Introduction

Navigating tax debt can feel like an overwhelming challenge. We understand that facing the complexities of the IRS 433-A Offer in Compromise (OIC) form can be daunting. This critical document is a lifeline for individuals seeking to settle their tax obligations for less than what they owe. It offers hope for those burdened by financial stress.

However, the journey to mastering the IRS 433-A OIC is filled with nuances and requirements. Many find themselves uncertain about the steps needed to create a compelling application that can withstand the IRS's scrutiny. What if you could turn this challenge into an opportunity for relief?

We’re here to help you navigate this process. Together, we can explore the essential steps to ensure your application stands a chance. Remember, you are not alone in this journey.

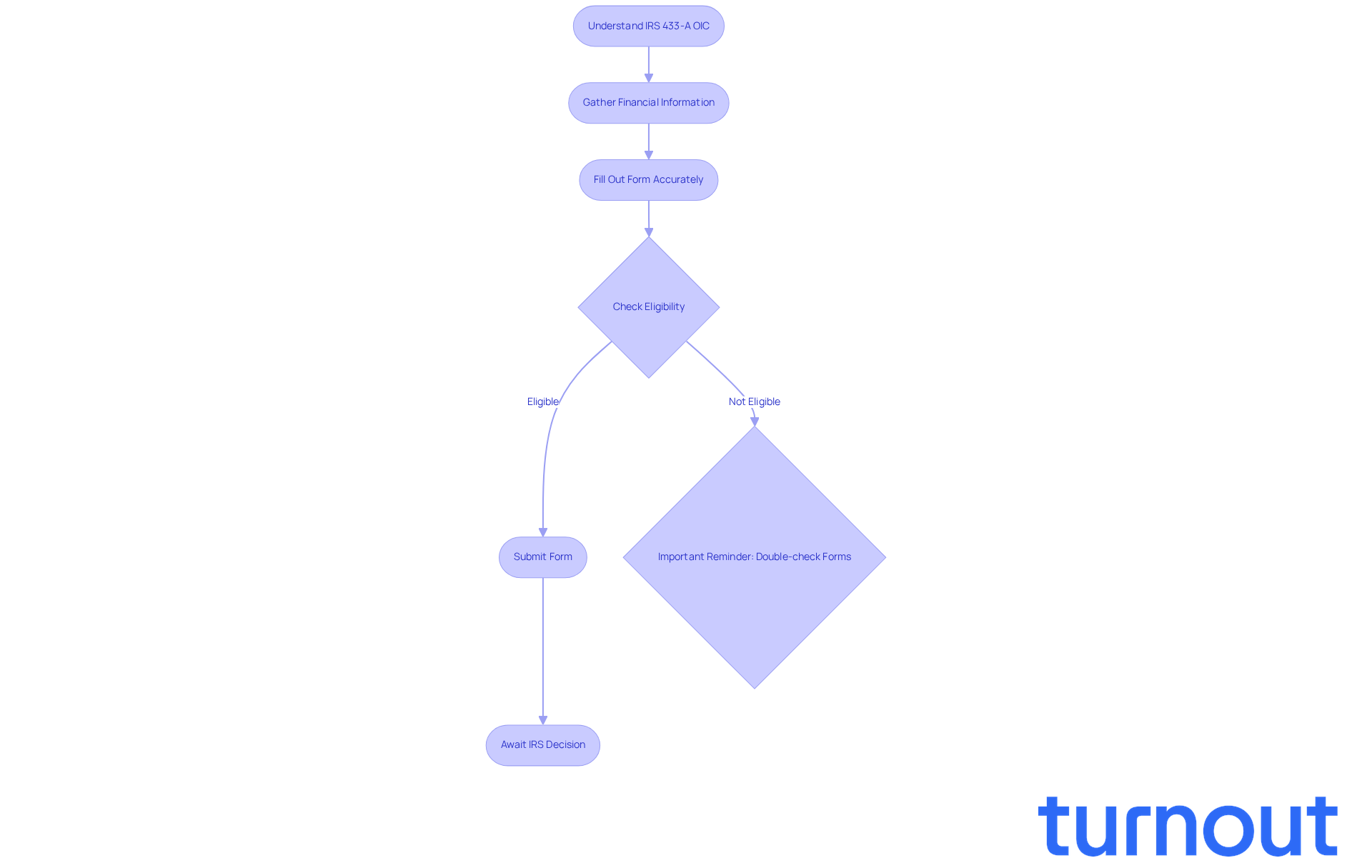

Understand the IRS 433-A OIC: Definition and Importance

The IRS 433-A OIC is more than just a form; it’s a lifeline for individuals seeking an Offer in Compromise (OIC) to settle their tax debts for less than what they owe. We understand that dealing with tax issues can be overwhelming, and this form is essential as it provides the IRS with a complete picture of your financial situation, including your income, expenses, and assets. Understanding this form is crucial because it directly affects your eligibility for the OIC program, which can significantly lighten your tax burden. By filling it out accurately, you can make a strong case for why the IRS should accept your offer.

Recent updates to the IRS Offer in Compromise program highlight just how important this form has become. For example, the IRS now allows individuals to check their eligibility and submit offers through their Online Account. This change streamlines the process and can help speed up resolutions. Plus, if the IRS takes more than 24 months to decide on an OIC, your offer is automatically approved. That’s a reassuring aspect of the timeline for your request.

Real-world examples show that taxpayers who carefully document their situations using Form 433-A often achieve better outcomes. Take one taxpayer, for instance, who was initially worried about their offer being rejected due to messy paperwork. By organizing their financials to meet IRS standards, they successfully navigated the process and had their offer accepted.

It’s also vital to double-check your forms before submitting them to avoid any delays or rejections. Keeping a copy of your submission packet for your records is a smart practice that can help you manage your application effectively. If you’re facing urgent economic hardship, exploring temporary relief options like Currently Not Collectible (CNC) status may provide you with additional support.

Understanding the nuances of the IRS 433-A OIC isn’t just about compliance; it’s about seizing the opportunity for tax relief. By presenting a clear and accurate financial picture, you enhance your chances of achieving a favorable resolution to your tax debt. Remember, you’re not alone in this journey, and we’re here to help you regain control of your economic future.

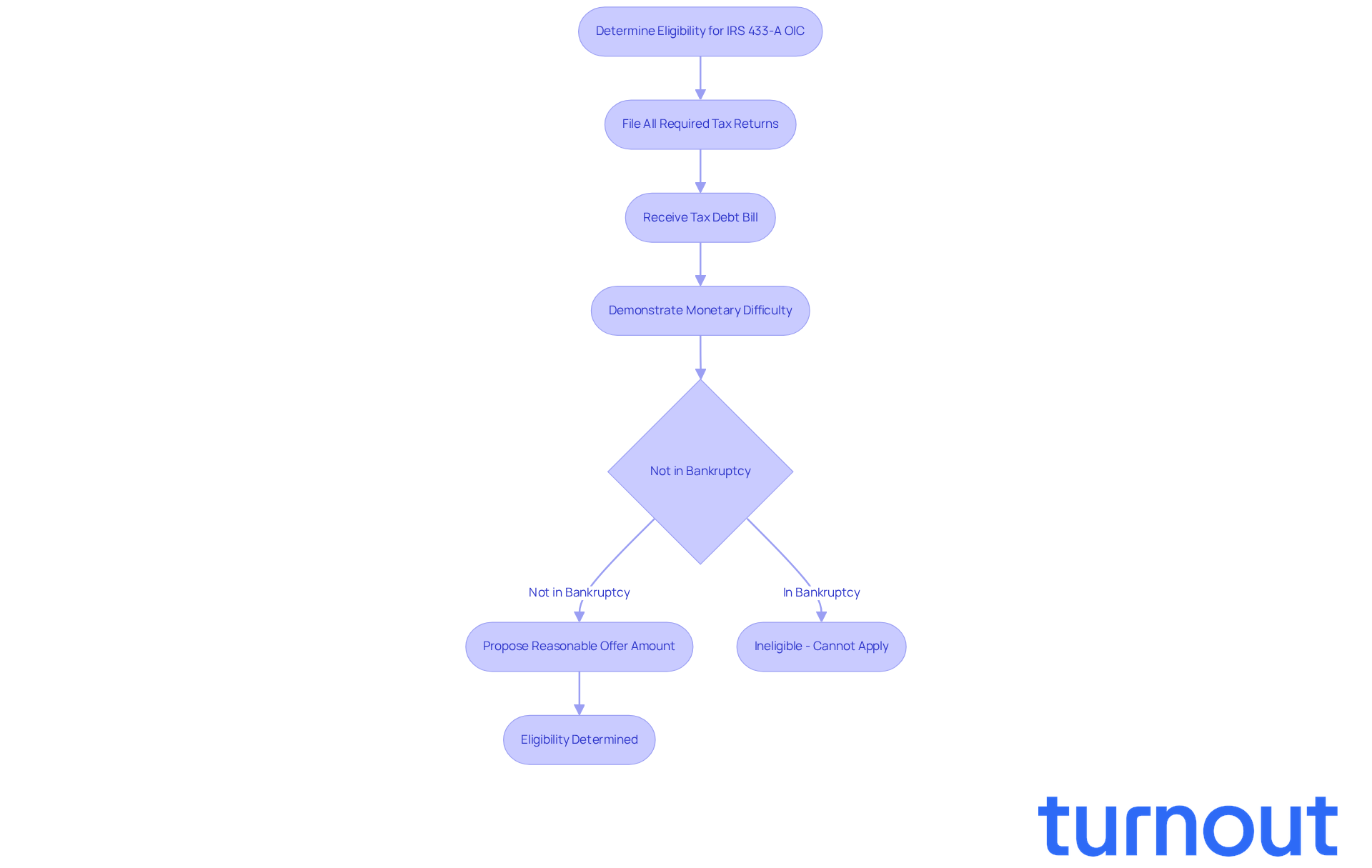

Determine Your Eligibility for the IRS 433-A OIC

Navigating tax issues can be overwhelming, but understanding the IRS 433-A OIC can help ease your burden. Here’s what you need to know:

- Tax Filing: It’s crucial to have all required tax returns filed. Incomplete filings can lead to immediate rejection of your application, so make sure this step is complete.

- Tax Debt: You need to have received a bill for at least one tax debt included in your offer. This ensures the IRS is aware of your financial obligations.

- Monetary Difficulty: Demonstrating that settling your full tax obligation would cause financial hardship is essential. For example, if you’re facing significant medical expenses or job loss, you may qualify under this criterion.

- Not in Bankruptcy: If you’re currently in an open bankruptcy proceeding, you won’t be able to apply, as this complicates the resolution of tax debts.

- Offer Amount: Your proposed offer must be reasonable based on your financial situation. The IRS will evaluate your ability to pay by considering your income, expenses, and asset equity.

In 2025, the IRS has made adjustments to its evaluation standards for the IRS 433-A OIC, allowing for more flexibility in qualifying for the Offer in Compromise program. Plus, you can use the IRS's Offer in Compromise Pre-Qualifier tool to check your eligibility before applying. If you’re a low-income taxpayer, you might even have the fee waived for the IRS 433-A OIC, which can significantly influence your decision to pursue an offer in compromise.

Understanding these requirements is vital. Did you know that about 30 to 40% of applicants successfully qualify for the OIC program? Real-life examples show that those who can clearly document their financial hardships, like struggling to meet basic living expenses, often have a better chance of approval. Consulting with a tax expert can further enhance your submission, ensuring it’s realistic and compliant with IRS expectations. As Mohamed Karmous, an expert in franchise and restaurant accounting, wisely states, 'A professional ensures your offer is realistic, complete, and compliant, increasing your chances of approval.'

Remember, you’re not alone in this journey. We’re here to help you navigate these challenges.

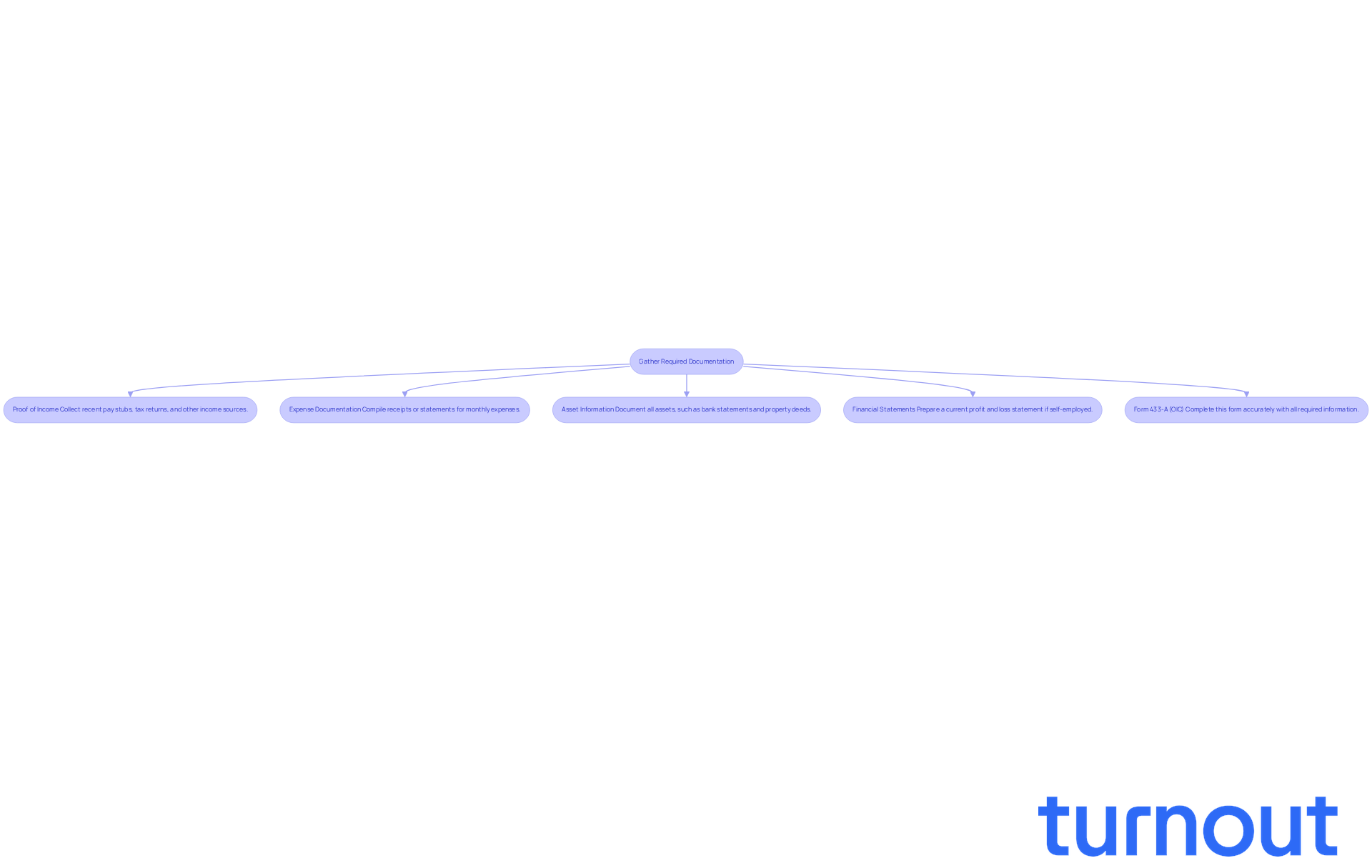

Gather Required Documentation for Your Application

To successfully submit your application for the IRS 433-A OIC, we understand that gathering comprehensive documentation can be overwhelming. But don’t worry; we’re here to help you through it. Here’s what you need to focus on:

- Proof of Income: Collect recent pay stubs, tax returns, and any other income sources to illustrate your economic situation. This will help paint a clear picture of your financial standing.

- Expense Documentation: Compile receipts or statements for monthly expenses, including housing, utilities, and transportation costs. Knowing your expenses is crucial for your application.

- Asset Information: Document all assets, such as bank statements, property deeds, and vehicle titles. This information provides a complete financial picture that the IRS needs.

- Financial Statements: If you’re self-employed, prepare a current profit and loss statement to reflect your business income and expenses. This shows the IRS your business's financial health.

- Form 433-A (OIC): Make sure this form is completed correctly, including all required information. Errors can lead to processing delays or rejections, which we want to avoid.

Did you know that nearly 40% of OIC requests are denied due to incomplete or inaccurate documentation? Having these documents organized will not only streamline the submission process but also significantly improve your chances of acceptance. If the IRS finds errors in your documentation, they may suspend collection activities, which underscores the importance of thorough preparation.

For instance, consider the case of a taxpayer who meticulously gathered all required documents. Despite facing initial rejections, their persistence led to an accepted offer. This highlights the critical role of accurate documentation in navigating the IRS process. Remember, you are not alone in this journey; we’re here to support you every step of the way.

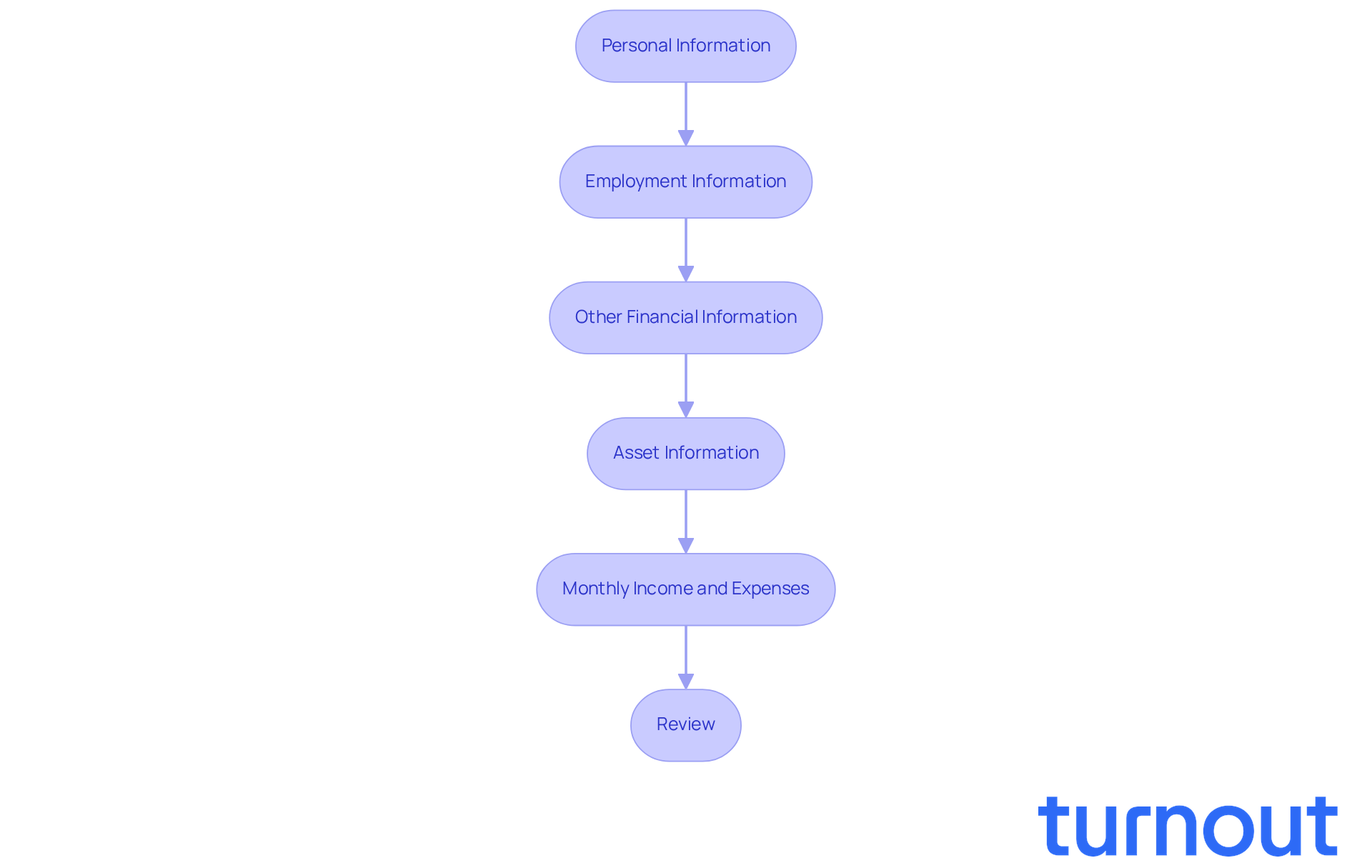

Complete the IRS 433-A OIC Form: Step-by-Step Instructions

To successfully complete the IRS 433-A OIC form, let’s walk through these important steps together:

- Section 1: Personal Information - Start by entering your full name, current address, and Social Security number accurately. We understand that getting this right is crucial.

- Section 2: Employment Information - Provide comprehensive details about your employment. This includes your employer's name, address, and your income. It’s common to feel overwhelmed, but we’re here to help you through it.

- Section 3: Other Financial Information - List all additional income sources, such as self-employment earnings and rental income. Make sure to capture every relevant detail; it can make a difference.

- Section 4: Asset Information - Detail all your assets, including bank accounts, real estate holdings, and vehicles, along with their estimated values. This step is vital for a complete picture.

- Section 5: Monthly Income and Expenses - Break down your monthly income and expenses meticulously. Ensure that all figures are accurate and supported by documentation. We know this can be tedious, but it’s worth it.

- Review - Before you submit, thoroughly double-check all entries for accuracy and completeness. This can help avoid delays or rejections.

Completing each section with care is crucial for presenting a compelling case for the IRS 433-A OIC. Common mistakes include omitting necessary details, using nicknames instead of legal names, and failing to provide supporting documentation for income and expenses. Organizing your documentation into sections can help IRS agents quickly locate necessary information, enhancing the clarity of your submission.

Be aware that the IRS OIC process can take 8-12 months, during which collections are paused. The fee for submitting an Offer In Compromise is $205, which is important to consider. Potential outcomes of your submission include acceptance, rejection, or return, so understanding these implications is vital for future compliance. Collaborating with tax experts can greatly improve your submission, assisting in managing the intricacies of the OIC process and steering clear of obstacles that could threaten your request. As Jugal Thacker notes, "Your goal is simple, submit a package the IRS can verify quickly, with numbers that match your documents and the IRS standards.

Submit Your IRS 433-A OIC Application: Final Steps

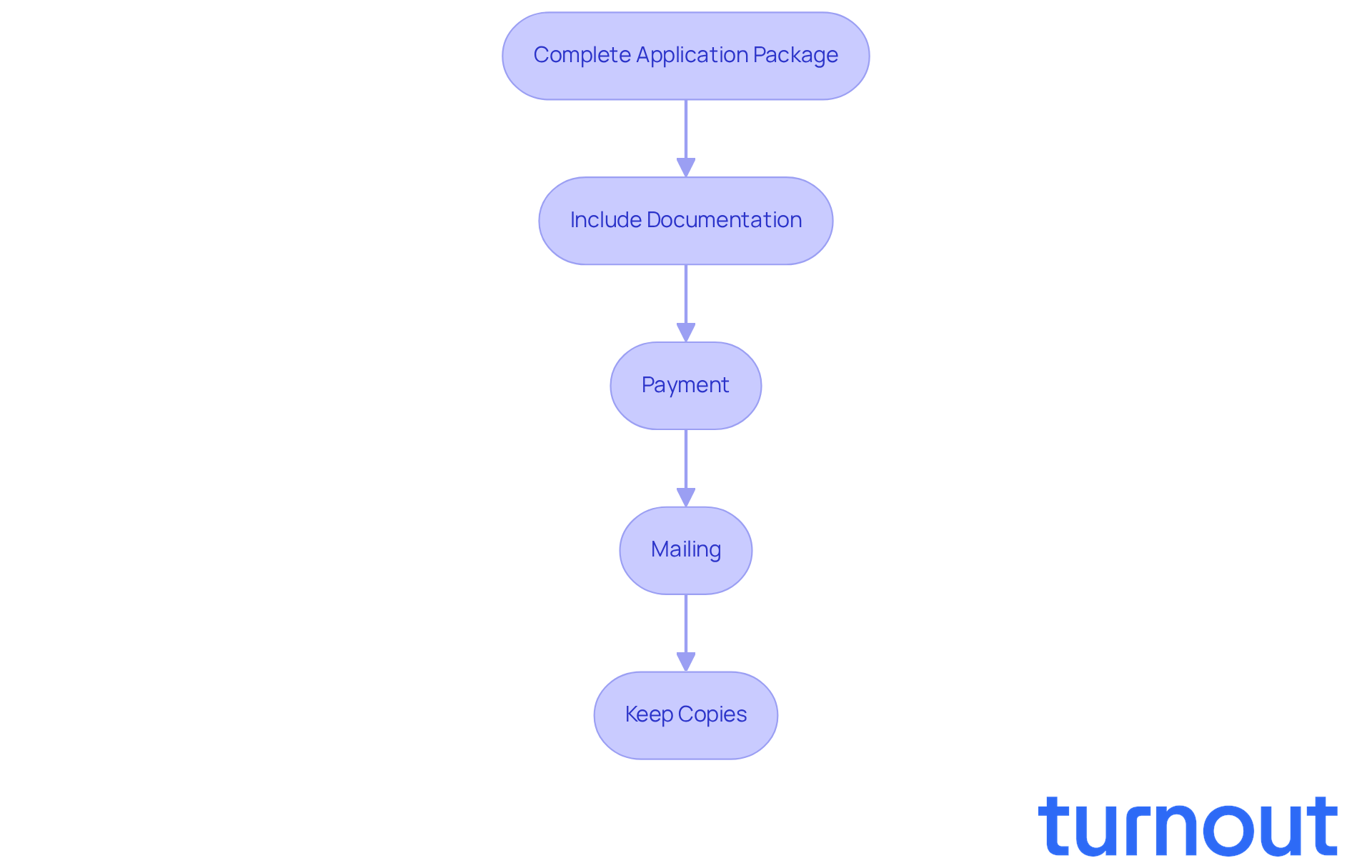

To successfully submit your IRS 433-A OIC application, let’s walk through these important steps together:

-

Complete the Application Package by accurately filling out the irs 433-a oic and Form 656 (Offer in Compromise). We understand that this can feel overwhelming, but taking it one step at a time makes it manageable.

-

Include Documentation: Attach all necessary documentation that supports your monetary claims, such as income statements and expense records. This is crucial for your application’s success.

-

Payment: Don’t forget to include the fee of $205, unless you qualify for a fee waiver based on your financial situation. We know that every dollar counts, so make sure to check your eligibility.

-

Mailing: Send your completed submission package to the designated IRS address for your location. This ensures that your application is processed properly and efficiently.

-

Keep Copies: Retain copies of all submitted documents for your records. This can be vital for tracking the status of your request.

By following these steps carefully, you can enhance the likelihood of your submission being processed smoothly. Remember, recent statistics show that timely and complete submissions can significantly reduce processing times, which currently average several months.

If you’re feeling uncertain, interacting with tax experts who specialize in Offer in Compromise submissions can provide valuable insights and increase your chances of success. You’re not alone in this journey; we’re here to help!

Anticipate Outcomes: What Happens After Submission

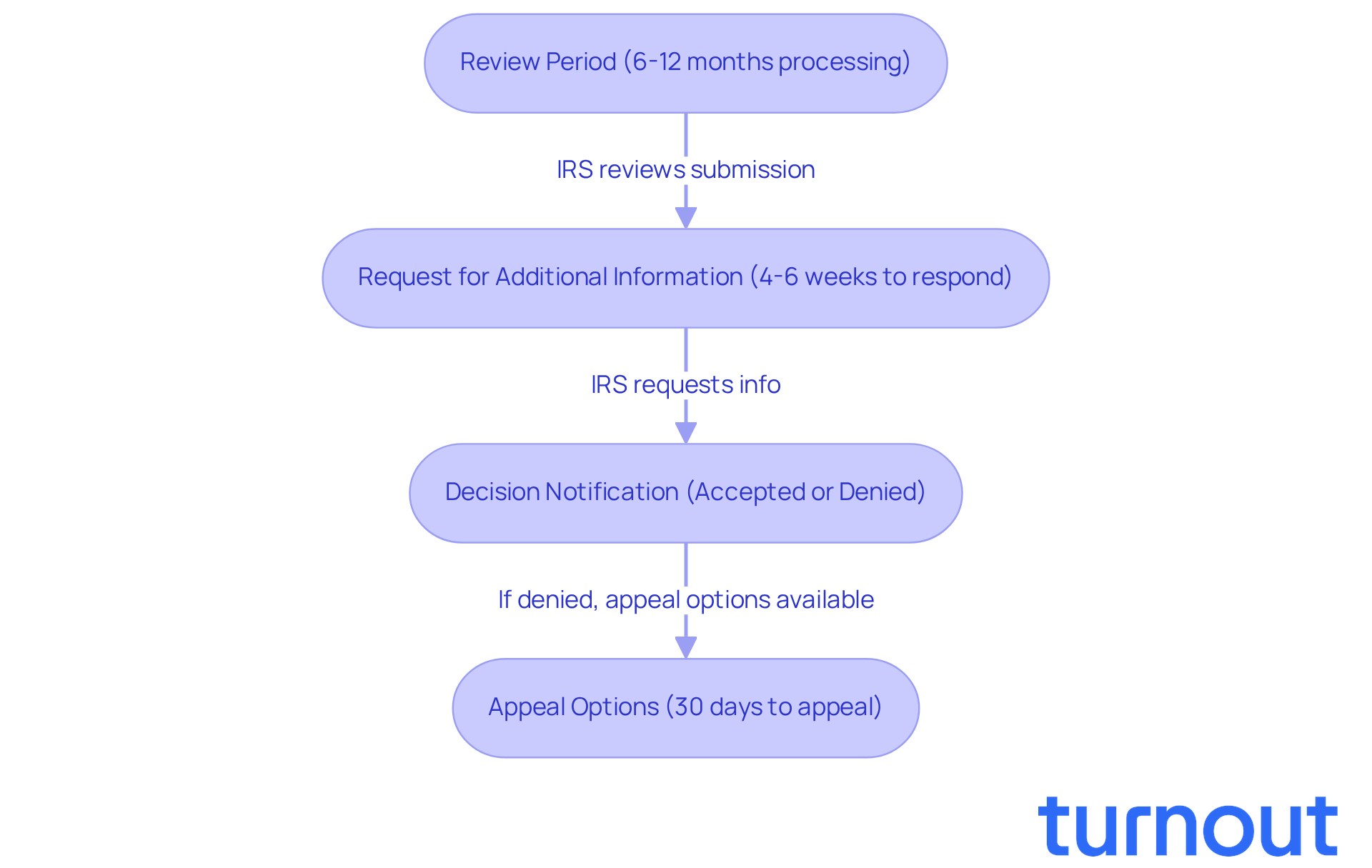

After submitting your IRS 433-A OIC, you might be wondering what comes next. We understand that this can be a stressful time, so here’s what to expect:

-

Review Period: The IRS typically takes between 6 to 12 months to process OIC requests. Initially, they’ll review your submission for about 2 to 4 weeks to confirm that all necessary forms and payments related to the IRS 433-A OIC are in order. Keep in mind, the overall timeline can vary based on how complex your case is.

-

Request for Additional Information: During the review, the IRS may reach out for more documentation or clarification about your financial situation. It’s important to respond promptly-usually within 4 to 6 weeks-to avoid any delays in the process.

-

Decision Notification: You’ll receive a written decision regarding your offer. If accepted, the IRS will provide instructions on how to proceed, including payment options. If denied, they’ll explain the reasons for the rejection, helping you understand any areas that may need improvement in your application.

-

Appeal Options: If your offer is rejected, don’t lose hope. You have 30 days from the rejection letter to file an appeal. This involves submitting Form 13711 along with a detailed explanation and any supporting documentation.

Understanding these outcomes can help you navigate the waiting period for the IRS 433-A OIC and prepare for what’s next. For instance, Joanna, who owed $47,000, successfully navigated the OIC process and became tax-debt-free after her offer was accepted nine months later. "I never thought I could get out of debt, but with the right help, I did!" Joanna shared, highlighting the importance of thorough preparation and patience throughout the OIC process. Remember, you’re not alone in this journey, and with the right support, you can find your way to a brighter financial future.

Conclusion

Mastering the IRS 433-A OIC isn’t just about filling out a form; it’s a chance for you to ease your tax burdens through the Offer in Compromise program. We understand that navigating these financial challenges can feel overwhelming. By grasping the nuances of this application, you can work towards a resolution that helps you regain control over your economic future.

In this article, we shared key insights about:

- Eligibility requirements

- Necessary documentation

- The step-by-step process of completing the IRS 433-A OIC form

From making sure all your tax returns are filed to gathering proof of income and expenses, each step is vital for crafting a strong application. We also highlighted the importance of thorough preparation and the possibility of appealing a rejection, emphasizing the need for persistence in the face of financial adversity.

Ultimately, understanding and effectively using the IRS 433-A OIC can lead to a brighter financial future. If you’re facing tax debts, it’s essential to take action. Seek professional guidance if needed, and leverage the resources available to you. By doing so, you can turn your tax challenges into a manageable path toward relief and recovery. Remember, you’re not alone in this journey; we’re here to help.

Frequently Asked Questions

What is the IRS 433-A OIC?

The IRS 433-A OIC is a form that provides the IRS with a comprehensive overview of an individual's financial situation, including income, expenses, and assets, which is essential for those seeking an Offer in Compromise (OIC) to settle tax debts for less than what they owe.

Why is the IRS 433-A OIC important?

This form is crucial because it directly impacts your eligibility for the OIC program, which can significantly reduce your tax burden. Accurately filling it out helps strengthen your case for the IRS to accept your offer.

What recent updates have been made to the IRS Offer in Compromise program?

Recent updates include the ability for individuals to check their eligibility and submit offers through their Online Account. Additionally, if the IRS takes more than 24 months to decide on an OIC, the offer is automatically approved.

How can I improve my chances of having my OIC accepted?

Carefully documenting your financial situation using Form 433-A and ensuring your forms are accurate before submission can lead to better outcomes. Keeping a copy of your submission for your records is also recommended.

What are the eligibility requirements for the IRS 433-A OIC?

Eligibility requirements include having all required tax returns filed, receiving a bill for at least one tax debt included in your offer, demonstrating monetary difficulty, not being in bankruptcy, and proposing a reasonable offer based on your financial situation.

How has the IRS adjusted its evaluation standards for the IRS 433-A OIC in 2025?

The IRS has made adjustments to allow more flexibility in qualifying for the Offer in Compromise program, and individuals can use the Offer in Compromise Pre-Qualifier tool to check their eligibility before applying.

What should I do if I'm facing urgent economic hardship?

If you are experiencing significant financial difficulties, exploring temporary relief options like Currently Not Collectible (CNC) status may provide additional support during this time.

How common is it for applicants to qualify for the OIC program?

Approximately 30 to 40% of applicants successfully qualify for the OIC program, especially those who can clearly document their financial hardships.