Overview

Navigating tax payments can feel overwhelming, especially when it comes to the Pennsylvania Department of Revenue. We understand that managing personal income tax, business tax, and estimated tax contributions can be a daunting task. That’s why we’ve put together a comprehensive step-by-step guide to help you through the process.

In this guide, you’ll find detailed instructions on how to make payments through the myPATH portal. We’ll walk you through each step, addressing common issues that may arise along the way. It’s common to feel uncertain about tax obligations, but understanding them is crucial to avoid penalties. Remember, you’re not alone in this journey; we’re here to help.

By following our guide, you’ll gain clarity and confidence in managing your tax responsibilities. We encourage you to take action and familiarize yourself with the payment process. Together, we can ensure that you meet your obligations smoothly and without stress.

Introduction

Navigating the complexities of tax payments can feel overwhelming, especially when dealing with the Pennsylvania Department of Revenue. We understand that the various categories of payments—like personal income tax and business levies—can be confusing. It’s essential for both individuals and companies to grasp these details to avoid penalties and ensure compliance.

This guide is here to help. We break down the step-by-step process for making payments and address common issues that may arise. Our goal is to empower you to tackle your tax obligations with confidence. Have you ever wondered what happens when a payment fails or if a confirmation email goes missing? You’re not alone in this journey, and the answers lie within these pages, ready to demystify the payment process and provide you with peace of mind.

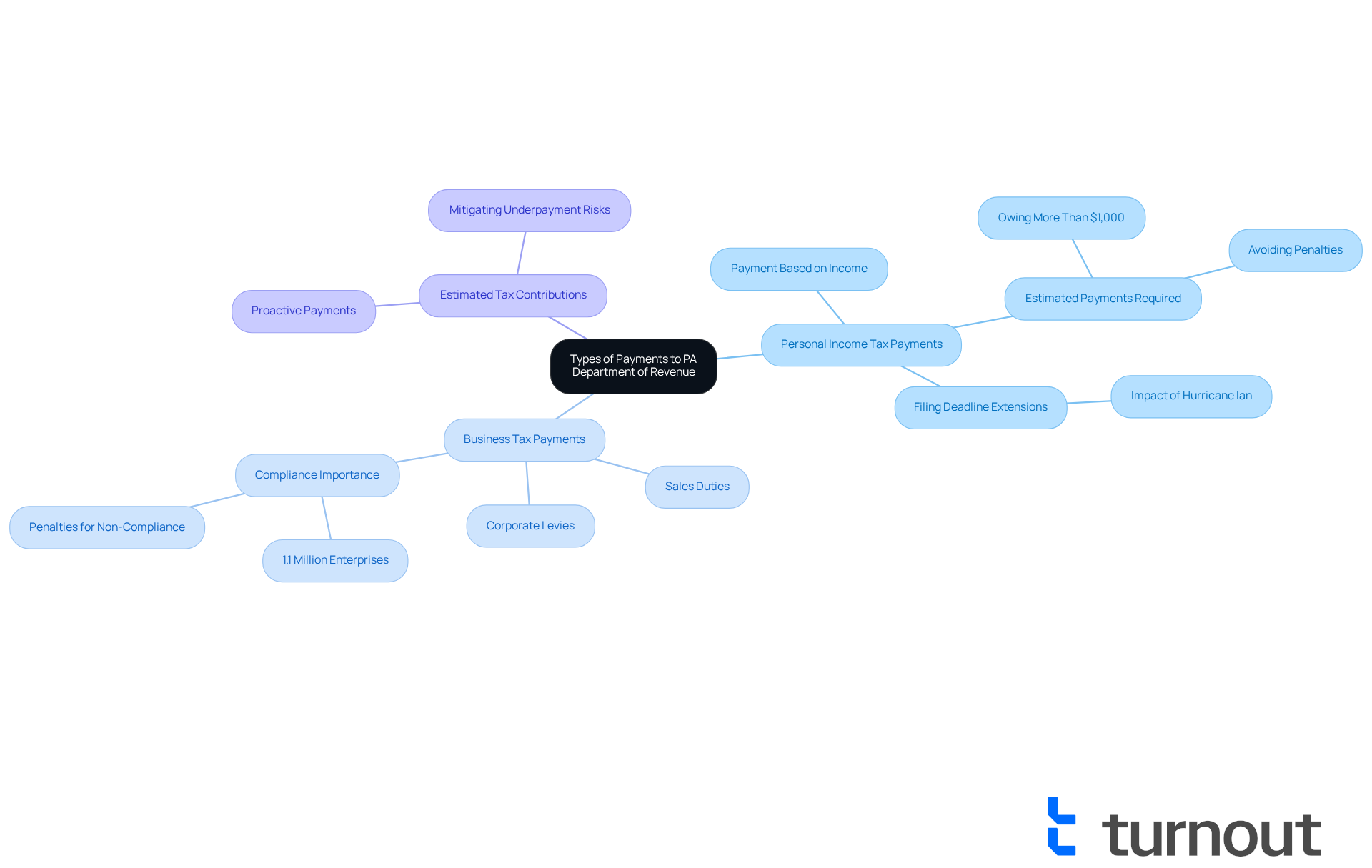

Understand Types of Payments to the PA Department of Revenue

The Pennsylvania Department of Revenue oversees several key categories of PA Dept of Revenue payment that are crucial for both individuals and businesses.

-

Personal Income Tax Payments: We understand that navigating tax payments can be overwhelming. Individuals are required to make payments based on their income, and it’s important to know whether you owe taxes for the current year or if estimated contributions are necessary. If you expect to owe more than $1,000, planning for estimated payments can help you avoid penalties for underpayment. Additionally, it’s comforting to know that the Department has extended tax return filing deadlines for individuals impacted by Hurricane Ian, providing some relief during challenging times.

-

Business Tax Payments: For businesses, understanding financial obligations is essential. Companies in the state face various responsibilities, including corporate levies and sales duties. With around 1.1 million enterprises in Pennsylvania required to pay business taxes, staying informed is vital. Non-compliance can lead to significant penalties, and we’re here to help you navigate these requirements.

-

Estimated Tax Contributions: If you anticipate a tax obligation over $1,000, making estimated contributions throughout the year is a proactive step. This approach can help mitigate the risk of incurring penalties due to underpayment.

By familiarizing yourself with these transaction classifications, you can maneuver through the procedures of PA Dept of Revenue payment more efficiently and ensure adherence to state tax regulations. As tax advisor Breea Boylan wisely notes, "Understanding your tax obligations is crucial for avoiding unnecessary penalties and ensuring you receive any benefits you may be entitled to." Remember, you are not alone in this journey; we’re here to support you every step of the way.

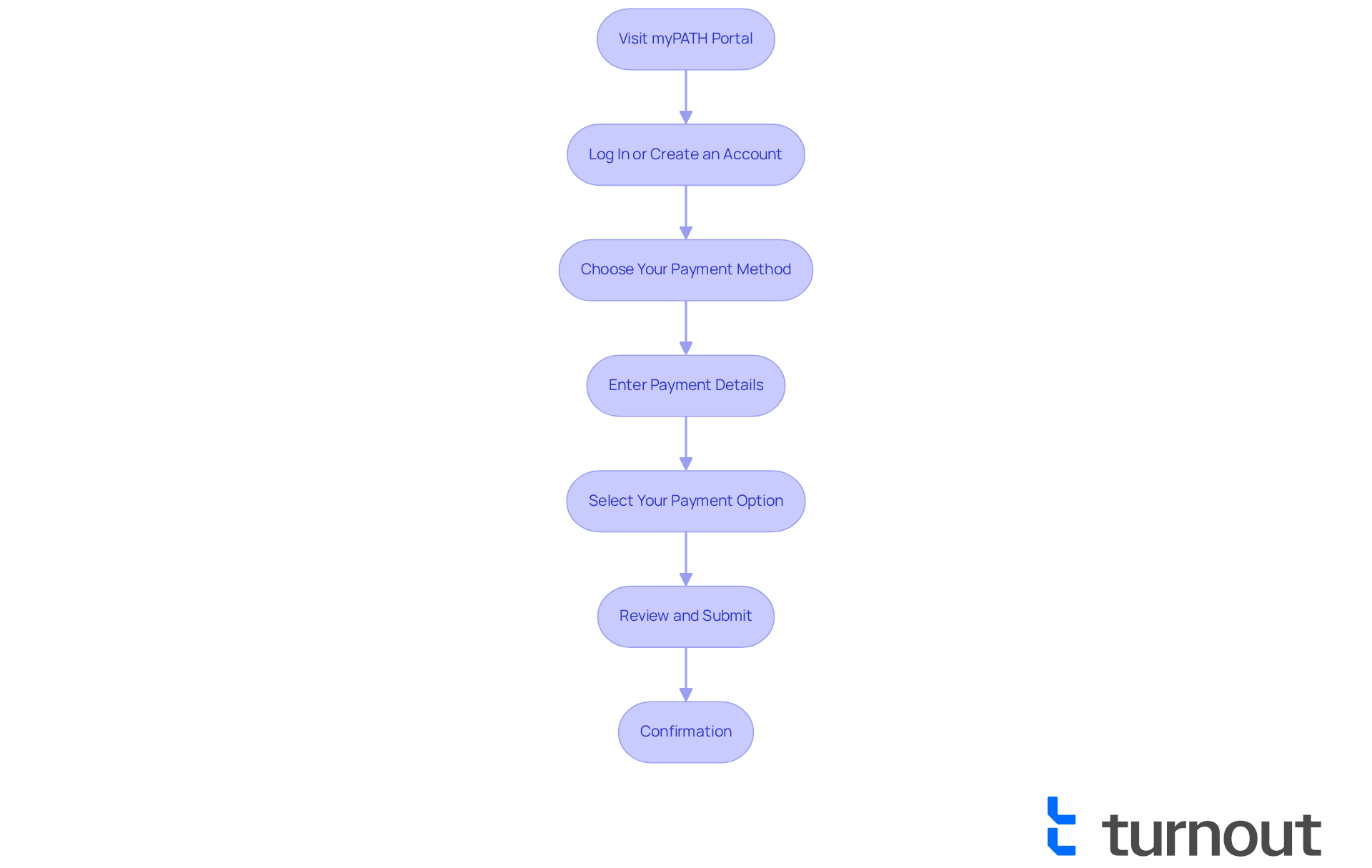

Initiate Your Payment: Step-by-Step Instructions

To start your payment to the PA Department of Revenue, we’re here to guide you through the process step by step:

- Visit the myPATH Portal: Head over to mypath.pa.gov to access the transaction system.

- Log In or Create an Account: If you already have an account, simply log in with your credentials. If you’re new, don’t worry—just create a new account by providing the necessary information.

- Choose Your Payment Method: Once logged in, navigate to the 'Payments' section and select the type of transaction you wish to complete, whether it’s personal income tax or business tax.

- Enter Payment Details: Fill in the required details, including the amount you want to pay and any relevant identification numbers, like your Social Security number or tax ID.

- Select Your Payment Option: Choose your preferred method—either by bank account (ACH) or credit/debit card. Just a heads up, card transactions might come with additional fees.

- Review and Submit: Take a moment to double-check all the information you’ve entered for accuracy, then proceed with your transaction.

- Confirmation: After you submit, you’ll receive a confirmation of your transaction. Be sure to keep this for your records.

We understand that navigating these processes can feel overwhelming at times. The average time for transactions through the myPATH portal is usually just a few business days. Tax experts recommend using the myPATH portal for its user-friendly interface and efficient processing capabilities when making a PA Department of Revenue payment. Plus, there are online filing options available for the Property Tax/Rent Rebate program, making things even easier for you. By following these steps, you can ensure that your transaction is processed smoothly and efficiently. Remember, you’re not alone in this journey—we’re here to help!

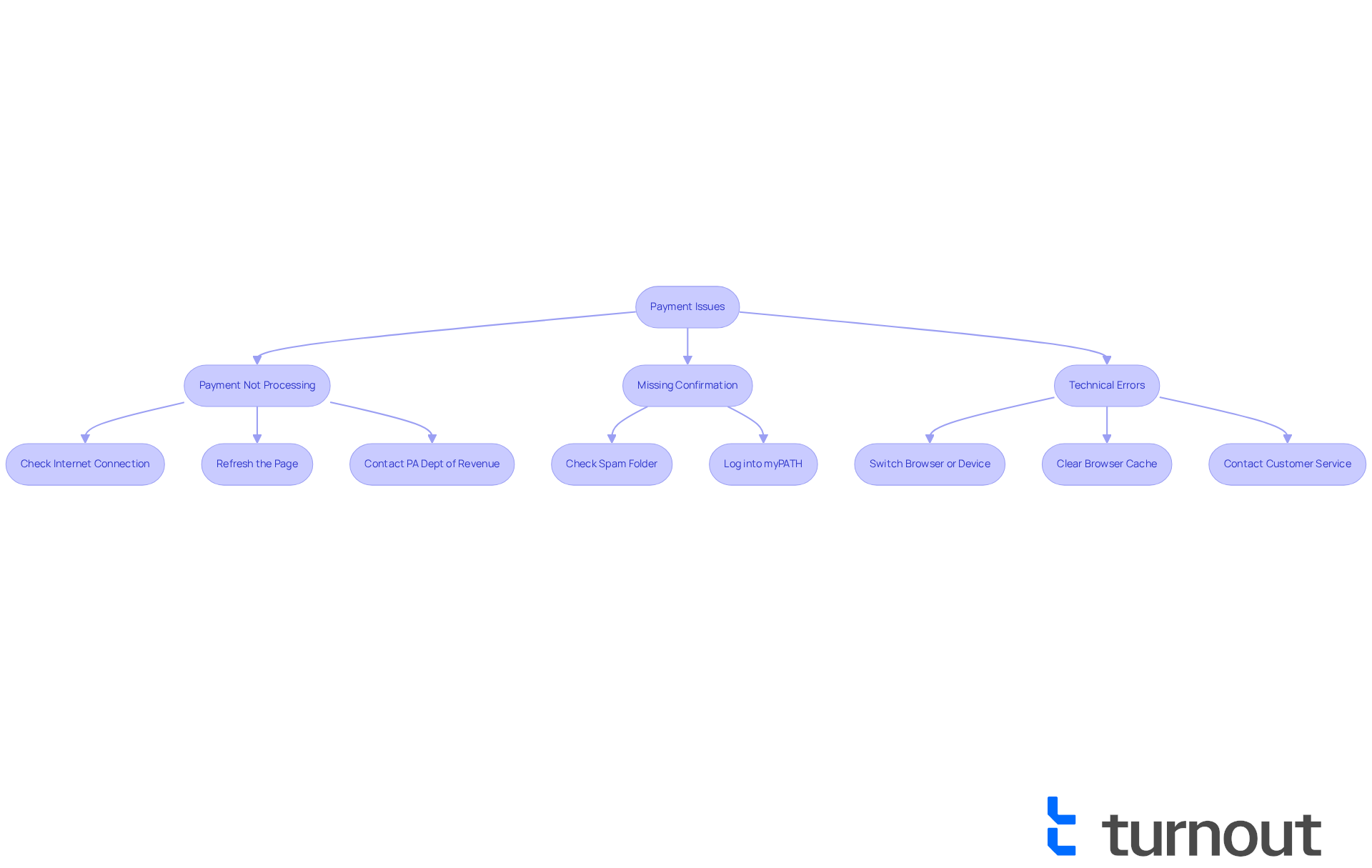

Troubleshoot Common Payment Issues

Facing issues with your pa dept of revenue payment in Pennsylvania can be frustrating, but you’re not alone. Here are some helpful tips to guide you through common problems:

-

Payment Not Processing: We understand how unsettling it can be when a payment doesn’t go through. First, check that your internet connection is stable. If the transaction concerning the pa dept of revenue payment fails, try refreshing the page or logging out and back into your account to give it another shot.

If you notice an incorrect amount, don’t hesitate to contact the PA Dept of Revenue payment immediately. It’s important to correct any mistakes before finalizing the transaction. -

Missing Confirmation: Not receiving a confirmation email can be concerning. Make sure to check your spam folder. If it’s not there, log back into myPATH to see if your transaction was recorded.

-

Technical Errors: Technical difficulties can be a hassle. If you encounter issues with the pa dept of revenue payment, switching to a different browser or device might help. Clearing your browser's cache can also resolve many common problems.

If you’re still having trouble with your pa dept of revenue payment, please reach out to the Pennsylvania Department of Revenue's customer service at 717-787-8201. They’re there to assist you.

By understanding these common issues and their solutions, you can navigate the payment process with greater ease and confidence. Remember, we’re here to help you every step of the way.

Conclusion

Navigating the complexities of the Pennsylvania Department of Revenue payment process can feel overwhelming for many individuals and businesses. We understand that grasping the different types of payments—like personal income tax, business tax, and estimated contributions—can be challenging. However, familiarizing yourself with these categories is crucial for effective financial management and compliance with state regulations. By doing so, you can avoid unnecessary penalties and confidently meet your obligations.

Our step-by-step guide simplifies the payment initiation process through the myPATH portal. It details each action you need to take, from logging in to confirming your transaction. We also address common payment issues, empowering you to troubleshoot effectively and minimize stress. With resources and support readily available, you can approach your tax responsibilities with confidence.

Ultimately, taking proactive steps in managing your tax payments not only safeguards against penalties but also enhances your overall financial well-being. Embracing these practices ensures a smoother experience with the PA Department of Revenue, allowing you to focus on what truly matters—achieving your financial goals. Remember, you are not alone in this journey; we're here to help you every step of the way.

Frequently Asked Questions

What types of payments does the Pennsylvania Department of Revenue oversee?

The Pennsylvania Department of Revenue oversees personal income tax payments, business tax payments, and estimated tax contributions.

What should individuals know about personal income tax payments?

Individuals must make payments based on their income and should determine if they owe taxes for the current year or need to make estimated contributions. If expecting to owe more than $1,000, planning for estimated payments is advisable to avoid underpayment penalties.

How has the Pennsylvania Department of Revenue supported individuals affected by Hurricane Ian?

The Department has extended tax return filing deadlines for individuals impacted by Hurricane Ian, providing relief during challenging circumstances.

What are the responsibilities of businesses regarding tax payments in Pennsylvania?

Businesses in Pennsylvania are responsible for various tax obligations, including corporate levies and sales duties. There are approximately 1.1 million enterprises required to pay business taxes, and non-compliance can result in significant penalties.

What are estimated tax contributions, and why are they important?

Estimated tax contributions are payments made throughout the year by individuals who anticipate a tax obligation over $1,000. Making these contributions helps reduce the risk of incurring penalties for underpayment.

How can individuals and businesses ensure compliance with PA Department of Revenue payment procedures?

By familiarizing themselves with the types of tax obligations and payment classifications, individuals and businesses can navigate the procedures more efficiently and adhere to state tax regulations.