Overview

Navigating the process of claiming Social Security Administration (SSA) back pay can feel overwhelming, especially for those awaiting disability benefits. We understand that this journey is filled with uncertainty and concern. That’s why it’s crucial to grasp the step-by-step process involved.

- First, it’s important to know the eligibility criteria. Understanding whether you qualify can ease some of the anxiety.

- Gathering the necessary documentation is the next step. This preparation is vital, as it can significantly reduce processing delays and financial uncertainty.

- Following a structured submission process is key to ensuring timely access to these essential payments.

Remember, thorough preparation can make a world of difference. You’re not alone in this journey; we’re here to help you every step of the way.

By taking these steps, you can feel more confident about your claim. It’s common to feel anxious, but with the right information and support, you can navigate this process successfully. Don’t hesitate to reach out for assistance; you deserve the benefits you’re entitled to.

Introduction

Navigating the complexities of SSA back pay can feel overwhelming, especially for those seeking Social Security Disability Insurance (SSDI) and Supplemental Security Income (SSI) benefits. We understand that this financial support is crucial, not just for compensating lost income during the waiting period, but also as a lifeline for individuals facing financial uncertainty due to disabilities.

However, claiming this vital assistance often comes with its own set of challenges. It’s common to feel confused or anxious about how to effectively navigate the intricacies of the SSA back pay claims process. How can you ensure that you receive timely and accurate compensation?

You are not alone in this journey. Many have faced similar hurdles, and there are ways to simplify the process. By understanding the steps involved and seeking the right support, you can move forward with confidence. Remember, we're here to help you every step of the way.

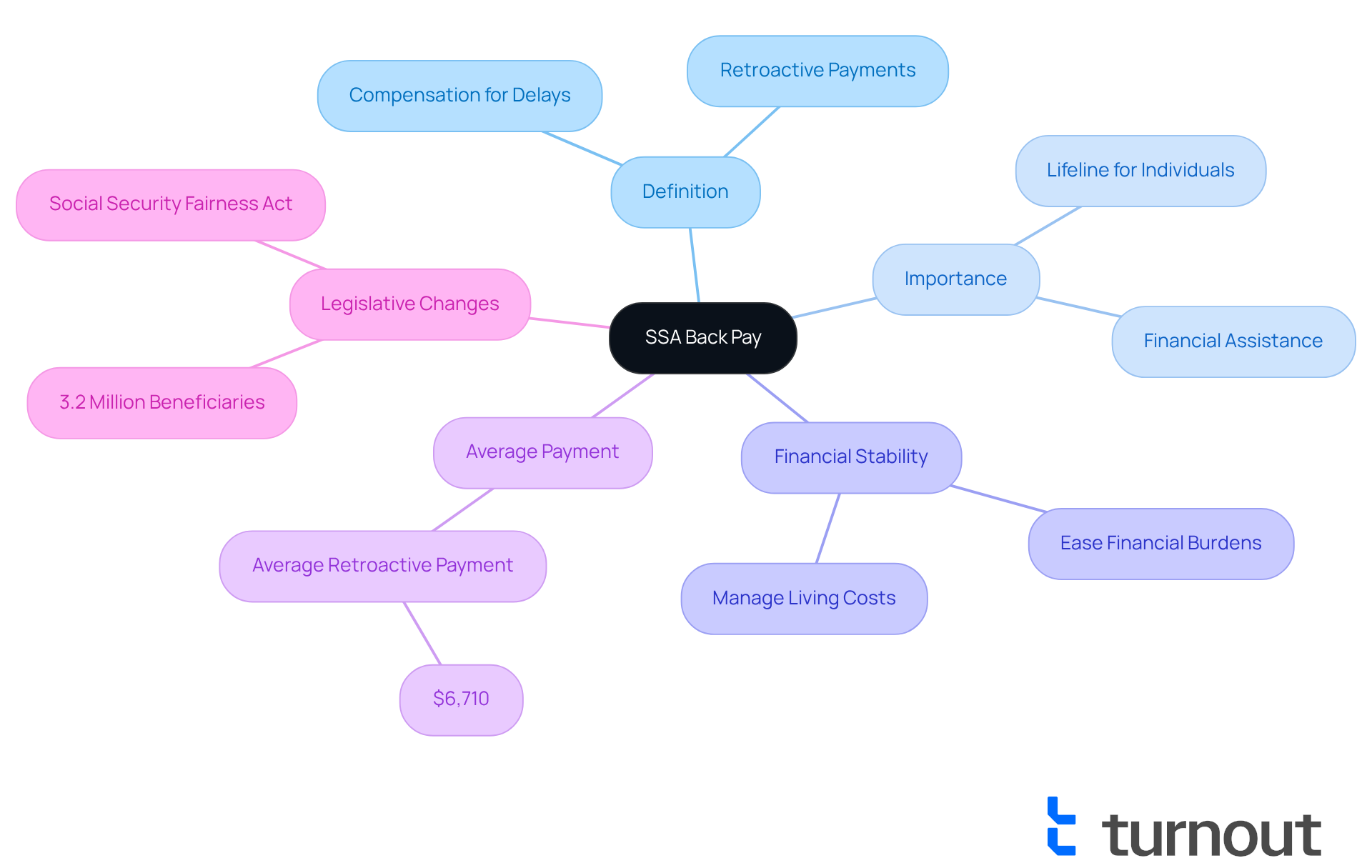

Understand SSA Back Pay: Definition and Importance

SSA back pay is more than just numbers; it represents a lifeline for individuals approved for Social Security Disability Insurance (SSDI) or Supplemental Security Income (SSI) benefits. These payments are referred to as SSA back pay and compensate for the months when claimants were eligible for benefits but hadn’t yet received them due to application processing delays. Understanding this concept is crucial, as it can significantly impact the financial stability of those unable to work due to disabilities, particularly in relation to SSA back pay.

We understand that waiting for benefits can be incredibly stressful. Retroactive pay, such as SSA back pay, offers essential financial assistance during these challenging times, helping individuals manage living costs and medical expenses that may have piled up while awaiting approval. For instance, the average retroactive payment issued so far is around $6,710. This amount can truly ease financial burdens for many recipients.

It’s common to feel overwhelmed by financial uncertainty, especially when delays occur. Recent analyses show that overdue pay is vital for maintaining financial stability, particularly for those who have faced such delays. Experts emphasize that these payments can be a lifeline, allowing individuals to navigate their finances more effectively during uncertain times. Moreover, statistics reveal that over 3.2 million people will benefit from recent legislative changes aimed at improving access to these essential payments. This highlights the ongoing need for advocacy and support in navigating the complexities of the Social Security system.

In summary, SSA back pay not only addresses lost income but also plays a crucial role in ensuring that disabled individuals can meet their financial responsibilities while they await the approval of their claims. Remember, you are not alone in this journey; we’re here to help.

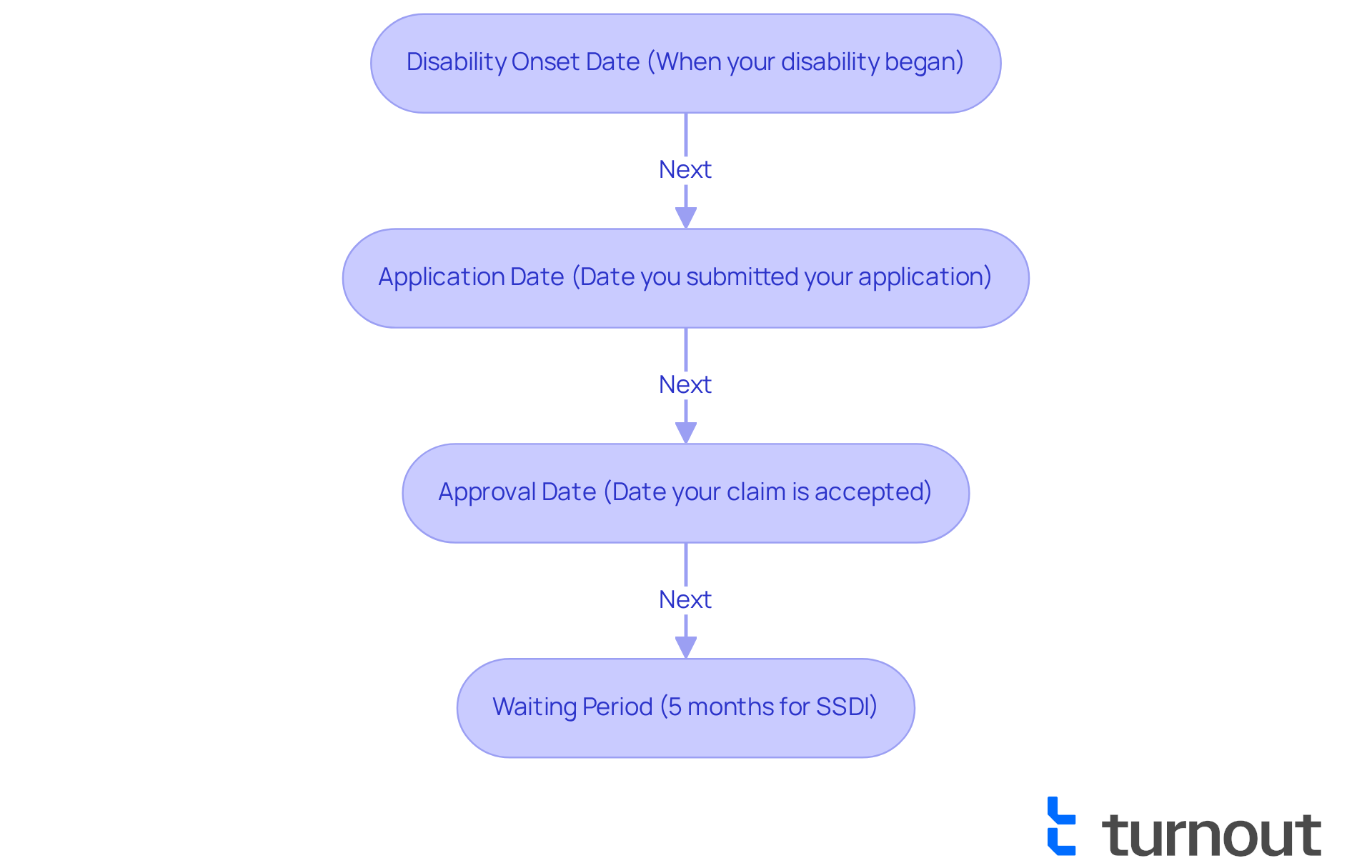

Determine Your Eligibility for SSA Back Pay

To find out if you qualify for SSA back pay, it’s important to first show that you meet the requirements for SSDI or SSI benefits. We understand that navigating this process can be overwhelming, so let’s break it down together. Here are some key factors to consider:

- Disability Onset Date: This is the date when your disability began, and it needs to be documented and verifiable. Knowing this date is crucial, as it impacts how overdue wages are calculated.

- Application Date: The date you submitted your application for benefits is significant, as retroactive payments are calculated from this point. It’s common to feel uncertain about this, especially since processing times can vary widely depending on the complexity of your case.

- Approval Date: The date your claim is accepted will determine how long you can receive retroactive payments. For SSDI, the average processing time for these payments is typically between 90 to 120 days, but it can take longer for more complicated cases. Remember, while SSDI offers retroactive payments, SSI payments start the first full month after approval.

- Waiting Period: For SSDI, there’s usually a five-month waiting period after your disability onset date before benefits kick in. On the other hand, SSI doesn’t have this waiting period, allowing for quicker access to benefits once you’re approved.

By verifying these details, you can better understand your eligibility for SSA back pay and how much you might be entitled to receive. Did you know that around 70% of SSDI applicants qualify for SSA back pay? Most eligible individuals should have noticed payment increases starting in April. It’s important to keep in mind that successful requests often hinge on clear documentation and timely submission of necessary information. Delays in gathering essential details can prolong the processing time for Social Security disability payments.

We’re here to support you in navigating these processes. Turnout offers trained non-legal advocates who can assist you with your SSD applications. Please remember, Turnout is not a law firm and does not provide legal advice, but we’re committed to helping you every step of the way. You are not alone in this journey.

Gather Required Documentation for Your Claim

Collecting the required paperwork is a crucial step in securing your SSA back pay. We understand that this process can feel overwhelming, but having the right documents can make a significant difference. Here’s a helpful list of essential documents you’ll need:

- Proof of Identity: This can include your Social Security card, birth certificate, or a government-issued ID.

- Medical Records: Documentation from your healthcare providers detailing your disability and its impact on your ability to work. Complete and organized medical records can significantly speed up the approval process.

- Work History: Records of your employment, such as W-2 forms or pay stubs, to establish your work history and earnings. Missing or incomplete work history can lead to delays in your SSDI application.

- Disability Onset Date Evidence: Any medical documentation that supports the date your disability began. This is crucial, as disputes over the established onset date can prolong the processing time for SSA back pay.

- Application Confirmation: A copy of your application for benefits, along with any correspondence from the SSA. Keeping a dedicated folder for all your SSDI paperwork, whether digital or physical, can help you manage your case effectively.

Statistics show that about 30% of requests are postponed due to missing documentation. This highlights the importance of careful preparation. Successful requests often come from applicants who submitted thorough documentation, leading to quicker processing times and fewer complications. For instance, a recent case study highlighted how a candidate who meticulously gathered their medical documents and employment history received their SSA back pay within just 30 days of approval.

Additionally, advocates stress the importance of proactive communication with healthcare providers to ensure all necessary documents are collected promptly. Remember, by being organized and prepared, you can help ensure that your application is processed without unnecessary delays. You are not alone in this journey; we’re here to help you every step of the way.

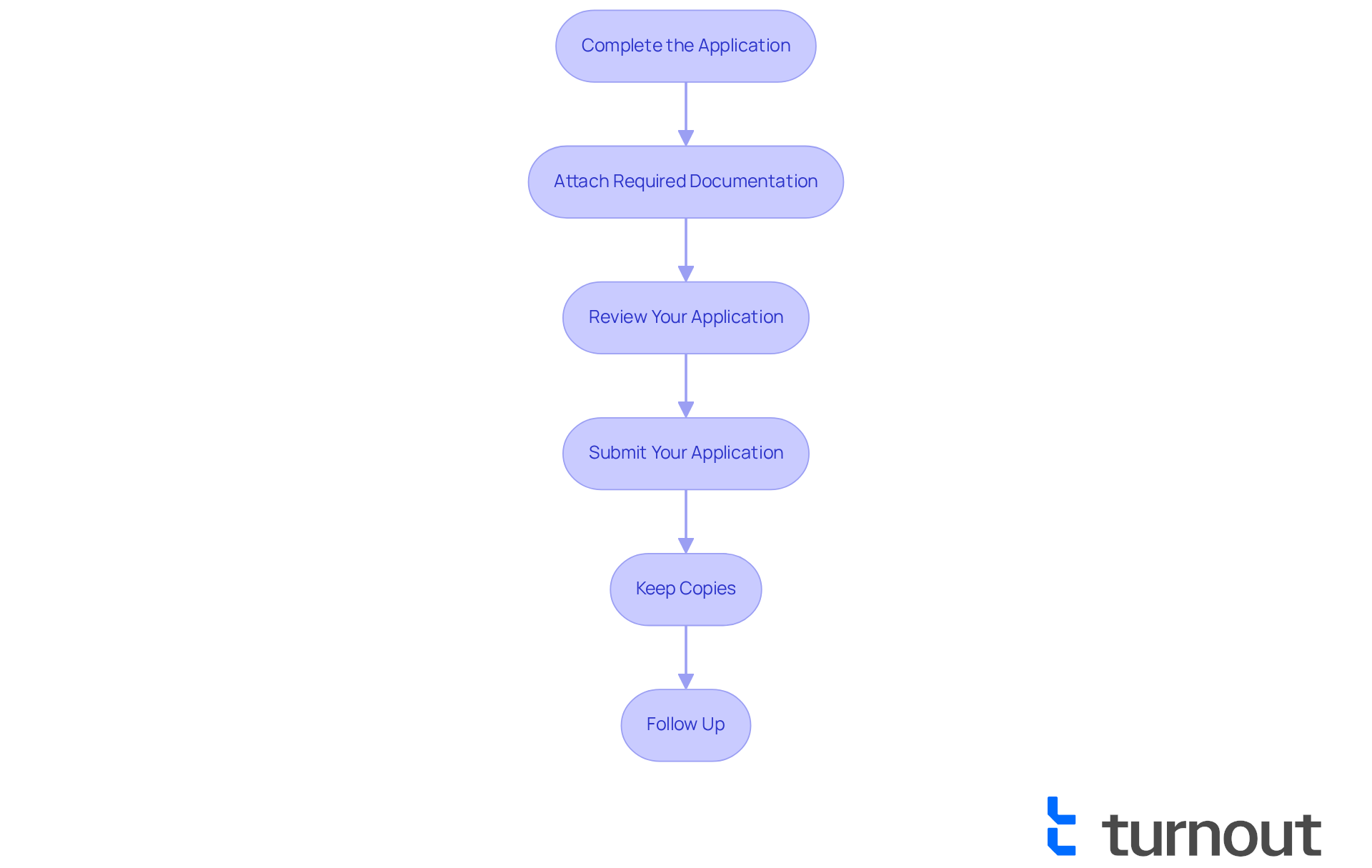

Submit Your Claim: Step-by-Step Process

Submitting your claim for SSA back pay may seem overwhelming, but we are here to assist you through the process. Follow these steps to make the process smoother:

- Complete the Application: You can apply online through the SSA website, by phone, or in person at your local SSA office. Make sure to fill out all sections accurately to avoid any complications.

- Attach Required Documentation: Include all necessary documents, like medical records and proof of income, to support your request effectively.

- Review Your Application: Take a moment to double-check all information for accuracy and completeness. It’s common to feel anxious about this step, but inaccuracies can lead to delays.

- Submit Your Application: If you're applying online, just follow the prompts to submit electronically. For mail submissions, send your application and documents to the appropriate SSA office.

- Keep Copies: Remember to retain copies of your application and all submitted documents for your records. This will be helpful for future reference.

- Follow Up: After submitting, track the status of your request by reaching out to the SSA or checking online. This proactive approach can help address any issues that may arise during processing.

It's important to note that while we provide guidance, we do not offer legal counsel. Our trained nonlegal advocates are here to assist you in navigating the complexities of SSD applications. Real-life experiences show just how crucial thoroughness is in this process. For example, one individual faced significant delays due to incomplete documentation, while another successfully navigated the system by keeping organized records and following up regularly.

According to recent data, most SSDI recipients receive their SSA back pay in a lump sum around the same time as their first monthly payment, typically within 30 to 90 days after approval. This timeline highlights the necessity of prompt and accurate submissions to facilitate timely payments. Setting up a 'My Social Security' account can further assist you in checking your payment status and confirming your bank information. Remember, you are not alone in this journey, and we’re here to support you every step of the way.

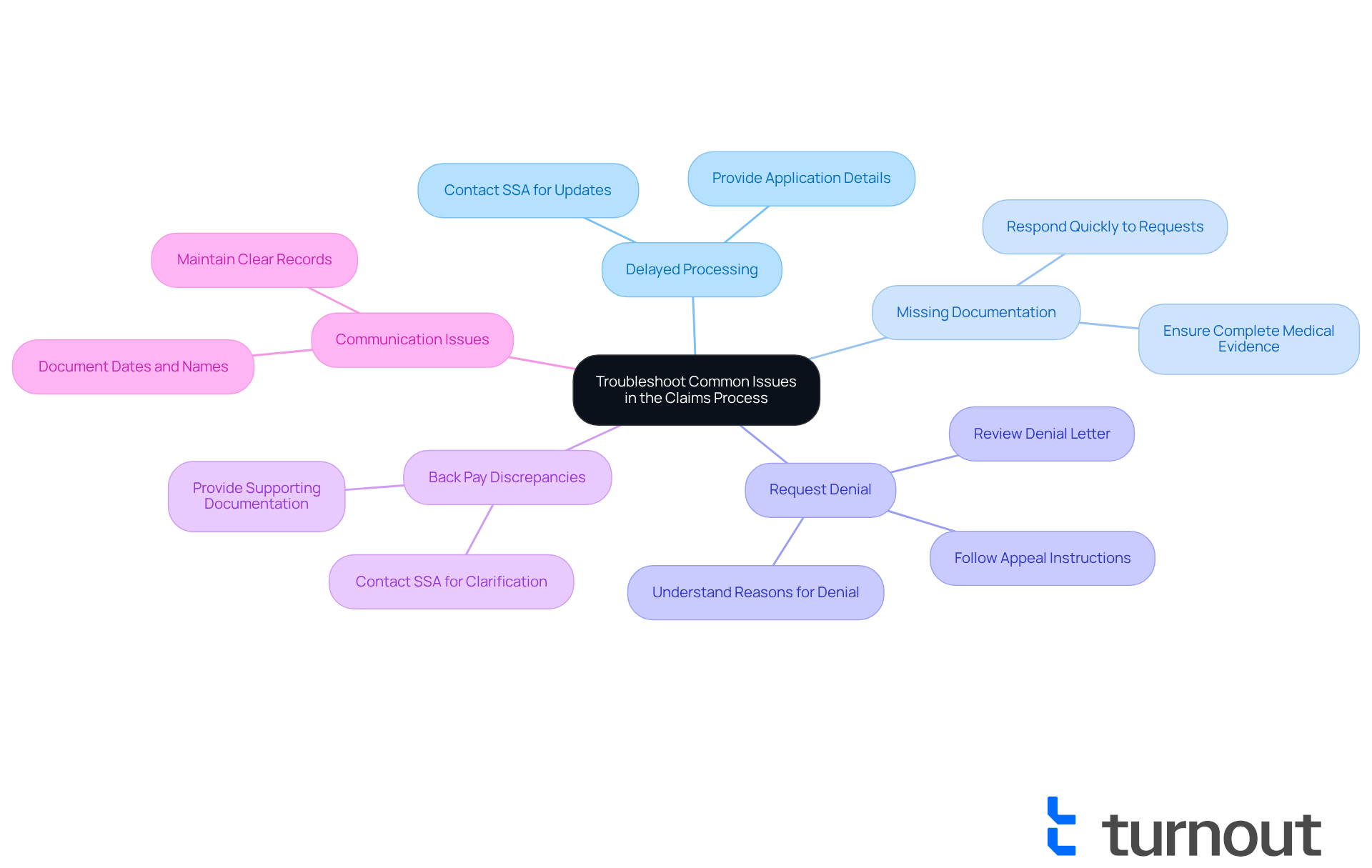

Troubleshoot Common Issues in the Claims Process

Navigating the process of requesting compensation can be challenging, and we understand that it can feel overwhelming at times. Here are some common issues you might face and how to troubleshoot them:

-

Delayed Processing: If your request is taking longer than expected, don’t hesitate to reach out to the SSA for an update. Be ready to provide your application details. With over a million requests pending, delays are common, and the average wait for a preliminary decision has increased significantly since the pandemic.

-

Missing Documentation: If the SSA asks for more information, respond quickly with the necessary documents to avoid further delays. Insufficient medical evidence is a leading cause of request denials, so it’s crucial to ensure all required documentation is submitted.

-

Request Denial: If your request is denied, take a moment to carefully review the denial letter to understand the reasons behind it. About 64% of initial SSD requests are denied, often due to insufficient evidence or not meeting the SSA's criteria. You can appeal the decision by following the instructions in the letter.

-

If you believe the amount of your SSA back pay is incorrect, contact the SSA for clarification and provide any supporting documentation. Keeping detailed records of your communications with the SSA, including dates and names of representatives, can be incredibly helpful in resolving any discrepancies.

-

Communication Issues: It’s important to maintain clear records of all your communications with the SSA, including dates and names of representatives. This documentation can be vital in addressing any problems that arise during the reimbursement process.

By being proactive and informed, you can effectively navigate these common issues and ensure a smoother process for your requests. Remember, staying engaged with the SSA and monitoring your claim status can significantly impact your chances of a successful outcome. You are not alone in this journey; we’re here to help.

Conclusion

Navigating the complexities of SSA back pay is crucial for anyone seeking financial stability through Social Security Disability Insurance (SSDI) or Supplemental Security Income (SSI) benefits. We understand that this process addresses the financial gaps caused by delays in benefit approval and serves as a vital support system for those unable to work due to disabilities. Recognizing the significance of SSA back pay can empower you to take the necessary steps toward securing your rightful benefits.

In this guide, we’ve shared key insights about:

- Eligibility criteria

- Required documentation

- The step-by-step submission process for SSA back pay claims

It’s important to emphasize that thorough preparation can make a world of difference. Organized documentation and proactive communication can significantly streamline your claims process. Plus, being aware of common issues and knowing how to troubleshoot them can help you avoid unnecessary delays and frustrations.

We know that the journey toward securing SSA back pay may feel overwhelming at times. But remember, support and resources are available to you. By taking informed steps and staying engaged with the process, you can navigate the complexities of your claims more effectively. Advocacy for timely and accurate SSA back pay isn’t just about financial relief; it’s about ensuring that you receive the support you need to maintain your quality of life. You are not alone in this journey, and we’re here to help.

Frequently Asked Questions

What is SSA back pay and why is it important?

SSA back pay refers to payments made to individuals who have been approved for Social Security Disability Insurance (SSDI) or Supplemental Security Income (SSI) benefits, compensating for the months they were eligible for benefits but had not received them due to processing delays. It is crucial as it helps maintain financial stability for those unable to work due to disabilities.

How does SSA back pay assist individuals financially?

SSA back pay provides essential financial assistance during the waiting period for benefits, helping individuals manage living costs and medical expenses that may have accumulated while awaiting approval. The average retroactive payment is around $6,710, which can significantly ease financial burdens.

What factors determine eligibility for SSA back pay?

To qualify for SSA back pay, individuals must meet the requirements for SSDI or SSI benefits. Key factors include the documented Disability Onset Date, the Application Date, the Approval Date, and understanding the Waiting Period for benefits.

How is the amount of SSA back pay calculated?

The amount of SSA back pay is calculated based on the Disability Onset Date, the Application Date, and the Approval Date. For SSDI, there is typically a five-month waiting period after the Disability Onset Date before benefits begin, while SSI payments start the first full month after approval.

What is the average processing time for SSA back pay?

The average processing time for SSDI back pay is typically between 90 to 120 days, but it can take longer for more complicated cases. SSI payments do not have a waiting period, allowing for quicker access to benefits once approved.

How common is it for SSDI applicants to receive SSA back pay?

Approximately 70% of SSDI applicants qualify for SSA back pay, indicating that most eligible individuals may notice payment increases starting in April.

Can I get assistance with my SSA application?

Yes, organizations like Turnout offer trained non-legal advocates to assist with SSD applications. They provide support throughout the process, although they do not offer legal advice.