Introduction

Navigating tax obligations can often feel overwhelming, especially when it comes to understanding the Collection Statute Expiration Date (CSED). This important date marks when the IRS can no longer collect on tax debts, usually ten years after the initial assessment. By getting to know the CSED, you can discover ways to ease your financial burdens and take charge of your financial future.

We understand that life can throw unexpected challenges your way, leaving you unsure of your next steps. What happens when those challenges alter your timeline? You're not alone in this journey, and there are paths to relief. Let's explore how you can regain control and find peace of mind.

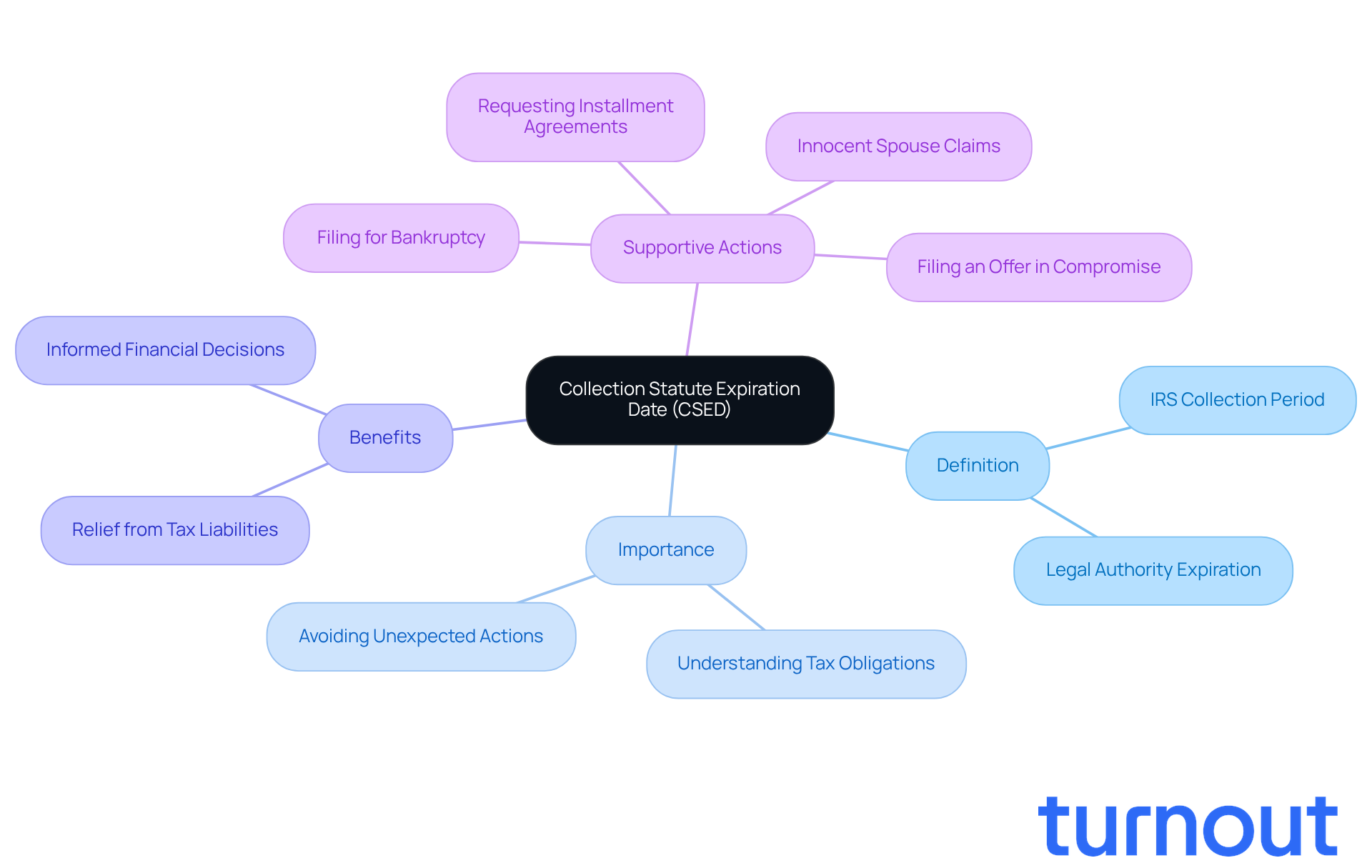

Define the Collection Statute Expiration Date (CSED)

The collection statute expiration date is a crucial concept for anyone facing tax obligations. It marks the collection statute expiration date, the moment when the IRS can no longer collect a tax debt, typically ten years from when the tax is assessed. Understanding the collection statute expiration date can provide a sense of relief to those burdened by tax liabilities.

We know that dealing with tax debt can be overwhelming. This knowledge empowers you to make informed financial decisions and engage with supportive services like Turnout. Millions of Americans are in similar situations, and knowing about the collection statute expiration date can significantly improve your financial outlook.

By grasping the implications of this program, you can plan your approach to tax relief more effectively. It helps you avoid unexpected collection actions and manage the complexities of your obligations with greater confidence. Remember, you are not alone in this journey, and we're here to help.

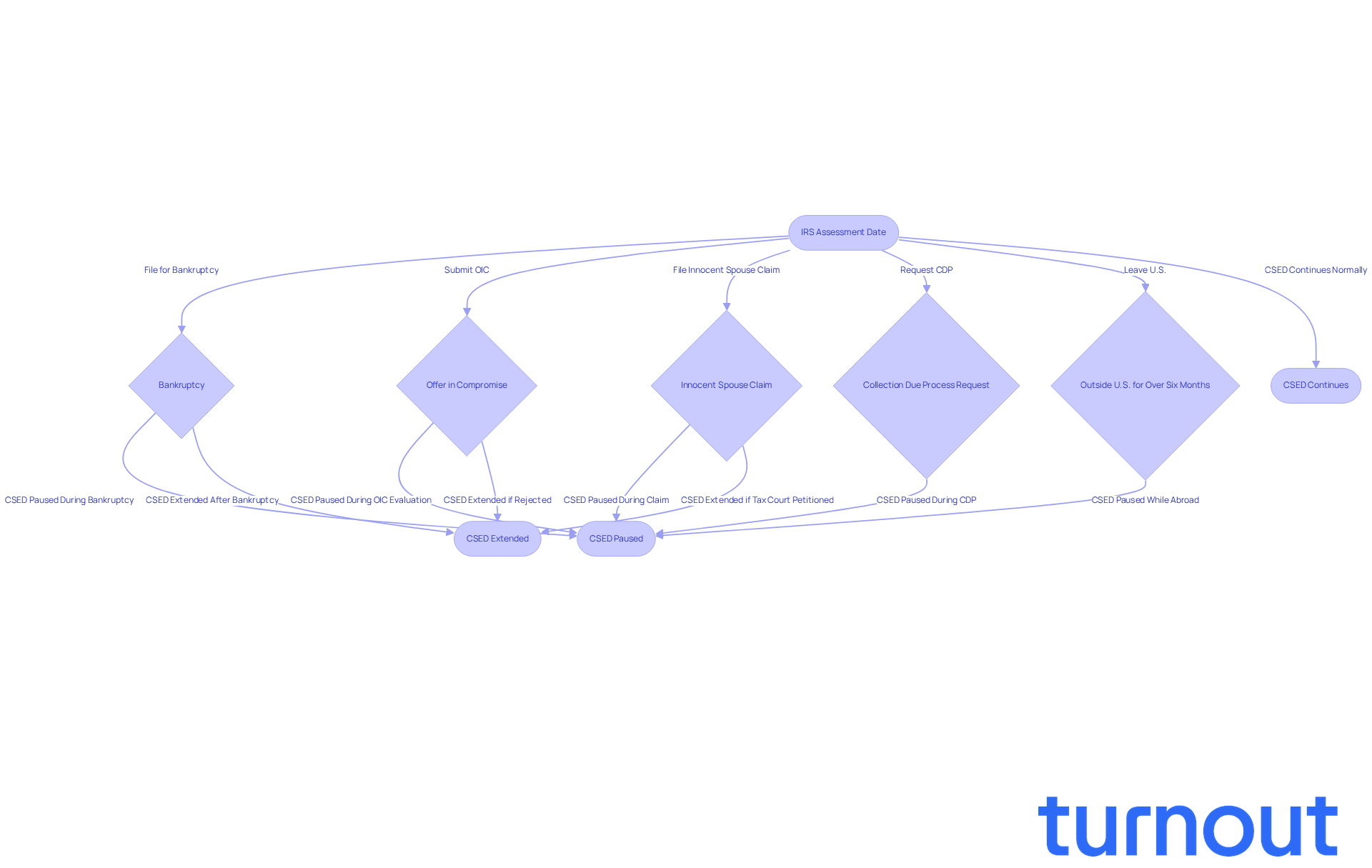

Explain How the CSED Works and Its Calculation

Understanding the collection statute expiration date is crucial for anyone facing tax obligations. This date starts from when the IRS formally assesses your tax responsibility, which could be when you file your return or when they identify additional taxes owed. To find out when your tax debts might expire, simply take that assessment date and add ten years.

However, life can throw some curveballs that affect this timeline. For instance, if you file for bankruptcy, the Child Support Enforcement Division pauses collection efforts during the proceedings and for six months afterward. This can provide a much-needed break. Similarly, if you submit an Offer in Compromise (OIC), the clock on your collection statute expiration date stops until the IRS decides on your offer, plus an additional 30 days if they decline it.

If you’re dealing with an Innocent Spouse claim, the collection period is also put on hold for the requesting spouse until the claim is resolved. And while a Collection Due Process (CDP) request is pending, you get more time to manage your tax obligations. If you find yourself outside the U.S. for over six months, the Collection Statute Expiration Date pauses during that time as well.

We understand that navigating these processes can be overwhelming. But knowing how these calculations work can empower you to take control of your financial future. Many taxpayers who successfully manage these situations find relief from their tax burdens, allowing them to breathe easier and regain their footing.

It's important to remember that evaluating an Offer in Compromise can take a year or more, which might extend the collection statute expiration date. But you are not alone in this journey; we’re here to help you through it.

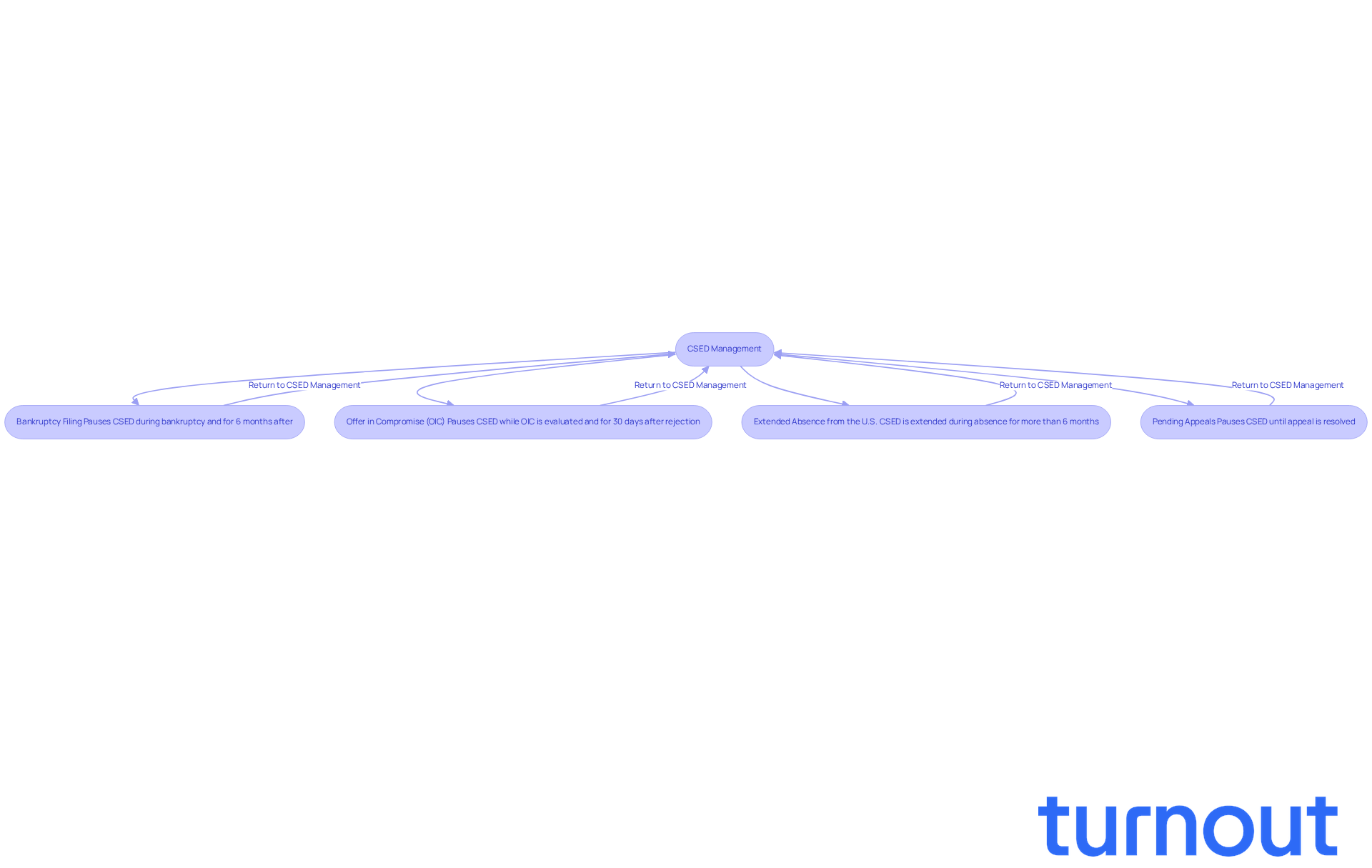

Identify Events That Can Extend or Pause the CSED

Several key events can either extend or pause the collection statute expiration date (CSED), which is crucial for effectively managing tax liabilities.

We understand that navigating tax obligations can be overwhelming. Here are some important events that may help you find relief:

-

Bankruptcy Filing: When you apply for bankruptcy, the Child Support Enforcement Division is paused until the bankruptcy case is resolved. This pause can provide significant relief, allowing you to focus on your financial recovery without the pressure of tax collection. Plus, the debt relief program is on hold for six months after the bankruptcy case concludes, giving you extra time to manage your tax responsibilities.

-

Offer in Compromise (OIC): Presenting an OIC to resolve your tax obligation also pauses the collection period while the IRS evaluates your proposal. This process can take a considerable amount of time, effectively extending the period during which the IRS cannot collect on your debt. Notably, IRS appeals data from 2025 shows that over 40% of OIC denials are later overturned on appeal. This highlights the importance of persistence in this process.

-

If you are outside the U.S. for an extended period, your absence may result in a prolonged collection statute expiration date. This can be particularly beneficial for individuals who need additional time to manage their tax obligations while abroad.

-

Pending Appeals: If you are contesting a tax assessment, the expiration date of the collection statute may be paused until the appeal is resolved. This allows you to contest the assessment without the immediate threat of collection actions.

Understanding these events is essential for consumers to navigate their tax situations effectively and avoid unexpected extensions of their obligations. Remember, consistently checking your financial statement is crucial. It helps you stay aware of your tax obligations and any possible changes in your circumstances.

You're not alone in this journey; we're here to help you every step of the way.

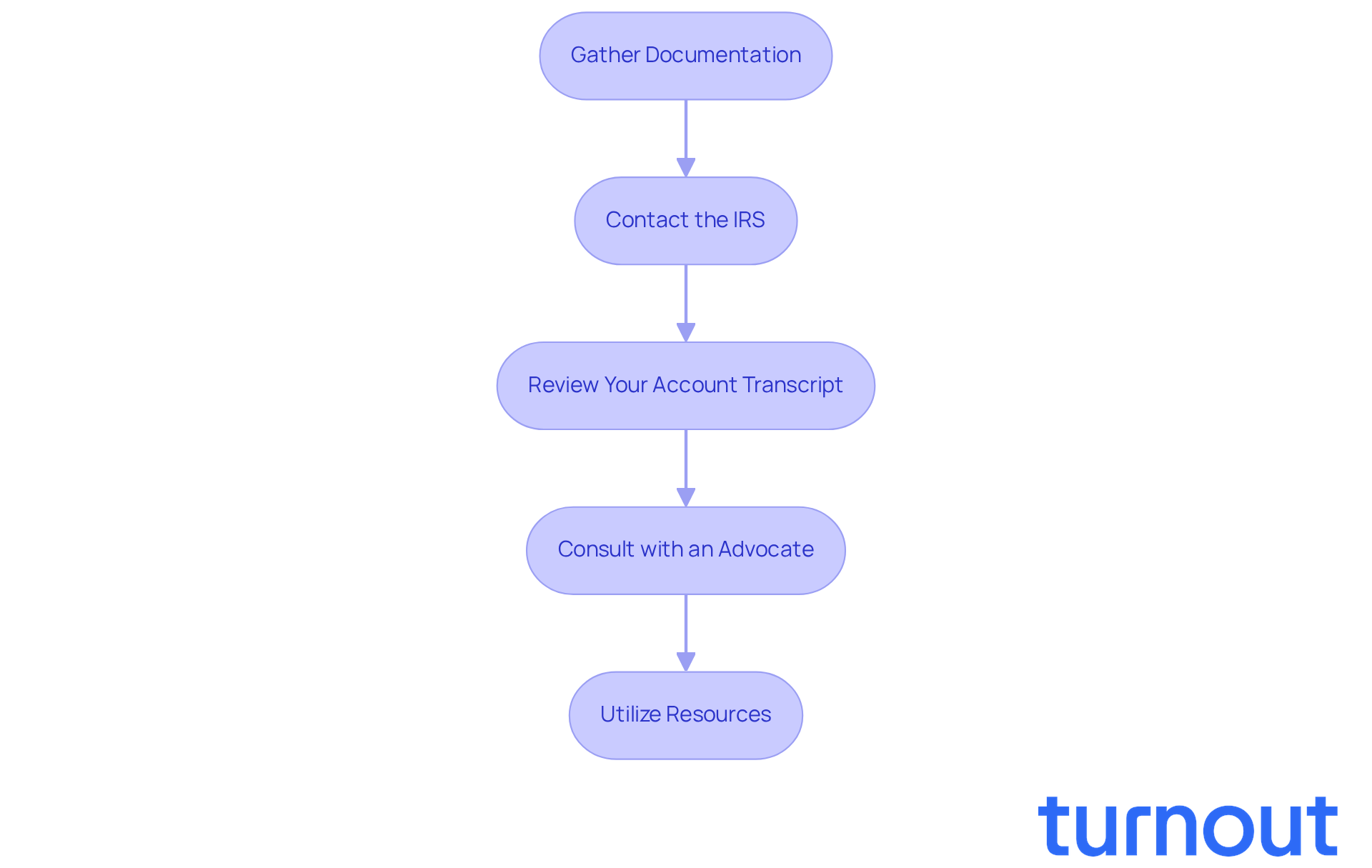

Guide on How to Verify Your CSED

To verify your Collection Statute Expiration Date (CSED), follow these essential steps:

-

Gather Documentation: Start by collecting all relevant tax documents, including your tax returns and any correspondence from the IRS. This foundational step ensures you have the necessary information at hand.

-

Contact the IRS: We understand that reaching out can feel overwhelming. Call the IRS toll-free or visit your local office. Request your account transcript, which contains crucial details about your tax assessments.

-

Review Your Account Transcript: Take a moment to examine your transcript for the date of assessment. This date is essential for determining your tax liability, as the IRS usually has ten years from this date to gather unpaid taxes.

-

Consult with an Advocate: If the process feels daunting, consider seeking assistance from a consumer advocacy organization like Turnout. Advocates can help you navigate the complexities of verifying your Child Support Enforcement Documents and ensure you understand your rights.

Each year, many taxpayers successfully confirm their collection statute expiration date with the help of resources like the Taxpayer Advocate Service. This organization provides guidance on taxpayer rights and the verification process. In fact, statistics show that about 70% of taxpayers who seek help from advocacy organizations clarify their collection statute expiration date effectively. By following these steps and utilizing available support, you can gain clarity on your tax situation and take informed actions.

For example, individuals who have worked with the Taxpayer Advocate Service have reported successful outcomes in verifying their collection statute expiration date. This highlights the importance of advocacy in navigating tax complexities. Remember, "the running of the collection period is generally suspended when the IRS is prohibited from collecting tax." Understanding your rights and the verification process is crucial, and we're here to help you every step of the way.

Conclusion

Understanding the Collection Statute Expiration Date (CSED) is crucial for anyone facing tax obligations. This date marks when the IRS can no longer pursue tax debts, typically ten years from the initial assessment. By familiarizing yourself with the CSED, you can find relief from the pressures of tax liabilities and take steps toward financial stability.

We understand that navigating tax issues can be overwhelming. Throughout this article, we've explored key insights into the workings of the CSED, including:

- How it’s calculated

- The events that can pause or extend this important timeline

Factors like bankruptcy, Offers in Compromise, and pending appeals significantly influence how long you can manage your obligations without the threat of collection actions looming over you.

Moreover, verifying your CSED is essential. Gathering documentation and seeking assistance when needed can make a world of difference. Remember, you’re not alone in this journey. Awareness and understanding of the CSED empower you to navigate your tax situation more effectively.

By leveraging this knowledge, you can make informed decisions and seek the support you deserve. Engaging with advocacy resources can provide additional guidance and reassurance. Together, we can ensure that you don’t have to face these challenges alone. Take that step today-your financial future is worth it.

Frequently Asked Questions

What is the Collection Statute Expiration Date (CSED)?

The Collection Statute Expiration Date (CSED) is the date after which the IRS can no longer collect a tax debt, typically ten years from when the tax is assessed.

Why is understanding the CSED important for individuals facing tax obligations?

Understanding the CSED can provide relief to those burdened by tax liabilities, empowering them to make informed financial decisions and engage with supportive services.

How can knowledge of the CSED improve financial outlook for individuals with tax debt?

Knowing about the CSED can help individuals plan their approach to tax relief more effectively, avoid unexpected collection actions, and manage their tax obligations with greater confidence.

What should individuals do if they are overwhelmed by tax debt?

Individuals should seek supportive services, such as Turnout, to help navigate their tax obligations and understand their rights regarding the CSED.

Is it common for Americans to face tax debt issues?

Yes, millions of Americans are in similar situations regarding tax debt, making awareness of the CSED particularly important.