Introduction

Navigating the complexities of Social Security Disability Insurance (SSDI) can feel overwhelming. We understand that many individuals face uncertainty, especially when it comes to the nuances of back pay. This retroactive compensation is crucial for those awaiting benefits, as it covers the period from when their disability began until their application is approved.

By exploring the step-by-step calculation process, you can gain valuable insights into determining your SSDI back pay. This knowledge empowers you to manage your financial expectations effectively. However, it’s common to encounter challenges—like misreported dates and application delays. So, how can you ensure that you accurately calculate what you are owed?

You're not alone in this journey. We're here to help you navigate these complexities with confidence.

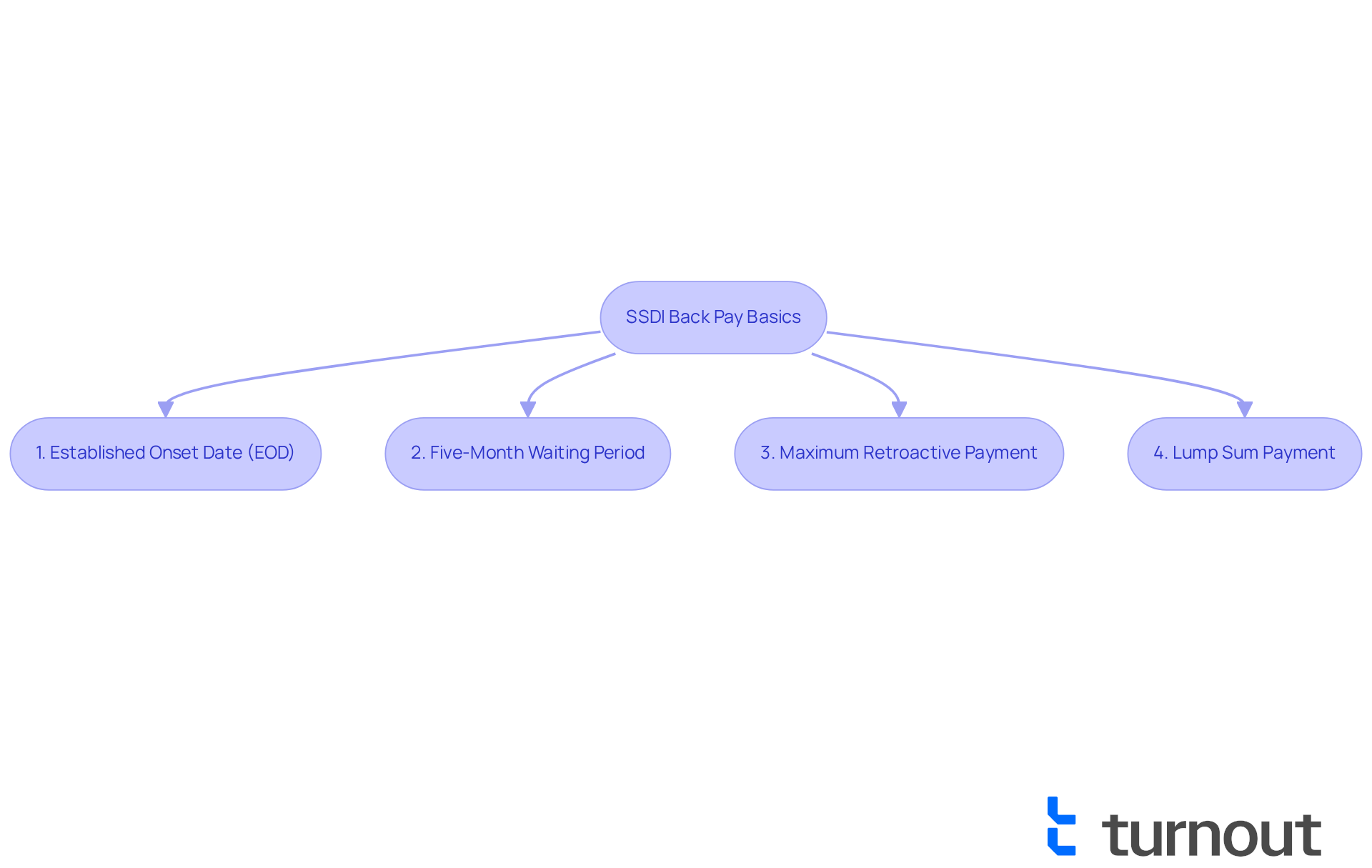

Understand SSDI Back Pay Basics

Navigating the world of Social Security Disability Insurance (SSDI) can be overwhelming, especially when it comes to understanding retroactive pay. This compensation represents the SSDI backpay owed to individuals who qualify for SSDI benefits, covering the period from the established onset date (EOD) of the disability until your application is approved. Let’s break down some key points to help you feel more informed and supported:

- Established Onset Date (EOD): This is the date when your disability began. Knowing this date is crucial for calculating your SSDI backpay amounts.

- Five-Month Waiting Period: It’s important to note that disability benefits don’t kick in until five months after the EOD. This means that calculations for SSDI backpay will start only after this waiting period.

- Maximum retroactive payment for SSDI backpay can cover up to 12 months before your application date, provided your disability onset date falls within that timeframe.

- Once approved, you typically receive your SSDI backpay as a lump sum retroactive payment. Depending on how long you waited and your monthly benefit amount, this can be a significant sum.

In 2025, the average amount of retroactive payment varies based on individual circumstances. Understanding these foundational elements can empower you to navigate the process more effectively. We understand that recent changes in regulations have simplified the payment process, ensuring that beneficiaries receive their owed amounts more efficiently.

It’s common to feel overwhelmed by the intricacies of disability insurance retroactive payments. Remember, you’re not alone in this journey. Seeking help can clarify your specific circumstances and make the process smoother. We’re here to help you every step of the way.

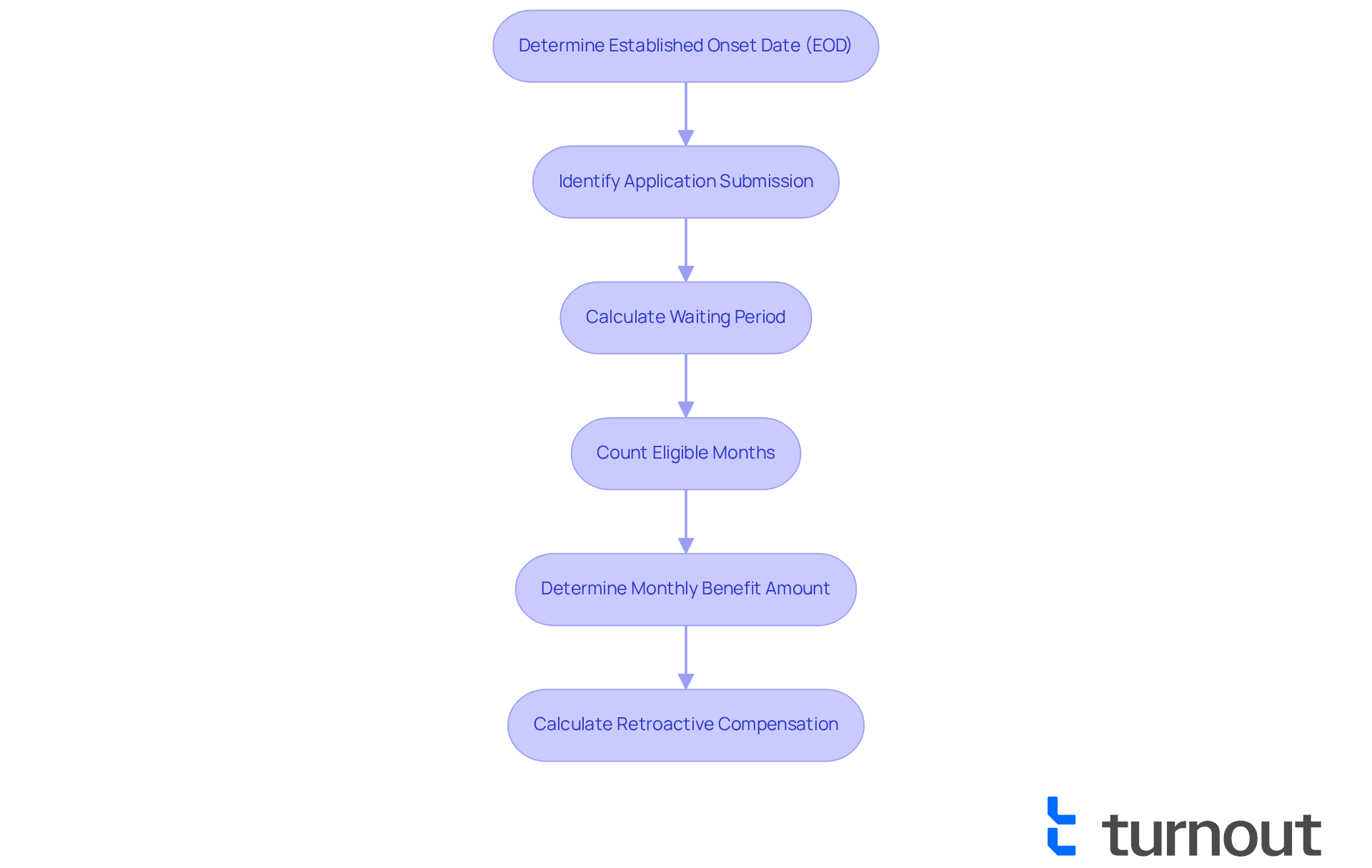

Follow the Step-by-Step Calculation Process

Calculating your ssdi backpay can feel overwhelming, but with the support of Turnout and our trained nonlawyer advocates, you’re not alone in this journey. Here’s a simple guide to help you through the process:

- Determine Your Established Onset Date (EOD): This is the moment when your disability began. Knowing this date is crucial for your calculation.

- Identify Your Application Submission: Take note of when you submitted your SSDI application. This helps you understand the timeline of your benefits.

- Calculate the Waiting Period: Subtract five months from your EOD. This is the time during which you won’t receive benefits, and it’s important to factor this in.

- Count the Eligible Months: Count the months from the end of the waiting period to when your application was approved. This period is what will qualify you for ssdi backpay.

- Determine Your Monthly Benefit Amount: Check your SSDI benefit amount, which is based on your work history and earnings.

- Calculate Retroactive Compensation: Multiply your monthly benefit amount by the number of months you qualify for retroactive pay (the total months counted in step 4). This gives you the total amount of ssdi backpay you can expect to receive.

For example, if your EOD is January 1, 2024, your application date is March 1, 2025, and your monthly benefit is $1,500, your calculation would look like this:

- EOD: January 1, 2024

- Waiting period ends: June 1, 2024

- Approval date: March 1, 2025

- Eligible months for back pay: June 2024 to February 2025 (9 months)

- Total back pay: $1,500 x 9 = $13,500.

It’s important to remember that retroactive payments can significantly impact your financial situation. Typically, the monthly SSDI payment is around $1,200, which could lead to about $9,600 in SSDI backpay for an eight-month duration. Also, keep in mind that lawyer expenses can take up to 25% of your past earnings, which may affect the total sum you receive. SSDI backpay can only be awarded for up to 12 months prior to your application date, and it is common to experience delays in receiving compensation after approval. So, it’s wise to manage your expectations regarding the timing of payments.

By following this structured approach, you can navigate this process with greater confidence and plan for your financial future. Remember, we’re here to help you every step of the way.

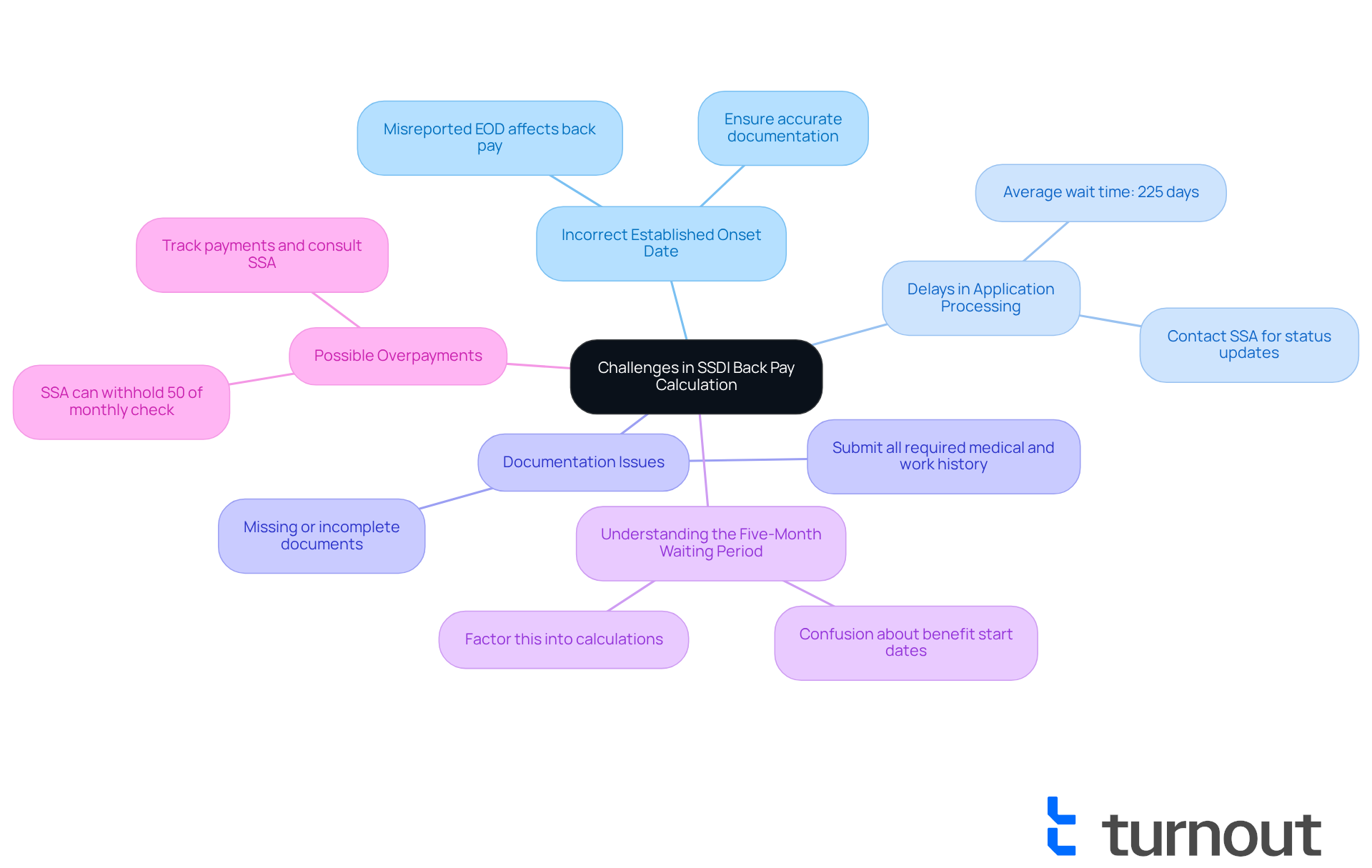

Navigate Common Challenges in Back Pay Calculation

When calculating SSDI back pay, we understand that you may face several challenges:

- Incorrect Established Onset Date: If your EOD is misreported, it can significantly affect the back pay amount. Make sure your EOD is accurately documented in your application.

- Delays in Application Processing: The disability benefits application process can be lengthy, with average wait times reported at 225 days as of November 2023. These delays might influence when you receive your SSDI back pay. It’s important to stay in contact with the SSA to check the status of your application.

- Documentation Issues: Missing or incomplete documentation can lead to delays or denials. Ensure that all required medical and work history documents are submitted with your application.

- Understanding the Five-Month Waiting Period: Many applicants are unaware of this waiting period, which can lead to confusion about when benefits begin. Be sure to factor this into your calculations.

- Possible Overpayments: If you receive retroactive payment and later find out you were overpaid, the SSA can withhold 50% of your monthly disability check. Keep track of your payments and consult with the SSA if you suspect an overpayment.

To help navigate these challenges, consider reaching out to a disability benefits advocate, like those provided by Turnout. They utilize trained nonlawyer advocates to assist with SSD claims. Remember, Turnout is not a law firm and does not provide legal advice. You might also find the SSDI back pay calculator on the SSA website to be a useful tool for confirming your calculations. Consulting knowledgeable professionals can significantly enhance your chances of a successful application and accurate back pay assessment. We're here to help, and you are not alone in this journey.

Conclusion

Understanding SSDI backpay is essential for anyone facing the challenges of Social Security Disability Insurance. This compensation not only offers financial relief but also represents the support owed to individuals from the moment their disability began. By grasping key components like the Established Onset Date, the five-month waiting period, and the calculation process, you can better prepare for the financial implications of your SSDI claims.

We understand that navigating this process can feel overwhelming. That’s why this article outlines a clear, step-by-step approach to calculating SSDI backpay. It emphasizes the importance of accurate dates and documentation. From determining your EOD to recognizing potential challenges, these insights equip you with the knowledge needed to confidently navigate your SSDI journey. Remember, while the process may seem daunting, there are resources and support systems available to help you overcome obstacles.

Ultimately, the journey toward securing SSDI backpay is not just about numbers; it’s about reclaiming your financial stability and peace of mind. Taking proactive steps, seeking assistance, and staying informed can significantly enhance your experience. For those facing the challenges of SSDI backpay, the message is clear: empowerment through knowledge is the key to overcoming hurdles and ensuring that the benefits owed to you are rightfully received. You are not alone in this journey; we’re here to help.

Frequently Asked Questions

What is SSDI back pay?

SSDI back pay refers to the retroactive compensation owed to individuals who qualify for Social Security Disability Insurance (SSDI) benefits, covering the period from the established onset date (EOD) of the disability until the application is approved.

What is the Established Onset Date (EOD)?

The Established Onset Date (EOD) is the date when your disability began. It is crucial for calculating your SSDI backpay amounts.

Is there a waiting period for SSDI benefits?

Yes, there is a five-month waiting period. Disability benefits do not begin until five months after the EOD, so SSDI backpay calculations start only after this waiting period.

How much retroactive payment can I receive for SSDI back pay?

The maximum retroactive payment can cover up to 12 months before your application date, provided your disability onset date falls within that timeframe.

How is SSDI back pay typically disbursed?

Once approved, you typically receive your SSDI backpay as a lump sum retroactive payment, which can be a significant amount depending on the duration of your wait and your monthly benefit amount.

How does the average amount of retroactive payment vary?

The average amount of retroactive payment varies based on individual circumstances, including the length of time waited and the specific benefit amounts.

What recent changes have affected the SSDI payment process?

Recent changes in regulations have simplified the payment process, ensuring that beneficiaries receive their owed amounts more efficiently.

What should I do if I feel overwhelmed by the SSDI back pay process?

If you feel overwhelmed, it’s recommended to seek help to clarify your specific circumstances and make the process smoother. Support is available to guide you through the journey.