Overview

Navigating the Offer in Compromise (OIC) process can feel overwhelming, but we're here to help you through it. Specifically, the 433 A OIC allows taxpayers like you to settle tax debts for less than the total amount owed.

It's essential to:

- Understand the eligibility criteria

- Gather the required documentation

- Be aware of the potential outcomes of your application

We understand that thorough preparation and a clear grasp of IRS guidelines are crucial for increasing your chances of acceptance. Remember, you're not alone in this journey, and with the right support, you can find a path forward.

Introduction

Navigating the complexities of tax debt can be overwhelming, and we understand that the burden may feel insurmountable. For many individuals, the Offer in Compromise (OIC) serves as a vital opportunity to settle tax liabilities for less than what is owed. This option can provide a lifeline for those facing financial hardship.

However, as the IRS refines its processes and eligibility criteria, you might wonder: how can you effectively master the 433 A OIC process to secure the relief you truly need?

This article will explore essential steps, requirements, and strategies that can enhance your chances of a successful OIC submission. We’re here to empower you on your journey to reclaiming your financial stability.

Understand the Offer in Compromise (OIC)

, often referred to as 433 a oic, is a compassionate agreement between a taxpayer and the IRS, allowing individuals to settle their for less than the total amount owed. For those facing , this option can be a lifeline. The is thoughtfully designed to provide relief to taxpayers who can demonstrate an inability to meet their debts, while still allowing the IRS to collect a reasonable amount. In 2025, the by adopting flexible evaluation standards that take into account increased living expenses, potentially opening the door for more taxpayers to qualify.

that the OIC can be a powerful tool for individuals striving to regain financial stability and alleviate the stress of overwhelming tax debt. For instance, consider the story of a COVID survivor who managed to settle a tax debt of $106,058 for just $100. This showcases the potential for significant relief and hope.

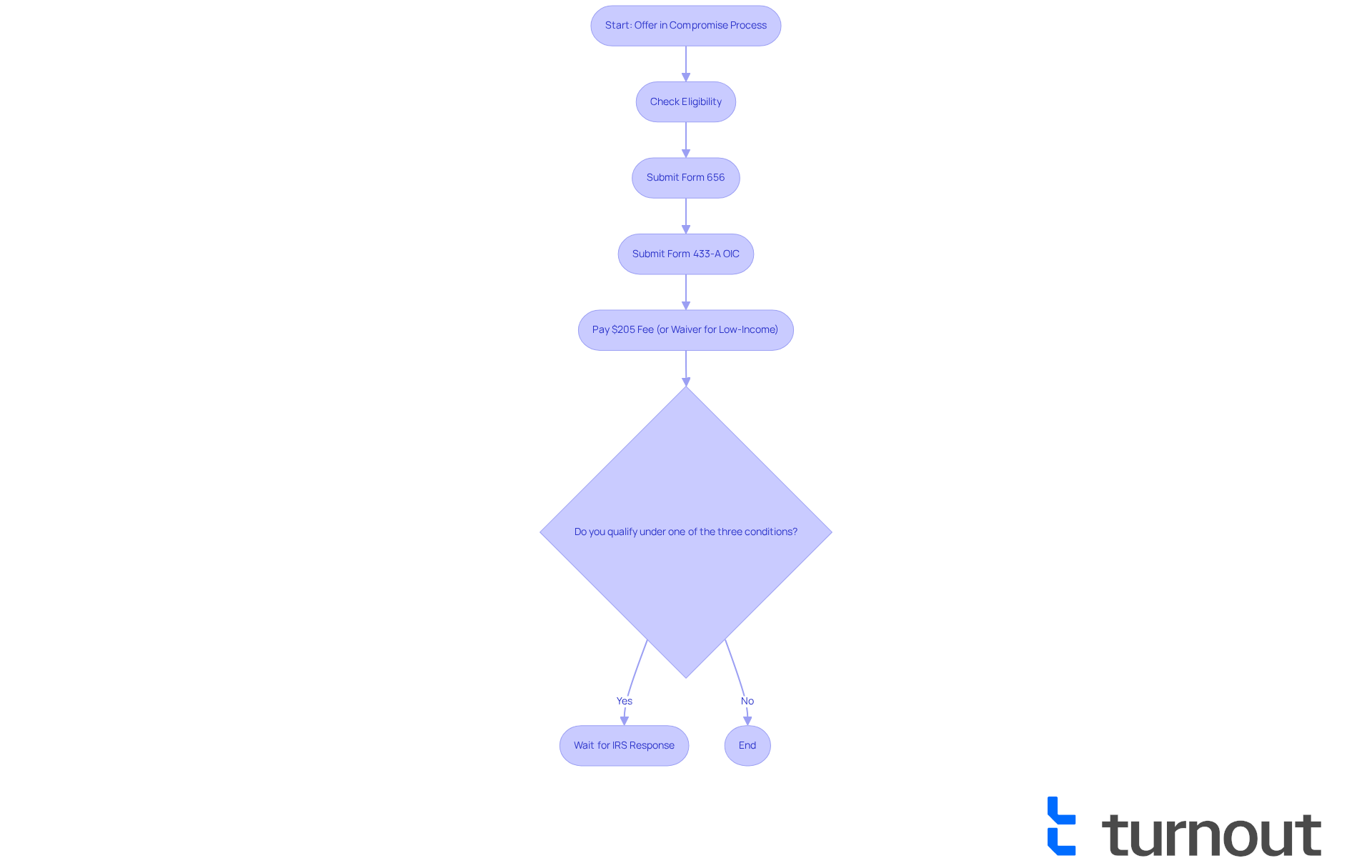

The OIC process involves submitting Form 656 and , along with a $205 processing fee, which can be waived for low-income individuals. To qualify, taxpayers must demonstrate one of three conditions:

- Doubt as to collectibility

- Doubt as to liability

- Effective tax administration

is crucial for enhancing the likelihood of a successful submission.

As the IRS continues to refine its processes, the OIC remains a vital option for those in financial distress, offering a pathway to reduced tax liability and a fresh start. By taking proactive steps and understanding the OIC process, you can find a viable solution to your tax challenges. Remember, you are not alone in this journey, and .

Determine Your Eligibility for OIC

If you're considering an (OIC), specifically the , it's important to know that you must meet specific criteria set by the IRS. We understand that can feel overwhelming, but we’re here to help you through it.

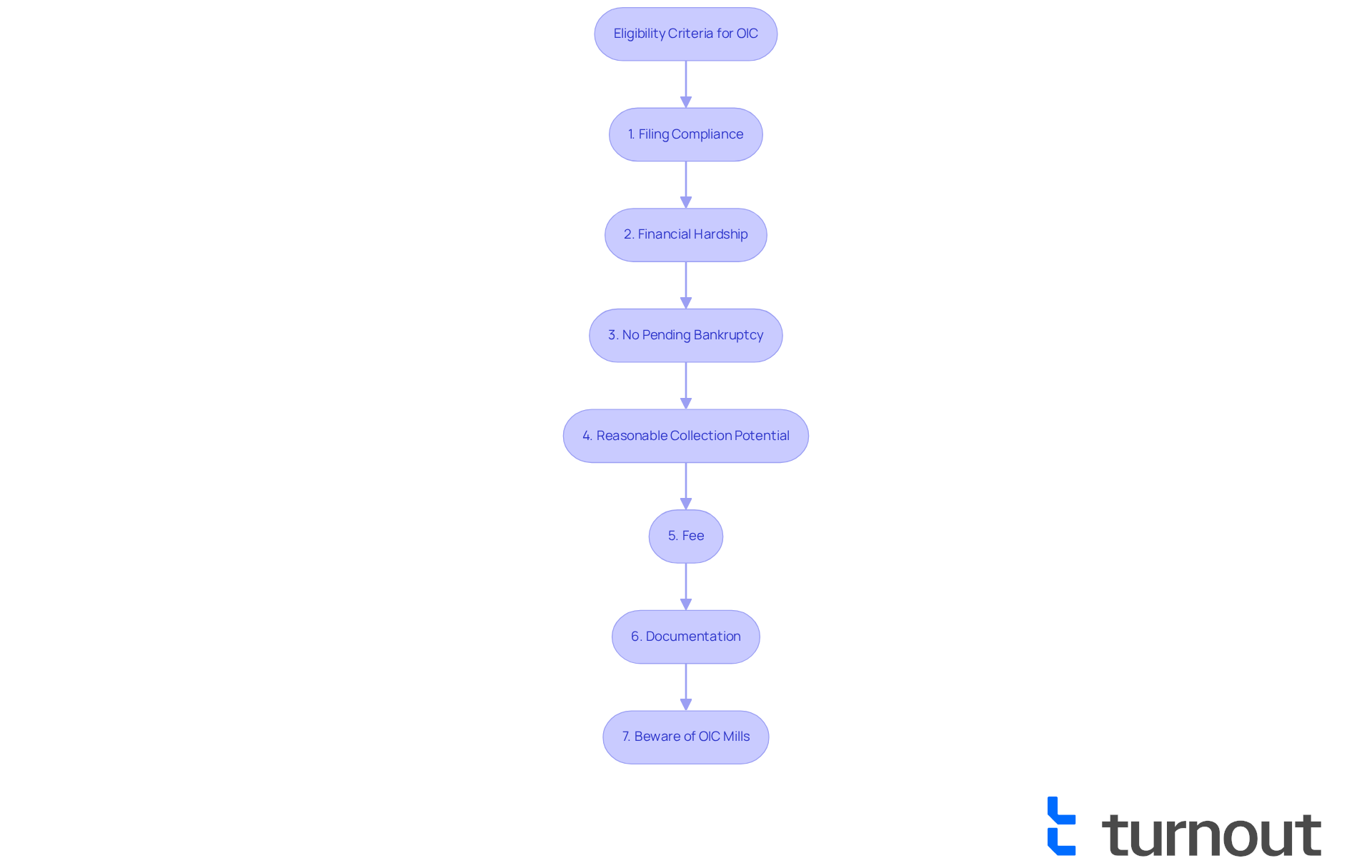

- Filing Compliance: First, ensure that all required tax returns are filed, and any estimated tax payments are made. This step is crucial, as the IRS won’t consider your submission if you have outstanding filing obligations.

- : You need to show that paying your tax debt in full isn’t possible due to . Typically, this means demonstrating that your monthly expenses exceed your income, reflecting a genuine inability to meet your tax obligations.

- No Pending Bankruptcy: It’s essential that you are not in bankruptcy proceedings when applying for a 433 a OIC. This requirement allows the IRS to evaluate your financial situation without complications from bankruptcy laws.

- Reasonable Collection Potential: The IRS must believe that the amount you offer is equal to or greater than what they could collect through other means. This assessment relies on your financial disclosures and the IRS’s evaluation of your ability to pay.

- Fee: Keep in mind that comes with a fee of $205, which can be waived for low-income taxpayers.

- Documentation: Be prepared to provide , credit reports, and proof of expenses, to support your request.

It's vital to review the latest version of the 433 a OIC Booklet. This will help you avoid processing delays and ensure you fully understand the requirements.

- Beware of OIC Mills: Unfortunately, some promoters may mislead taxpayers about their qualifications for a 433 a OIC, potentially costing them thousands. We encourage you to work closely with skilled experts to navigate this process effectively.

Many taxpayers face financial difficulties, and it’s common to seek an OIC under such circumstances. Recent statistics reveal that fewer than half of all submissions are approved. To gauge your eligibility before submitting a request, consider using the IRS's Offer in Compromise Pre-Qualifier tool. This can help ensure that you are well-prepared and knowledgeable about the process.

Remember, patience and honesty are key throughout the submission process. The IRS may request additional documentation during their review, and knowing this can help ease your concerns. You are not alone in this journey; we’re here to support you every step of the way.

Gather Required Documentation for Your Application

When applying for an (OIC), we understand that it can feel overwhelming. It’s crucial to provide that accurately reflects your . Let’s look at the key documents you’ll need:

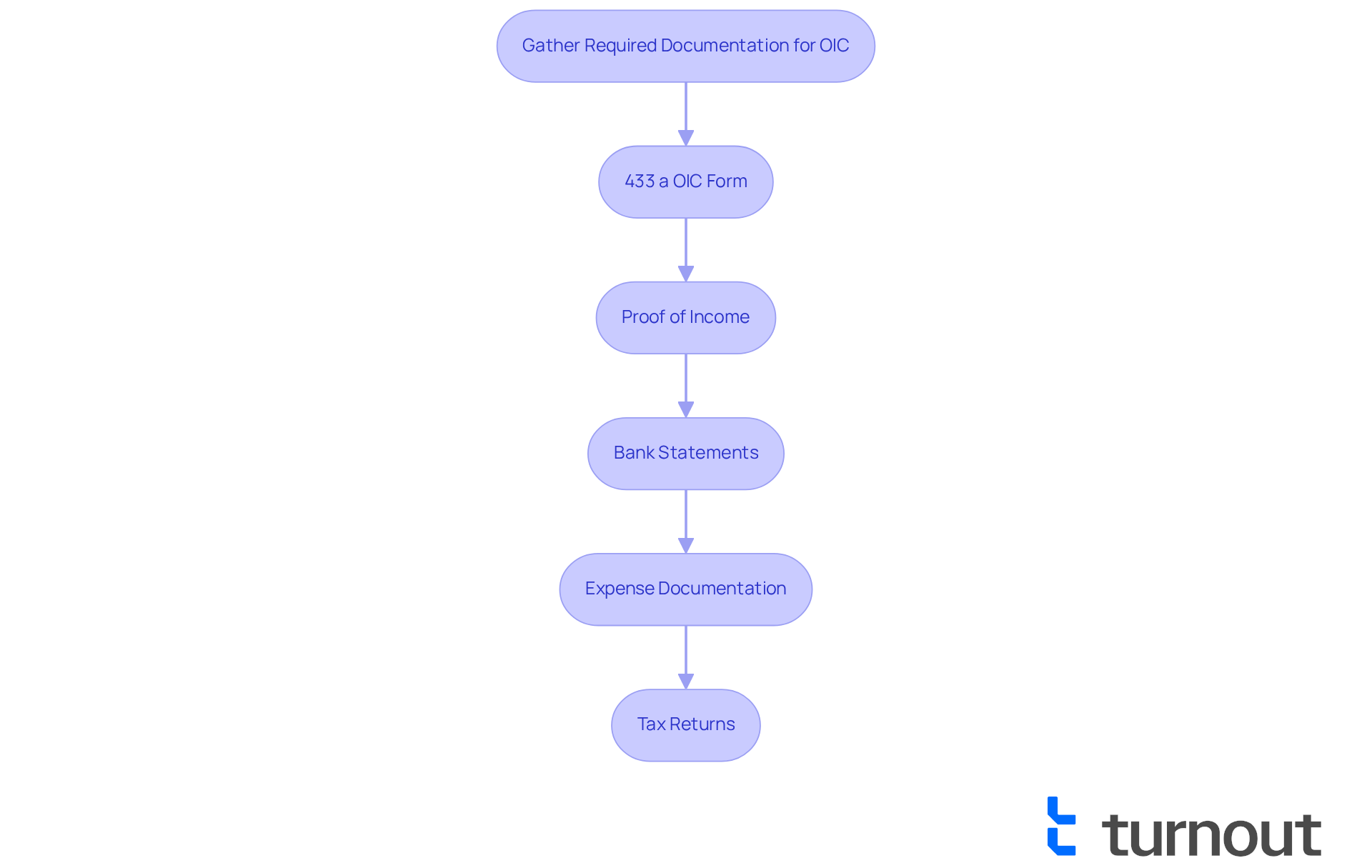

- The gathers detailed information about your financial status, including income, expenses, and assets.

- Proof of Income: Recent pay stubs, W-2s, or 1099s are necessary to verify your earnings.

- Bank Statements: Statements from the last three months are essential to illustrate your financial activity.

- Expense Documentation: Collect receipts or statements that detail your monthly expenses, such as housing, utilities, and transportation.

- Tax Returns: Copies of your most recent tax returns are needed to demonstrate compliance with filing requirements.

Arranging these documents beforehand not only simplifies the submission process but also greatly improves your likelihood of acceptance. As highlighted by tax experts, 'A well-structured submission with complete documentation is crucial for successfully .' We recommend collaborating with a skilled who can assist you in navigating the intricacies of the OIC process and enhance your likelihood of success.

It’s common to feel anxious about applying too early. If you can pay through other means, the IRS may reject your offer and suggest those alternatives instead. Remember, the IRS will scrutinize every aspect of your financial situation, so thoroughness and honesty are paramount. Incomplete or inconsistent information can lead to rejection, making it essential to present a clear and accurate financial picture. You're not alone in this journey; we're here to help you through it.

Complete and Submit the 433 A OIC Form

Completing for an can feel overwhelming, but we're here to guide you through it. Follow these steps to ensure a :

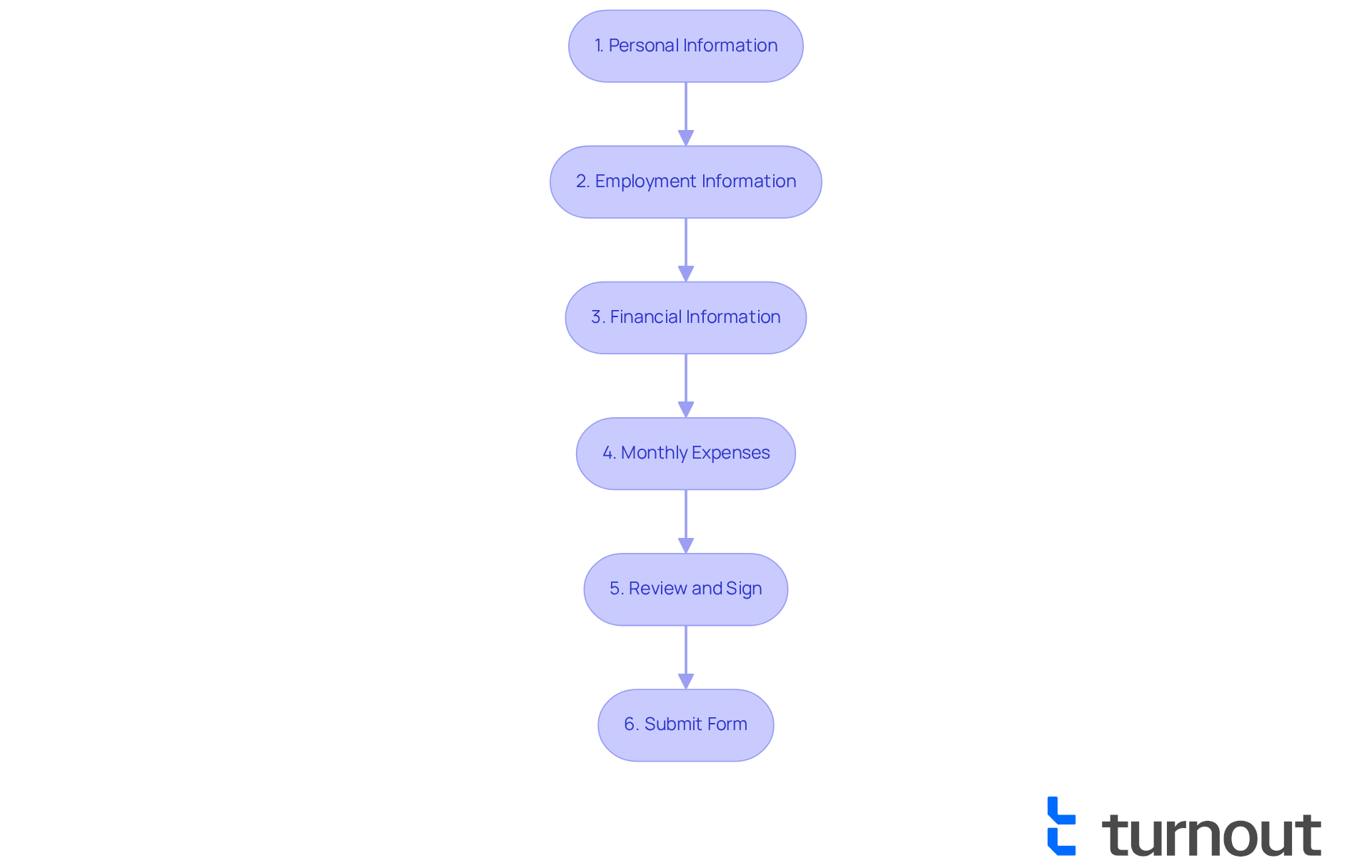

- Personal Information: Begin by filling in your name, address, date of birth, Social Security number, and contact information in Section 1. This foundational data is crucial for the IRS to identify your case.

- Employment Information: In Section 2, provide comprehensive details about your current employment, including your employer's name, address, and contact information. If you're married, include your spouse's employer information as well.

- Financial Information: Section 4 requires a thorough listing of all sources of income, assets, and liabilities. Be honest and detailed, as the IRS will verify this information. Include bank account balances, investment assets, vehicle details (make, model, model year, mileage, loan balance, and monthly payment), and the cash value of any life insurance policies.

- Monthly Expenses: Document your according to IRS guidelines. Make sure your reported expenses align with allowable spending standards, as exceeding these may require additional proof. It's common to feel anxious about this, but adhering strictly to these guidelines will help you avoid unnecessary complications.

- Review and Sign: Before submitting, double-check all entries for accuracy and completeness. Remember, the form is signed under penalty of perjury, so honesty is paramount.

Once finished, send the form along with any necessary documentation, including recent bank statements and the fee of $205, to the relevant IRS address. Retain copies of everything for your records to ensure you have a reference in case of follow-up inquiries.

include:

- Not disclosing all income sources

- Errors in asset valuation

- Omitting essential documentation

- Failing to review the most recent version of the 433 A OIC booklet for thorough information on the submission process

By being thorough and precise, you can enhance your chances of a successful OIC submission. Remember, you're not alone in this journey; we understand the challenges you face, and with careful attention, you can successfully.

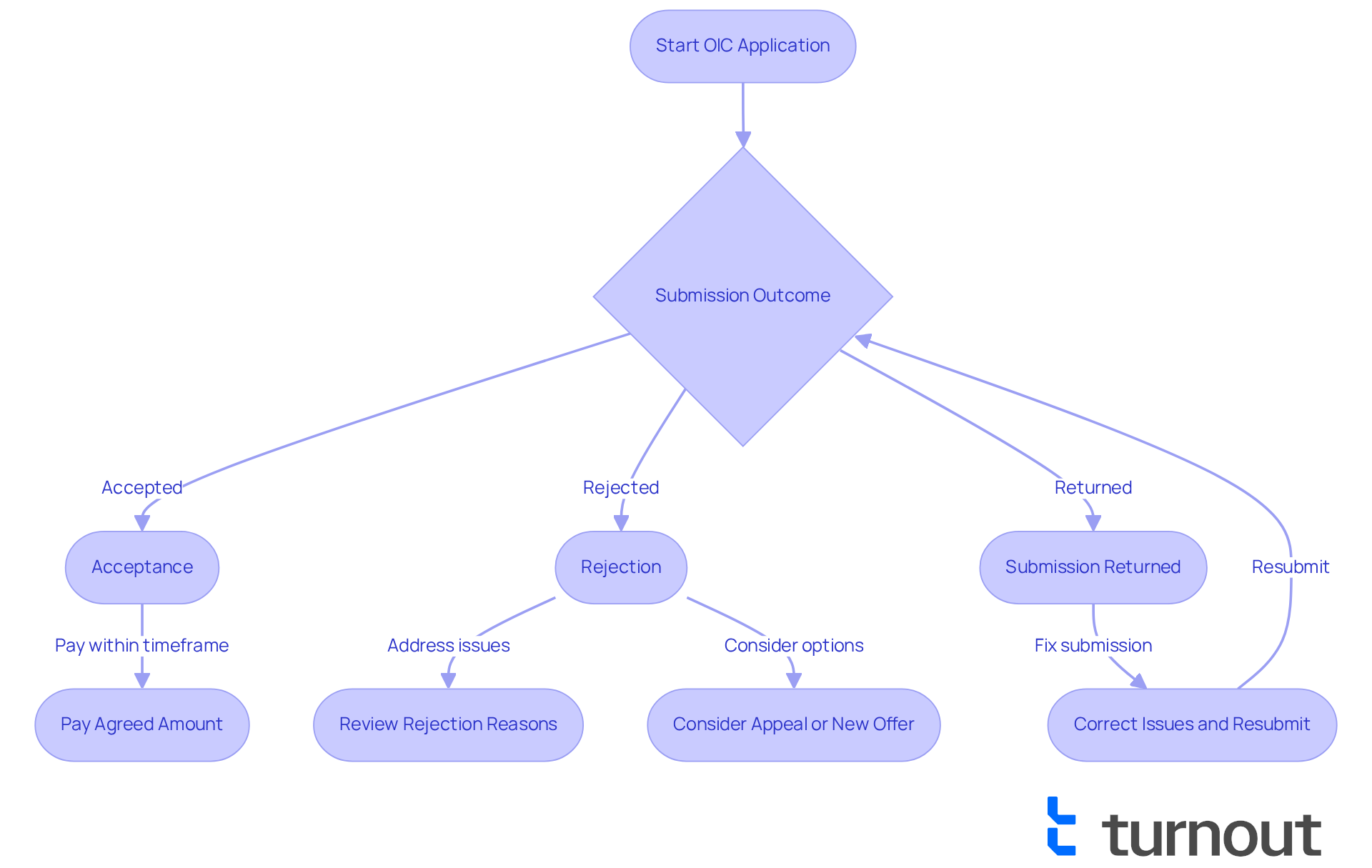

Understand Possible Outcomes After Submission

After submitting your OIC application, you can anticipate one of three outcomes:

- Acceptance: If the IRS accepts your offer, you will receive written confirmation. You must then within the specified timeframe. This can be a moment of relief, knowing your effort has paid off.

- Rejection: If your offer is rejected, the IRS will send a letter detailing the reasons for the denial. or incomplete documentation. It’s important to know that recent data indicates only about , with over 15,000 out of roughly 50,000 offers filed in the last complete fiscal year being accepted. This statistic highlights the competitive nature of the program, which can feel daunting.

- The IRS may send back your submission if it is incomplete or if you do not meet the eligibility criteria. In this situation, you will need to tackle the identified issues and resubmit your request. We understand that this can be frustrating, but can lead to a successful outcome.

If your offer is rejected, you have the option to within 30 days or submit a new offer with revised information. can provide valuable strategies for appealing a rejected OIC, thereby increasing your chances of success. It’s common to feel overwhelmed, but remember that you are not alone in this journey. Additionally, failing to appeal a rejected OIC may result in the , making it crucial to understand these outcomes. Knowing these possibilities will empower you to navigate the next steps effectively, ensuring you remain proactive in managing your tax obligations.

Remember, there is a non-refundable application fee of $205 associated with submitting an OIC. We’re here to help you through this process and support you in making informed decisions.

Conclusion

Navigating the 433 A Offer in Compromise (OIC) process can feel overwhelming for taxpayers seeking relief from tax debt. This compassionate agreement with the IRS allows individuals to settle their tax obligations for less than what they owe, paving the way to financial stability. It's essential to understand the intricacies of the OIC process—determining eligibility, gathering documentation, and submitting the necessary forms—to maximize your chances of success.

We recognize the importance of demonstrating financial hardship, meeting specific eligibility criteria, and providing meticulous documentation for your application. It’s also crucial to understand the potential outcomes after submission, which may include:

- Acceptance

- Rejection

- The need to resubmit

With statistics indicating that only 30-40% of OIC submissions are accepted, thorough preparation and adherence to guidelines can significantly enhance your likelihood of success.

Ultimately, the 433 A OIC process offers a valuable opportunity for individuals facing financial difficulties to regain control over their tax situation. By understanding the steps involved and seeking assistance when needed, you can approach this challenge with confidence. Embracing this process not only opens doors to potential relief but also empowers you to take proactive steps toward a more secure financial future. Remember, you are not alone in this journey; we’re here to help you every step of the way.

Frequently Asked Questions

What is an Offer in Compromise (OIC)?

An Offer in Compromise (OIC) is an agreement between a taxpayer and the IRS that allows individuals to settle their tax debt for less than the total amount owed, particularly for those facing financial hardship.

What are the benefits of an OIC?

The OIC can provide significant relief for taxpayers, allowing them to settle their tax debts for a reduced amount, which can help them regain financial stability and alleviate stress from overwhelming tax obligations.

What forms are required to submit an OIC?

To submit an OIC, taxpayers must complete Form 656 and Form 433 a OIC, along with a $205 processing fee, which can be waived for low-income individuals.

What are the eligibility criteria for an OIC?

To qualify for an OIC, taxpayers must demonstrate one of the following conditions: doubt as to collectibility, doubt as to liability, or effective tax administration.

What is required for filing compliance before applying for an OIC?

Taxpayers must ensure that all required tax returns are filed and any estimated tax payments are made, as the IRS will not consider submissions with outstanding filing obligations.

How can a taxpayer demonstrate financial hardship for an OIC?

A taxpayer must show that their monthly expenses exceed their income, indicating a genuine inability to pay their tax debt in full.

Are there any restrictions regarding bankruptcy when applying for an OIC?

Yes, applicants must not be in bankruptcy proceedings when applying for a 433 a OIC, as this allows the IRS to assess the financial situation without complications from bankruptcy laws.

What is "Reasonable Collection Potential" in the context of an OIC?

The IRS must believe that the amount offered in the OIC is equal to or greater than what they could collect through other means, based on the taxpayer's financial disclosures.

What documentation is needed when submitting an OIC?

Taxpayers should be prepared to provide extensive documentation such as bank statements, credit reports, and proof of expenses to support their request.

What is the Offer in Compromise Pre-Qualifier tool?

The Offer in Compromise Pre-Qualifier tool is an IRS resource that helps taxpayers gauge their eligibility for an OIC before submitting a request.

What should taxpayers be cautious of regarding OIC promoters?

Taxpayers should beware of OIC mills or promoters who may mislead them about their qualifications for a 433 a OIC, as this could result in unnecessary costs and complications.

What is the approval rate for OIC submissions?

Recent statistics indicate that fewer than half of all OIC submissions are approved, highlighting the importance of being well-prepared and knowledgeable about the process.