Introduction

Navigating Pennsylvania’s tax system can feel overwhelming, whether you’re a resident or a non-resident. We understand that with a flat personal earnings tax rate, varying local taxes, and potential pitfalls in filing, it’s easy to feel lost. But don’t worry-understanding the core components of your tax obligations is essential for achieving financial success.

This article will explore key practices designed to simplify the tax payment process. We’ll help you avoid common mistakes and leverage available resources. How can you and your business stay ahead of the ever-changing tax landscape? Let’s ensure you’re compliant while maximizing your financial benefits.

You’re not alone in this journey. Many people share your concerns, and we’re here to help you navigate these challenges with confidence.

Understand Pennsylvania's Tax Structure and Obligations

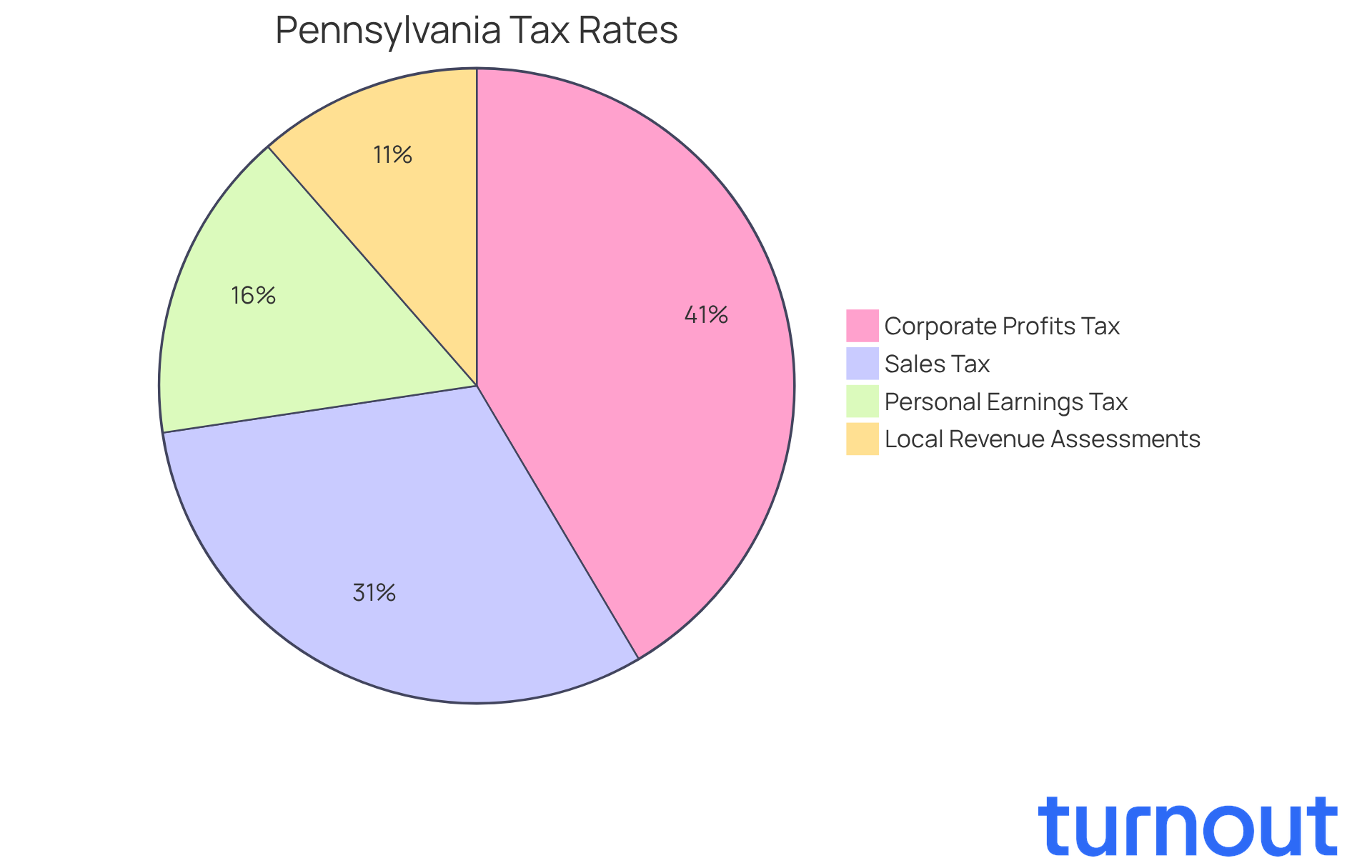

Pennsylvania's tax system features a flat personal earnings tax rate of 3.07%, which applies to both residents and non-residents. We understand that navigating taxes can be daunting, but this straightforward approach simplifies your obligations, allowing you to plan effectively.

In addition to the personal earnings tax, the state imposes a sales tax of 6% and a corporate profits tax that will decrease from 7.99% in 2025 to 7.49% in 2026. It's important to be aware of local revenue assessments, which can vary from 0.5% to 3.9%, depending on your municipality. Familiarizing yourself with the PA-40 form is essential, as it is necessary for submitting your personal tax returns.

By understanding these rates and the types of taxes applicable, including the estimated Pennsylvania tax payment burden of 8.4% for 2024, you can better anticipate your liabilities and avoid unexpected financial burdens. Remember, you are not alone in this journey. As tax expert Scott Drenkard pointed out, "One aspect of the tax code where significant complexity and low compliance are closely linked-and where reform is urgently required-is in states’ nonresident personal tax reporting and withholding regulations." We're here to help you navigate these complexities.

Identify and Avoid Common Tax Filing Mistakes

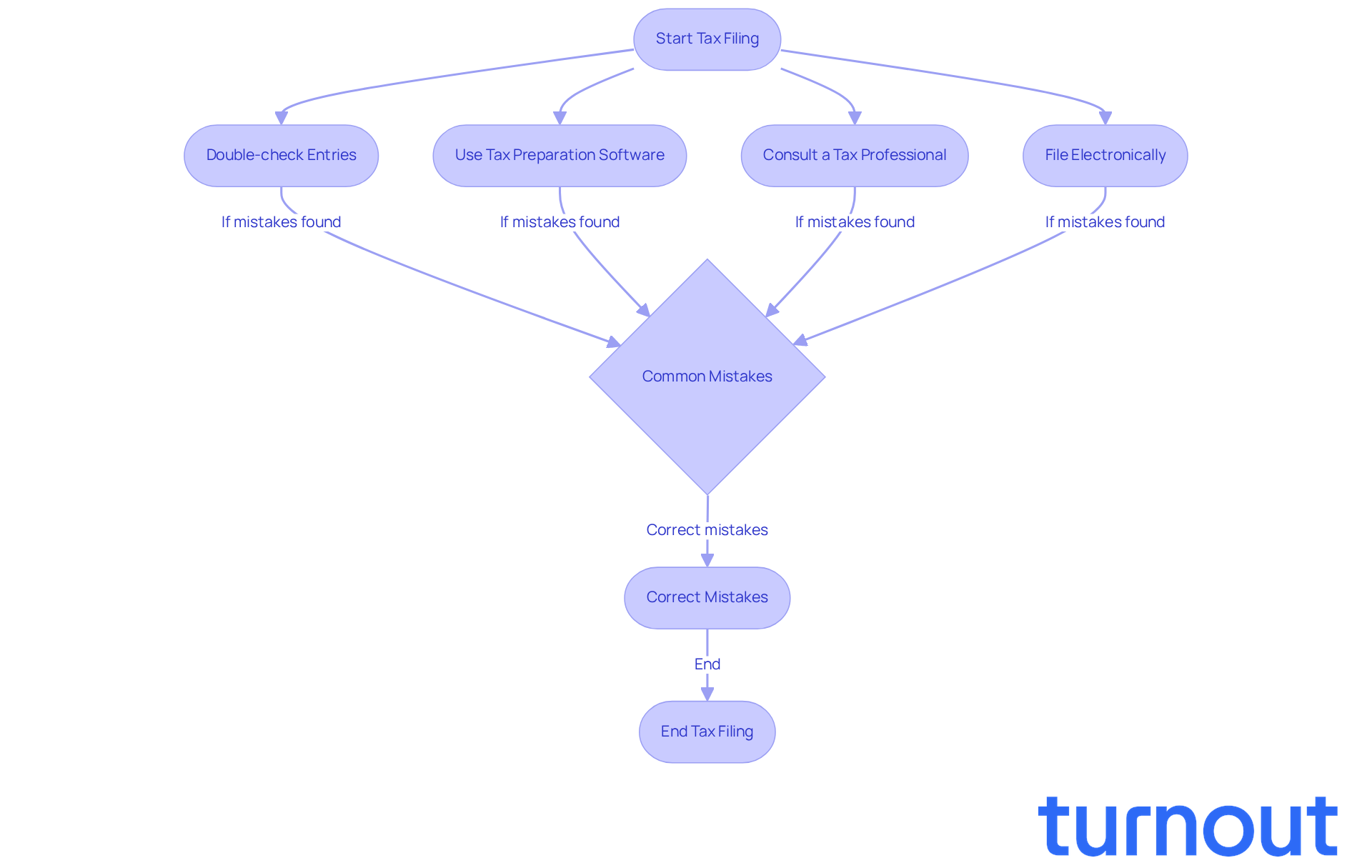

Common tax submission mistakes can really impact how your return turns out. We understand that errors like incorrect Social Security numbers, misspelled names, and using the wrong tax forms can be frustrating. In fact, the IRS reported over 2 million math errors on individual income tax returns in fiscal year 2024, highlighting just how common these mistakes are.

It's also easy to overlook deductions and credits, which can mean missing out on potential savings. To help you avoid these pitfalls, we encourage you to double-check all your entries. Using tax preparation software can be a great way to ensure you don’t miss anything, as it prompts you for the necessary information.

If your tax situation feels complex, consulting with a tax professional can be a wise choice. They can provide tailored guidance and help you navigate the intricacies of tax law. Filing electronically is another effective strategy to reduce errors; many software programs automatically check for common mistakes before submission.

With IRS staffing reduced by about 25%, the 2026 submission season is expected to be more challenging. This makes it even more important to prioritize accuracy. As Shawn Brubaker, CPA, wisely points out, "Accuracy is now more critical than speed." By seeking professional advice when needed and ensuring all your documentation is complete before submission, you can significantly enhance your chances of a successful tax submission experience. Remember, you are not alone in this journey - we're here to help!

Leverage Resources and Support for Efficient Tax Management

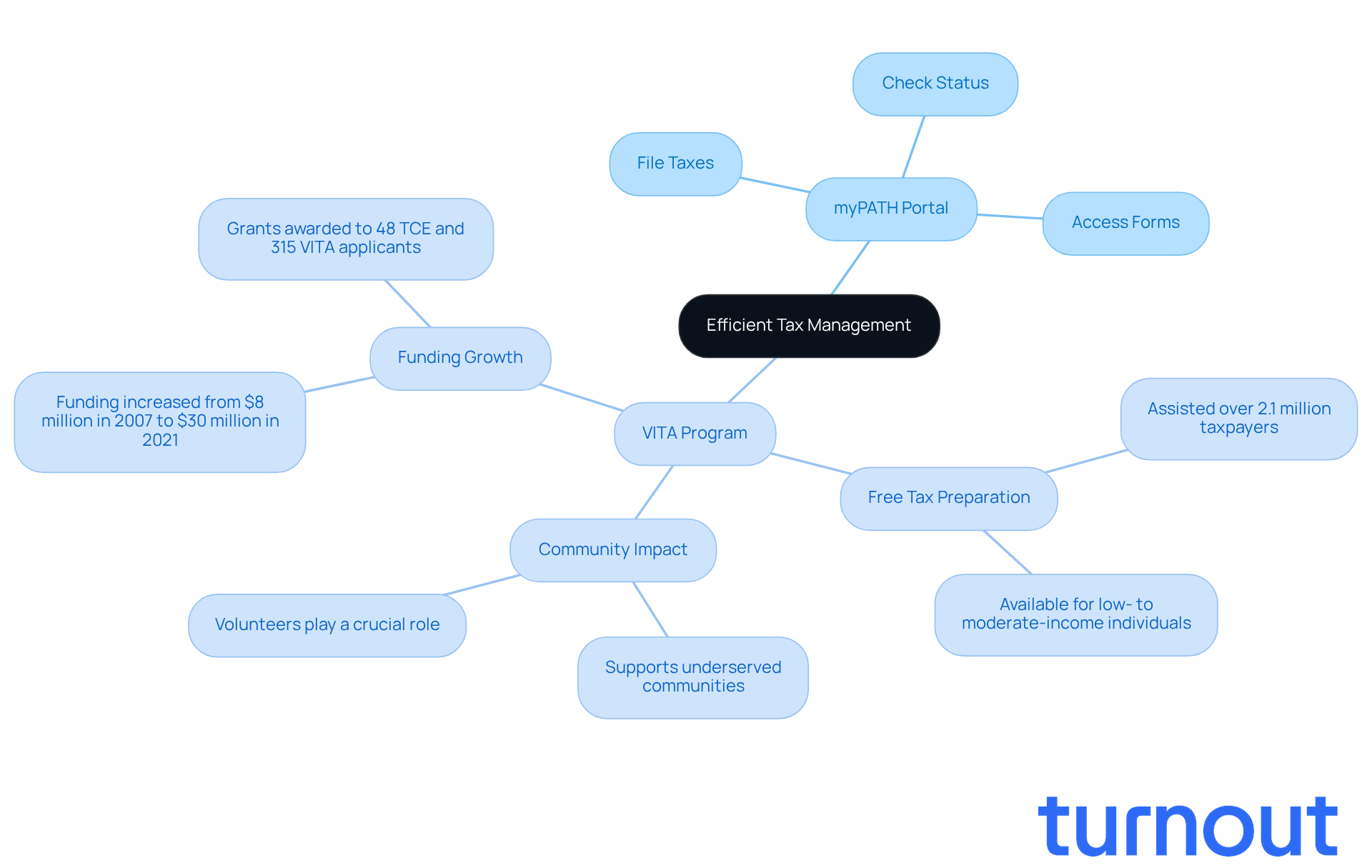

Taxpayers in Pennsylvania, we understand that managing your Pennsylvania tax payment can feel overwhelming. Thankfully, there’s a wealth of resources available to help you navigate this process with ease. The Pennsylvania Department of Revenue's online portal, myPATH, is designed just for you. It allows users to file their taxes, check their status, and access necessary forms effortlessly.

As we move into 2026, myPATH continues to evolve, offering enhanced features like improved navigation and user-friendly interfaces. These updates simplify the submission process and make your experience smoother. For those who may need extra help, the Volunteer Income Tax Assistance (VITA) program is here to provide free tax preparation services. This ensures that eligible individuals receive the support they truly deserve.

In the most recent tax season, VITA sites assisted over 2.1 million taxpayers, showcasing their vital role in our community. This growth is made possible by increased funding for VITA programs, which rose from $8 million in 2007 to $30 million in 2021. This expansion highlights the program's commitment to serving those in need. However, we recognize that challenges remain, particularly in recruiting volunteers essential for the program's success, especially in underserved communities.

Utilizing these resources not only simplifies tax filing but also keeps you informed about potential credits, such as the Working Pennsylvanians Tax Credit, which can significantly ease financial burdens. Tax professionals have praised the myPATH portal for its user-friendly interface and efficiency, making it a valuable tool for managing Pennsylvania tax payment. Remember, you are not alone in this journey; we’re here to help.

Stay Updated on Tax Law Changes and Implications

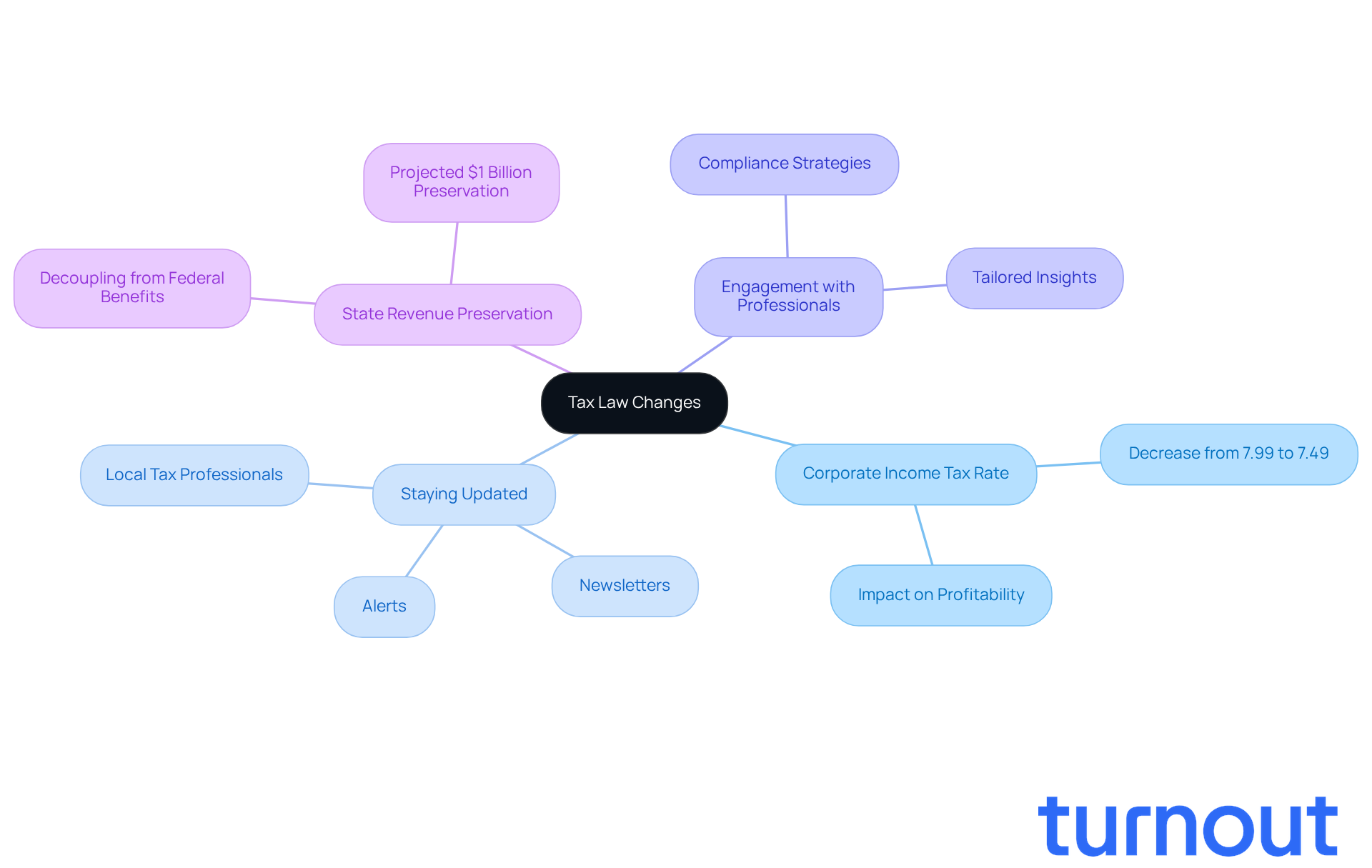

Navigating the changes in tax laws, including the Pennsylvania tax payment, can feel overwhelming, and we understand that this is crucial for your business. The corporate income tax rate is set to decrease from 7.99% in 2025 to 7.49% in 2026. This shift could significantly impact your operations and profitability.

It's essential to stay updated with the latest information regarding Pennsylvania tax payment from the Pennsylvania Department of Revenue. Consider subscribing to newsletters or alerts that detail legislative changes. Engaging with local tax professionals can provide you with tailored insights into how these adjustments may affect your specific Pennsylvania tax payment. This way, you can ensure compliance and make informed decisions.

As tax attorney Jennifer Karpchuk wisely points out, "Understanding these changes is vital for businesses to navigate the evolving tax landscape effectively." Additionally, Pennsylvania's recent decision to decouple from federal corporate tax benefits is projected to preserve over $1 billion in state revenue. This further emphasizes the importance of staying informed.

Remember, businesses that adapt to tax changes often find themselves better positioned for competitiveness and growth in our ever-evolving economic landscape. You're not alone in this journey; we're here to help you navigate these changes.

Conclusion

Understanding Pennsylvania's tax landscape is essential for effective financial planning and compliance. We know that navigating taxes can feel overwhelming, but familiarizing yourself with the state's tax structure - like the flat personal earnings tax and local revenue assessments - can help you manage your obligations with confidence.

Accuracy in tax filing is crucial. It’s common to make mistakes that could lead to financial setbacks, but you don’t have to face this alone. Utilizing resources like the myPATH portal and the Volunteer Income Tax Assistance program can greatly enhance your filing experience, ensuring you receive the support you need.

Staying updated on tax law changes is vital. These changes can directly impact your personal and business finances. For instance, the upcoming reduction in the corporate income tax rate and the implications of decoupling from federal corporate tax benefits are important points to consider. Engaging with tax professionals and using digital tools can help you remain compliant and informed, ultimately leading to better financial outcomes.

As tax regulations evolve, it’s increasingly important for Pennsylvania residents to stay proactive in managing their tax obligations. Embracing the available resources and support can simplify the tax filing process and empower you to make informed decisions that align with your financial goals. Remember, by taking these steps, you can navigate the complexities of Pennsylvania's tax system with greater ease and confidence. We're here to help you every step of the way.

Frequently Asked Questions

What is the personal earnings tax rate in Pennsylvania?

Pennsylvania has a flat personal earnings tax rate of 3.07%, applicable to both residents and non-residents.

What is the sales tax rate in Pennsylvania?

The sales tax rate in Pennsylvania is 6%.

How will the corporate profits tax rate change in Pennsylvania?

The corporate profits tax rate in Pennsylvania will decrease from 7.99% in 2025 to 7.49% in 2026.

Are there additional local taxes in Pennsylvania?

Yes, local revenue assessments in Pennsylvania can vary from 0.5% to 3.9%, depending on the municipality.

What form is necessary for submitting personal tax returns in Pennsylvania?

The PA-40 form is necessary for submitting personal tax returns in Pennsylvania.

What is the estimated Pennsylvania tax payment burden for 2024?

The estimated Pennsylvania tax payment burden for 2024 is 8.4%.

What challenges are associated with nonresident personal tax reporting in Pennsylvania?

There is significant complexity and low compliance linked to nonresident personal tax reporting and withholding regulations, indicating a need for reform.