Overview

This article serves as a comprehensive guide for those navigating the SSDI back pay processing center. We understand that understanding eligibility and applying for retroactive payments can feel overwhelming. That's why we detail the essential steps you should take to ensure a smoother process.

It's crucial to emphasize the importance of thorough documentation and proactive communication with the Social Security Administration. By doing so, you can minimize delays and maximize your chances of receiving the benefits you deserve. We share statistics on average payments and provide common troubleshooting advice to support you on this journey.

Remember, you are not alone in this process. We're here to help you every step of the way. Take a deep breath, and let’s explore how you can navigate this system effectively.

Introduction

Navigating the world of Social Security Disability Insurance (SSDI) can feel overwhelming. We understand that the intricacies of back pay can add to your stress.

For many individuals awaiting approval, the prospect of receiving retroactive payments—averaging over $6,700—can be a beacon of hope, potentially making the difference between financial stability and uncertainty.

This guide aims to support you in mastering the SSDI back pay processing center. We will explore:

- Eligibility criteria

- Application procedures

- Common pitfalls to avoid together

But what happens when delays and complications arise, threatening the timely receipt of these vital funds?

You're not alone in this journey, and we’re here to help.

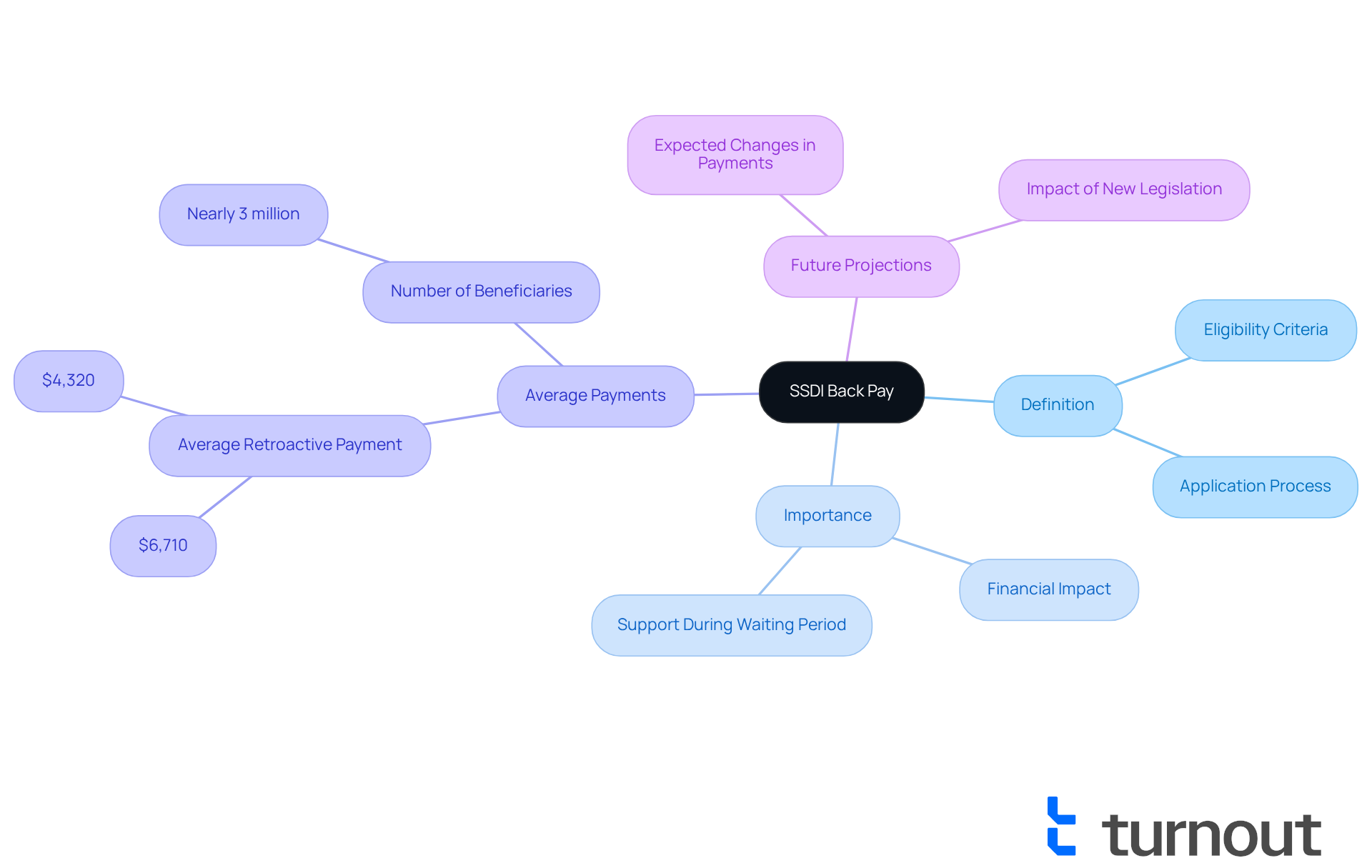

Understand SSDI Back Pay: Definition and Importance

SSDI retroactive payments refer to the payments owed to individuals who qualify for Social Security Disability Insurance benefits. This compensation covers the period from when an individual became eligible for benefits until their application is approved, including any mandatory waiting periods. Understanding the SSDI back pay processing center is essential, as it can significantly impact your financial situation during the often lengthy approval process.

For many, receiving an average of $6,710 in retroactive payments can provide crucial support during this waiting period. This amount is calculated from the established onset date of the disability, which is vital for determining the total owed. By grasping how retroactive pay works, applicants can navigate the SSDI process more effectively and set realistic expectations for their financial assistance.

In 2025, the importance of SSDI retroactive payments becomes even clearer, with nearly 3 million Americans expected to receive an average of $4,320 in delayed payments for benefits throughout the year. This financial assistance can be a lifeline, helping to cover living expenses and medical costs while awaiting regular benefits to commence. Therefore, understanding the details of the SSDI back pay processing center is not only beneficial but crucial for effective financial planning.

At our organization, we strive to simplify this process by connecting you with trained advocates who can assist you in navigating your SSD claims. It’s important to note that Turnout is not a law firm, and the information provided does not constitute legal advice. Our advocates are dedicated to ensuring you receive the support you need, without the complexities of legal representation. We’re here to help you every step of the way.

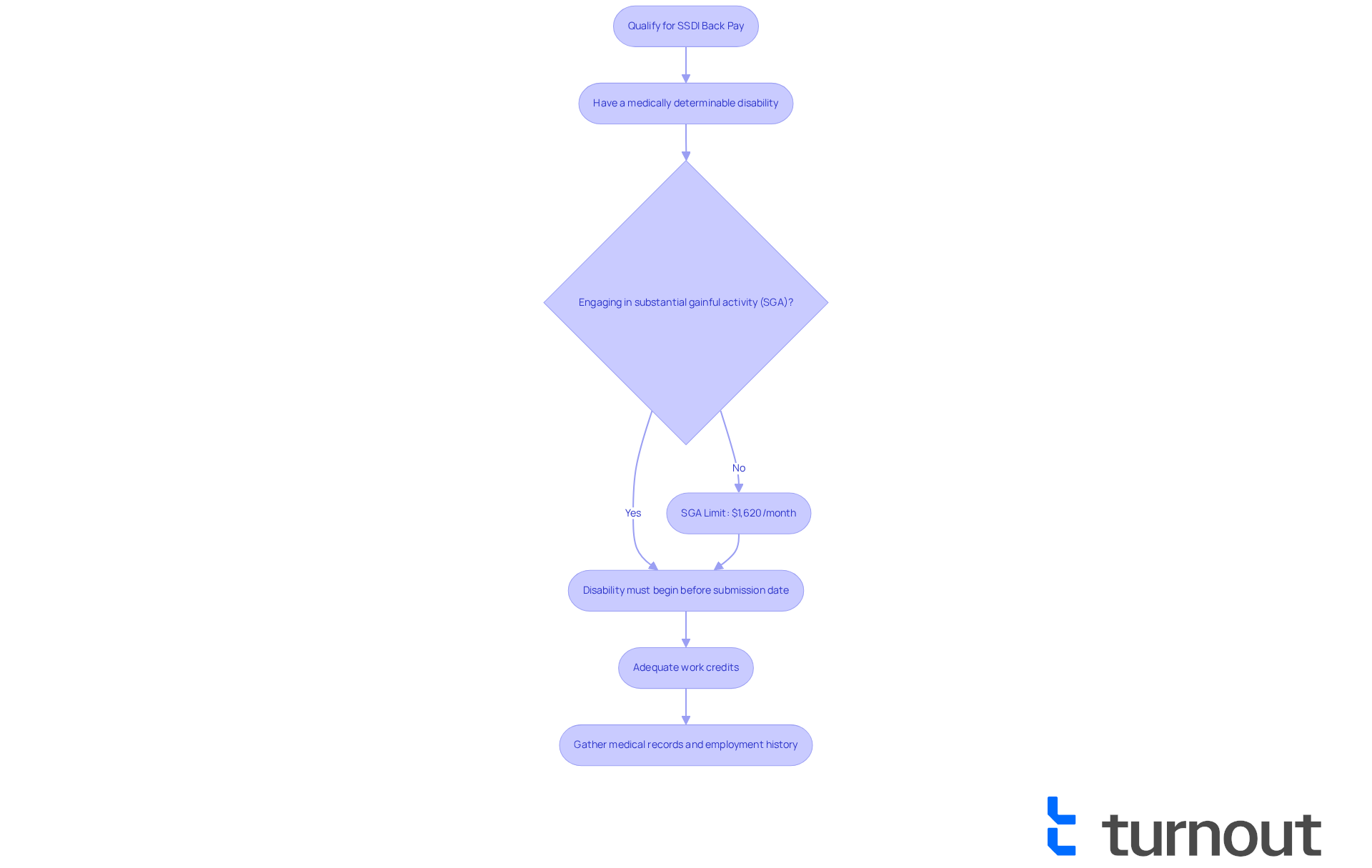

Determine Eligibility for SSDI Back Pay

To qualify for SSDI retroactive payment, it’s important to understand the specific eligibility criteria set by the Social Security Administration (SSA). First and foremost, you need to have a medically determinable disability that prevents you from engaging in substantial gainful activity (SGA). As of 2025, the SGA limit is $1,620 per month for non-blind individuals, reflecting an increase designed to accommodate inflation and changes in wages. Additionally, your disability must have begun prior to your submission date, and you need to have adequate work credits from your employment history. This typically means you should have worked a certain number of years and contributed to Social Security taxes during that time.

We understand that the process can feel overwhelming, especially with the mandatory five-month waiting period following your established onset date (EOD) before you can start receiving benefits. For instance, if your EOD is January 2024 and your application is accepted in January 2025, your retroactive pay would generally begin from June 2024.

To assess your eligibility for retroactive payment, it’s helpful to gather your medical records, employment history, and any documents that support your claim. This preparation is essential when applying for back pay, as it strengthens your case and helps ensure a smoother process. Remember, the 2025 cost-of-living adjustment (COLA) is 2.5%, which may influence the overall benefits you receive. Understanding these criteria and being well-prepared can significantly enhance your chances of receiving the benefits you deserve.

You are not alone in this journey. This organization is here to assist you, utilizing trained non-professional advocates who can provide support without forming a client-representative relationship. Please note that this organization is not a legal practice and does not offer legal guidance. We're here to help you navigate this process with compassion and understanding.

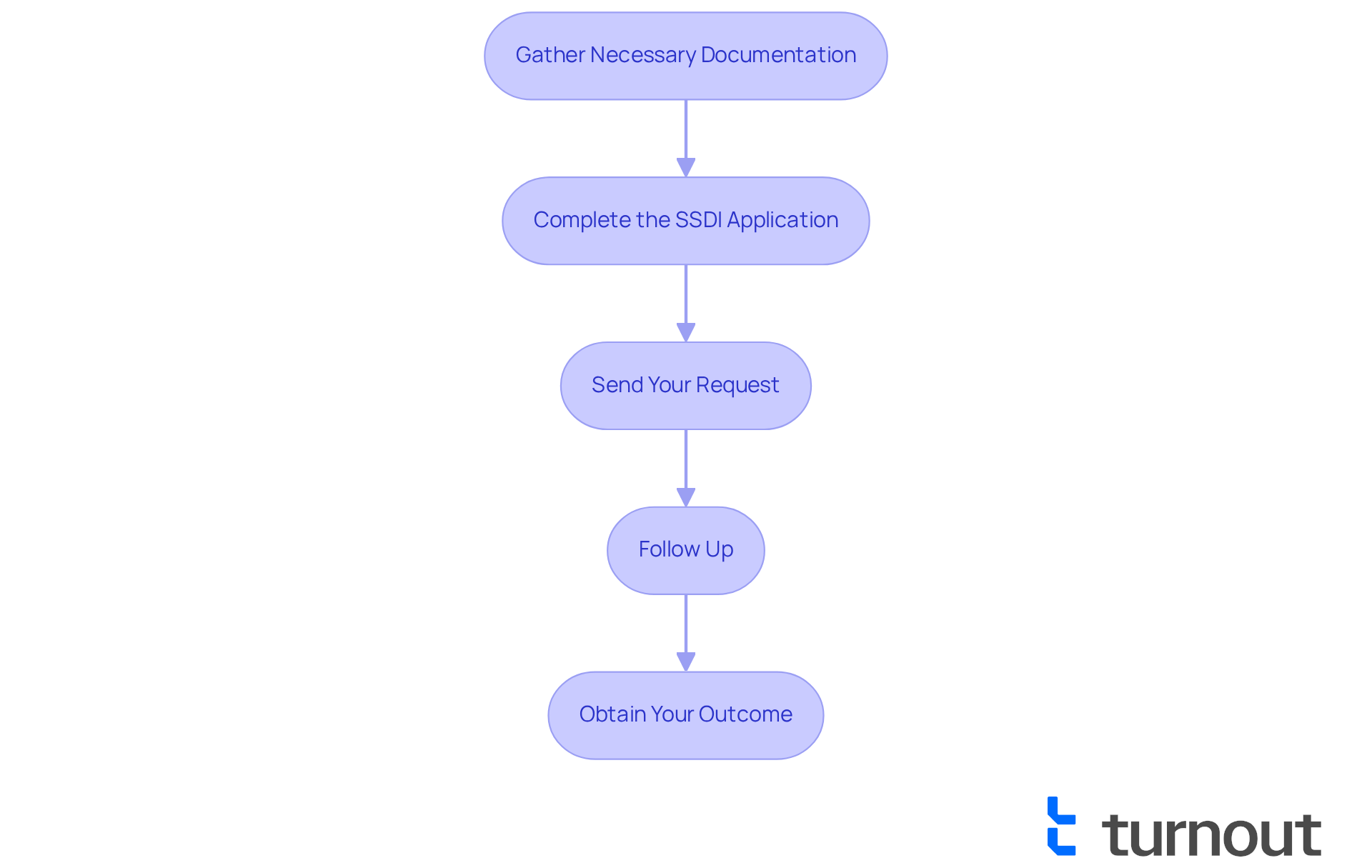

Apply for SSDI Back Pay: Step-by-Step Process

-

Gather Necessary Documentation: We understand that starting this process can feel overwhelming. Begin by collecting all relevant documents, such as medical records, proof of income, and your work history. It's vital to have proof of your disability onset date and any previous requests or rejections. This will effectively bolster your case. Participating in this step can help you understand which specific documents are required to enhance your submission.

-

Complete the SSDI Application: You are not alone in this journey. You can apply online through the SSA website, by phone, or in person at your local SSA office. Ensure that you fill out the form thoroughly, providing all requested information. This will help minimize the risk of delays in processing. The organization offers guidance through this process, assisting you in navigating the complexities without needing professional representation.

-

Send Your Request: After finalizing your submission, send it along with all supporting documents. Remember to keep copies of everything for your records, as this will be important for future reference. Trained nonlegal advocates can assist in ensuring that your submission is thorough and correct, providing you with peace of mind.

-

Follow Up: Once your application is submitted, it's important to regularly check its status. You can do this online or by contacting the SSA directly. We encourage you to be proactive in addressing any requests for additional information, as this can help expedite the process. Staying engaged and informed throughout this stage is crucial.

-

Obtain Your Outcome: After processing, you will receive a determination regarding your eligibility for SSDI benefits and any overdue payments owed. If authorized, the SSA will determine your retroactive payment based on your established onset date and the date of approval. Remember, SSDI allows for retroactive benefits up to 12 months before the application date if the established onset date is at least 17 months prior to your application. Please note that SSDI has a mandatory five-month waiting period during which no retroactive payments are issued. The SSDI back pay processing center determines these payments based on how much you earned and contributed to the system through payroll taxes. With the expert guidance provided, you can gain a clearer understanding of these calculations and what to anticipate.

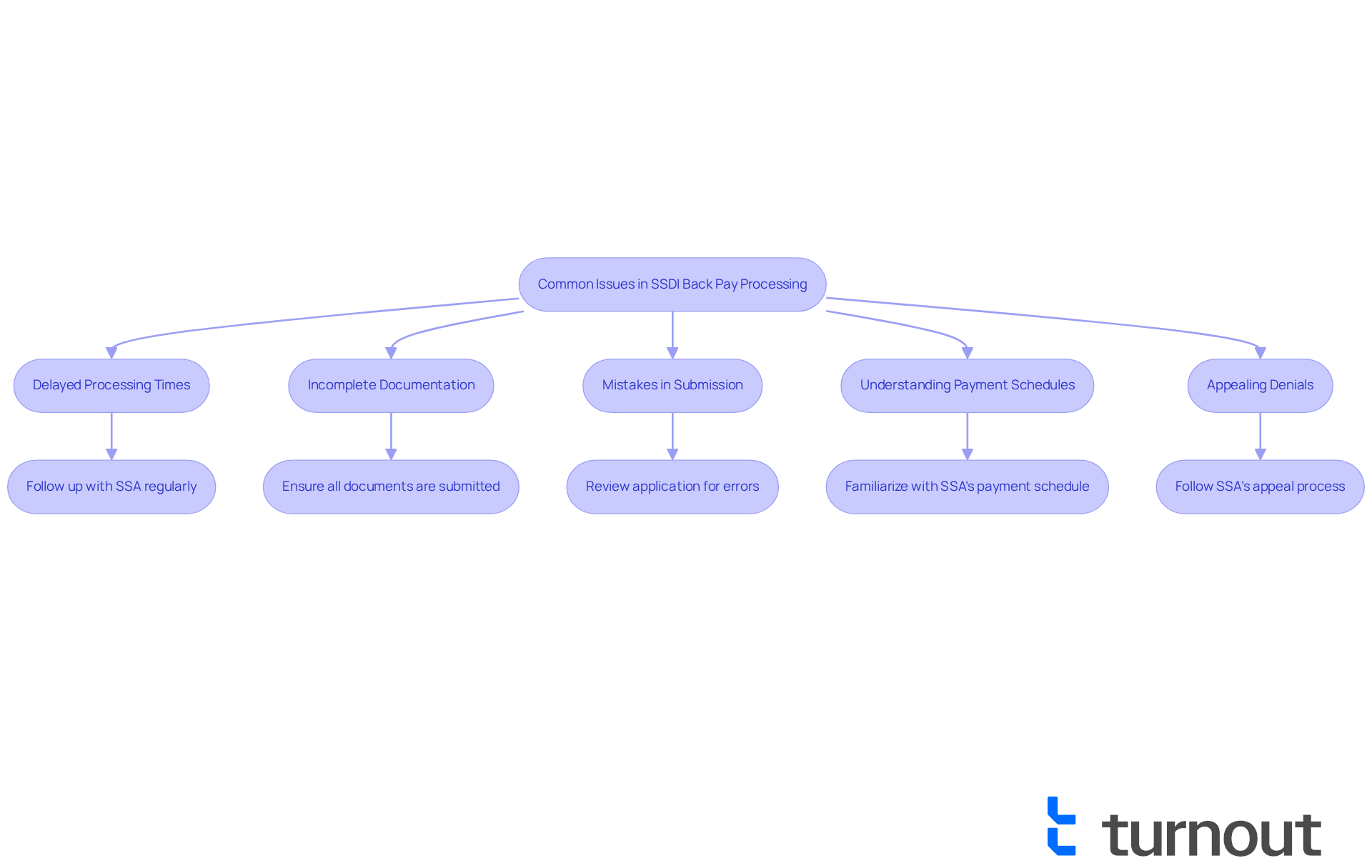

Troubleshoot Common Issues in SSDI Back Pay Processing

-

Delayed Processing Times: We understand that delays in receiving your SSDI back pay can be frustrating, often stemming from administrative backlogs at the SSDI back pay processing center of the Social Security Administration (SSA). While it's important to remain patient, being proactive is essential. Regularly follow up with the SSA to check on your case status and stay informed of any developments. This organization, which is not a legal practice, is here to assist you in navigating these complexities by offering resources and support.

-

Incomplete Documentation: To prevent processing delays, it's crucial to ensure that all necessary documents are submitted with your request. Missing information can significantly slow down the process. If you receive a request for additional documentation, please respond promptly to keep your case moving forward. Turnout's trained nonlawyer advocates are available to help you understand the documentation needed and ensure everything is in order. If you encounter unexplained extended delays at the SSDI back pay processing center, consider seeking professional assistance to help navigate the situation.

-

Mistakes in Your Submission: It's common to feel anxious about your submission. Carefully review your application for any errors or inconsistencies before sending it off. Mistakes can lead to denials or further delays. If you discover an error after submitting your application, contact the SSA immediately to rectify it. Remember, if you believe your back pay has been calculated incorrectly, you have the right to appeal the determination. The supporters of the initiative are here to assist you through this process, ensuring you comprehend your rights and choices.

-

Understanding Payment Schedules: Back pay is generally issued as a lump sum, but the timing can vary widely. Familiarize yourself with the SSA's payment schedule to set realistic expectations about when you might receive your funds. Additionally, be aware that the established onset date (EOD) can affect the amount and timing of compensation received. Participation can offer insights into how these factors may influence your situation.

-

Appealing Denials: If your application is denied, remember that you have the right to appeal. Follow the SSA's appeal process, which includes requesting reconsideration and potentially a hearing. Gather additional evidence to strengthen your case during this process, as this can significantly improve your chances of a favorable outcome. Turnout's nonlawyer advocates are equipped to assist you in preparing for your appeal, ensuring you have the necessary support to navigate this challenging process.

Conclusion

Understanding the intricacies of the SSDI back pay processing center is essential for anyone navigating the complexities of Social Security Disability Insurance. We recognize that the significance of these retroactive payments cannot be overstated; they provide crucial financial support during the often lengthy application process. By grasping the eligibility criteria, application steps, and common challenges, you can better prepare yourself to secure the benefits you deserve.

Throughout this guide, we’ve highlighted key points, including:

- The importance of gathering necessary documentation

- Understanding the eligibility requirements

- Being proactive in following up with the Social Security Administration

We understand that potential issues, such as delayed processing times and the appeal process, can be daunting. However, the insights shared here equip you with the knowledge to navigate these obstacles effectively. Utilizing trained advocates can further enhance your experience, ensuring that you receive the support you need without the complexities of legal representation.

Ultimately, the journey to securing SSDI back pay is not just about the financial assistance received; it’s also about empowering you to advocate for your rights and well-being. By taking informed steps and seeking support, you can navigate the SSDI process with confidence. It’s crucial to remain engaged, informed, and prepared. These actions can significantly impact your outcome and provide the financial relief necessary during challenging times. Remember, you are not alone in this journey, and we’re here to help.

Frequently Asked Questions

What are SSDI retroactive payments?

SSDI retroactive payments are the payments owed to individuals who qualify for Social Security Disability Insurance benefits, covering the period from when they became eligible for benefits until their application is approved, including any mandatory waiting periods.

Why is understanding SSDI back pay important?

Understanding SSDI back pay is important because it can significantly impact an individual's financial situation during the lengthy approval process for benefits.

How much can individuals expect to receive in retroactive payments?

Individuals can expect to receive an average of $6,710 in retroactive payments, calculated from the established onset date of their disability.

What is the significance of the year 2025 regarding SSDI retroactive payments?

In 2025, nearly 3 million Americans are expected to receive an average of $4,320 in delayed SSDI payments, highlighting the importance of these payments in covering living and medical expenses while awaiting regular benefits.

How can individuals get assistance with their SSDI claims?

Individuals can connect with trained advocates through our organization, who can assist in navigating SSDI claims without the complexities of legal representation.

Is the organization providing legal advice for SSDI claims?

No, the organization does not constitute a law firm and the information provided does not constitute legal advice; it aims to simplify the process and provide support.