Introduction

Navigating Pennsylvania's sales tax can feel overwhelming, and you're not alone in this. Many individuals and businesses share the same struggle, facing a complex web of taxable and non-taxable items. Understanding these nuances is crucial for staying compliant and planning your finances effectively.

This guide is here to help you every step of the way. We’ll break down the process of mastering Pennsylvania sales tax payments, empowering you to manage your obligations with confidence. But what if tax laws change unexpectedly? Or if local jurisdictions impose their own rates? It’s common to feel uncertain about these complexities, but we’re here to shed light on your tax responsibilities.

By exploring these issues together, we can ensure that you’re well-informed and prepared. Let’s embark on this journey to clarity and confidence in your tax matters.

Understand Taxable and Non-Taxable Items in Pennsylvania

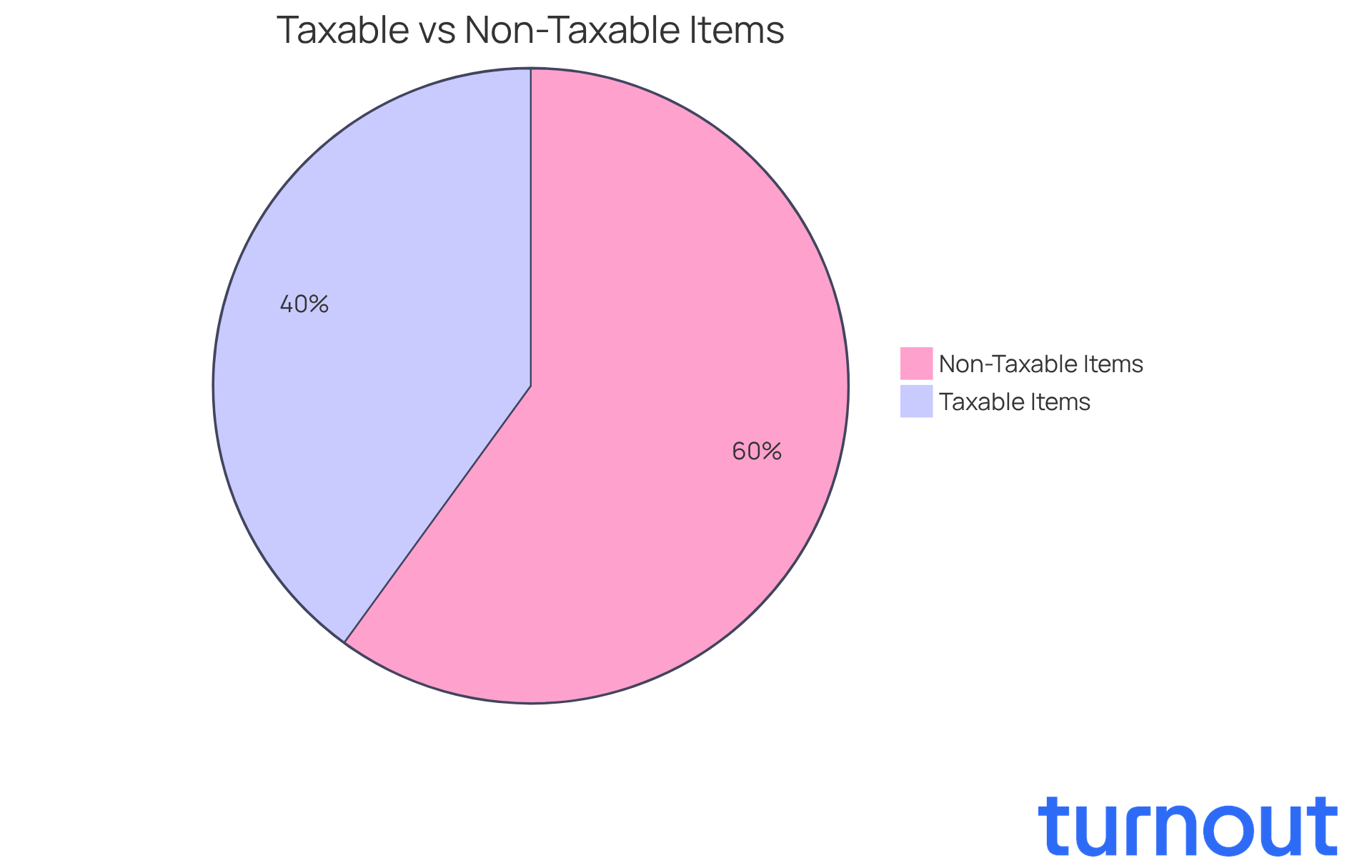

In Pennsylvania, transaction tax affects most tangible personal property and certain services. We understand that navigating what is taxable versus non-taxable can be challenging, but knowing these details is crucial for compliance.

Taxable Items: Common taxable items include furniture, electronics, and clothing, though there are exceptions. Services like telecommunications and specific repairs also incur a tax. It's important to be aware of these to avoid surprises.

Non-Taxable Items: On the bright side, most food items, prescription medications, and clothing priced under $200 are exempt from sales tax. This exemption on clothing is particularly beneficial, saving consumers significantly. Did you know that groceries represent the largest exemption category? This saves consumers approximately $2 billion in the upcoming fiscal year, which can make a real difference in your budget.

Consult Resources: To verify the tax status of specific items, we encourage you to refer to the state's Department of Revenue's resources. The Sales Tax Guide provides detailed lists of taxable and non-taxable items, ensuring clarity in your transactions. Remember, businesses must also file tax returns and ensure that a pa sales tax payment is made, even if no taxable transactions occurred during the period.

Stay Updated: Tax laws can change, and we understand that keeping up with these updates is essential to avoid unexpected liabilities. Recent discussions among lawmakers suggest potential modifications to tax exemptions, which could impact various goods and services soon. It's worth noting that the state hasn't increased its tax rate since 1968, highlighting the stability of the current tax framework.

We're here to help you navigate these complexities, so you’re not alone in this journey.

Calculate Your Pennsylvania Sales Tax Accurately

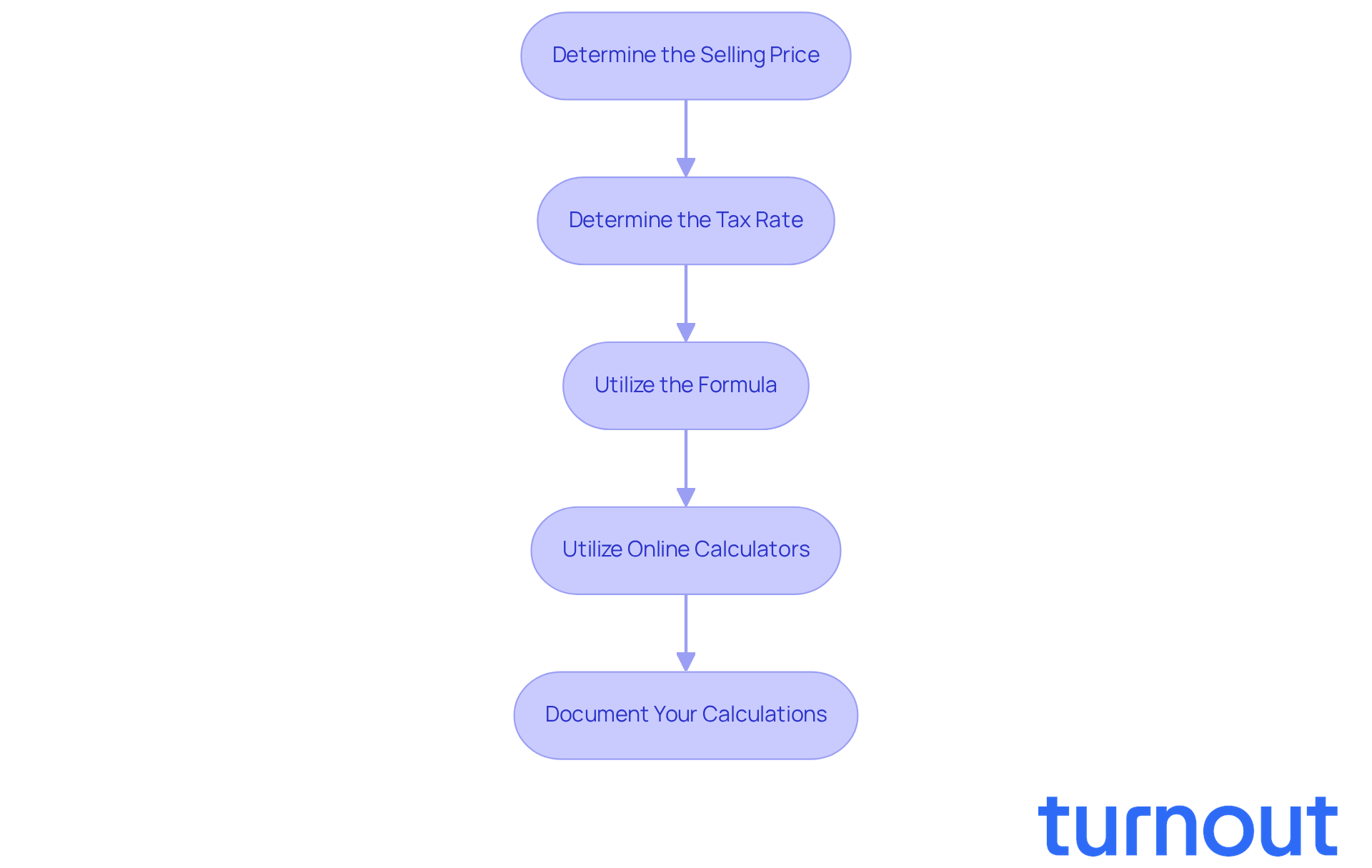

Calculating your pa sales tax payment can feel a bit overwhelming, but we're here to help you through the process. Just follow these simple steps:

- Determine the Selling Price: Start by identifying the total selling price of the item or service you’re purchasing.

- Determine the Tax Rate: The state transaction tax rate is 6%. Keep in mind that local jurisdictions may add their own taxes, including a 2% pa sales tax payment in Philadelphia or a 1% in Allegheny County.

- Utilize the Formula: To find the total tax, multiply the selling price by the combined tax rate. For instance, if your sale price is $100 and you’re in Philadelphia, the calculation would look like this:

- Total Tax = Sale Price × (State Rate + Local Rate)

- Total Tax = $100 × (0.06 + 0.02) = $8

- Utilize Online Calculators: If numbers aren’t your thing, don’t worry! Tools like the Sales Tax Calculator can simplify this process for you.

- Document your calculations, as keeping records of your calculations is a good idea for future reference and to ensure your pa sales tax payment is compliant. This way, you’ll have everything organized and ready when you need it.

We understand that navigating taxes can be tricky, but with these steps, you’re well on your way to mastering your sales tax calculations!

Make Your Pennsylvania Sales Tax Payment

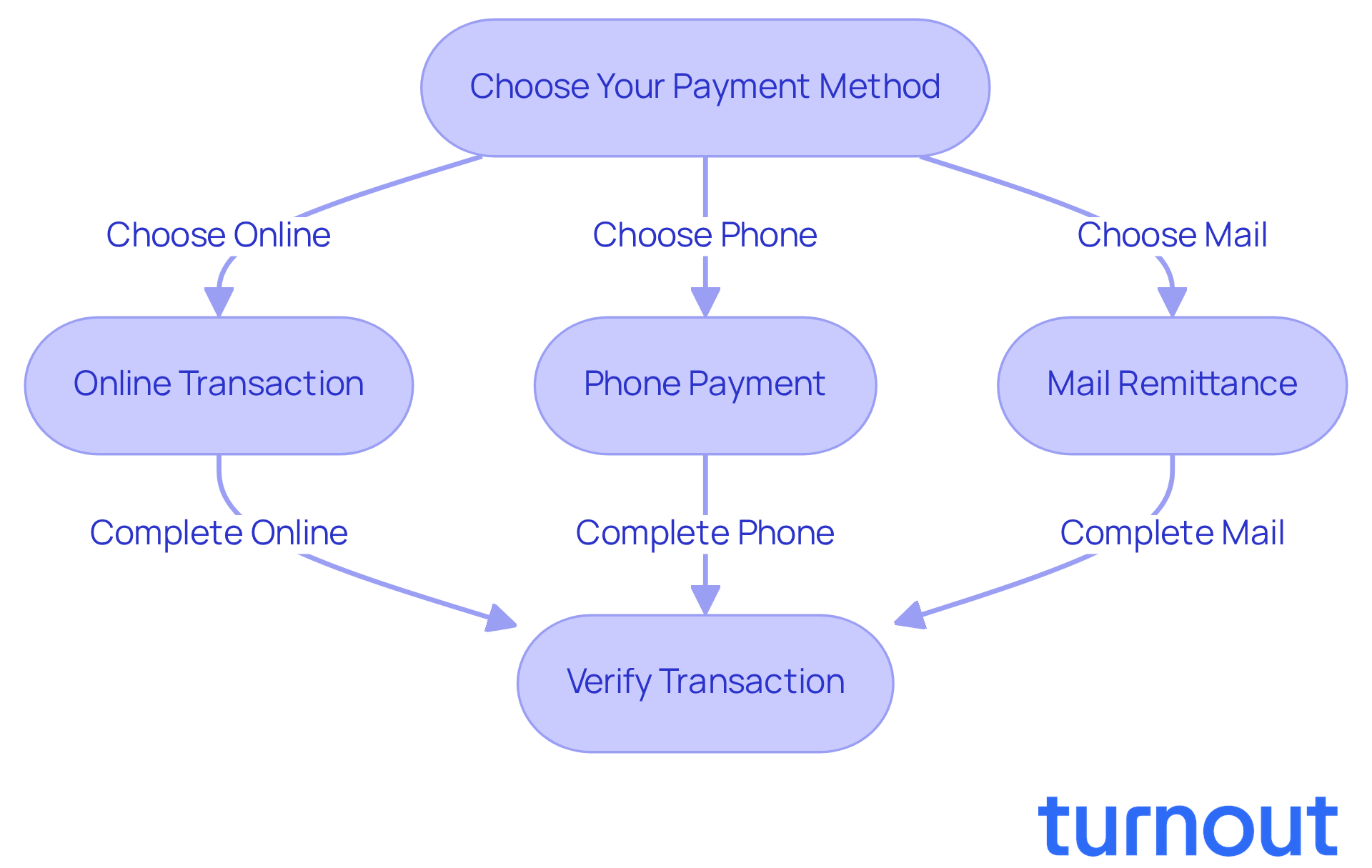

Making your pa sales tax payment can feel overwhelming, but we're here to help you through it. Follow these simple steps to ensure a smooth process:

-

Choose Your Payment Method: You have options! Payments can be made online, by phone, or via mail. Many Pennsylvanians prefer online transactions for their speed and convenience. In fact, nearly 1 million residents are expected to use the myPATH portal in 2026, showing a growing trend towards digital transactions.

-

Online Transaction: If you choose to pay online, log into the myPATH portal. You'll need your tax account number and transaction details. Tax experts agree that myPATH simplifies the process, making it easier for businesses to manage their tax responsibilities. Did you know that sales tax collections in Pennsylvania have increased at a 7.0 percent yearly rate from FY16 to FY25? This highlights the importance of making timely contributions for the pa sales tax payment.

-

Phone Payment: Prefer to talk to someone? Call the Pennsylvania Department of Revenue at 1-800-748-8299. Just follow the prompts to securely enter your billing information.

-

Mail Remittance: If mailing a check is more your style, send your remittance along with the appropriate tax return form to the address specified on the form. Just make sure to mail it well before the due date to avoid any penalties.

-

Verify Transaction: After completing your transaction, it’s crucial to confirm that it has been processed. Check your account status in myPATH or contact the Department of Revenue. This step ensures your transaction is recorded accurately and on time.

Using the myPATH portal not only streamlines your payment process but also helps you track and manage your tax responsibilities more effectively. Remember, nearly 1 million Pennsylvanians will qualify for a new tax credit in 2026, which could further encourage timely tax payments. You're not alone in this journey, and taking these steps can make a significant difference.

Access Resources for Ongoing Sales Tax Management

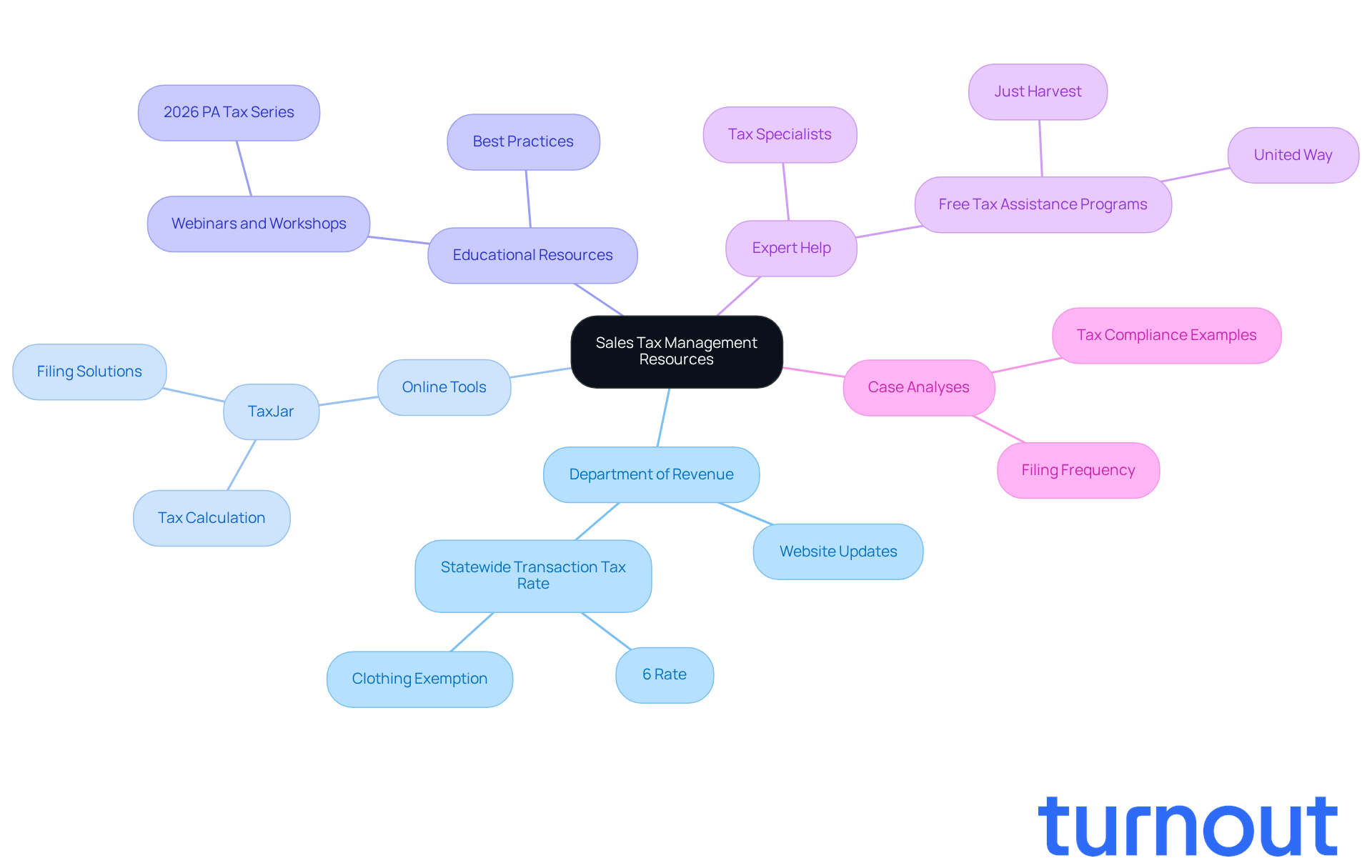

Managing your obligations for pa sales tax payment in Pennsylvania can feel overwhelming, but you’re not alone in this journey. Here are some resources that can help you navigate this complex landscape with confidence:

-

The Department of Revenue: We understand that keeping up with tax rates and deadlines can be challenging. Regularly checking the Department of Revenue's website is essential for the latest updates on tax rates, filing deadlines, and compliance guidelines. Did you know that Pennsylvania has a statewide transaction tax rate of 6%? Most clothing is exempt from this tax, which can significantly impact your obligations.

-

Online Tools: Consider utilizing online calculators and software designed to simplify tax calculations and filings. Platforms like TaxJar offer comprehensive solutions that streamline the tax process for businesses, ensuring compliance and efficiency. This can save you time and reduce stress.

-

Educational Resources: Participating in webinars and workshops, such as the 2026 PA Tax Series, can be incredibly beneficial. These educational opportunities help you learn about best practices and recent changes in tax laws. Knowledge is power, and improving your understanding of tax regulations can make a big difference.

-

Expert Help: Seeking advice from a tax specialist or accountant who focuses on state sales tax can be a game changer. Their expertise ensures adherence and enhances your tax strategy, allowing you to manage the intricacies of transaction tax with assurance. As state Sen. Lindsey Williams noted, "They often refer constituent calls to the free tax assistance available through Just Harvest and United Way and other similar programs." This highlights the importance of seeking professional guidance.

-

Case Analyses: Examining case analyses, such as those on filing frequency for tax in a specific state, can provide practical examples of adherence. Understanding how other companies handle their tax responsibilities can offer valuable insights into best practices.

By utilizing these resources, you can effectively navigate the complexities of the pa sales tax payment landscape. Remember, you are not alone in this journey, and we’re here to help you ensure compliance.

Conclusion

Mastering Pennsylvania sales tax payment is essential for both consumers and businesses. We understand that navigating this landscape can feel overwhelming, but it’s crucial to ensure compliance and avoid unexpected liabilities. By recognizing the distinctions between taxable and non-taxable items, accurately calculating sales tax, and utilizing available resources, you can simplify this often daunting process.

Key insights from this guide include:

- Recognizing which items incur sales tax.

- Staying updated with changing tax laws.

- Following a structured approach to calculate and make payments.

The myPATH portal offers a user-friendly platform for transactions. Additionally, expert resources and tools can further aid in managing your tax obligations effectively. Remember, you’re not alone in this journey.

As the landscape of sales tax continues to evolve, it’s crucial to remain informed and proactive. Engaging with educational resources, seeking professional advice, and utilizing online tools can empower you to navigate the complexities of Pennsylvania's sales tax system confidently. Embracing these strategies can lead to not only compliance but also enhanced financial management in the long run. We’re here to help you every step of the way.

Frequently Asked Questions

What items are generally taxable in Pennsylvania?

Common taxable items in Pennsylvania include furniture, electronics, and clothing, although there are exceptions. Additionally, services such as telecommunications and specific repairs are also subject to tax.

What items are considered non-taxable in Pennsylvania?

Most food items, prescription medications, and clothing priced under $200 are exempt from sales tax in Pennsylvania. This exemption on clothing is particularly beneficial for consumers.

How much do food exemptions save consumers in Pennsylvania?

Grocery items represent the largest exemption category, saving consumers approximately $2 billion in the upcoming fiscal year.

Where can I verify the tax status of specific items in Pennsylvania?

You can refer to the Pennsylvania Department of Revenue's resources, such as the Sales Tax Guide, which provides detailed lists of taxable and non-taxable items.

Do businesses in Pennsylvania need to file tax returns if no taxable transactions occurred?

Yes, businesses must file tax returns and ensure that a Pennsylvania sales tax payment is made, even if no taxable transactions occurred during the period.

Are there any recent discussions regarding changes to tax exemptions in Pennsylvania?

Yes, recent discussions among lawmakers suggest potential modifications to tax exemptions, which could impact various goods and services in the near future.

When was the last time Pennsylvania increased its tax rate?

The state has not increased its tax rate since 1968, indicating the stability of the current tax framework.