remember, you are not alone in this journey; we’re here to help.

Apply for Your IRS Payment Plan: Step-by-Step Instructions

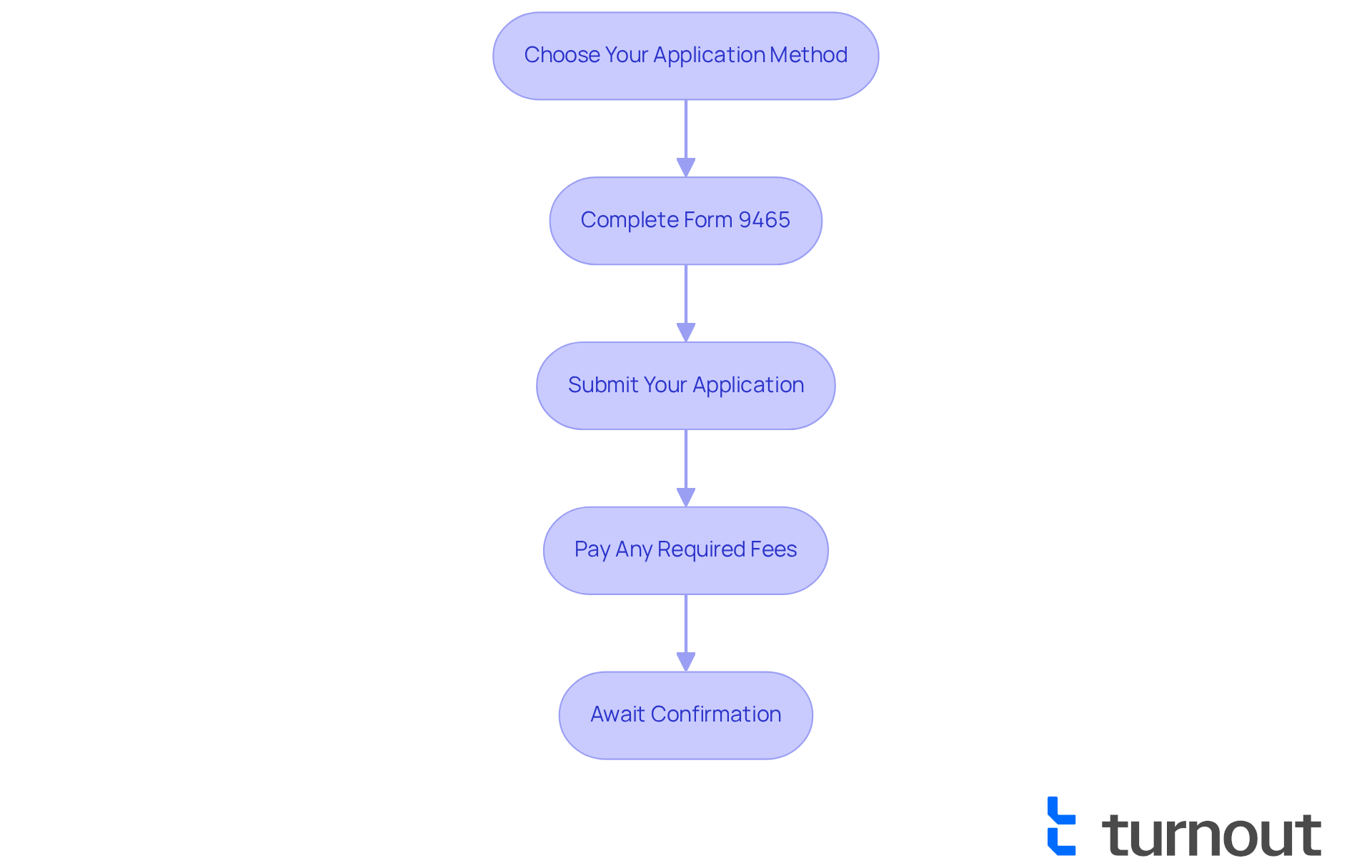

Although applying for the IRS payment plan for taxes owed can feel overwhelming, we're here to help you through it. Follow these simple steps to make the process smoother:

-

Choose Your Application Method: You have options! Apply online using the IRS Online Payment Agreement tool, by phone, or by mail with Form 9465. Choose what feels best for you.

-

Complete Form 9465: Take your time to fill out the form accurately with your personal and financial information. This helps avoid any delays in processing, and we know how important it is to get this right.

-

Submit Your Application: If you’re applying online, just follow the prompts on the IRS website. For mail applications, send your completed Form 9465 to the address specified in the instructions. It’s straightforward, and you’re doing great!

-

Pay Any Required Fees: Be aware that setup charges may apply for certain types of IRS arrangements. These fees can vary based on your application method. For example, online applications usually have a lower fee compared to those submitted by mail. It’s good to know what to expect.

-

Await Confirmation: After you submit your application, the IRS will review it and notify you of their decision. If approved, you’ll receive information about your financial arrangement, including the IRS Notice CP523, which verifies your IRS payment plan for taxes owed. If you applied online, you’ll get immediate notification of approval, allowing you to manage your tax obligations effectively. Remember, if you tried to comply with tax laws but faced challenges beyond your control, you might qualify for penalty relief.

We understand that navigating tax issues can be stressful, but you are not alone in this journey. Take it one step at a time, and know that support is available.

Troubleshoot Common Issues with IRS Payment Plans

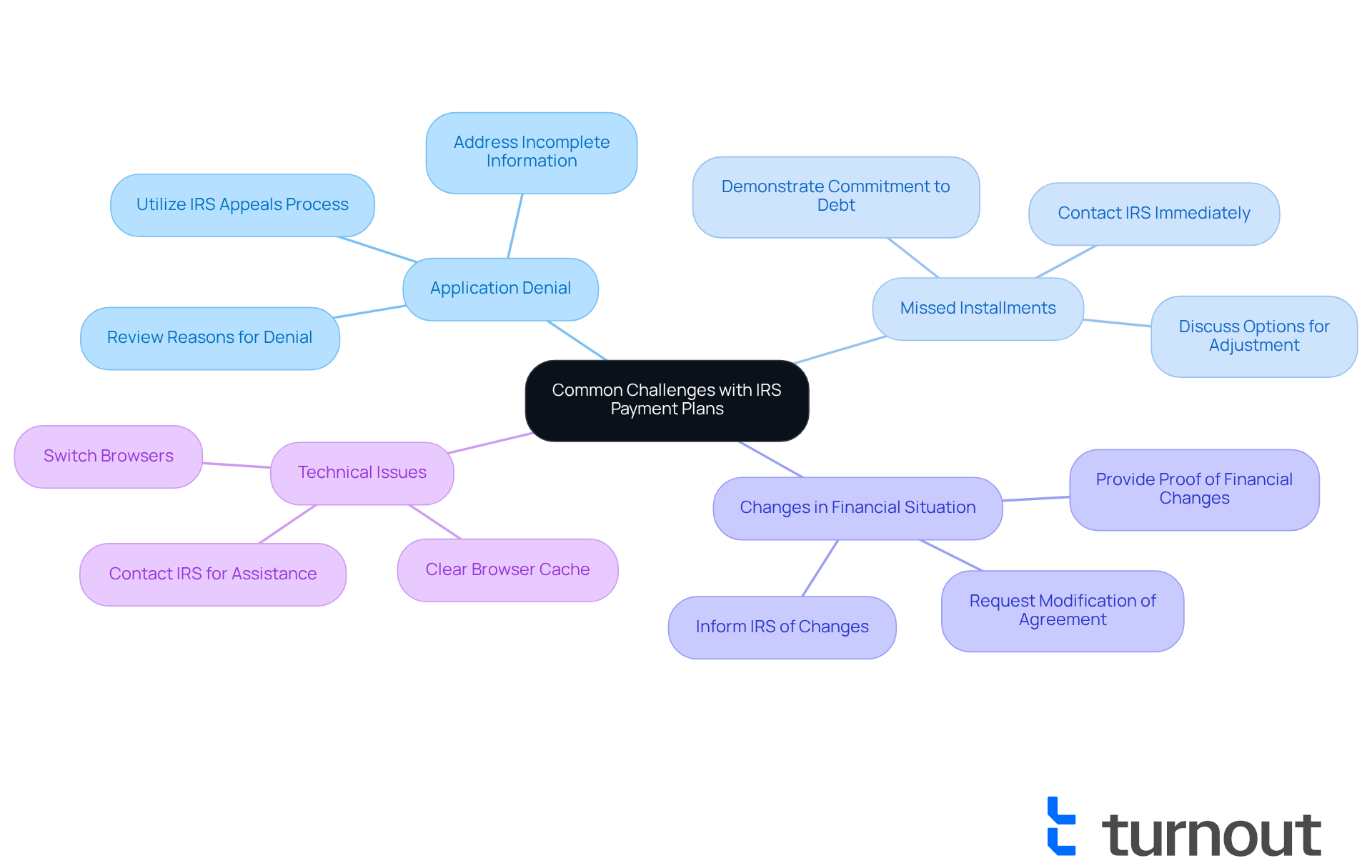

When applying for an IRS payment plan, we understand that you may face several common challenges that can complicate the process:

-

Application Denial: If your application is denied, it’s important to carefully review the reasons provided by the IRS. Common reasons for denial include incomplete financial information, overlooked dues on previous agreements, or discrepancies in your tax filings. Addressing these issues thoroughly before reapplying can significantly improve your chances of approval. Remember, you can also utilize the IRS appeals process, which is designed to help taxpayers resolve disputes without the need for court involvement.

-

Missed Installments: Missing a payment can lead to serious consequences, including the termination of your financial arrangement. If this happens, please reach out to the IRS right away to discuss your options. You might be able to adjust your financial arrangement or restore it by demonstrating your commitment to addressing the debt. It’s worth noting that the IRS has acknowledged delays in processing some electronic transactions, which could affect your status.

-

Changes in Financial Situation: Life can be unpredictable, and changes in your financial situation can impact your ability to pay. If you find yourself in this position, it’s crucial to inform the IRS as soon as possible. They may allow you to modify your financial arrangement to better suit your current economic situation, potentially lowering your monthly payments or temporarily postponing collection efforts.

-

Technical Issues: Technical difficulties can arise when using the IRS online application system. If you encounter problems, try clearing your browser cache or switching to a different browser. If issues persist, don’t hesitate to contact the IRS for assistance to ensure your application is processed smoothly.

Understanding the percentage of applications denied for an IRS payment plan for taxes owed can also shed light on the challenges many face. Reports indicate that a significant number of applications are denied due to incomplete information or non-compliance with IRS requirements. Engaging with a tax advisor can be incredibly beneficial in troubleshooting these issues, as they can offer tailored advice and strategies to navigate the complexities of the IRS system effectively. For instance, a tax advisor can help you gather necessary documentation and clarify discrepancies in your financial information, increasing your chances of a successful application.

Conclusion

Understanding the IRS payment plan for taxes owed is essential for taxpayers who want to manage their financial obligations effectively. We know that dealing with taxes can be overwhelming, but by utilizing installment agreements, you can ease the stress of immediate payments and avoid severe penalties. This way, you can regain control of your finances and move forward with confidence.

In this guide, we highlight the importance of knowing eligibility criteria, gathering necessary documentation, and following a structured application process to secure a payment plan that fits your financial situation. Many taxpayers qualify for these arrangements, and recent updates - like the removal of user fees for low-income individuals - make these plans even more accessible.

Key insights discussed throughout the article include:

- The types of payment plans available

- The significance of timely tax return submissions

- The steps involved in applying for an IRS payment plan

It's common to feel uncertain about these processes, but understanding common issues and troubleshooting strategies can enhance your chances of a successful application.

Ultimately, the IRS payment plan for taxes owed serves as a vital resource for individuals facing financial challenges. It empowers you to navigate your tax responsibilities with confidence and reduces anxiety surrounding tax debts. Remember, you are not alone in this journey. Taking the first step by exploring available payment options can lead to a more manageable financial future. We're here to help you every step of the way.

Frequently Asked Questions

What is the IRS payment plan for taxes owed?

The IRS payment plan, also known as installment agreements, allows taxpayers to pay off their tax debts gradually instead of all at once, providing flexibility for those facing financial challenges.

What are the types of IRS payment plans available?

There are two types of IRS payment plans: short-term (up to 180 days) and long-term (more than 180 days). Choosing the right option depends on your financial situation.

How common are IRS installment agreements among taxpayers?

In 2025, it is expected that around 30% of taxpayers will utilize these installment agreements, indicating their growing importance in managing tax debt.

Are there user fees associated with IRS payment plans?

Yes, there are user fees tied to setting up and maintaining these agreements, which can create additional financial pressure, particularly on low-income taxpayers. However, recent changes have removed these fees for low-income individuals.

What are the eligibility criteria for an IRS payment plan?

To qualify for an IRS payment plan, you generally need to owe $50,000 or less in total tax, penalties, and interest, and all required tax returns must be filed. You should also be up to date on estimated tax contributions.

What if I owe more than $50,000?

If your tax obligation exceeds $50,000, you may still qualify for an installment arrangement, but you will need to provide more comprehensive financial details.

What is a Simple Payment Plan?

Over 90% of individual taxpayers with a balance due qualify for a Simple Payment Plan, making it a viable option for many. This plan is available for those with balances under $100,000, allowing up to 180 days to settle the debt in full.

What happens if I cannot pay my tax debt?

If you are unable to pay your tax debt, the IRS payment plan may provide a delay in collection until your financial condition improves, though penalties and interest will continue to accrue during this time.

What financial situations might lead to eligibility for an IRS payment plan?

Financial situations such as unexpected medical expenses, job loss, or other hardships that impact your ability to pay taxes in full may lead to eligibility for an IRS payment plan.