Introduction

The Recovery Rebate Credit (RRC) is a vital financial lifeline for many Americans, especially for those who may have missed out on previous Economic Impact Payments. This refundable tax incentive not only gives you the opportunity to reclaim funds but also plays a significant role in helping our economy recover after the pandemic.

We understand that navigating the complexities of eligibility can be overwhelming. What are the specific requirements? How can you avoid common pitfalls when claiming this credit? These are important questions, and it’s completely normal to feel uncertain.

Understanding these nuances is essential for maximizing your potential benefits. By doing so, you can pave a smoother path toward financial stability. Remember, you’re not alone in this journey - we’re here to help you every step of the way.

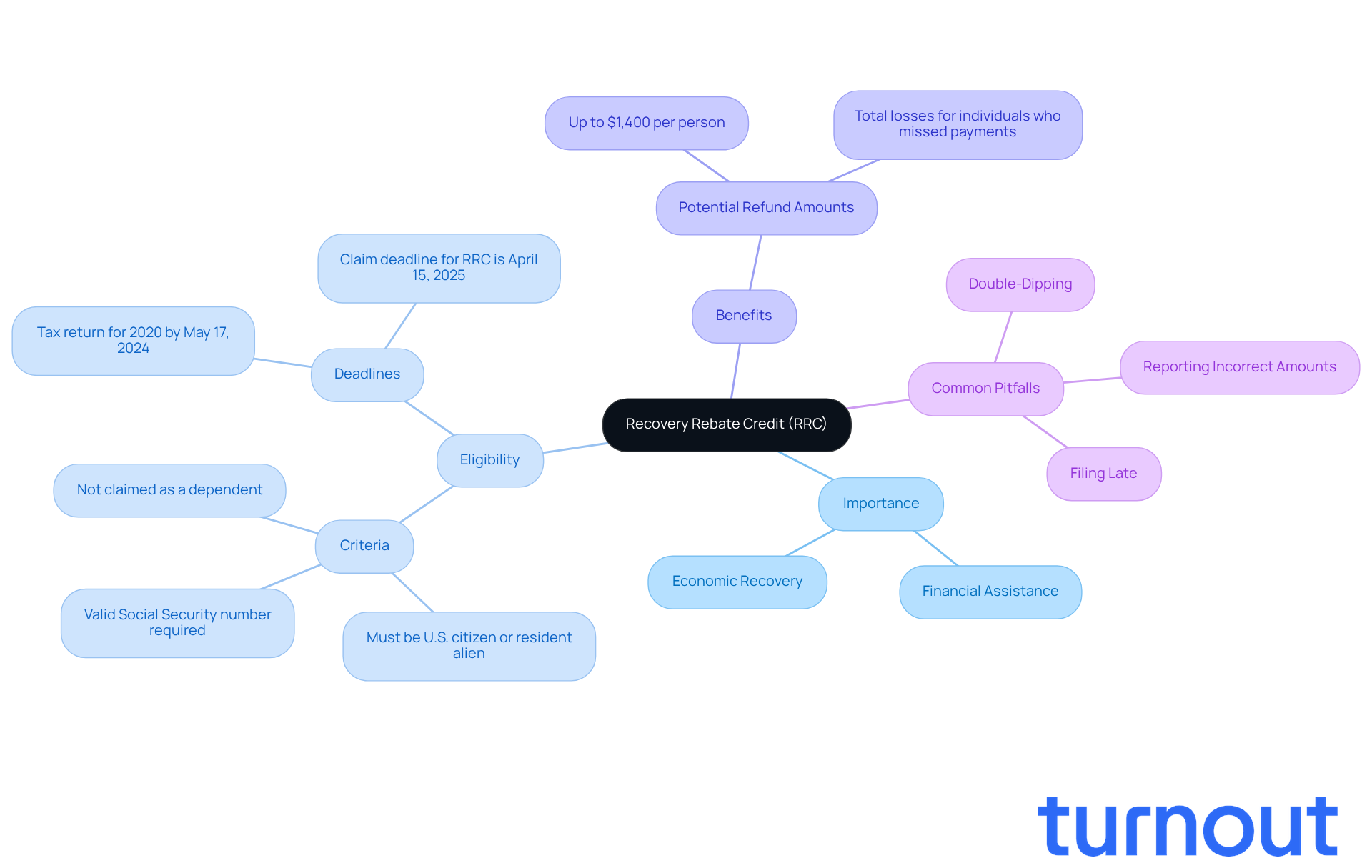

Define the Recovery Rebate Credit and Its Importance

The Recovery Rebate Benefit (RRB) is a refundable tax incentive designed to provide financial assistance to those whose recovery rebate credit eligibility may not have allowed them to receive their full Economic Impact Payments (EIPs), often known as stimulus checks. This credit, related to recovery rebate credit eligibility, is crucial as it allows eligible individuals to reclaim missed payments from previous years, potentially increasing their tax refunds by up to $1,400 for each person. Understanding the recovery rebate credit eligibility is crucial for anyone who has faced financial difficulties during the pandemic, as it provides a significant opportunity to recover funds that rightfully belong to them.

We understand that navigating the complexities of claiming the RRC can be overwhelming, especially for those also pursuing Social Security Disability (SSD) claims or seeking tax debt relief. While Turnout isn’t a law firm and doesn’t provide legal representation, our trained nonlawyer advocates and IRS-licensed enrolled agents are here to support you through these processes. We want to ensure you understand your rights and options every step of the way.

The RRC not only helps alleviate immediate financial burdens but also plays a pivotal role in the broader context of economic recovery. For instance, individuals who missed out on the initial stimulus checks can recover substantial amounts through the RRC, making a real difference in their financial stability. Expert insights highlight the RRC's importance as a lifeline for many Americans navigating the aftermath of the pandemic. As Mel Whitney noted, "The Recovery Rebate Credit emerged from the Coronavirus Aid, Relief, and Economic Security (CARES) Act as a beacon of hope amid the economic turmoil of the pandemic."

Real-world examples demonstrate that recovery rebate credit eligibility allows individuals who filed for the credit after realizing they were eligible for missed payments to recover significant amounts, easing their financial strain. However, it’s essential to be aware of common pitfalls related to recovery rebate credit eligibility when claiming the RRC, such as double-dipping and reporting incorrect amounts. Remember, the legal deadline for filing a tax return to claim the RRC is May 17, 2024. Timely action is crucial. This highlights the importance of being informed about recovery rebate credit eligibility, as it can be a key factor in achieving financial recovery and stability.

You are not alone in this journey. We’re here to help you navigate these challenges and ensure you receive the support you deserve.

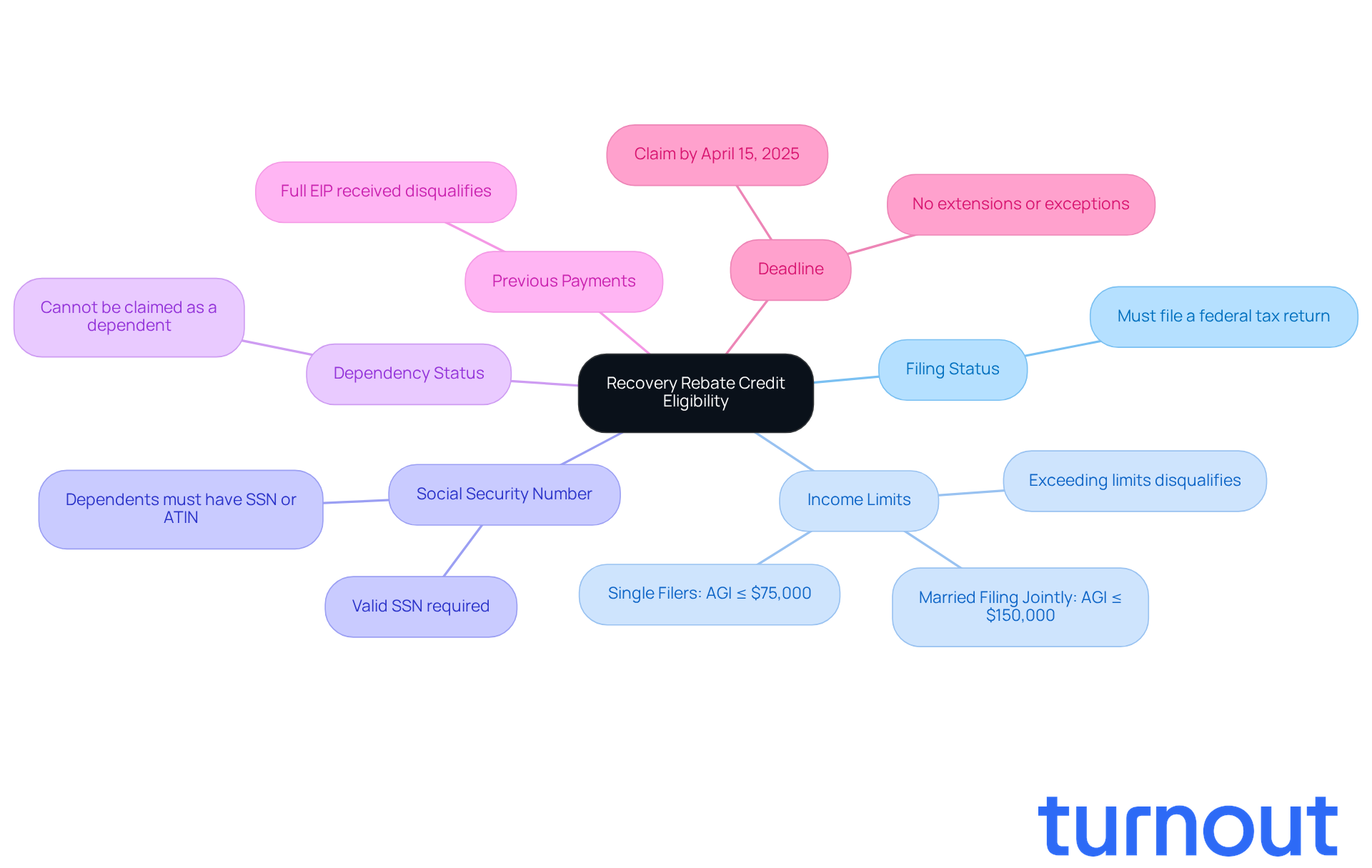

Outline Eligibility Requirements for the Recovery Rebate Credit

To qualify for the Recovery Rebate Credit, it’s important to understand the specific eligibility criteria that can help you secure this benefit:

- Filing Status: You need to file a federal tax return for the relevant tax year.

- Income Limits: For the 2021 tax year, single filers should have an adjusted gross income (AGI) of $75,000 or less. If you’re married and filing jointly, your AGI must be $150,000 or less. Exceeding these limits means you won’t qualify for the benefit.

- Social Security Number: A valid Social Security Number (SSN) is necessary to obtain the benefit. This also applies to dependents, who must have a valid SSN or Adoption Taxpayer Identification Number.

- Dependency Status: You cannot be claimed as a dependent on someone else's tax return to qualify for the credit.

- Previous Payments: If you received the full amount of the Economic Impact Payments (EIPs), you won’t be eligible for the Recovery Rebate Credit.

We understand that navigating these requirements can feel overwhelming. However, knowing them is essential for determining your eligibility and ensuring a successful claim. For example, if you didn’t receive the third EIP, you might still qualify for recovery rebate credit eligibility if you meet the criteria mentioned above.

It’s also crucial to remember that the deadline for claiming this credit is April 15, 2025. This deadline is firm, with no extensions or exceptions available. Missing it could lead to significant financial losses, so timely filing is key.

You’re not alone in this journey. Turnout is here to help you navigate these complexities and ensure you access the financial support you deserve, including assistance with SSD claims and tax debt relief. We’re committed to guiding you every step of the way.

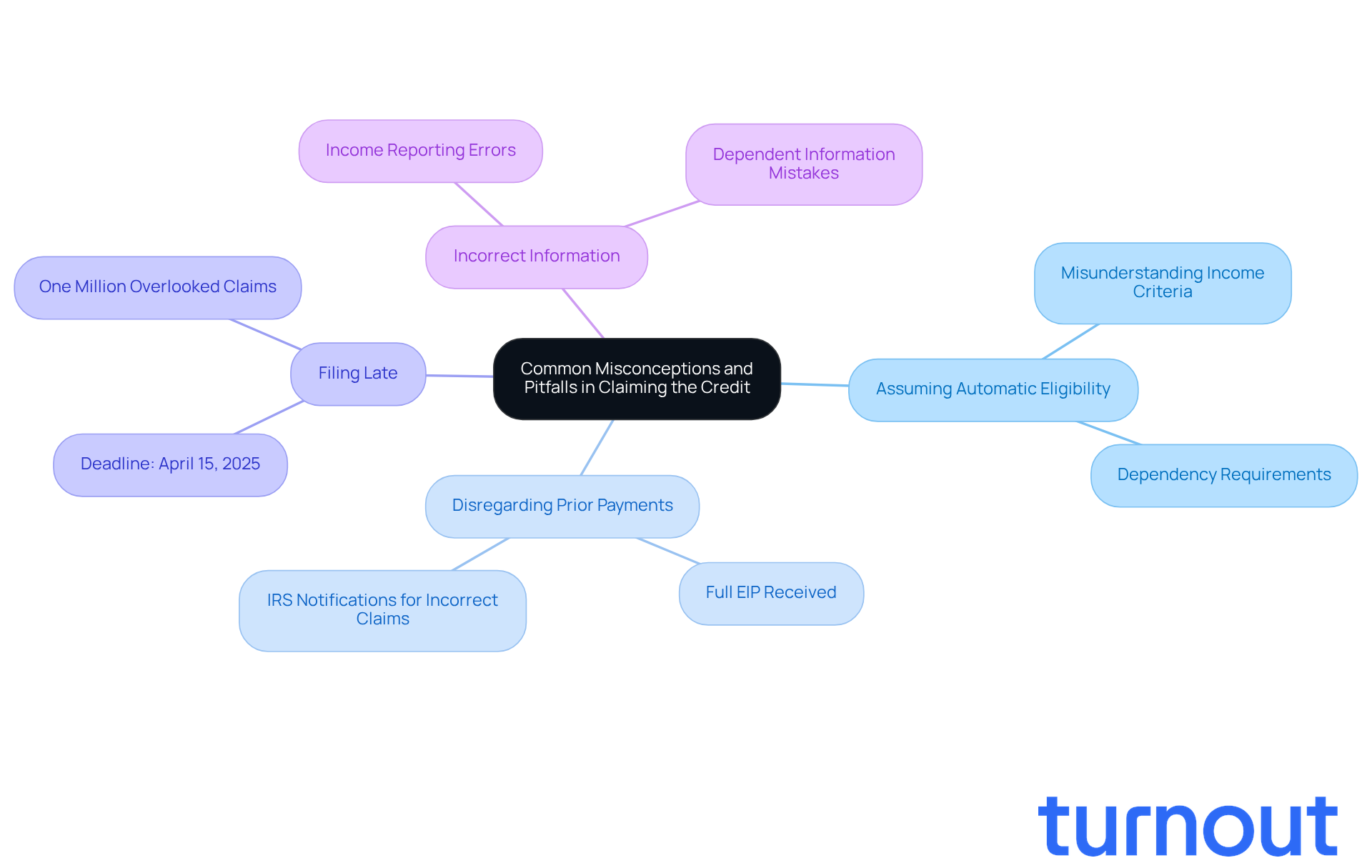

Identify Common Misconceptions and Pitfalls in Claiming the Credit

When it comes to claiming the Recovery Rebate Credit, many taxpayers face overwhelming misconceptions and pitfalls related to recovery rebate credit eligibility.

-

Assuming Automatic Eligibility: It’s easy to think that if you filed a tax return, you automatically qualify for this benefit. However, it’s crucial to meet specific income and dependency criteria for recovery rebate credit eligibility. As Susan Tompor highlights, many individuals who claimed the recovery rebate credit are discovering that their recovery rebate credit eligibility for additional funds may not be valid after all.

-

Disregarding Prior Payments: Some taxpayers mistakenly assert their entitlement to the benefit even after receiving the full Economic Impact Payments (EIPs). This can lead to complications and potential penalties. The IRS is sending notifications to those whose recovery rebate credit eligibility was incorrectly claimed for additional stimulus funds on their 2021 federal income tax returns.

-

Filing Late: Remember, the deadline to request the benefit for the 2021 tax year was April 15, 2025. Missing this deadline means losing the chance to claim what you deserve. It’s important to note that one million individuals overlooked claiming the recovery rebate credit eligibility when they were eligible.

-

Incorrect Information: Failing to accurately report your income or dependent information can lead to delays or denials of the credit. By recognizing these common traps, you can prepare your submissions more effectively and avoid unnecessary complications. The initiative for the recovery rebate credit eligibility was designed to simplify the process for eligible individuals, but it also highlights the complexities that taxpayers face.

We understand that navigating these issues can be challenging, but you are not alone in this journey. We're here to help you through it.

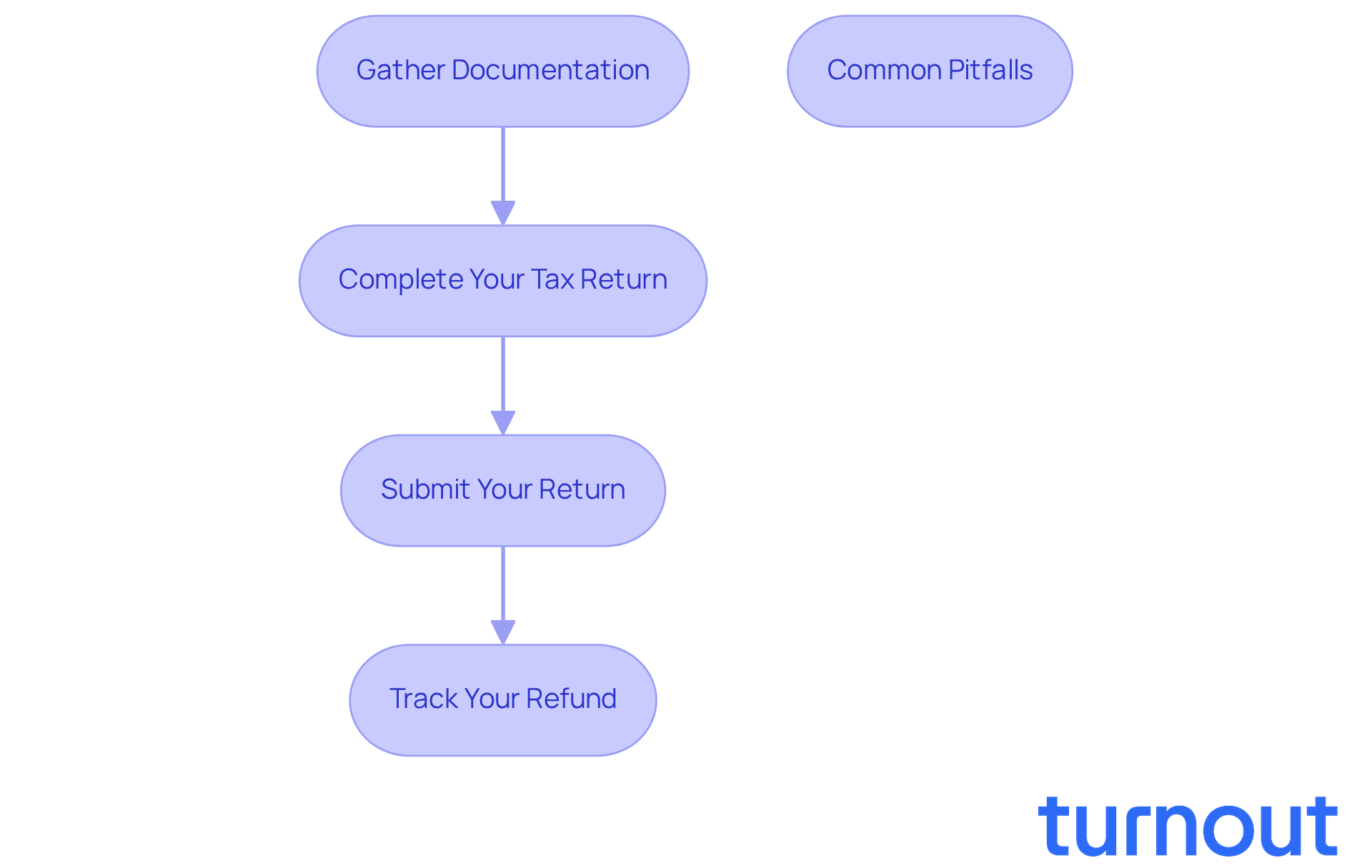

Provide a Step-by-Step Guide to Claiming the Recovery Rebate Credit

Claiming the Recovery Rebate Credit can feel overwhelming, but we're here to guide you through it. Just follow these simple steps:

- Gather Documentation: Start by collecting your essential tax documents. This includes your previous tax returns and any IRS notices about Economic Impact Payments (EIPs). The recovery rebate credit eligibility is an important aspect to consider. Determine recovery rebate credit eligibility by reviewing the eligibility criteria. To meet the recovery rebate credit eligibility, you must be a U.S. citizen or resident alien and not be claimed as a dependent.

- Complete Your Tax Return: When you're ready, fill out your federal tax return using Form 1040 or 1040-SR. On Line 30, make sure to specify the amount of the Recovery Rebate Credit you're claiming.

- Submit Your Return: To speed up the process, consider electronic filing. If you prefer, you can also mail your return to the IRS. Remember to keep copies of all submitted documents for your records. The IRS will start accepting tax returns on February 1. The recovery rebate credit eligibility is an important aspect to consider, so be prepared to file as soon as you can.

- Track Your Refund: After you submit, use the IRS 'Where's My Refund?' tool to keep an eye on your refund status.

Common Pitfalls: It's easy to make mistakes when claiming the Recovery Rebate Credit. Be mindful of reporting incorrect amounts or filing late, as these can delay your claims.

By following these steps, you can confidently navigate the process of determining your recovery rebate credit eligibility. Remember, you’re not alone in this journey, and with a little preparation, you could unlock significant financial benefits.

Conclusion

The Recovery Rebate Credit is a crucial financial lifeline for those who may have missed out on previous Economic Impact Payments. We understand that navigating these financial waters can be overwhelming, but knowing the eligibility criteria and how to claim this credit is essential. It’s not just about maximizing potential refunds; it’s about ensuring that you reclaim what is rightfully yours. This credit can ease immediate financial pressures and plays a vital role in helping households recover from economic hardships.

Throughout this article, we’ve highlighted key points that matter to you. We’ve covered specific eligibility requirements, addressed common misconceptions that might hinder your claims, and provided a step-by-step guide for successfully filing for the Recovery Rebate Credit. Understanding income limits and avoiding pitfalls like double-dipping and incorrect reporting are crucial. Remember, being informed is your best ally. And with deadlines approaching, timely action is more important than ever.

Ultimately, the Recovery Rebate Credit is an opportunity for many to regain financial stability. We encourage you to take proactive steps to understand and claim this benefit. You deserve the support that’s available to you. By staying informed and seeking help when needed, you can navigate these complexities and secure the financial relief that the Recovery Rebate Credit offers. Remember, you are not alone in this journey; we’re here to help.

Frequently Asked Questions

What is the Recovery Rebate Credit (RRC)?

The Recovery Rebate Credit (RRC) is a refundable tax incentive that provides financial assistance to individuals who may not have received their full Economic Impact Payments (EIPs), commonly known as stimulus checks. It allows eligible individuals to reclaim missed payments from previous years.

Why is the Recovery Rebate Credit important?

The RRC is important because it enables eligible individuals to potentially increase their tax refunds by up to $1,400 for each person, helping to alleviate financial difficulties, especially for those affected by the pandemic.

Who can benefit from the Recovery Rebate Credit?

Individuals who faced financial difficulties during the pandemic and missed out on receiving their full Economic Impact Payments may benefit from the RRC.

How can the Recovery Rebate Credit assist with financial recovery?

The RRC helps individuals recover substantial amounts of money that they are entitled to, which can significantly improve their financial stability and alleviate immediate financial burdens.

What should individuals be aware of when claiming the Recovery Rebate Credit?

Individuals should be cautious of common pitfalls such as double-dipping and reporting incorrect amounts when claiming the RRC.

What is the deadline for filing a tax return to claim the Recovery Rebate Credit?

The legal deadline for filing a tax return to claim the RRC is May 17, 2024.

Who can assist individuals in navigating the Recovery Rebate Credit process?

Trained nonlawyer advocates and IRS-licensed enrolled agents can provide support to individuals navigating the complexities of claiming the RRC, especially those also pursuing Social Security Disability claims or seeking tax debt relief.