Overview

The article "Master Tax Resolution Express: Key Strategies for Success" addresses the challenges many face when dealing with tax issues, whether with the IRS or state tax authorities. We understand that navigating these complexities can be overwhelming. This piece emphasizes the importance of:

- Grasping your tax liabilities

- Exploring resolution options such as Installment Agreements and Offers in Compromise

- Maintaining open communication with tax authorities

These elements are crucial for successfully overcoming tax challenges and achieving the financial stability you deserve. Remember, you are not alone in this journey. With the right strategies and support, you can find a path forward.

If you're feeling uncertain, take heart. There are effective solutions available that can help you regain control of your financial situation. We’re here to help you every step of the way.

Introduction

Navigating the complexities of tax resolution can often feel like an uphill battle. We understand that the daunting statistics surrounding unpaid taxes—like the staggering $514 billion income tax gap in 2022—can be overwhelming. This article is here to help you explore essential strategies that empower you to tackle your tax liabilities effectively.

We will offer insights into various resolution options, the importance of documentation, and the role of open communication with tax authorities. As you seek relief, you may wonder: how can you successfully negotiate with the IRS and leverage available resources to achieve financial stability amidst these challenges?

You're not alone in this journey.

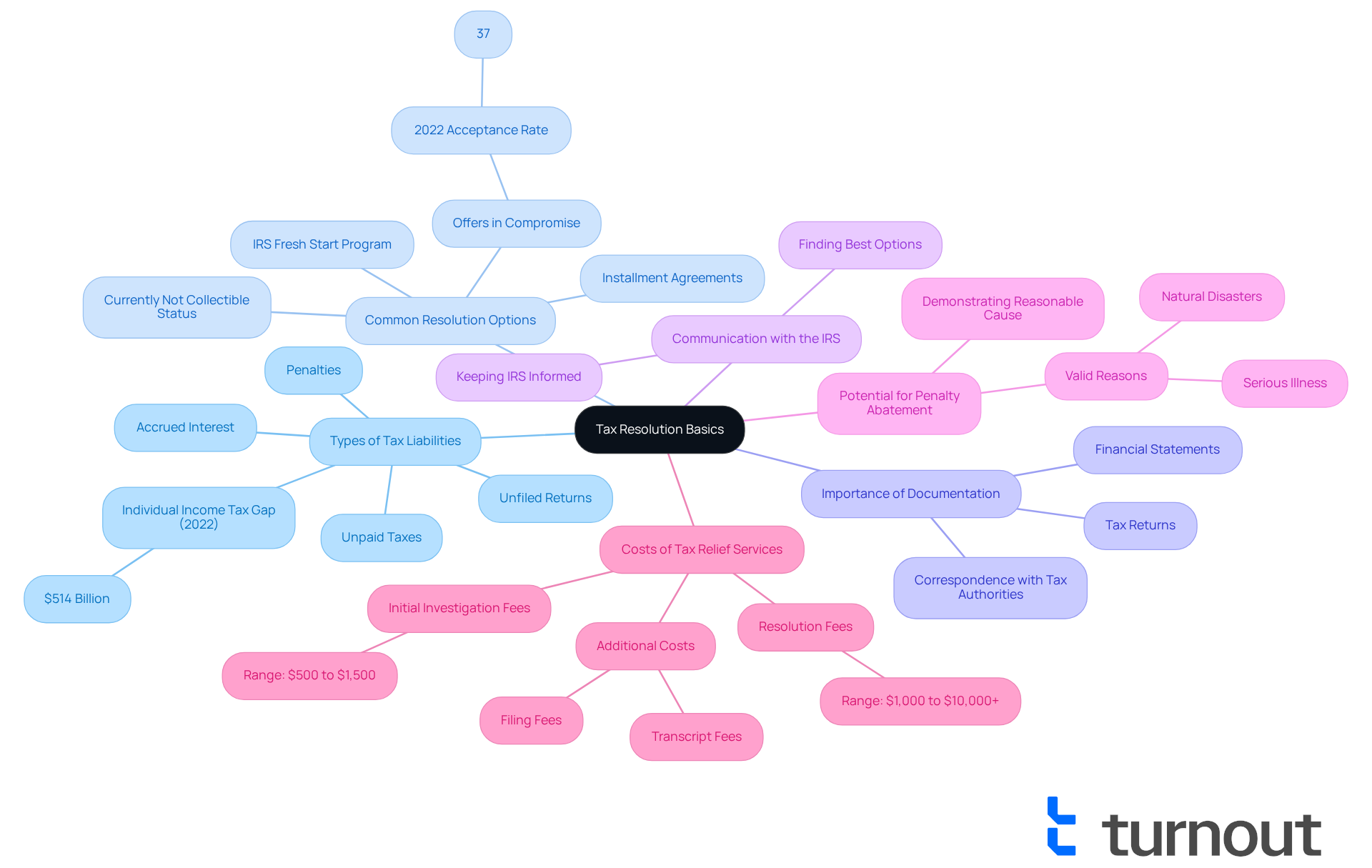

Understand Tax Resolution Basics

Tax management encompasses the processes and strategies that help you tackle tax debts using tax resolution express with the IRS or state tax authorities. We understand that navigating these challenges can be daunting, and having a solid grasp of the fundamentals is essential for finding your way through:

-

Types of Tax Liabilities: Tax liabilities can include unpaid taxes, unfiled returns, penalties, and accrued interest. Each category carries distinct implications and potential resolutions. For instance, the individual income tax gap for 2022 was estimated at $514 billion, highlighting the prevalence of unpaid taxes among Americans.

-

Common Resolution Options: You have several avenues to explore, including Installment Agreements, Offers in Compromise, Currently Not Collectible status, and the IRS's Fresh Start program. Each option has specific eligibility criteria and benefits. For example, the IRS accepted 13,165 offers out of 36,022 submitted in 2022, reflecting a 37 percent acceptance rate for those seeking to settle their debts for less than the total amount owed.

-

The Importance of Documentation: Thorough and precise documentation is vital in any tax settlement process. This includes maintaining financial statements, tax returns, and all correspondence with tax authorities. Proper documentation can significantly influence the outcome of your resolution efforts, as it provides the necessary evidence to support your claims and negotiations.

-

Communication with the IRS: Keeping the IRS informed about your circumstances is crucial. Open communication can help you discover the best options for resolving your tax obligations and regaining control of your financial future.

-

Potential for Penalty Abatement: You may qualify for penalty relief if you can demonstrate reasonable cause for failing to pay your tax obligation on time. This option can alleviate some of the financial burden associated with tax liabilities.

-

Costs of Tax Relief Services: It's important to consider the expenses related to tax relief services, which can differ significantly depending on the complexity of your case and the approach required. Understanding these costs can help set realistic expectations as you seek professional assistance.

By mastering these key concepts, you can enhance your ability to navigate tax challenges and pursue effective solutions with tax resolution express tailored to your circumstances. Remember, you are not alone in this journey; we're here to help you every step of the way.

Implement Effective Tax Resolution Strategies

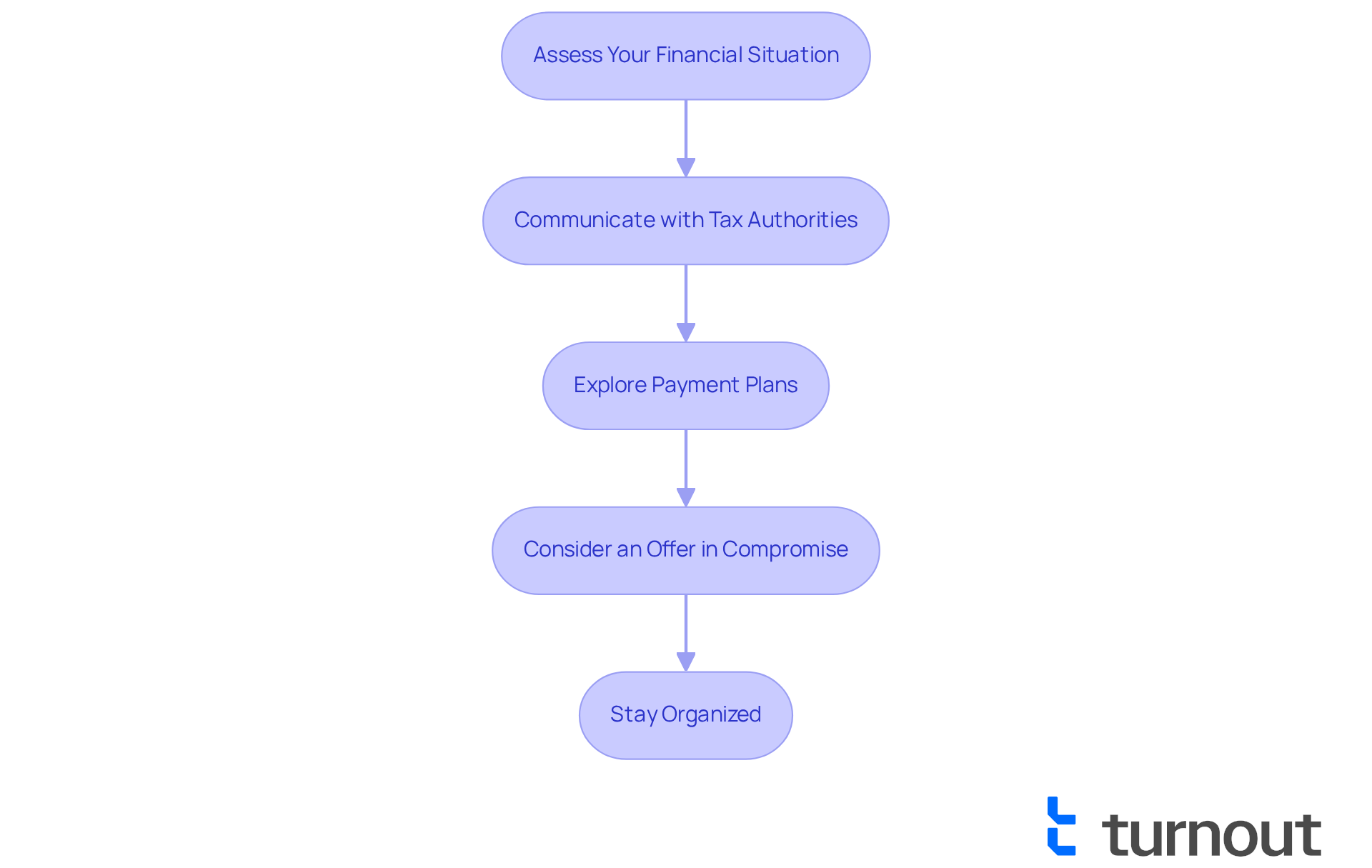

To effectively resolve tax issues, consider the following strategies:

-

Assess Your Financial Situation: We understand that evaluating your current financial status can feel overwhelming. Start by looking at your income, expenses, and existing debts. This assessment will help you identify feasible solutions. Remember, knowing your monthly disposable income is crucial as it influences your eligibility for various tax relief programs.

-

Communicate with Tax Authorities: It’s common to feel anxious about reaching out to the IRS or your state tax agency. However, maintaining open lines of communication is vital. Proactively addressing your situation can lead to better outcomes. Studies show that staying calm and courteous during these interactions can significantly improve your chances of a positive resolution. IRS Commissioner Chuck Rettig has mentioned that no one can get a better deal for taxpayers than they can usually get for themselves by working directly with the IRS, highlighting the importance of self-advocacy.

-

Explore Payment Plans: If you owe taxes, consider asking about setting up an Installment Agreement. This option allows you to pay off your obligations in manageable monthly installments. Approximately 40% of clients who seek tax assistance qualify for such agreements, providing a structured way to handle tax responsibilities.

-

Consider an Offer in Compromise: If paying your tax obligation in full feels impossible, an Offer in Compromise might be the solution you need. This option allows you to resolve your debt for less than the total amount owed. Ensure you meet the eligibility criteria and provide the necessary documentation. Notably, around 30% of clients in tax assistance services qualify for this option, showcasing its potential effectiveness. Plus, Offer in Compromise settlements do not appear on credit reports, which may ease concerns about credit impacts for those considering this route.

-

Stay Organized: Keeping meticulous records of all correspondence, payments, and documentation related to your tax situation can make a big difference. This organization will help facilitate smoother interactions with tax authorities and track your progress. A case study has shown that timely updates can prevent missed notices and deadlines, leading to better interactions with the IRS. By preparing with structured documentation, you can achieve quicker and more favorable outcomes in tax debt situations.

By implementing these strategies, you can take proactive steps toward achieving tax resolution express and moving toward financial stability. Remember, you are not alone in this journey, and we’re here to help.

Leverage Resources and Support Systems

To enhance your tax resolution express efforts, we understand that navigating this process can be overwhelming. Consider leveraging the following resources and support systems that are here to help you:

-

Taxpayer Advocate Service (TAS): This independent organization within the IRS is dedicated to assisting taxpayers like you in resolving issues and navigating the tax system. TAS can provide crucial support if you are facing financial difficulties or if your tax issue is causing undue hardship.

-

Low-Income Taxpayer Clinics (LITCs): These clinics offer free or low-cost assistance to individuals who cannot afford professional help. LITCs provide guidance on tax disputes and representation before tax authorities, significantly improving your chances of a successful outcome. In 2023 alone, LITCs represented nearly 20,000 taxpayers and educated over 140,000 individuals about their rights and responsibilities.

-

Online Resources: Websites such as the IRS and state tax agency sites offer valuable information on tax settlement options, forms, and guidelines. Utilizing these resources helps you stay informed about your rights and responsibilities, especially regarding new electronic payment methods being introduced.

-

Professional Support: While steering clear of legal references, consider obtaining assistance from tax experts who focus on tax issues. They can provide personalized guidance and strategies tailored to your specific situation, ensuring you navigate the complexities of tax issues effectively.

-

Community Programs: Numerous local organizations provide workshops and seminars on tax settlement and financial literacy. Participating in these programs can offer additional insights and support, particularly for disabled individuals who may face unique challenges in the tax system.

By leveraging these resources, you can enhance your understanding of tax resolution express and access the support you need to navigate your challenges effectively. Remember, you are not alone in this journey, and there is help available for you.

![]()

Conclusion

Navigating the complexities of tax resolution can be a challenging endeavor. We understand that it can feel overwhelming, but grasping the foundational elements is crucial for achieving success. Mastering tax resolution involves recognizing the various types of tax liabilities, exploring common resolution options, and maintaining clear communication with tax authorities. By equipping yourself with this knowledge, you can take significant steps toward alleviating your financial burdens.

Key strategies include:

- Assessing your financial situation

- Considering payment plans

- Exploring options such as Offers in Compromise

The importance of meticulous documentation and organized communication cannot be overstated. These factors play a pivotal role in facilitating effective interactions with the IRS and other tax agencies. Additionally, leveraging resources like the Taxpayer Advocate Service and Low-Income Taxpayer Clinics can provide invaluable support in navigating tax challenges.

Ultimately, taking proactive steps toward tax resolution is essential for regaining control over your financial future. The journey may seem daunting, but with the right strategies and support systems in place, you can move toward financial stability. Embracing these practices and seeking assistance when needed can empower you to overcome your challenges and achieve lasting success in your tax resolution efforts. Remember, you're not alone in this journey; we're here to help.

Frequently Asked Questions

What is tax management?

Tax management involves processes and strategies that help individuals tackle tax debts using tax resolution methods with the IRS or state tax authorities.

What types of tax liabilities exist?

Tax liabilities can include unpaid taxes, unfiled returns, penalties, and accrued interest, each with distinct implications and potential resolutions.

What was the estimated individual income tax gap for 2022?

The individual income tax gap for 2022 was estimated at $514 billion, indicating a significant prevalence of unpaid taxes among Americans.

What are some common resolution options for tax debts?

Common resolution options include Installment Agreements, Offers in Compromise, Currently Not Collectible status, and the IRS's Fresh Start program, each with specific eligibility criteria and benefits.

What was the acceptance rate for Offers in Compromise in 2022?

In 2022, the IRS accepted 13,165 out of 36,022 submitted Offers in Compromise, resulting in a 37 percent acceptance rate.

Why is documentation important in the tax settlement process?

Thorough and precise documentation is vital as it includes financial statements, tax returns, and correspondence with tax authorities, which can significantly influence the outcome of resolution efforts.

How should one communicate with the IRS regarding tax obligations?

Keeping the IRS informed about your circumstances is crucial for discovering the best options for resolving tax obligations and regaining control of your financial future.

What is penalty abatement, and how can one qualify for it?

Penalty abatement is a potential relief option where individuals may qualify if they can demonstrate reasonable cause for failing to pay their tax obligation on time.

What should one consider regarding the costs of tax relief services?

It's important to consider that the costs of tax relief services can vary significantly based on the complexity of the case and the required approach, which helps set realistic expectations when seeking professional assistance.