Introduction

Understanding Social Security benefits can feel like navigating a maze. Many people struggle with calculating Average Indexed Monthly Earnings (AIME), which is crucial for determining the support they receive during retirement or disability. It’s common to feel overwhelmed by this process.

But mastering the AIME calculator can open doors to maximizing your benefits and securing a stable financial future. Imagine the peace of mind that comes with knowing you’re getting the support you deserve. Yet, what happens when income fluctuations and work history complicate things?

We understand that these complexities can be daunting. How can you effectively navigate these challenges? You’re not alone in this journey, and we’re here to help you find the answers.

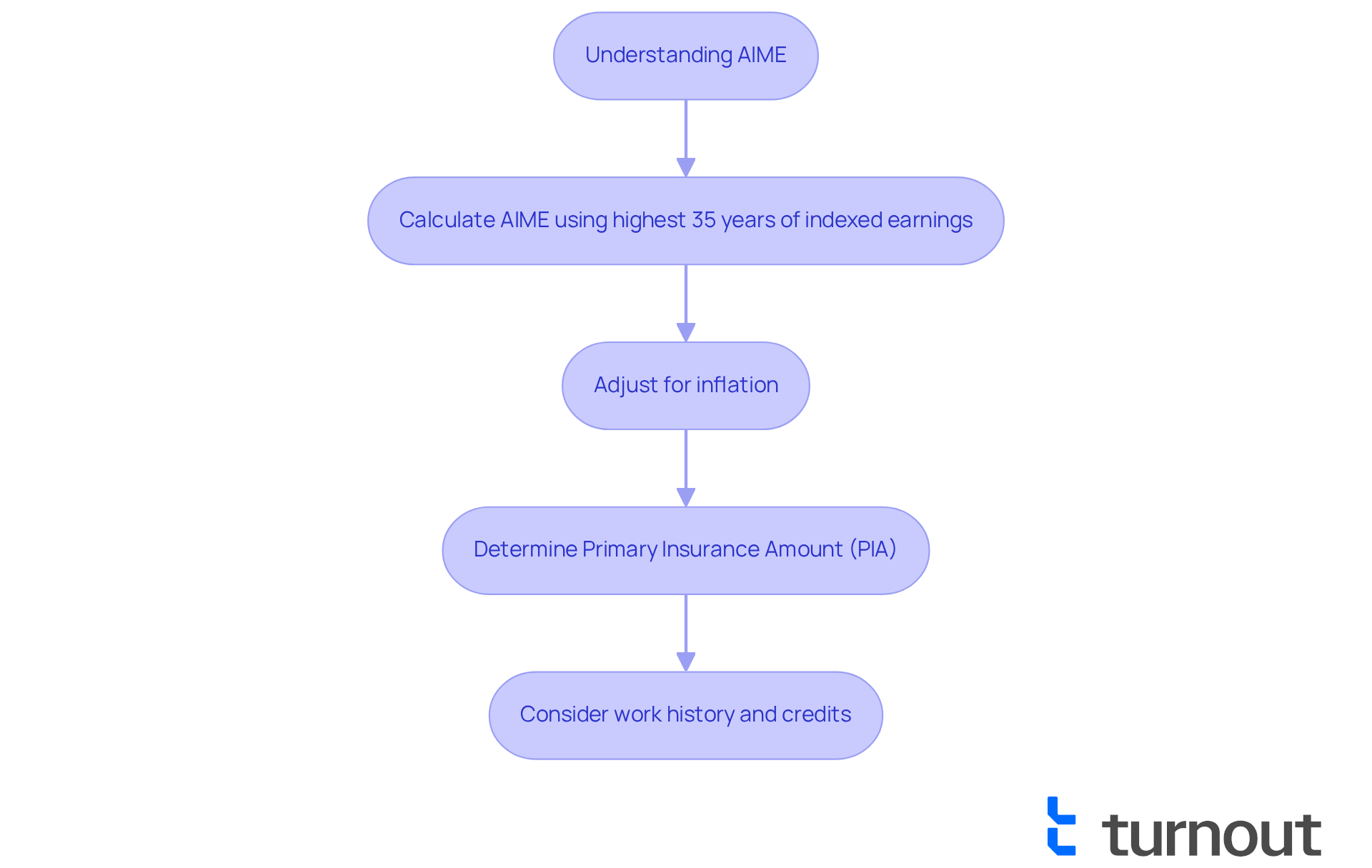

Understand Average Indexed Monthly Earnings (AIME)

Understanding the aime calculator for social security is crucial for securing the benefits you deserve, especially if you're navigating the complexities of disability payments in the United States. The Social Security Administration (SSA) employs an aime calculator for social security, which calculates AIME by averaging your highest 35 years of indexed earnings and adjusting for inflation to reflect wage growth. This adjustment ensures a fair evaluation of your benefits in today’s economic landscape.

We know that comprehending this program can feel overwhelming, but it directly impacts the benefits you’ll receive. For example, a retiree with an AIME of $10,000 can expect a Primary Insurance Amount (PIA) of around $3,467.55 if they claim at full retirement age. Conversely, having fewer than 35 years of work history may lead to zero-income years, which can negatively affect your entitlements.

In 2025, the maximum taxable earnings threshold is set at $176,100. To qualify for assistance, individuals need to earn 40 credits - equivalent to $1,810 in earnings per credit. The importance of this program cannot be overstated; it forms the foundation of your security entitlements, making it vital for effective financial planning for retirement or disability support.

At Turnout, we understand that managing the intricacies of Social Security can be daunting, especially for those pursuing SSD claims. Our compassionate nonlawyer advocates are here to help you grasp your average indexed monthly earnings and maximize your benefits without the need for legal representation. By mastering the aime calculator for social security, you can confidently navigate the complexities of Social Security and ensure you receive the support you deserve.

Additionally, Turnout offers a variety of tools and services designed to simplify the process and enhance your understanding of your benefits. Remember, you’re not alone in this journey; we’re here to help you every step of the way.

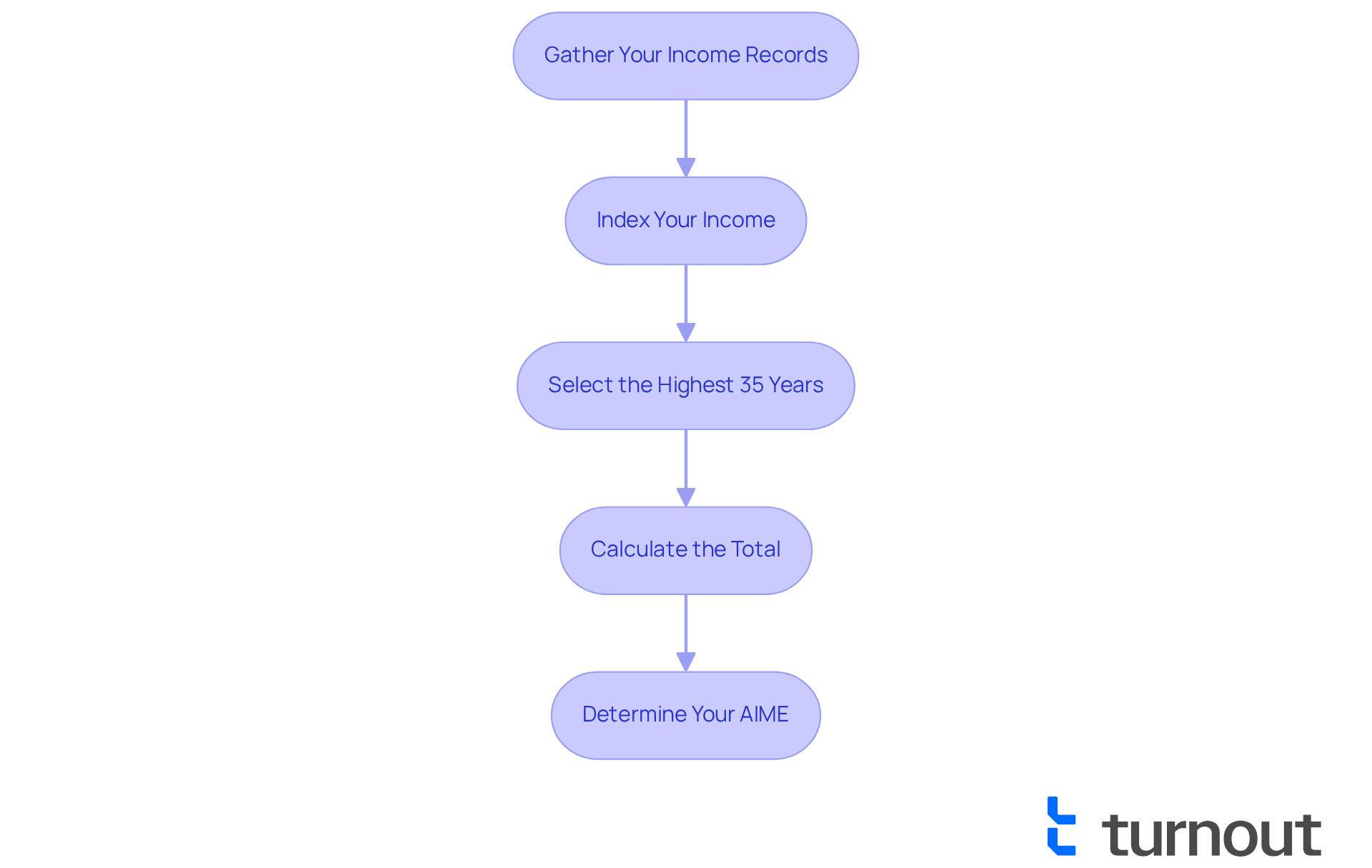

Calculate Your AIME: Step-by-Step Process

Using an aime calculator for social security to calculate your Average Indexed Monthly Earnings (AIME) can feel overwhelming, but we're here to help you through it. Let’s break it down into manageable steps:

-

Gather Your Income Records: Start by collecting your income records for each year you worked. You can find this information on your Social Security Statement or tax documents. This is the first step in understanding your financial journey.

-

Index Your Income: Next, adjust each year’s income for inflation using the SSA's indexing factors. This adjustment ensures that your past income reflects current wage levels, making it more relevant to your situation today.

-

Select the Highest 35 Years: From your indexed income, choose the highest 35 years. If you have fewer than 35 years of income, don’t worry-just include all the years you have. This selection is crucial for maximizing your benefits using the aime calculator for social security.

-

Calculate the Total: Now, add together the indexed earnings from your highest 35 years. This total will give you a clearer picture of your earnings.

-

Determine Your AIME: Finally, divide the total by 420 (the number of months in 35 years) to find your average indexed monthly earnings. This figure is essential for determining your Social Security payments.

For example, a worker who consistently earned at or above the maximum taxable amount could use an AIME calculator for social security to see a significant AIME, positively impacting their retirement benefits. In September 2023, the average Social Security payment was reported at $1,706.98 per month, with 66.84 million recipients relying on this support.

Understanding these calculations is vital, especially with new changes to Social Security expected in 2026 that may affect future benefits. Remember, maximizing your adjusted income measure can lead to a better financial outcome in retirement. You are not alone in this journey; we’re here to support you every step of the way.

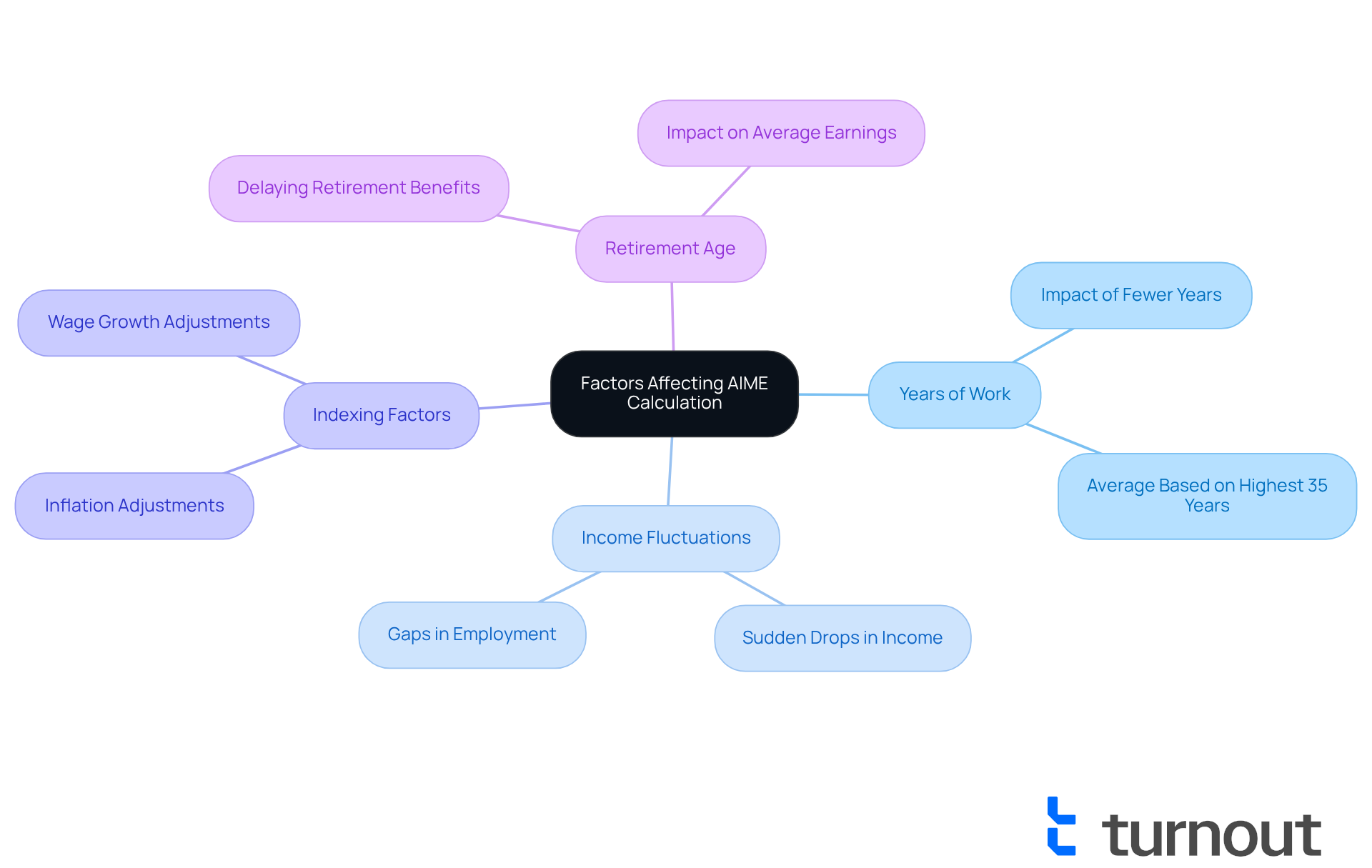

Identify Factors Affecting Your AIME Calculation

Several factors can significantly influence your AIME calculation, and we understand that navigating these can feel overwhelming:

- Years of Work: The total number of years you’ve worked plays a crucial role in determining your AIME. Fewer years can lead to a lower average, as the aime calculator for social security computes the Average Indexed Monthly Earnings based on your highest 35 years of indexed income. It’s common to feel concerned about how this might affect your future.

- Income Fluctuations: Variations in your income, like a sudden drop or gaps in employment, can impact your highest indexed revenue. If you experience a period of reduced income, it may replace higher earnings from previous years, thus lowering your average indexed monthly amount. We know this can be stressful, but understanding it is the first step.

- Indexing Factors: The SSA adjusts past earnings for inflation and wage growth, which can change yearly. Understanding how these adjustments work is crucial for accurate calculations in the aime calculator for social security, as they can greatly influence your compensation amount. It’s normal to have questions about this process.

- Retirement Age: The age at which you choose to retire also affects your average indexed monthly earnings. Benefits are calculated based on income until your retirement age, meaning that delaying retirement can allow for additional earnings to be included in your average, potentially enhancing your benefits.

In 2025, the average number of years worked by beneficiaries will be essential for the aime calculator for social security, as it directly relates to the average indexed monthly earnings calculation. With the average compensation increase expected to be around $49 per month, understanding these factors can help you plan effectively for your retirement income. As highlighted by the Bipartisan Policy Center, proposed changes to the compensation formula aim to enhance progressivity, which could further influence how your work history impacts your Average Indexed Monthly Earnings and overall benefits.

Remember, you’re not alone in this journey. We’re here to help you navigate these complexities and ensure you’re prepared for a secure retirement.

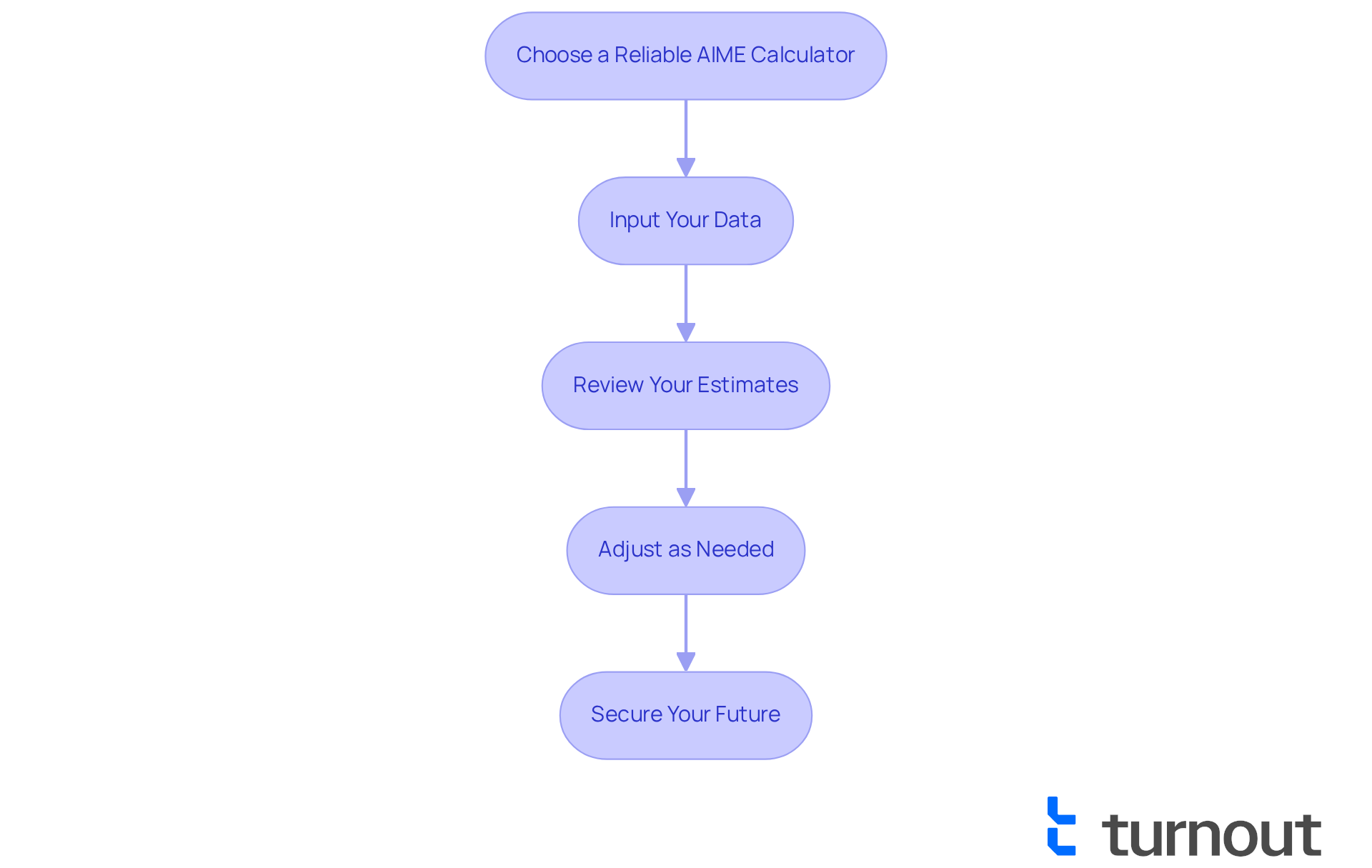

Utilize the AIME Calculator to Estimate Benefits

Assessing your retirement benefits using your Average Indexed Monthly Earnings (AIME) can feel overwhelming, but you’re not alone in this journey. We’re here to help you navigate it with ease. Here’s how you can get started:

-

Choose a reliable AIME calculator for social security by visiting the official website of the Social Security Administration or other reputable financial planning sites that offer this tool. These trusted sources ensure that you receive accurate and up-to-date information.

-

Input Your Data: Next, enter your indexed earnings, retirement age, and any other required information into the calculator. Remember, precise data entry is essential. Your estimates will depend on the information you provide, so take your time to ensure accuracy.

-

Review Your Estimates: Once you’ve entered your data, the calculator will give you an estimate of your monthly benefits based on your AIME. For example, projected Social Security retirement payments at your desired retirement age could be around $1,358 monthly or $16,296 annually. Take a moment to examine these estimates. Consider how different factors, like your retirement age or additional income, might influence your benefits.

-

Adjust as Needed: If you anticipate changes in your income or employment situation, it’s wise to check the calculator regularly. Refresh your estimates and plan accordingly. Keep in mind that a lack of substantial earnings history can lead to unreliable retirement payment estimates, so ensure your data is as accurate as possible.

Effectively using an AIME calculator for social security can significantly impact your retirement planning. Many individuals who actively engage with these tools find that using an AIME calculator for social security helps them better strategize their retirement savings and entitlement claims. In fact, data suggest that those who use trustworthy calculators often express greater confidence in their retirement planning. This highlights the importance of precise estimates in managing the complexities of your benefits.

According to the Social Security Administration, a significant percentage of beneficiaries aged 65 and older rely on Social Security for more than 50% of their retirement income. This underscores the critical nature of understanding and estimating these benefits accurately. Remember, you’re taking a vital step towards securing your future.

Conclusion

Mastering the AIME calculator for Social Security benefits is crucial for anyone looking to secure their financial future, especially when facing the challenges of disability and retirement planning. We understand that navigating these waters can feel overwhelming. By grasping how Average Indexed Monthly Earnings (AIME) are calculated, you can not only estimate your benefits more accurately but also appreciate how your work history and earnings play a vital role in determining your entitlement levels.

This article explores the nuances of calculating AIME, highlighting essential factors like your years of work, income fluctuations, and the effects of inflation adjustments. By following a structured approach - gathering your income records, indexing your earnings, and selecting your highest 35 years - you can maximize your AIME and, in turn, your Social Security benefits. Remember, using reliable AIME calculators and regularly updating your estimates is key; these tools can significantly boost your confidence in retirement planning.

Ultimately, understanding and utilizing the AIME calculator goes beyond mere numbers; it’s about taking charge of your financial destiny. Social Security benefits are a cornerstone of retirement income for many, and engaging with the AIME calculation process can lead to better preparedness and peace of mind. Embracing this knowledge and leveraging available resources can profoundly enhance your quality of life in retirement. You are not alone in this journey, and we’re here to help you take this vital step toward a secure financial future.

Frequently Asked Questions

What is Average Indexed Monthly Earnings (AIME)?

AIME is a calculation used by the Social Security Administration (SSA) to determine benefits by averaging an individual’s highest 35 years of indexed earnings, adjusted for inflation to reflect wage growth.

How does the AIME impact Social Security benefits?

A retiree's AIME directly affects their Primary Insurance Amount (PIA). For example, an AIME of $10,000 could result in a PIA of approximately $3,467.55 at full retirement age.

What happens if someone has fewer than 35 years of work history?

Having fewer than 35 years of work history may result in zero-income years, which can negatively impact the calculation of Social Security benefits.

What is the maximum taxable earnings threshold for Social Security in 2025?

The maximum taxable earnings threshold for 2025 is set at $176,100.

How many credits are needed to qualify for Social Security assistance?

Individuals need to earn 40 credits to qualify for assistance, which is equivalent to $1,810 in earnings per credit.

What services does Turnout provide regarding Social Security?

Turnout offers nonlawyer advocacy to help individuals understand their average indexed monthly earnings and maximize their benefits, along with various tools and services to simplify the process.

Why is understanding AIME important for financial planning?

Understanding AIME is crucial for effective financial planning for retirement or disability support, as it forms the foundation of an individual’s security entitlements.