Introduction

Navigating the complexities of Social Security Disability Insurance (SSDI) and its retroactive pay can feel overwhelming, especially for those facing financial uncertainty due to disabilities. We understand that this essential program is meant to provide crucial support, yet the specific rules surrounding retroactive payments can significantly impact your financial stability.

It’s common to feel confused about how to calculate SSDI retroactive pay and the timeline for receiving benefits. Many individuals share this struggle, and it’s important to know that you’re not alone in this journey. How can you ensure that you fully understand your entitlements and overcome the challenges associated with this vital assistance?

We’re here to help you navigate these waters with clarity and compassion.

Define SSDI and Retroactive Pay

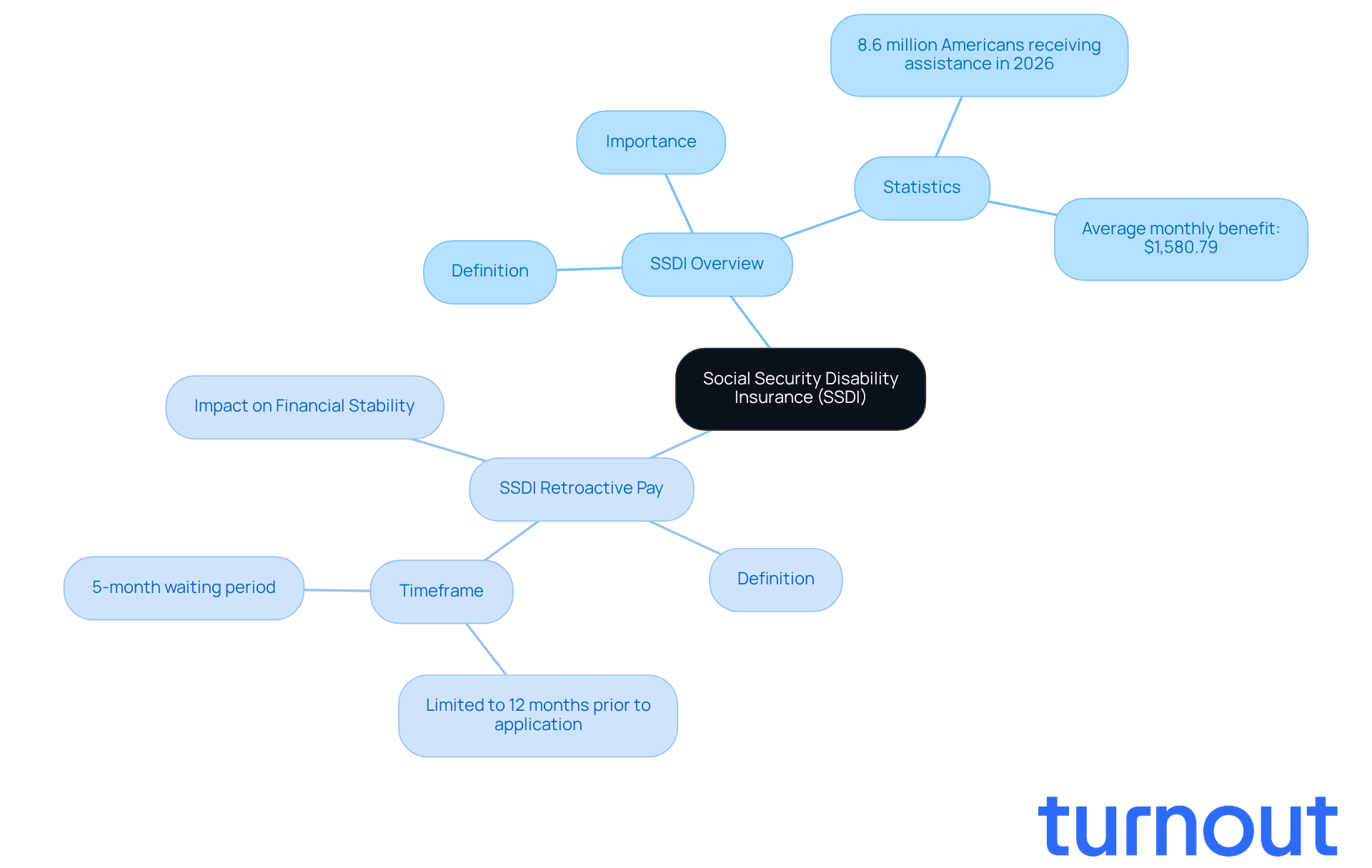

Social Security Disability Insurance is a vital federal program that provides financial support to those who can’t work due to a qualifying disability. We understand that navigating this system can be overwhelming, especially when it comes to understanding SSDI retroactive pay. This compensation covers the months before you submitted your application, specifically for the time when you qualified but hadn’t yet started receiving payments.

In 2026, around 8.6 million Americans will be receiving disability assistance, highlighting just how crucial this program is for many. It’s common to feel uncertain about how these benefits work, but knowing about Social Security Disability Insurance and SSDI retroactive pay can make a significant difference in your experience. These elements directly impact the amount and timing of the payments you receive.

For instance, SSDI retroactive pay is typically limited to 12 months before your submission date. However, back pay can extend beyond that, covering the period from your submission date to when your claim is approved. This can greatly influence your financial stability, especially for those who successfully navigate the claims process.

Remember, you’re not alone in this journey. We’re here to help you understand your options and ensure you receive the support you deserve.

Calculate SSDI Retroactive Pay Amounts

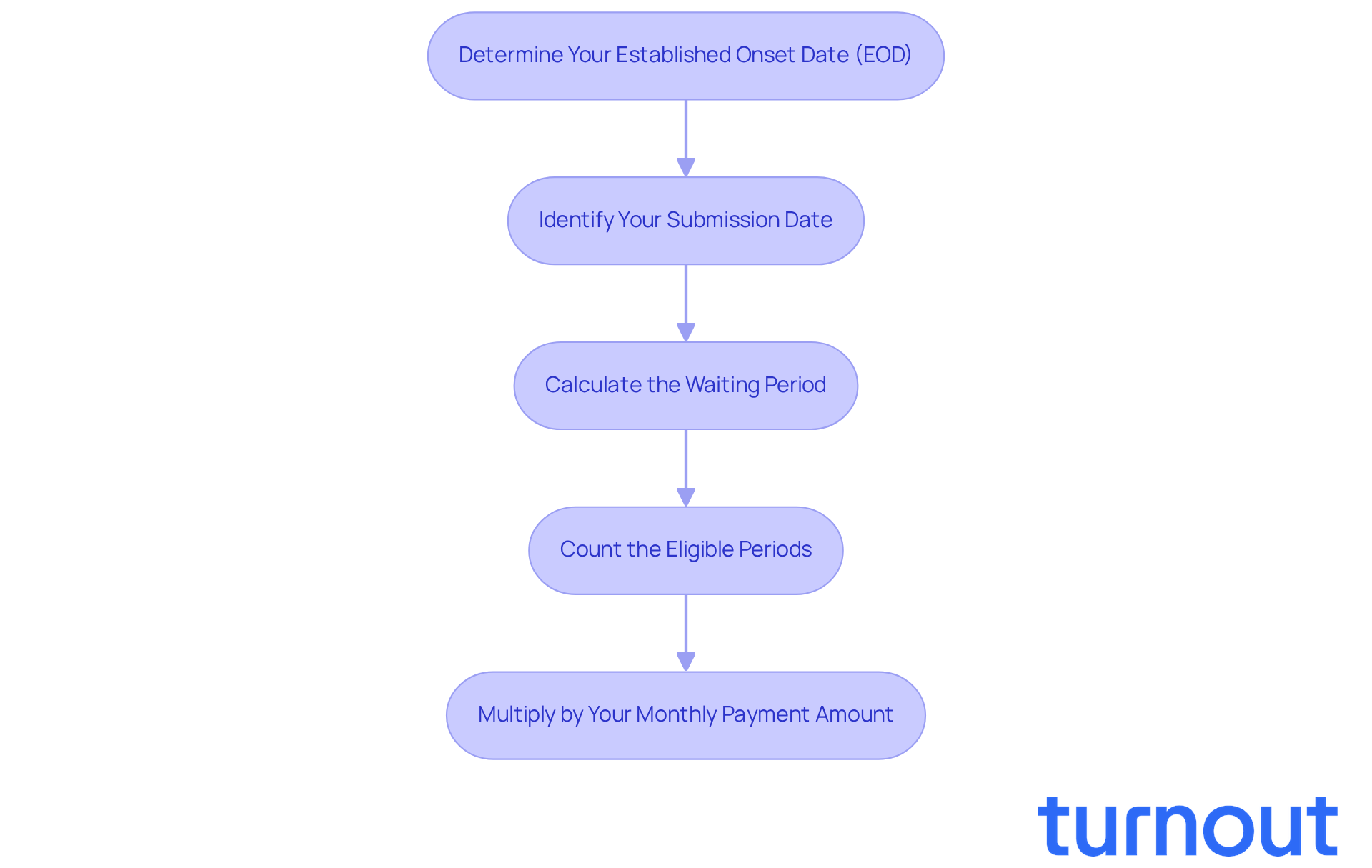

Calculating your ssdi retroactive pay might seem overwhelming, but we're here to assist you with it. Follow these steps to ensure you understand the process and what you might be entitled to:

- Determine Your Established Onset Date (EOD): This is the date the Social Security Administration (SSA) recognizes as the start of your disability. Knowing this date is crucial for your calculations.

- Identify Your Submission Date: This is when you submitted your request for disability benefits. It marks the beginning of your journey toward receiving support.

- Calculate the Waiting Period: SSDI includes a mandatory five-month waiting period starting from your EOD. During this time, you won’t receive benefits, but it’s an important part of the process.

- Count the Eligible Periods: Look at the intervals from your EOD to your submission date, excluding that five-month waiting period. You can receive ssdi retroactive pay for up to 12 months before your application date, so it’s important to count carefully.

- Multiply by Your Monthly Payment Amount: Once you have the count of eligible periods, multiply this by your approved monthly SSDI payment amount. This will give you your total retroactive compensation.

For example, if your EOD is January 1, 2024, and you applied on June 1, 2024, you would count the intervals from January to May (5 intervals) and then begin counting from June, leading to 7 periods of retroactive pay eligible for calculation. This method helps you accurately evaluate the benefits owed to you, which can significantly impact your financial stability.

Remember, you are not alone in this journey. Recipients of disability benefits can receive ssdi retroactive pay for up to 12 months prior to the submission date. Organizations like Turnout utilize trained nonlawyer advocates to help you navigate this process effectively, ensuring you understand how back pay rules apply to your individual case. We understand that this can be a lot to take in, but with the right support, you can manage it.

Understand the Timeline for Receiving Benefits

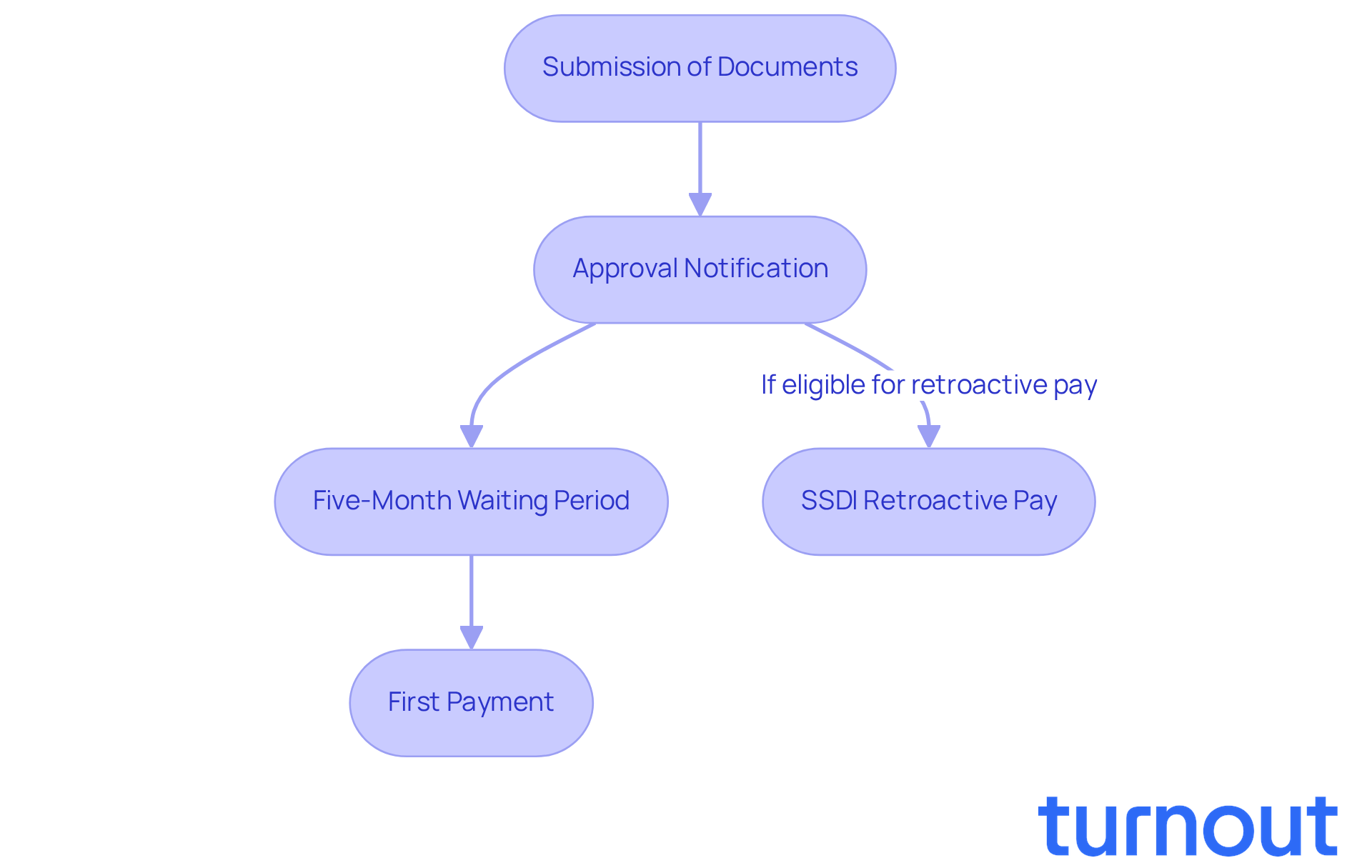

Navigating the timeline for receiving SSDI benefits can feel overwhelming, but understanding each stage can help ease your concerns. Here’s what to expect:

-

Submission of Documents: Once you send your request, the Social Security Administration (SSA) begins processing it. Currently, the average processing time is around 6 to 8 months. However, many applicants face longer waits due to backlogs. We understand that this can be frustrating.

-

Approval Notification: If your application is approved, you’ll receive a notification detailing your payment amount and when your payments will start. As of November 2023, the average wait for a decision was about 225 SSDI retroactive pay days, which is an increase of 86% since 2019. It’s common to feel anxious during this waiting period.

-

Five-Month Waiting Period: Remember, benefits won’t start until after a mandatory five-month waiting period from your Established Onset Date (EOD). So, even if your claim is approved, you won’t receive payments until this time has passed. This can be a tough wait, but it’s a necessary step.

-

First Payment: Your first disability payment will arrive in the sixth month following your EOD. For example, if your EOD is January 1, 2025, you can expect your first payment in June 2025. Knowing this can help you plan ahead.

-

SSDI retroactive pay: If you qualify for SSDI retroactive pay, you’ll typically receive this amount as a lump sum shortly after your approval notification, usually within 60 days. This can provide some relief during the waiting period.

Understanding this timeline is crucial for managing your expectations and planning your financial future effectively. Remember, you’re not alone in this journey, and we’re here to help you every step of the way.

Address Common Challenges and Misconceptions

Navigating the disability benefits process can feel overwhelming, and it’s completely normal to have concerns. Let’s explore some common issues together:

-

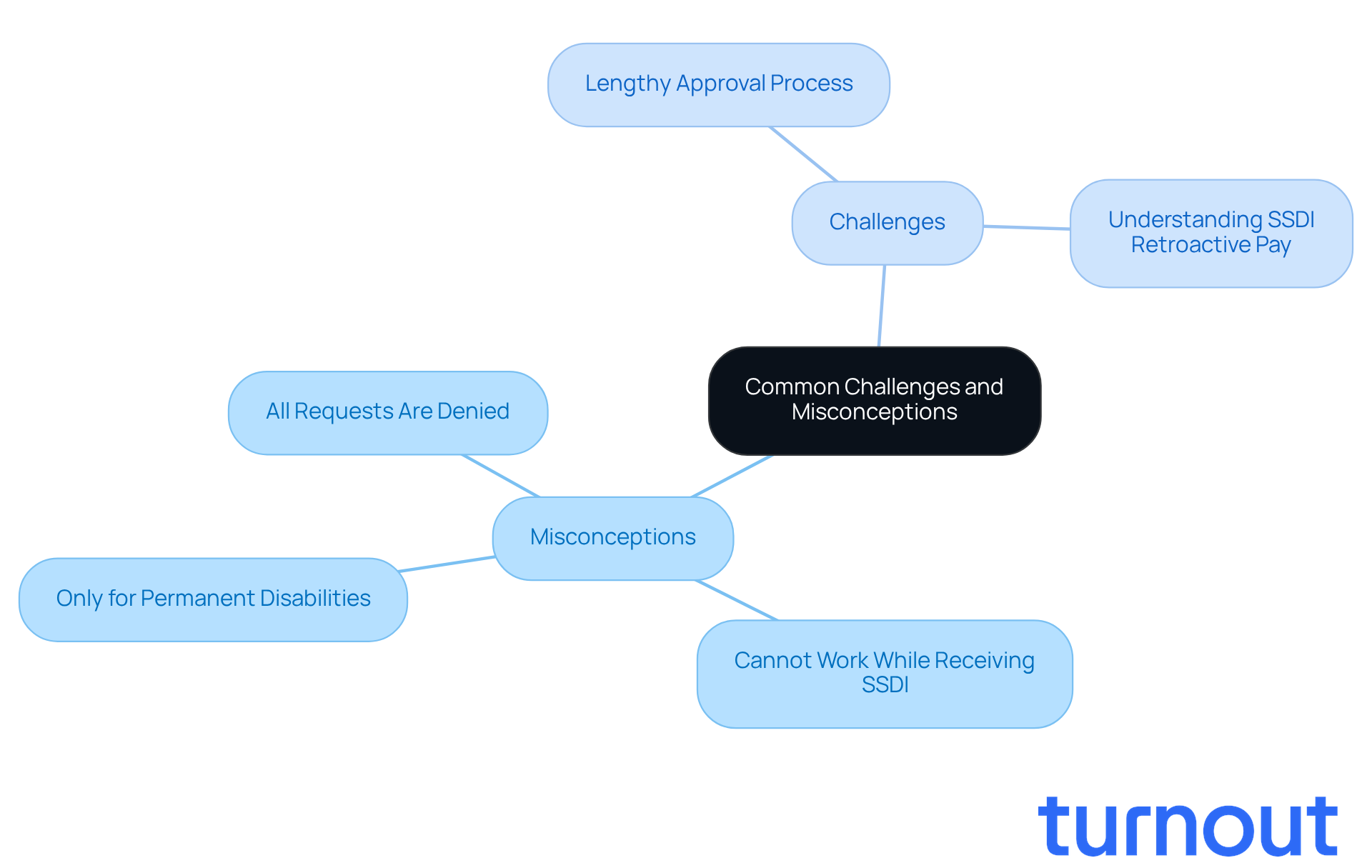

Misconception: Social Security Disability Insurance is only for permanent disabilities. Many people think this program is just for permanent disabilities. The truth is, it also covers temporary disabilities that keep you from working for a significant time. This means a wider range of conditions can qualify.

-

Challenge: Lengthy Approval Process. The approval process for disability benefits can take several months. It’s important to be prepared for this timeline and stay hopeful. Many who face delays eventually receive the assistance they need.

-

Misconception: You Cannot Work While Receiving SSDI. Some believe that any work disqualifies them from SSDI. In reality, there are work incentives and programs that allow you to work while still receiving benefits. This can help ease your transition back into the workforce.

-

Challenge: Understanding SSDI retroactive pay. Many applicants find SSDI retroactive pay confusing. It’s essential to understand that retroactive pay is based on your determined onset date (EOD) and submission date. This can significantly impact your financial situation and planning.

-

Misconception: All Requests Are Denied. While it’s true that initial denial rates for disability benefits range from 31% to 36%, this doesn’t mean yours will be denied. By understanding the process and preparing your application thoroughly, you can greatly improve your chances of approval.

By addressing these challenges and misconceptions, you can approach the SSDI process with a clearer understanding and greater confidence. Remember, you’re not alone in this journey, and we’re here to help.

Conclusion

Navigating the complexities of SSDI and its retroactive pay can feel overwhelming. We understand that for many, this program is a lifeline, providing essential financial support for those unable to work due to disabilities. It’s not just about receiving benefits; it’s also about ensuring you get compensated for the time you qualified before your application was approved. By understanding the intricacies of SSDI retroactive pay, you can manage your expectations and plan your finances more effectively.

Throughout this article, we highlighted key points that matter to you. We discussed:

- How retroactive pay amounts are calculated

- The timeline for receiving benefits

- The common challenges you might face during the application process

Remember, SSDI retroactive pay is typically limited to 12 months before your application date. Understanding the waiting periods and approval timelines is crucial for your financial stability. By addressing misconceptions and challenges, you can navigate the SSDI system with greater confidence.

Ultimately, being informed about SSDI retroactive pay and the overall benefits process can significantly impact your financial future. We encourage you to seek support and resources to guide you through this journey. By overcoming challenges and misconceptions, you can secure the benefits you deserve and pave the way for a more stable financial outlook. Remember, you are not alone in this journey; we’re here to help.

Frequently Asked Questions

What is SSDI?

Social Security Disability Insurance (SSDI) is a federal program that provides financial support to individuals who cannot work due to a qualifying disability.

What is SSDI retroactive pay?

SSDI retroactive pay is compensation that covers the months before you submitted your application, specifically for the time when you qualified but had not yet started receiving payments.

How many Americans are expected to receive disability assistance in 2026?

In 2026, around 8.6 million Americans are expected to be receiving disability assistance.

How does SSDI retroactive pay affect my payments?

SSDI retroactive pay can significantly impact the amount and timing of the payments you receive, as it covers the time you qualified for benefits before your application was submitted.

How long can SSDI retroactive pay be applied?

SSDI retroactive pay is typically limited to 12 months before your submission date, but back pay can extend beyond that, covering the period from your submission date to when your claim is approved.

Why is understanding SSDI and retroactive pay important?

Understanding SSDI and retroactive pay is important because it can greatly influence your financial stability, especially for those navigating the claims process.