Overview

Understanding residual disability is essential for those navigating its challenges. This article explores the benefits available, the eligibility criteria, and effective strategies to maximize your insurance support. We understand that facing residual disability can be overwhelming, but it’s important to know that financial assistance through insurance policies is possible if you can demonstrate a significant decrease in earnings.

By providing practical strategies, we aim to empower you to navigate the insurance landscape effectively. You are not alone in this journey; there are steps you can take to ensure you receive the support you deserve. Remember, we’re here to help you through this process, offering guidance and understanding as you seek the assistance you need.

Introduction

Residual disability can leave individuals in a challenging financial situation. While they may still be able to work, they often face significant income reductions due to their condition. We understand that navigating this complex landscape can be overwhelming. That’s why understanding the nuances of residual disability is essential. It not only impacts eligibility for insurance benefits but also shapes the support available to those affected.

What strategies can you employ to maximize your benefits? This article delves into the intricacies of residual disability, offering insights into its definition, the benefits available through insurance policies, eligibility criteria, and effective strategies for financial empowerment. Remember, you are not alone in this journey; we’re here to help you find the support you need.

Define Residual Disability and Its Importance

A condition that many face is , where a person may not be completely incapacitated but struggles to perform one or more essential tasks of their job. This often leads to a significant decrease in income. We understand that this situation can be incredibly challenging. It’s important to acknowledge that many individuals can still work, albeit at a reduced capacity, which can deeply impact their .

Comprehending this definition is crucial for those . It directly influences eligibility and the type of support available through insurance policies concerning residual disability. You are not alone in this journey; many people find themselves in similar circumstances. Residual support is designed to bridge the gap between pre-impairment earnings and the diminished income that results from being unable to work at full capacity.

If you or someone you know is navigating this difficult path, remember that can empower you to seek the help you need. We're here to help you and find the .

Explore Residual Disability Benefits in Insurance Policies

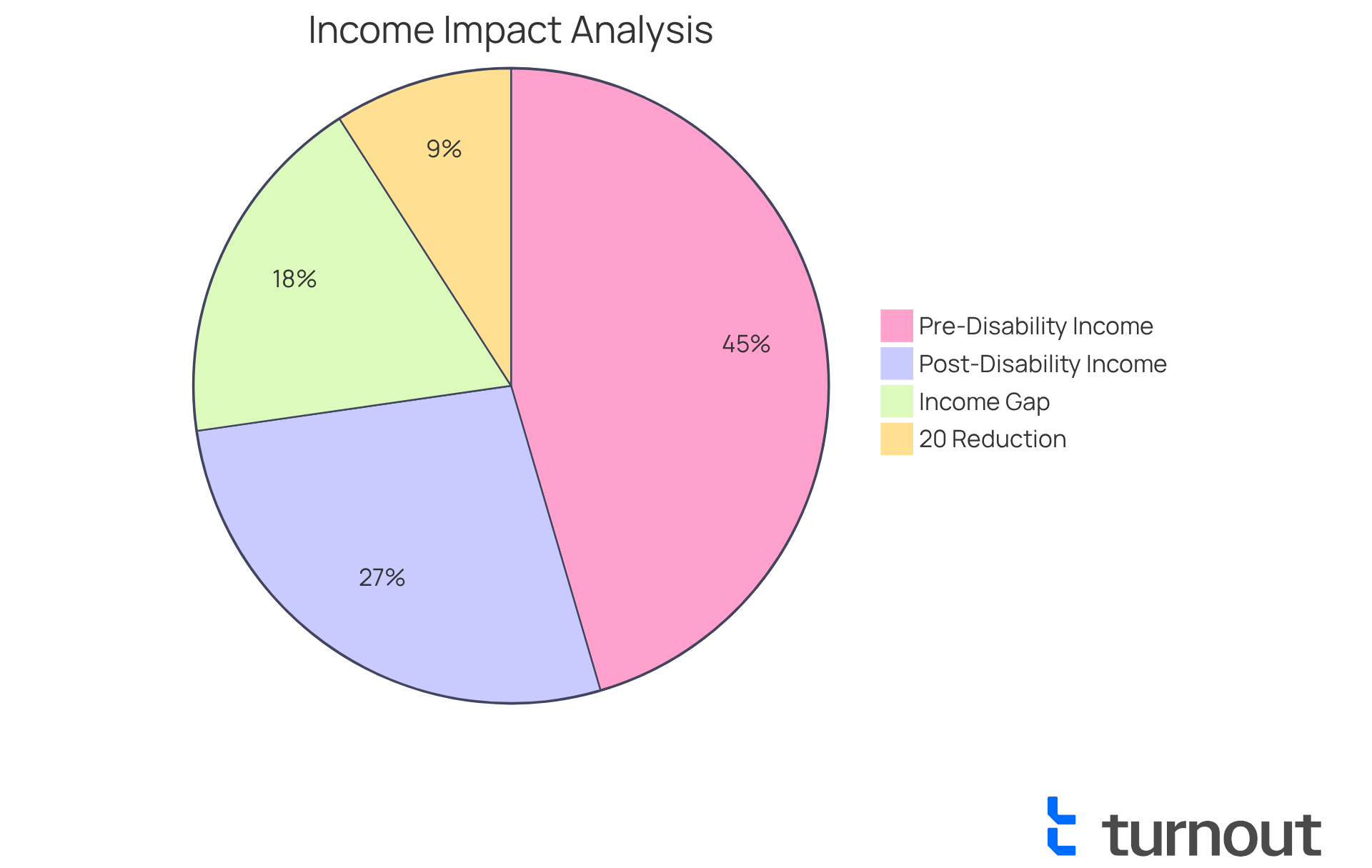

often include allowances for . These benefits provide crucial to individuals who, despite being capable of working, have experienced a due to their condition. For instance, if someone was earning $5,000 a month before their condition and can now only earn $3,000, the remaining support can help bridge that gap in lost income.

It's important to note that policies can vary, but many require the insured to demonstrate a reduction in income of at least 20% to qualify for these benefits. We understand that navigating these requirements can be challenging. Furthermore, some policies may offer riders that enhance coverage, providing additional financial security in cases of residual disability. Remember, you are not alone in this journey, and we’re here to help you .

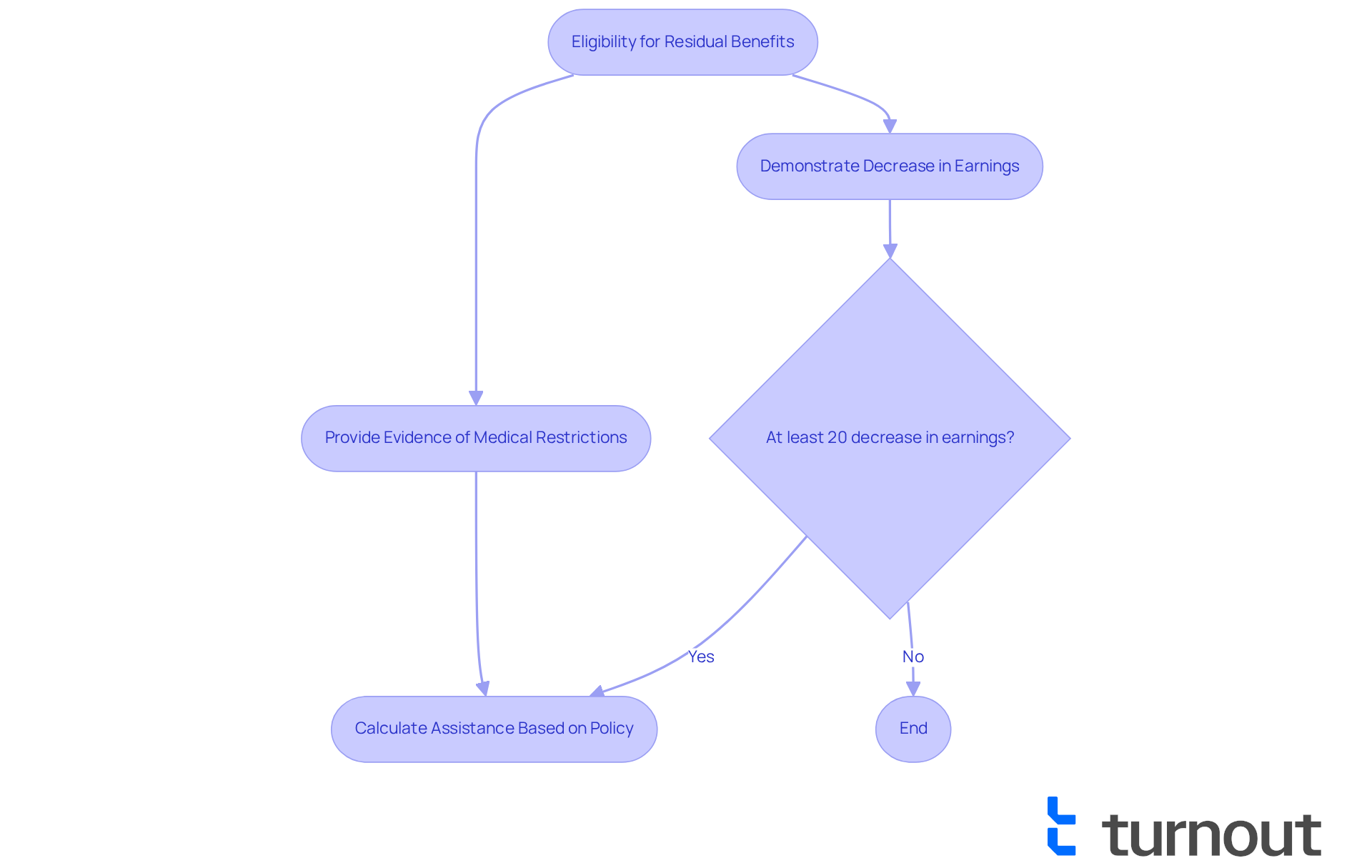

Understand Eligibility and Calculation of Residual Benefits

We understand that navigating the world of insurance can be overwhelming. To be eligible for , individuals typically need to meet specific requirements outlined in their insurance contract. Common criteria include:

- Demonstrating a of at least 20% compared to pre-disability wages

- Providing continuous evidence of medical restrictions related to

It's important to assess the impact of the impairment on income and the resulting residual disability. For example, if someone experiences a 40% reduction in income, their assistance might be calculated as a portion of the total disability compensation stated in their policy. Grasping these calculations is essential for individuals to accurately understand their financial situation and ensure they receive the support they need.

At , we're here to help. We simplify access to government assistance and by guiding you through the with trained advocates. You are not alone in this journey; we ensure that you can effectively navigate these complex systems with compassion and care.

Implement Strategies to Maximize Residual Disability Benefits

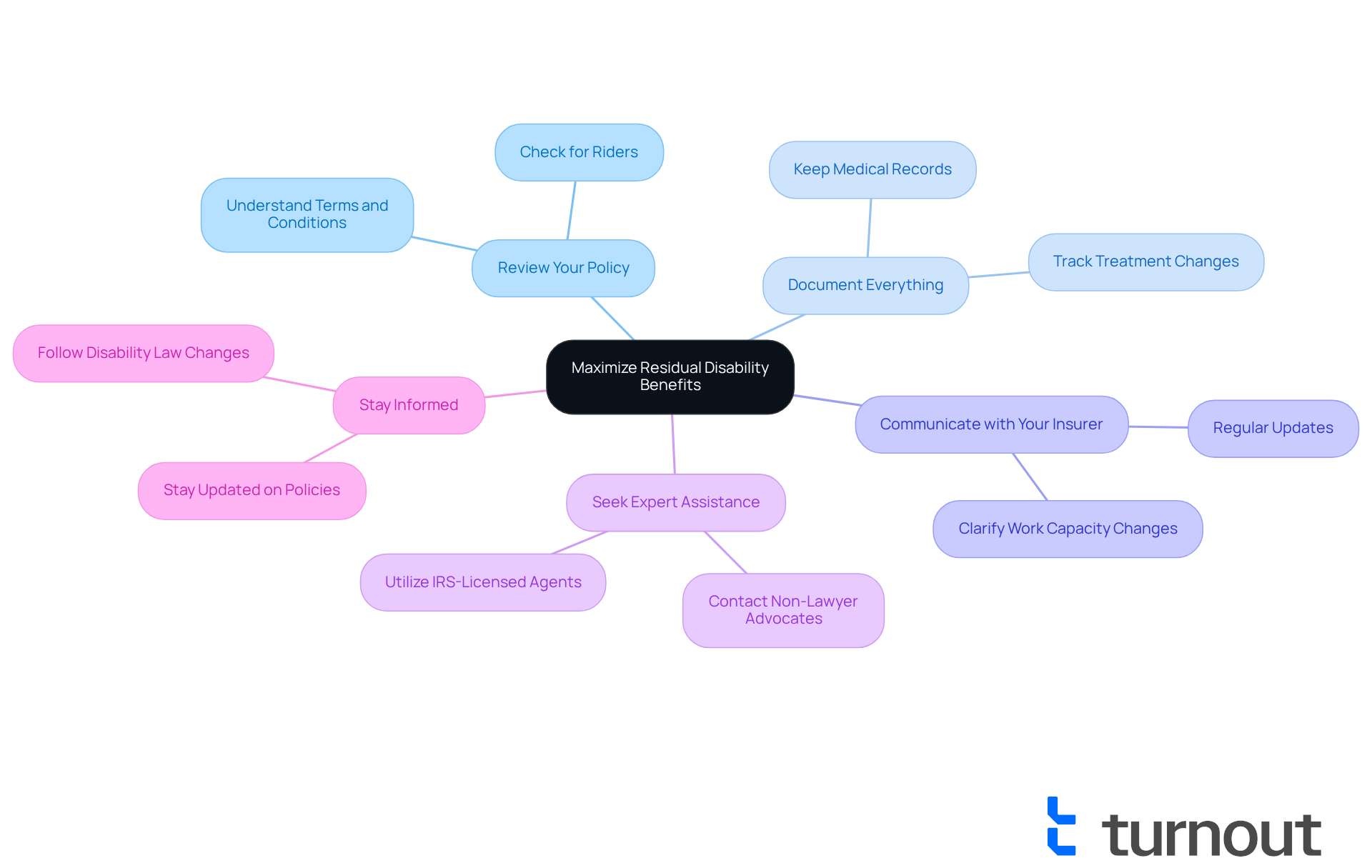

To maximize your , it's important to consider several supportive strategies that can truly make a difference in your journey:

- Review Your Policy: Take the time to of your insurance policy, including any riders that may enhance your coverage. Knowing your policy inside and out is a crucial step.

- Document Everything: Keeping detailed records of your medical condition, treatment, and any changes in your ability to work is essential. This documentation will be vital in demonstrating your eligibility and the extent of your condition.

- : We understand that maintaining open lines of communication with your insurance provider can be daunting. Regularly updating them on your condition and any changes in your work capacity is key to ensuring your needs are met.

- Seek Expert Assistance: Consider reaching out to . They can guide you through the and help you optimize your advantages. Remember, Turnout is not a law firm and does not provide legal representation. For , they collaborate with IRS-licensed enrolled agents, offering comprehensive support without the need for legal counsel.

- Stay Informed: It's common to feel overwhelmed with changes in disability laws or insurance policies. Keeping up to date can empower you to make timely decisions regarding your claims. Remember, you are not alone in this journey; we’re here to help you navigate through it.

Conclusion

Understanding residual disability and its implications is essential for anyone facing the challenges of reduced work capacity. We recognize that this journey can be overwhelming, but it’s important to see residual disability not just as a medical condition, but as a critical factor that impacts your financial stability and overall quality of life. By grasping the nuances of residual disability, you can better navigate your options for support and insurance benefits.

Key insights include:

- Understanding insurance policies that offer residual disability benefits

- The eligibility criteria that must be met

- The strategies you can employ to maximize these benefits

From demonstrating a decrease in income to maintaining open communication with insurers, each step you take can significantly affect the financial assistance you receive. Additionally, keeping thorough documentation and seeking expert guidance, such as from Turnout’s advocates, can empower you to make informed decisions about your claims.

Ultimately, the journey through residual disability can feel daunting, but remember that support is available. Taking proactive steps to understand and manage the implications of residual disability can lead to improved financial security and peace of mind. By staying informed and utilizing available resources, you can navigate this complex landscape with confidence, ensuring you receive the assistance you deserve. You are not alone in this journey; we’re here to help.

Frequently Asked Questions

What is residual disability?

Residual disability refers to a condition where a person is not completely incapacitated but struggles to perform one or more essential tasks of their job, leading to a significant decrease in income.

Why is understanding residual disability important?

Understanding residual disability is crucial as it influences eligibility for assistance and the type of support available through insurance policies related to this condition.

How does residual disability affect financial stability?

Residual disability can deeply impact financial stability by reducing a person's income due to their inability to work at full capacity.

What is the purpose of residual support?

Residual support is designed to bridge the gap between pre-impairment earnings and the diminished income resulting from being unable to work fully.

What should individuals do if they are facing residual disability?

Individuals facing residual disability should seek to understand their situation, as this knowledge can empower them to explore options and find the appropriate support available to them.