Overview

Navigating the world of Social Security Disability Insurance (SSDI) back pay can be challenging, especially for those seeking financial support due to disabilities. We understand that this journey can be overwhelming, and it’s crucial to grasp the eligibility, application, and calculation steps involved.

Establishing the disability onset date and gathering the necessary documentation are essential components of this process. By understanding these criteria, you can maximize your benefits and ensure timely compensation. It’s common to feel uncertain during the lengthy approval process, but know that you are not alone in this journey.

We’re here to help you through each step, providing guidance and support. Remember, taking the time to understand these steps can make a significant difference in your experience. You deserve the assistance you need, and we encourage you to take action today.

Introduction

Navigating the intricacies of Social Security Disability Insurance (SSDI) back pay can be overwhelming. We understand that this journey is often filled with uncertainty and concern. These retroactive payments can offer vital financial relief, bridging the gap between when a disability begins and when a claim is approved. However, securing these benefits is not always straightforward. From determining eligibility to calculating the correct amount owed, challenges abound.

What steps can you take to ensure you receive the compensation you deserve? It’s common to feel lost in the application process, but there are ways to overcome these hurdles. Knowing you are not alone in this journey can be a source of comfort, and we’re here to help guide you through each step.

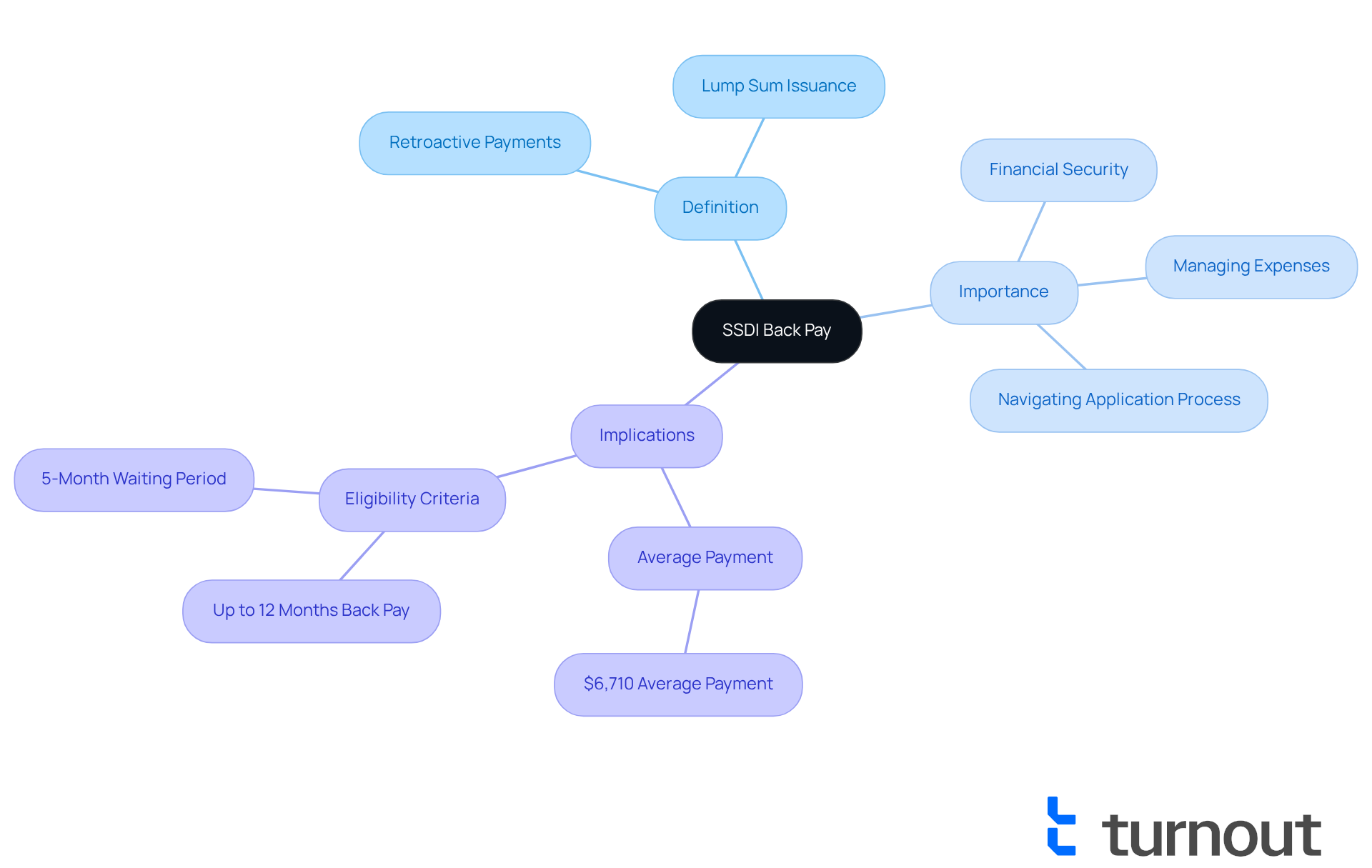

Understand SSDI Back Pay: Definition and Importance

from the Social Security Administration (SSA) for the period between a person's disability onset date and the approval of their claim are known as . These payments serve to compensate for the period when individuals were eligible for benefits but had not yet received them. Understanding ssdi back pay is essential, as it can significantly impact the of those unable to work due to impairments. Typically issued as a lump sum, retroactive pay provides to those in need.

The importance of ssdi back pay cannot be overstated; it serves as a vital financial support for individuals facing economic hardships while waiting for their claims to be processed. Many people share that receiving retroactive pay has helped them manage essential expenses, such as housing and medical bills, alleviating the burden of financial uncertainty. By grasping the definition and significance of , individuals can navigate the complexities of the more effectively and ensure they receive the benefits they deserve.

Moreover, the average retroactive payment issued thus far is around $6,710, which can make a meaningful difference in the lives of those who have been struggling financially. Understanding the regulations surrounding ssdi back pay is crucial for and ensuring that individuals receive the full amount they are entitled to, especially since ssdi back pay can cover up to 12 months prior to the application date if eligibility criteria are met. This knowledge empowers individuals to advocate for themselves and secure the financial support necessary for their well-being. Remember, you are not alone in this journey; we’re here to help you navigate through it.

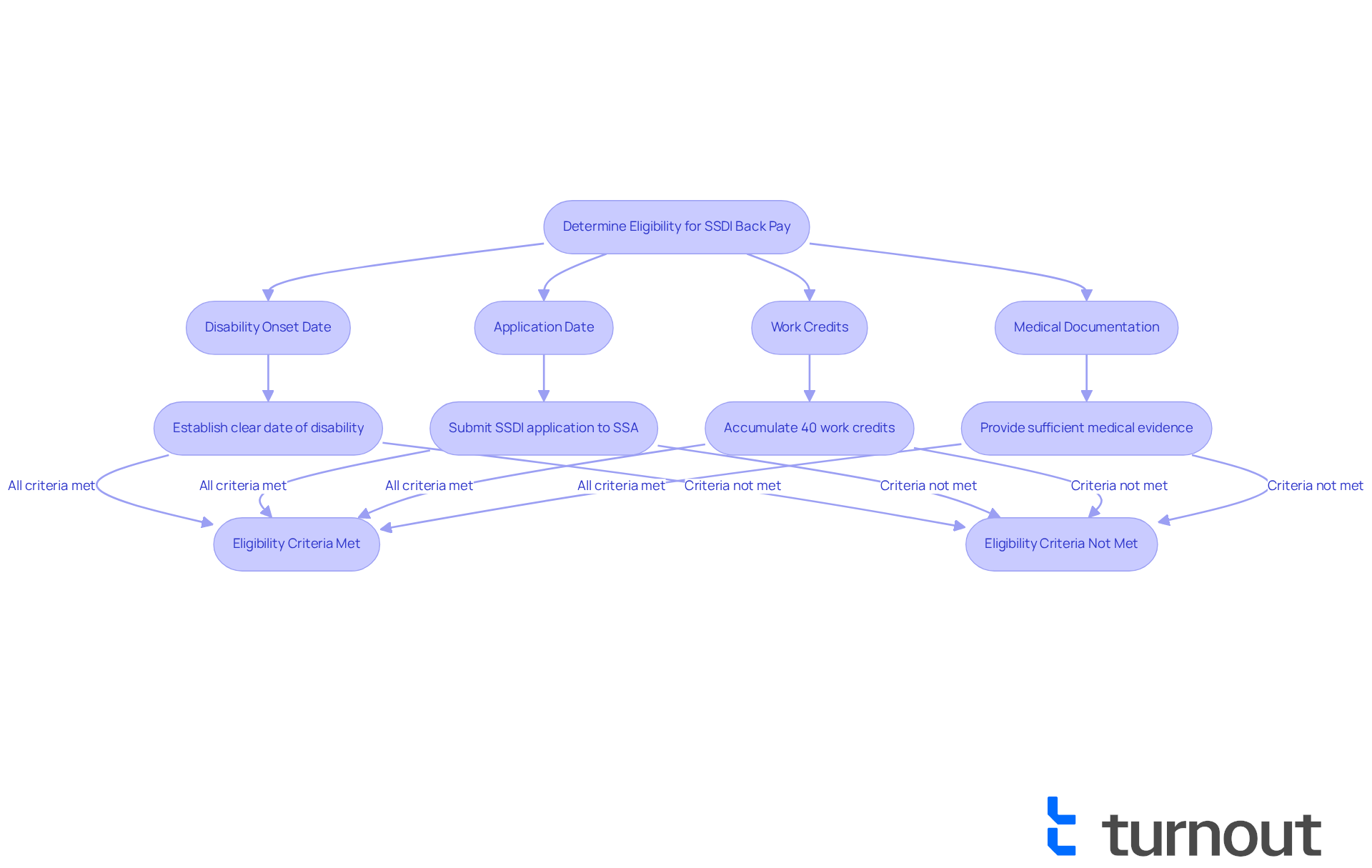

Determine Eligibility for SSDI Back Pay

Navigating the world of can be challenging, particularly when it involves understanding . We recognize that this process can feel overwhelming, but you are not alone. To be eligible for these payments, there are that you must satisfy. Here are some key factors to consider:

- : Establishing a clear date when your disability began is essential. This date determines the timeframe for which you may receive retroactive compensation.

- Application Date: Your SSDI application must be submitted to the SSA. The SSDI back pay period generally begins from the disability onset date, but it's important to note that payments will not be made for the initial five months after this date due to the SSA's required waiting period.

- Work Credits: You need to have accumulated enough work credits through your employment history. Typically, 40 credits are required, with at least 20 earned in the last 10 years before your disability began.

- Medical Documentation: is necessary to support your claim. This documentation must demonstrate that your disability meets the SSA's criteria.

We understand that accurately recording the disability onset date is crucial. Any modifications made by the SSA can influence the total amount of SSDI back pay you receive. For instance, if the SSA changes the onset date to a later time, it may lead to decreased compensation. However, this change can be contested if you believe the initial date should remain.

Statistics indicate that roughly 70% of SSDI claims are rejected due to eligibility issues. This highlights the importance of thorough preparation and understanding of the criteria. Remember, you are not alone in this journey. Our trained non-legal advocates are here to assist you in navigating these challenges. We can help you and prepare the necessary documentation for your application. Together, we can work towards securing the support you need.

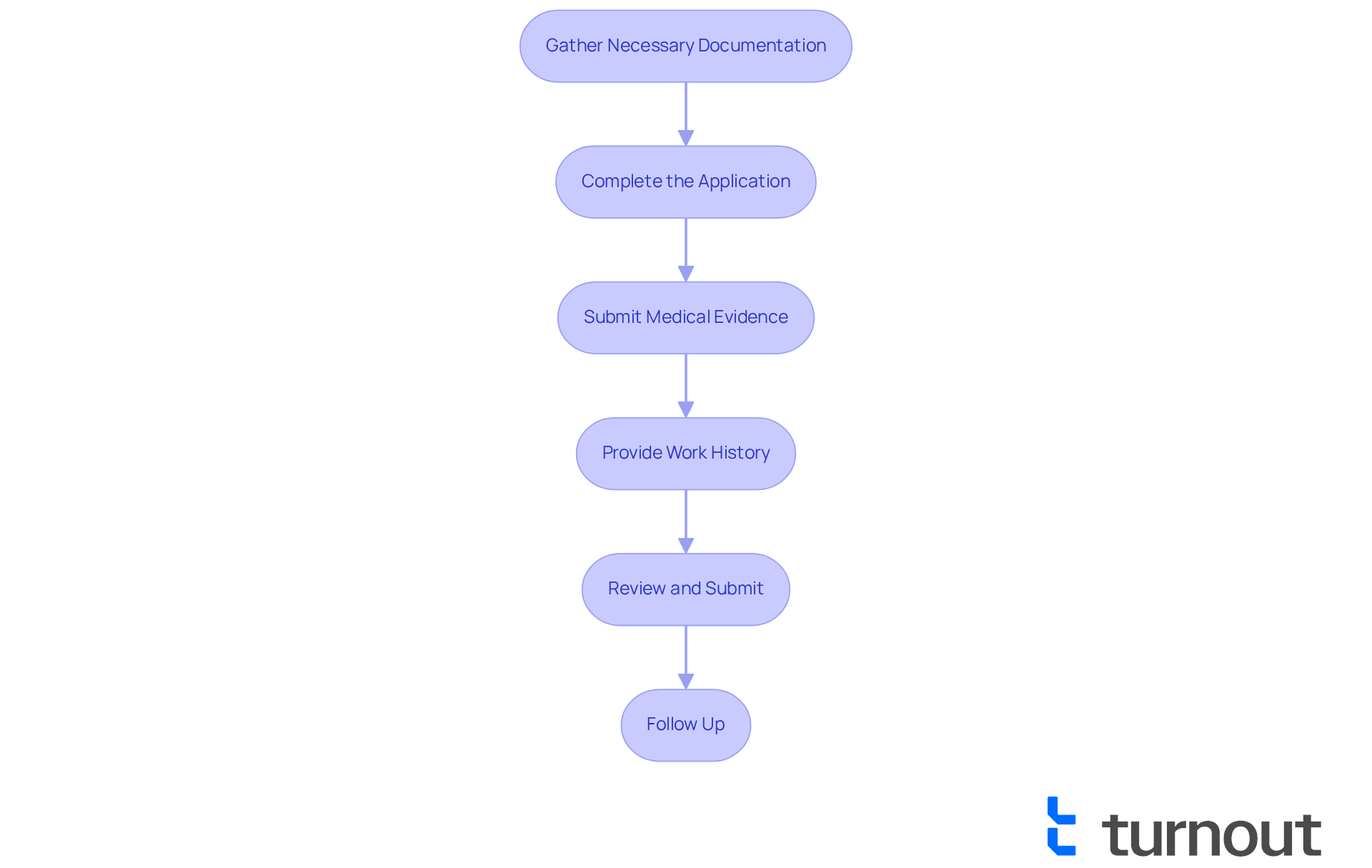

Apply for SSDI Back Pay: A Step-by-Step Process

Requesting retroactive disability payments can feel overwhelming, but we're here to help. Follow this step-by-step guide to ensure a smoother :

- : Start by collecting all relevant documents, such as your Social Security number, , work history, and any other information that supports your claim. We understand that this can be a lot, but having everything in order will ease your journey.

- Complete the Application: You can apply online through the SSA's website, by phone, or in person at your local SSA office. Make sure to fill out the application accurately and completely to avoid delays. It's common to feel anxious about this step—remember, only around 30% of Insurance applicants are approved initially, so thoroughness is essential.

- : Include comprehensive medical documentation that clearly outlines your disability and its impact on your ability to work. This may consist of doctor’s notes, test results, and treatment history. The SSA may backtrack up to 12 months before your application date to calculate benefits, but keep in mind there is a before payments begin.

- Provide Work History: Detail your work history, including the jobs you held, the dates of employment, and the nature of your work. This information helps the SSA assess your eligibility based on your work credits. Accurate documentation can significantly influence the outcome of your application, so take your time with this.

- Review and Submit: Before submitting your application, review all information for accuracy. Once you are confident that everything is correct, submit your application. Many recipients find that they obtain their around the same time as their initial monthly payment, usually within 30 to 90 days following approval.

- : After submission, keep track of your application status. You can do this online or by contacting the SSA. Be prepared to respond to any requests for additional information promptly. If you do not receive a payment within 60 days, it’s advisable to contact the SSA for a status update.

By adhering to these steps, you can navigate through the application procedure for with increased assurance and understanding. Remember, you are not alone in this journey, and we are here to support you.

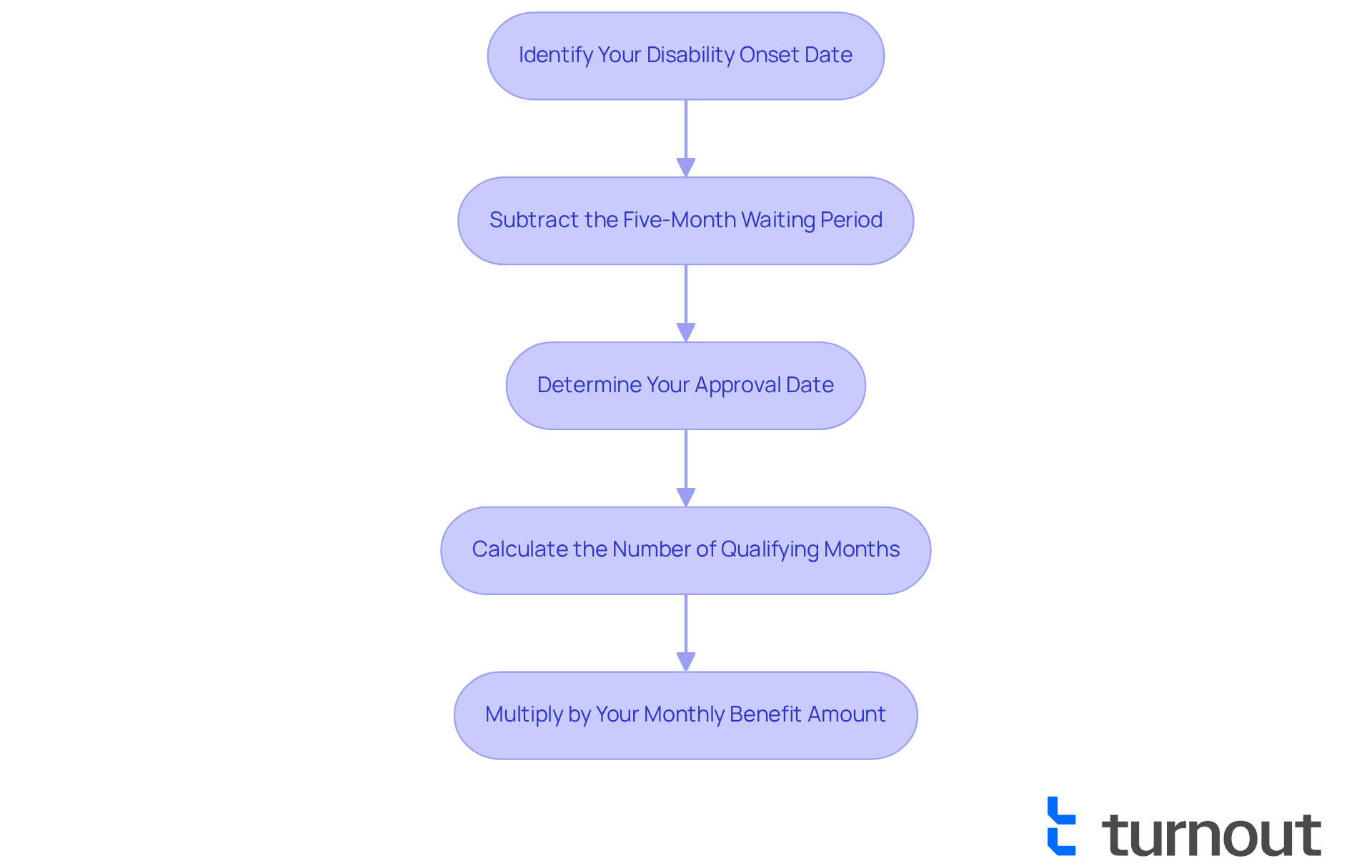

Calculate Your SSDI Back Pay Amount

Determining your disability insurance retroactive payment amount can feel overwhelming, but we’re here to help you through it. Follow these simple steps to gain clarity:

- Identify Your Disability Onset Date: Start by determining when your disability began. This date is crucial as it marks the beginning of your calculations.

- Subtract the : It's common to feel frustrated by the SSA's five-month waiting period from your disability onset date before benefits kick in. For example, if your disability onset date is January 1, 2025, your benefits would begin on June 1, 2025.

- Determine Your Approval Date: Next, identify the date your disability claim was approved. This date signifies the end of the waiting period and is essential for your calculations.

- : Count the months between the end of the waiting period and your approval date. If your claim was approved on August 1, 2025, you would count the months from June to August, totaling three months.

- Multiply by Your Monthly Benefit Amount: Finally, multiply the number of qualifying months by your approved monthly disability benefit amount. If your monthly benefit is $1,200, your retroactive payment would be calculated as follows: 3 months x $1,200 = $3,600.

By following these steps, you can of you may be eligible to receive. Remember, if your disability began before your application date, you might qualify for covering up to 12 months prior, provided you can give proof of your earlier disability.

It’s important to know that SSDI back pay is typically issued as a lump sum soon after approval. Adjusting your expectations accordingly can help ease the process. Additionally, having precise medical evidence is vital for to you.

through trained to help you navigate this process effectively. It’s important to note that Turnout is not a law firm and does not provide legal representation. We are also not affiliated with any law firm or government agency. This ensures you understand your entitlements and the calculations involved. Furthermore, your compensation amount will not be reduced for any fees related to representation. You are not alone in this journey; we are here to support you every step of the way.

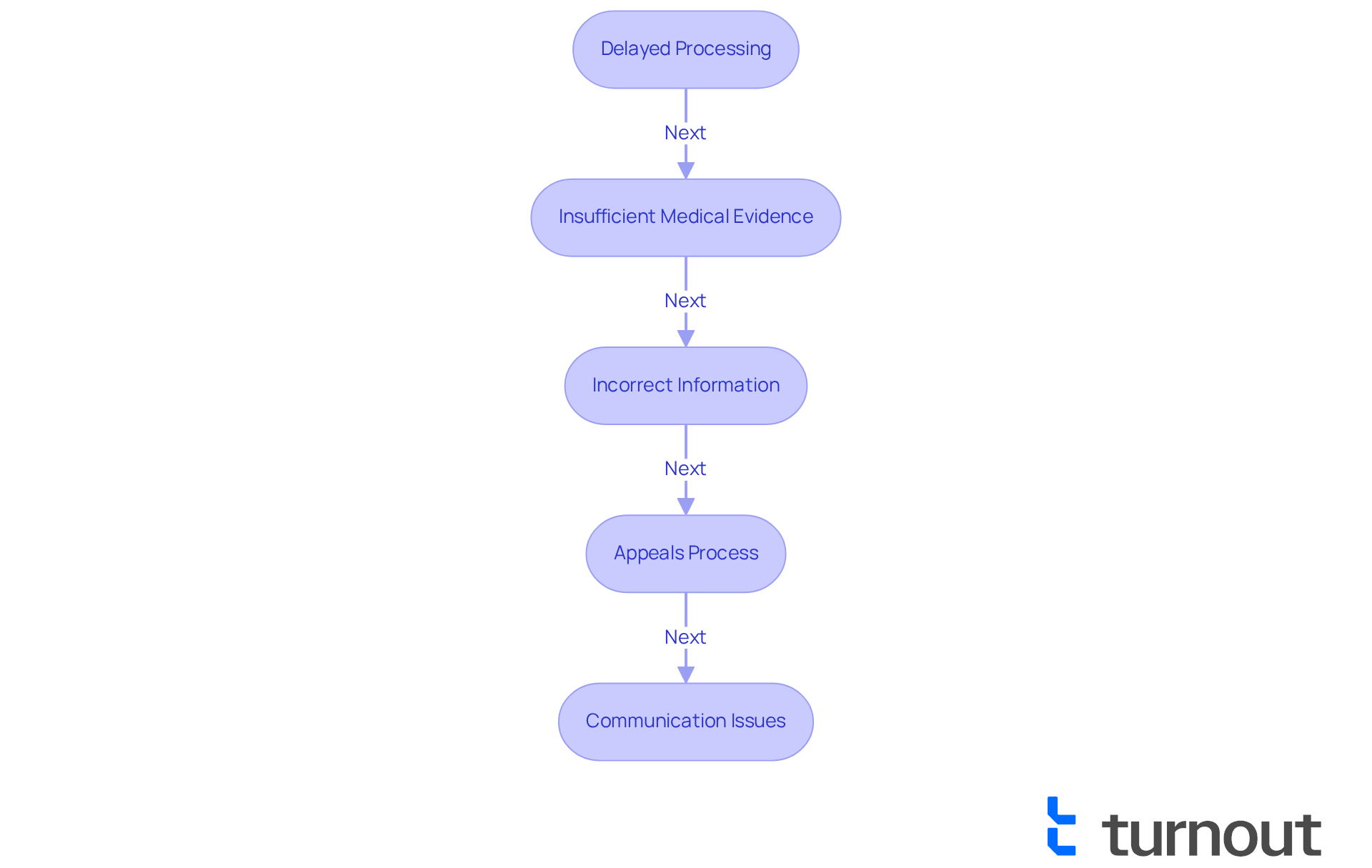

Troubleshoot Common Issues in SSDI Back Pay Claims

When seeking retroactive , it’s common to encounter several challenges. We understand that this process can feel overwhelming, so here are some supportive tips to help you navigate these issues:

- : If your application is taking longer than expected, it’s important to check the status online or reach out to the SSA for updates. or missing documentation. As of March 2023, the is around 222 days, which is a significant increase from pre-pandemic levels.

- : If your claim is denied due to a lack of medical evidence, don’t lose heart. Gather additional documentation from your healthcare providers to strengthen your case. Ensure that your medical records clearly outline your disability and its impact on your ability to work. Research shows that have a higher chance of approval.

- Incorrect Information: It’s crucial to double-check all information provided in your application. Errors in personal details, work history, or medical information can lead to delays or denials. If you find mistakes, promptly submit corrections to the SSA. Remember, incomplete applications can significantly prolong processing times, so accuracy is key.

- : If your claim is denied, please don’t lose hope. You have the right to appeal the decision. Follow the SSA's guidelines for filing an appeal, and consider seeking assistance from a knowledgeable advocate to strengthen your case. Statistics indicate that obtaining professional assistance can double the success rate of disability claims, making it a valuable step in this journey.

- Communication Issues: Maintaining open communication with the SSA is essential. If you have questions or concerns, don’t hesitate to reach out. Keeping a record of all correspondence can help clarify any misunderstandings. We understand that the SSA is currently facing staffing challenges, which can affect response times, so effective communication is more important than ever.

By being aware of these common issues and knowing how to address them, you can enhance your chances of successfully claiming . Remember, you are not alone in this journey, and we’re here to help you every step of the way.

Conclusion

Understanding SSDI back pay is crucial for individuals seeking financial support during their disability journey. These retroactive payments not only provide essential relief but also empower beneficiaries to navigate the complexities of the application process effectively. By grasping the nuances of eligibility, application steps, and calculation methods, individuals can ensure they receive the benefits they rightfully deserve.

We understand that determining eligibility can feel overwhelming. It’s important to consider factors such as disability onset dates, work credits, and medical documentation. The article outlines a step-by-step application process and offers insights into calculating potential back pay amounts. Additionally, common challenges, such as delayed processing and insufficient medical evidence, are addressed, providing you with actionable strategies to enhance your chances of success.

Ultimately, SSDI back pay represents more than just financial assistance; it symbolizes a lifeline for those facing economic hardships due to disabilities. By staying informed and proactive, you can navigate this often daunting process with confidence. Remember, seeking support from knowledgeable advocates can further enhance your likelihood of securing the benefits needed for a more stable future. You are not alone in this journey, and we’re here to help.

Frequently Asked Questions

What is SSDI back pay?

SSDI back pay refers to retroactive payments from the Social Security Administration (SSA) for the period between a person's disability onset date and the approval of their claim. These payments compensate individuals for the time they were eligible for benefits but had not yet received them.

Why is understanding SSDI back pay important?

Understanding SSDI back pay is essential because it significantly impacts the financial security of individuals unable to work due to impairments. It provides immediate financial relief and helps manage essential expenses such as housing and medical bills during the claims processing period.

How is SSDI back pay typically issued?

SSDI back pay is usually issued as a lump sum payment, which can provide immediate financial support to those in need.

What is the average amount of SSDI back pay issued?

The average retroactive payment issued for SSDI back pay is around $6,710, which can significantly help individuals facing financial struggles.

What are the eligibility criteria for SSDI back pay?

To be eligible for SSDI back pay, individuals must meet specific criteria set by the SSA, including: - Establishing a clear disability onset date. - Submitting an SSDI application to the SSA. - Accumulating enough work credits, typically 40 credits with at least 20 earned in the last 10 years before the disability began. - Providing sufficient medical documentation to support the claim.

Is there a waiting period for SSDI back pay?

Yes, there is a required waiting period of five months after the disability onset date before payments are made.

How can changes to the disability onset date affect SSDI back pay?

If the SSA changes the disability onset date to a later time, it may decrease the total amount of SSDI back pay received. However, individuals can contest this change if they believe the initial date should remain.

What percentage of SSDI claims are rejected due to eligibility issues?

Approximately 70% of SSDI claims are rejected due to eligibility issues, highlighting the importance of thorough preparation and understanding of the criteria.

Who can assist individuals in navigating the SSDI application process?

Trained non-legal advocates can assist individuals in evaluating their eligibility for disability benefits and preparing the necessary documentation for their SSDI application.