Introduction

Navigating the complexities of the Comptroller of Maryland's payment system can feel overwhelming. We understand that many users are turning to the online portal in search of efficient financial solutions. This guide is here to provide you with a clear, step-by-step approach to mastering the payment process, so you can confidently manage your tax obligations.

It's common to feel uncertain with various payment methods and potential pitfalls. How can you ensure a smooth transaction experience? We're here to help you every step of the way.

Understand the Comptroller of Maryland's Payment System

Navigating the comptroller of maryland payment system can feel overwhelming, but we're here to assist you every step of the way. Let’s explore some key features that will make your experience smoother:

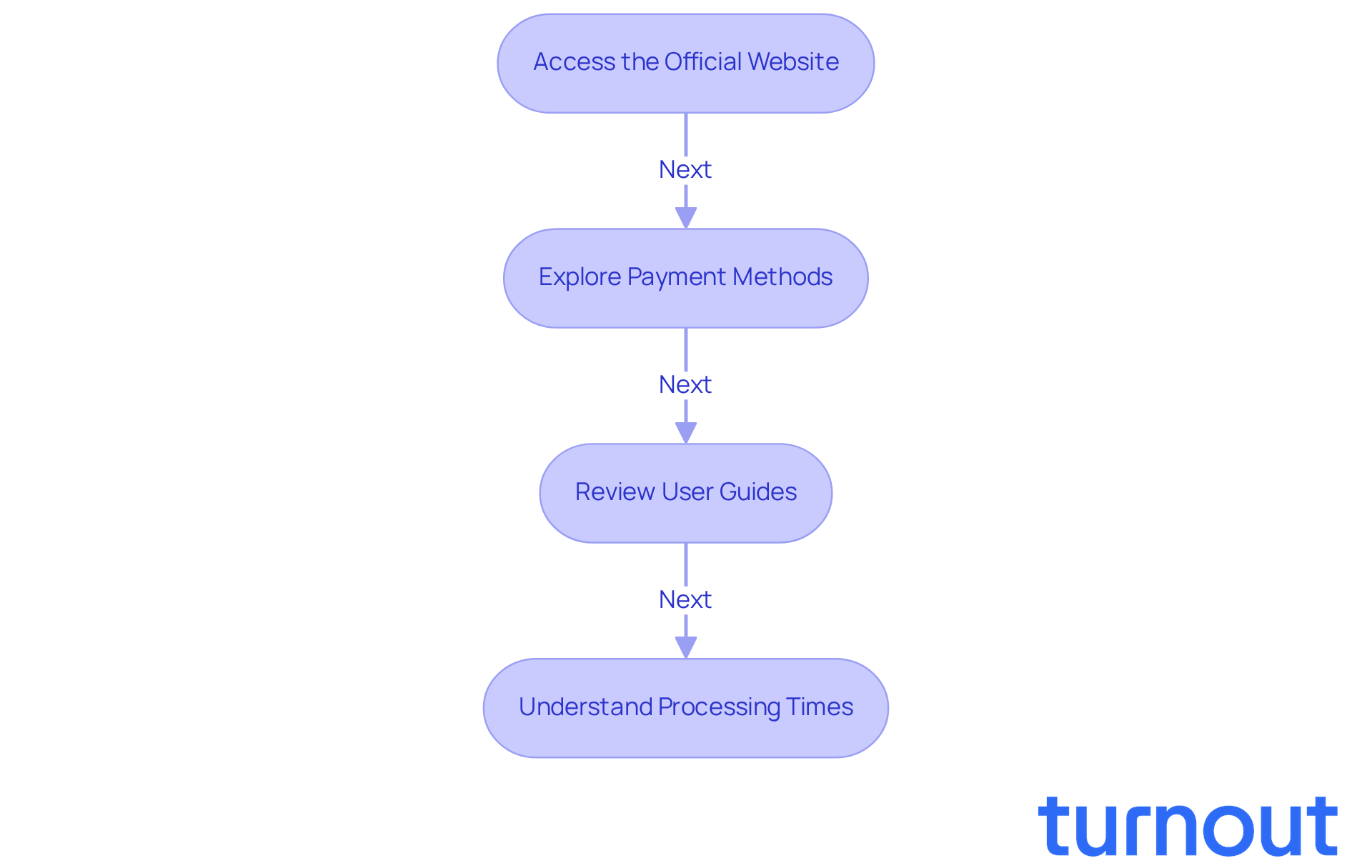

- Access the Official Website: Start by visiting the Maryland Tax Connect portal. This secure platform allows you to interact with the transaction system efficiently.

- Explore Payment Methods: It’s important to understand the different transaction options available. Whether you choose online transactions, guest transactions, or transaction agreements, each option has specific requirements tailored to your needs.

- Review User Guides: Take advantage of resources like the Guest Payment Guide. This guide provides step-by-step instructions to help you complete transactions with ease. As the Maryland Comptroller's Office states, "The Maryland Tax Connect portal is an official online platform provided by the state of Maryland, created to simplify the entire procedure of managing state taxes."

- Understand the Processing Times: Knowing that electronic transactions typically process within 3-7 business days, while paper checks may take longer, can help you organize your financial transactions effectively.

As of February 2026, there is a significant rise in users on the Comptroller of Maryland payment transaction portal. This reflects the growing demand for accessible government financial solutions. The portal's user-friendly interface, complete with clear instructions and navigation tools, empowers you to manage your tax obligations confidently.

We understand that navigating these processes can be challenging, but remember, you are not alone in this journey. Advocates emphasize that understanding these steps is crucial for accessing the benefits and services you deserve. So, take a deep breath and explore the resources available to you!

Prepare Your Documentation and Information

Before you proceed with your payment, it’s important to gather the necessary documentation to ensure everything goes smoothly:

-

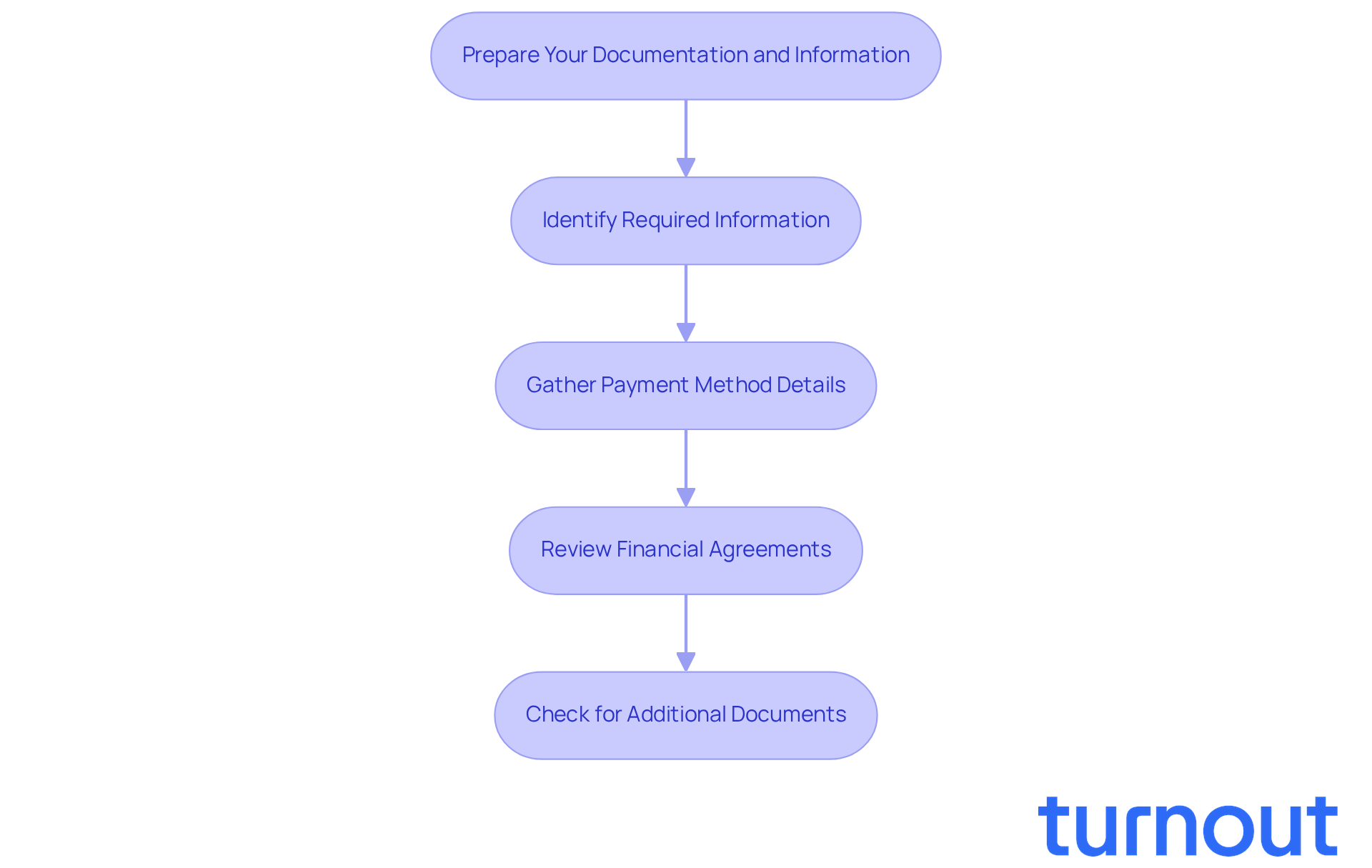

Identify Required Information: You’ll need your Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN), along with any relevant tax bill or notice number. This information is crucial for processing your transaction accurately and avoiding delays.

-

Gather Payment Method Details: If you plan to pay online, make sure you have your bank account information ready for direct debit or your credit card details if applicable. Having this information on hand can speed up the transaction process and reduce the chances of mistakes.

-

Review Financial Agreements: If you’re setting up a payment plan, keep your agreement number and any related correspondence handy. This documentation is essential for verifying your financial terms and ensuring compliance with the requirements for the comptroller of Maryland payment.

-

Check for Additional Documents: Depending on your transaction type, you might need to provide extra documentation, such as proof of income or previous tax returns. Ensure all documents are current and accurate, as this can significantly impact your processing and eligibility for any potential relief options.

We understand that navigating tax regulations can be overwhelming. Recent estimates suggest that Americans will spend around 7.1 billion hours complying with tax regulations for Tax Year 2024. This highlights the importance of thorough preparation. Additionally, taxpayers face an estimated $148 billion in out-of-pocket costs related to tax compliance, underscoring the need to be well-informed and organized. By preparing these documents in advance, you can approach the transaction process with greater confidence and efficiency. Remember, you’re not alone in this journey; we’re here to help!

Execute Your Payment with the Comptroller's System

To successfully execute your payment through the Comptroller of Maryland's system, we’re here to guide you through each step:

-

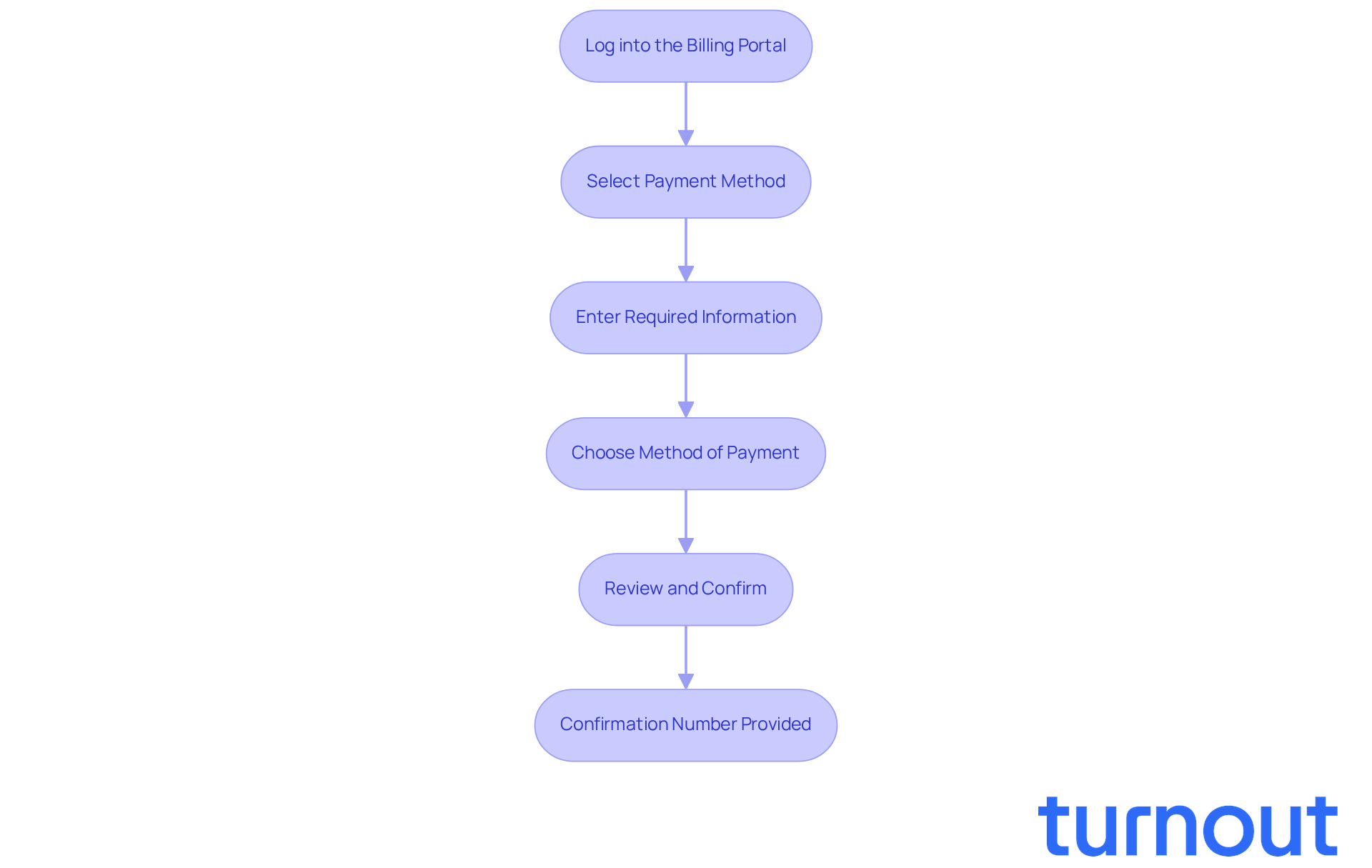

Log into the Billing Portal: Start by accessing the comptroller of maryland payment system and logging in with your credentials. If you don’t have an account yet, don’t worry! You can choose the guest checkout option. To register for a Maryland Individual Taxpayer Account, you’ll need to provide the primary taxpayer's SSN, name, address, phone number, and date of birth.

-

Select Payment Method: Next, identify the type of transaction you wish to make. Whether it’s bill settlement, an estimated charge, or an agreement for a transaction, we’re here to help you navigate this.

-

Enter Required Information: Complete the necessary fields, including your SSN or ITIN, the amount due, and any relevant notice numbers. If you’re registering, you’ll also need to verify your identity by entering the Federal Adjusted Gross Income from your previous year's tax return, specifically from the 2023 tax return on MD form 520, line 1.

-

Choose Method of Payment: Now, select your preferred method of transaction. Whether it’s direct debit or credit card, just input the required details, and you’re almost there!

-

Review and Confirm: Take a moment to carefully review all the information you’ve entered. It’s common to feel a bit anxious about this step, but financial specialists emphasize the importance of verifying transaction details to prevent mistakes and ensure prompt processing. Once you’re confident everything is correct, submit your fee. A confirmation number will be provided for your records.

We understand that processing durations for various transaction types can differ, so it’s wise to check the portal for specific timelines. Many have successfully executed online transactions, demonstrating the efficiency of the system. Remember, you’re not alone in this journey; we’re here to help!

Troubleshoot Common Payment Issues

When you encounter issues with the comptroller of Maryland payment, it’s important to know that you’re not alone. We understand that navigating these situations can be stressful, so here are some supportive steps to help you resolve the problem effectively:

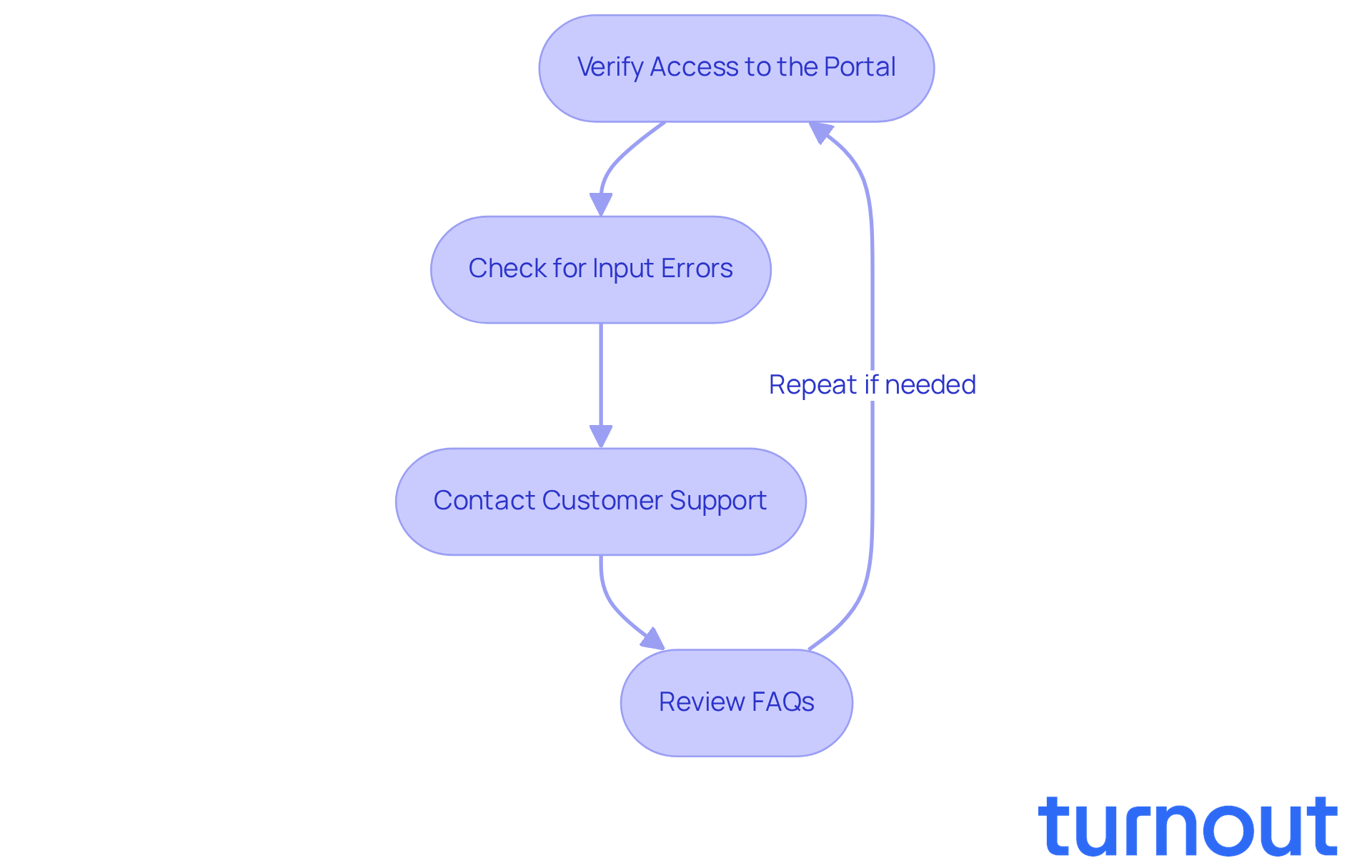

- Verify Access to the Portal: First, confirm that you’re using the correct portal for your specific tax type. If you’re opting for the guest option, please ensure you’ve accepted the terms and conditions.

- Check for Input Errors: Take a moment to carefully review all the information you’ve entered. Look for any typos or inaccuracies, especially with your Social Security Number, transaction amount, and bank details.

- Contact Customer Support: If you’re still facing challenges, don’t hesitate to reach out to the finance office at 410-260-7980. Their team is ready to assist you with transaction processing or account access issues.

- Review FAQs: For additional guidance, check out the FAQs section on the Comptroller's website. It addresses common issues and offers helpful solutions.

Consumer advocates emphasize the importance of these steps. Many users have successfully resolved transaction issues by following them. For instance, one user shared that after confirming their portal access, they were able to complete their transaction smoothly. Plus, the average response time for customer support inquiries about transaction issues is typically quick, with many users receiving help within minutes. As consumer advocate Erin noted, "Taking these proactive measures can significantly simplify the transaction." By following these steps, you can navigate the payment process with greater confidence and efficiency. Remember, we’re here to help you every step of the way.

Conclusion

Navigating the Comptroller of Maryland's payment system can feel overwhelming at first. We understand that managing tax obligations is no small task. However, by familiarizing yourself with the Maryland Tax Connect portal and the steps for making payments, you can approach this process with confidence.

Here are four essential steps to help you master the payment process:

- Access the official website.

- Prepare the required documentation.

- Execute the payment.

- Troubleshoot common issues.

Each step is designed to guide you through the complexities of tax transactions. Preparation and accuracy are key to avoiding potential delays. Remember, resources like user guides and customer support are available to assist you whenever challenges arise.

In conclusion, taking the time to understand and follow these steps not only simplifies the payment process but also enhances your overall experience in managing tax obligations. By leveraging the resources available and proactively addressing any issues, you can effectively navigate the Comptroller of Maryland's payment system. Embrace this knowledge and approach your tax responsibilities with confidence, knowing that support is available every step of the way. You're not alone in this journey; we're here to help.

Frequently Asked Questions

What is the Maryland Tax Connect portal?

The Maryland Tax Connect portal is a secure online platform provided by the state of Maryland that allows users to interact with the comptroller's payment system efficiently and manage their state taxes.

What payment methods are available through the comptroller's payment system?

The payment system offers various transaction options, including online transactions, guest transactions, and transaction agreements, each with specific requirements tailored to users' needs.

Where can I find guidance on using the payment system?

Users can refer to resources like the Guest Payment Guide, which provides step-by-step instructions for completing transactions easily.

How long do transactions typically take to process?

Electronic transactions usually process within 3-7 business days, while paper checks may take longer.

Why has there been an increase in users on the Comptroller of Maryland payment transaction portal?

As of February 2026, there has been a significant rise in users due to the growing demand for accessible government financial solutions.

What features make the Maryland Tax Connect portal user-friendly?

The portal includes a user-friendly interface with clear instructions and navigation tools, empowering users to manage their tax obligations confidently.