Introduction

Understanding the complexities of the 941 semi-weekly deposit schedule can feel overwhelming. We know that for many businesses, staying compliant with IRS regulations is a top priority. This schedule not only determines when payroll tax payments are due but also plays a vital role in maintaining financial stability and avoiding costly penalties.

It's common to feel confused about deadlines and eligibility criteria. You’re not alone in this journey. Many employers grapple with these challenges, raising an important question: how can businesses navigate these complexities to ensure timely and accurate tax submissions?

This article is here to help. We provide a step-by-step guide to mastering the 941 semi-weekly deposit schedule. Our goal is to empower you to streamline your payroll processes and overcome common hurdles. Together, we can make this process smoother and less stressful.

Clarify the 941 Semi Weekly Deposit Schedule: Importance and Overview

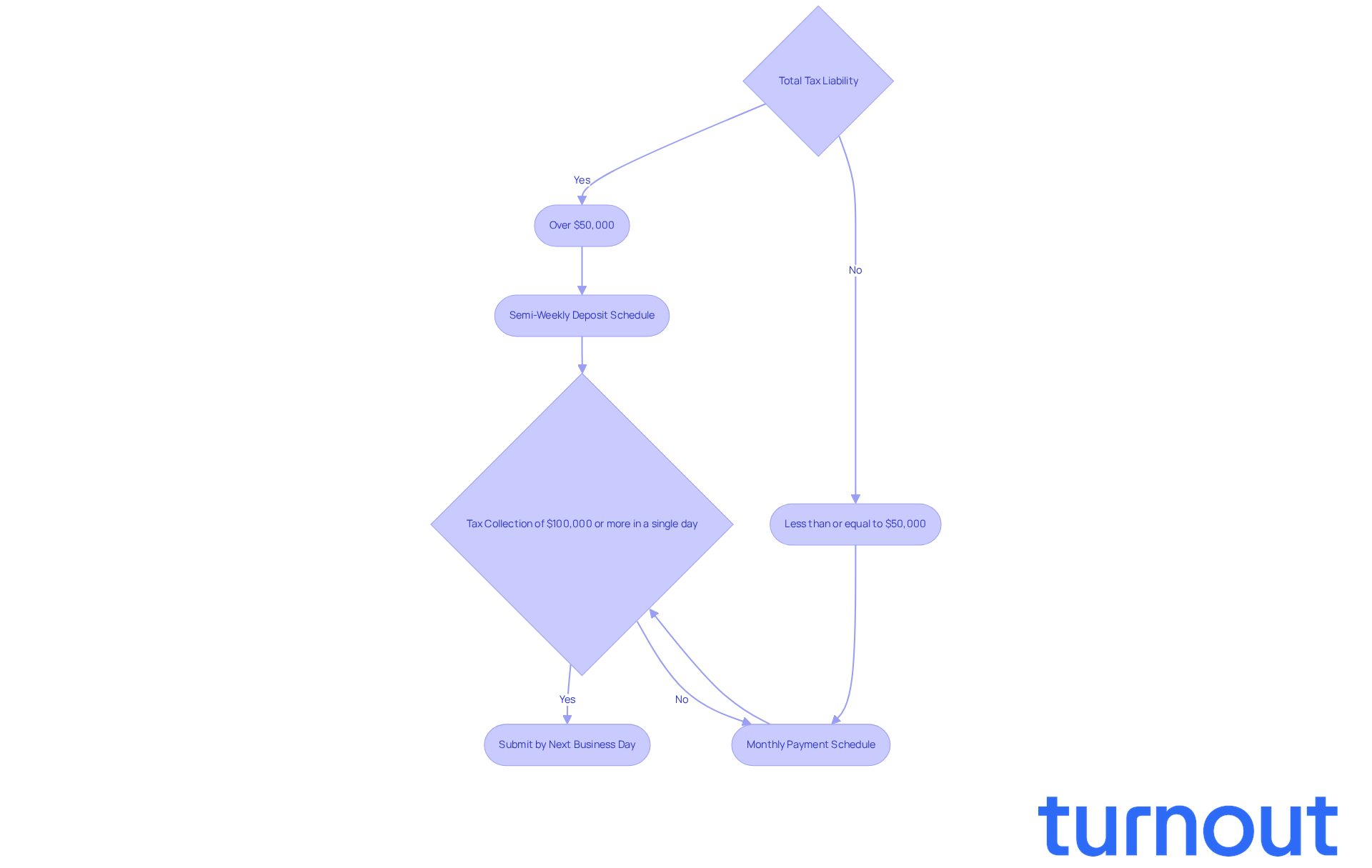

The 941 semi weekly deposit schedule is an essential tool designed by the IRS to help businesses manage their payroll tax submissions effectively. If your business has reported a total tax liability exceeding $50,000 during the lookback period, the 941 semi weekly deposit schedule is especially important for you. We understand that navigating these requirements can be overwhelming, especially if you’ve reported $50,000 or less in employment contributions, which means you’ll need to follow a monthly payment schedule instead.

Understanding this timetable is crucial. It dictates when you must pay your employment taxes, which include Social Security, Medicare, and withheld federal income taxes. Missing these deadlines can lead to significant penalties, so it’s vital to grasp the importance and nuances of this schedule. The 941 semi weekly deposit schedule allows for two funding periods each week, providing flexibility but also requiring diligence in tracking payroll dates and funding deadlines.

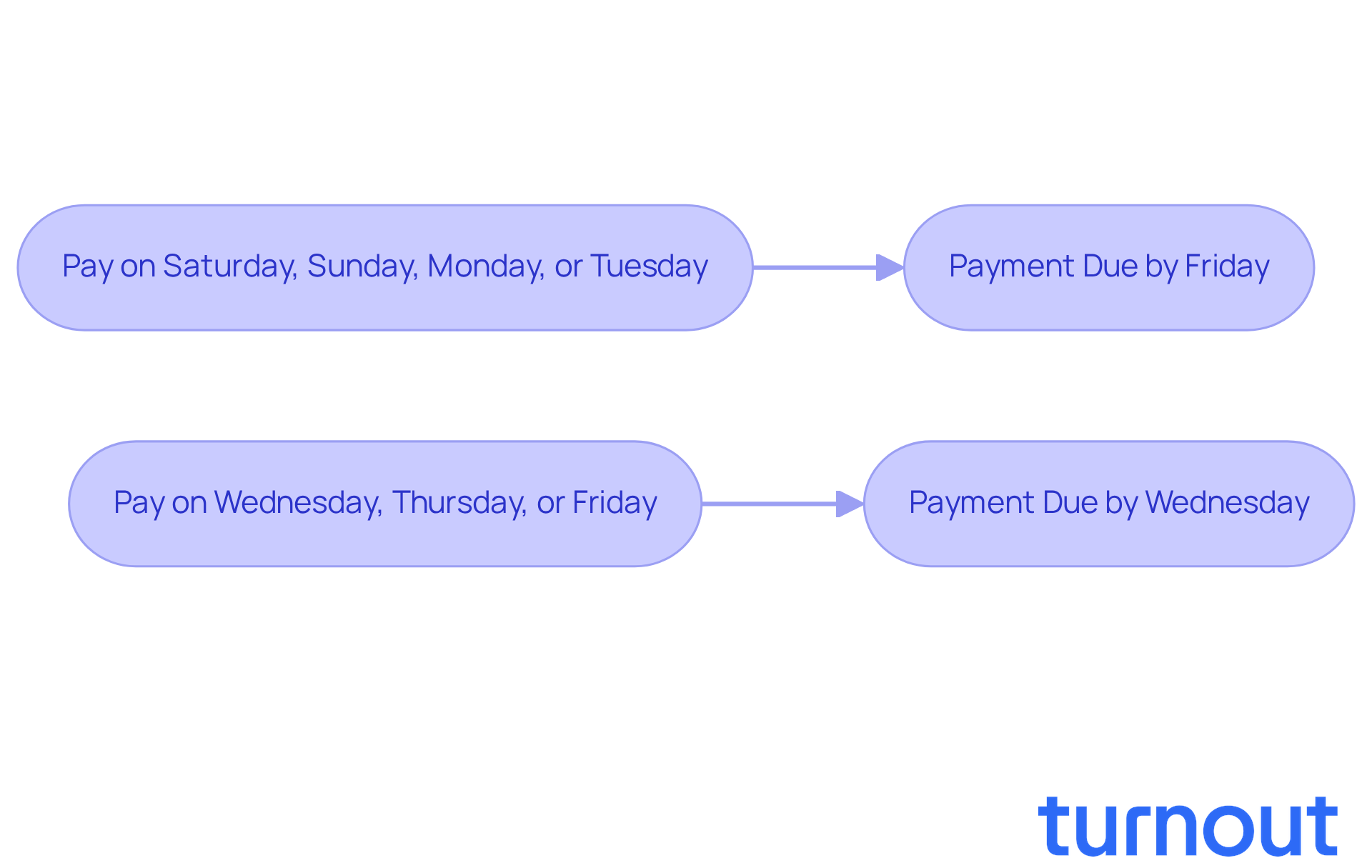

For instance, if you pay wages on a Saturday, Sunday, Monday, or Tuesday, your payment is due by the following Friday. On the other hand, if salaries are paid on a Wednesday, Thursday, or Friday, the payment must be made by the following Wednesday. This structure not only helps you stay compliant but also supports maintaining a consistent cash flow.

We know that keeping track of these deadlines can be stressful. The IRS imposes penalties for late payments, and the failure-to-deposit (FTD) penalties can escalate quickly. That’s why timely compliance is essential. Recent changes to IRS payroll tax submission schedules have further underscored the importance of staying informed about your contribution requirements.

Additionally, if your company accumulates $100,000 or more in taxes on any day during a monthly or semiweekly payment period, you must submit the tax by the next business day. By adhering to the 941 semi weekly deposit schedule, you can streamline your payroll processes and enhance payment consistency, ultimately fostering a more efficient financial management system.

Remember, payroll transfers can be completed via the Electronic Federal Tax Payment System (EFTPS) anytime, offering you the convenience of handling your transactions at your own pace. We’re here to help you navigate these requirements, ensuring you’re not alone in this journey.

Identify Eligibility Criteria for the Semi Weekly Deposit Schedule

We understand that navigating tax obligations can be overwhelming. To qualify for the 941 semi weekly deposit schedule, a company must report a total tax liability exceeding $50,000 during the lookback period, which spans the four quarters ending on June 30 of the previous year. If your tax obligation is $50,000 or less, you’ll follow a monthly payment schedule.

It's common to feel anxious about deadlines, especially if your company gathers $100,000 or more in taxes on any single day during a collection period. In that case, you must submit that tax by the following business day, no matter your assigned collection frequency. Grasping these standards is essential for ensuring adherence to IRS regulations and avoiding fines, which can range from 2% to 15% depending on how long contributions are delayed.

Remember, all federal tax submissions must be made electronically to comply with IRS requirements. You're not alone in this journey; we're here to help you navigate these complexities with confidence.

Outline Steps for Compliance with the 941 Semi Weekly Deposit Schedule

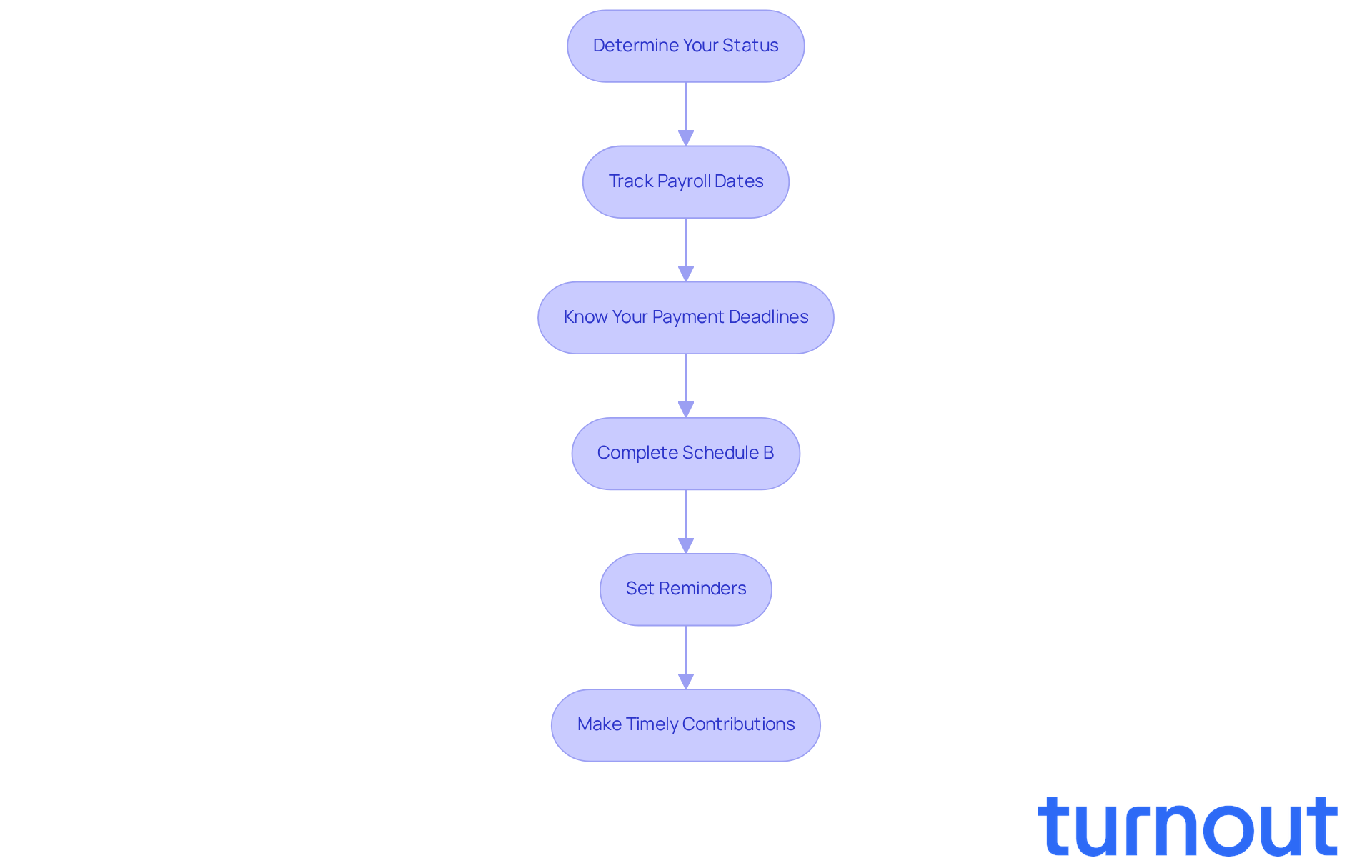

Navigating the 941 semi weekly deposit schedule can feel overwhelming, but we're here to help. By following these steps, you can ensure compliance and ease your worries:

-

Determine Your Status: First, confirm whether you’re a semiweekly or monthly depositor based on your tax liability during the lookback period. This is crucial for setting the right course.

-

Track Payroll Dates: Next, identify the days your employees are paid. For those on the 941 semi weekly deposit schedule, the timing relies on these paydays, making it essential to keep track.

-

Know Your Payment Deadlines: It’s common to feel confused about deadlines. For wages paid on Wednesday, Thursday, or Friday, submissions are due the following Wednesday. If wages are paid on Saturday, Sunday, Monday, or Tuesday, payments are due by the following Friday.

-

If you’re a semiweekly depositor, remember to complete and attach Schedule B to your Form 941 each quarter according to the 941 semi weekly deposit schedule. This helps you report your tax liabilities accurately.

-

Set Reminders: Establish a system to notify you of upcoming payment deadlines. This simple step can help you avoid late fees and penalties, giving you peace of mind.

-

Make Timely Contributions: Finally, ensure that all contributions are made on or before the due dates. Staying on top of this helps you maintain compliance with IRS regulations.

By following these steps, you can effectively navigate the complexities of payroll tax payment compliance. Remember, you’re not alone in this journey, and taking these actions can help mitigate common issues associated with IRS payment schedules.

Address Common Challenges in Following the Semi Weekly Deposit Schedule

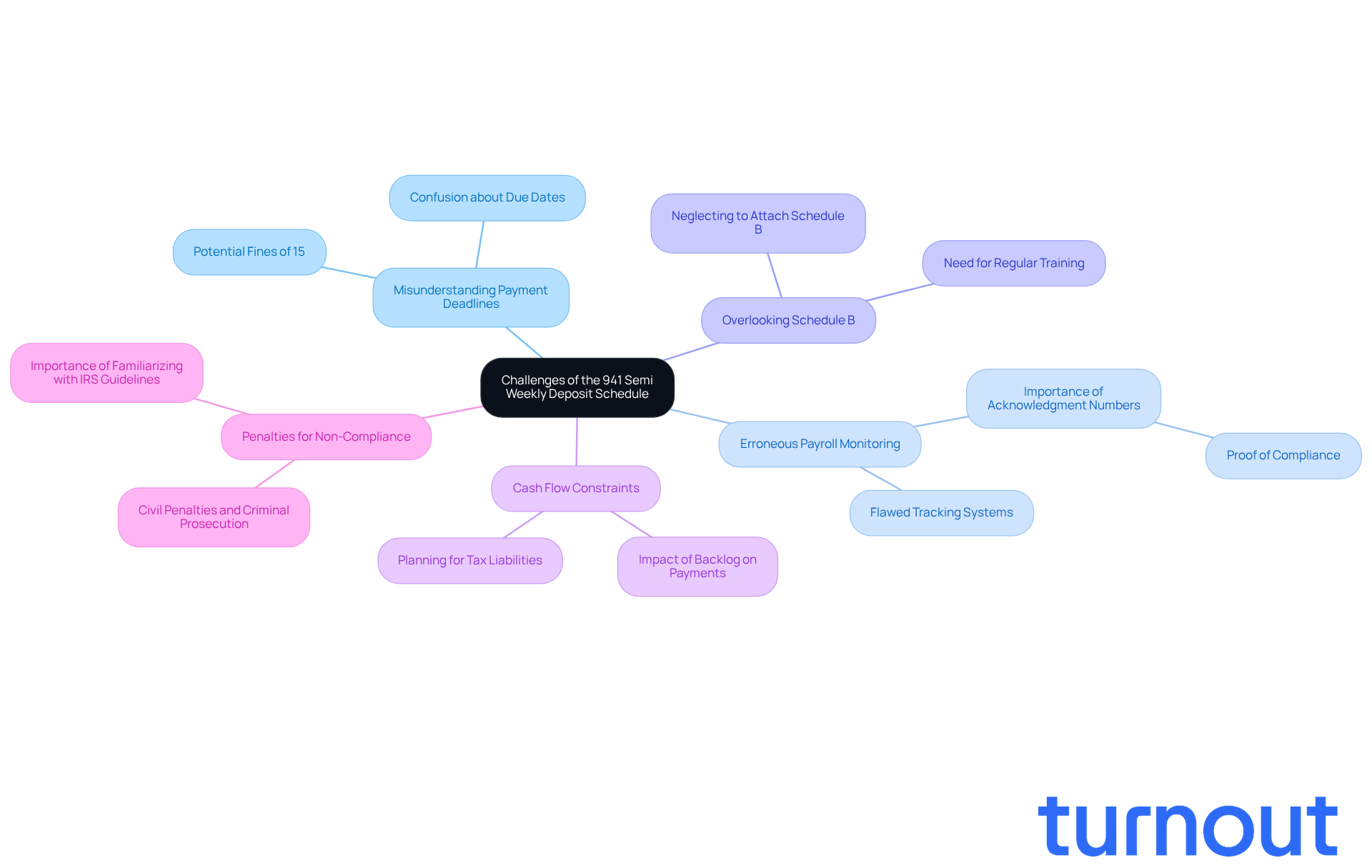

Employers often face several challenges when it comes to the 941 Semi Weekly Deposit Schedule, and we understand how overwhelming this can be:

-

Misunderstanding Payment Deadlines: It’s common to feel confused about payment deadlines, which can lead to late payments. To avoid penalties, it’s crucial for employers to clearly understand the 941 semi weekly deposit schedule and which days correspond to specific payment due dates. Did you know that businesses violating the next-day payment rule can incur fines of up to 15% of the amount not submitted, even for delays of just a few days?

-

Erroneous Payroll Monitoring: Flawed tracking of payroll dates can easily result in missed payments. Implementing reliable payroll systems, including a 941 semi weekly deposit schedule, is essential for ensuring accuracy and timely compliance. Angela Carter, a certified tax professional, emphasizes the importance of keeping acknowledgment numbers for each EFTPS transaction as proof of compliance.

-

Overlooking Schedule B: Some organizations may neglect to complete and attach Schedule B to their Form 941, leading to compliance issues. Regular training and reminders can significantly reduce this risk, helping you stay on track.

-

Cash Flow Constraints: Cash flow issues can obstruct prompt contributions, and we know how stressful that can be. Employers should plan ahead and maintain a reserve for tax liabilities to ensure they can meet their obligations. The ongoing backlog of Form 941 submissions has created additional pressure on businesses to reconcile their tax liabilities accurately.

-

Penalties for Non-Compliance: Understanding the penalties linked to late deposits can motivate organizations to prioritize adherence. Willful neglect to pay employment taxes can lead to serious consequences, including civil penalties and criminal prosecution, with potential imprisonment for up to five years, as determined by the IRS. Familiarizing yourself with IRS guidelines and potential penalties is crucial for maintaining diligence and avoiding costly fines.

By addressing these challenges proactively, you can enhance your payroll processes and ensure compliance with IRS requirements. Remember, you are not alone in this journey; we’re here to help!

Conclusion

Understanding the 941 semi-weekly deposit schedule is crucial for businesses grappling with significant payroll tax liabilities. We know that navigating these regulations can feel overwhelming, but this schedule is here to help you ensure timely compliance with IRS requirements while maintaining a steady cash flow. By mastering this schedule, you can avoid costly penalties and streamline your payroll processes, leading to a more efficient financial management system.

Throughout this article, we’ve explored key aspects such as:

- Eligibility criteria

- Steps for compliance

- Common challenges you might face as an employer

It’s important to remember that if your business reports a tax liability exceeding $50,000, adhering to this schedule is essential. Tracking payroll dates and deadlines is vital, and we understand that this can sometimes feel like a daunting task. Addressing challenges like misunderstanding payment deadlines and managing cash flow constraints is crucial for staying compliant and avoiding severe penalties.

In conclusion, navigating the complexities of the 941 semi-weekly deposit schedule is vital for any business aiming to remain compliant with IRS requirements. By taking proactive steps and utilizing available resources, you can mitigate common issues and enhance your payroll processes. Remember, you’re not alone in this journey. Embracing these practices not only fosters compliance but also contributes to a more organized and stress-free payroll management experience. We’re here to help you every step of the way.

Frequently Asked Questions

What is the 941 semi weekly deposit schedule?

The 941 semi weekly deposit schedule is an IRS tool designed to help businesses manage their payroll tax submissions effectively, particularly for those with a total tax liability exceeding $50,000 during the lookback period.

Who needs to follow the 941 semi weekly deposit schedule?

Businesses that have reported a total tax liability exceeding $50,000 during the lookback period must follow the 941 semi weekly deposit schedule. Those reporting $50,000 or less in employment contributions will follow a monthly payment schedule instead.

What types of taxes are included in the 941 semi weekly deposit schedule?

The schedule dictates when businesses must pay employment taxes, which include Social Security, Medicare, and withheld federal income taxes.

What are the consequences of missing the payment deadlines?

Missing the payment deadlines can lead to significant penalties, including failure-to-deposit (FTD) penalties that can escalate quickly.

How does the 941 semi weekly deposit schedule determine payment due dates?

Payments are due based on when wages are paid: if wages are paid on Saturday, Sunday, Monday, or Tuesday, the payment is due by the following Friday. If paid on Wednesday, Thursday, or Friday, the payment is due by the following Wednesday.

What should a company do if it accumulates $100,000 or more in taxes on any day during a payment period?

If a company accumulates $100,000 or more in taxes on any day during a monthly or semiweekly payment period, it must submit the tax by the next business day.

How can businesses make payroll transfers?

Payroll transfers can be completed via the Electronic Federal Tax Payment System (EFTPS) anytime, allowing businesses to handle their transactions at their own pace.

Why is it important to stay informed about the IRS payroll tax submission schedules?

Staying informed is crucial due to recent changes in the schedules and to ensure timely compliance, which helps streamline payroll processes and maintain consistent cash flow.