Introduction

Tax season can feel overwhelming, can't it? Many individuals find themselves tangled in the complexities of deductions and allowances. We understand that navigating these financial waters is crucial, especially when it comes to figuring out the right number of allowances to claim.

This article is here to help you. We’ll explore the significance of tax allowances and provide a comprehensive guide on using calculators that simplify this process. Our goal is to empower you to make informed financial decisions.

But how do you strike that perfect balance between maximizing your take-home pay and avoiding unexpected tax bills? You're not alone in this journey, and together, we can find the answers.

Understand Tax Allowances and Their Importance

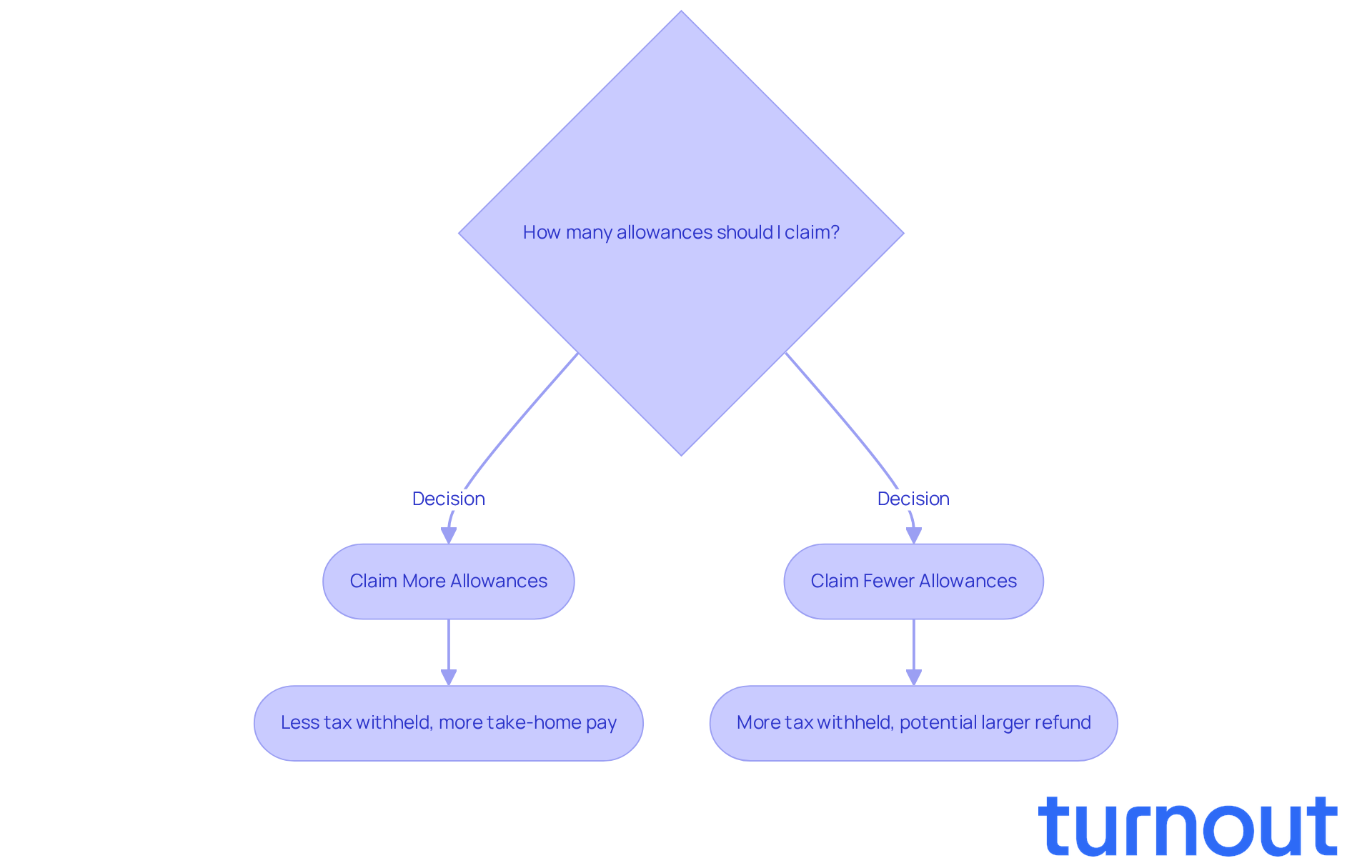

Tax exemptions can feel a bit overwhelming, but they’re really just deductions that reduce the amount of your income that gets taxed. This directly affects how much money is taken out of your paycheck. We understand that determining how many deductions to claim can be tricky, but using a how many allowances should I claim calculator is crucial because it impacts your net income and tax responsibility.

For instance, if you claim more exemptions, less tax is withheld, which means you get to take home more money each pay period. However, it’s important to remember that this could lead to owing money when tax time rolls around if not enough is withheld. On the flip side, claiming fewer deductions increases your withholding, which might result in a larger tax refund.

Finding the right balance can help you manage your finances more effectively and avoid any surprises during tax season. Remember, you’re not alone in this journey; we’re here to help you navigate these decisions with confidence.

Access the Allowances Calculator

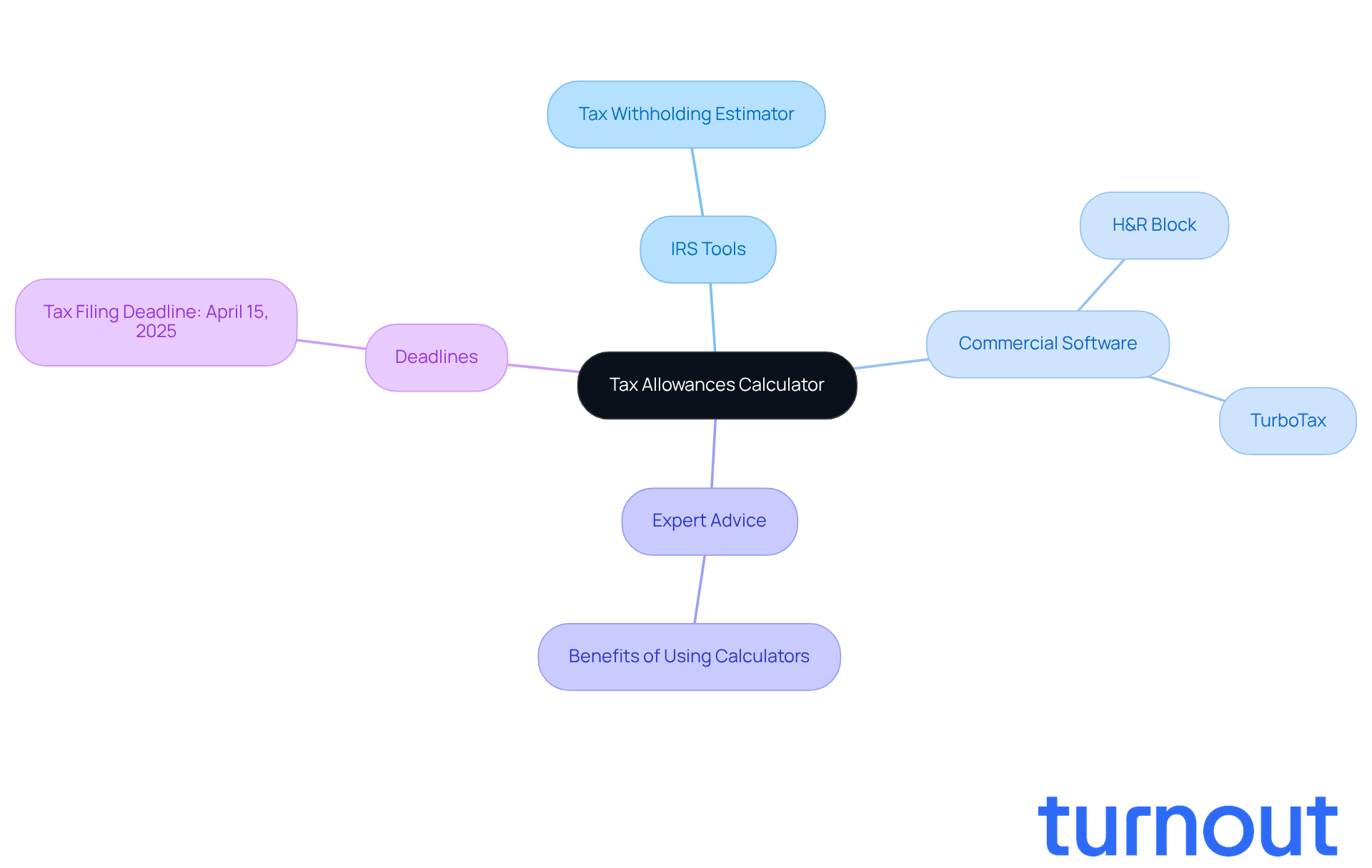

Are you feeling overwhelmed by the thought of tax deductions? You're not alone. Many people find navigating tax season to be a daunting task. But don’t worry; there are helpful tools such as the how many allowances should I claim calculator available to make this process easier for you.

The IRS offers a Tax Withholding Estimator, a reliable resource that can help you figure out how much federal income tax should be withheld from your paycheck. This tool is particularly useful if you've experienced significant life changes, like starting a new job or getting married. It allows you to adjust your withholding based on your current financial situation. You can easily access it at IRS Tax Withholding Estimator.

In addition to the IRS tool, services like H&R Block and TurboTax offer user-friendly options, including a how many allowances should I claim calculator, to help you determine the right number of exemptions based on your financial circumstances. Did you know that around 44% of tax filers prefer using commercial tax-prep software? This trend shows how many people are turning to these digital solutions for assistance. Just visit their websites and follow the prompts to get started.

Tax experts agree that utilizing the how many allowances should I claim calculator can significantly simplify the process of identifying your deductions. This can lead to better tax management and planning, giving you peace of mind. Remember, once you've made adjustments, be sure to submit your new withholding amount on Form W-4 to your employer. And don’t forget, the deadline to file your federal tax returns is April 15, 2025. By taking advantage of these resources, you can make informed decisions that align with your financial goals. We're here to help you every step of the way!

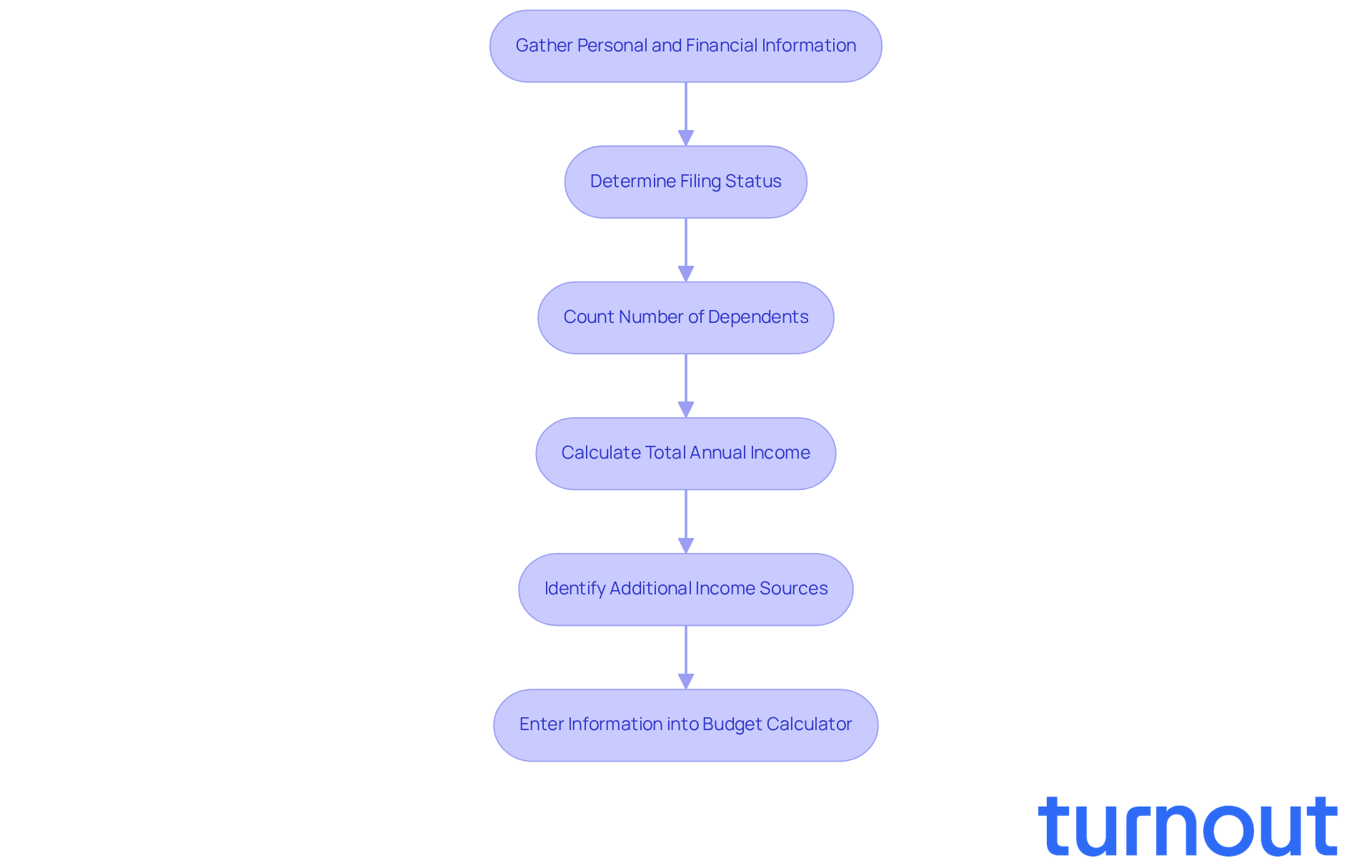

Input Your Personal and Financial Information

We understand that navigating tax season can be overwhelming. To make the most of the budget calculator, it’s essential to enter specific personal and financial information. This includes:

- Your filing status - whether you’re single, married, or head of household

- The number of dependents

- Your total annual income

- Any additional income sources

Start by gathering important documents like your most recent pay stubs, last year's tax return, and any other relevant financial records. Remember, accurate data is crucial. Tax consultants often emphasize that even small discrepancies can lead to significant differences in your tax outcomes. For instance, many disabled individuals frequently file as head of household, which can impact their tax benefits.

In 2025, the standard deduction amounts are set at $15,750 for single filers and $23,625 for head of household. These figures can significantly influence your tax calculations. Once you have all this information ready, follow the prompts on the device to enter your details. This will enable the how many allowances should I claim calculator to provide a personalized assessment of how many deductions you should request, enhancing your tax situation for the upcoming year.

We’re here to help you through this process, ensuring you feel confident and informed every step of the way.

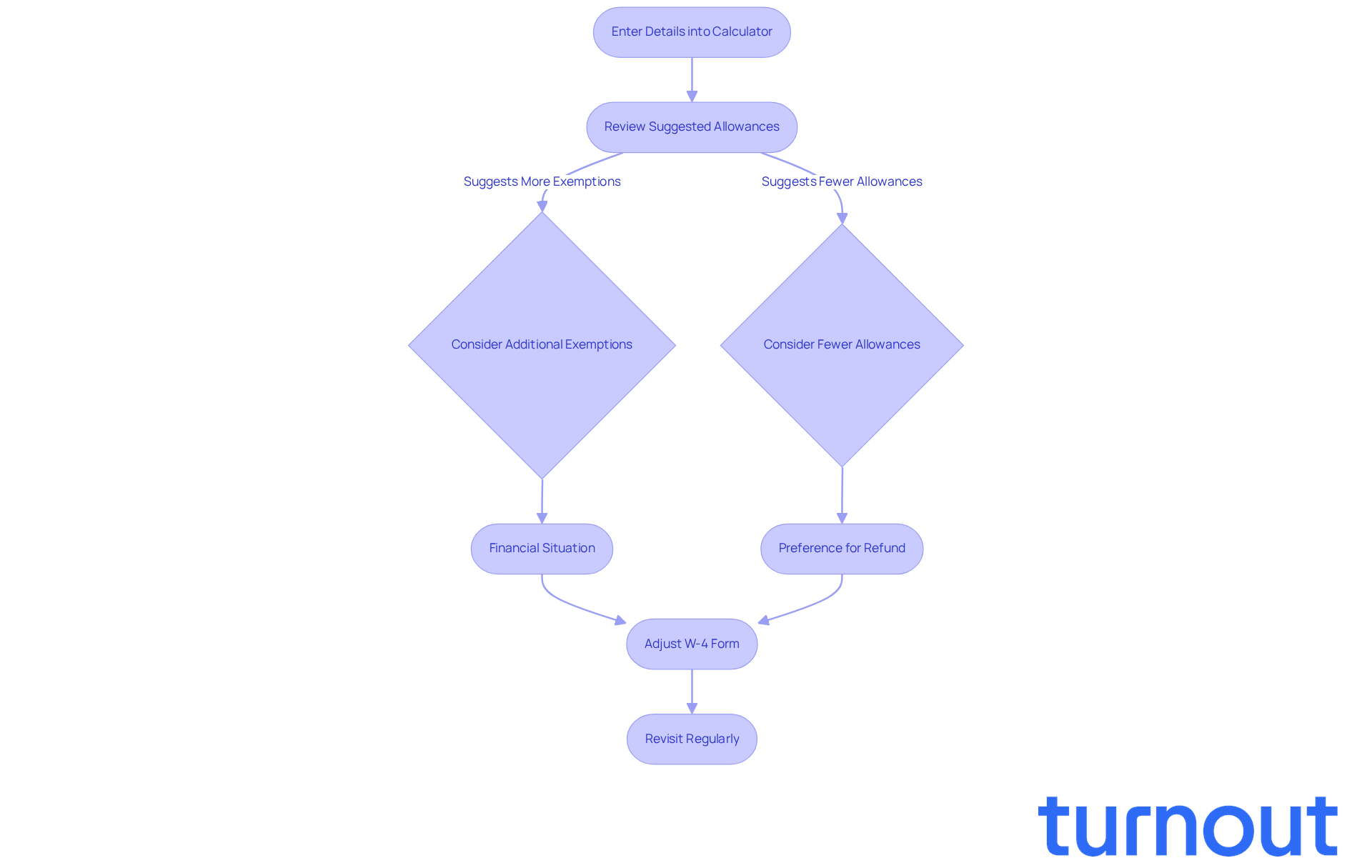

Interpret the Calculator Results and Make Informed Decisions

After entering your details, the benefits estimator will use the how many allowances should I claim calculator to suggest a quantity of claims to request. Take a moment to review these results carefully. If the device recommends requesting additional exemptions, consider your financial situation and whether you can handle having reduced taxes deducted. On the other hand, if it suggests fewer allowances, think about whether you’d prefer a larger refund at tax time or if you can manage a higher withholding throughout the year. Adjust your W-4 form as needed based on these insights. And remember, it’s wise to check the tool regularly, especially after major life changes like marriage, having children, or changing jobs.

We understand that many taxpayers lean towards receiving refunds rather than owing taxes. In fact, a significant portion prefers the security of a refund at tax time. Financial advisors, including Roger Young, emphasize the importance of making informed choices based on these suggestions. He states, 'As always, the best approach is personal.' Your income, life stage, and financial goals all play a role in how these rules apply to you. Individuals who have adjusted their W-4 forms after utilizing the how many allowances should I claim calculator often report feeling more in control of their finances and tax obligations.

By staying proactive and revisiting your withholding strategy, you can optimize your tax situation and align it with your financial goals. Remember, you are not alone in this journey. We're here to help you navigate these decisions.

Conclusion

Mastering the allowances calculator is crucial for managing tax deductions and optimizing your financial outcomes. We understand that figuring out how many allowances to claim can feel overwhelming, but it can significantly influence your take-home pay and tax responsibilities. By using the right tools, you can make informed decisions that align with your financial goals and help you avoid unexpected tax liabilities.

Key insights throughout this article highlight the importance of having accurate personal and financial information when using the allowances calculator. Tools like the IRS Tax Withholding Estimator and various tax-prep software can be invaluable resources, guiding you in determining the right number of exemptions. Remember, it’s common to feel uncertain, especially after major life changes, so regularly revisiting these calculations is essential for maintaining optimal tax management.

Ultimately, being proactive in understanding and utilizing tax allowances can lead to greater financial control and peace of mind. By taking advantage of the resources available to you and making informed choices, you can navigate the complexities of tax season with confidence. Embrace the tools at your disposal, and know that you are not alone in this journey. Together, let’s ensure your tax strategy aligns with your financial aspirations for the year ahead.

Frequently Asked Questions

What are tax allowances?

Tax allowances are deductions that reduce the amount of your income that is subject to taxation, directly affecting how much money is withheld from your paycheck.

How do tax allowances impact my paycheck?

Claiming more tax allowances means less tax is withheld from your paycheck, allowing you to take home more money each pay period. Conversely, claiming fewer allowances increases the amount withheld, which may result in a larger tax refund.

What is the importance of determining how many allowances to claim?

Determining the right number of allowances is crucial because it impacts your net income and overall tax responsibility, helping you manage your finances effectively and avoid surprises during tax season.

What could happen if I claim too many allowances?

If you claim too many allowances, you may end up owing money when tax time arrives because not enough tax was withheld throughout the year.

What happens if I claim too few allowances?

Claiming too few allowances increases your tax withholding, which might lead to a larger tax refund when you file your taxes.

How can I find out how many allowances I should claim?

Using a 'how many allowances should I claim' calculator can help you determine the appropriate number of allowances based on your financial situation.