Introduction

Navigating the complexities of tax debt can feel like an uphill battle. We understand that many are struggling to regain their financial footing. The IRS Fresh Start Program offers a lifeline, simplifying the repayment process and providing various relief options tailored to your individual circumstances. Whether it’s installment agreements or offers in compromise, there are solutions available.

However, it’s common to feel overwhelmed by the eligibility criteria and application steps. Many taxpayers find themselves asking:

- How can one successfully navigate the online application process?

- How can one maximize the benefits of this program?

You're not alone in this journey, and we're here to help.

Understand the IRS Fresh Start Program

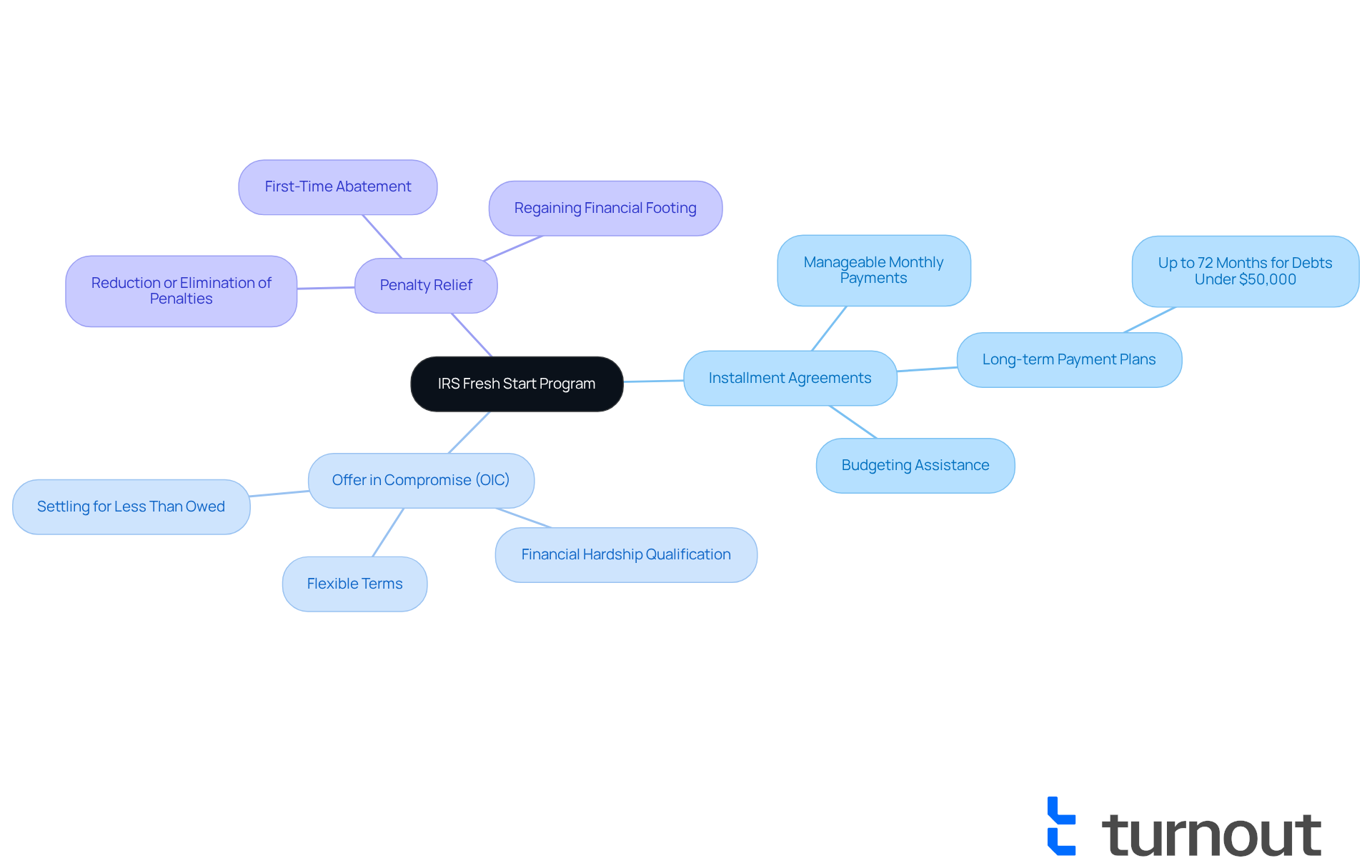

The IRS New Start Program is a vital initiative designed to help taxpayers who are struggling with tax debt. We understand that dealing with tax issues can be overwhelming, and this program offers a range of relief options to simplify the repayment process and prevent tax liens. Here are some key features:

- Installment Agreements: This option allows you to settle your tax debt through manageable monthly payments. It makes budgeting and planning your finances much easier.

- Offer in Compromise (OIC): If you're facing financial hardship, you may qualify to settle your tax debt for less than what you owe. This can provide significant relief during tough times.

- Penalty Relief: The program includes provisions to reduce or eliminate penalties associated with late payments or filings. This helps you regain your financial footing.

Understanding these components is essential for navigating the IRS Fresh Start Program application online process effectively and maximizing the benefits available under the program. Recent updates have made it easier for individuals to qualify, with streamlined requirements and increased thresholds for installment agreements. For example, if you owe up to $50,000, you can now set up long-term payment plans lasting up to 72 months. This enhances accessibility to relief options.

Real-world examples show the program's impact: many taxpayers have successfully utilized the Start Program to alleviate their tax burdens, allowing them to focus on rebuilding their financial stability. As the IRS continues to refine the program, staying informed about the latest options and requirements is crucial for those seeking tax relief. Remember, you are not alone in this journey, and we're here to help.

Determine Your Eligibility for the Program

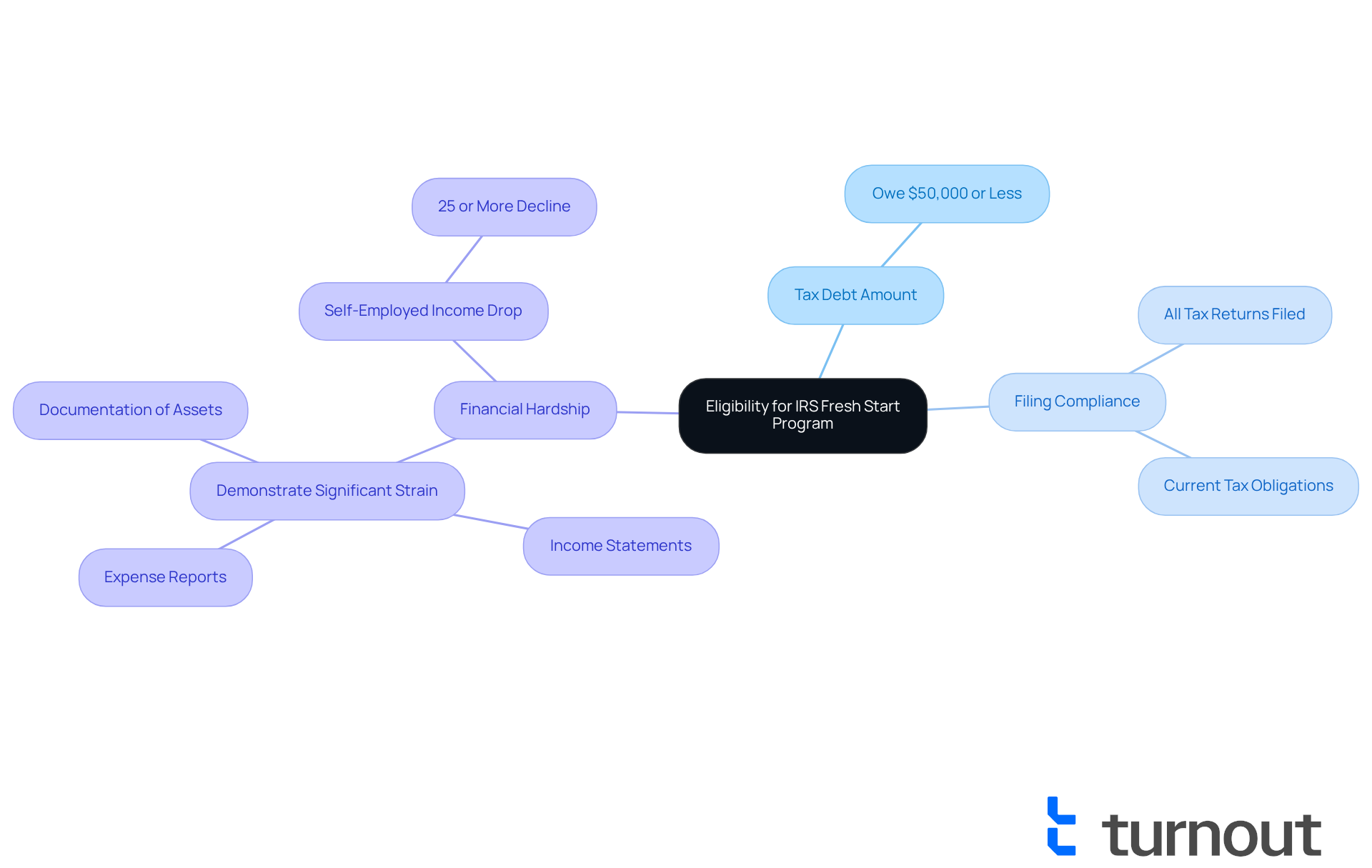

Navigating tax debt can be overwhelming, but the IRS Fresh Start Program application online offers a way forward. To qualify, there are specific eligibility criteria you need to meet:

- Tax Debt Amount: Generally, you must owe $50,000 or less in tax debt to access streamlined options.

- Filing Compliance: It’s essential that all required tax returns are filed. The IRS won’t consider any relief unless your filings are current. If you haven’t filed, don’t worry-just catch up on your returns first.

- Financial Hardship: You need to show that paying your tax debt in full would create significant financial strain. This can be demonstrated through income statements, expense reports, and documentation of assets. If you’re self-employed and have experienced a 25% or more drop in income, you may qualify for expanded options under the program.

Before you complete the IRS Fresh Start Program application online, it’s crucial to gather necessary documents like tax returns, income statements, and any relevant financial information to support your eligibility. We understand that this process can feel daunting, and tax professionals emphasize that a thorough review of your financial situation is essential. Not everyone qualifies automatically for the program, and that’s okay. As IRS tax attorney Nick Nemeth wisely states, "New Start can absolutely provide life-changing relief, but not everyone qualifies automatically."

Grasping these requirements can greatly improve your chances of effectively managing the enrollment process. Remember, you’re not alone in this journey-we’re here to help.

Follow the Step-by-Step Application Process

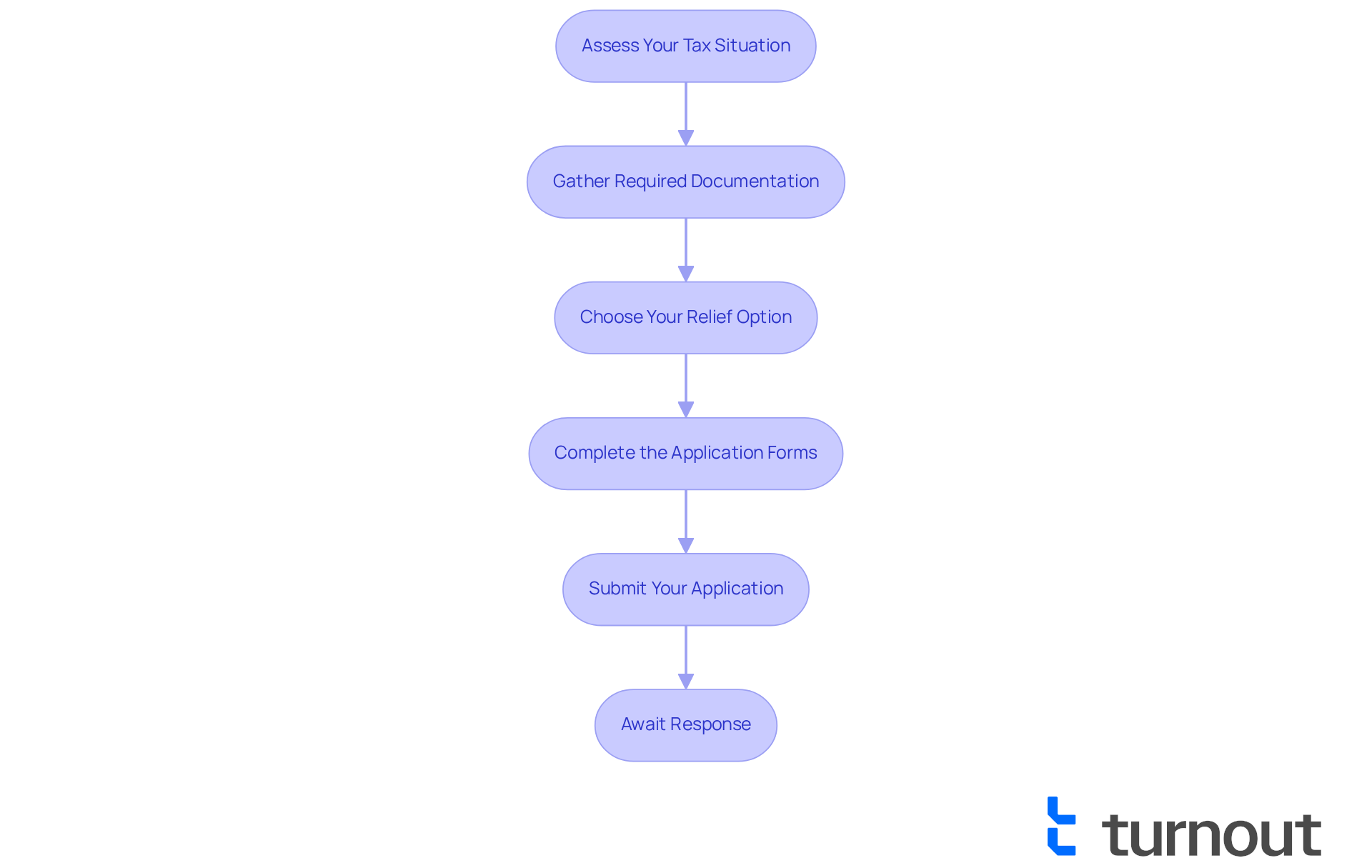

Navigating tax issues can be overwhelming, but the IRS Fresh Start Program application online offers a path to relief. Here’s how to take those essential steps with confidence:

-

Assess Your Tax Situation: Start by understanding the total amount of tax debt you owe. It’s important to ensure that all your tax returns are filed. We understand that this can feel daunting, but taking this first step is crucial.

-

Gather Required Documentation: Collect the necessary documents to support your application. This typically includes:

- Recent tax returns

- Proof of income, like pay stubs and bank statements

- Documentation of expenses, such as bills and mortgage statements

Having everything organized can make a significant difference.

-

Choose Your Relief Option: Think about which relief option suits your financial situation best. Whether it’s an installment agreement, an offer in compromise, or another form of relief, knowing your choices is empowering.

-

Complete the Application Forms: Depending on your chosen option, fill out the appropriate forms:

- For an installment agreement, use IRS Form 9465.

- For an offer in compromise, complete IRS Form 656 and Form 433-A (OIC).

Remember, taking your time here can help ensure accuracy.

-

Submit Your Application: Once your forms are complete, send them along with your supporting documents to the IRS. You can submit applications online through the IRS Online Payment Agreement tool or by mailing your forms. It’s common to feel anxious at this stage, but you’re taking a positive step forward.

-

Await Response: After submission, keep an eye on your status. Be prepared to provide additional information if the IRS requests it. Patience is key here.

Statistics show that thorough documentation significantly boosts your chances of a successful submission. Tax professionals often recommend ensuring all paperwork is complete and accurate to avoid delays or denials. It’s also important to be aware that interest and penalties may continue to accrue during payment plans or while in Currently Not Collectible status. Typically, the IRS New Beginning Program submission takes about 1 to 3 months for processing, but remember that complicated cases might require more time.

By following these steps and keeping your records organized, you can navigate the IRS Fresh Start Program application online submission process with greater ease. Remember, you’re not alone in this journey, and we’re here to help.

Troubleshoot Common Application Issues

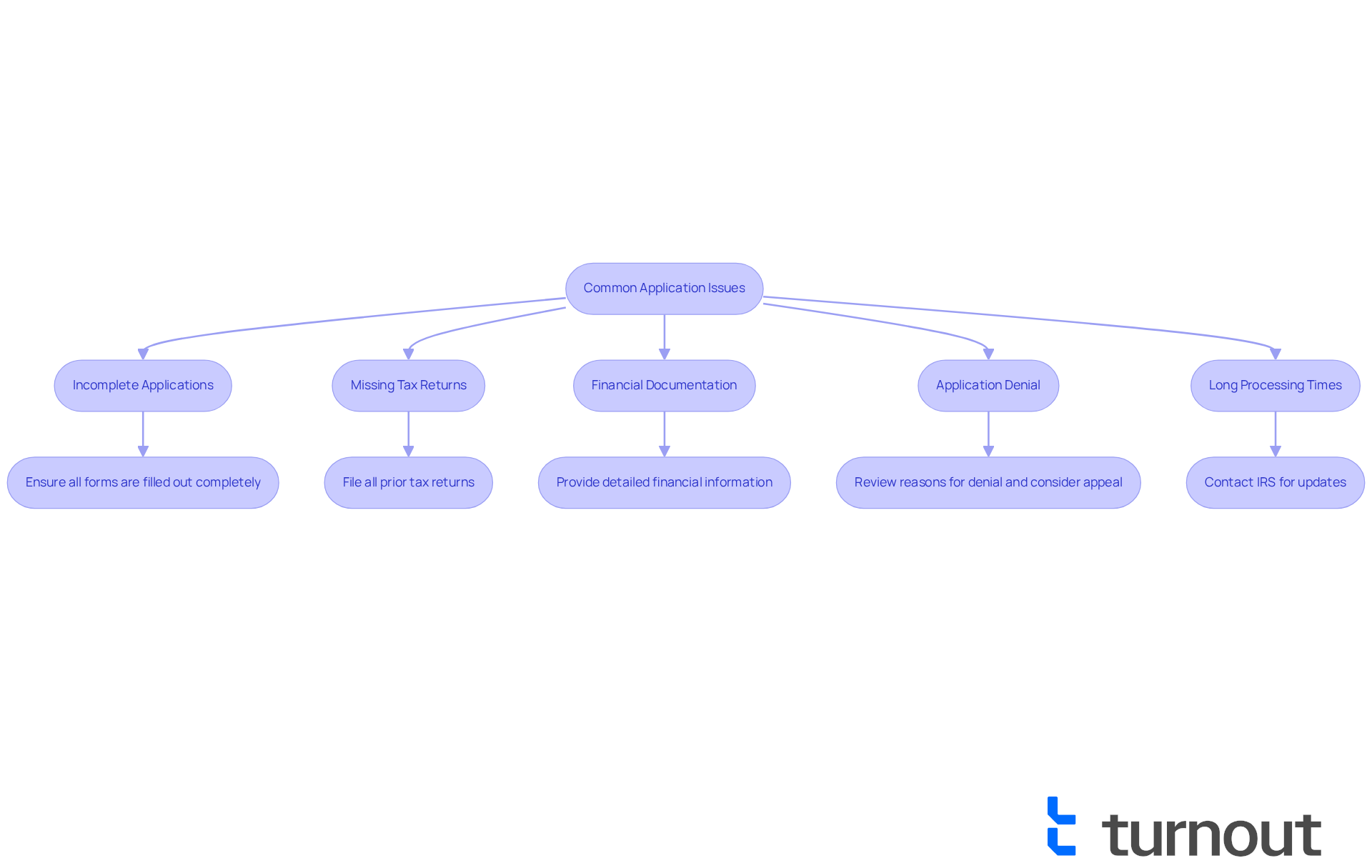

The process of completing the IRS Fresh Start Program application online can feel overwhelming, and it's common to encounter a few bumps along the way. But don’t worry; we’re here to help you navigate through these challenges. Here’s how to troubleshoot some of the most frequent issues:

-

Incomplete Applications: Many applications face denial due to incomplete submissions. To avoid this, ensure that all required forms are filled out completely. Double-check that you’ve included all necessary documentation. Missing information can lead to frustrating delays or outright denials. Remember, the acceptance rate for Offer in Compromise remains low, even with Fresh Start's expanded criteria. This highlights just how important it is to submit comprehensive applications for the IRS Fresh Start Program application online.

-

Missing Tax Returns: It’s crucial to have all your tax returns filed before applying. The IRS won’t process your request if you have unfiled returns. Even one missing return can disqualify you from the program. Make sure all prior tax returns are submitted and received by the IRS to ensure your eligibility for the IRS Fresh Start Program application online for tax relief.

-

Financial Documentation: Be ready to provide detailed financial information. The IRS often requests additional documentation, so responding promptly is key to avoiding processing delays. Precise and thorough financial disclosures are essential for a successful submission. As the Tax Hardship Center notes, "Absolutely. We provide ongoing support to ensure compliance with the program’s requirements."

-

Application Denial: If your application is denied, take a moment to carefully review the reasons provided by the IRS. Common issues include insufficient documentation or not meeting eligibility criteria. You have the option to appeal the decision or reapply with additional supporting information to strengthen your case.

-

Long Processing Times: Approval for the IRS New Start Program usually takes about 4 to 6 weeks, but complex cases may take longer. If you find yourself facing delays, consider reaching out to the IRS directly for updates on your IRS Fresh Start Program application online status. Maintaining open communication can help ease frustrations and clarify any outstanding issues. Also, ensure you’re compliant with IRS regulations, including timely responses to notices and avoiding new tax debts during the relief request process.

Remember, you’re not alone in this journey. We understand that navigating these processes can be tough, but with the right information and support, you can move forward with confidence.

Conclusion

The IRS Fresh Start Program is a vital lifeline for taxpayers facing the heavy burden of tax debt. We understand that navigating these challenges can feel overwhelming, but this program offers a structured pathway to financial relief. By exploring options like installment agreements, offers in compromise, and penalty relief, you can take meaningful steps toward regaining control over your financial situation.

In this article, we outlined essential steps for applying to the IRS Fresh Start Program online. From determining your eligibility to gathering necessary documentation and troubleshooting common application issues, each step is crucial. Thorough preparation and compliance can significantly reduce the stress associated with tax debt. Remember, every action you take - from assessing your tax situation to submitting a complete application - enhances your chances of approval.

Ultimately, the IRS Fresh Start Program shines as a beacon of hope for those struggling with tax obligations. It’s important to stay informed about eligibility requirements and application procedures to fully benefit from what this program has to offer. Taking action now can pave the way for a more secure financial future, allowing you to focus on rebuilding your life without the weight of overwhelming tax debt. You're not alone in this journey; we're here to help.

Frequently Asked Questions

What is the IRS Fresh Start Program?

The IRS Fresh Start Program is an initiative designed to help taxpayers struggling with tax debt by offering various relief options to simplify repayment and prevent tax liens.

What are the key features of the IRS Fresh Start Program?

Key features include Installment Agreements for manageable monthly payments, Offer in Compromise (OIC) to settle tax debt for less than owed, and Penalty Relief to reduce or eliminate penalties for late payments or filings.

How do Installment Agreements work under the Fresh Start Program?

Installment Agreements allow taxpayers to settle their tax debt through manageable monthly payments, making it easier to budget and plan finances.

What is an Offer in Compromise (OIC)?

An Offer in Compromise (OIC) is an option for taxpayers facing financial hardship to settle their tax debt for less than the total amount owed, providing significant relief during difficult financial times.

How does the Fresh Start Program provide Penalty Relief?

The program includes provisions to reduce or eliminate penalties associated with late payments or filings, helping taxpayers regain their financial footing.

What recent updates have been made to the IRS Fresh Start Program?

Recent updates have streamlined requirements and increased thresholds for installment agreements, allowing individuals who owe up to $50,000 to set up long-term payment plans lasting up to 72 months.

Can you provide examples of how the Fresh Start Program has helped taxpayers?

Many taxpayers have successfully utilized the Fresh Start Program to alleviate their tax burdens, enabling them to focus on rebuilding their financial stability.

Why is it important to stay informed about the IRS Fresh Start Program?

Staying informed about the latest options and requirements is crucial for those seeking tax relief, as the IRS continues to refine the program to enhance accessibility.