Introduction

Navigating the complexities of back taxes can feel overwhelming, and we understand that it might seem like an insurmountable challenge. However, knowing the options available through IRS payment plans can provide a much-needed lifeline. This guide explores various payment arrangements designed to ease your financial burden, offering insights into eligibility criteria and the application process.

With multiple pathways to choose from, it’s common to feel uncertain about which plan is right for you. How can you ensure that you select the option that aligns with your unique financial situation? Remember, you are not alone in this journey, and we’re here to help you find the best solution.

Understand IRS Payment Plans for Back Taxes

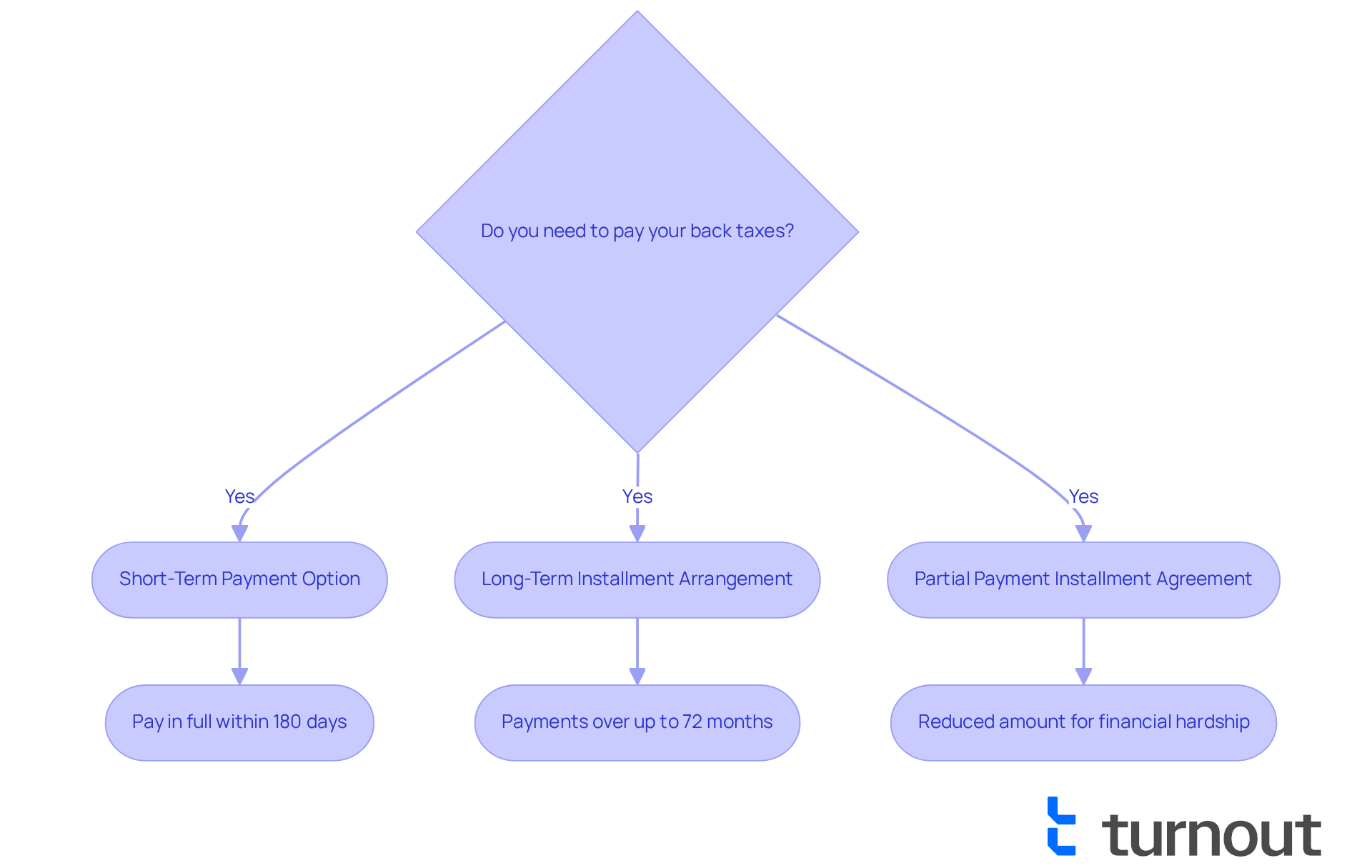

If you’re feeling overwhelmed by back taxes, know that you’re not alone. The IRS provides several settlement options, such as an IRS payment plan for back taxes, to assist you in managing your tax obligations gradually. Let’s explore these options together:

-

Short-Term Payment Option: This is a great choice if you can pay your balance in full within 180 days. It’s perfect for those who just need a little extra time but can tackle their debt quickly.

-

Long-Term Installment Arrangement: If you need more time, this option allows you to make payments over an extended period, usually up to 72 months. It’s designed for individuals with larger tax debts who can’t pay everything at once.

-

Partial Payment Installment Agreement: This option lets you pay a reduced amount over time, which might be less than what you owe. It’s especially helpful for those facing significant financial hardship.

Understanding the IRS payment plan for back taxes is crucial. They empower you to select the right arrangement based on your financial situation and tax responsibilities. Remember, we’re here to help you navigate this journey.

Determine Your Eligibility for a Payment Plan

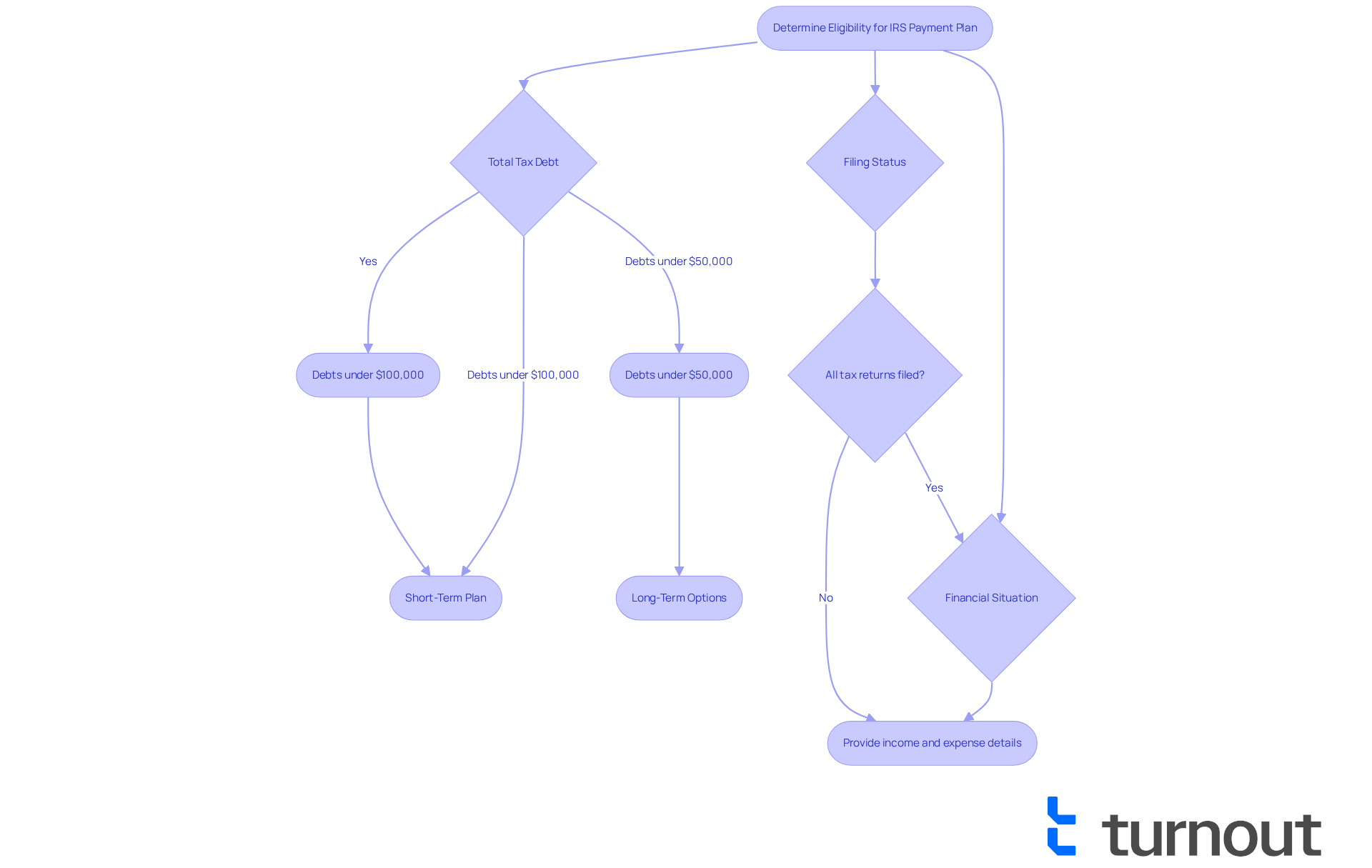

Navigating tax debt can be overwhelming, but understanding the criteria for an IRS payment plan can help ease your worries. Here’s what you need to know:

-

Total Tax Debt: If you owe less than $100,000, you may qualify for a short-term plan. For long-term options, aim for a balance of $50,000 or less. Excitingly, the IRS is introducing a Simple Payment Plan in Spring 2025, allowing repayment over up to 10 years. Recent data shows that about 90% of individuals with back taxes are eligible for this new program, which is a hopeful sign for many.

-

Filing Status: It’s crucial to have all your required tax returns filed. If you have unfiled returns, addressing these is the first step before seeking a financial arrangement. Remember, timely filing is essential to avoid complications down the road.

-

Financial Situation: The IRS may ask for details about your income and expenses to understand your ability to pay. This is especially important for partial compensation agreements, where demonstrating financial hardship can make a significant difference. We recommend using direct debit for payments; it helps ensure timely settlements and reduces the risk of default.

By carefully reviewing these criteria, you can determine your eligibility for a financial arrangement that suits your situation. Many individuals have successfully navigated these requirements, leading to manageable repayment solutions. Remember, you’re not alone in this journey, and we’re here to help you find the best path forward.

Follow the Step-by-Step Application Process

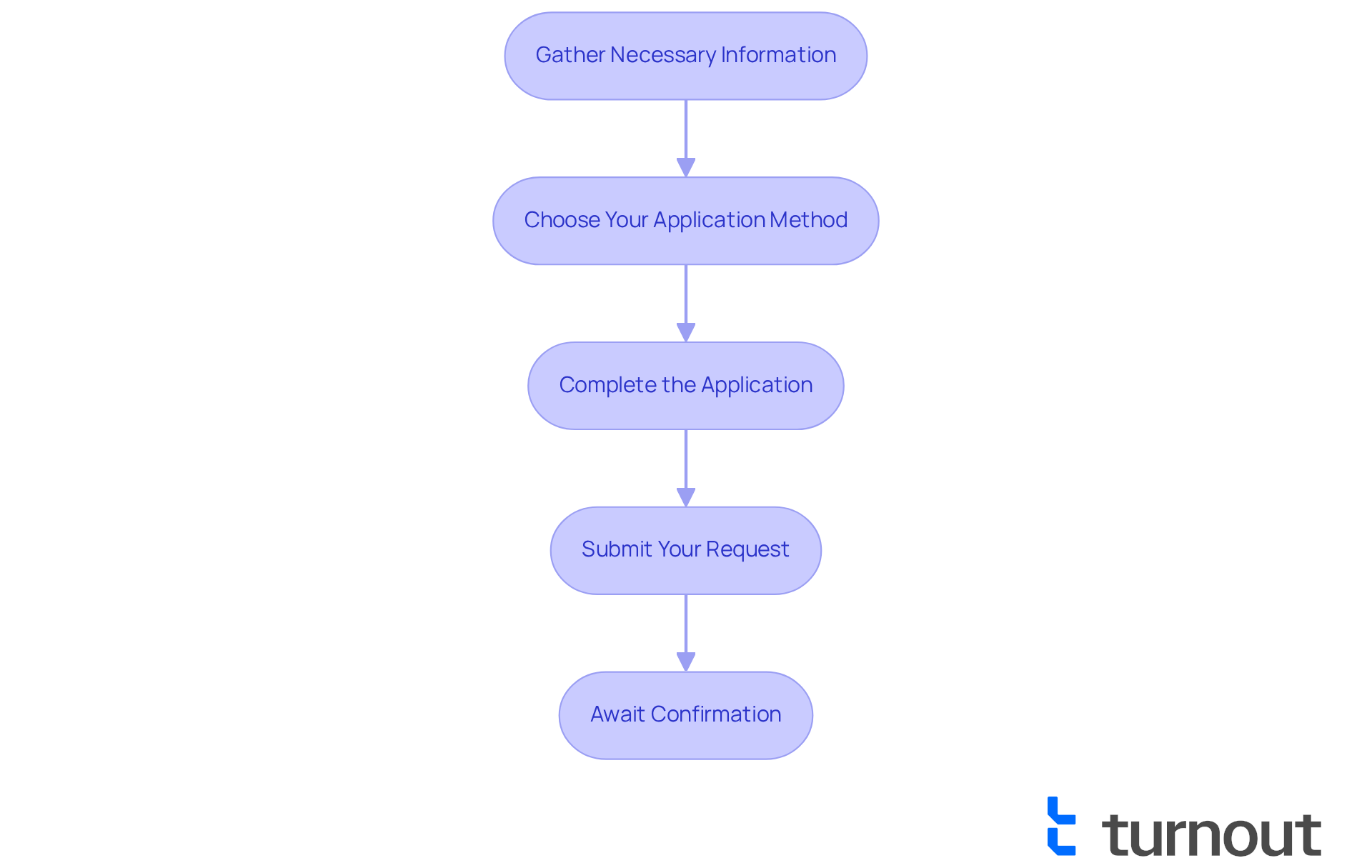

Applying for an IRS payment plan can feel overwhelming, but we're here to help you through it. Follow these steps to ease your journey:

-

Gather Necessary Information: Start by collecting your essential tax information, like your Social Security number, tax return details, and financial data. Having everything organized can make your submission process much smoother.

-

Choose Your Application Method: You have options! Apply online using the IRS Online Payment Agreement tool, call them, or mail in Form 9465. Choose what feels best for you.

-

Complete the Application: If you’re applying online, just follow the prompts to enter your information. For Form 9465, make sure to fill out all required fields completely. It’s important to be thorough.

-

Submit Your Request: For online submissions, send your application directly through the IRS portal. If you’re going the paper route, mail your completed form to the address provided in the instructions.

-

Await Confirmation: After you submit, the IRS will review your request and let you know if it’s approved or if there are any issues. Expect updates via email or mail. Most taxpayers qualify for an IRS payment plan for back taxes, making this process accessible. Typically, the processing time is quick, and you’ll receive prompt notifications for online submissions. Remember, "Once you finish your online submission, you will receive prompt notification of whether your financial arrangement has been approved."

Real-world examples show that individuals who carefully follow these steps often find relief from their tax burdens. You are not alone in this journey; many have successfully navigated this process, and you can too!

Troubleshoot Common Application Issues

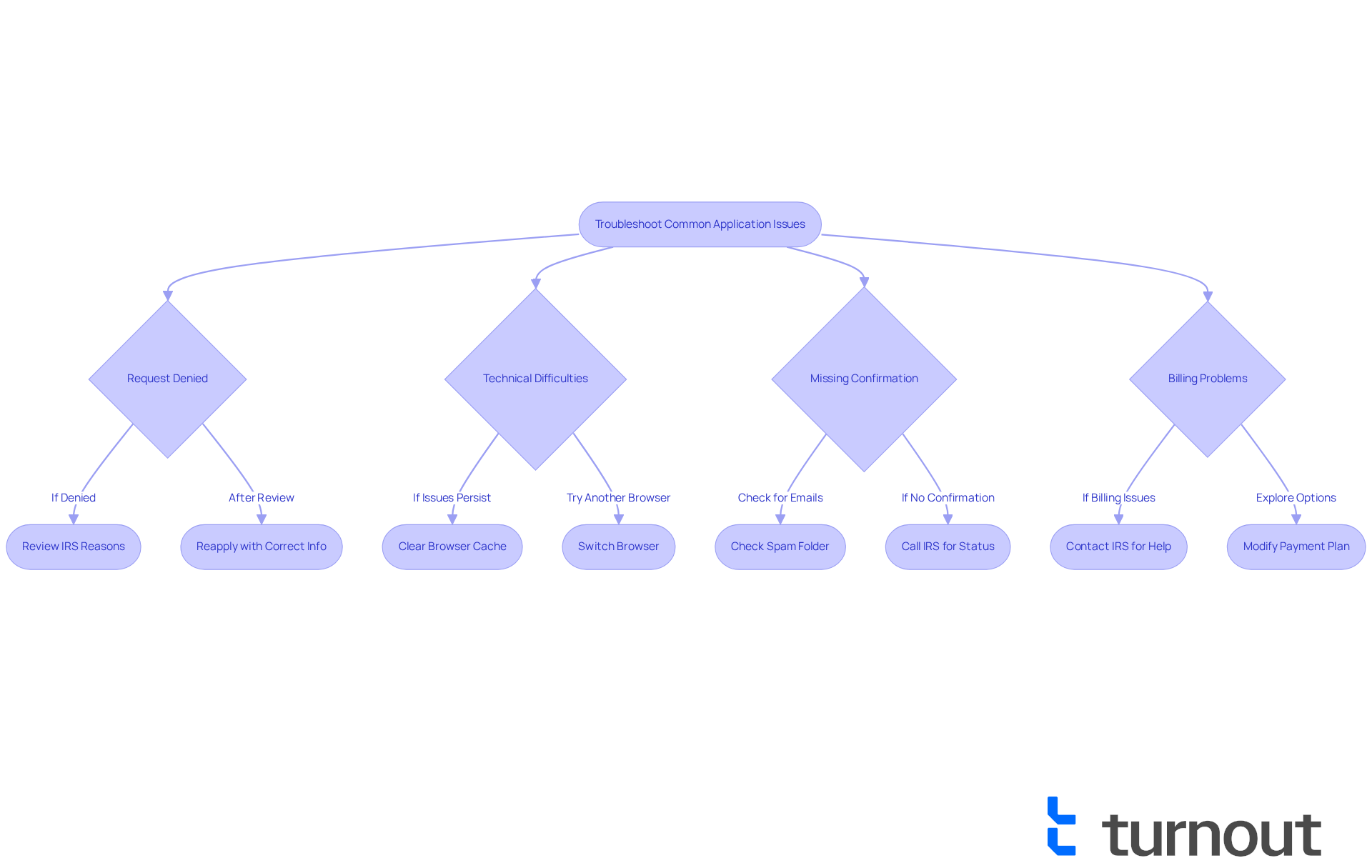

If you’re facing challenges while applying for an IRS payment plan for back taxes, remember that you’re not alone. Here are some helpful tips to guide you through the process:

-

Request Denied: If your request is denied, take a moment to review the reasons provided by the IRS. Common issues often stem from incomplete information or not meeting eligibility criteria. By addressing these concerns, you can confidently reapply.

-

Technical Difficulties: Experiencing issues with the online tool? It’s common to feel frustrated. Try clearing your browser cache or switching to a different browser. Also, ensure your internet connection is stable to avoid interruptions.

-

Missing Confirmation: Not receiving confirmation after submitting your request can be unsettling. Check your spam folder for emails from the IRS. If you still don’t see anything, don’t hesitate to call the IRS to verify the status of your application.

-

Billing Problems: If you encounter difficulties with transactions after your arrangement is approved, reach out to the IRS promptly. They’re there to help you explore your options, and they may allow you to modify your payment plan based on your current financial situation.

By being proactive and informed, you can navigate these common issues effectively. Remember, we’re here to help you every step of the way.

Conclusion

Navigating the complexities of back taxes can feel overwhelming, and we understand that. However, grasping the IRS payment plan options available is crucial for regaining your financial stability. These plans offer a structured way to manage tax debts, allowing you to choose arrangements that align with your unique financial situation. Whether you’re considering a short-term solution or a long-term installment agreement, remember that there are viable paths to easing your tax burdens.

In this guide, we’ve explored various types of IRS payment plans, including:

- Short-term options

- Long-term arrangements

- Partial payment agreements

Each choice is designed to cater to different financial circumstances, highlighting the importance of assessing your eligibility based on total tax debt, filing status, and any financial hardships you may be facing. Plus, the step-by-step application process we outlined aims to provide clarity and confidence for those ready to take action toward resolving their tax obligations.

Ultimately, understanding and utilizing IRS payment plans is incredibly significant. By taking proactive steps to address your tax debts, you not only reduce financial stress but also pave the way for a more secure financial future. Engaging with these resources and seeking help when needed can transform a complicated situation into a manageable one. Remember, taking that first step today is vital to ensure that tax obligations don’t hinder your future opportunities for financial growth and peace of mind. You are not alone in this journey, and we’re here to help.

Frequently Asked Questions

What options does the IRS provide for managing back taxes?

The IRS offers several settlement options, including short-term payment options, long-term installment arrangements, and partial payment installment agreements.

What is the short-term payment option?

The short-term payment option is suitable for individuals who can pay their balance in full within 180 days. It provides extra time to settle the debt quickly.

How does the long-term installment arrangement work?

The long-term installment arrangement allows individuals to make payments over an extended period, usually up to 72 months, making it ideal for those with larger tax debts who cannot pay everything at once.

What is a partial payment installment agreement?

A partial payment installment agreement allows individuals to pay a reduced amount over time, which may be less than the total amount owed. This option is particularly beneficial for those experiencing significant financial hardship.

Why is it important to understand IRS payment plans for back taxes?

Understanding IRS payment plans is crucial as it empowers individuals to choose the right arrangement based on their financial situation and tax responsibilities.