Introduction

Receiving an IRS CP23 notice can feel overwhelming. Many taxpayers experience anxiety when they see discrepancies in their estimated tax payments, which could lead to unexpected financial challenges. This important communication from the IRS deserves your careful attention. It outlines adjustments made to your tax returns that may result in additional amounts owed.

Statistics show that only one in three taxpayers fully understands the implications of such notices. This makes it crucial to know how to respond effectively. We understand that navigating this complex process can be daunting. How can you ensure that you address your tax issues promptly and accurately, avoiding penalties and further complications?

You're not alone in this journey. We're here to help you understand your options and take the right steps forward.

Understand the IRS CP23 Notice

The IRS Notice is an important communication from the Internal Revenue Service, letting you know about discrepancies related to your estimated tax payments. This announcement often means that the IRS has made adjustments to your tax return, which could result in an additional amount owed. It details the specific changes made, including the amounts altered and how they affect your overall tax balance.

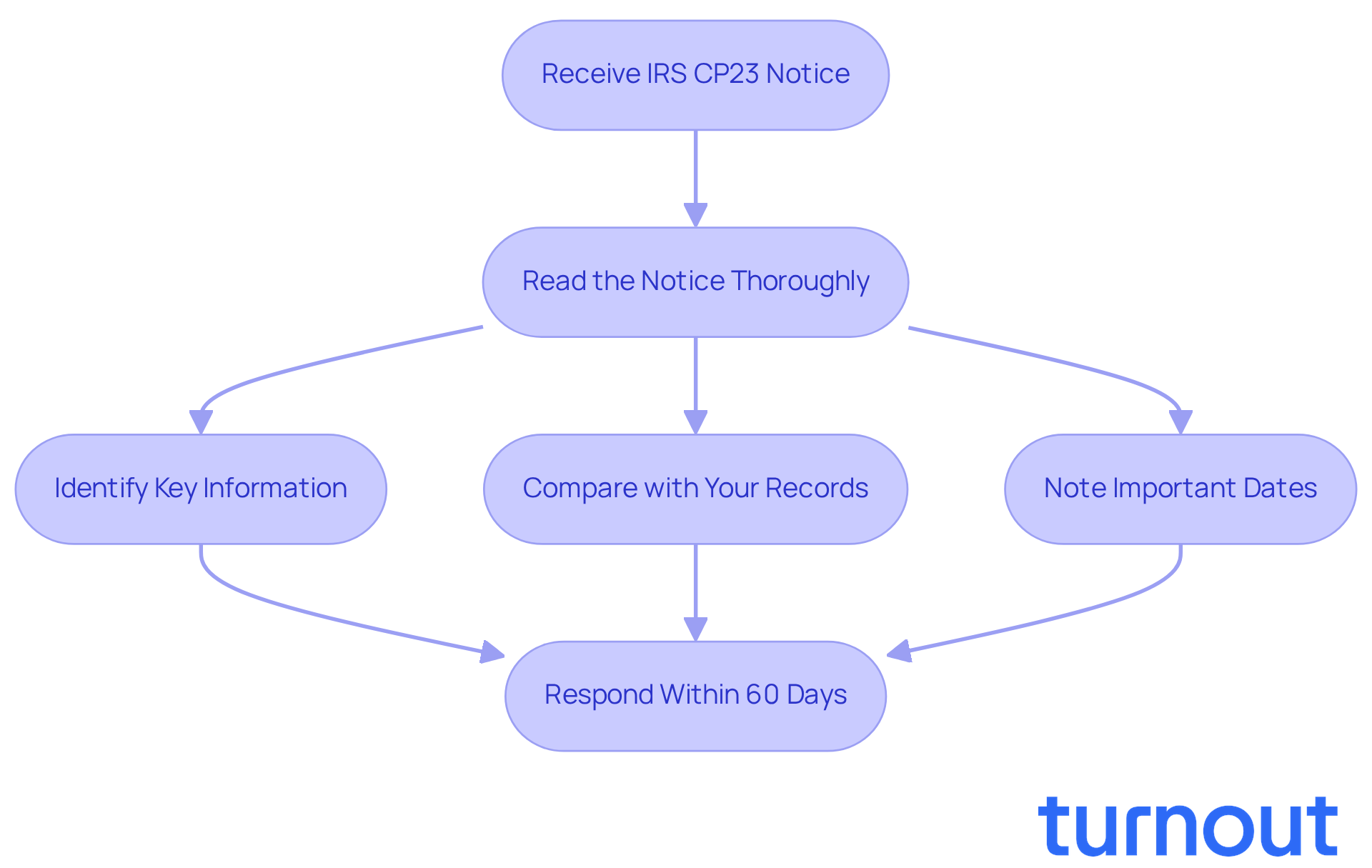

To help you understand your CP23 Notice, here are some steps to follow:

- Read the Notice Thoroughly: Take your time to review the details, including the tax year in question and the specific changes made to your return.

- Identify Key Information: Look for the amount owed, the payment due date, and any instructions provided by the IRS.

- Compare with Your Records: Cross-reference the information from the notice with your own tax records to spot any discrepancies.

- Note Important Dates: Keep an eye on deadlines for responding or making payments to avoid penalties.

Understanding the IRS CP23 notice is crucial for addressing any issues it raises. Remember, you have a 60-day period to respond to this communication to preserve your appeal rights. If you think the adjustments indicated on the IRS CP23 are incorrect, it’s essential to reach out to them within this timeframe to potentially reverse the changes made to your return. Ignoring the notice can lead to escalating collection actions, including further communications and possible levies on your bank accounts or wages. In fact, failing to act can cause your balance owed to grow significantly due to accumulating penalties and interest.

Statistics show that only about one in three taxpayers fully understand the implications of a tax notice, highlighting the need for clear guidance. By taking proactive steps to understand and address your notice, you can navigate this complex process with greater confidence and reduce the risk of additional complications. Remember, you’re not alone in this journey; we’re here to help.

Identify Why You Received the CP23 Notice

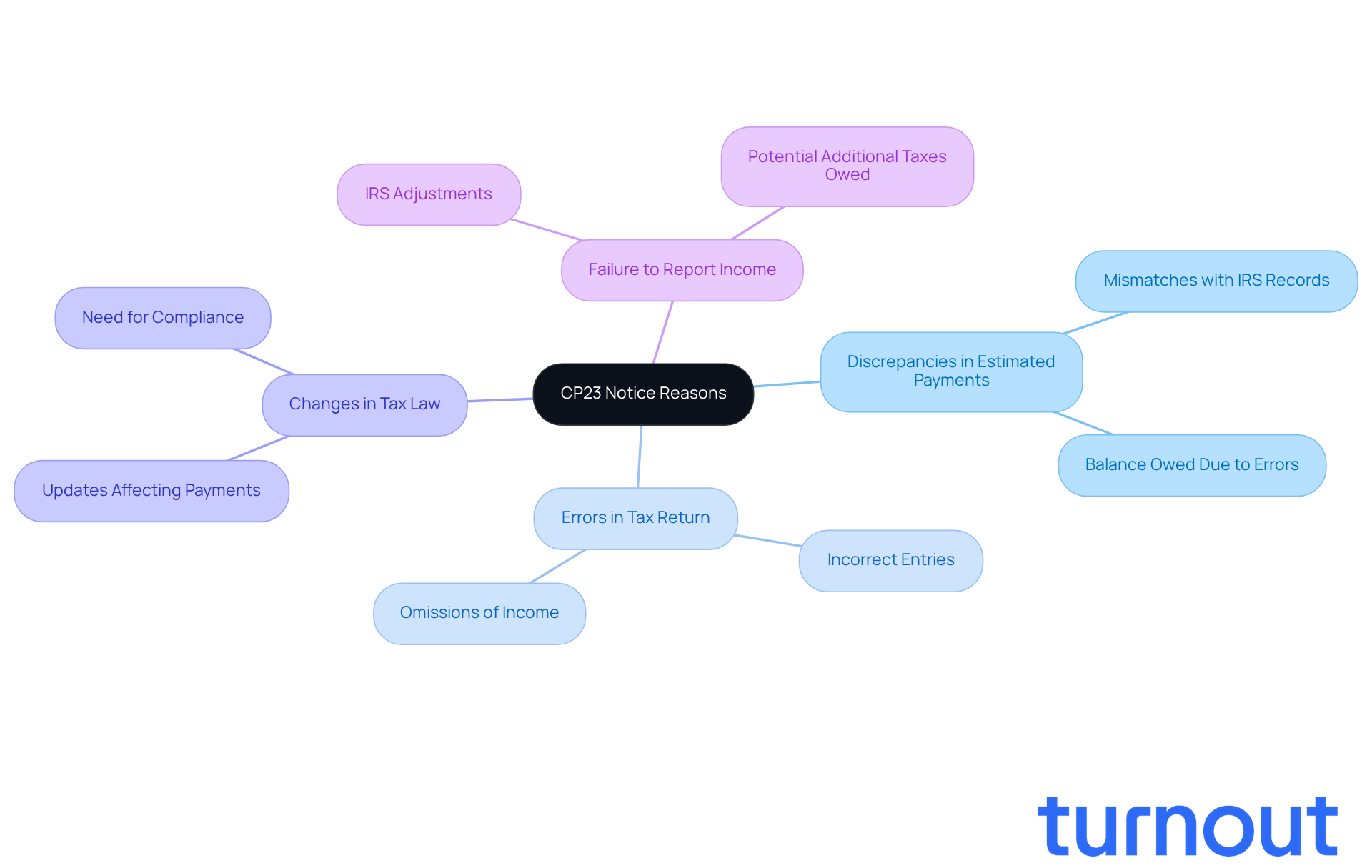

To effectively respond to the notice, it’s important to understand why it was issued. We know that receiving such a notice can be stressful, so let’s explore some common triggers:

-

Discrepancies in Estimated Payments: Many tax notices arise from mismatches between the estimated tax payments you reported and those documented by the IRS. This often leads to a balance owed, and it’s common for taxpayers to receive alerts because of this issue.

-

Errors in Tax Return: Mistakes like incorrect entries or omissions can prompt the IRS to issue a notice, indicating adjustments to your account. For example, you might get a notice if you didn’t report all your income or miscalculated your estimated payments.

-

Changes in Tax Law: Updates in tax regulations can affect your estimated payments, leading to discrepancies that the IRS needs to address. Staying informed about these changes is crucial for your filings.

-

Failure to report income can lead the IRS to adjust your return, which may result in receiving an IRS CP23. This adjustment could result in additional taxes owed.

To find out the specific reason for your alert, carefully review the explanation provided within it. This will guide your next steps in addressing the issue effectively. Remember, you have 60 days to reach out to the IRS to reverse any changes if you can support your claim. It’s common to feel overwhelmed, but neglecting to respond by the due date may lead to accumulating penalties and interest. We’re here to help you navigate this process.

Respond to the CP23 Notice: Step-by-Step Actions

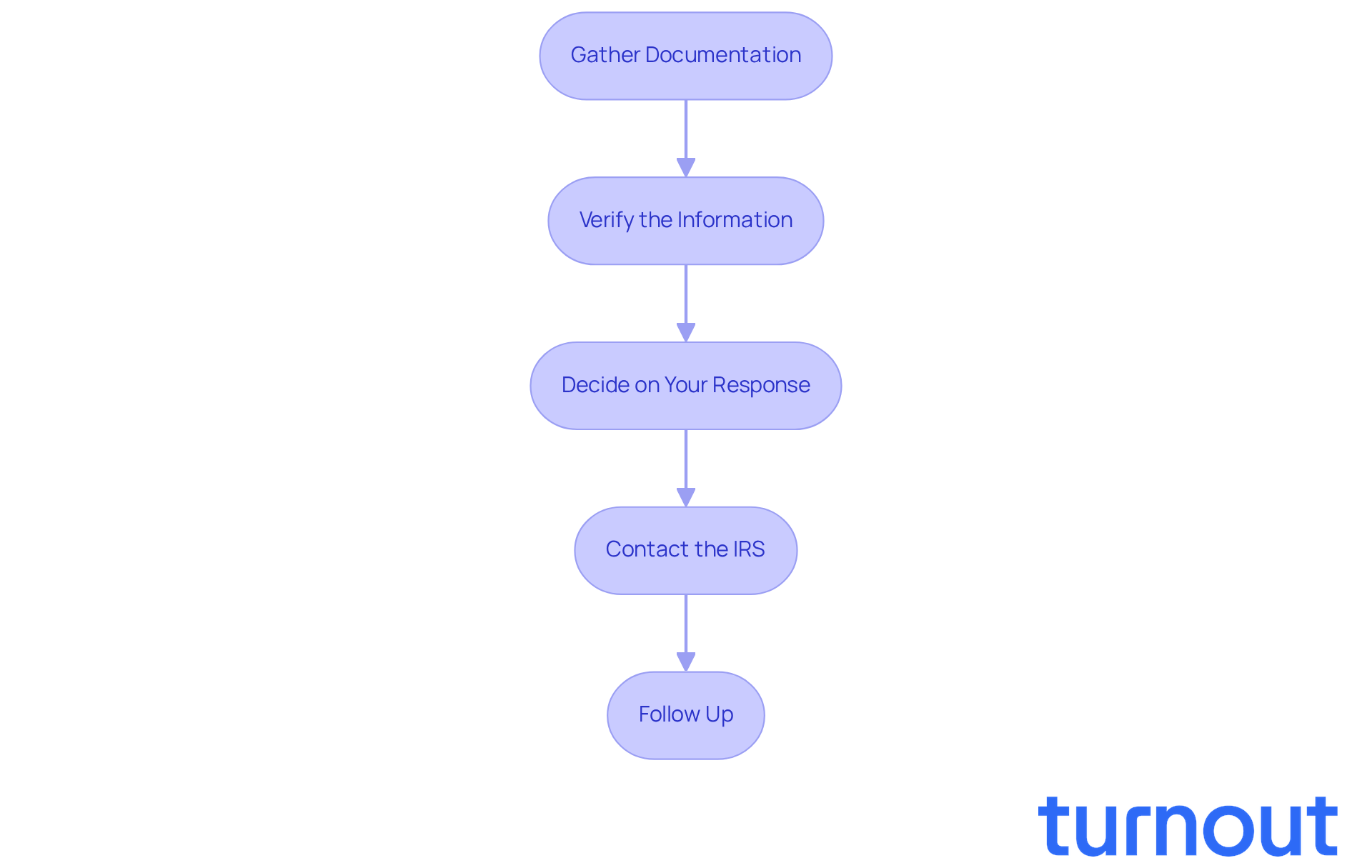

To effectively respond to the CP23 Notice, let’s walk through some essential steps together:

-

Gather Documentation: Start by collecting all the important documents you’ll need, like your tax return, payment records, and any correspondence from the IRS. This documentation is vital for supporting your case and ensuring you’re prepared.

-

Verify the Information: It’s common to feel overwhelmed, but take a moment to cross-check the amounts listed in the announcement against your own records. Confirm whether the IRS CP23 adjustments are accurate; discrepancies related to the IRS CP23 can lead to further complications, and we want to avoid that.

-

Decide on Your Response: If you agree with the announcement, prepare to make the payment by the specified due date. If you disagree, don’t worry-formulate a clear dispute based on your findings. Remember, you have the right to voice your concerns.

-

Contact the IRS: Use the contact information provided in the communication to reach out to the IRS. Whether you choose to call or write, clearly explain your situation and provide any necessary documentation to support your claim. We understand that this can be daunting, but you’re not alone in this.

-

Follow Up: After your initial response, keep an eye out for any further communications from the IRS. Respond promptly to any additional requests for information to avoid penalties and interest, which can accumulate if deadlines are missed. If you fail to substantiate the reversal, your return may be forwarded for an audit, and we want to help you prevent that.

Statistics show that taxpayers have 60 days to contact the IRS CP23 to reverse any changes made due to discrepancies. Timely responses can significantly improve your chances of a successful dispute. In 2023, the IRS accepted only about 1 in 3 Offers in Compromise, highlighting the importance of thorough documentation and prompt action in resolving tax issues. If you need further support, consider reaching out to a Low Income Taxpayer Clinic. Remember, we’re here to help you navigate this process.

Anticipate Next Steps After Your Response

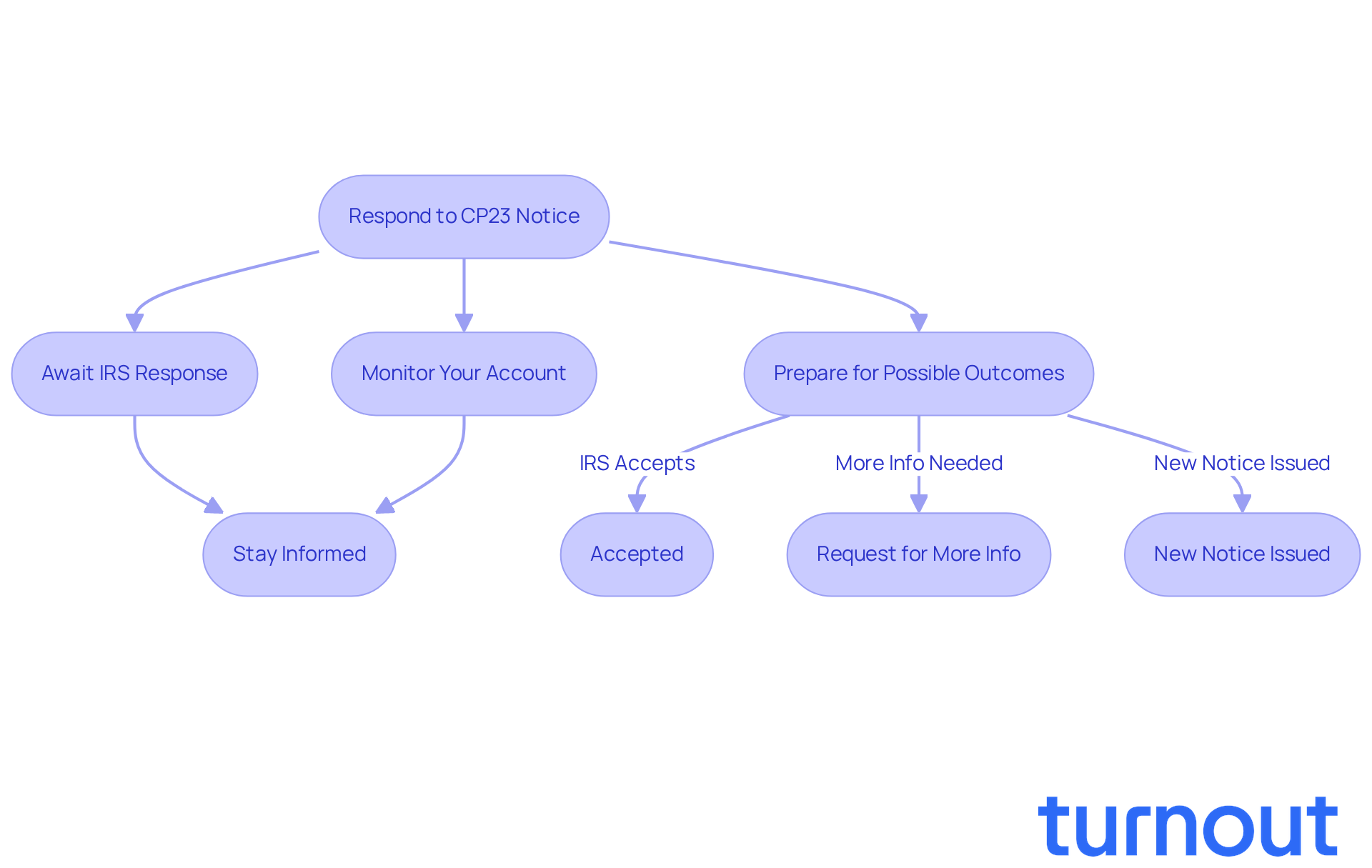

After responding to the CP23 Notice, it’s important to think about what comes next:

-

Await IRS Response: We understand that waiting can be tough. The IRS usually takes several weeks to review your response. While patience is key, being proactive is equally important. If you haven’t heard anything after a reasonable time, consider following up. Remember, timely responses can significantly improve outcomes. Many taxpayers have successfully resolved discrepancies by acting promptly.

-

Monitor Your Account: It’s wise to regularly check your IRS account for updates or changes related to your case. You can easily access your account status online through the IRS website. This way, you can stay informed about any developments. Tools like the IRS online account can help you track your status effectively.

-

Prepare for Possible Outcomes: Depending on your response, the IRS may:

- Accept your explanation and adjust your account accordingly.

- Request additional information or documentation to clarify your case.

- Issue a new notice if they disagree with your response, which could lead to further action. It’s common to feel anxious about this, but maintaining communication with the IRS CP23 is essential. As one expert noted, "We may assess an estimated tax penalty if you didn’t pay enough tax throughout the year, either through withholding or by making estimated tax payments."

-

Stay Informed: Continuously educating yourself about your tax obligations and rights is essential. Resources like the IRS website and taxpayer advocacy groups can provide valuable insights and support. Remember, you have 60 days to contact the IRS to potentially reverse any changes made to your return, so timely action is crucial.

By anticipating these next steps, you can navigate the process more effectively and be ready for any developments regarding your tax situation. We’re here to help, and staying proactive can make a difference in avoiding additional penalties.

Conclusion

Receiving an IRS CP23 notice can feel overwhelming. We understand that this situation might bring up a lot of concerns about your financial well-being. But don’t worry - knowing how to respond effectively is key to navigating this challenge. This guide has laid out essential steps to help you tackle the complexities of this notice, ensuring you’re equipped to address any discrepancies and protect your rights.

First, take a moment to thoroughly read the notice. It’s important to identify the specific reasons behind its issuance. Remember, you have a 60-day window to respond, so prompt action is crucial. Gather the necessary documentation, verify the information, and communicate clearly with the IRS. By doing this, you can significantly improve your chances of resolving any issues and avoiding further complications.

Staying informed and proactive is vital when dealing with IRS communications. Understanding the implications of the CP23 notice and following these outlined steps can help reduce the stress associated with tax discrepancies. You’re not alone in this journey; empowerment through knowledge and timely action can lead to a smoother resolution process. Take a deep breath, and move forward with confidence.

Frequently Asked Questions

What is the IRS CP23 Notice?

The IRS CP23 Notice is a communication from the Internal Revenue Service informing taxpayers about discrepancies related to their estimated tax payments and potential adjustments made to their tax return, which may result in an additional amount owed.

What should I do when I receive a CP23 Notice?

You should read the notice thoroughly, identify key information such as the amount owed and payment due date, compare the notice details with your own tax records, and note any important dates for responding or making payments.

How long do I have to respond to the CP23 Notice?

You have a 60-day period to respond to the CP23 Notice to preserve your appeal rights.

What happens if I believe the adjustments on the CP23 Notice are incorrect?

If you believe the adjustments are incorrect, it is essential to reach out to the IRS within the 60-day response period to potentially reverse the changes made to your return.

What are the consequences of ignoring the CP23 Notice?

Ignoring the CP23 Notice can lead to escalating collection actions, including further communications from the IRS and possible levies on your bank accounts or wages. Additionally, your balance owed may grow significantly due to accumulating penalties and interest.

Why is it important to understand the IRS CP23 Notice?

Understanding the IRS CP23 Notice is crucial for addressing any issues it raises, as many taxpayers struggle to comprehend the implications of tax notices. Taking proactive steps can help navigate the process more confidently and reduce the risk of complications.