Introduction

Navigating the complexities of tax obligations can often feel like an uphill battle. We understand that facing the daunting prospect of back taxes can be overwhelming. Fortunately, the IRS offers a range of payment plans designed to alleviate financial stress. These plans allow individuals to repay their debts in manageable increments, providing a path toward relief.

This article delves into the intricacies of these plans, highlighting the benefits and strategies for selecting the right option tailored to your specific financial situation. It's common to feel uncertain about which choice to make. But with various options available, how can you determine the best course of action to avoid penalties and regain financial stability? We're here to help you navigate this journey.

Explore Tax Payment Plans: An Overview

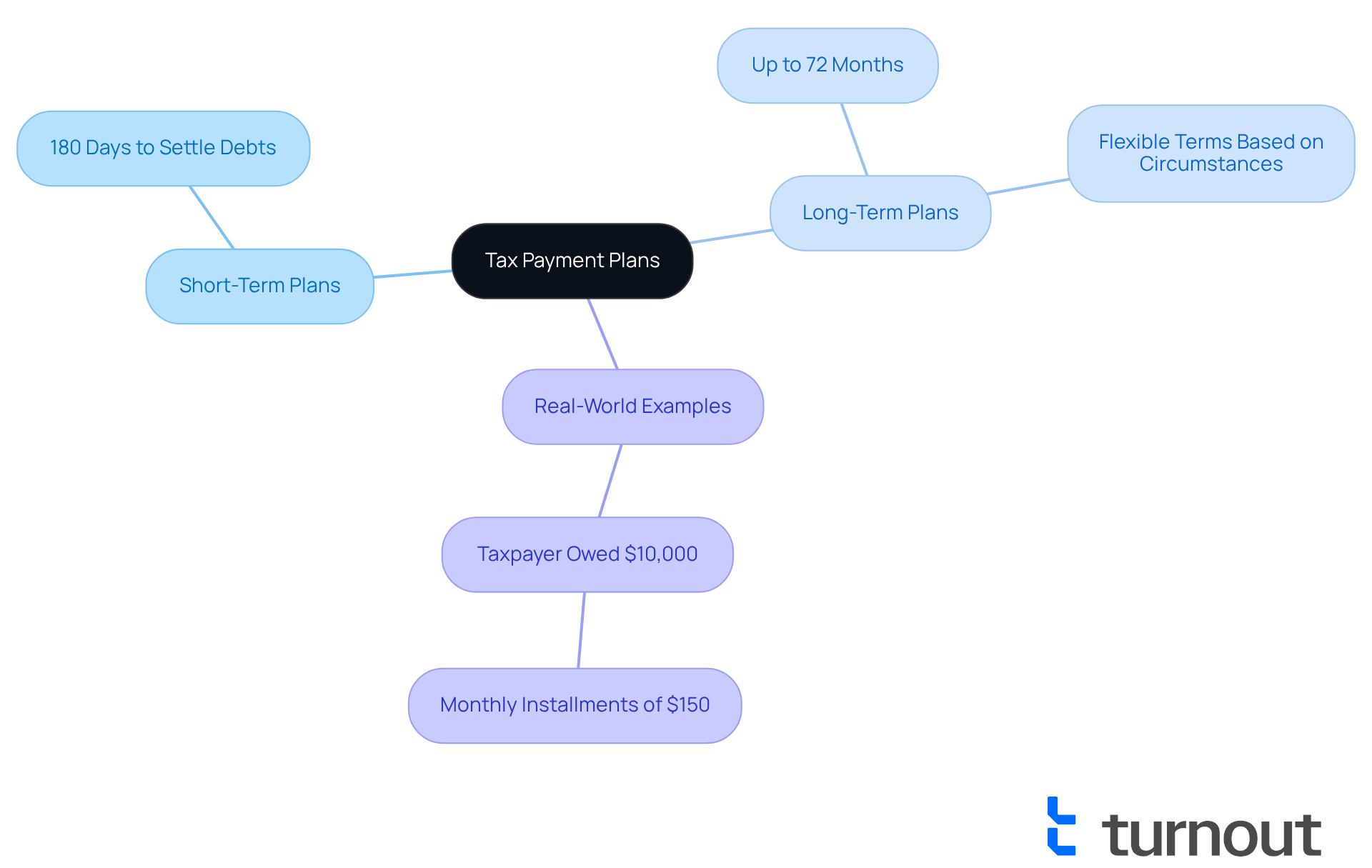

Tax settlement arrangements, often referred to as installment agreements, can provide a pay back taxes payment plan that enables individuals to gradually resolve their tax obligations instead of facing them all at once. We understand that financial challenges can be overwhelming, and the IRS offers various options tailored to different situations, including both short-term and long-term strategies. This knowledge is essential for anyone navigating tough financial times, as it can help avoid penalties and aggressive collection actions.

For example, a short-term pay back taxes payment plan allows individuals to settle their debts within 180 days. On the other hand, a pay back taxes payment plan can last up to 72 months or even longer, depending on the amount owed and personal financial circumstances. This flexibility is designed to ease the financial burden, providing a manageable pathway to a pay back taxes payment plan for resolving tax obligations.

In 2025, around 1.5 million individuals took advantage of a pay back taxes payment plan, showcasing a growing trend among those seeking structured repayment options. Financial consultants often highlight the benefits of these agreements, noting that they can empower individuals to take control of their finances and alleviate the stress associated with one-time payments. As one advisor shared, "A pay back taxes payment plan can be a lifeline for those struggling with tax debt, allowing them to regain their financial footing without the fear of immediate repercussions."

Moreover, the 2025 Nationwide Tax Forum Online enhances access to tax education resources for professionals, emphasizing the importance of understanding tax strategies and options for managing tax debt. Real-world examples illustrate the effectiveness of IRS installment agreements. For instance, a taxpayer who owed $10,000 successfully arranged a pay back taxes payment plan, which allowed them to pay off their debt in manageable monthly installments of $150. This approach not only lightened their financial load but also helped them stay compliant with their tax obligations, ultimately leading to a more stable financial situation.

As a gentle reminder, starting September 30, 2025, nearly all transactions with the federal government, including tax payments, will need to be conducted electronically, phasing out paper checks. This change underscores the evolving landscape of tax transaction methods and the importance of staying informed about these updates. Remember, you are not alone in this journey, and we're here to help you navigate these changes.

Differentiate Between Short-Term and Long-Term Payment Plans

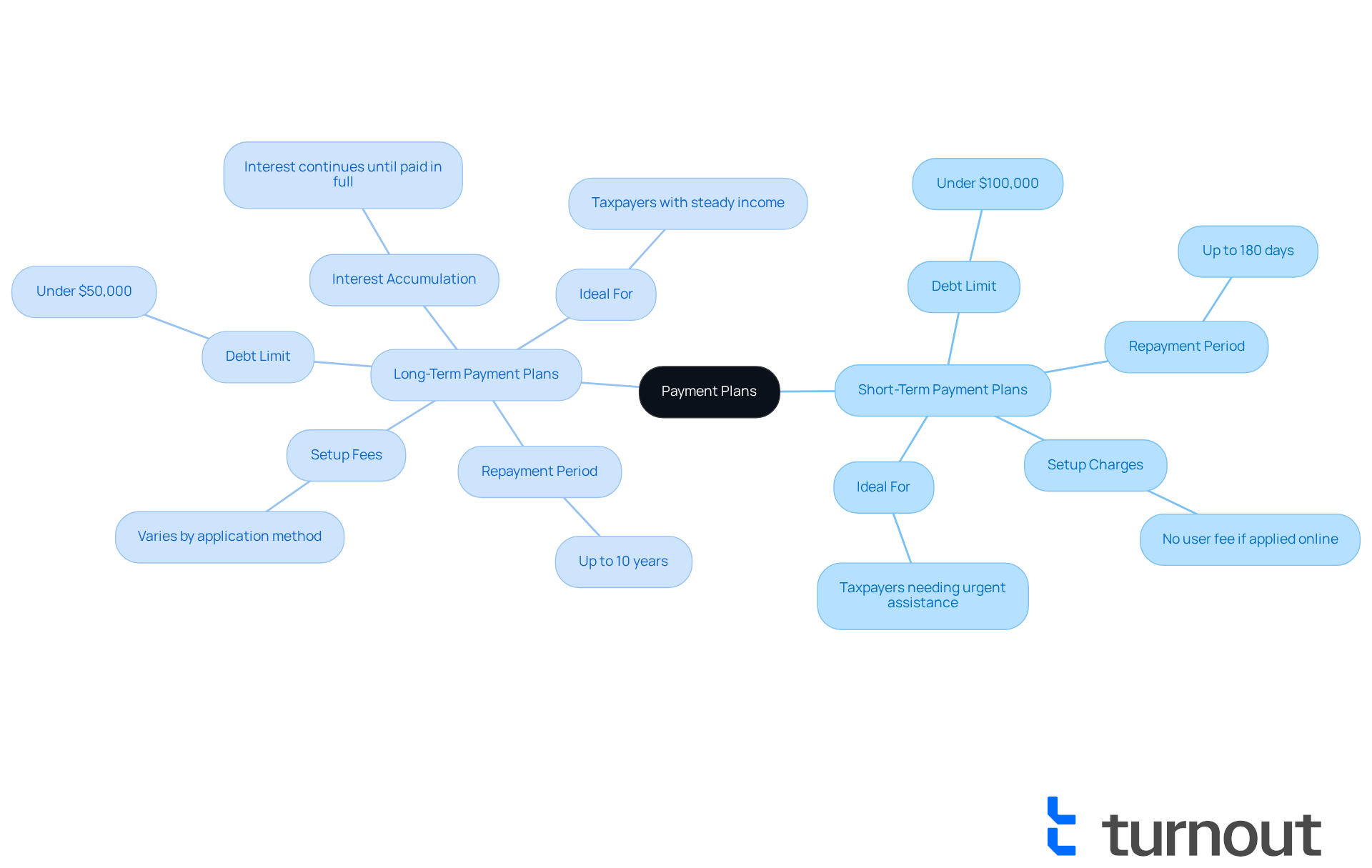

If you're feeling overwhelmed by debt, know that you're not alone. Short-term financing options can be a lifeline for taxpayers with a total debt of under $100,000, including taxes, penalties, and interest. These arrangements allow for repayment within 180 days and typically don’t involve setup charges. This makes them an appealing choice for those who need urgent assistance.

On the other hand, if your situation allows for a longer repayment period, a pay back taxes payment plan or long-term installment agreements might be the right fit for you. These are designed for individuals who owe $50,000 or less and need more time to pay off their debt, often through a pay back taxes payment plan that can extend up to 10 years. While they offer flexibility, it’s important to consider that they may come with setup fees and interest accumulation, which can increase the total cost of repayment.

We understand that choosing between these options can be daunting. Financial specialists recommend evaluating your current financial situation and future income possibilities. For instance, if you're facing temporary financial difficulties, a short-term strategy might help you quickly address your debt. Conversely, if you have a steady income, a long-term arrangement could allow you to manage your expenses more comfortably over time.

Grasping these differences is essential for selecting the most appropriate method for your needs. Remember, we're here to help you navigate this journey.

Assess Eligibility for Tax Payment Plans

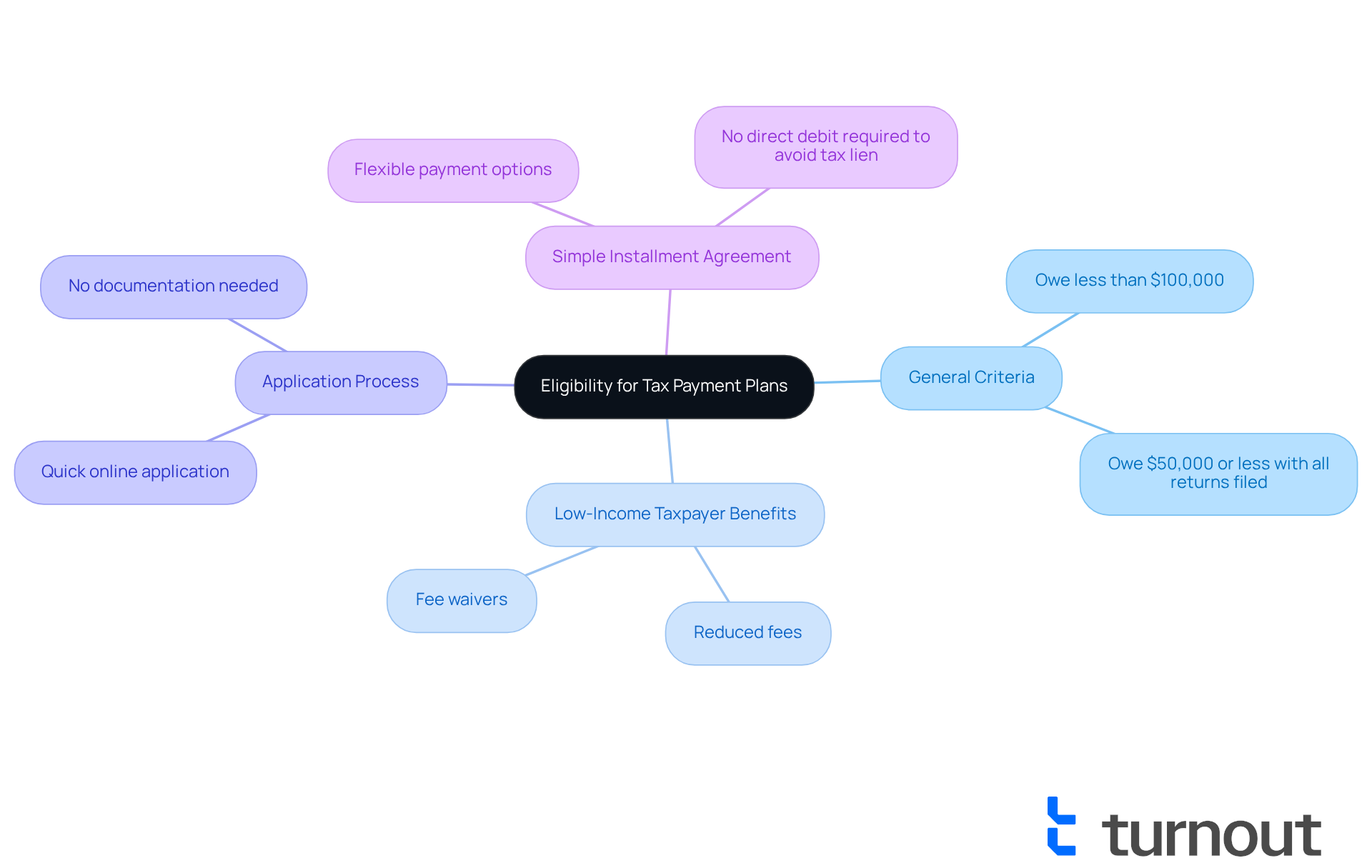

We understand that navigating tax obligations can be overwhelming. To qualify for a pay back taxes payment plan, it’s important to understand the specific criteria set by the IRS. For temporary arrangements, individuals must owe less than $100,000 in total tax, penalties, and interest. If you’re looking for a pay back taxes payment plan, the total owed must be $50,000 or less, and all required tax returns should be filed.

It's common to feel stressed about financial responsibilities, but staying up to date on your obligations and ensuring there are no unresolved tax liens can help. If you’re a low-income taxpayer, you might qualify for reduced fees or even fee waivers. This makes it crucial to assess your financial situation and gather the necessary documentation before applying.

The online application procedure for IRS financial arrangements is designed to be quick and easy, taking just a few minutes. You won’t need any documentation or direct interaction with the IRS. After completing the online application, you’ll receive prompt notification of your financial arrangement approval.

Additionally, the pay back taxes payment plan, specifically the Simple Installment Agreement, offers flexible financial options and doesn’t require direct debit to avoid a tax lien. Understanding these eligibility requirements can streamline your application process and increase your chances of approval. Remember, you are not alone in this journey; we’re here to help.

Navigate the Application Process for Payment Plans

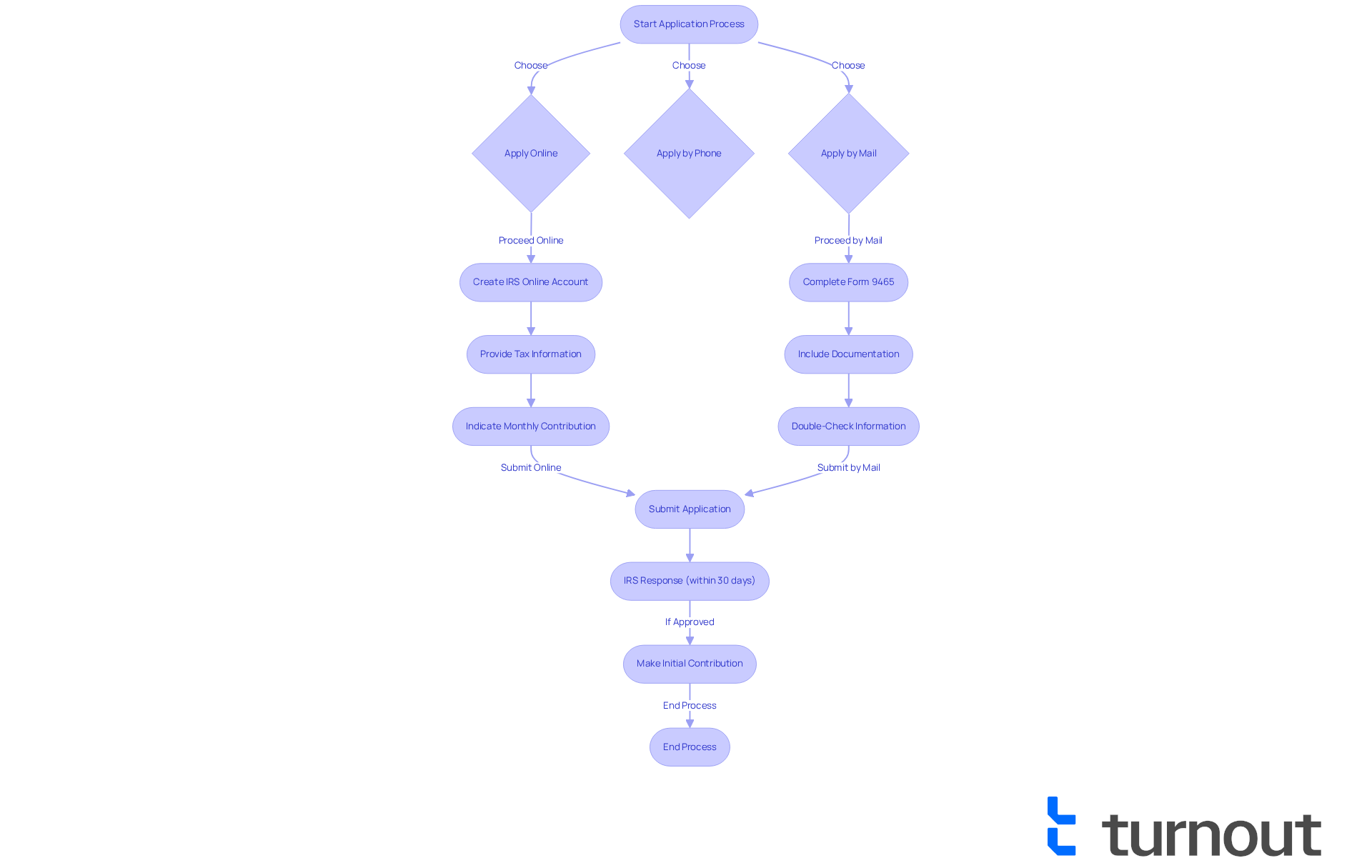

Applying for a pay back taxes payment plan can feel overwhelming, but assistance is available. You can choose to apply online, by phone, or via mail, depending on what feels most comfortable for you.

If you prefer the online route, the IRS Online Payment Agreement tool is a great option. It offers immediate feedback on your eligibility and approval, making the process smoother. To get started, simply create an IRS Online Account, provide your tax information, and indicate your proposed monthly contribution amount.

For those who wish to apply by mail, you’ll need to complete Form 9465, the Installment Agreement Request, and send it to the IRS. Remember to include any necessary documentation and double-check that all your information is accurate to avoid any delays.

Once you submit your application, the IRS typically responds within 30 days. Be prepared to make your initial contribution to the pay back taxes payment plan as soon as your proposal is approved. It’s common to feel anxious during this time, but rest assured, you’re taking a positive step towards resolving your tax situation.

Understand the Implications of Payment Plans on Tax Obligations

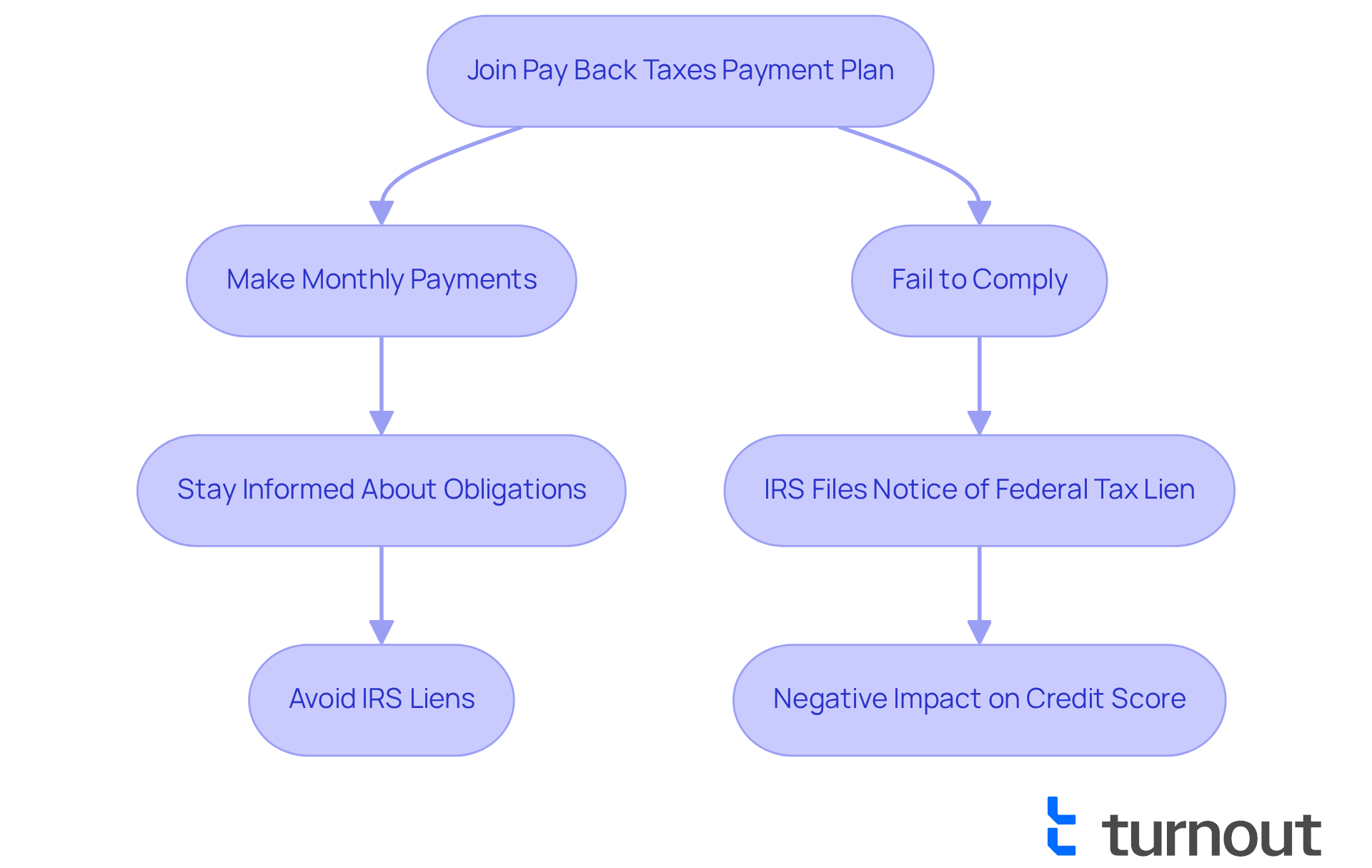

Joining a pay back taxes payment plan can feel overwhelming, but it provides a path forward for taxpayers. It allows for a pay back taxes payment plan with manageable installments over time, but it’s important to remember that the total amount due, including any accumulating interest and penalties, still needs to be settled. We understand that keeping up with tax returns and adhering to a pay back taxes payment plan can be daunting, but doing so is crucial to avoid defaulting on your arrangement.

Failure to comply can lead to the IRS filing a Notice of Federal Tax Lien, which can negatively impact your credit score. In recent years, particularly in 2025, the IRS has been more proactive in filing liens for installment plan defaults, and statistics show a notable increase in such filings. This is why staying informed about your obligations is so important.

Tax professionals, like Jim Buttonow, emphasize the value of maintaining open communication with the IRS when setting up a pay back taxes payment plan. It’s common to feel anxious about tax debts, but you’re not alone in this journey. For instance, consider a taxpayer who once faced a significant tax debt of $51,900 and is exploring a pay back taxes payment plan. They successfully entered a pay back taxes payment plan with a calculated minimum monthly payment of $590. This allowed them to manage their tax debt effectively by utilizing a pay back taxes payment plan while avoiding a lien.

It’s also reassuring to know that back taxes do not appear on credit reports. This is essential for protecting your financial health and ensuring a smoother resolution of your tax obligations. Remember, we’re here to help you navigate this process, and with the right support, you can find a way forward.

Conclusion

Navigating the complexities of tax obligations can feel overwhelming, and we understand that. However, knowing about the options available for pay back taxes payment plans can truly make a difference. These structured repayment arrangements, whether short-term or long-term, provide the flexibility you need to manage your tax debts more comfortably, easing the stress that often comes with lump-sum payments. By utilizing these plans, you can regain control over your financial situation while steering clear of penalties and aggressive collection actions.

In this guide, we've shared key insights about the different types of tax payment plans, eligibility criteria, and the application process. Short-term plans are designed for those who need quick relief, while long-term plans offer a more extended repayment period for larger debts. Understanding these distinctions is crucial for making informed decisions that fit your unique financial circumstances. Remember, maintaining compliance and open communication with the IRS is vital to prevent any negative repercussions.

Ultimately, you don’t have to face the journey of managing tax debts alone. With the right information and support, you can explore viable options that not only help settle your tax obligations but also pave the way toward financial stability. It’s essential to take action, assess your personal situation, and consider applying for a pay back taxes payment plan that aligns with your needs. Embracing these strategies can transform the burden of tax debt into an opportunity for recovery and growth. We're here to help you every step of the way.

Frequently Asked Questions

What are tax payment plans and why are they useful?

Tax payment plans, also known as installment agreements, allow individuals to gradually resolve their tax obligations instead of paying everything at once. They are useful for managing financial challenges and can help avoid penalties and aggressive collection actions.

What are the different types of tax payment plans?

There are short-term and long-term tax payment plans. Short-term plans allow individuals to settle their debts within 180 days, while long-term plans can last up to 72 months or longer, depending on the amount owed and personal financial circumstances.

How many people utilized tax payment plans in 2025?

In 2025, approximately 1.5 million individuals took advantage of tax payment plans, indicating a growing trend among those seeking structured repayment options.

What are the benefits of using a tax payment plan?

Tax payment plans empower individuals to take control of their finances, alleviate stress from one-time payments, and help them stay compliant with tax obligations, ultimately leading to a more stable financial situation.

What is the difference between short-term and long-term payment plans?

Short-term payment plans are for taxpayers with total debts under $100,000 and allow repayment within 180 days without setup charges. Long-term payment plans are for individuals who owe $50,000 or less and can extend up to 10 years, potentially involving setup fees and interest.

When will electronic transactions for tax payments begin?

Starting September 30, 2025, nearly all transactions with the federal government, including tax payments, will need to be conducted electronically, phasing out paper checks.

How can I choose the right tax payment plan for my situation?

It's important to evaluate your current financial situation and future income possibilities. A short-term plan may be suitable for urgent financial difficulties, while a long-term plan could be better for managing expenses over time with a steady income.