Introduction

Navigating the complexities of the IRS Automated Collection System can feel overwhelming for many taxpayers. We understand that millions are facing tax collection challenges, and knowing how to effectively use the IRS ACS phone number is crucial for managing overdue payments and avoiding serious consequences. But what if the automated system seems more like a barrier than a bridge to resolution?

This guide is here to offer essential insights and practical steps to empower you in your interactions with the IRS. You're not alone in this journey, and with the right tools, you can tackle any obstacles that arise along the way.

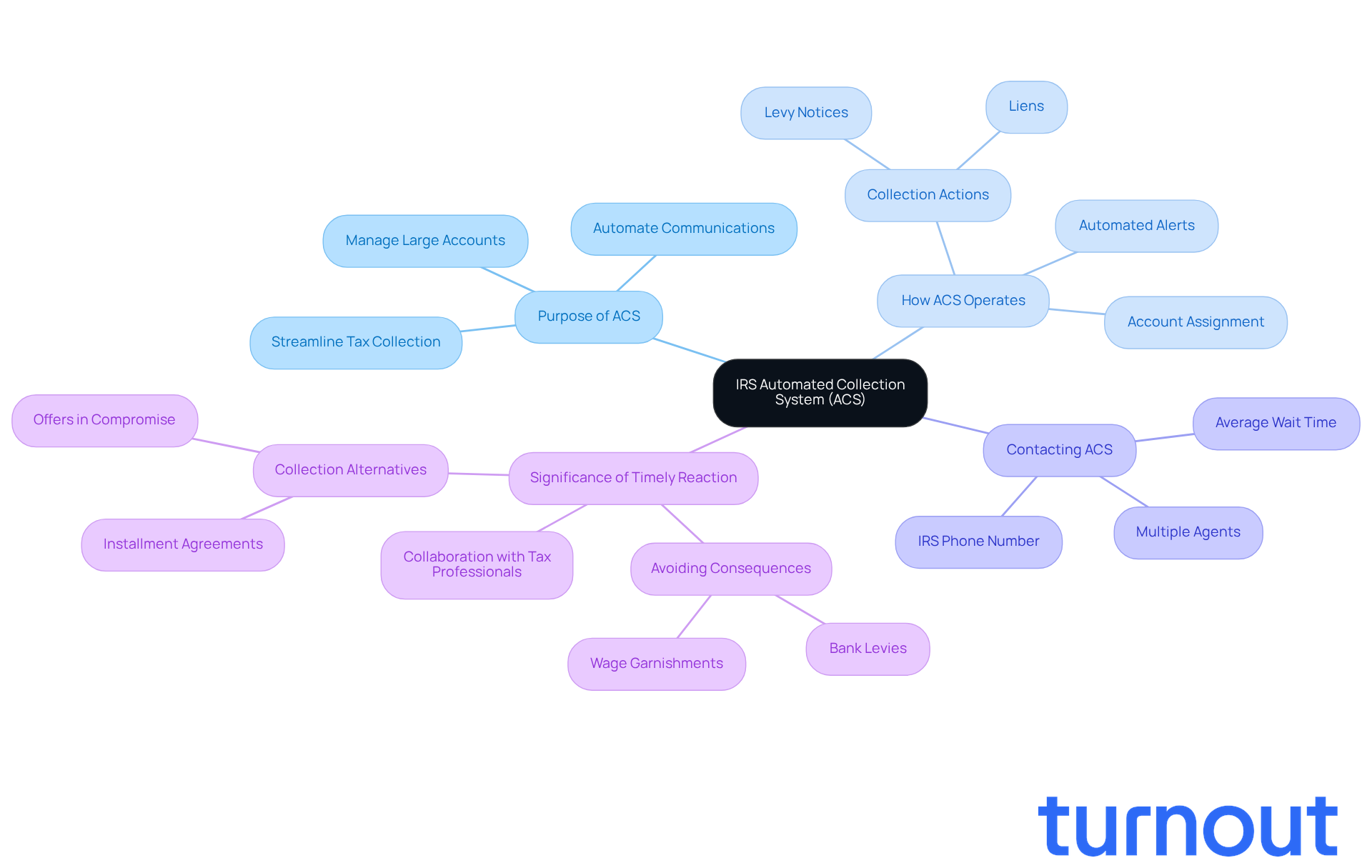

Understand the IRS Automated Collection System (ACS)

Navigating the IRS automated collection system phone number can feel overwhelming, especially when you're facing tax collection challenges. We understand that dealing with overdue payments can be stressful, and it’s crucial to grasp how this system operates. Here’s what you need to know:

-

Purpose of ACS: The ACS is here to help streamline the tax collection process. By automating communications and actions regarding unpaid taxes, the IRS can effectively manage a large number of accounts, and the IRS automated collection system phone number is a key tool in this process. This means that you’re not alone in this; there’s a system in place to handle these situations.

-

How ACS Operates: If you miss a tax payment, your account may be assigned to the ACS. The system automatically sends alerts requesting payment and may initiate collection actions, like levies or liens, to recover what’s owed. It’s important to stay informed about these actions to avoid further complications.

-

If you need to reach out, you can contact ACS representatives by calling the IRS automated collection system phone number provided in IRS correspondence. However, keep in mind that there isn’t a single agent assigned to your case. This means you might have to explain your situation multiple times. Currently, the average wait time for ACS calls is around 38 minutes, so patience is key.

-

Significance of Timely Reaction: Responding quickly to any communications from ACS is vital. Ignoring these messages can lead to serious consequences, such as wage garnishments or bank levies. Tax professionals often recommend establishing a collection alternative, like an installment agreement or an offer in compromise, to help ease these burdens. Collaborating with a tax attorney can also provide tailored solutions to navigate the complexities of the ACS.

As we look ahead to 2025, millions of taxpayers will be interacting with the IRS ACS. Understanding this system is essential for managing your tax obligations effectively and avoiding potential pitfalls. Remember, you are not alone in this journey, and there are resources available to help you through it.

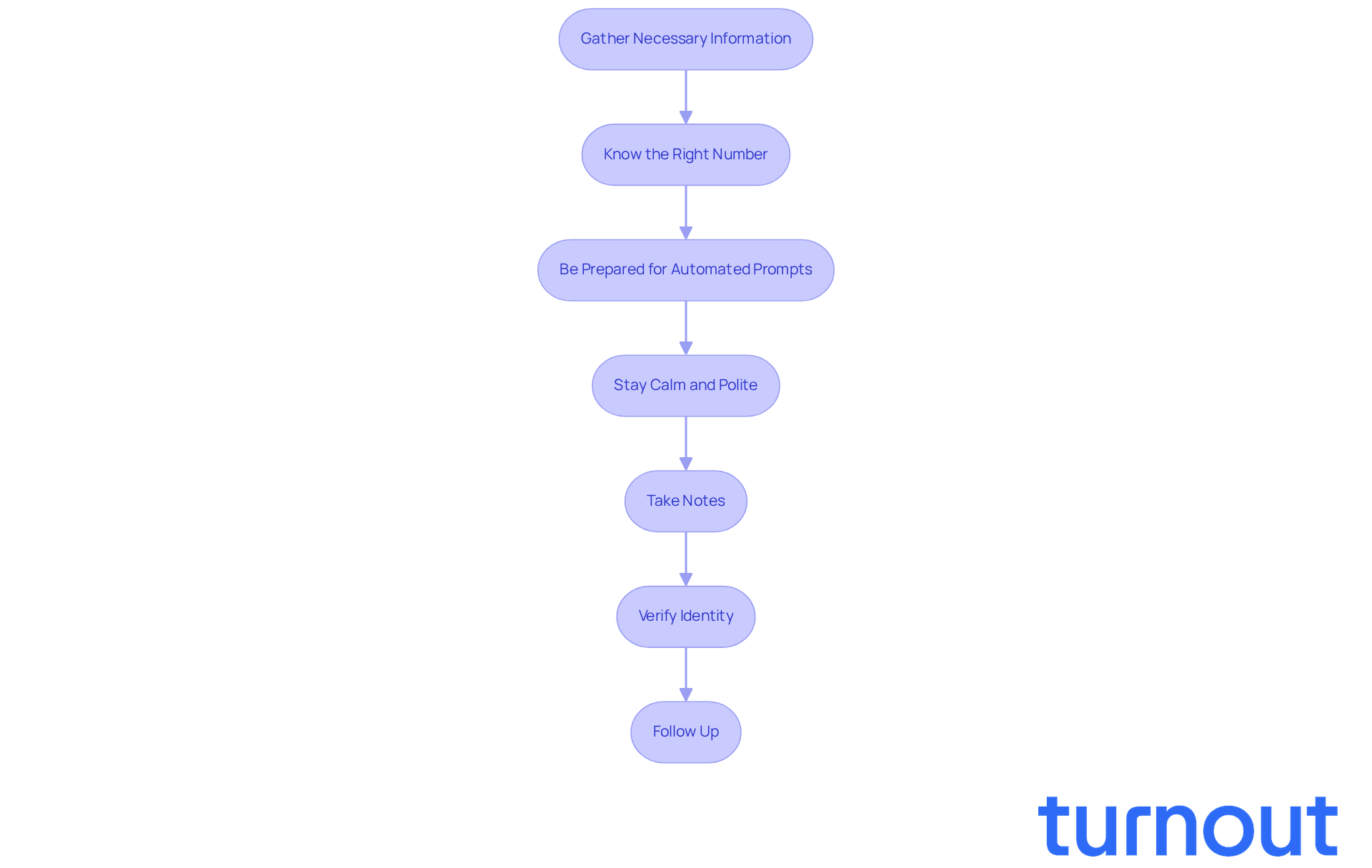

Utilize the IRS ACS Phone Number Effectively

To effectively use the IRS Automated Collection System (ACS) phone number, let’s walk through some helpful steps together:

-

Gather Necessary Information: Start by collecting all relevant documents, like tax alerts, your Social Security number, and any previous correspondence with the IRS. Having this information ready will help the representative assist you more efficiently.

-

Know the Right Number: The IRS automated collection system phone number is 1-800-829-1040. Make sure to call during operating hours, which are typically Monday through Friday, from 7 AM to 7 PM local time.

-

Be Prepared for Automated Prompts: When you call, expect an automated system. Listen carefully to the prompts and select options that relate to your situation, including your language preference and the reason for your call.

-

Stay Calm and Polite: Once you’re connected to a representative, it’s important to maintain a calm and polite demeanor. Clearly explain your situation and the assistance you need. If the representative can’t help, don’t hesitate to ask to speak to a supervisor.

-

Take Notes: Document your call by taking detailed notes. Include the representative's name, employee ID, and any instructions or information they provide. This will be useful for future reference.

-

Verify Identity: Before sharing any personal information, verify the identity of the IRS representative by asking for their name and ID number. This step is crucial to protect yourself from potential scams.

-

Follow Up: Make sure to adhere to any specific instructions or timelines given during the call. If you don’t receive a response within the expected timeframe, it’s perfectly okay to call back to check on your case.

By following these steps, you can enhance your communication with the IRS ACS and improve your chances of resolving tax issues efficiently. Remember, effective communication can significantly boost taxpayer satisfaction, so approaching these interactions with preparation and composure is key. Also, keep in mind that the IRS's renewed use of ACS may increase the risk of enforced collection actions for taxpayers with delinquent accounts, making proactive engagement essential. You're not alone in this journey, and we're here to help!

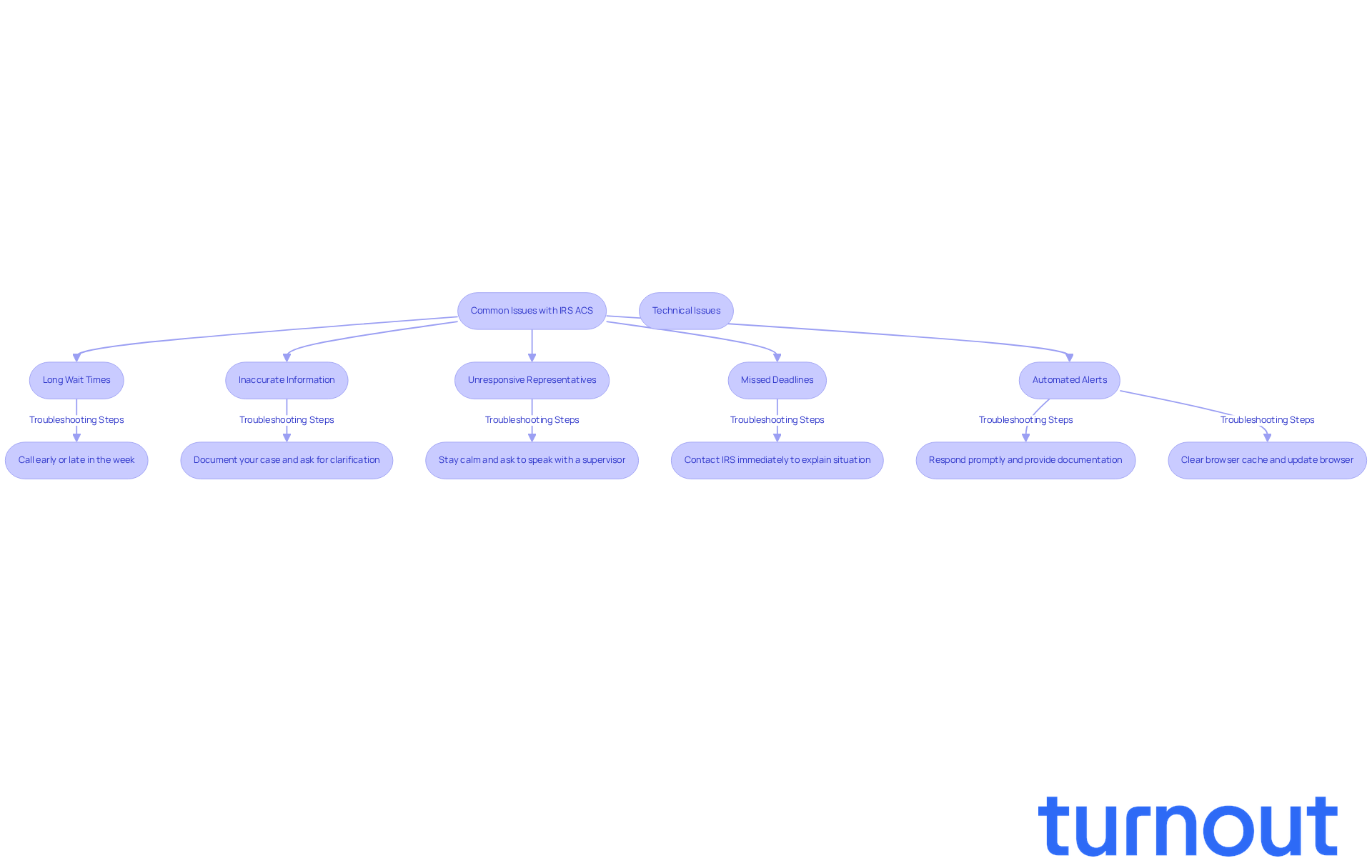

Troubleshoot Common Issues with the IRS ACS

When dealing with the IRS automated collection system phone number, it’s common to encounter a few challenges. Here’s how you can troubleshoot them with confidence:

-

Long Wait Times: We understand that long wait times can be frustrating. If you find yourself on hold, try calling early in the morning or later in the week. Mondays and days after tax deadlines tend to be the busiest, leading to longer waits. While the IRS achieved an 88% Level of Service during Filing Season 2024, it’s still possible to experience delays.

-

Inaccurate Information: If you suspect the information from the IRS is incorrect, don’t hesitate to document your case thoroughly. Ask for clarification from the representative, and if needed, request to speak with a supervisor. Having your documentation ready can make a significant difference in resolving any discrepancies. Tax professionals often stress the importance of careful documentation to help navigate these situations effectively.

-

Unresponsive Representatives: If you encounter a representative who seems unhelpful or dismissive, it’s important to stay calm. Politely ask to speak with a supervisor and explain your situation clearly. Many taxpayers have shared their experiences of inconsistent responses from ACS agents, which can be understandably frustrating.

-

Missed Deadlines: If you miss a deadline due to confusion or lack of communication, reach out to the IRS right away. Explain your situation, as they may grant extensions or offer alternative solutions based on your circumstances. Acting quickly is crucial, as the ACS can initiate collection actions if deadlines are overlooked.

-

Automated Alerts: If you receive automated alerts that seem incorrect, respond promptly. Follow the outlined guidelines and provide any necessary documentation to dispute the claim effectively. Common notices include CP14, indicating an overdue balance, and CP503, which serves as a reminder of taxes due.

-

Technical Issues: If you run into technical difficulties accessing IRS online services, make sure your browser is updated and try clearing your cache. If problems persist, don’t hesitate to reach out to the IRS for assistance. Many taxpayers have faced challenges accessing timely information, which can complicate their situations.

By being aware of these common issues and knowing how to address them, you can navigate the IRS automated collection system phone number more effectively. Remember, you’re not alone in this journey, and we’re here to help reduce the stress associated with tax collection.

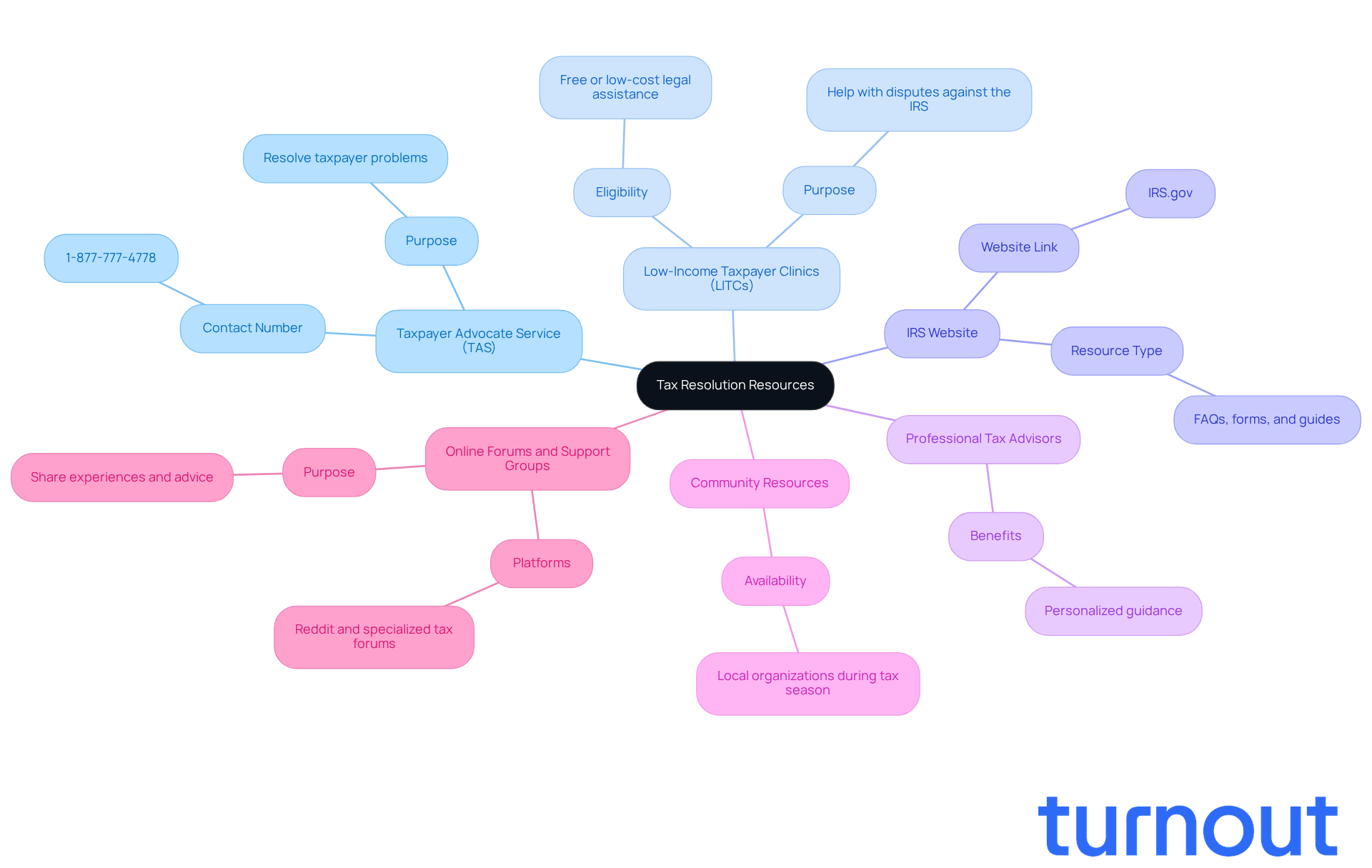

Access Additional Resources for Tax Resolution

If you're feeling overwhelmed by tax issues beyond the IRS automated collection system phone number, remember that you're not alone. There are resources available to help you navigate these challenges with confidence:

- Taxpayer Advocate Service (TAS): This independent organization within the IRS is dedicated to helping taxpayers like you resolve problems. You can reach out to them at 1-877-777-4778 for assistance.

- Low-Income Taxpayer Clinics (LITCs): If you qualify, these clinics offer free or low-cost legal assistance. They can help you with disputes against the IRS and provide valuable education on your tax rights.

- IRS Website: The IRS website is a treasure trove of information, featuring FAQs, forms, and guides on various tax topics. Visit IRS.gov to explore more resources.

- Professional Tax Advisors: Consulting with a tax professional who specializes in tax resolution can be a game-changer. They can offer personalized guidance and strategies tailored to your unique situation.

- Community Resources: Many local organizations provide tax assistance programs, especially during tax season. Look for nonprofits or community centers in your area that can lend a helping hand.

- Online Forums and Support Groups: Engaging with online communities can offer additional insights and support from others who have faced similar tax issues. Websites like Reddit or specialized tax forums can be great places to share experiences and advice.

By utilizing these resources, you can enhance your understanding of tax resolution options. Remember, we're here to help you find the support you need to navigate your tax challenges effectively.

Conclusion

Navigating the complexities of the IRS Automated Collection System (ACS) can feel overwhelming. We understand that managing tax obligations is no small feat, and knowing how the ACS works is essential for finding your way through it. This system aims to simplify tax collection, offering vital tools for both taxpayers and the IRS. By getting familiar with the ACS phone number and the processes involved, you can take meaningful steps to address your tax issues and steer clear of unnecessary complications.

Throughout this article, we’ve shared key insights into how the ACS operates, the importance of timely communication, and practical strategies for effectively using the IRS ACS phone number. From gathering necessary documentation to troubleshooting common issues, these tips empower you to engage confidently with the IRS. We also highlighted valuable resources like the Taxpayer Advocate Service and Low-Income Taxpayer Clinics, which can provide further assistance as you navigate your tax challenges.

Ultimately, proactive engagement with the IRS ACS is crucial for avoiding serious consequences like wage garnishments or bank levies. By taking the time to understand the ACS system and utilizing the resources available, you can alleviate stress and work towards a favorable resolution. Embracing these strategies not only enhances your individual tax management but also fosters a more informed and empowered taxpayer community. Remember, you are not alone in this journey, and we’re here to help.

Frequently Asked Questions

What is the purpose of the IRS Automated Collection System (ACS)?

The purpose of the ACS is to streamline the tax collection process by automating communications and actions regarding unpaid taxes, allowing the IRS to effectively manage a large number of accounts.

How does the ACS operate if I miss a tax payment?

If you miss a tax payment, your account may be assigned to the ACS, which will automatically send alerts requesting payment and may initiate collection actions, such as levies or liens, to recover the owed amount.

How can I contact the ACS if I need assistance?

You can contact ACS representatives by calling the IRS automated collection system phone number provided in IRS correspondence. However, be aware that there isn't a single agent assigned to your case, so you may need to explain your situation multiple times.

What is the average wait time for calls to the ACS?

The average wait time for ACS calls is around 38 minutes, so it is recommended to be patient when calling.

Why is it important to respond quickly to communications from the ACS?

Responding quickly is vital because ignoring communications can lead to serious consequences, such as wage garnishments or bank levies.

What are some recommended actions to take if I am facing tax collection challenges?

Tax professionals often recommend establishing a collection alternative, such as an installment agreement or an offer in compromise, and collaborating with a tax attorney for tailored solutions to navigate the complexities of the ACS.

Why is understanding the ACS important for taxpayers?

Understanding the ACS is essential for managing tax obligations effectively and avoiding potential pitfalls, especially as millions of taxpayers will be interacting with the IRS ACS in the coming years.