Overview

This article offers a compassionate, step-by-step guide to mastering the IRS installment payment plan, a helpful option for taxpayers who wish to manage their tax obligations over time rather than facing the stress of a lump sum payment.

We understand that navigating tax issues can be overwhelming, which is why we take the time to explain the eligibility requirements, application methods, and troubleshooting tips.

By following these guidelines, you can effectively manage your tax debts and avoid the anxiety of severe collection actions.

Remember, you are not alone in this journey; we're here to help you every step of the way.

Introduction

Navigating the complexities of tax obligations can feel overwhelming, especially when unexpected financial challenges arise. We understand that for many taxpayers, the IRS installment payment plan serves as a vital lifeline. This option allows individuals to manage their tax debts over time, alleviating the pressure of a lump sum payment. In this article, we’ll guide you through the process of mastering the IRS installment payment plan, exploring eligibility requirements, application methods, and common pitfalls.

It's common to feel anxious about what happens when the application process becomes daunting or when unforeseen issues arise. By understanding the nuances of this system, you can empower yourself to regain control of your financial future. Remember, you're not alone in this journey; we're here to help.

Understand IRS Installment Payment Plans

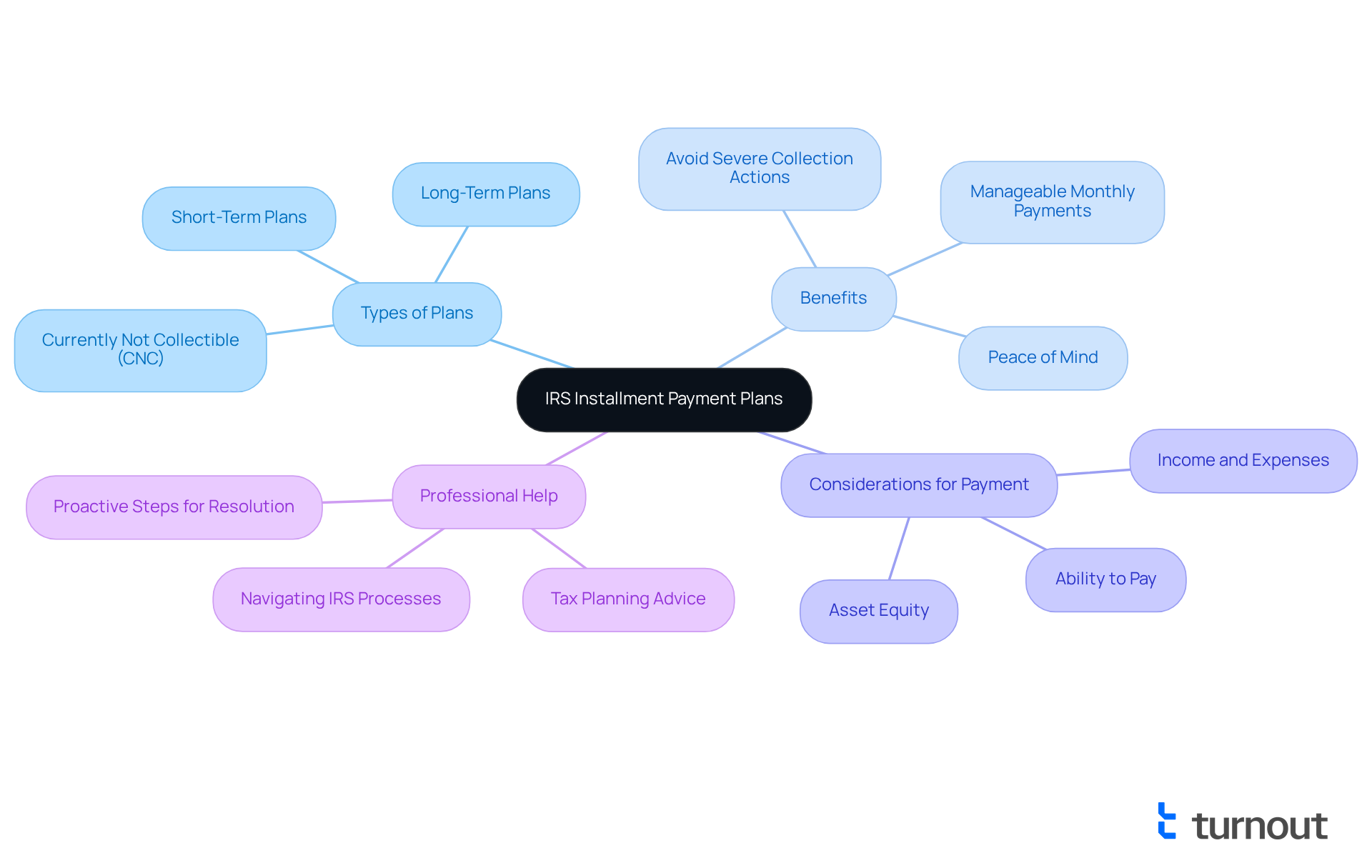

The installment payment plan IRS allows taxpayers to settle their tax obligations over time rather than in one lump sum, often referred to as payment agreements. If you find yourself unable to pay your tax bill in full by the due date, these plans are designed with you in mind. By entering into a payment plan, you can avoid more severe collection actions, such as wage garnishments or bank levies. The IRS provides various options for an installment payment plan IRS, including both short-term and long-term plans, tailored to the amount owed and your financial situation. Understanding these plans is the first step toward effectively managing your tax debt.

In 2025, millions of taxpayers are finding relief through these agreements, highlighting their growing importance in tax debt management. When evaluating offers for an Offer in Compromise (OIC), the IRS considers your ability to pay, income, expenses, and asset equity—important factors for those seeking relief.

As Taylor Randolph wisely notes, "By taking proactive steps and seeking professional help, you can resolve your tax issues and regain financial stability." This reinforces the significance of utilizing an installment payment plan IRS as a practical approach for managing tax debts.

For individuals facing significant financial challenges, a long-term repayment plan may be the best option. It allows for manageable monthly payments while preventing immediate collection actions. Additionally, if you are experiencing severe financial difficulties, you might consider Currently Not Collectible (CNC) status, which offers temporary relief from IRS collection activities.

Turnout plays a vital role in helping individuals navigate IRS and state tax burdens. We ensure that you understand your options and can effectively manage your tax obligations. The benefits of an installment payment plan IRS are substantial, as they provide a systematic way to settle your tax obligations, reduce the threat of harsh collection strategies, and grant you peace of mind.

Determine Eligibility and Requirements

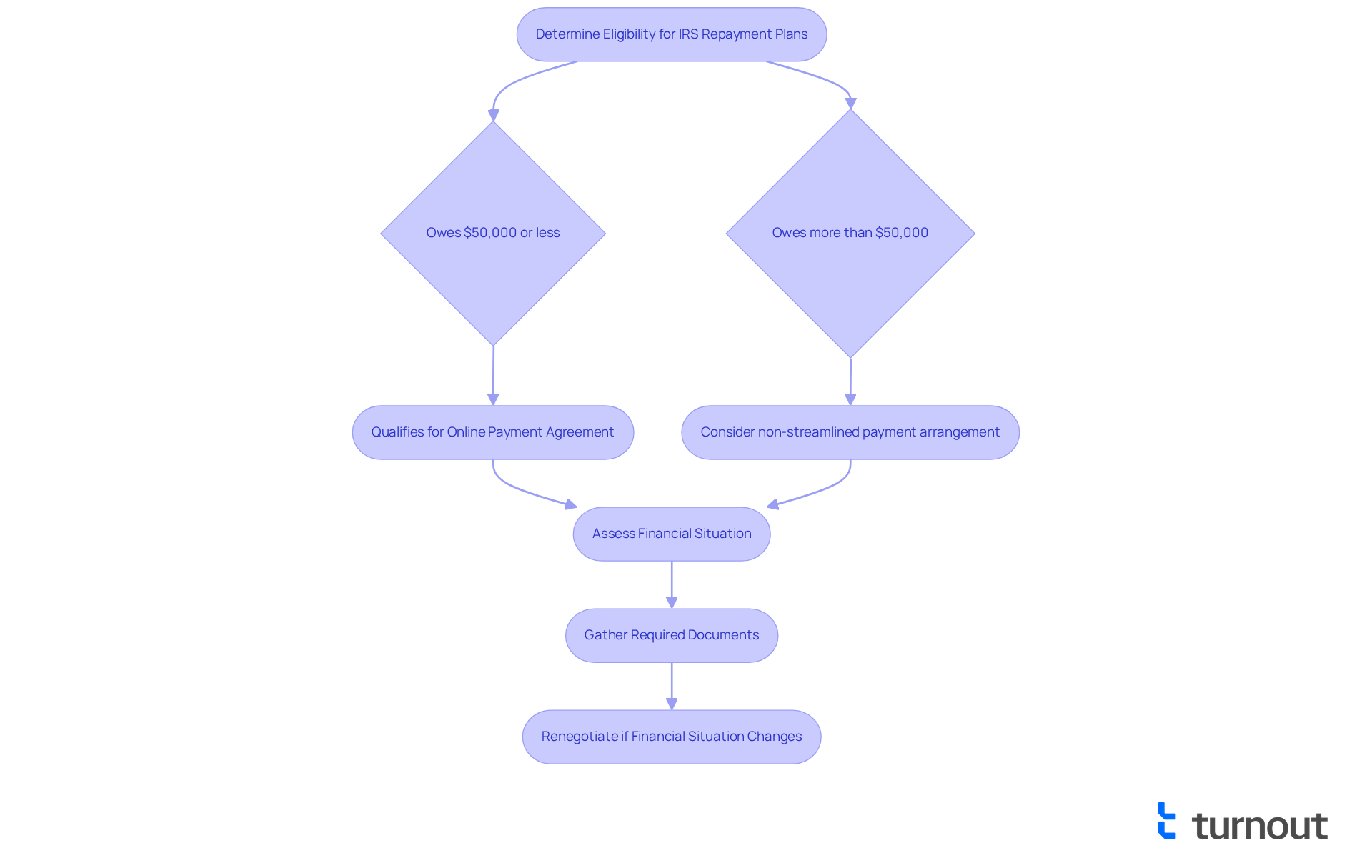

Navigating IRS repayment plans can feel overwhelming, but we’re here to help you understand the process. To qualify for an IRS repayment plan, it’s important to know the specific criteria. Generally, individuals must owe $50,000 or less in total tax, penalties, and interest, and they must have filed all required tax returns. Many individual taxpayers find hope in the Online Payment Agreement (OPA), which simplifies the process significantly.

If your debts exceed this threshold, don’t lose heart—a non-streamlined payment arrangement may still be an option. However, be prepared for additional documentation. It’s crucial to assess your financial situation to ensure that the proposed monthly payments are manageable. Remember, the IRS will evaluate your ability to pay during the application process.

If your financial circumstances change, you can always renegotiate the terms of the agreement based on your ability to pay. To make this assessment easier, gather essential documents, including your tax returns and financial statements. These will support your case for an installment agreement.

Be aware that the IRS typically imposes a late filing penalty of 5 percent per month on any unpaid balance, and the current interest rate for unpaid taxes is 7 percent per year, compounded daily. Understanding these requirements is essential for effectively navigating the landscape of the installment payment plan IRS. You are not alone in this journey; taking these steps can lead to a more manageable financial future.

Apply for Your IRS Installment Payment Plan

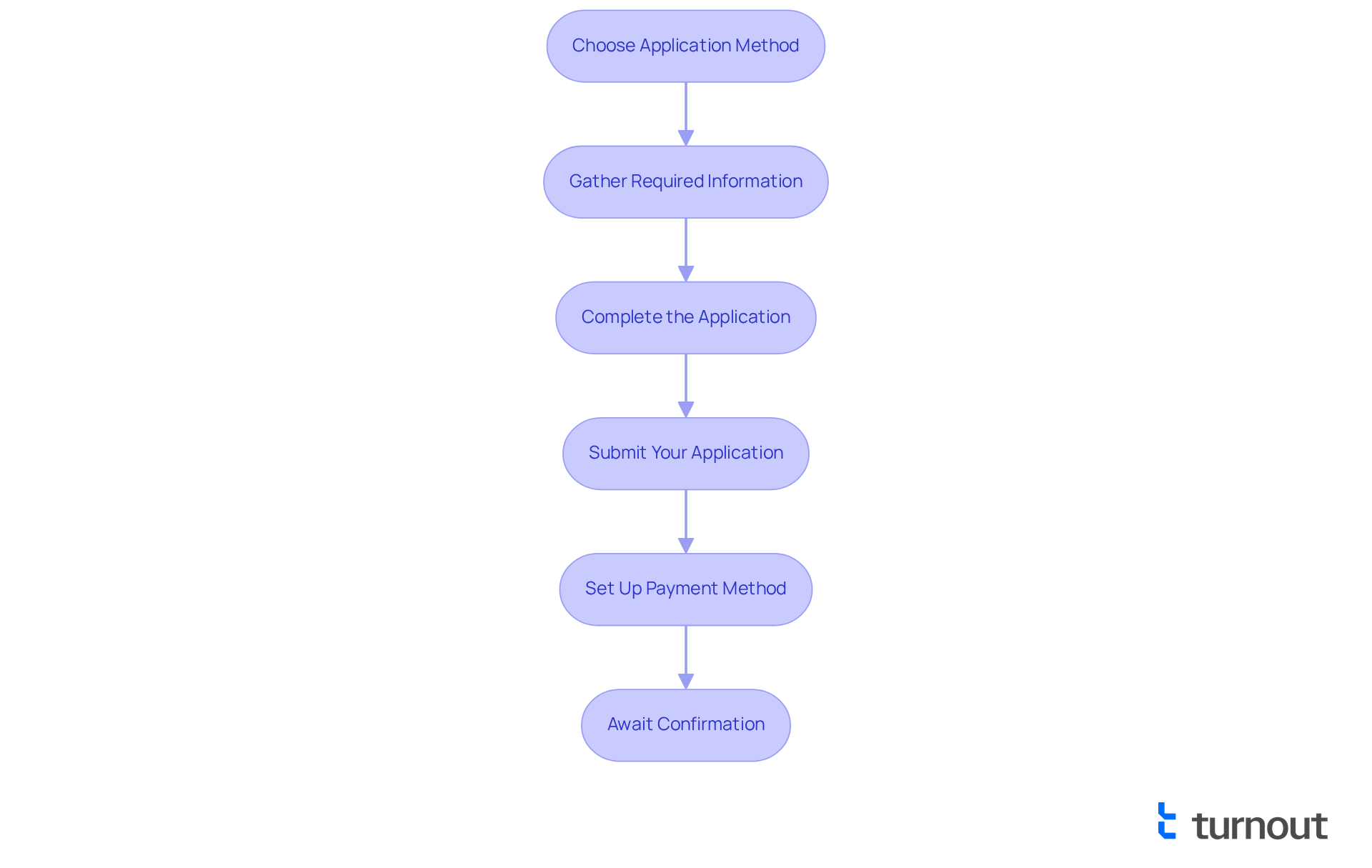

Applying for an installment payment plan IRS can feel overwhelming, but we're here to help you through it. Follow these simple steps to make the process easier:

-

Choose Your Application Method: You have options! You can apply online through the IRS Online Payment Agreement tool, by phone, or by mailing Form 9465, Installment Agreement Request. Choose the method that feels most comfortable for you.

-

Gather Required Information: Before you start, it’s important to have your personal information, tax return details, and financial information ready. This includes your Social Security number, filing status, and the amount you owe. We understand that this can be a lot, so take your time to prepare.

-

Complete the Application: If you’re applying online, visit the IRS website and follow the prompts to fill out the application. If you’re using Form 9465 as part of an installment payment plan IRS, ensure all sections are completed accurately. Remember, it’s okay to ask for help if you need it.

-

Submit Your Application: Once you’ve completed your application, submit it electronically if you’re applying online. If you’re mailing it, send the completed form to the address specified in the instructions. You’ve taken a big step!

-

Set Up Payment Method: Now, select how you wish to make your contributions. Options include direct debit, payroll deduction, or check transactions. Direct debit is often recommended for its convenience, making it easier for you to manage your payments.

-

Await Confirmation: After submission, the IRS will review your application and notify you of their decision. It’s common to feel anxious during this waiting period, but keep an eye on your mail for any correspondence regarding your application status. Remember, you are not alone in this journey, and support is available every step of the way.

Troubleshoot Common Application Issues

When applying for an installment payment plan IRS, it's common to encounter a few challenges. We understand that this process can be overwhelming, and we're here to help you navigate it with some supportive troubleshooting tips:

-

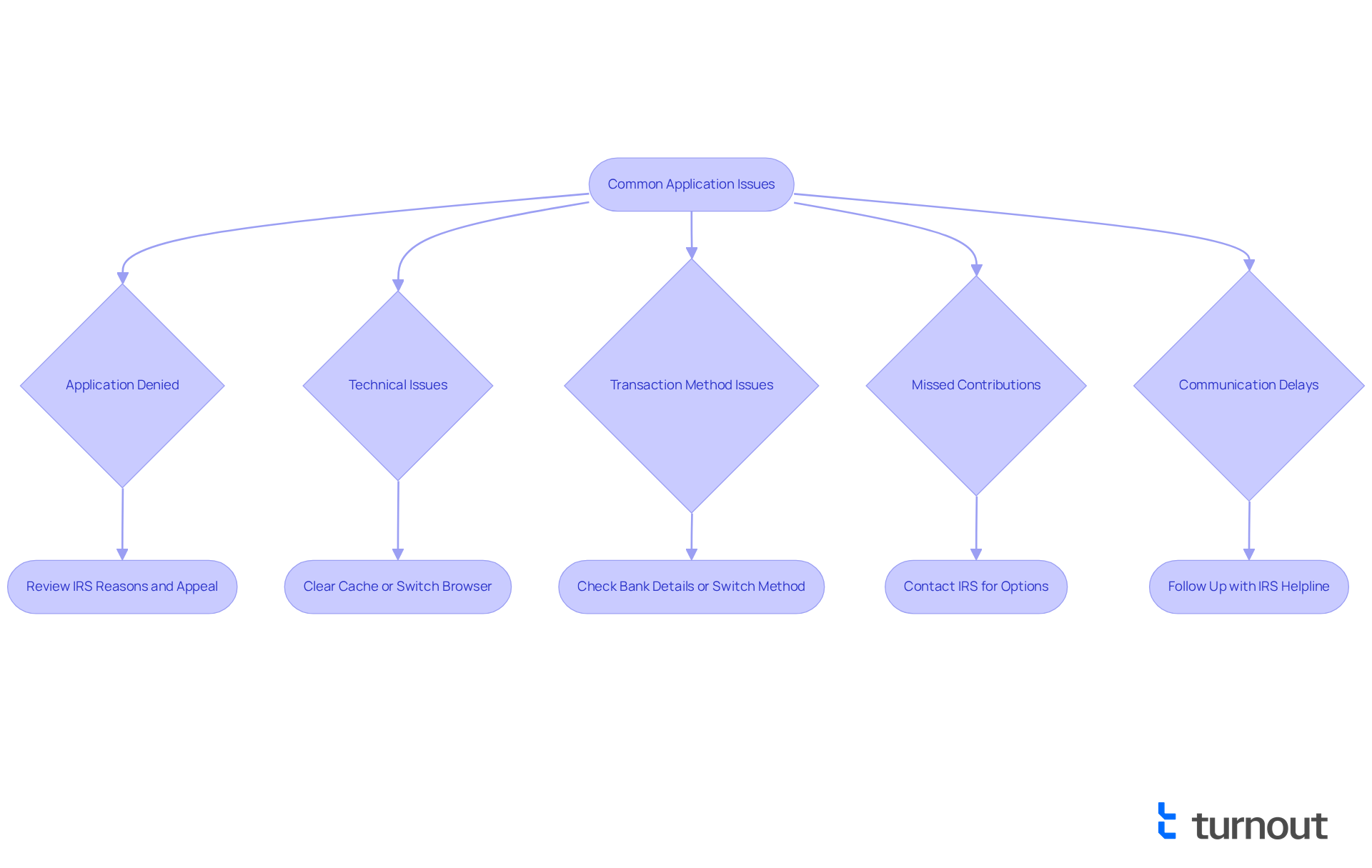

Application Denied: If your application is denied, take a moment to review the reasons provided by the IRS. Common issues may include incomplete information or not meeting eligibility criteria. Remember, you can appeal the decision related to your installment payment plan IRS by providing additional documentation or correcting any errors.

-

Technical Issues: Experiencing technical difficulties while applying online can be frustrating. If this happens, try clearing your browser cache or switching to a different browser. Also, ensure that your internet connection is stable to avoid interruptions.

-

Transaction Method Issues: If your selected transaction method is not accepted, don’t worry. Double-check your bank account details, or consider switching to an alternative option that might work better for you.

-

Missed Contributions: If you happen to miss a contribution, reach out to the IRS promptly. It's important to discuss your options, as you may be able to modify your payment plan or request a temporary delay based on your current financial situation.

-

Communication Delays: If you don't receive confirmation of your application within a reasonable timeframe, it's perfectly okay to follow up with the IRS by calling their helpline. Keeping records of all communications can be helpful for reference.

By being proactive and prepared, you can navigate the application process more smoothly. Remember, you are not alone in this journey, and there are options available to help you address any issues that arise.

Conclusion

We understand that managing tax obligations can be overwhelming. Utilizing an IRS installment payment plan offers a structured approach to alleviating financial stress, allowing you to make manageable payments over time. This method not only helps you avoid severe collection actions but also provides a pathway to regain control over your financial situation.

Key insights from this guide highlight the importance of understanding eligibility requirements, the application process, and common pitfalls to avoid when applying for an installment payment plan. By preparing the necessary documentation, selecting the right application method, and being proactive about potential issues, you can navigate this process with greater confidence and ease.

Ultimately, mastering the IRS installment payment plan process is significant. It empowers you to address your tax debts responsibly, paving the way for a more secure financial future. Taking the first step towards applying for a payment plan can lead to relief and stability, ensuring that you do not have to face your tax burdens alone.

Frequently Asked Questions

What is an IRS installment payment plan?

An IRS installment payment plan allows taxpayers to settle their tax obligations over time rather than in one lump sum. This helps individuals who are unable to pay their tax bill in full by the due date.

Why should I consider an installment payment plan?

By entering into an installment payment plan, you can avoid severe collection actions such as wage garnishments or bank levies, providing a more manageable way to handle tax debts.

What types of installment payment plans are available?

The IRS offers various options for installment payment plans, including both short-term and long-term plans, tailored to the amount owed and your financial situation.

What factors does the IRS consider for an Offer in Compromise (OIC)?

When evaluating an Offer in Compromise, the IRS considers your ability to pay, income, expenses, and asset equity.

What is Currently Not Collectible (CNC) status?

Currently Not Collectible (CNC) status provides temporary relief from IRS collection activities for individuals experiencing severe financial difficulties.

How can an installment payment plan help manage tax debt?

An installment payment plan provides a systematic way to settle tax obligations, reduces the threat of harsh collection strategies, and offers peace of mind to taxpayers.

Who can assist with navigating IRS tax burdens?

Professionals, such as Turnout tax enrolled agents, can help individuals understand their options and effectively manage their tax obligations.