Introduction

Navigating the complexities of the Employee Retirement Income Security Act (ERISA) can feel overwhelming. We understand that many individuals struggle with its intricacies, especially when it comes to employee benefits. This article is here to help you. It serves as a vital guide, shedding light on the essential steps to master the ERISA statute of limitations and effectively advocate for your rights.

With the clock ticking on claims and the potential for costly misunderstandings, it’s common to feel anxious about whether you’re prepared to act within the required timeframes. But don’t worry; you’re not alone in this journey. Together, we’ll explore how you can secure the benefits you deserve.

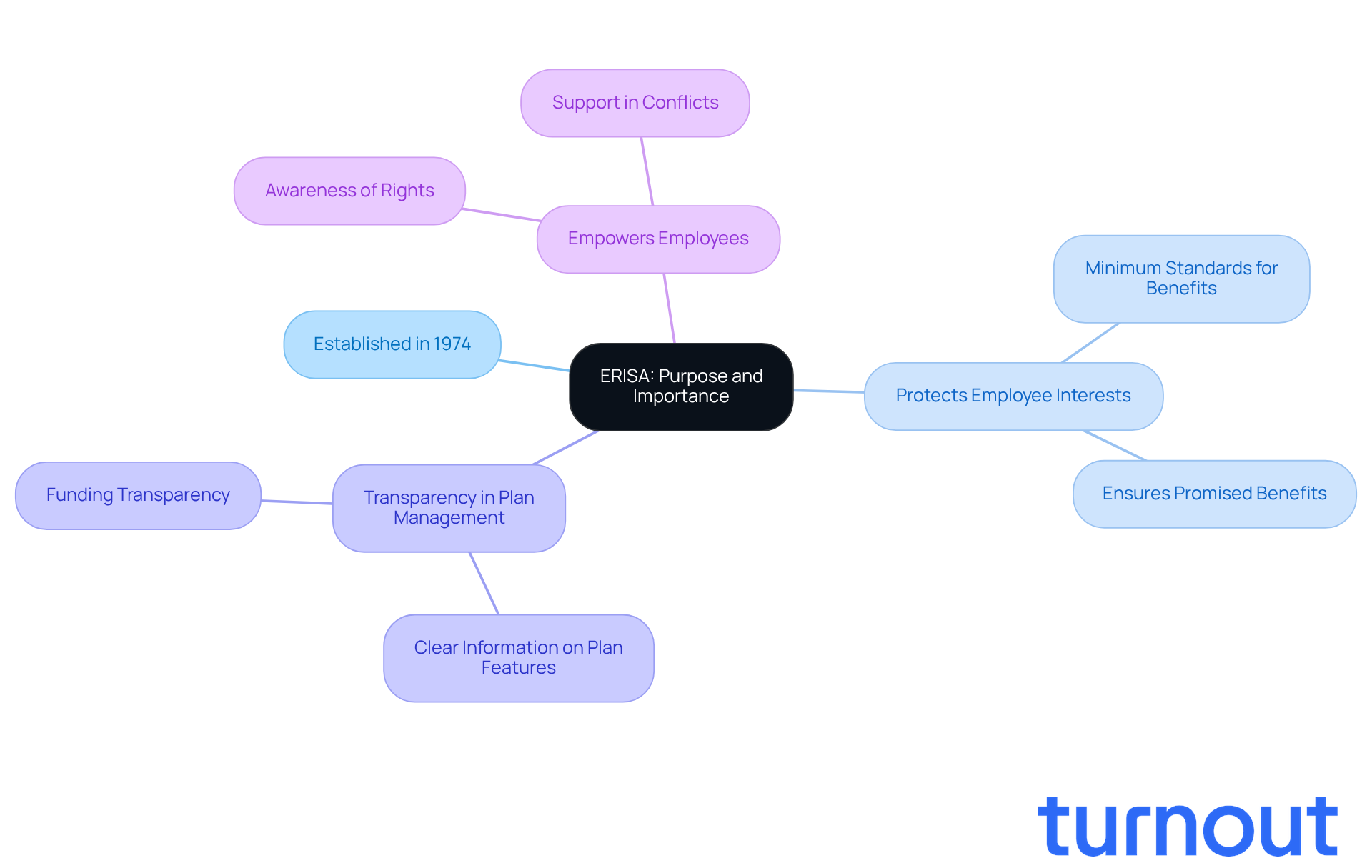

Explore ERISA: Understanding Its Purpose and Importance

The Employee Retirement Income Security Act (ERISA) was established in 1974 to protect the interests of those participating in employee benefit programs and their beneficiaries. This important legislation sets minimum standards for pension and health programs in private industry, ensuring that you receive the benefits you’ve been promised.

We understand that navigating these regulations can feel overwhelming. ERISA mandates transparency in plan management, requiring employers to provide clear information about plan features and funding. This means you have the right to know how your benefits are managed and funded, which is crucial for making informed decisions about your future.

Comprehending these regulations is essential for you to manage your benefits effectively. It empowers you to be aware of your rights, especially in situations where conflicts or refusals arise. Remember, you are not alone in this journey; we’re here to help you understand your benefits and advocate for your rights.

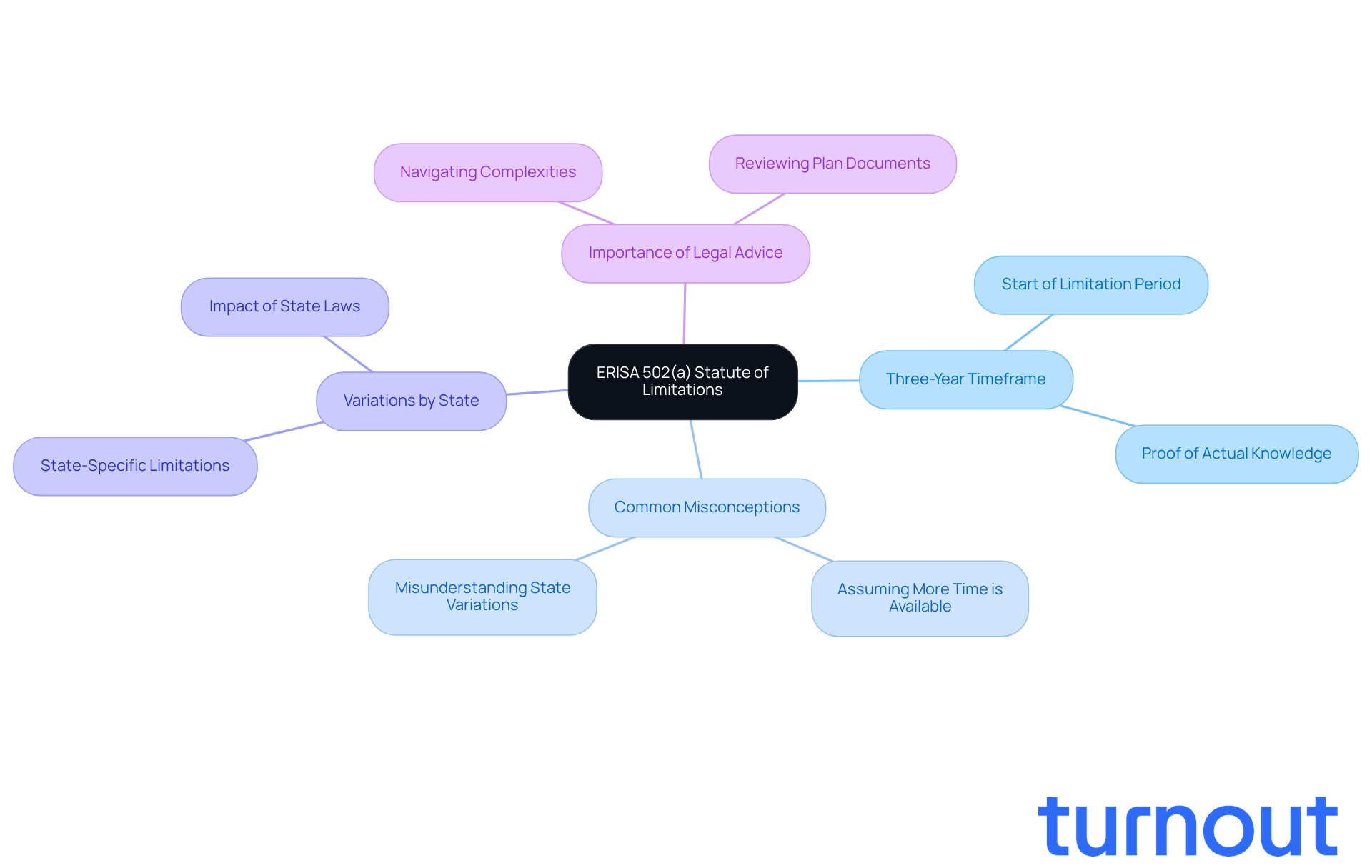

Clarify the ERISA 502(a) Statute of Limitations: Key Facts and Misconceptions

We understand that navigating the complexities of the Employee Retirement Income Security Act (ERISA) can be overwhelming. Many individuals are often surprised to learn that the ERISA statute of limitations for submitting a request under Section 502(a) is typically just three years from the date they knew or should have known about a breach of fiduciary duty or denial of benefits.

It's common to feel that you might have more time to file a claim than this stipulated period. However, the reality is that the timeframe can vary based on specific provisions, including the ERISA statute of limitations and other applicable state laws. Misunderstanding the ERISA statute of limitations can lead to requests being prohibited, which is why it’s so important to carefully examine plan documents and seek legal advice when necessary.

For instance, if assertions are submitted after the three-year timeframe, they may be rejected, especially if the petitioner cannot prove 'actual knowledge' of the violation. Recent legal opinions have emphasized this point, underscoring the need for vigilance.

Therefore, it’s crucial for you to be proactive in understanding your rights and the deadlines associated with your claims. Remember, you are not alone in this journey, and we’re here to help you navigate these challenges.

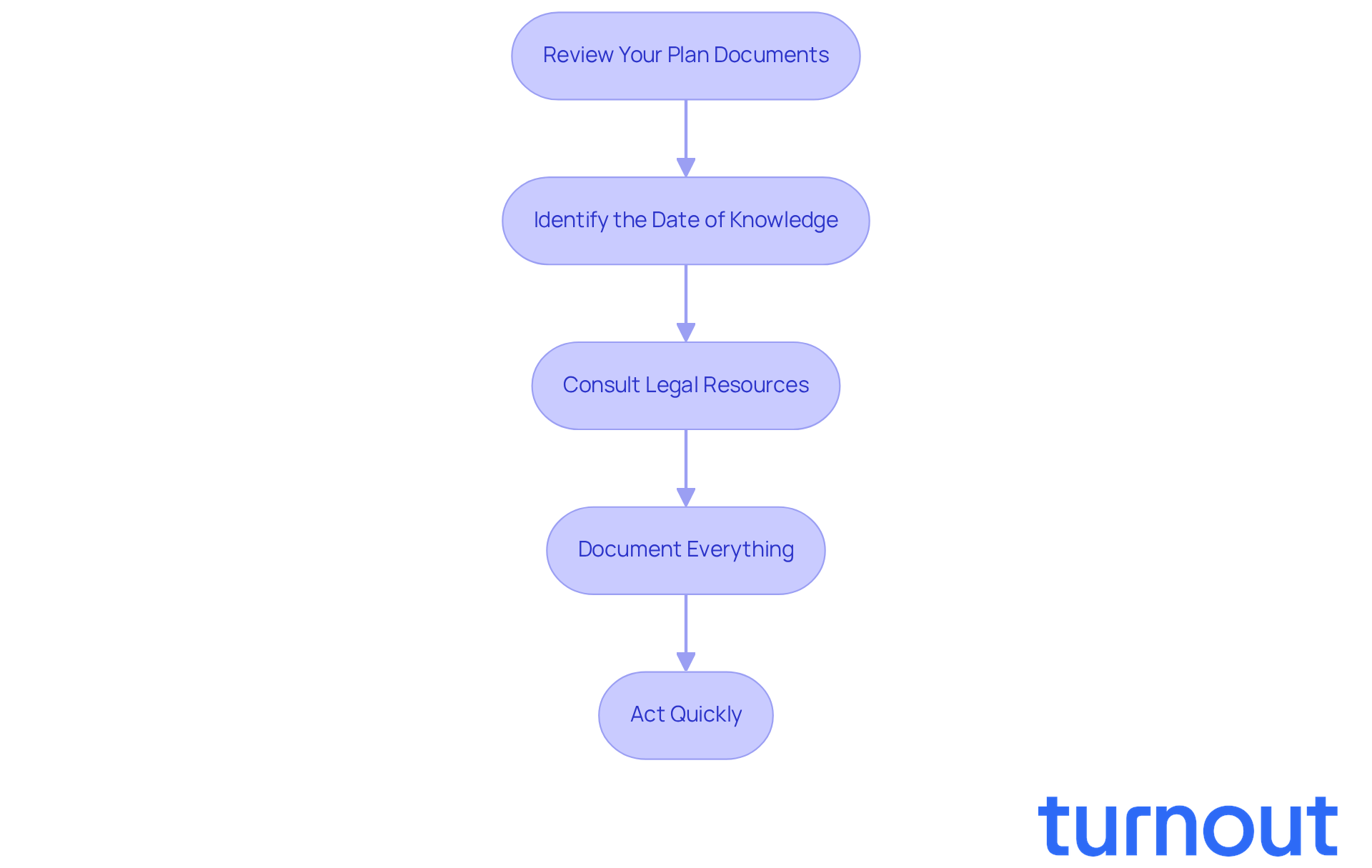

Determine Your ERISA Statute of Limitations: Steps to Assess Your Case

Navigating the ERISA statute of limitations may feel overwhelming, but we are here to assist you. Follow these essential steps to ensure you understand your rights and take action when needed:

-

Review Your Plan Documents: Start by carefully examining your Summary Plan Description (SPD) and any related documents. Look for specific statements about time frames, as these will guide your understanding of your rights.

-

Identify the Date of Knowledge: It's important to pinpoint when you first became aware of the denial or breach. This date is crucial, marking the start of the ERISA statute of limitations period. Generally, you have six years from the last violation or three years from when you became aware to submit a claim according to the ERISA statute of limitations.

-

Consult Legal Resources: If your plan documents leave you feeling uncertain, don’t hesitate to reach out to a benefits attorney. Their expertise can clarify your situation and help you navigate the complexities of the law. Remember, the Supreme Court has ruled that actual knowledge of the breach is necessary under the ERISA statute of limitations, specifically §1113(2), highlighting the importance of being aware of relevant facts.

-

Document Everything: Keep meticulous records of all communications and documents related to your case. This documentation is vital for any potential legal actions and can support your case if disputes arise.

-

Act Quickly: We understand that deadlines can be stressful. Be proactive, especially as you approach the end of your time limits. Delaying action could jeopardize your right to benefits. If you're nearing a deadline, submit your request or seek legal support promptly to protect your interests. Remember, complications can arise in class action certification for cases within the latter half of the six-year ERISA statute of limitations, so timely action is essential.

By grasping these steps, you can effectively manage your benefits requests and ensure you meet the necessary deadlines. You're not alone in this journey, and taking these actions can empower you to secure the benefits you deserve.

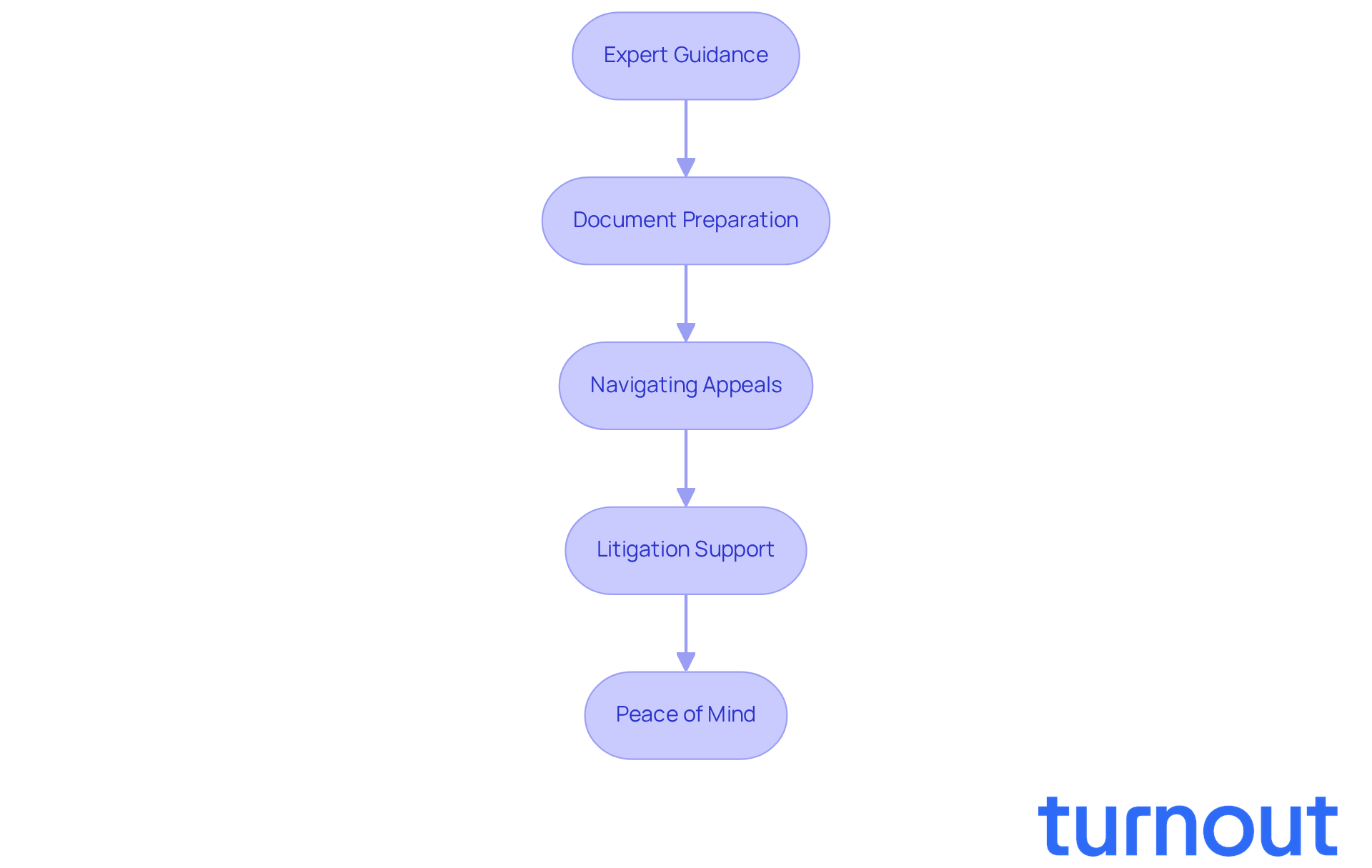

Engage Legal Support: How Attorneys Can Assist with ERISA Claims

Handling employee benefits disputes can be overwhelming, and involving legal assistance can make a significant difference. We understand that navigating these challenges can feel daunting, but you’re not alone in this journey. Here’s how attorneys can support you:

-

Expert Guidance: Attorneys who specialize in ERISA law are well-versed in the complexities of the statute. They can offer tailored advice that addresses your unique situation, helping you feel more confident in your approach.

-

Document Preparation: Ensuring that all necessary documentation is correctly prepared and submitted is crucial. An attorney can assist you in this process, reducing the risk of delays or denials that can add to your stress.

-

Navigating Appeals: If your claim is denied, it’s common to feel frustrated and uncertain about what to do next. An attorney can guide you through the appeals process, making sure you meet all deadlines and requirements, so you can focus on what matters most.

-

Litigation Support: Should it become necessary to file a lawsuit, having an experienced attorney by your side can significantly enhance your chances of success in court. They’ll advocate for your rights and ensure your voice is heard.

-

Peace of Mind: Knowing that a professional is handling your case allows you to concentrate on your health and recovery. You deserve to focus on your well-being, rather than the complexities of the legal system.

We’re here to help you navigate this challenging time. Remember, seeking assistance is a step towards reclaiming your peace of mind.

Conclusion

Understanding the complexities of the Employee Retirement Income Security Act (ERISA) is vital for anyone navigating employee benefit programs. This legislation not only protects your rights but also lays out clear guidelines for claiming benefits. We understand that being informed about the ERISA statute of limitations is crucial; it dictates the time frame within which claims must be filed, helping you take proactive steps to safeguard your interests.

This article highlights several key components for managing ERISA claims effectively:

- Review your plan documents.

- Identify when you became aware of any breaches.

- Seek legal assistance when needed.

By following these steps, you can navigate the complexities of ERISA with greater confidence and secure the benefits you deserve. Remember, the role of legal support is invaluable. Attorneys can provide expert guidance, assist with documentation, and help you through appeals or litigation processes.

Ultimately, staying informed and acting promptly can significantly impact the outcome of your ERISA claims. By understanding your rights and the steps necessary to protect them, you empower yourself to advocate for the benefits you deserve. Engaging with legal professionals can further enhance your ability to navigate these challenges. You are not alone in this journey. Take charge of your benefits today, and don’t hesitate to seek the assistance you need to secure your future.

Frequently Asked Questions

What is ERISA and when was it established?

The Employee Retirement Income Security Act (ERISA) was established in 1974 to protect the interests of individuals participating in employee benefit programs and their beneficiaries.

What does ERISA aim to achieve?

ERISA aims to set minimum standards for pension and health programs in the private industry, ensuring that participants receive the benefits they have been promised.

How does ERISA promote transparency in benefit plans?

ERISA mandates transparency in plan management, requiring employers to provide clear information about plan features and funding, allowing participants to understand how their benefits are managed.

Why is it important to understand ERISA regulations?

Understanding ERISA regulations is essential for effectively managing your benefits and being aware of your rights, especially in cases of conflicts or refusals regarding benefits.

What support is available for individuals navigating ERISA?

There are resources available to help individuals understand their benefits and advocate for their rights, ensuring they are not alone in their journey.