Introduction

Navigating the complexities of tax payments can feel overwhelming, especially for individuals with disabilities. In a state like Pennsylvania, where the tax structure is unique, these challenges can seem even more daunting. We understand that managing these obligations is not just about compliance; it’s about ensuring you’re maximizing your potential savings and accessing the benefits available to you.

This article explores essential strategies and resources designed to empower disabled taxpayers. We’re here to help you take control of your tax situation and find peace of mind. How can you ensure that you’re not only compliant but also making the most of the opportunities that exist? Let’s dive into this journey together.

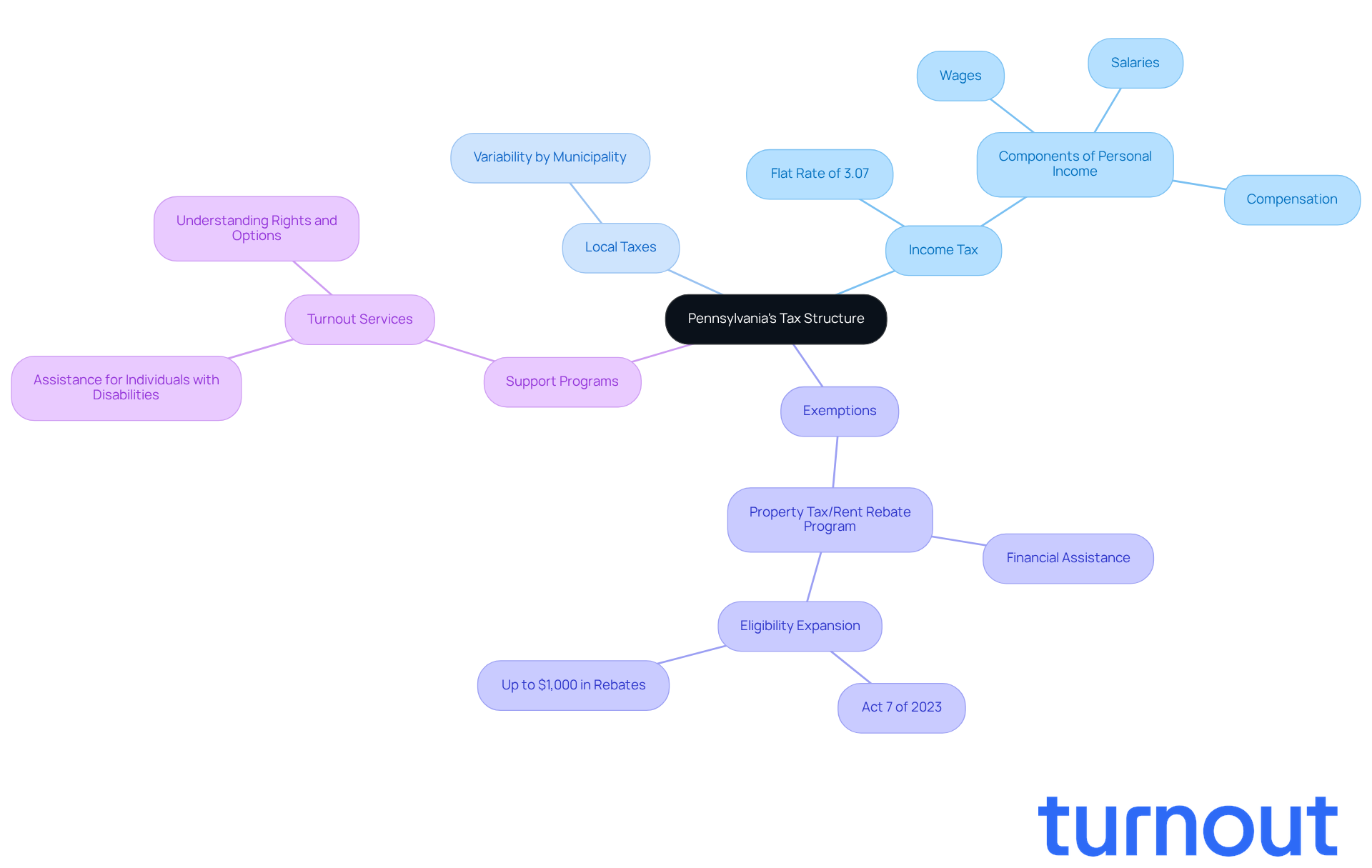

Understand Pennsylvania's Tax Structure and Obligations

Managing tax payments can feel overwhelming, especially for disabled individuals. To navigate this landscape effectively, it’s important to understand Pennsylvania's tax structure, particularly the pa state tax payment. The state has a flat income tax rate of 3.07% on personal income, which includes wages, salaries, and various forms of compensation, affecting your pa state tax payment. Local taxes can also vary by municipality, including the pa state tax payment, impacting your overall tax liability. Knowing these rates is crucial for planning an accurate pa state tax payment.

You might be relieved to learn that there are specific exemptions or deductions available to ease your tax burden. One notable option is the Property Tax/Rent Rebate Program, which offers financial assistance to qualified individuals, potentially lowering your overall tax obligation. Recently, Governor Josh Shapiro signed Act 7 of 2023, expanding this program to include nearly 175,000 more Pennsylvanians. If you qualify, you could receive up to $1,000 in rebates, depending on your income level. Staying informed about changes in tax legislation is essential, as these can affect your eligibility for benefits and tax rates each year. Remember, applications for the 2025 Property Tax/Rent Rebates are currently being accepted, with a submission deadline of June 30, 2026.

We understand that navigating these complex financial systems can be challenging. That’s where Turnout comes in. They provide access to tools and services designed to help consumers like you. With trained nonlawyer advocates, Turnout assists people with disabilities in understanding their rights and options regarding SSD claims and tax relief. You don’t have to face this journey alone; support is available to ensure you get the assistance you need.

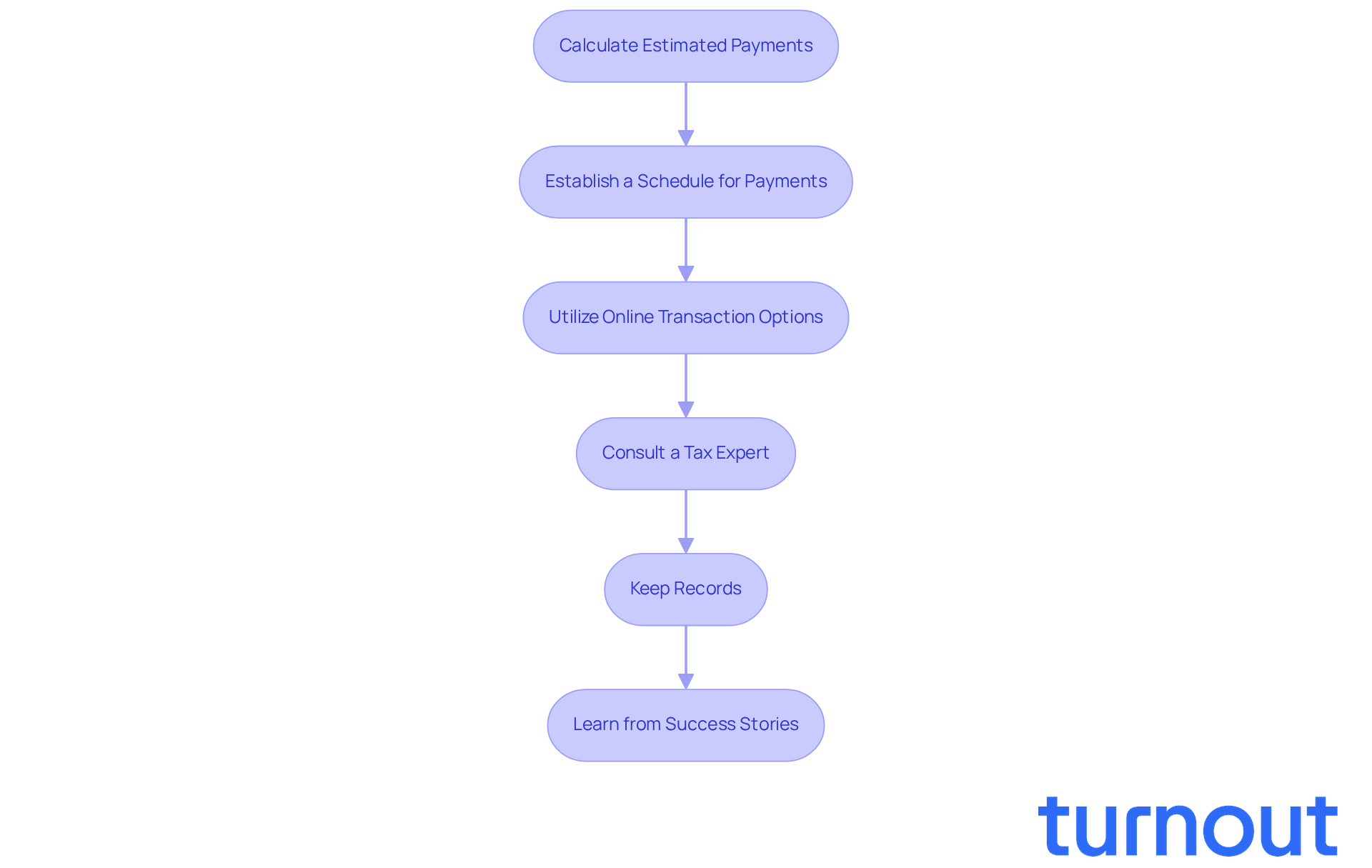

Implement Effective Strategies for Estimated Tax Payments

Managing tax responsibilities can feel overwhelming, especially for disabled individuals. But with a strategic approach to estimated tax contributions, you can navigate this process with confidence. Here are some supportive steps to consider:

-

Calculate Estimated Payments: Start by looking at last year's tax return. This can help you estimate your current year's tax liability, giving you a solid foundation for calculating your quarterly amounts.

-

Establish a Schedule for Payments: Remember the estimated tax due dates: April 15, June 15, September 15, and January 15 of the following year. Setting reminders can significantly reduce the risk of overdue bills, which can incur a 5% fine for each month delayed, capped at 25% of the outstanding balance.

-

Utilize Online Transaction Options: The Pennsylvania Department of Revenue offers convenient online methods for timely submissions. Consider signing up for automatic withdrawals to simplify the process and ensure you never miss a deadline.

-

Consult a Tax Expert: If your financial situation is complex, seeking guidance from a tax expert who understands the specific responsibilities for those with disabilities can be invaluable. They can provide tailored advice and help identify potential deductions or credits that may apply to you.

-

Keep Records: It's essential to maintain accurate documentation of all estimated tax contributions and any credits claimed. This practice helps avoid penalties and ensures compliance with your tax obligations.

-

Learn from Success Stories: Reflect on the experiences of others with disabilities who have successfully managed their estimated tax payments. Their stories can inspire you and offer practical insights into navigating your tax responsibilities.

By implementing these strategies, you can approach your tax responsibilities with greater confidence. Remember, you're not alone in this journey, and taking these steps can help reduce the likelihood of incurring penalties.

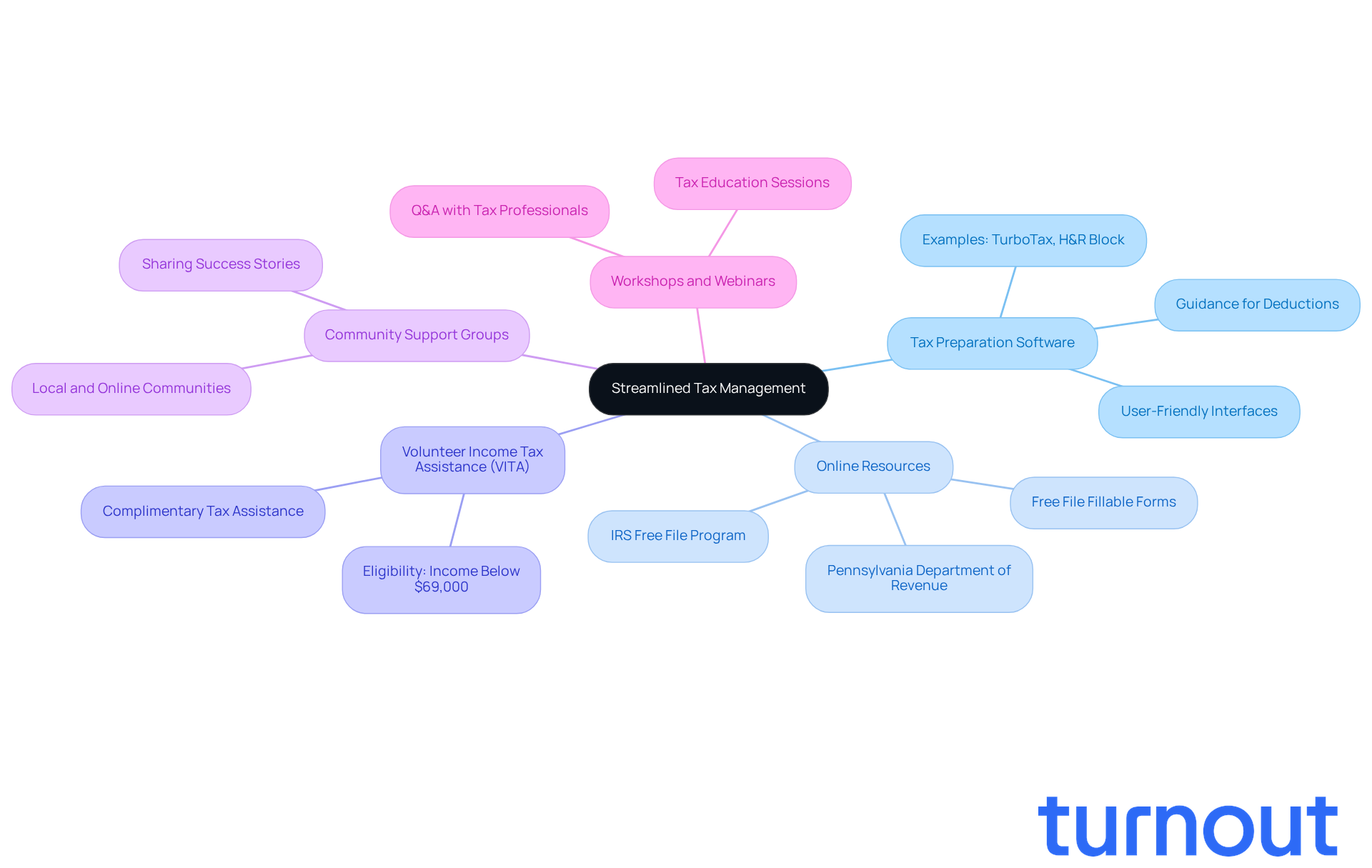

Utilize Resources and Tools for Streamlined Tax Management

Managing taxes can feel overwhelming, especially for individuals with disabilities. But don’t worry; there are many resources and tools available to help simplify this process. Here’s how you can navigate tax management with ease:

-

Tax Preparation Software: Look for tax preparation software that’s designed with you in mind. Many programs offer user-friendly interfaces and guidance specifically for people with disabilities. They provide step-by-step instructions and help identify eligible deductions, making the filing process much more manageable.

-

Online Resources: The Pennsylvania Department of Revenue's website is a fantastic resource for comprehensive information on pa state tax payment obligations, forms, and deadlines. Bookmarking this site ensures you have easy access to essential information throughout tax season. Plus, the IRS Free File program offers free online tax preparation and filing services for eligible taxpayers, which can be especially helpful for those with limited income.

-

Volunteer Income Tax Assistance (VITA): If you’re earning below certain income thresholds or have a disability, the VITA program can provide complimentary tax assistance. Utilizing VITA can significantly ease the tax preparation process, particularly for your pa state tax payment, and help ensure you receive all eligible benefits.

-

Community Support Groups: Joining local or online support groups for people with disabilities can be incredibly beneficial. These communities often share valuable insights and experiences related to tax management. You might find members sharing success stories about how they effectively utilized available resources to manage their tax obligations.

-

Workshops and Webinars: Consider attending workshops or webinars focused on tax education for disabled individuals. These sessions offer in-depth knowledge and the chance to ask specific questions about tax obligations and available benefits. Tax professionals often highlight the importance of these educational resources in enhancing understanding and compliance.

We understand that navigating taxes can be challenging, but remember, you’re not alone in this journey. By utilizing these resources, you can take control of your tax management and ensure you’re making the most of the benefits available to you.

Conclusion

Navigating Pennsylvania's tax landscape can feel overwhelming, especially for disabled individuals. We understand that grasping the state's tax structure and available resources is crucial for managing your finances effectively. By getting familiar with the flat income tax rate and local tax variations, you can better assess your financial obligations. Plus, programs like the Property Tax/Rent Rebate can help lighten your tax burden.

To manage estimated tax payments, consider these key strategies:

- Calculate payments based on previous tax returns

- Stick to payment schedules

- Utilize online resources

- Don’t hesitate to seek professional advice when needed

These steps not only simplify the tax payment process but also empower you to take control of your financial responsibilities. Additionally, using tools like tax preparation software, community support, and educational workshops can significantly boost your understanding and compliance with tax obligations.

Remember, you don’t have to face the journey of managing taxes alone. By tapping into available resources and implementing effective strategies, you can navigate your tax responsibilities with greater confidence and ease. Taking proactive steps today can lead to more manageable tax experiences in the future, ensuring that you fully realize all eligible benefits and deductions. We're here to help you every step of the way.

Frequently Asked Questions

What is Pennsylvania's flat income tax rate?

Pennsylvania has a flat income tax rate of 3.07% on personal income, which includes wages, salaries, and various forms of compensation.

How do local taxes affect Pennsylvania state tax payments?

Local taxes can vary by municipality and impact your overall tax liability, including your Pennsylvania state tax payment.

Are there any exemptions or deductions available for Pennsylvania taxpayers?

Yes, there are specific exemptions and deductions available, such as the Property Tax/Rent Rebate Program, which can help lower your overall tax obligation.

What is the Property Tax/Rent Rebate Program?

The Property Tax/Rent Rebate Program offers financial assistance to qualified individuals, potentially lowering their tax obligations. Recent expansions have included nearly 175,000 more Pennsylvanians.

How much can qualified individuals receive from the Property Tax/Rent Rebate Program?

Depending on income level, qualified individuals could receive up to $1,000 in rebates through the program.

What is the deadline for applying for the 2025 Property Tax/Rent Rebates?

Applications for the 2025 Property Tax/Rent Rebates are currently being accepted, with a submission deadline of June 30, 2026.

What resources are available for individuals with disabilities navigating tax obligations?

Turnout provides access to tools and services to help consumers, including trained nonlawyer advocates who assist people with disabilities in understanding their rights and options regarding SSD claims and tax relief.