Introduction

Navigating the complexities of tax obligations can feel overwhelming. Many individuals find themselves unsure of their options, and that’s completely understandable. But here’s the good news: the IRS offers a lifeline through payment plans. These plans allow taxpayers to tackle their debts in manageable installments, rather than facing the burden of a lump-sum payment.

So, how can you effectively navigate these payment plans? What strategies can help ensure compliance and avoid pitfalls? Understanding the nuances of IRS payment plans is crucial for anyone seeking financial relief and stability. Remember, you’re not alone in this journey. We’re here to help you find the best path forward.

Understand IRS Payment Plans

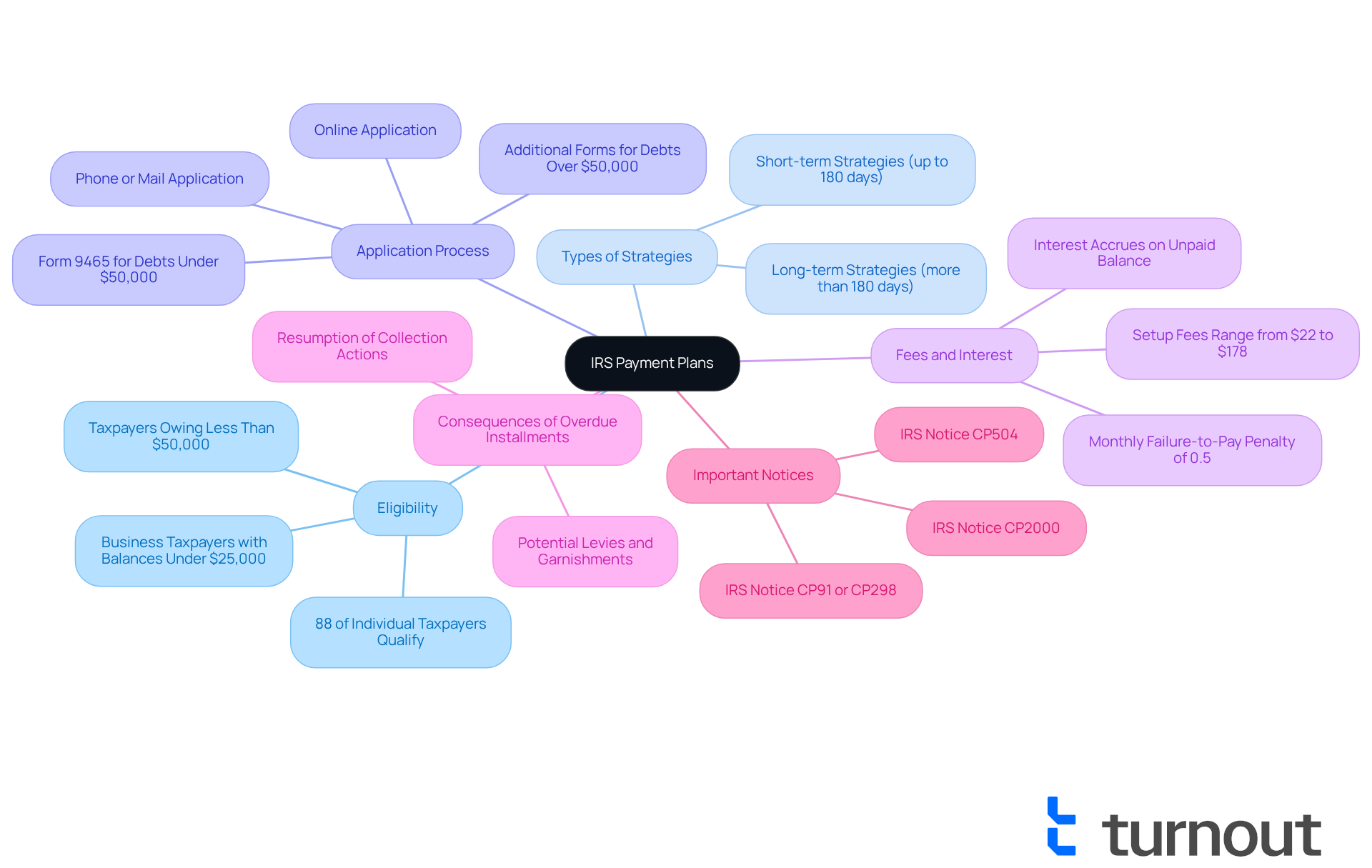

IRS installment arrangements, commonly known as a paying back taxes payment plan, allow you to settle your tax obligations gradually rather than in one hefty payment. We understand that managing tax responsibilities can feel overwhelming, but grasping these strategies is the first step toward taking control. Here are some key points to consider:

-

Eligibility: Most individual taxpayers qualify for a payment plan if they owe less than $50,000 in combined tax, penalties, and interest. In fact, 88% of individual taxpayers fall into this category, making streamlined installment agreements (SLIAs) a popular choice.

-

Types of Strategies: There are short-term strategies (up to 180 days) and long-term strategies (more than 180 days). Knowing the difference can help you choose the right option based on your financial situation. If your company has debts exceeding $10,000, setting up a paying back taxes payment plan will require automatic deductions from a bank account.

-

Application Process: Familiarize yourself with the application process, which can be completed online, by phone, or via mail. Each method has its own requirements and processing times. For debts under $50,000, the streamlined application process requires minimal documentation, primarily Form 9465. However, if your debt exceeds $50,000, you’ll need to provide detailed financial information regarding the paying back taxes payment plan, which may affect how long the application takes.

-

Fees and Interest: Be aware that there may be setup fees and interest charges related to these arrangements, which can impact the total amount you’ll pay over time. The setup charge for a long-term financing arrangement can range from $22 to $178, depending on how you apply. Interest continues to accrue on the unpaid balance, and a monthly failure-to-pay penalty of 0.5% applies until the debt is fully settled. Importantly, this fine is reduced by fifty percent when you’re on a paying back taxes payment plan.

-

Consequences of Overdue Installments: It’s crucial to stick to your repayment schedule. Missing installments can lead to the resumption of collection actions, which may involve levies and garnishments.

-

Important Notices: Stay alert for IRS notices, such as CP91 or CP298, which indicate serious matters needing your immediate attention.

By understanding these aspects, you can make informed decisions about managing your tax debt. Remember, you’re not alone in this journey, and we’re here to help.

Explore Types of Payment Plans

Navigating tax debt can be overwhelming, but the IRS provides several options, such as a paying back taxes payment plan, tailored to your unique financial situation. Here’s a look at some options that might help you find relief:

-

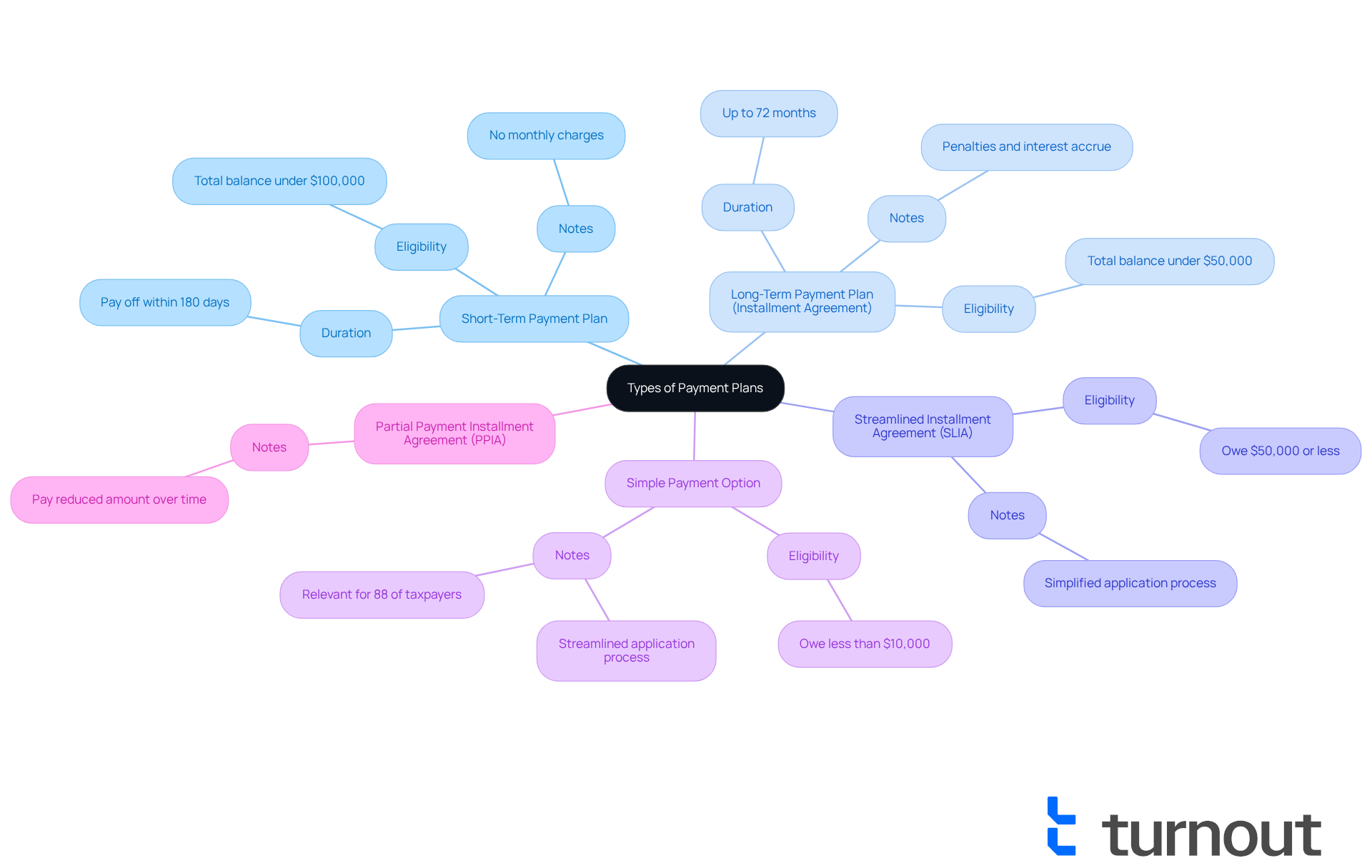

Short-Term Payment Plan: If you can pay off your tax debt within 180 days, this plan might be right for you. It’s straightforward-no monthly charges, just the total amount due at the end of the period.

-

Long-Term Payment Plan (Installment Agreement): For those who need a bit more time, this paying back taxes payment plan allows you to pay off your debt over 72 months. While monthly installments are necessary, it’s important to remember that penalties and interest will continue to accrue during this time.

-

Streamlined Installment Agreement (SLIA): If you owe $50,000 or less, this arrangement simplifies the payment process. You won’t need to provide extensive financial disclosures, making it more accessible for many taxpayers.

-

Simple Payment Option: Designed for individual taxpayers who owe less than $10,000, this option streamlines the application process and may come with lower fees. In fact, 88% of individual taxpayers owe less than $25,000, which highlights how relevant this option can be for many.

-

Partial Payment Installment Agreement (PPIA): If paying your full tax debt feels impossible, this paying back taxes payment plan allows you to pay a reduced amount over time, offering some breathing room.

We understand that sometimes life can throw unexpected challenges your way. If you find yourself unable to pay, you can also request a temporary delay in the collection process. Each of these strategies has its own eligibility criteria and implications, so it’s essential to assess your financial situation carefully.

As Jim Buttonow, Senior Vice President for Post-Filing Tax Services, wisely points out, "The best aspect of this new financial arrangement is that it is easy to establish with the IRS." Remember, you’re not alone in this journey. For more information and to explore your options, we encourage you to visit IRS.gov. We're here to help you take the next step towards financial relief.

Apply for a Payment Plan

Applying for an IRS payment plan can feel overwhelming, but we're here to help you through it. Follow these simple steps to ease your worries:

-

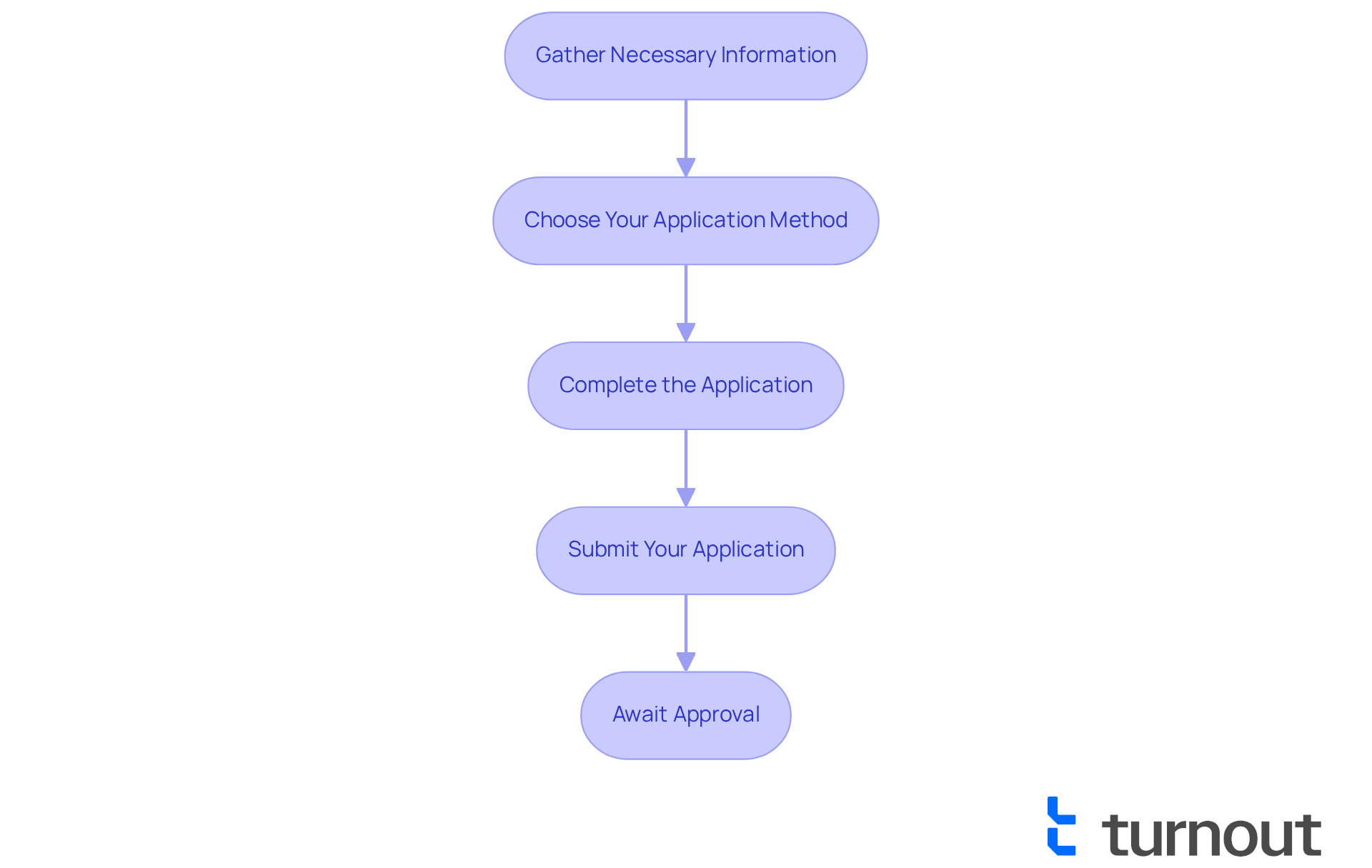

Gather Necessary Information: Start by collecting essential tax information, like your Social Security number, tax return details, and the total amount owed. This preparation is crucial for a smooth application process and can help alleviate some of your stress.

-

Choose Your Application Method: You have options! You can apply online through the IRS website, by phone, or by mailing Form 9465 (Installment Agreement Request). We recommend the online method, as it usually leads to faster processing times and immediate confirmation of your application. Remember, most individual taxpayers are eligible for a paying back taxes payment plan, which makes this a practical choice for managing tax debts.

-

Complete the Application: If you decide to apply online, just follow the prompts to fill out the required information carefully. For those using Form 9465, make sure all sections are accurately completed to avoid any delays. It’s common to feel anxious about this step, but taking your time can make a big difference.

-

Submit Your Application: Once your application is complete, submit it according to your chosen method. Online submissions provide instant acknowledgment, while mailed applications may take longer to process. If you opt for a Long Term Payment Plan with Direct Debit, keep in mind that there is a setup fee of $22.

-

Await Approval: The IRS will review your application and notify you of their decision. If approved, you’ll receive details about your financial arrangement, including the monthly contribution amount and due dates. Typically, approval notifications arrive within 30-45 days for phone or mail requests, and almost instantly for online applications. Plus, if you’ve made genuine efforts to comply with tax laws, you might qualify for penalty relief.

By following these steps, you can confidently apply for a paying back taxes payment plan that helps you manage your tax responsibilities with greater ease. Remember, you are not alone in this journey, and most individual taxpayers qualify for a paying back taxes payment plan, which makes it a feasible choice for managing tax debts.

Manage Your Payment Plan Effectively

Once your paying back taxes payment plan is established, managing it effectively is essential to avoid penalties and ensure compliance.

-

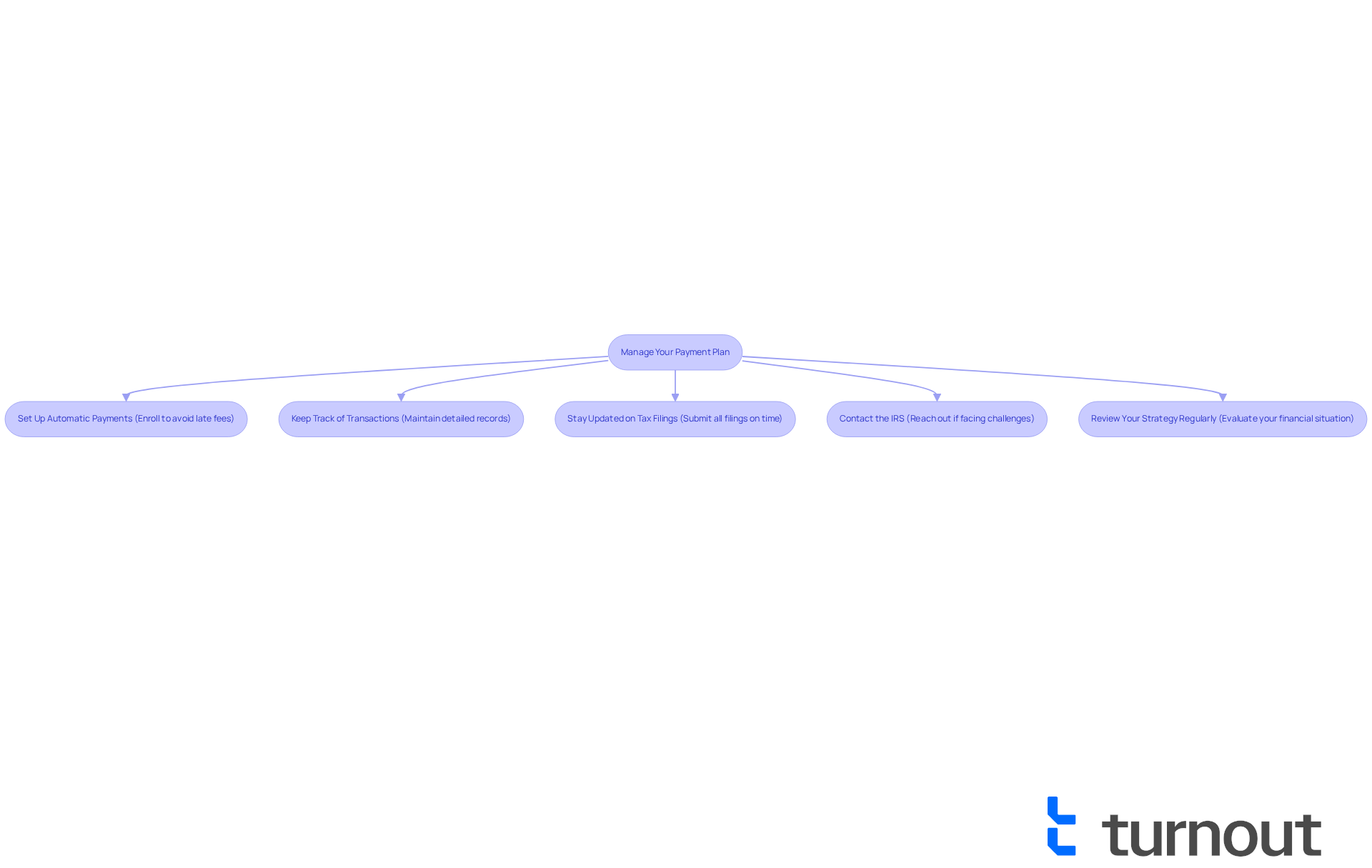

Set Up Automatic Payments: We understand that keeping track of due dates can be overwhelming. Enrolling in automatic payments is a smart move to help you stay on top of your obligations. This method can significantly reduce the chance of late fees and penalties, as being part of a paying back taxes payment plan ensures timely payments, which are crucial for maintaining your agreement. Remember, if you qualify for a short-term repayment plan, the IRS states, "you will not be liable for a user fee."

-

Keep Track of Transactions: It’s important to maintain a detailed record of all transactions, including dates and amounts. This practice not only helps you track your progress but also ensures that your payments are applied accurately, keeping you on the right path.

-

Stay Updated on Tax Filings: It’s common to feel stressed about tax returns, but submitting all necessary filings on time is vital while in an arrangement. The IRS requires compliance with all tax obligations to ensure your paying back taxes payment plan remains in good standing. Missing a deadline can jeopardize your plan, so staying organized is key.

-

Contact the IRS: If you find yourself facing financial challenges that impact your ability to meet your obligations, don’t hesitate to reach out to the IRS. They may offer options like adjusting your payment amount or considering alternative arrangements. Remember, you are not alone in this journey.

-

Review Your Strategy Regularly: Periodically evaluating your financial situation and the terms of your repayment agreement is crucial. If your circumstances change, you might qualify for a different arrangement or modifications to your current plan.

By actively managing your paying back taxes payment plan, you can navigate your tax responsibilities more effectively and avoid potential pitfalls. Did you know that nearly 3 million taxpayers established IRS installment agreements in the last two years? This shows how appealing these arrangements can be. Additionally, 88% of individual taxpayers owe less than $25,000 to the IRS, highlighting the accessibility of streamlined installment agreements (SLIAs) for many. Setting up automatic payments not only simplifies the process but also reduces the risk of default, ensuring you remain compliant and avoid extra penalties.

Don’t forget to utilize the Online Payment Agreement tool to manage your payment plan efficiently. We're here to help you every step of the way!

Conclusion

Understanding how to effectively manage and repay tax debts through IRS payment plans is crucial for those seeking financial relief. We understand that navigating these complexities can feel overwhelming. By breaking down these plans, you can take steps to regain control over your financial situation. The central idea is clear: utilizing a payment plan for back taxes can provide a manageable pathway to fulfilling your obligations without the stress that often accompanies it.

Throughout this article, we’ve highlighted key insights, including:

- Eligibility criteria for various payment plans

- The application process

- The importance of sticking to repayment schedules

From short-term options to streamlined installment agreements, there’s a solution available for most taxpayers, especially those with debts under $50,000. Additionally, understanding potential fees and consequences of missed payments reinforces the necessity of diligent management of these plans.

Ultimately, navigating tax debt doesn’t have to be an isolating experience. By leveraging IRS payment plans and actively engaging with the process, you can find a way to alleviate your financial burdens. It’s essential to stay informed, utilize available resources, and maintain open communication with the IRS. Remember, you are not alone in this journey. Taking these steps not only fosters a sense of empowerment but also paves the way for a more secure financial future.

Frequently Asked Questions

What are IRS payment plans?

IRS payment plans, also known as installment arrangements, allow taxpayers to pay back their tax obligations gradually rather than in a single large payment.

Who is eligible for an IRS payment plan?

Most individual taxpayers qualify for a payment plan if they owe less than $50,000 in combined tax, penalties, and interest. Approximately 88% of individual taxpayers fall into this category.

What types of payment strategies are available?

There are short-term strategies (up to 180 days) and long-term strategies (more than 180 days). The choice depends on your financial situation.

What is the application process for an IRS payment plan?

The application process can be completed online, by phone, or via mail. For debts under $50,000, the streamlined application requires minimal documentation, primarily Form 9465. For debts over $50,000, more detailed financial information is required.

Are there any fees or interest associated with IRS payment plans?

Yes, there may be setup fees and interest charges. The setup fee for a long-term arrangement can range from $22 to $178, depending on the application method. Interest continues to accrue on the unpaid balance, and a monthly penalty of 0.5% applies until the debt is fully settled, which is reduced by fifty percent if you are on a payment plan.

What happens if I miss a payment on my installment plan?

Missing payments can lead to the resumption of collection actions, which may include levies and garnishments.

What important notices should I be aware of from the IRS?

Stay alert for IRS notices such as CP91 or CP298, which indicate serious matters that require your immediate attention.