Introduction

Navigating financial support options can feel overwhelming for seniors in their golden years. With the introduction of a new $6,000 credit for the elderly set to take effect in 2025, understanding this opportunity is more important than ever. This nonrefundable tax credit not only eases tax burdens but also enhances the financial stability of older adults. It allows them to allocate resources toward essential needs like healthcare and living expenses.

We understand that the process of qualifying and applying for this credit can be daunting. Many may wonder:

- What are the specific eligibility requirements?

- How can one successfully navigate the application process to ensure they receive the support they deserve?

You're not alone in this journey, and we're here to help.

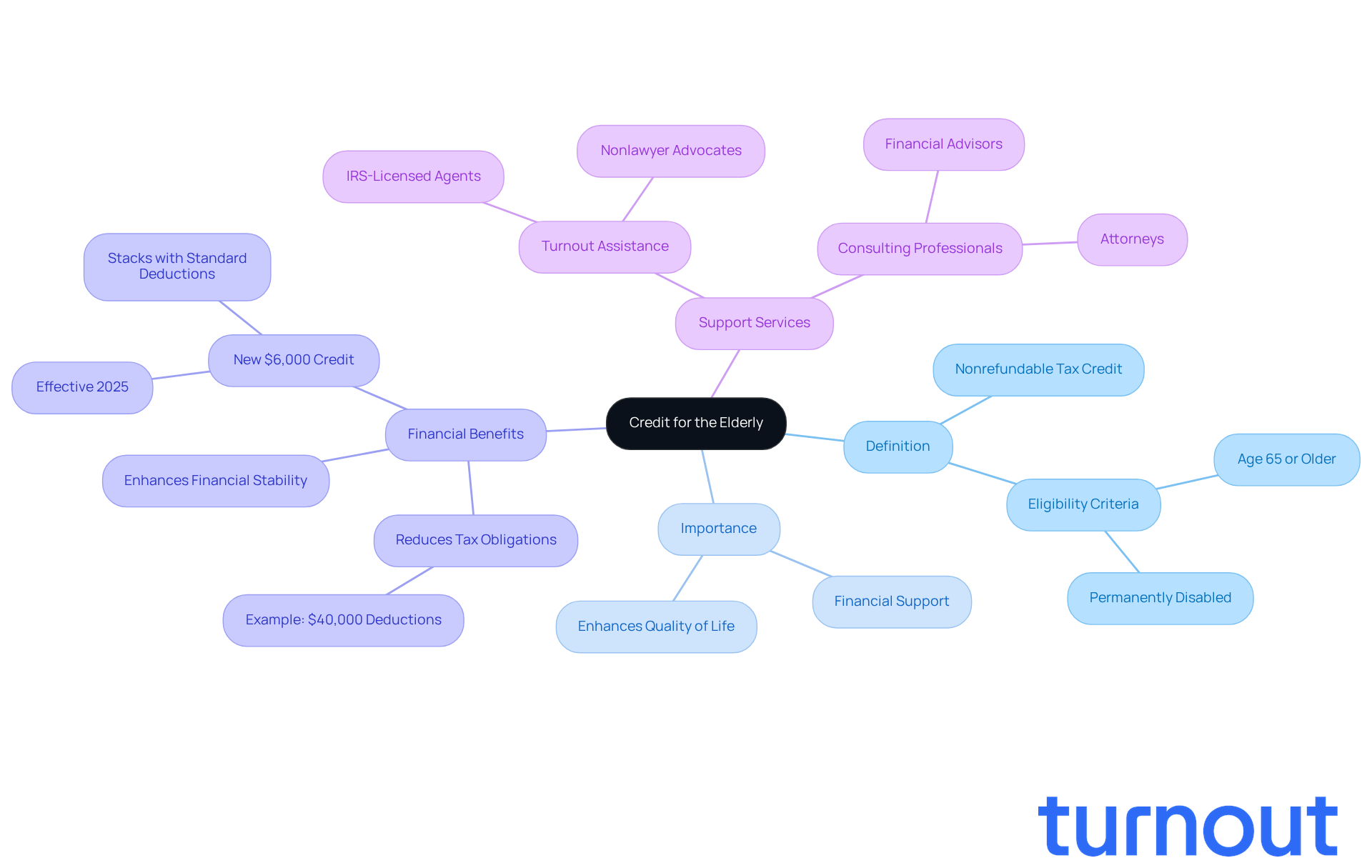

Define the Credit for the Elderly and Its Importance

The nonrefundable tax credit known as credit for the elderly or the disabled is designed to assist individuals aged 65 and older, as well as those who are permanently and totally disabled. The credit for the elderly can significantly lower tax obligations, offering essential support to older adults who often rely on fixed incomes.

With a new $6,000 credit for the elderly coming into effect in 2025, understanding this credit for the elderly is more important than ever. It not only reduces tax burdens but also enhances the financial stability of elderly taxpayers by providing credit for the elderly. This allows them to allocate more funds toward vital needs like healthcare and living expenses.

For instance, a qualifying 65-year-old taxpayer with $40,000 in itemized deductions could see a substantial reduction in their taxable income. This demonstrates how credit for the elderly can help alleviate economic pressures. By taking advantage of credit for the elderly, seniors can enhance their quality of life, ensuring they have the resources to navigate their golden years with dignity and security.

We understand that navigating these financial benefits can be overwhelming. That’s where Turnout comes in. They provide valuable assistance, utilizing trained nonlawyer advocates to help clients with SSD claims and IRS-licensed enrolled agents for tax debt relief. With their support, individuals can access the help they need without the complexities of legal representation. Remember, you are not alone in this journey.

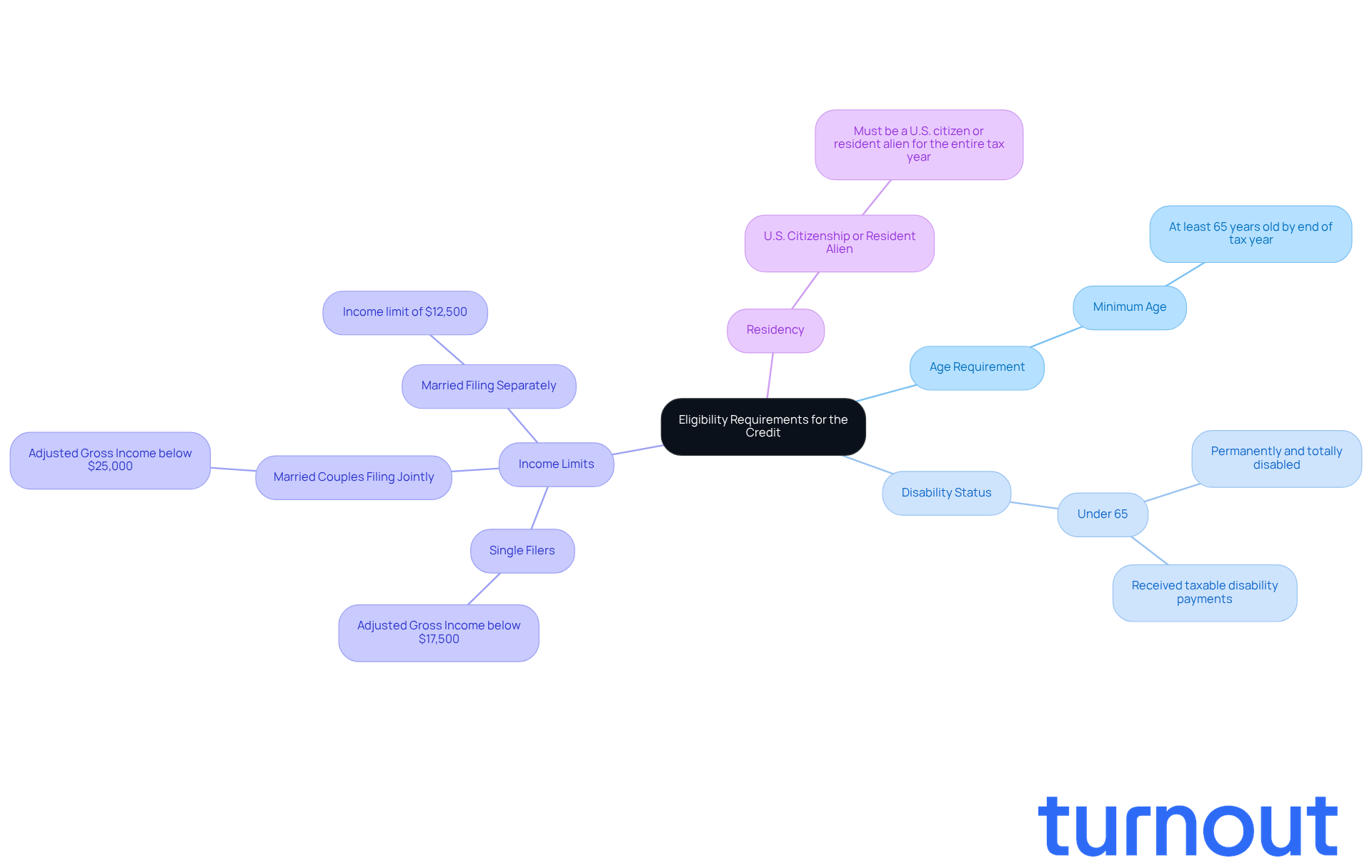

Identify Eligibility Requirements for the Credit

Understanding the specific criteria is important to qualify for the Credit for the Elderly or Disabled, which can assist you or your loved ones.

- Age Requirement: You need to be at least 65 years old by the end of the tax year.

- Disability Status: If you’re under 65, you might qualify if you are permanently and totally disabled and have received taxable disability payments.

- Income Limits: For 2025, your adjusted gross income should be below certain thresholds: $17,500 for single filers and $25,000 for married couples filing jointly.

- Residency: You must be a U.S. citizen or resident alien.

We understand that navigating these requirements can feel overwhelming. Approximately 9 million adults in the U.S. may qualify for the credit for the elderly, and many seniors have successfully benefited from it based on their age or disability status. This assistance can significantly ease financial burdens.

For instance, if you meet the earnings thresholds and provide the necessary documentation, you can effectively lower your tax obligations and receive the support you deserve.

We’re here to help you through this process. Our trained nonlawyer advocates and IRS-licensed enrolled agents can guide you in understanding your eligibility and options for support, all without the need for legal representation.

As Hubert Johnson wisely points out, evaluating your earnings and expenses throughout the year is crucial to staying within eligibility limits. This credit for the elderly can play a vital role in enhancing financial stability for seniors and individuals with disabilities. Remember, you are not alone in this journey; we’re here to support you every step of the way.

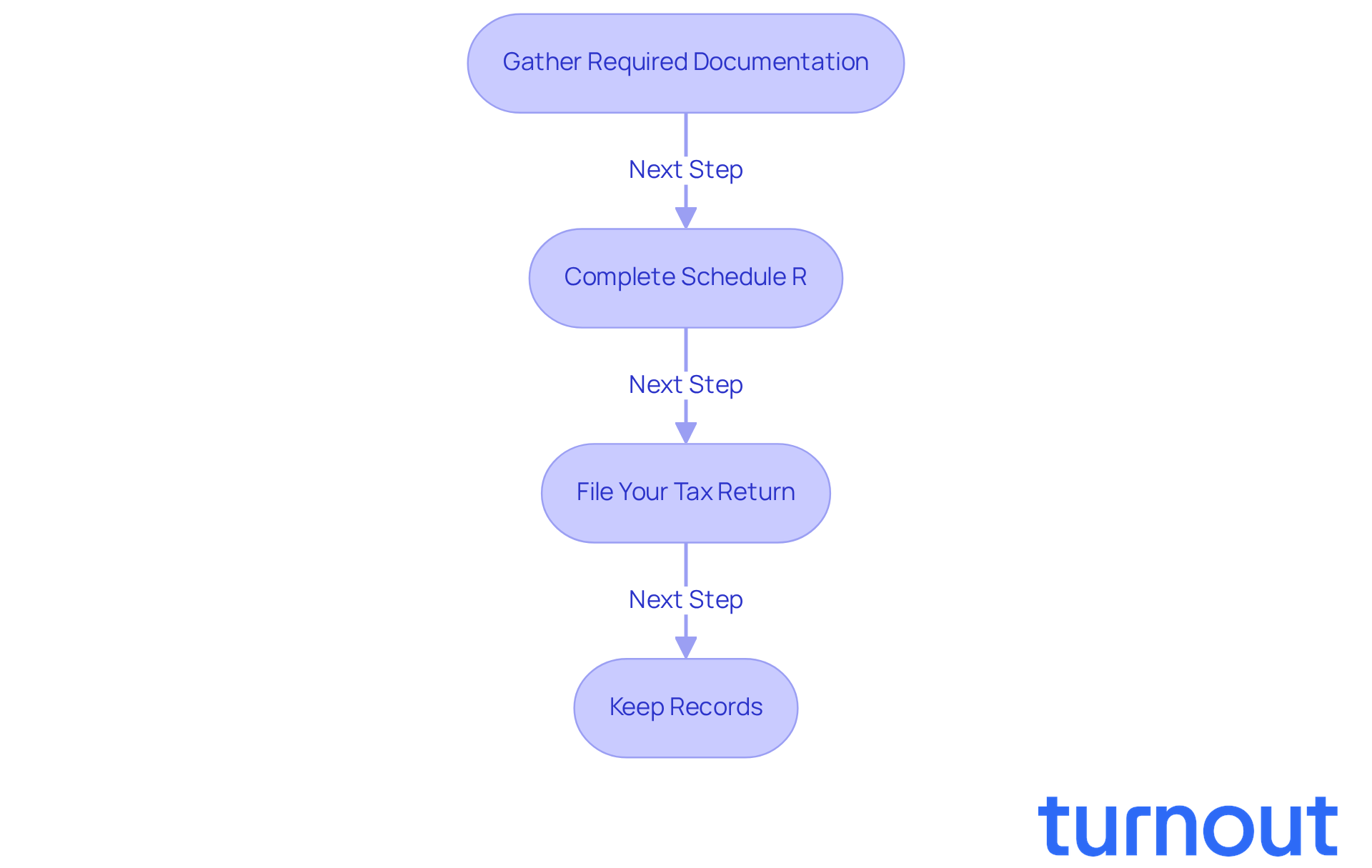

Outline the Application Process and Required Documentation

Applying for credit for the elderly or disabled can feel overwhelming, but we're here to help you through it. Here are some essential steps to guide you:

-

Gather Required Documentation: Start by collecting necessary documents, like proof of age (a birth certificate works), disability documentation (if applicable), and financial statements. Accurate documentation is crucial; errors can lead to delays or denials. For 2025, the earnings threshold is $17,500 for individuals and $25,000 for joint filers.

-

Complete Schedule R: This form is vital for calculating your credit. You’ll need to provide information about your age, disability status, and earnings. Using the IRS-provided worksheet can simplify this process and help ensure accurate calculations. It’s common to feel anxious about making mistakes, so double-check your income reporting and remember to attach all necessary documents.

-

File Your Tax Return: When you file your tax return, attach Schedule R to your Form 1040 or 1040-SR. Make sure all information is accurate to avoid potential delays in processing your claim. If you’re 65 or older, don’t forget about the additional standard deduction of $6,000 in 2025 - it can make a difference!

-

Keep Records: It’s important to maintain copies of all documents you submit and any correspondence with the IRS. This practice will help you address any issues that may arise during the review of your application. Consulting a tax professional can also provide peace of mind, ensuring you meet all requirements and maximize your benefits.

By diligently following these steps, older adults can navigate the application process with confidence and secure the credit for the elderly that they deserve. Remember, you are not alone in this journey. Turnout offers support through trained nonlawyer advocates and IRS-licensed enrolled agents, who can provide personalized assistance in gathering documentation and completing forms. This guidance can help ease some of the financial burdens associated with aging or disability.

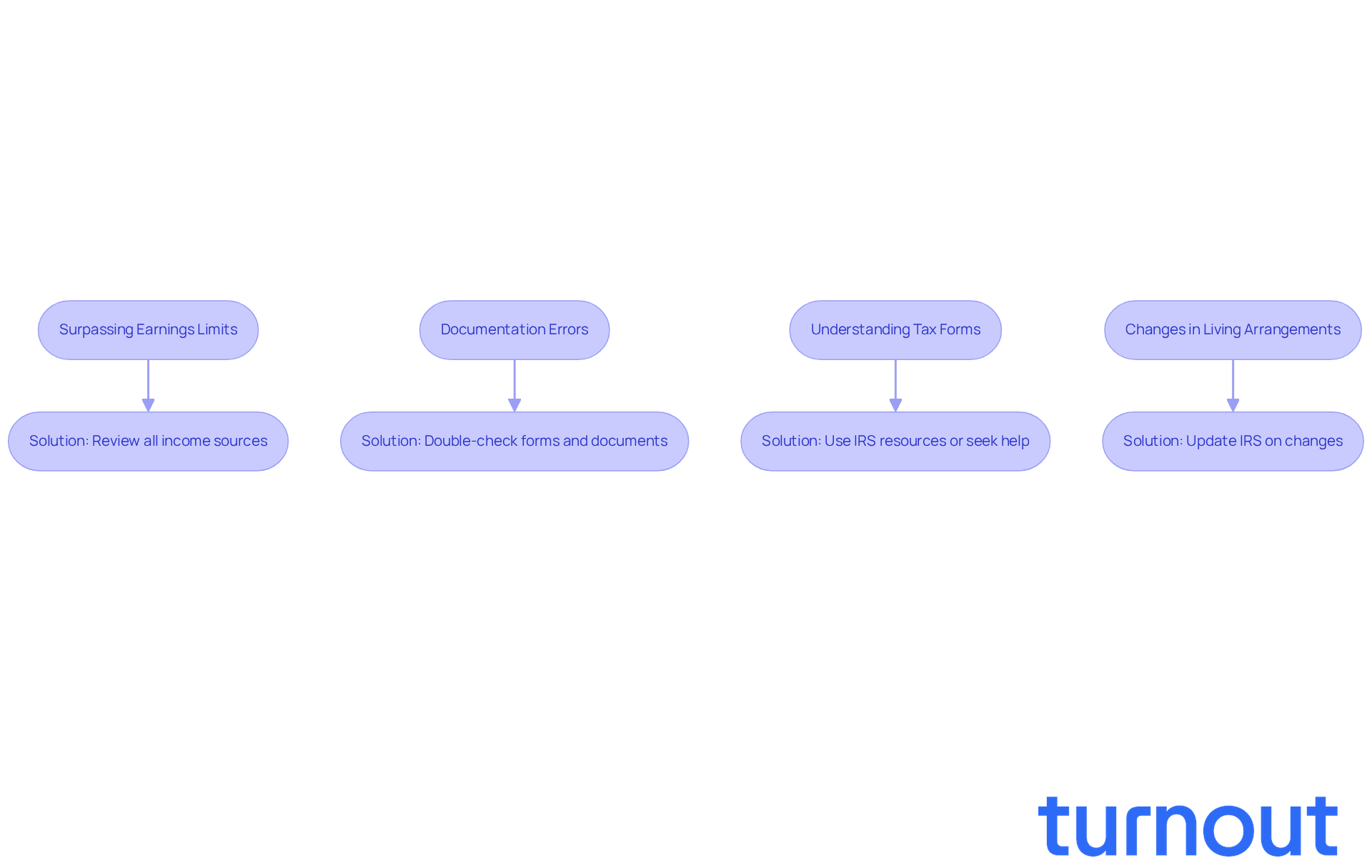

Highlight Common Challenges and Solutions in Claiming the Credit

Seniors often face various challenges when claiming credit for the elderly or disabled.

-

Surpassing Earnings Limits: It’s common for older adults to unknowingly exceed the earnings threshold for eligibility.

Solution: We recommend conducting a thorough review of all income sources, including Social Security benefits and pensions, to confirm your eligibility. -

Documentation Errors: Incomplete or incorrect documentation can lead to frustrating delays or denials.

Solution: Take a moment to double-check all forms and required documents before submission. If you need help, consider reaching out to a tax professional to ensure everything is accurate. -

Understanding Tax Forms: The complexity of tax forms can feel overwhelming.

Solution: Utilize resources like IRS publications or user-friendly tax preparation software that guides you step-by-step through the filing process. Additionally, Turnout offers support through trained nonlawyer advocates who can assist you in navigating these complexities. -

Changes in Living Arrangements: Moving or changes in household composition can impact your eligibility for the credit.

Solution: It’s important to keep the IRS updated on any changes that may affect your tax situation, ensuring that your records reflect your current circumstances.

By recognizing these challenges and implementing the suggested solutions, you can significantly improve your chances of successfully claiming credit for the elderly, which can provide up to $7,500 in tax relief. Remember, you are not alone in this journey, and we’re here to help.

Conclusion

Understanding the Credit for the Elderly is essential for seniors aged 65 and older, as well as those who are permanently disabled. With the credit set to increase to $6,000 in 2025, it’s important to know the eligibility criteria and application process. This credit can significantly ease tax burdens, enhancing financial stability and empowering older adults to manage their expenses effectively. It helps ensure they maintain a quality standard of living during their retirement years.

We recognize that navigating this process can be challenging. Key points include specific eligibility requirements such as age, income limits, and residency status. The article outlines the necessary steps for applying, emphasizing the importance of accurate documentation and completing Schedule R. Common challenges, like exceeding income limits and documentation errors, are addressed alongside practical solutions to help seniors overcome these obstacles.

It’s crucial for seniors and their families to understand the significance of the Credit for the Elderly. By taking proactive steps - like understanding eligibility, gathering necessary documentation, and seeking support - individuals can maximize their benefits. Remember, you are not alone in this journey. Engaging with resources like Turnout can provide invaluable assistance, ensuring that you have the support you need. Taking action now can lead to a more secure and dignified future for those who have contributed so much to society.

Frequently Asked Questions

What is the credit for the elderly?

The credit for the elderly is a nonrefundable tax credit designed to assist individuals aged 65 and older, as well as those who are permanently and totally disabled.

Why is the credit for the elderly important?

It is important because it can significantly lower tax obligations for older adults who often rely on fixed incomes, enhancing their financial stability and allowing them to allocate more funds toward essential needs like healthcare and living expenses.

What changes are coming to the credit for the elderly in 2025?

A new $6,000 credit for the elderly will come into effect in 2025, making it even more crucial for seniors to understand this credit.

How does the credit for the elderly affect taxable income?

For example, a qualifying 65-year-old taxpayer with $40,000 in itemized deductions could see a substantial reduction in their taxable income due to the credit for the elderly.

How can the credit for the elderly improve a senior's quality of life?

By taking advantage of the credit, seniors can alleviate economic pressures, ensuring they have the resources needed to navigate their golden years with dignity and security.

What assistance is available for navigating financial benefits related to the credit for the elderly?

Turnout offers valuable assistance through trained nonlawyer advocates for SSD claims and IRS-licensed enrolled agents for tax debt relief, helping individuals access the support they need without the complexities of legal representation.