Introduction

Understanding Social Security Disability Insurance (SSDI) is crucial for millions of Americans who rely on it for financial stability during tough times. We understand that navigating this federal program can feel overwhelming, especially when it comes to the complex calculations of benefit amounts. It’s common to feel confused about what factors truly influence SSDI payments.

This program provides essential support for individuals unable to work due to long-term medical conditions. So, how can you ensure you receive the maximum benefits you’re entitled to? This article delves into the intricacies of SSDI benefit calculations, offering valuable insights and guidance to help you navigate the system effectively. Remember, you are not alone in this journey; we're here to help.

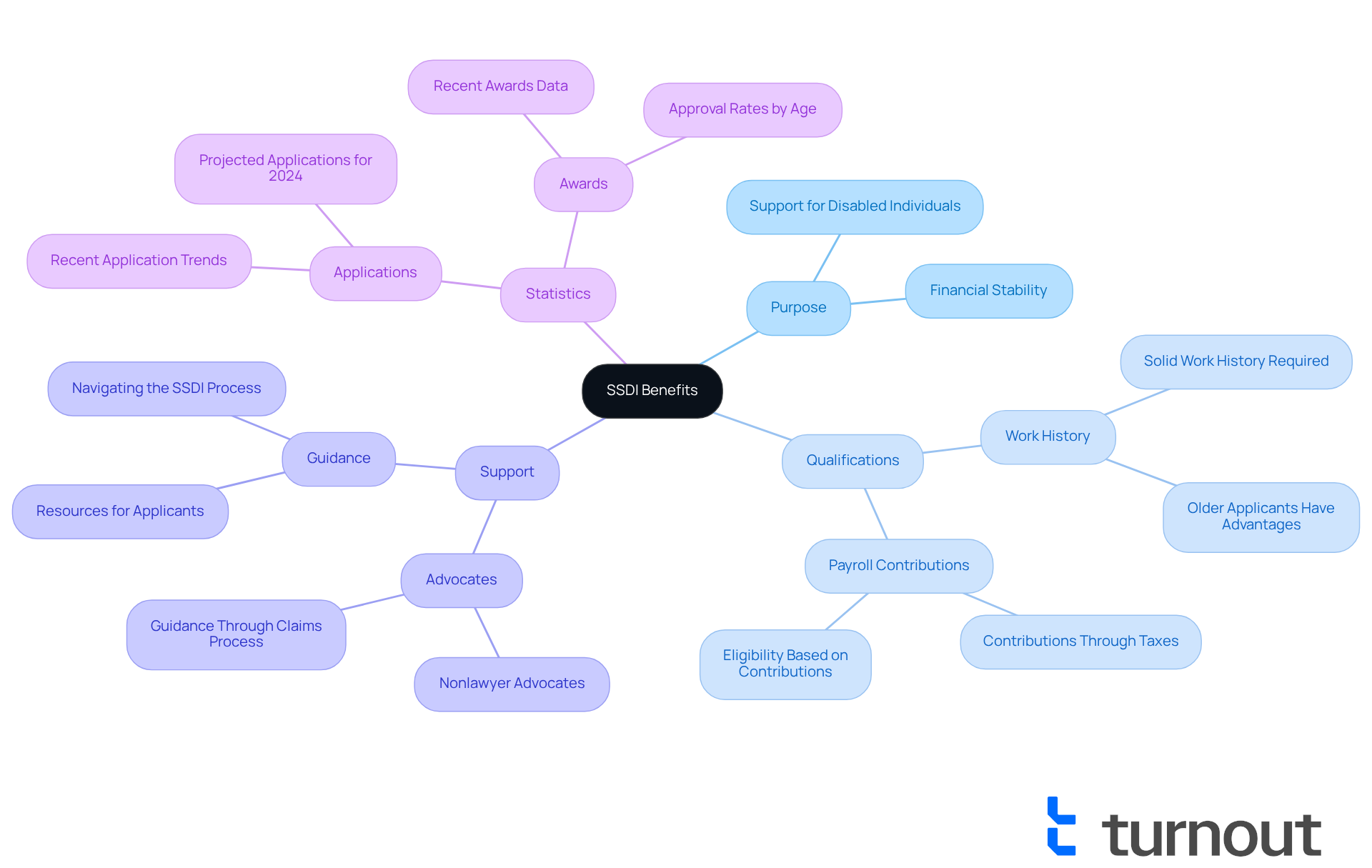

Explore the Basics of SSDI Benefits

Social Security Disability Insurance is a vital federal program designed to support individuals who can’t work due to a medical condition that is expected to last at least a year or lead to death. We understand that applying for disability benefits can feel overwhelming, especially when you’re already facing challenges. To qualify, applicants need to demonstrate a solid work history and show that they’ve contributed to Social Security through payroll taxes. This program aims to assist those who have actively participated in the workforce, ensuring they receive the necessary support during tough times.

As of 2025, millions of Americans rely on the SSDI benefit amount, highlighting its crucial role in providing financial stability for those with disabilities. Understanding the basics of this insurance is essential for navigating the often-complex world of disability support. That’s where Turnout comes in. We’re here to help simplify this process by connecting you with trained nonlawyer advocates who can guide you through your SSD claims. They ensure you’re well-informed and supported every step of the way.

It’s important to note that Turnout does not provide legal representation, but our advocates empower you to make informed decisions about your claims. With the significant number of applications and awards in recent months - like the 167,328 applications and 115,111 awards reported in November 2024 - having the right support is more important than ever. Remember, you are not alone in this journey. We’re here to help you navigate the process with confidence.

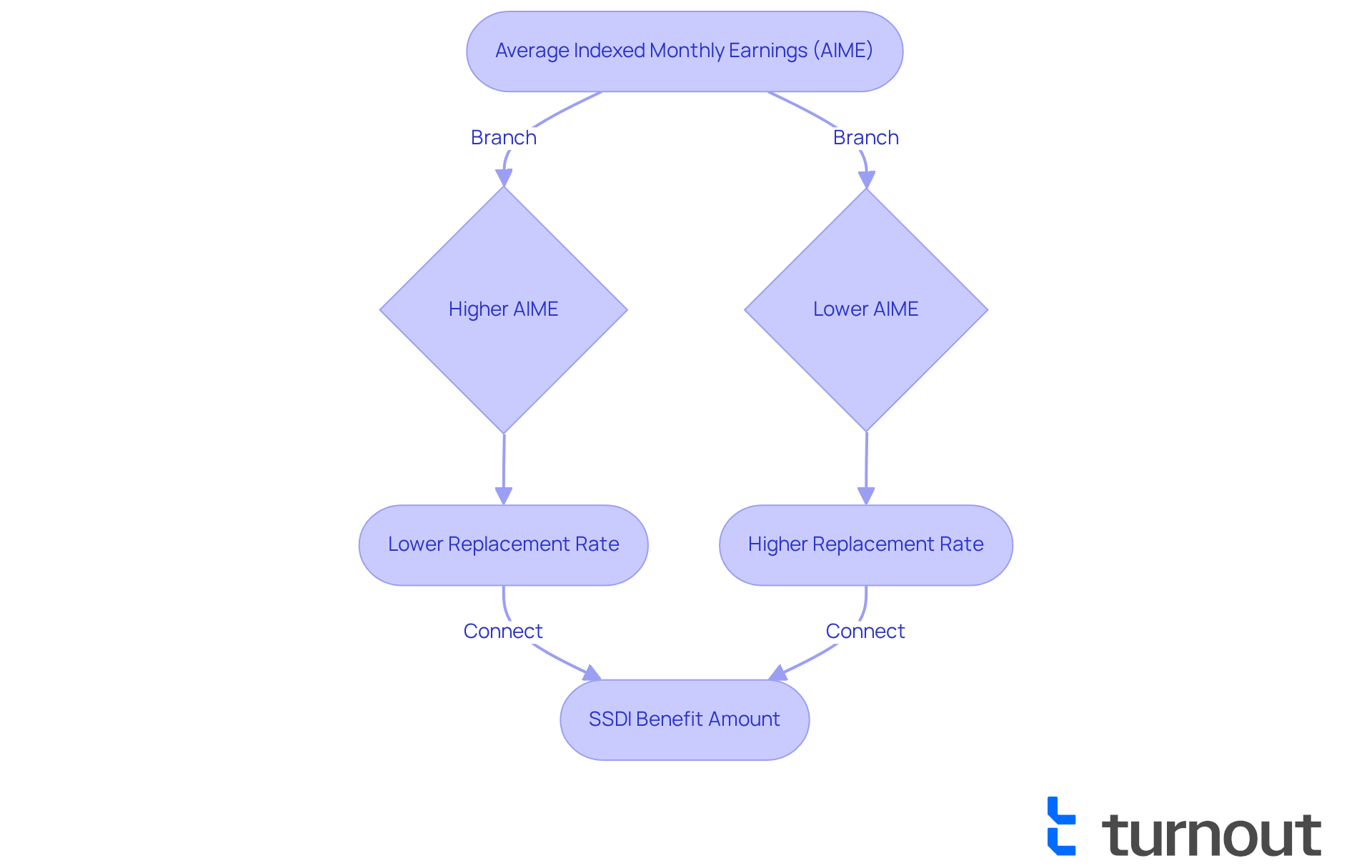

Understand How SSDI Benefit Amounts Are Calculated

Navigating the world of SSDI assistance can feel overwhelming, and we understand that many of you may have concerns about the SSDI benefit amount that you can expect. The SSDI benefit amount you receive is primarily influenced by your Average Indexed Monthly Earnings (AIME), which reflects your income throughout your working years, adjusted for inflation. The Social Security Administration (SSA) uses a specific formula to calculate your Primary Insurance Amount (PIA), which determines your SSDI benefit amount for monthly payments. Generally, a higher AIME correlates with a larger SSDI benefit amount. For 2025, the SSDI benefit amount is projected to be around $4,018 per month at maximum, while the average SSDI benefit amount is approximately $1,586. Understanding this calculation is essential for you to accurately estimate the SSDI benefit amount for your potential financial support.

To illustrate, let’s consider an example. If your AIME is calculated at $2,500, your monthly payment would be determined by the SSA's formula, which tends to favor lower earners with a more generous payment structure. This means that individuals with lower lifetime earnings might receive a greater percentage of their pre-disability income when considering the SSDI benefit amount compared to those with higher earnings. For instance, someone with an AIME of $1,800 could receive a payout that replaces a significant portion of their former income, while a person with an AIME of $3,000 may find their replacement rate to be lower.

The SSA's calculation methods are thoughtfully designed to ensure that your entitlements, such as the SSDI benefit amount, reflect your work history and contributions to the system. Therefore, grasping how AIME influences disability assistance is crucial for you to manage your financial planning effectively. Remember, you are not alone in this journey, and understanding these details can empower you to make informed decisions about your future.

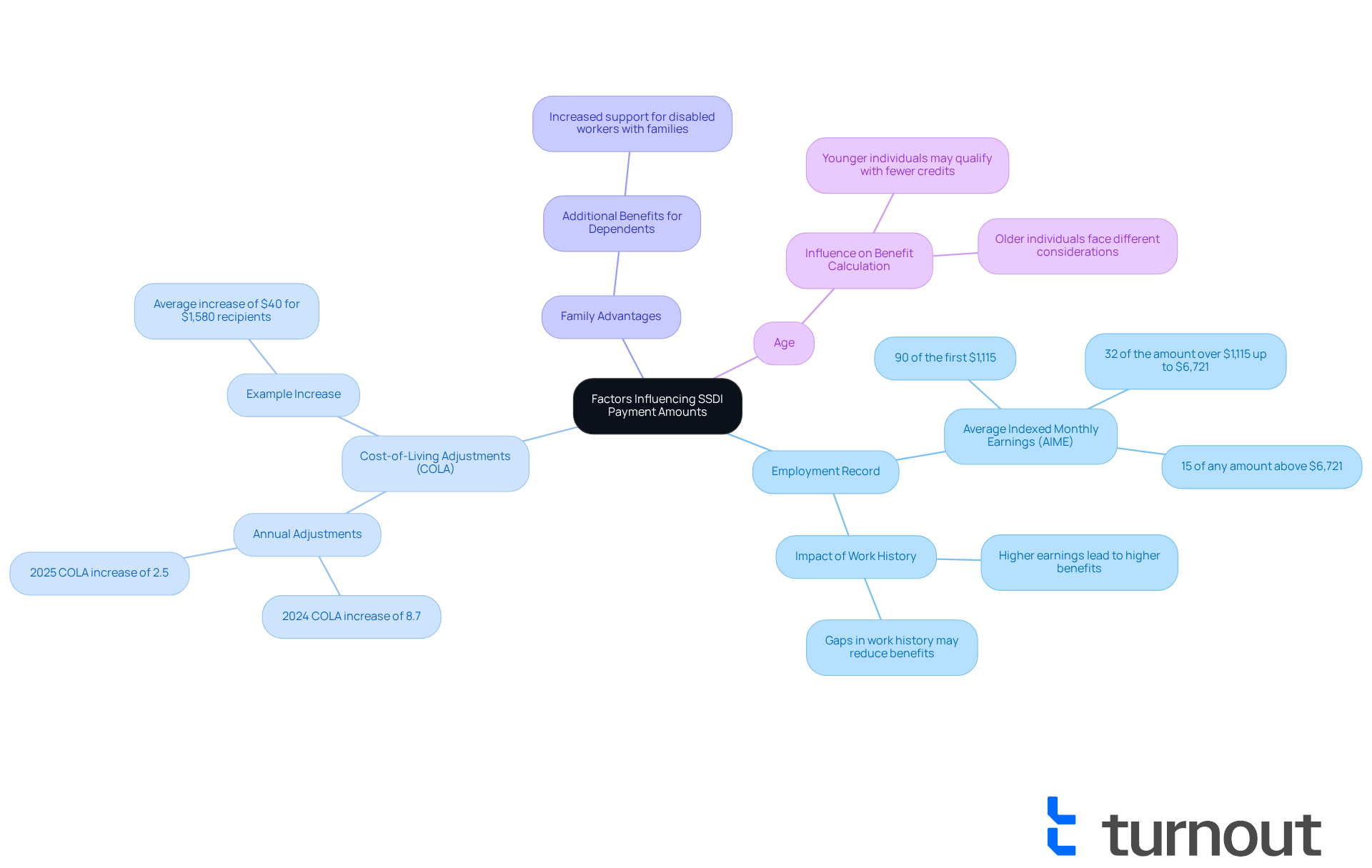

Identify Factors Influencing SSDI Payment Amounts

Understanding the factors that influence your ssdi benefit amount can feel overwhelming, but you’re not alone in this journey. Several key elements can significantly impact the ssdi benefit amount you receive, and we’re here to help you navigate through them.

-

Employment Record: Your employment history plays a vital role in determining your Average Indexed Monthly Earnings (AIME), which directly affects your disability benefits. The Social Security Administration (SSA) uses a specific formula that applies different percentages to portions of your AIME: 90% of the first $1,115, 32% of the amount over $1,115 up to $6,721, and 15% of any amount above $6,721. This tiered approach ensures that individuals with lower lifetime earnings receive a greater percentage of the ssdi benefit amount, making your work history a crucial factor in calculating your benefits.

-

Cost-of-Living Adjustments (COLA): It’s comforting to know that the SSDI benefit amount is adjusted annually to keep pace with inflation. This means the ssdi benefit amount you receive monthly can increase over time. For example, in 2025, beneficiaries will see a 2.5% increase in their payments, which translates to an average rise of about $40 per month for those receiving around $1,580.

-

Family Advantages: If you have dependents, you may be eligible for additional benefits, which can significantly raise your total assistance. For instance, a disabled worker with a partner and children might notice a considerable increase in their monthly support, which could affect their ssdi benefit amount, reflecting the extra help needed for family members.

-

Age: Your age at the time of disability can also influence how your benefits are calculated. Younger individuals may qualify for disability insurance with fewer credits, while those closer to retirement age might face different considerations in their benefit assessment.

Recognizing these factors is essential for predicting the ssdi benefit amount. Individuals with a strong employment background often secure greater advantages, while those with gaps in their work history may face challenges. Keeping detailed records of your employment and income is crucial; it strengthens your case for eligibility and helps you manage the complexities of the application process. Remember, you’re not alone in this - we’re here to support you every step of the way.

Examine the Impact of SSDI on Retirement and Other Income

Receiving disability payments can feel overwhelming, especially when considering your future. We understand that many worry about how these payments might affect your retirement funds. The good news is that they don’t! In fact, when you reach full retirement age, your disability payments automatically convert to retirement payments. This means the SSDI benefit amount you receive from Social Security Disability Insurance remains consistent, providing you with stability during this transition.

Moreover, it’s comforting to know that SSDI benefits are not counted as income when determining eligibility for other government assistance programs. This allows you to receive additional support without risking your SSDI payments. However, it’s important to keep in mind that other income sources, like pensions or investment income, could impact your overall financial situation.

Understanding these interactions is crucial for effective financial planning. You’re not alone in this journey, and we’re here to help you navigate these complexities. Take a moment to reflect on your financial landscape and consider how these benefits can work for you.

Conclusion

Understanding the complexities of Social Security Disability Insurance (SSDI) benefits is crucial for anyone facing the challenges of disability. This program not only offers vital financial support but also highlights the significance of your work history and contributions. By learning how SSDI benefit amounts are calculated and what factors influence these calculations, you can better prepare for your financial future.

Key insights reveal that the SSDI benefit amount is primarily determined by Average Indexed Monthly Earnings (AIME). Various factors, such as your employment record, cost-of-living adjustments, family considerations, and age, all play a significant role in shaping the monthly support you receive. This ensures that the system is fair and responsive to the needs of those who have contributed.

Ultimately, understanding SSDI benefits goes beyond just numbers; it’s about finding peace of mind during tough times. We encourage you to take proactive steps in gathering your employment records and seeking guidance on your claims. By doing so, you empower yourself to navigate the complexities of SSDI, ensuring you receive the support you deserve while planning for a stable financial future.

Remember, you are not alone in this journey. We're here to help you every step of the way.

Frequently Asked Questions

What is SSDI?

Social Security Disability Insurance (SSDI) is a federal program designed to support individuals who cannot work due to a medical condition expected to last at least a year or lead to death.

Who qualifies for SSDI benefits?

To qualify for SSDI benefits, applicants need to demonstrate a solid work history and show that they have contributed to Social Security through payroll taxes.

Why is SSDI important?

SSDI is crucial as it provides financial stability for millions of Americans with disabilities, helping them during tough times when they cannot work.

How can Turnout assist with the SSDI application process?

Turnout connects individuals with trained nonlawyer advocates who can guide them through the SSD claims process, ensuring they are well-informed and supported.

Does Turnout provide legal representation for SSDI claims?

No, Turnout does not provide legal representation, but their advocates empower individuals to make informed decisions about their claims.

What was the volume of SSDI applications and awards reported recently?

In November 2024, there were 167,328 SSDI applications and 115,111 awards reported.

How can individuals feel supported during the SSDI application process?

Individuals can feel supported by utilizing the services of advocates from Turnout, who help navigate the complex process and provide guidance along the way.