Introduction

Navigating the complexities of taxation on disability income can feel overwhelming. We understand that this is a crucial aspect of managing your finances effectively. This guide aims to clarify the tax implications surrounding disability benefits, providing you with essential insights into what income is taxable and what isn’t.

You might be wondering:

- Are all disability benefits subject to taxation?

- How can you ensure compliance while maximizing your financial support?

These are common questions, and we’re here to help you find the answers.

By exploring strategies to minimize your tax liability, you can feel more confident in your financial decisions. Remember, you are not alone in this journey. Together, we can navigate these regulations and empower you to make informed choices.

Understand Disability Income Taxation Basics

Understanding taxes on disability income can feel overwhelming, but you are not alone in this journey. It’s essential to understand how taxes on disability income relate to assistance for disabilities. The Internal Revenue Service (IRS) has guidelines that can help clarify your situation. Let’s break it down together:

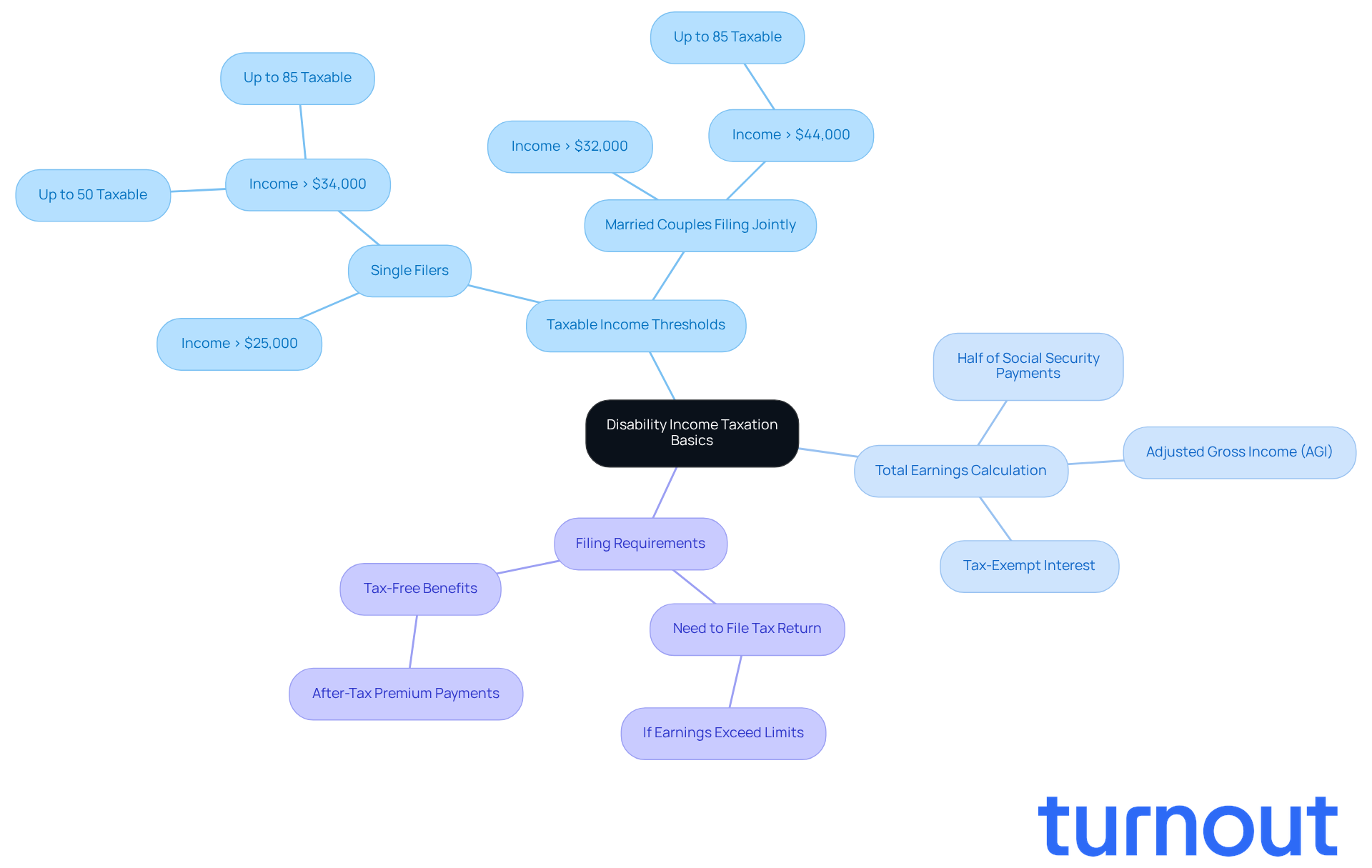

-

Taxable Income Thresholds: For the tax year 2026, if your combined income exceeds $25,000 as a single filer or $32,000 for married couples filing jointly, you might find that up to 50% of your benefits could be taxable. If your earnings go beyond $44,000, that percentage can rise to 85%. It’s common to feel uncertain about these thresholds, but knowing them can help you plan better.

-

Total Earnings Calculation: To determine your total earnings, you’ll need to add your adjusted gross income (AGI) to half of your Social Security payments and any tax-exempt interest. This calculation is crucial for understanding your taxes on disability income liability. Remember, it’s important to disclose your SSDI earnings alongside other Social Security benefits to meet your tax responsibilities.

-

Filing Requirements: Are you unsure if you need to file a tax return? If your earnings exceed the limits mentioned, you’ll need to report your assistance payments. The IRS continues to enforce these rules for 2026, ensuring that beneficiaries like you remain compliant with tax obligations. And if your insurance payments were made with after-tax funds, you might be relieved to know that your payouts could be tax-free.

By familiarizing yourself with these fundamentals, you can confidently approach the taxes on disability income related to your earnings. Remember, we’re here to help you navigate these financial obligations.

Identify Taxable and Non-Taxable Disability Benefits

Navigating the world of disability assistance can feel overwhelming, particularly in understanding taxes on disability income. We know that understanding taxes on disability income and determining which benefits are taxable and which aren’t is essential for your financial planning. Let’s break it down together:

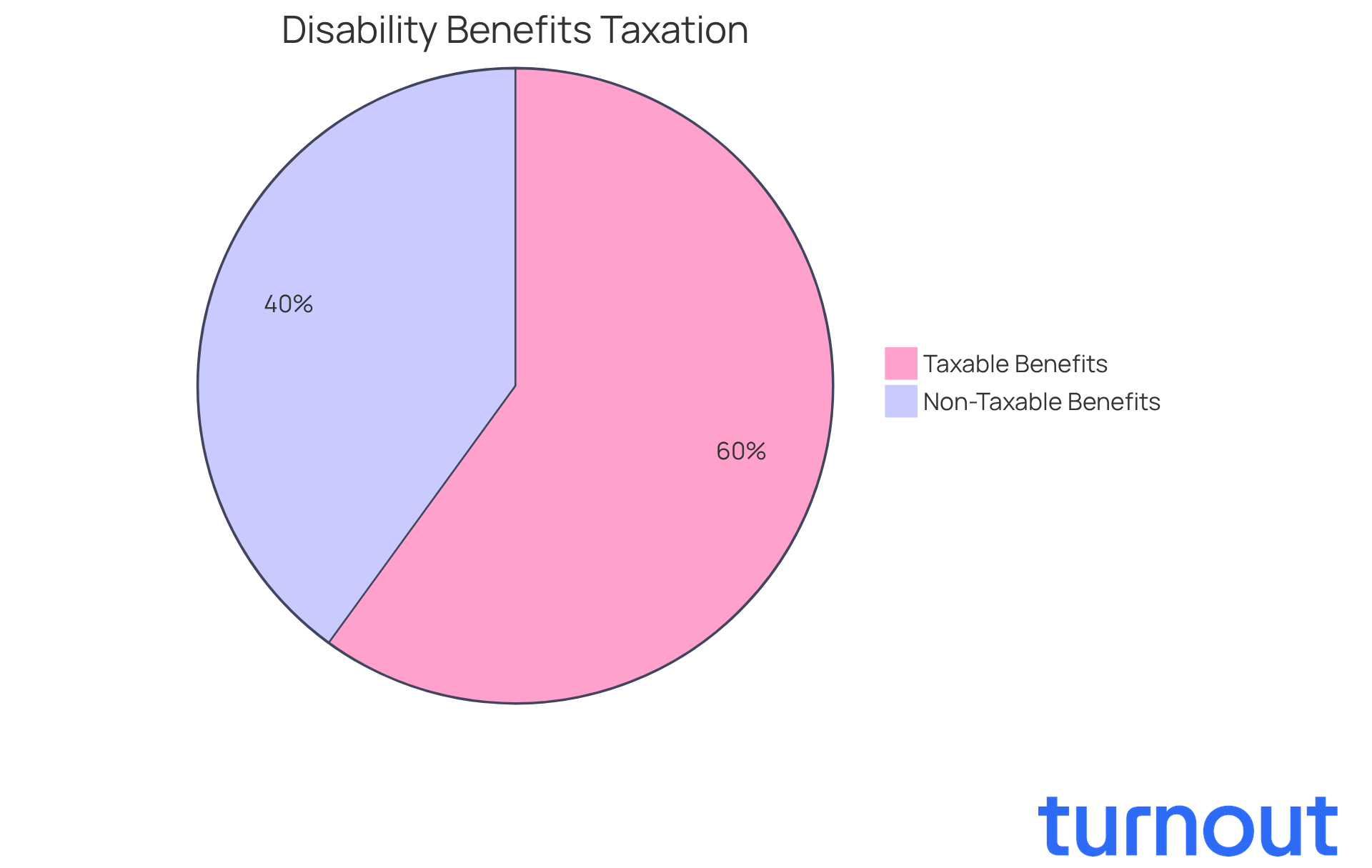

- Taxable Benefits: Social Security Disability Insurance (SSDI) benefits might be taxed if your combined income goes over certain limits. For individuals, that limit is $25,000, and for married couples filing jointly, it’s $32,000. Additionally, long-term assistance from employer-funded plans can also be subject to taxation.

- Non-Taxable Benefits: On the brighter side, Supplemental Security Income (SSI) is not taxable. This means it can provide you with crucial financial support without the worry of tax implications. Plus, if you paid for your disability insurance premiums with after-tax dollars, the payments you receive are usually exempt from taxes.

- Documentation: Keeping accurate records of your benefits and any related paperwork is vital. This practice not only helps you understand your tax obligations but also ensures you can prepare your tax return accurately.

Being aware of these distinctions is key to managing your responsibilities regarding taxes on disability income and maximizing your benefits. Remember, you’re not alone in this journey. Turnout offers tools and services to help you navigate these complex financial and governmental systems. For SSD claims, they utilize trained nonlawyer advocates, and for tax debt relief, they collaborate with IRS-licensed enrolled agents. Understanding these distinctions is crucial for effective tax planning and compliance. We're here to help you every step of the way.

Implement Strategies to Reduce Tax Liability

Minimizing your taxes on disability income can significantly enhance your financial well-being. We understand that navigating these waters can be challenging, but there are effective strategies you can consider:

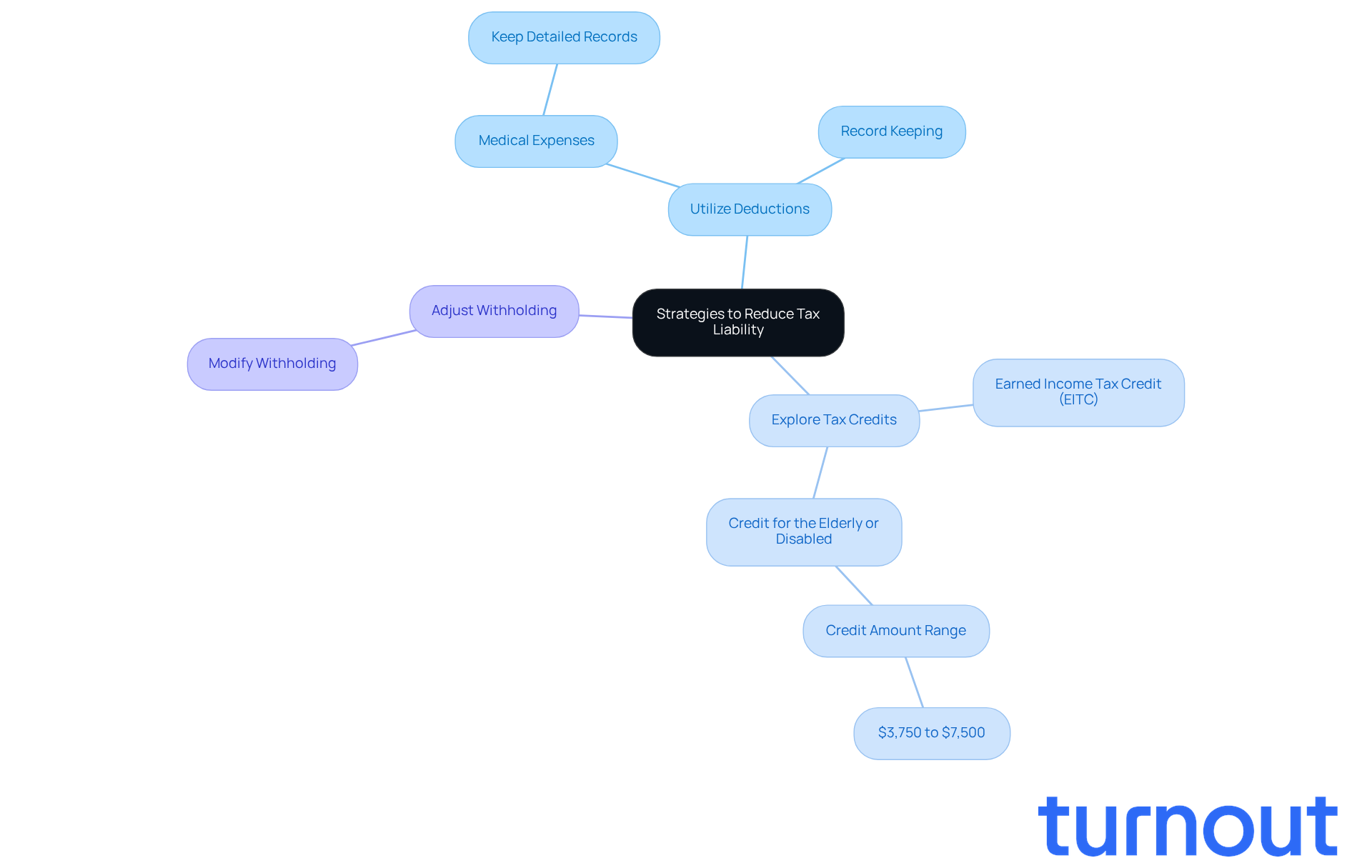

- Utilize Deductions: Leverage available deductions, especially for medical expenses. These can substantially lower your taxable income. Keeping detailed records of all medical costs related to your condition is crucial. As one tax professional wisely notes, "Keeping detailed records of medical expenses is essential for ensuring you can claim all eligible deductions."

- Explore Tax Credits: Investigate tax credits available for individuals with impairments, like the Earned Income Tax Credit (EITC) and the Credit for the Elderly or Disabled. In 2026, these credits can offer significant savings. The Credit for the Elderly or Disabled can vary from $3,750 to $7,500, depending on your earnings and eligibility.

- Adjust Withholding: If you anticipate owing taxes, consider modifying your withholding on other revenue sources. This proactive step can help you avoid a hefty tax bill at the end of the year, allowing for better financial planning.

Consulting a tax expert who understands the complexities of taxes on disability income can lead to tailored strategies for your situation. Their expertise can help you navigate these complexities and ensure you’re maximizing available deductions and credits. As highlighted in a recent case study, proactive consultations can lead to significant tax savings.

By applying these strategies, you can retain more of your hard-earned income and alleviate financial stress. Remember, you’re not alone in this journey; we’re here to help.

Explore Frequently Asked Questions About Disability Income Taxes

Here are some frequently asked questions regarding disability income taxes that we hope will help you navigate this complex topic:

-

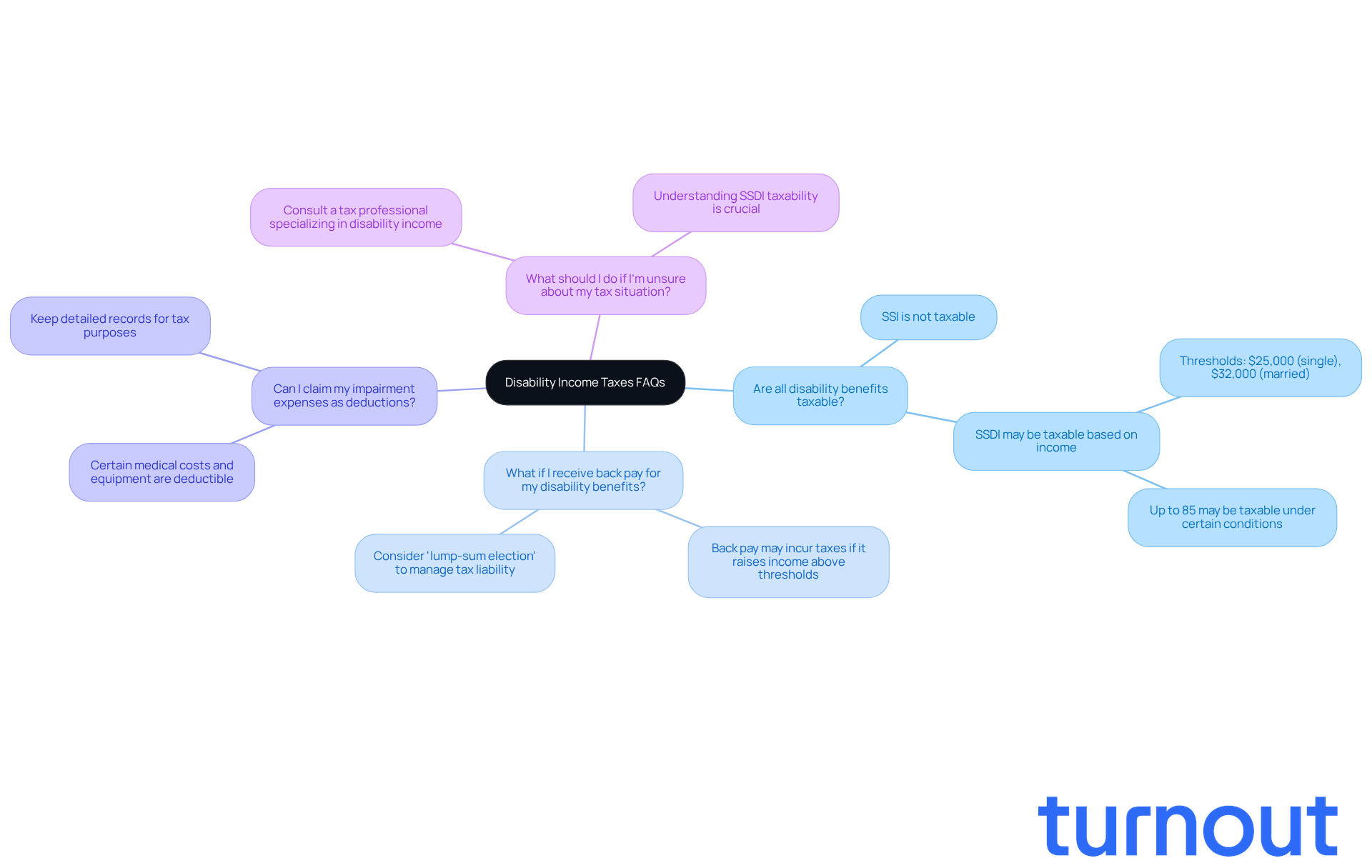

Are all disability benefits taxable?

We understand that tax obligations can be confusing. Not all benefits are taxable. For instance, Supplemental Security Income (SSI) is not subject to federal taxes. However, there may be taxes on disability income from Social Security Disability Insurance (SSDI) depending on your overall earnings. If your modified adjusted gross income exceeds $25,000 for single filers or $32,000 for married couples filing jointly, a portion of your SSDI payments may be taxable. In fact, under certain circumstances, up to 85% of SSDI payments could be subject to taxes on disability income, as noted by tax professionals. -

What if I receive back pay for my disability benefits?

It's common to feel uncertain about back pay. This amount may incur taxes on disability income if it raises your income above the thresholds for the year you receive it. For example, if you receive a lump sum that exceeds the taxable threshold, you may owe taxes on that amount. Tax experts often recommend using the 'lump-sum election' approach to allocate back pay payments to the year they should have been received, taking into account the impact of taxes on disability income. This can help manage your tax liability more effectively. Remember, in 2010, 47.1 percent of beneficiary families owed taxes on disability income from their benefits, highlighting the importance of understanding your tax situation. -

Can I claim my impairment expenses as deductions?

Yes, you can! Certain expenses related to your disability, like medical costs and necessary equipment, can be claimed as deductions on your tax return. This can help lower your overall taxable amount. We encourage you to keep detailed records of these expenses, as they can make a significant difference. -

What should I do if I’m unsure about my tax situation?

If you have questions or uncertainties about your tax obligations, it’s always a good idea to consult with a tax professional who specializes in disability income. They can provide personalized advice to ensure you’re compliant and help optimize your tax situation. As Christine Scott points out, understanding the nuances of SSDI taxability is crucial for beneficiaries navigating their financial responsibilities.

These FAQs aim to clarify common concerns and provide guidance for navigating the complexities of disability income taxation. Remember, you are not alone in this journey, and we're here to help.

Conclusion

Understanding the complexities of taxes on disability income is crucial for your financial stability. We know that navigating these waters can be overwhelming, but grasping the fundamental principles of how disability benefits are taxed can empower you to manage your financial obligations with confidence. Recognizing the difference between taxable and non-taxable benefits is essential, as this knowledge directly impacts your financial planning and compliance with IRS regulations.

Throughout this article, we’ve shared key insights about taxable income thresholds and the importance of accurate earnings calculations. Keeping thorough documentation is vital, too. We also discussed strategies to reduce your tax liability, like leveraging deductions for medical expenses and exploring available tax credits. Addressing frequently asked questions has provided clarity on common concerns many beneficiaries face. Remember, consulting tax professionals for personalized guidance can make a significant difference.

Ultimately, understanding taxes on disability income isn’t just about compliance; it’s about empowering you to make informed financial decisions. By taking proactive steps and utilizing available resources, you can optimize your financial well-being and alleviate the stress that often comes with tax obligations. Embracing this knowledge is crucial for navigating the complexities of disability income taxation and ensuring a secure financial future. You are not alone in this journey, and we’re here to help.

Frequently Asked Questions

What is the taxable income threshold for disability benefits in 2026?

For the tax year 2026, if your combined income exceeds $25,000 as a single filer or $32,000 for married couples filing jointly, up to 50% of your benefits could be taxable. If your earnings exceed $44,000, that percentage can rise to 85%.

How do I calculate my total earnings for tax purposes?

To determine your total earnings, add your adjusted gross income (AGI) to half of your Social Security payments and any tax-exempt interest. This calculation is essential for understanding your tax liability on disability income.

Do I need to file a tax return if I receive disability benefits?

Yes, if your earnings exceed the specified limits of $25,000 for single filers or $32,000 for married couples filing jointly, you will need to report your assistance payments and file a tax return.

Are disability insurance payments made with after-tax funds taxable?

If your insurance payments were made with after-tax funds, those payouts could be tax-free, meaning you may not have to pay taxes on them.

How can I better understand my tax obligations related to disability income?

Familiarizing yourself with the taxable income thresholds, total earnings calculations, and filing requirements can help you confidently navigate your tax obligations related to disability income.