Introduction

Navigating the complexities of the Delaware Division of Revenue payment system can feel overwhelming. We understand that the many tax obligations facing individuals and businesses can be daunting. However, mastering this process is essential for ensuring compliance and avoiding unnecessary penalties.

This guide is here to help you through the essential steps and considerations for managing your payments successfully. From understanding transaction types to troubleshooting common issues, we’ll walk you through it all. What challenges might arise during this journey? It’s common to feel uncertain, but together, we can find effective ways to streamline your tax payment experience.

Understand the Delaware Division of Revenue Payment System

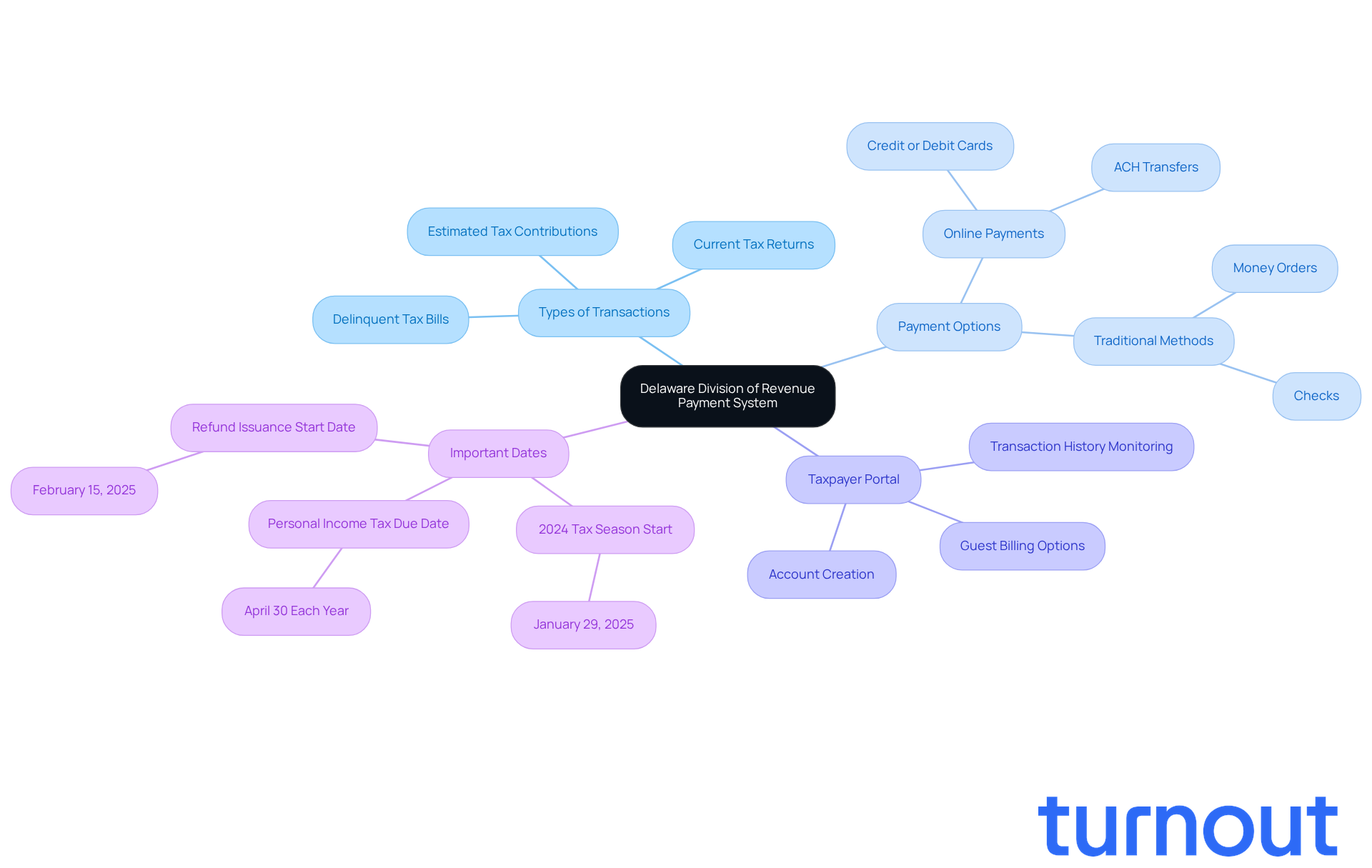

The Delaware Division of Revenue payment system plays a vital role in collecting taxes and overseeing transactions for various state taxes, including personal income tax, corporate tax, and gross receipts tax. We understand that navigating this system can feel overwhelming, but grasping how it functions is the first step toward managing your financial obligations effectively. Here are some key components to consider:

-

Types of Transactions: It's essential to familiarize yourself with the different forms of transactions you can make. This includes estimated tax contributions, delinquent tax bills, and current tax returns. Each type comes with specific requirements and deadlines, and knowing these can ease your stress.

-

Payment Options: The DOR offers various options for transactions, including online payments via credit or debit cards, ACH transfers, and traditional methods like checks and money orders, as well as the Delaware Division of Revenue payment. Understanding your options allows you to choose the most convenient method for your situation.

-

Taxpayer Portal: The Delaware Taxpayer Portal is an invaluable resource for managing your dues. By creating an account, you can monitor your transaction history, submit fees, and access important tax documents. If registering feels like too much, don’t worry - guest billing options are also available.

-

Important Dates: Staying aware of key deadlines for tax payments is crucial to avoid penalties. For instance, personal income taxes are generally due by April 30 each year. Keeping a calendar of these dates can help you stay compliant. Additionally, Delaware's tax season for processing 2024 individual income tax returns starts on January 29, 2025, with refunds beginning to be issued on February 15, 2025. We encourage you to file electronically, as paper returns take longer to process.

By understanding these elements, you’ll feel more prepared to navigate the transaction process with confidence. Remember, you are not alone in this journey - we're here to help!

Gather Required Documentation and Confirm Eligibility

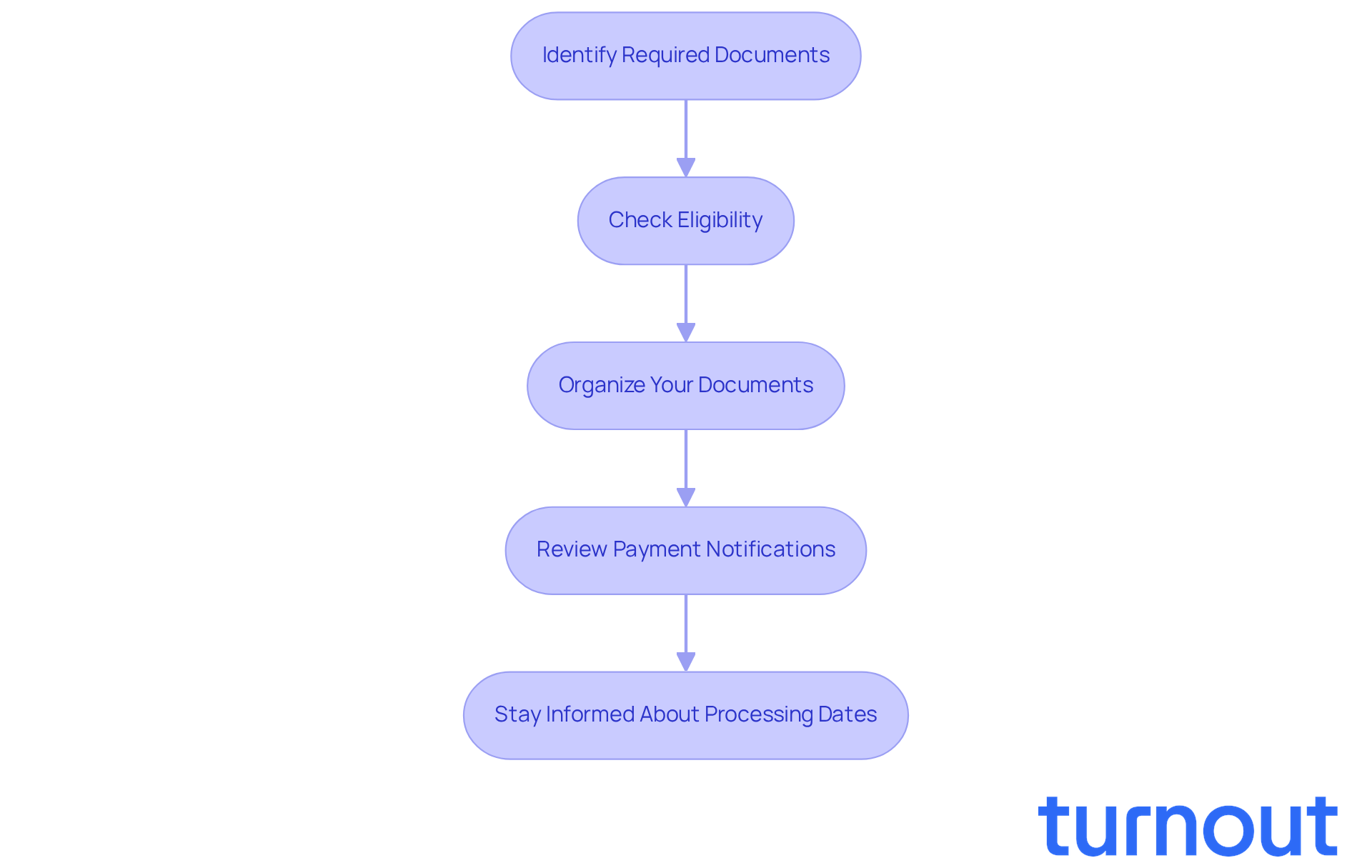

Before you submit a fee to the Delaware Division of Revenue payment, it’s important to gather the necessary documentation and confirm your eligibility. We understand that this process can feel overwhelming, but following these steps can help you feel more prepared:

-

Identify Required Documents: Depending on your transaction type, you may need specific documents. Commonly required items include:

- Tax returns from previous years

- Payment notices or bills from the DOR

- Identification numbers (Social Security Number or Employer Identification Number)

-

Check Eligibility: It’s essential to ensure that you qualify for the transaction. For example, if you’re making an estimated contribution, confirm that you meet the income thresholds set by the DOR. As tax professional Robert Kiyosaki wisely states, "It's not how much money you make, but how much you keep and how hard it works for you." This highlights the importance of confirming your eligibility before moving forward.

-

Organize Your Documents: Consider creating a folder-whether physical or digital-to keep all relevant documents together. This organization will make it easier for you to access what you need when you’re ready to complete your transaction.

-

Review Payment Notifications: If you’ve received a notice regarding a transaction, take the time to examine it thoroughly. Understanding the amount owed and any specific guidance from the DOR can help you avoid errors during the transaction process.

-

Stay Informed About Processing Dates: Delaware will begin processing individual income tax returns on January 29, 2025, and refunds won’t start until February 15, 2025. Being aware of these dates can help you organize your finances accordingly.

By completing these steps, you’ll be well-prepared to move forward with your transaction. Remember, you’re not alone in this journey-we’re here to help!

Submit Your Payment to the Delaware Division of Revenue

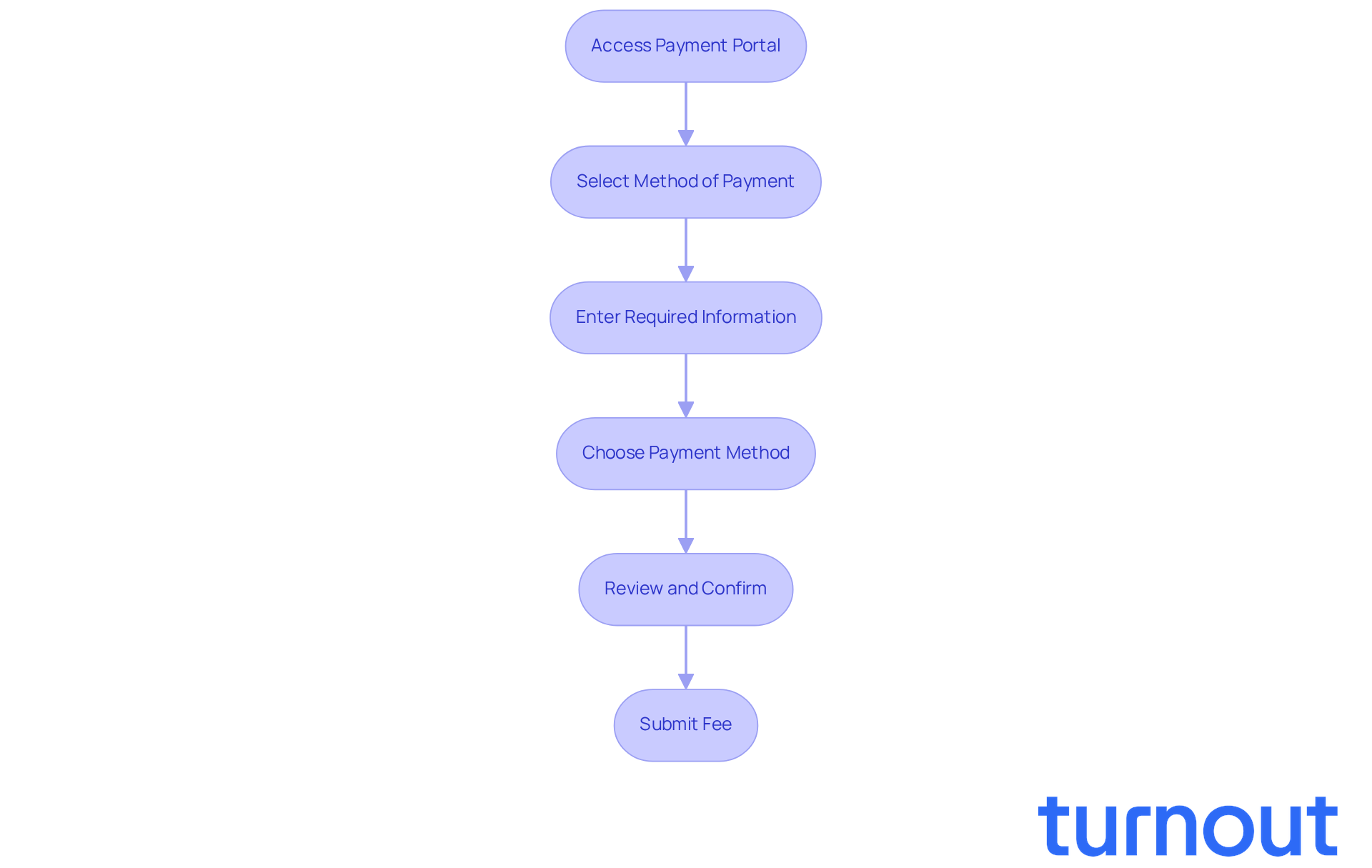

Once you’ve gathered your documentation and confirmed your eligibility, you’re ready to submit your fee. Let’s walk through the steps together:

- Access the Delaware Division of Revenue payment transaction portal at tax.delaware.gov. If you have an account, simply log in; if not, don’t worry-just use the guest checkout option.

- Select Method of Payment: Choose the type of transaction you’re making, like estimated tax or delinquent tax. Picking the right option is key to avoiding any processing hiccups.

- Enter Required Information: Fill in the necessary fields, including your identification number, transaction amount, and any other required details. Double-checking this information can help prevent delays.

- Choose Method of Payment: Decide on your preferred payment method, whether it’s a credit/debit card or ACH transfer. Just a heads-up-there might be processing fees if you opt for a card.

- Review and Confirm: Before you finalize your transaction, take a moment to review all the information you’ve entered. Confirm that everything looks correct to sidestep any issues.

- Submit Fee: Click the submit button to process your fee. You should receive a confirmation of your transaction, either on-screen or via email. Be sure to save this confirmation for your records.

We understand that navigating these processes can be overwhelming. The state has made significant improvements to its processing system, allowing refunds to be issued within eight days if no manual review is needed. By responding quickly to any requests for additional documentation, you can further enhance processing times.

Additionally, for residents of New Castle County, it’s important to note that the property tax due date has been proposed to be extended to the end of the year. By following these steps, you’ll successfully submit your fee to the Delaware Division of Revenue payment and benefit from this streamlined process. Remember, you’re not alone in this journey-we’re here to help!

Troubleshoot Common Payment Issues

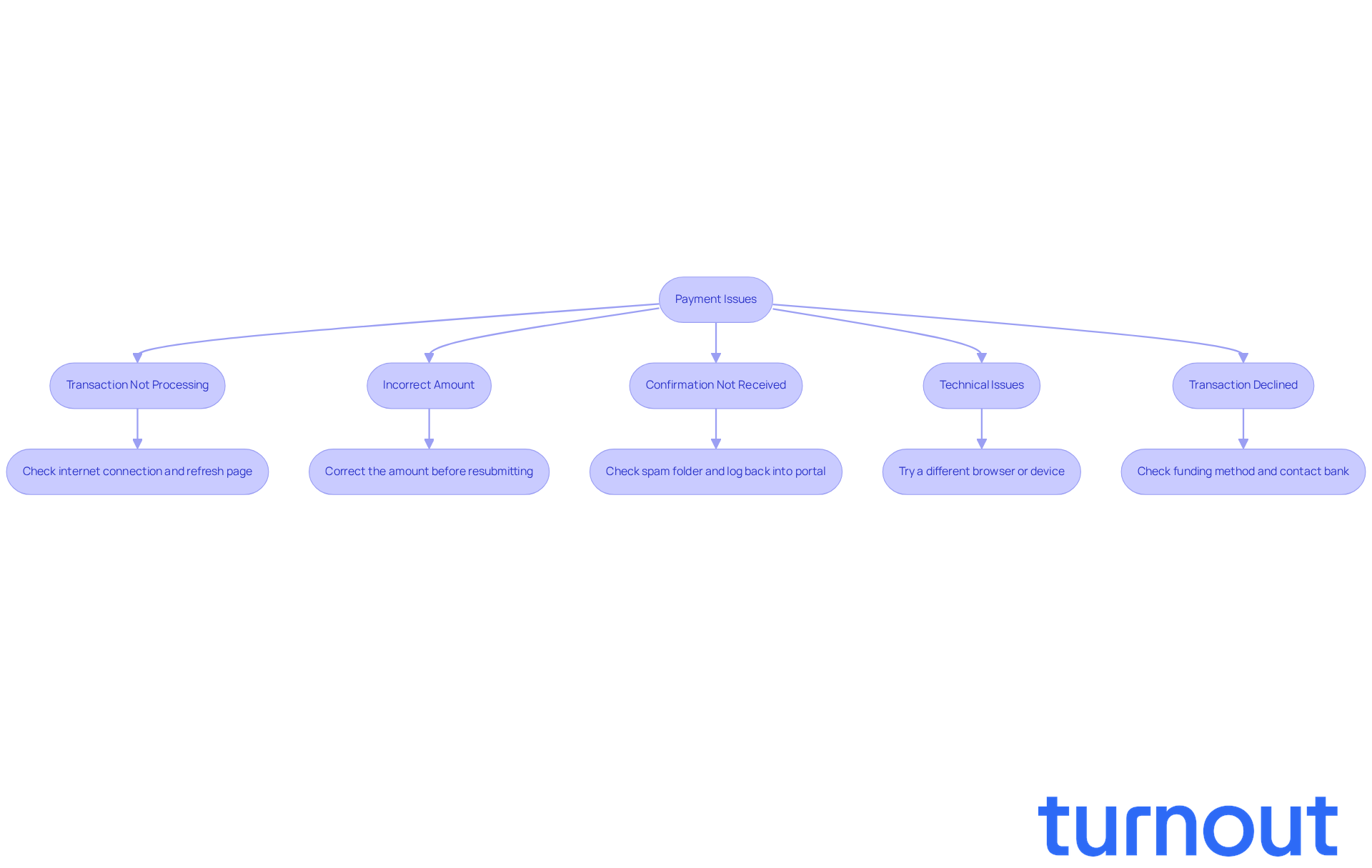

Even with careful preparation, we understand that you might face challenges when making a Delaware Division of Revenue payment. Here are some common issues you may encounter, along with helpful solutions:

- Transaction Not Processing: If your transaction isn’t processing, it’s a good idea to check your internet connection and refresh the page. Make sure you’ve entered all required information correctly.

- Incorrect Amount: If you realize you’ve entered the wrong figure, please don’t submit the transaction. Instead, take a moment to correct the amount before resubmitting.

- Confirmation Not Received: If you haven’t received a confirmation after submitting your transaction, check your spam folder for the email. If it’s still missing, log back into the portal to see if the transaction was processed.

- Technical Issues: If you run into technical difficulties with the transaction portal, consider trying a different browser or device. For assistance, you can also contact the Delaware Division of Revenue at (302) 577-8785.

- Transaction Declined: If your transaction is declined, check that your funding method has enough funds and that your bank or card issuer hasn’t blocked the transaction. Don’t hesitate to contact your bank if needed.

By being aware of these common issues and their solutions, you can navigate the payment process more smoothly and with greater confidence. Remember, you’re not alone in this journey, and we’re here to help!

Conclusion

Mastering the Delaware Division of Revenue payment process is crucial for meeting your state tax obligations and managing your financial responsibilities with confidence. We understand that navigating this system can feel overwhelming, but by familiarizing yourself with the payment options, transaction types, and the valuable Taxpayer Portal, you can approach this process with greater ease.

Gathering the necessary documentation, confirming your eligibility, and being mindful of critical deadlines are essential steps to avoid penalties. It’s common to feel uncertain about these details, but knowing common payment issues and their solutions can significantly enhance your experience when submitting payments. These proactive measures not only simplify the process but also empower you to take control of your financial obligations.

Ultimately, being informed about the Delaware Division of Revenue payment system can make a substantial difference in managing your tax responsibilities. Embracing this knowledge alleviates stress and fosters a smoother transaction experience. Remember, you’re not alone in this journey. Engage with the resources available, stay organized, and take action to ensure timely and accurate payments. Together, we can pave the way for your financial success in the upcoming tax seasons.

Frequently Asked Questions

What is the purpose of the Delaware Division of Revenue payment system?

The Delaware Division of Revenue payment system is responsible for collecting taxes and overseeing transactions for various state taxes, including personal income tax, corporate tax, and gross receipts tax.

What types of transactions can I make through the Delaware Division of Revenue payment system?

You can make several types of transactions, including estimated tax contributions, delinquent tax bills, and current tax returns. Each type has specific requirements and deadlines.

What payment options are available through the Delaware Division of Revenue?

The DOR offers various payment options, including online payments via credit or debit cards, ACH transfers, checks, money orders, and the Delaware Division of Revenue payment method.

How can I manage my tax payments and documents?

You can manage your tax payments and documents through the Delaware Taxpayer Portal by creating an account. This allows you to monitor your transaction history, submit fees, and access important tax documents. Guest billing options are also available if you prefer not to register.

What are some important dates I should be aware of for tax payments?

Personal income taxes are generally due by April 30 each year. For the 2024 individual income tax returns, Delaware's tax season starts on January 29, 2025, with refunds beginning to be issued on February 15, 2025.

What is the recommended method for filing tax returns in Delaware?

It is encouraged to file electronically, as paper returns take longer to process.