Overview

This article serves as a caring and comprehensive guide for individuals with disabilities, offering a step-by-step approach to navigating Pennsylvania tax payments. We understand that tax obligations can feel overwhelming, but by grasping the basics of taxation, you can take control of your financial responsibilities.

Explore the various payment options available to you, ensuring that you find the method that best suits your needs. It’s common to encounter challenges along the way, but don’t worry; we provide troubleshooting tips to help you resolve common issues. This information is designed to empower you to manage your tax obligations with confidence and ease.

Remember, you are not alone in this journey. We're here to help you every step of the way.

Introduction

Navigating the complexities of tax payments can be particularly daunting for disabled individuals in Pennsylvania. We understand that grasping the nuances of the tax system is crucial. This comprehensive guide aims to illuminate the various tax types and available exemptions, while also outlining effective payment methods tailored to your individual needs.

It's common to feel overwhelmed with multiple options and potential hurdles. How can one ensure a smooth and stress-free tax payment experience? We're here to help you through this journey.

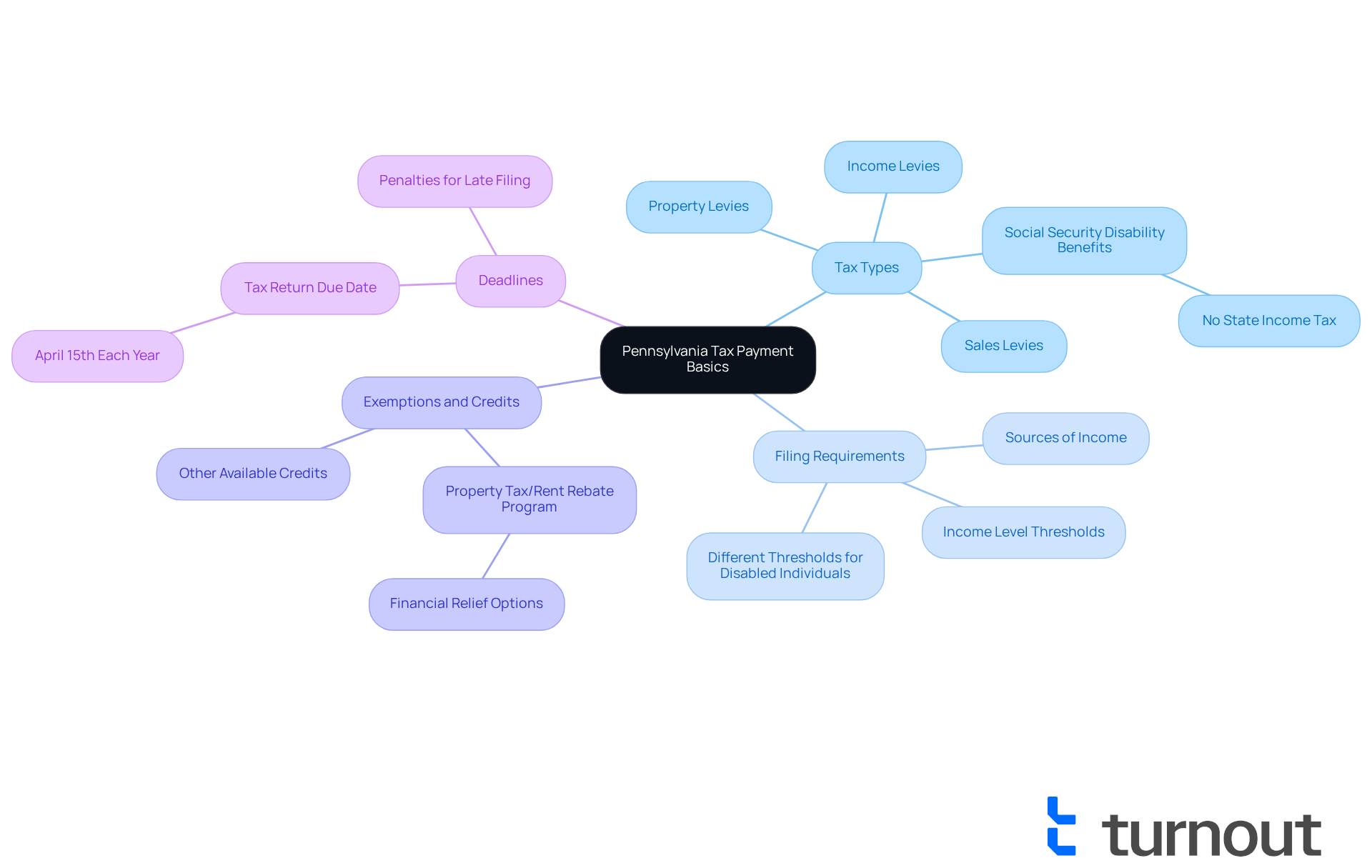

Understand Pennsylvania Tax Payment Basics

Before making any pa tax payments in the state, we understand that it’s essential to grasp the basics of the tax system. This state implements various levies, including income levies, property levies, and sales levies. For disabled individuals, there may be specific exemptions or credits available that can alleviate some financial burdens. Familiarizing yourself with the following key points can make a significant difference:

- Tax Types: It's important to know which taxes apply to you. For instance, if you receive Social Security Disability benefits, you may not owe state income tax on those benefits.

- Filing Requirements: Determine if you need to file a tax return based on your income level and sources. Remember, disabled individuals may have different thresholds for filing.

- Exemptions and Credits: Research available tax credits and exemptions for disabled individuals, such as the Property Tax/Rent Rebate Program, which can provide financial relief. Turnout is here to assist you in understanding these options and how to apply for them.

- Deadlines: Be aware of important tax deadlines to avoid penalties. Typically, tax returns for the state are due by April 15th each year.

Grasping these fundamentals will empower you to make knowledgeable choices about your pa tax payment and any potential advantages. Remember, you are not alone in this journey—Turnout is here to support you every step of the way.

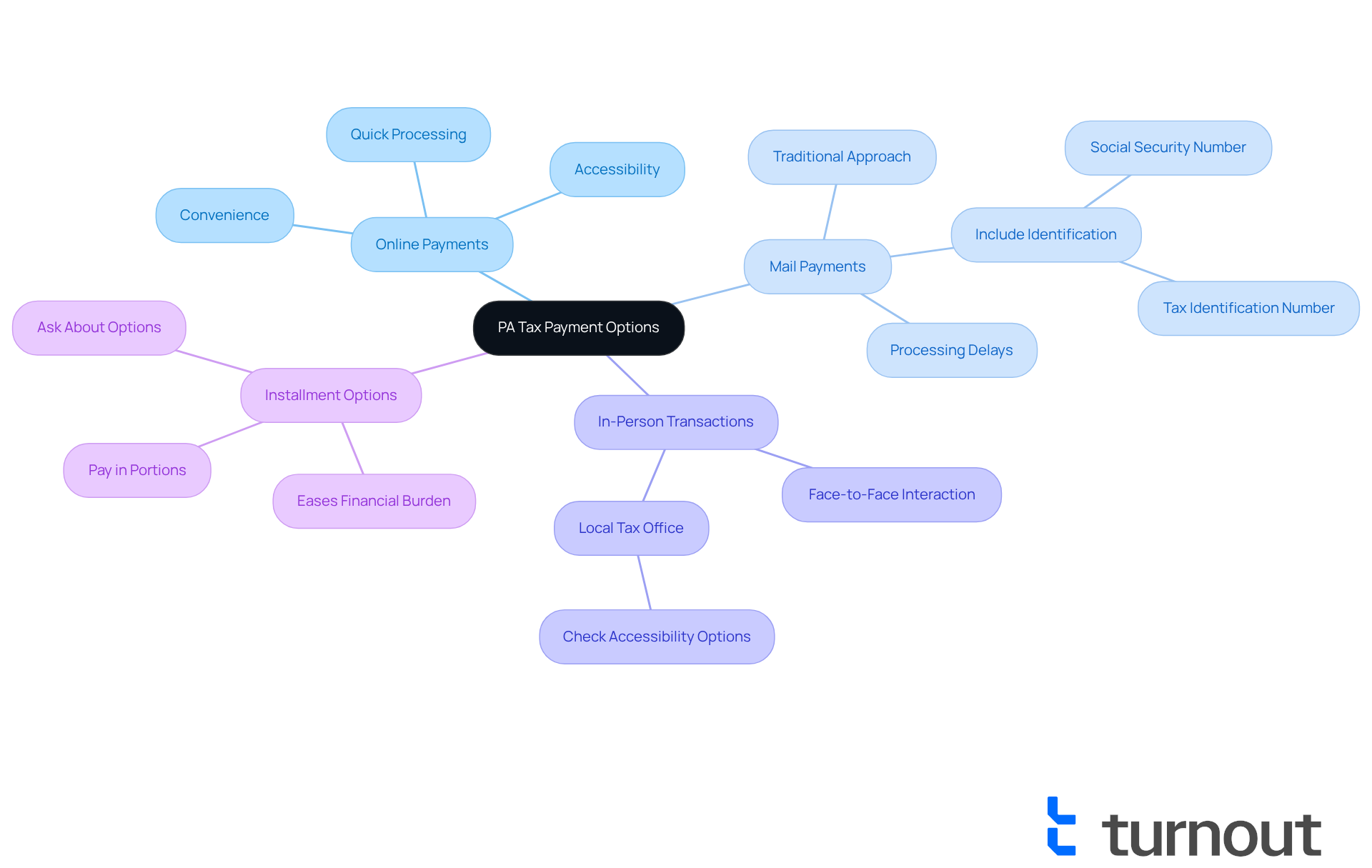

Explore Payment Options for PA Taxes

The state provides a variety of methods for pa tax payment, accommodating your unique preferences and needs. We understand that managing your pa tax payment can be stressful, and we’re here to help you navigate your options with ease.

- Online Payments: If you’re looking for convenience, the Pennsylvania Department of Revenue provides an online portal for pa tax payment. This can be the quickest method, especially if mobility is a concern.

- Mail Payments: Prefer a more traditional approach? You can send a check or money order by mail to the appropriate address. Just remember to include your Social Security number or tax identification number to avoid any processing delays.

- In-Person Transactions: For those who appreciate face-to-face interactions, you can make payments at designated locations. It’s a good idea to check with your local tax office for details on accessibility options.

- Installment Options: If paying your taxes all at once feels overwhelming, consider asking about installment options. This allows you to pay in portions, easing the financial burden and making it more manageable.

By exploring these options, you can choose the method that aligns best with your circumstances regarding pa tax payment. Remember, you’re not alone in this journey, and we’re here to support you every step of the way.

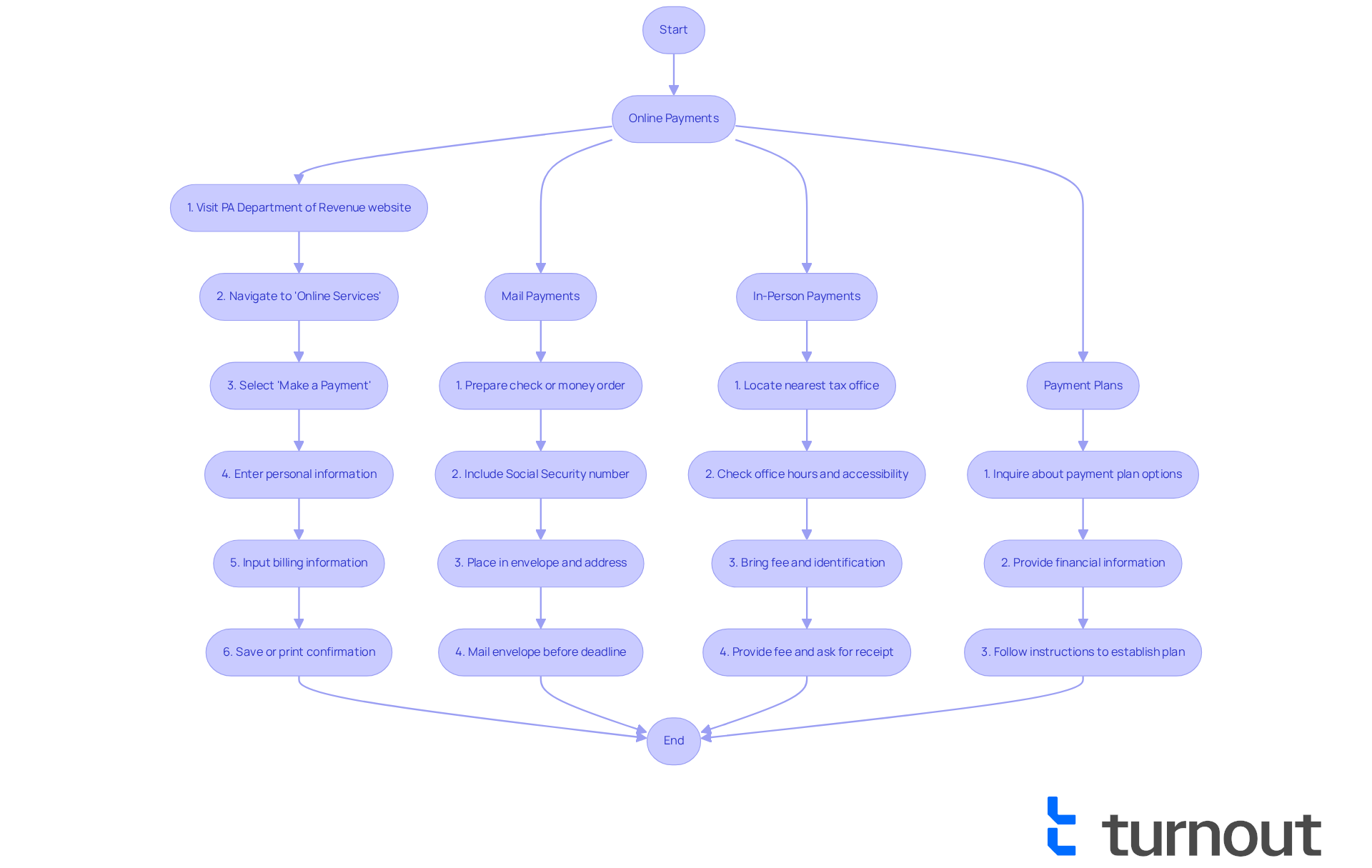

Follow Step-by-Step Instructions to Make Your Payment

Making your Pennsylvania tax payment can feel overwhelming, but we're here to help guide you through the process, step by step, based on your preferred payment method:

For Online Payments:

- Start by visiting the Pennsylvania Department of Revenue website.

- Navigate to the 'Online Services' section—this is where you can find the assistance you need.

- Select 'Make a Payment' and choose the type of tax you are paying. We understand that this can be a bit confusing, so take your time.

- Enter your personal information, including your Social Security number, ensuring everything is accurate.

- Follow the prompts to input your billing information and verify the transaction. Remember, it's important to double-check your details.

- Finally, save or print the confirmation for your records. This step is crucial to keep everything organized.

For Mail Payments:

- Prepare your check or money order made out to the Pennsylvania Department of Revenue. This step is straightforward, but we know it can feel daunting.

- Include your Social Security number or tax identification number with the transaction to ensure it’s processed correctly.

- Place the fee in an envelope and direct it to the suitable tax office. Make sure you have the right address!

- Mail the envelope, ensuring it is sent well before the deadline to avoid any late fees. We understand that timing can be stressful.

For In-Person Payments:

- Locate your nearest tax office using the Pennsylvania Department of Revenue website. This can help you find the best option for you.

- Check the office hours and any accessibility options available. It's common to want to ensure everything is in place before you go.

- Bring your fee and any required identification. This will help the process go smoothly.

- Provide your fee to the staff and ask for a receipt for your records. Keeping track of everything is important, and we're here to support you.

For Payment Plans:

- Reach out to the Pennsylvania Department of Revenue to inquire about plan options for payments. You are not alone in this journey; many people seek similar assistance.

- Provide your financial information as required. This step may feel personal, but it’s necessary for establishing a plan that works for you.

- Follow the instructions to establish your financial plan and ensure you comprehend the terms. We want you to feel confident in your choices.

By following these steps, you can successfully finalize your PA tax payment obligation. Remember, you are taking a positive step forward, and we are here to support you every step of the way.

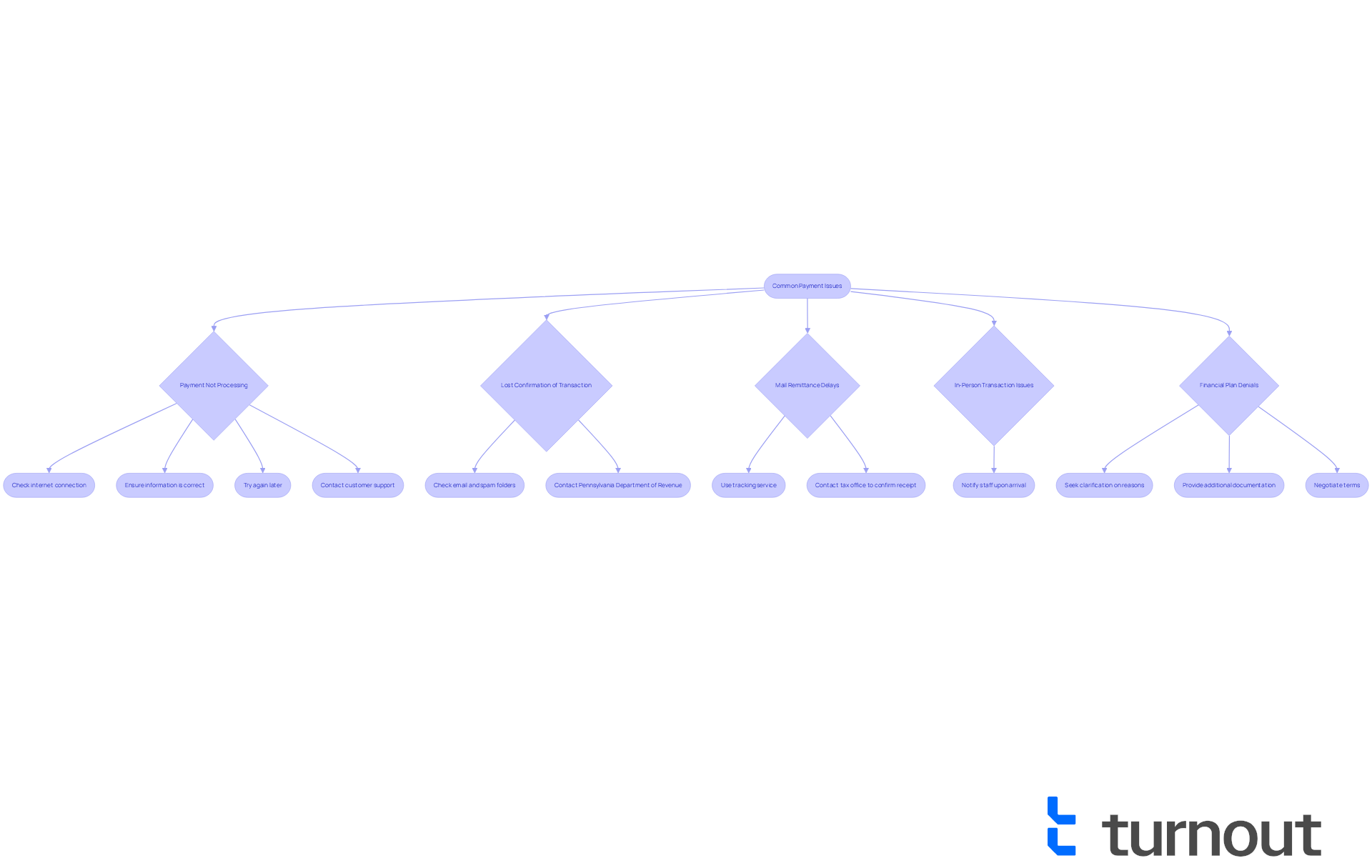

Troubleshoot Common Payment Issues

Even with careful planning, we understand that issues may arise during the tax transaction process. Here are some common problems you might encounter and how to troubleshoot them:

-

Payment Not Processing: If your online payment fails, please check your internet connection and ensure that all information entered is correct. If the problem persists, don’t hesitate to try again later or reach out to customer support for assistance.

-

Lost Confirmation of Transaction: If you do not receive a confirmation after completing a transaction, check your email, including your spam folders, for any messages. If you still cannot find it, remember that the Pennsylvania Department of Revenue is here to help you.

-

Mail Remittance Delays: If you’ve sent your remittance and are worried about delays, consider using a tracking service for upcoming remittances. For current concerns, it’s a good idea to contact the tax office to confirm receipt.

-

In-Person Transaction Issues: If you face accessibility challenges at the tax office, please notify the staff upon arrival. They are trained to assist individuals with disabilities and can provide alternative solutions to ensure you receive the help you need.

-

Financial Plan Denials: If your request for a financial arrangement is denied, seek clarification on the reasons. You may need to provide additional documentation or negotiate terms to find a solution that works for you.

By being prepared for these common issues, you can navigate the payment process with greater ease and confidence. Remember, you are not alone in this journey, and we are here to help.

Conclusion

Understanding the intricacies of Pennsylvania tax payments can feel overwhelming, especially for disabled individuals who face unique challenges. We recognize that navigating this system may bring about feelings of uncertainty. This guide has illuminated essential aspects of the tax system, including various tax types, available exemptions, and the importance of meeting filing deadlines. By familiarizing yourself with these components, you can approach the tax landscape with greater confidence and clarity.

Key insights discussed include the diverse payment options available—online, by mail, or in-person. We've provided step-by-step instructions tailored to each method to help ease your experience. Additionally, common payment issues have been addressed, along with practical solutions to ensure a smooth transaction process. These insights empower you to take control of your tax obligations while minimizing stress and confusion.

Ultimately, managing Pennsylvania tax payments does not have to be daunting. By leveraging the information presented, you can make informed decisions that alleviate financial burdens. Remember, it's essential to seek assistance when needed. Resources like Turnout are available to provide support at every step. Taking proactive measures in understanding and managing your tax responsibilities can lead to a more secure and informed financial future. You are not alone in this journey; we’re here to help.

Frequently Asked Questions

What types of taxes are implemented in Pennsylvania?

Pennsylvania implements various taxes, including income taxes, property taxes, and sales taxes.

Are Social Security Disability benefits taxable in Pennsylvania?

No, if you receive Social Security Disability benefits, you may not owe state income tax on those benefits.

What should I consider regarding filing requirements for Pennsylvania taxes?

You need to determine if you are required to file a tax return based on your income level and sources, noting that disabled individuals may have different thresholds for filing.

What exemptions or credits are available for disabled individuals in Pennsylvania?

Disabled individuals may qualify for specific exemptions and credits, such as the Property Tax/Rent Rebate Program, which provides financial relief.

When are Pennsylvania tax returns typically due?

Pennsylvania tax returns are usually due by April 15th each year.

How can I get assistance with understanding Pennsylvania tax payments?

Turnout is available to assist you in understanding tax options and how to apply for available credits and exemptions.