Introduction

Navigating the complex world of tax relief debt can often feel like an uphill battle. Many individuals experience overwhelming stress from their obligations to the IRS and state tax authorities. We understand that this can be a daunting experience, and it’s common to feel lost in the process.

This article delves into essential strategies and concepts that empower you to take control of your financial future. We’ll offer insights into programs like Offer in Compromise and Installment Agreements, which can provide much-needed relief. However, with the rise of scams targeting those seeking help, how can you discern legitimate assistance from misleading promises?

Understanding these dynamics is crucial for anyone looking to master their tax relief journey. Remember, you are not alone in this. We're here to help you navigate these challenges and find the support you need.

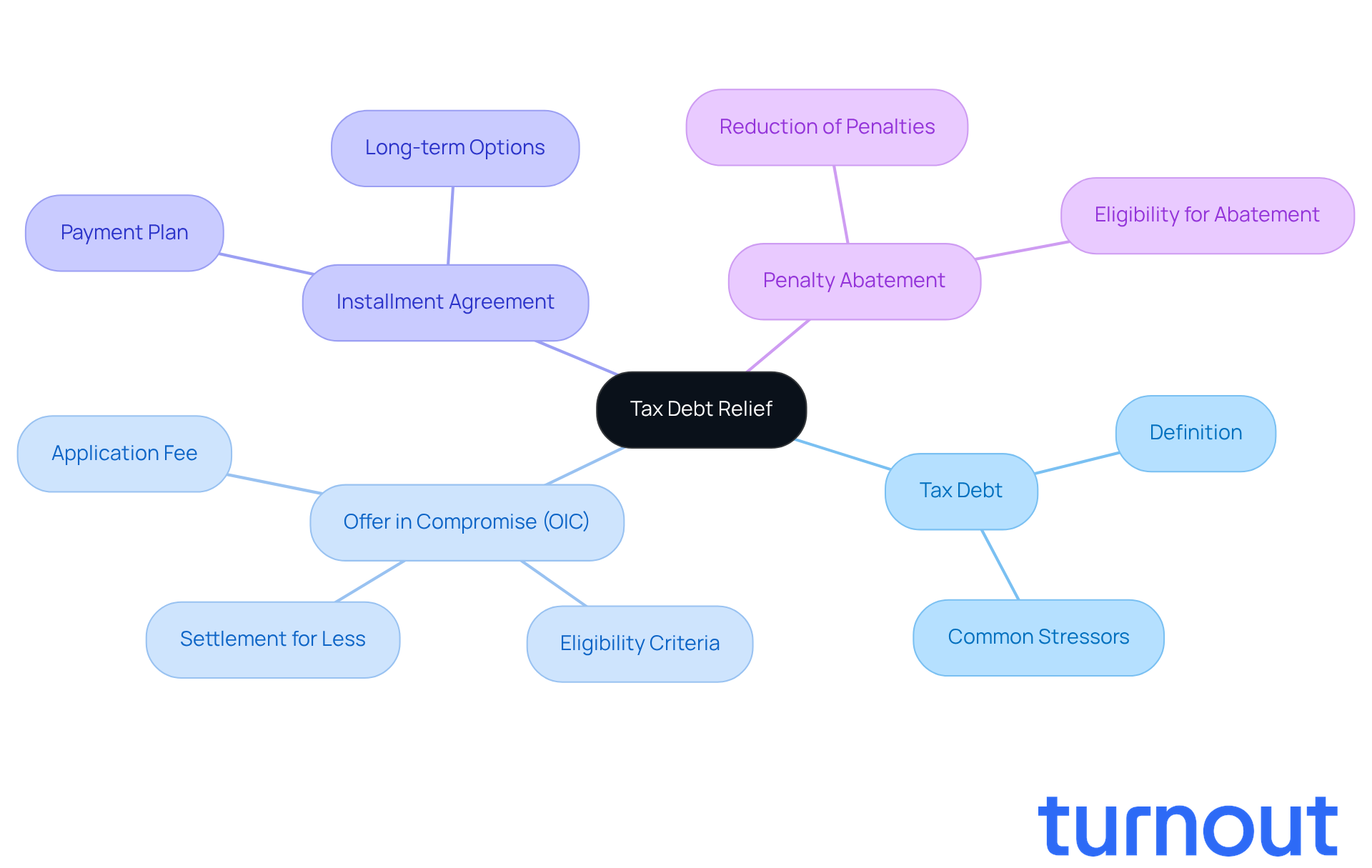

Understand Tax Debt Relief: Definitions and Key Concepts

Tax relief debt can serve as a lifeline for many, providing various programs and strategies to help manage, reduce, or even eliminate tax obligations. We understand that navigating this landscape can feel overwhelming, but knowing the key concepts can empower you on this journey.

- Tax Debt: This is the amount you owe to the IRS or state tax authorities, which may include unpaid taxes, penalties, and interest. It’s common to feel stressed about this burden.

- Offer in Compromise (OIC): This program allows you to settle your tax obligation for less than what you owe, based on your ability to pay. Imagine the relief of resolving your tax issues without the full weight of your debt.

- Installment Agreement: This payment plan lets you pay off your tax debt over time, making it more manageable. It’s a step towards regaining control of your finances.

- Penalty Abatement: If you’ve faced challenges that led to unpaid taxes, you can request a reduction or elimination of penalties. This option is often granted under specific circumstances, providing a chance for relief.

Understanding these terms is the first step in effectively navigating tax relief debt options. Remember, you’re not alone in this journey. We’re here to help you find the best path forward.

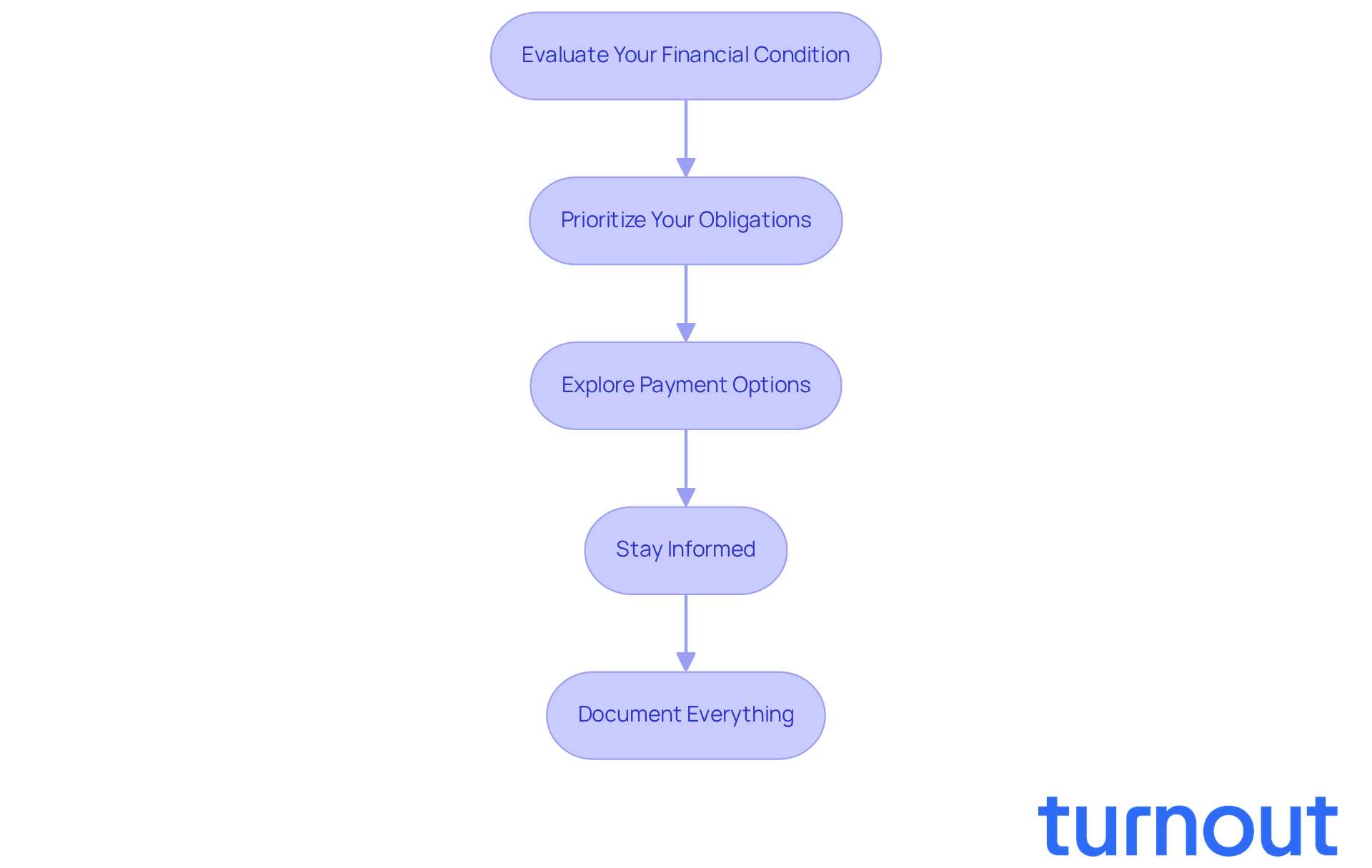

Implement Effective Strategies for Managing Tax Debt

Managing tax relief debt can feel overwhelming, but you are not alone in this journey. Here are some strategies to help you navigate this challenging situation:

-

Evaluate Your Financial Condition: Start by gathering all your financial records - income statements, expenses, and current liabilities. Understanding your financial landscape is crucial for making informed decisions. We understand that this can be daunting, but taking this step is essential.

-

Prioritize Your Obligations: Focus on high-interest liabilities first, as they can accumulate quickly. Did you know that the average interest rate on tax liabilities is currently 7%? Prioritizing your tax relief debt over other financial obligations can prevent serious repercussions, like wage garnishment or legal action. In fiscal year 2024, the IRS evaluated $17.8 billion in extra taxes for late-filed returns, underscoring the importance of addressing tax obligations promptly.

-

Explore Payment Options: Look into available payment plans with the IRS. For amounts under $50,000, the Installment Agreement allows up to 72 months for repayment. You might also consider the Offer in Compromise (OIC) program, which can settle tax liabilities for less than what you owe. Additionally, the IRS's First-Time Penalty Abatement policy can relieve penalties for those with a clean compliance history. Remember, there are options available to help you.

-

Stay Informed: Keeping up with changes in tax regulations and assistance programs is vital. The IRS Fresh Start Program may provide new options for resolving tax relief debt and enhancing financial flexibility. This year, the IRS has broadened its reasonable cause criteria, allowing qualification for assistance if you can show that you exercised ordinary business care. Staying informed can empower you to make better decisions.

-

Document Everything: Keep thorough records of all communications with tax authorities and any agreements made. This documentation is invaluable in protecting your rights and resolving disputes effectively. Financial specialists emphasize that neglecting tax obligations can lead to serious consequences, so it’s essential to handle these responsibilities proactively.

We’re here to help you through this process. Remember, taking these steps can lead to a brighter financial future.

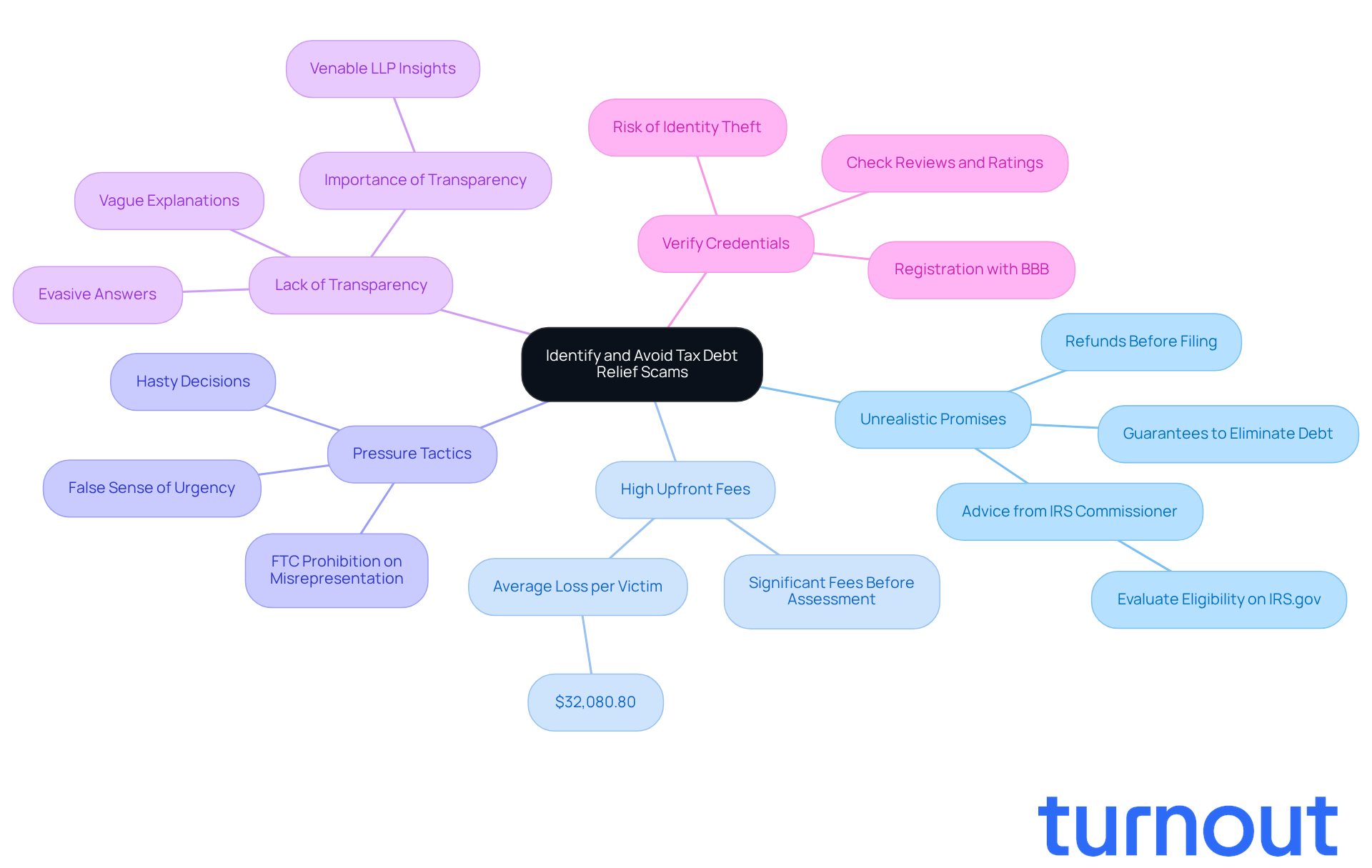

Identify and Avoid Tax Debt Relief Scams

Tax obligation scams are on the rise, and they can take many misleading forms. We understand how overwhelming this can feel, so here are some critical indicators to help you identify and steer clear of these scams:

- Unrealistic Promises: Be cautious of companies that guarantee to eliminate your tax debt or promise refunds before you file your taxes. Such claims are often misleading and unrealistic. IRS Commissioner Danny Werfel advises taxpayers to evaluate their eligibility for assistance programs using resources on IRS.gov. This way, you can avoid hiring costly promoters who may not have your best interests at heart.

- High Upfront Fees: Legitimate tax assistance services typically charge fees based on the services provided, rather than requiring large upfront payments. If a service demands significant fees before assessing your situation, be wary. The average loss per victim from tax scams has reached $32,080.80, highlighting the financial risks involved.

- Pressure Tactics: Scammers often create a false sense of urgency, pushing you to make hasty decisions without fully understanding the consequences. If you ever feel rushed, take a step back and reassess. Remember, the FTC has emphasized that misrepresenting connections to government agencies in the tax debt assistance industry is prohibited, yet scammers continue to exploit this tactic.

- Lack of Transparency: Trustworthy companies provide clear, detailed information about their services, fees, and processes. If you encounter vague explanations or evasive answers, consider it a significant red flag. Transparency and accurate representation are essential safeguards against regulatory risk, as noted by Venable LLP.

- Verify Credentials: Always verify the credentials of any tax assistance service. Look for reviews, ratings, and registration with the Better Business Bureau or similar organizations to ensure legitimacy. Scammers often lack verifiable records, making this step crucial in protecting yourself. Be cautious, as scammers may request personal information too soon, posing a risk of identity theft.

By recognizing these warning signs, you can better navigate the complex landscape of tax assistance services. Remember, you are not alone in this journey, and by staying informed, you can avoid falling victim to scams.

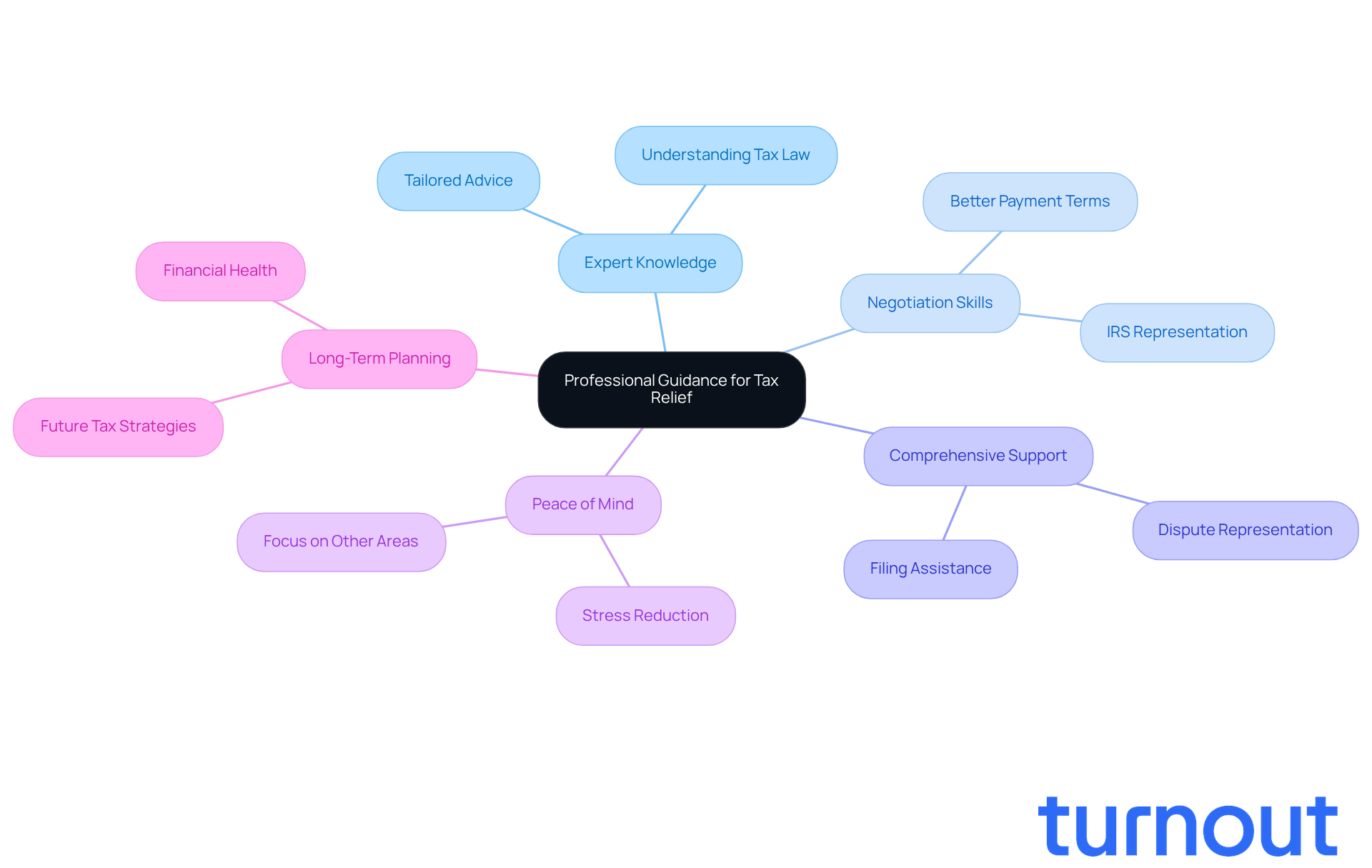

Seek Professional Guidance for Tax Relief Success

Hiring an expert for tax assistance can significantly improve your chances of success. We understand that navigating tax issues can be overwhelming, and having the right support makes all the difference. Here’s how an expert can help:

- Expert Knowledge: Tax professionals, including IRS-licensed enrolled agents, are well-versed in the complexities of tax law. They can provide tailored advice that fits your unique situation, ensuring you feel understood and supported.

- Negotiation Skills: It’s common to feel anxious about dealing with the IRS. Experienced advocates can negotiate on your behalf, potentially securing better terms for payment plans or settlements, giving you peace of mind.

- Comprehensive Support: Professionals can assist with every aspect of tax assistance, from filing necessary paperwork to representing you in disputes. At Turnout, we utilize trained nonlawyer advocates who are dedicated to supporting clients through these processes.

- Peace of Mind: Knowing that a qualified expert is handling your case can alleviate stress, allowing you to focus on other important areas of your life. You deserve to feel secure in your financial decisions.

- Long-Term Planning: Beyond immediate relief, professionals can help you develop strategies to avoid future tax issues. This ensures your long-term financial health, so you can look forward to a brighter future.

Remember, you are not alone in this journey. We're here to help you every step of the way.

Conclusion

Navigating tax relief debt can feel overwhelming, but you’re not alone in this journey. Understanding the options and strategies available can truly empower you to take charge of your financial situation. It’s important to familiarize yourself with key concepts like tax debt, Offer in Compromise, Installment Agreements, and Penalty Abatement. By grasping these definitions, you can make informed decisions and feel more at ease with your circumstances.

Throughout this article, we’ve explored various strategies to help you manage tax debt effectively. Evaluating your financial condition, prioritizing your obligations, exploring payment options, staying informed about regulations, and documenting your interactions with tax authorities are all vital steps. Remember, it’s crucial to recognize and avoid scams to protect yourself from misleading promises and high fees. Seeking professional guidance can significantly enhance your chances of success, as experts bring valuable knowledge and negotiation skills to the table.

Ultimately, taking proactive steps toward understanding and managing tax relief debt is essential for achieving financial stability. We encourage you to explore the resources available and seek expert assistance when needed. By taking these actions, you can not only alleviate the burden of tax debt but also pave the way for a secure financial future, free from the worry of tax obligations. Remember, we’re here to help you every step of the way.

Frequently Asked Questions

What is tax debt?

Tax debt is the amount you owe to the IRS or state tax authorities, which may include unpaid taxes, penalties, and interest.

What is an Offer in Compromise (OIC)?

An Offer in Compromise (OIC) is a program that allows you to settle your tax obligation for less than what you owe, based on your ability to pay.

What is an installment agreement?

An installment agreement is a payment plan that allows you to pay off your tax debt over time, making it more manageable.

What is penalty abatement?

Penalty abatement is a process that allows you to request a reduction or elimination of penalties if you have faced challenges that led to unpaid taxes. This option is often granted under specific circumstances.

How can understanding these terms help me?

Understanding these terms is the first step in effectively navigating tax relief debt options, empowering you to find the best path forward.