Overview

Navigating tax debt can feel overwhelming, but we're here to help. This article outlines a structured approach to mastering tax debt resolution through five essential steps:

- Assess your financial situation.

- Negotiate with the IRS.

- Explore relief programs.

- Don't hesitate to seek professional guidance.

Each step is supported by practical strategies and insights.

Understanding your tax obligations is crucial. Evaluating your options can bring clarity and relief. It's common to feel uncertain, but maintaining effective communication with tax authorities is key to achieving a favorable outcome. Remember, you're not alone in this journey, and with the right support, you can find your way to financial peace.

Introduction

Navigating the complexities of tax debt can feel overwhelming and daunting for many individuals. It's common to experience uncertainty about your options, and we understand how challenging this can be. However, understanding the various strategies for tax debt resolution is crucial. This knowledge empowers you to regain control of your financial future. With so many choices available, how can you determine the best path forward amidst the confusion and potential pitfalls?

This article will guide you through five essential steps to master tax debt resolution. We’re here to ensure that you are equipped to tackle your obligations effectively and confidently. Remember, you are not alone in this journey, and support is available to help you navigate these challenges.

Understand Tax Debt Resolution Basics

Tax debt resolution encompasses various strategies available to individuals facing debts to tax authorities. We understand that navigating this landscape can feel overwhelming, but grasping these fundamentals is essential for effectively addressing your tax issues. Let's explore some key concepts together:

- Tax Debt: This term refers to any unpaid taxes owed to the IRS or state tax authorities. These debts can accumulate penalties and interest over time, complicating your financial situation further.

- Resolution Options: Common methods for resolving tax obligations include payment plans, offers in compromise, and currently not collectible status. It's important to note that approximately 40% of taxpayers utilize payment plans to manage their tax obligations, according to IRS data. Each option comes with its own eligibility criteria and implications, making it crucial to evaluate which is best suited for your unique circumstances.

- IRS Procedures: Familiarizing yourself with how the IRS operates, including their collection processes and your rights as a taxpayer, is vital. We understand that effective communication with the IRS can significantly impact the resolution of your tax issues. As Angelica Leicht, senior editor for CBSNews.com, mentions, "But remember, regardless of which option you select, communication with the IRS is crucial—so ensure you keep them updated about your situation to assist you in finding the best resolution to settle your tax obligations and regain control of your economic future."

By mastering these concepts, you will be better equipped to manage your tax obligations and explore the options available to regain control of your economic future. Successful instances of tax debt resolution, such as the Offer in Compromise program, demonstrate how individuals can resolve their liabilities for less than the total amount required, offering a path to economic recovery. Remember, you are not alone in this journey; we’re here to help you navigate these challenges.

Assess Your Tax Situation and Options

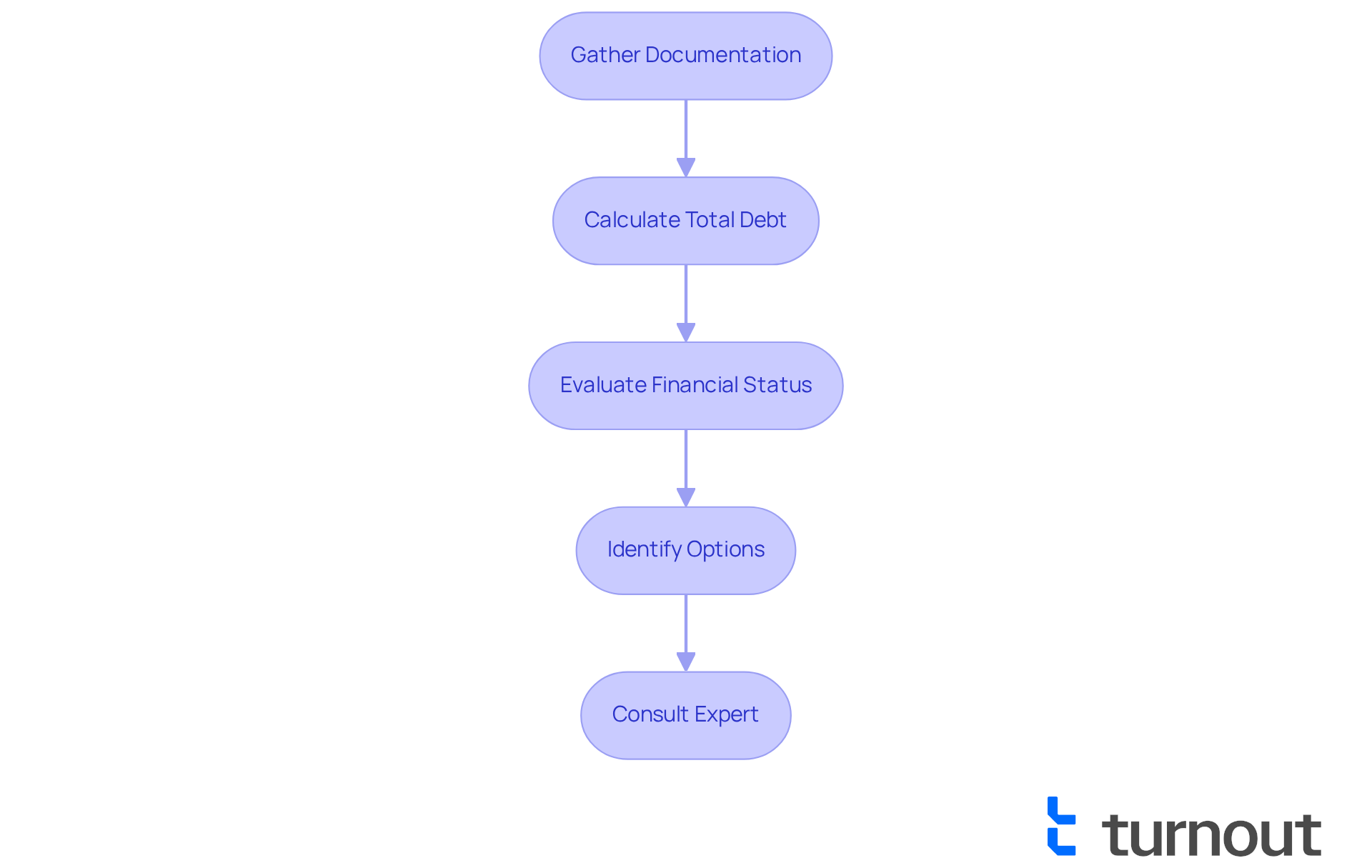

To effectively achieve tax debt resolution, it’s important to start by assessing your current financial situation. We understand that this can be a daunting task, but taking these steps can help you regain control.

- Gather Documentation: Begin by collecting all relevant tax materials, including previous returns, notifications from the IRS, and any communication related to your tax obligations. This will provide a solid foundation for your next steps.

- Calculate Total Debt: Next, determine the total amount owed, including penalties and interest. This will give you a clear picture of your financial obligation. On average, individuals in the U.S. owe around $16,000 in tax obligations, which can include various penalties and interest charges. It’s important to be aware that tax settlement services often impose high charges, which may not be justifiable for minor tax obligations.

- Evaluate Financial Status: Analyze your income, expenses, and assets to understand your ability to pay off the debt. This assessment will help you decide which options for tax debt resolution are feasible. Advisors suggest a comprehensive evaluation of your monetary situation to pinpoint possible areas for savings and modifications.

- Identify Options: Based on your assessment, consider the various options available, such as installment agreements, offers in compromise, or seeking penalty relief. Each option has its risks and benefits, so it’s essential to assess which approach best aligns with your monetary objectives and repayment capability. Interacting with a tax debt resolution expert can offer valuable insights into which option aligns best with your goals.

Additionally, be cautious of scams in the tax resolution industry. Identifying warning signs can shield you from economic damage. Remember, you are not alone in this journey. By completing this assessment, you will be prepared to move forward with a clear understanding of your situation and the importance of maintaining compliance with tax obligations to prevent future issues.

Negotiate Effectively with the IRS

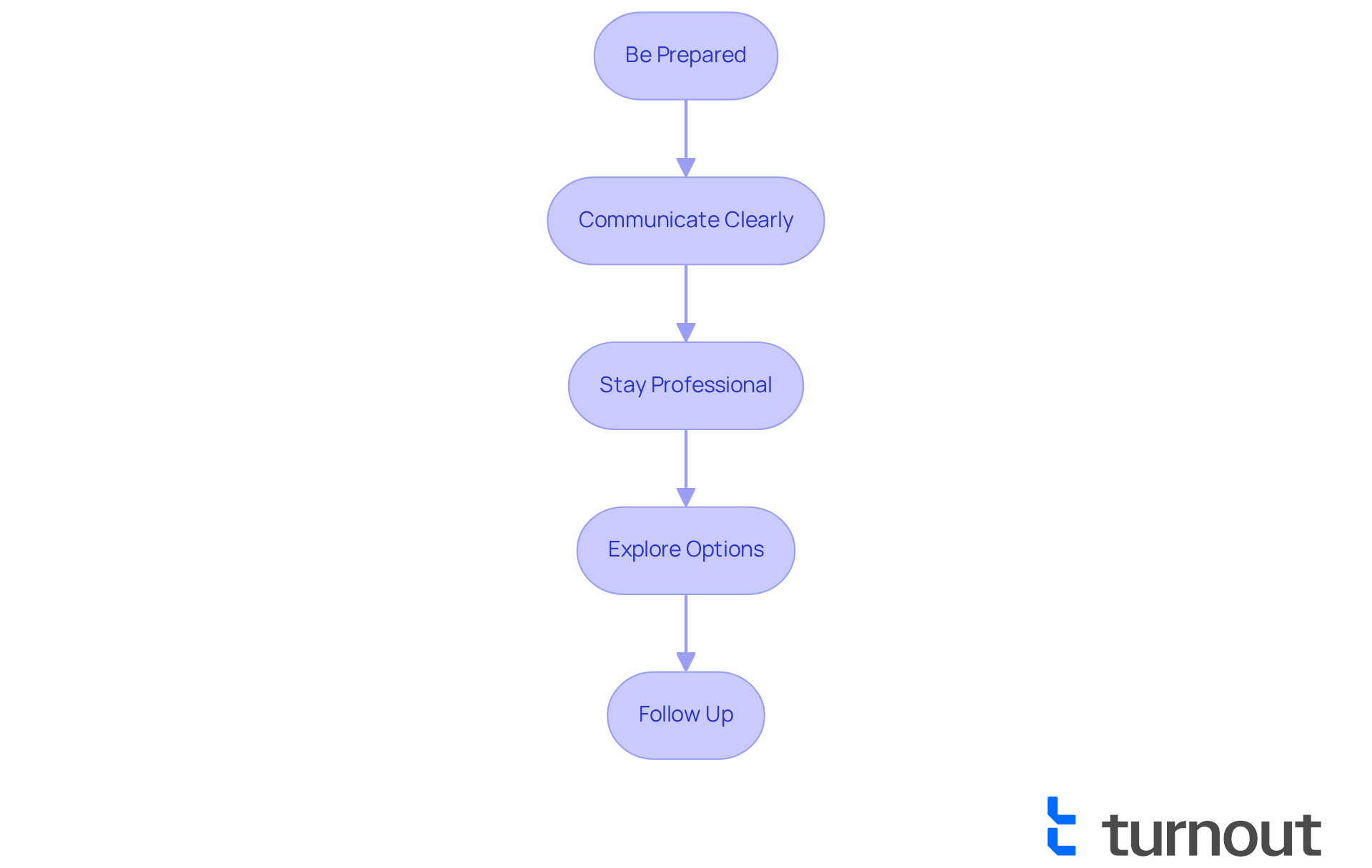

When negotiating with the IRS, we understand that it can feel overwhelming. Consider these compassionate strategies to help you navigate this process:

- Be Prepared: Gather all essential documentation, including income statements and past tax returns. This preparation allows you to fully comprehend your economic situation before reaching out to the IRS. Well-organized records not only enhance your credibility but also facilitate smoother negotiations. As Darrin Mish wisely states, "Preparation is the key."

- Communicate Clearly: When speaking with IRS representatives, it's important to articulate your situation clearly and concisely. Providing relevant information helps them understand your case better and fosters a more productive dialogue.

- Stay Professional: Maintaining a respectful and professional demeanor during negotiations is crucial. This approach can create a cooperative atmosphere, increasing the likelihood of a favorable outcome.

- Explore Options: It's beneficial to discuss various resolution avenues, such as payment plans or offers in compromise. Be open to suggestions from the IRS while also being aware of your financial limits to negotiate effectively. Remember, taxpayers are required to submit Form 433-A or 433-F to calculate a fair payment amount.

- Follow Up: After your initial negotiation, it’s essential to follow up to ensure your case is being processed and to address any additional questions or requirements. This proactive approach demonstrates your commitment to resolving the issue.

Understanding your rights as a taxpayer, as outlined in the Taxpayer Bill of Rights, is also essential before starting negotiations. By employing these negotiation techniques, you can significantly enhance your chances of achieving a favorable tax debt resolution with the IRS. Remember, you are not alone in this journey, and we’re here to help.

Explore Tax Relief Programs and Services

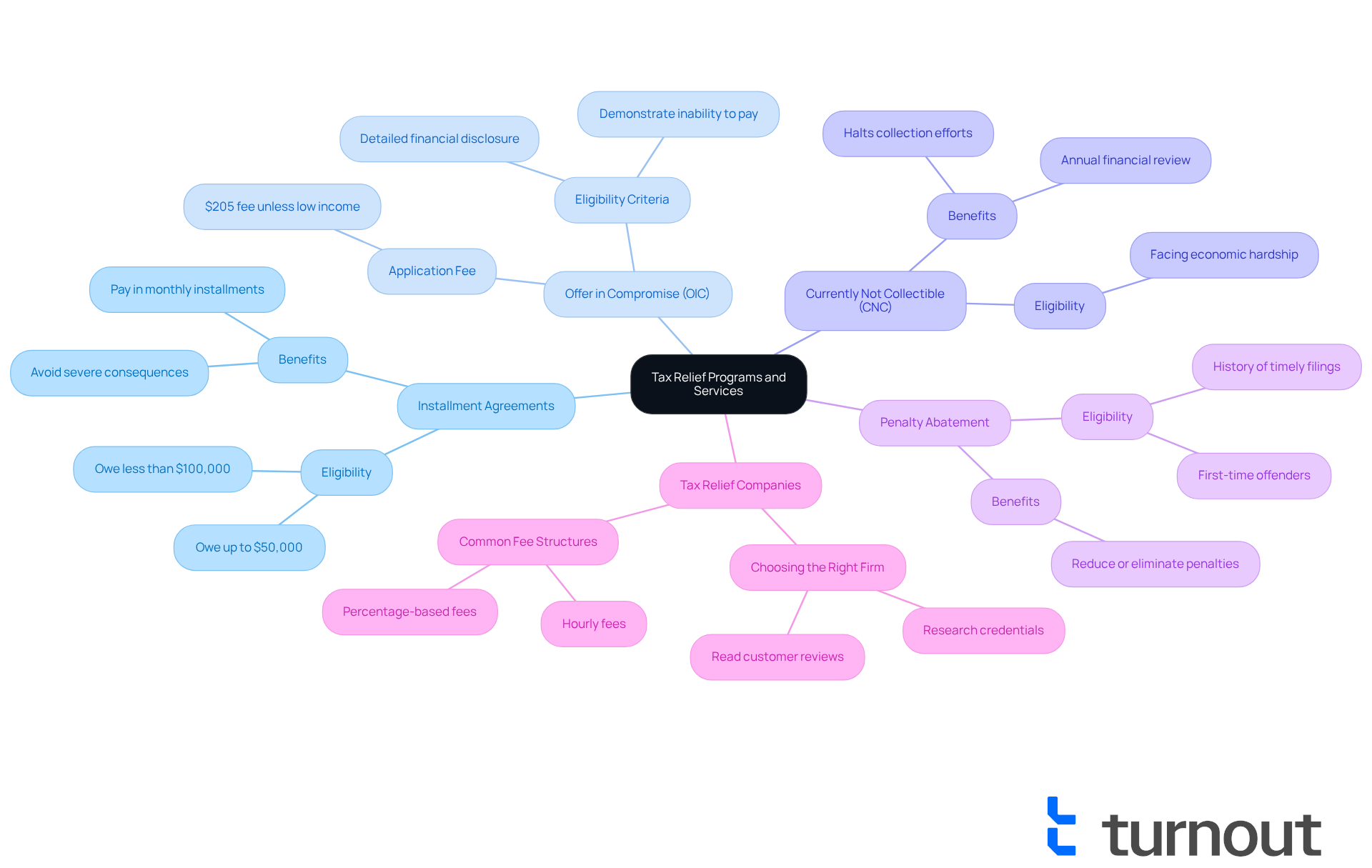

Managing tax debt resolution can feel overwhelming, and it's completely understandable to seek assistance. Fortunately, several relief programs and services are available to assist you in navigating this challenge effectively:

- Installment Agreements: This option allows you to pay your tax obligation in manageable monthly installments over time. If you owe up to $50,000, you can apply for a long-term payment plan. Those with balances under $100,000 may qualify for short-term plans, often without setup fees. According to the IRS, individuals can pay off their balance in monthly installments over up to 72 months under an Installment Agreement.

- Offer in Compromise (OIC): An OIC enables you to settle your tax debt for less than the total amount owed, provided you meet specific criteria. While the application process requires detailed monetary disclosure and can be complex, many have successfully reduced their tax burdens through this route. Tax experts note that the OIC process has been simplified for applicants experiencing economic difficulties, making it a viable option for many.

- Currently Not Collectible (CNC): If you are facing economic hardships, you may qualify for CNC status, which temporarily halts collection efforts. This status allows you to focus on your recovery without the immediate pressure of tax payments. The IRS evaluates your financial situation annually to determine your continued eligibility for this status.

- Penalty Abatement: If you have a valid reason for not paying your taxes on time, you may request a penalty abatement to reduce or eliminate penalties. This option is particularly beneficial for first-time offenders or those with a history of timely filings. The IRS can waive penalties if you have been compliant in the past or have a reasonable cause for your failure.

- Engaging with reputable tax relief companies can provide valuable assistance in tax debt resolution and help navigate these options. They can negotiate on your behalf and ensure you understand the best strategies for your situation. As emphasized by Angelica Leicht, selecting the appropriate tax relief company is essential for achieving sustainable solutions to tax obligation challenges.

Researching and applying for these programs can significantly ease your tax burden, allowing you to regain control of your financial situation. Many individuals have successfully utilized Installment Agreements to manage their financial obligations effectively. This demonstrates the potential for positive results when engaging with these relief options. Remember, you are not alone in this journey—we’re here to help you find the best path forward.

Seek Professional Guidance for Tax Resolution

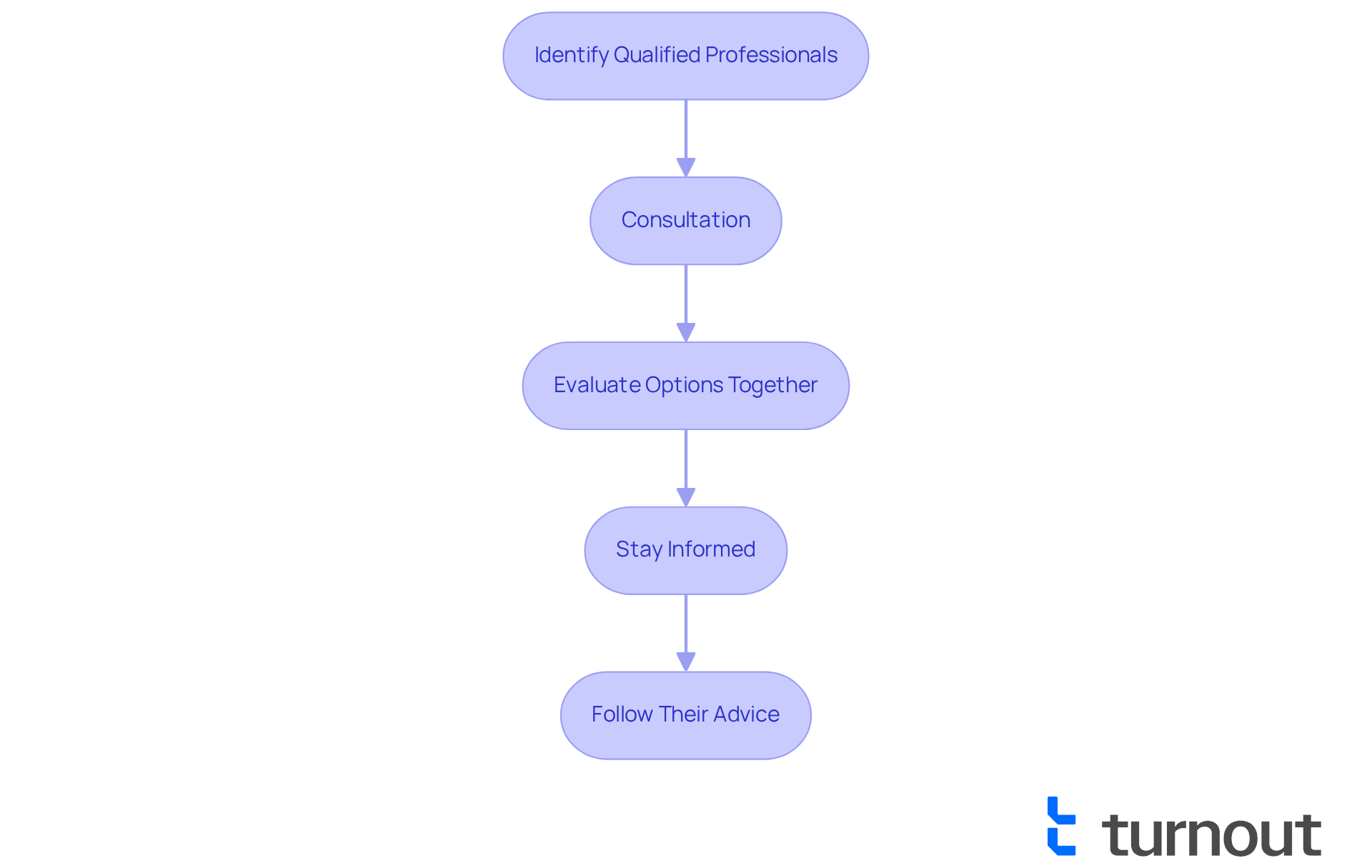

When dealing with tax debt resolution, it's important to seek professional guidance. We understand that this can be a daunting experience, but you are not alone in this journey.

- Identify Qualified Professionals: Look for tax professionals who specialize in tax resolution and have a proven track record of success. This is a crucial first step in finding the right support.

- Consultation: Schedule a consultation to discuss your situation and explore potential strategies for resolution. This is your opportunity to share your concerns and learn about the options available to you.

- Evaluate Options Together: Work with your chosen professional to evaluate the best options for your specific circumstances. Whether it involves negotiating with the IRS or applying for relief programs, having someone by your side can make a significant difference.

- Stay Informed: Keep communication open with your tax professional. It's common to feel anxious during this process, so ensure you are informed about the progress of your case and any necessary actions you need to take.

- Follow Their Advice: Trust their expertise and follow their recommendations. Navigating the complexities of tax resolution can be challenging, but with the right guidance, you can move forward with confidence.

By seeking professional guidance, you can enhance your chances of successfully achieving tax debt resolution. Remember, we're here to help you every step of the way.

Conclusion

Mastering tax debt resolution is a crucial step towards regaining your financial stability. We understand that navigating tax obligations can be overwhelming, but knowing the various options and strategies available empowers you to take control. By familiarizing yourself with the basics of tax debt, assessing your personal financial situation, and effectively negotiating with the IRS, you can approach this complex landscape with confidence.

This article has outlined essential steps to tackle tax debt resolution. Start by gathering your documentation and evaluating your financial status. Explore relief programs and consider seeking professional guidance. Each section provides valuable insights into available options, such as:

- Installment agreements

- Offers in compromise

- Penalty abatements

All designed to alleviate the burden of tax debt. Remember, clear communication and professionalism during negotiations are vital, as these elements can significantly influence the outcome.

Ultimately, the journey towards tax debt resolution is not one to be undertaken alone. Engaging with qualified professionals and utilizing available programs can lead to successful outcomes and a renewed sense of financial freedom. By taking proactive steps and remaining informed, you can transform your tax challenges into manageable solutions, paving the way for a brighter economic future. You're not alone in this journey; we're here to help you every step of the way.

Frequently Asked Questions

What is tax debt?

Tax debt refers to any unpaid taxes owed to the IRS or state tax authorities, which can accumulate penalties and interest over time, complicating the financial situation further.

What are the common methods for resolving tax obligations?

Common methods for resolving tax obligations include payment plans, offers in compromise, and currently not collectible status. Approximately 40% of taxpayers utilize payment plans to manage their tax obligations.

Why is understanding IRS procedures important?

Familiarizing yourself with how the IRS operates, including their collection processes and your rights as a taxpayer, is vital. Effective communication with the IRS can significantly impact the resolution of your tax issues.

What steps should I take to assess my tax situation?

To assess your tax situation, you should gather relevant documentation, calculate your total debt including penalties and interest, evaluate your financial status, and identify available resolution options.

What should I include in the documentation I gather?

You should collect all relevant tax materials, including previous tax returns, notifications from the IRS, and any communication related to your tax obligations.

How can I calculate my total tax debt?

Determine the total amount owed, including any penalties and interest, to get a clear picture of your financial obligation. On average, individuals in the U.S. owe around $16,000 in tax obligations.

What should I evaluate when analyzing my financial status?

Analyze your income, expenses, and assets to understand your ability to pay off the debt, which will help you decide on feasible options for tax debt resolution.

What options are available for tax debt resolution?

Options include installment agreements, offers in compromise, and seeking penalty relief. Each option has its risks and benefits, so it's essential to assess which aligns best with your monetary objectives and repayment capabilities.

How can I avoid scams in the tax resolution industry?

Be cautious of high charges from tax settlement services and look for warning signs of scams to protect yourself from economic damage.

What is the significance of maintaining compliance with tax obligations?

Maintaining compliance with tax obligations is important to prevent future issues and to ensure you are in a better position to manage your tax responsibilities effectively.