Introduction

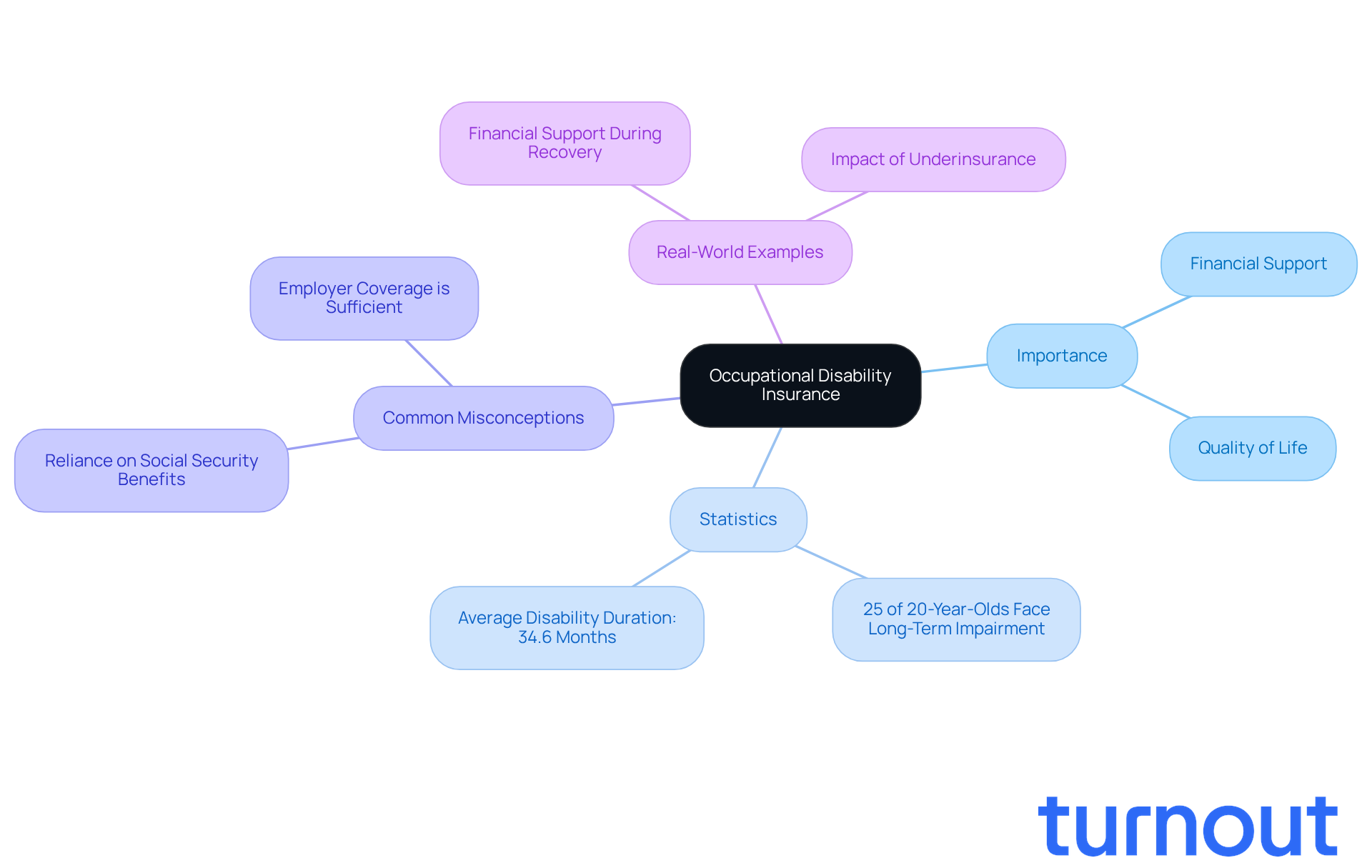

Occupational disability insurance is a vital safety net for professionals who may find themselves unable to work due to unexpected illness or injury. Did you know that over a quarter of young adults will face a long-term impairment before they retire? This statistic underscores the undeniable need for such coverage.

Yet, many people are unaware of the limitations of relying solely on Social Security or employer-provided plans. This often leads to inadequate protection when it’s needed most.

We understand that navigating the complexities of occupational disability insurance can feel overwhelming. How can you ensure comprehensive coverage and financial security during challenging times? You're not alone in this journey, and we're here to help.

Define Occupational Disability Insurance and Its Importance

Occupational disability insurance serves as a vital safety net for those who find themselves unable to fulfill their job responsibilities due to illness or injury. We understand that this can be a challenging time, especially for professionals whose livelihoods hinge on their ability to perform specific tasks. Occupational disability insurance is designed to replace a significant portion of lost income, helping you meet your financial obligations and maintain your quality of life during these tough periods.

Did you know that more than 25% of 20-year-olds will face a long-term impairment lasting over a year before retirement? This statistic highlights the importance of having coverage such as occupational disability insurance. Many people mistakenly believe that Social Security benefits or employer coverage will be enough to meet their disability needs, which often leads to underinsurance.

Real-world examples show how occupational disability insurance can provide essential financial support, allowing individuals to focus on their recovery without the added stress of economic instability. By understanding the advantages of occupational disability insurance, you can make informed choices about your security. Remember, you are not alone in this journey; we’re here to help you safeguard your most precious asset - your ability to earn an income.

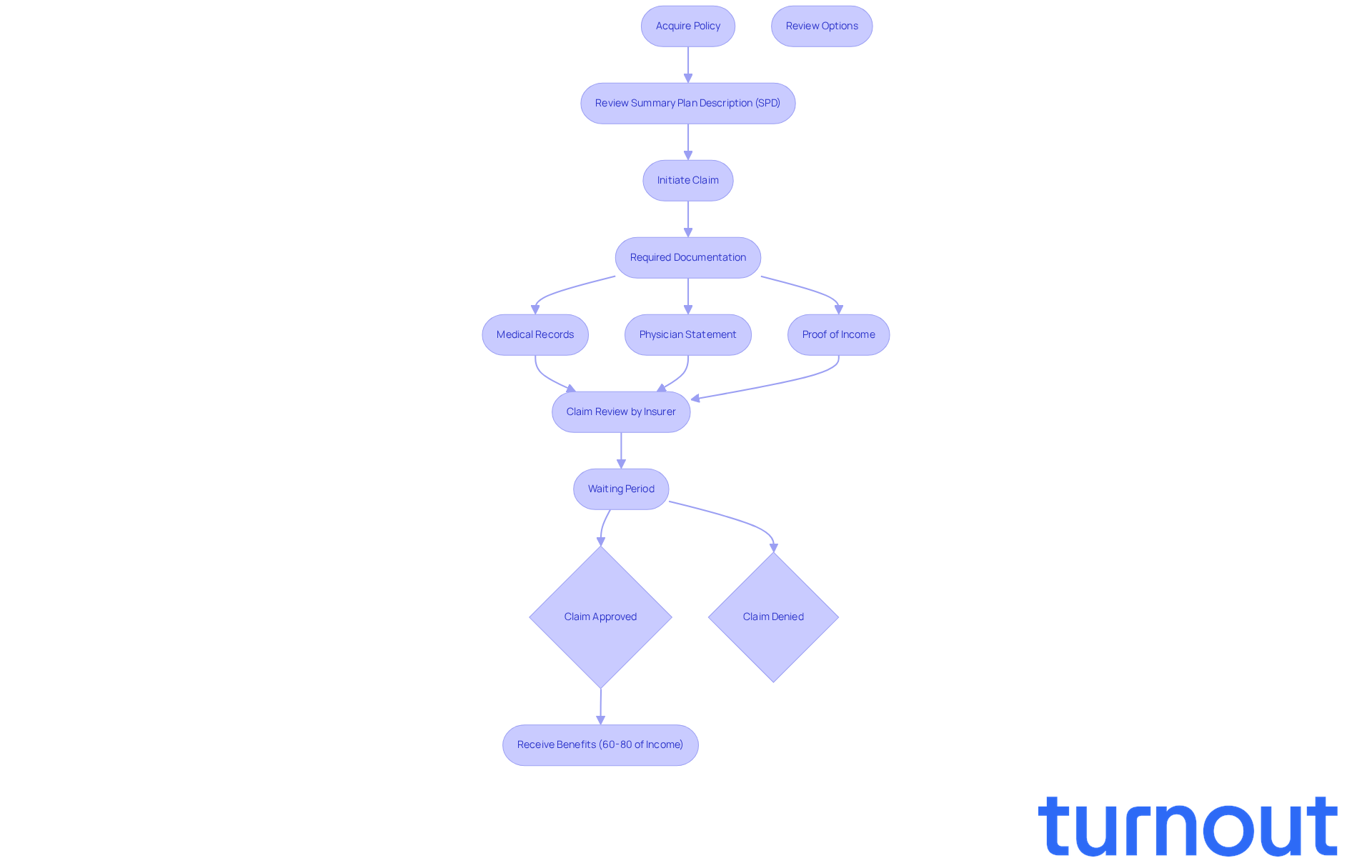

Explain How Occupational Disability Insurance Works

Occupational disability insurance provides you with financial support when you can’t perform your specific job due to a qualifying impairment. We understand that navigating this process can feel overwhelming, but it starts with acquiring a policy that clearly outlines your coverage terms. This includes what qualifies as an impairment, the benefit amounts, and how long you can receive payments.

Before you apply for benefits, it’s essential to review the Summary Plan Description (SPD). This document will help you understand the claim filing procedures and ensure you meet the eligibility requirements. If you encounter an impairment, you’ll need to initiate a claim by submitting important documentation. Typically, this includes:

- Medical records

- A statement from your attending physician detailing your condition

- Proof of income

Once your claim is filed, the insurer will review your application. This process can take anywhere from one week to over a month. It’s common to feel anxious during this waiting period, but recent trends show that more applicants are receiving decisions earlier, thanks to improvements in staffing and internal procedures within insurance companies. If your claim is approved, you can expect to receive a percentage of your income, usually between 60% and 80%, for a specified duration or until you’re able to return to work.

It’s important to recognize that mental health issues account for 10% of long-term impairment claims. This highlights the necessity for comprehensive coverage. To ensure a smooth claims process, prepare thoroughly. Avoid common pitfalls like submitting incomplete medical records or vague information. Interacting with experts who specialize in claims related to impairments can significantly improve your chances of a favorable outcome.

Understanding these mechanisms is crucial for navigating your plans and obtaining the benefits you deserve. Remember, you are not alone in this journey. With at least 51 million working adults in the U.S. lacking adequate occupational disability insurance beyond Social Security, the urgency of securing ODI cannot be overstated. We’re here to help you every step of the way.

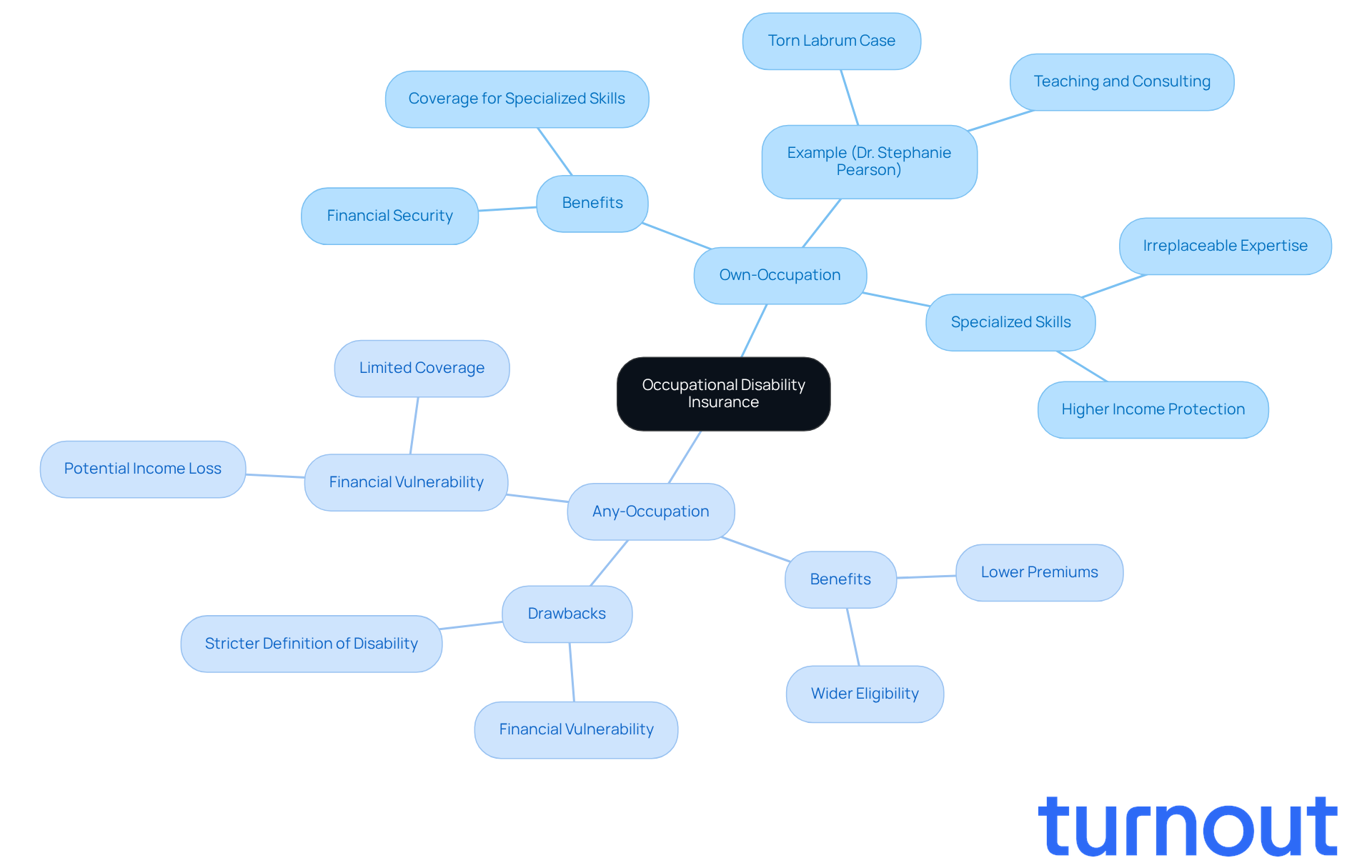

Compare Own-Occupation and Any-Occupation Policies

We understand that navigating your options for occupational disability insurance can feel overwhelming. You might find yourself facing two main types of coverage: Own-Occupation and Any-Occupation. An Own-Occupation plan is designed to provide benefits if you’re unable to perform the specific duties of your profession, no matter if you can work in another field. This type of coverage is particularly beneficial for those with specialized skills, like physicians, whose expertise is hard to replace.

Take, for example, Dr. Stephanie Pearson, an OBGYN. After suffering a torn labrum, she couldn’t perform surgeries, yet she was still able to receive benefits while teaching or consulting. This ensured her financial security, even when she couldn’t operate. It’s a powerful reminder of the risks associated with relying solely on Any-Occupation coverage, which may not adequately protect specialized professionals like her.

On the other hand, an Any-Occupation plan only pays benefits if you’re unable to work in any job that suits your education, training, and experience. While these plans often come with lower premiums, they can leave you financially vulnerable. For instance, a physician with an Any-Occupation plan might be deemed capable of taking on a different role, such as medical coding, even if it results in a significant drop in income.

Insurance specialists emphasize the importance of selecting the right coverage, such as occupational disability insurance, based on your unique career path and financial needs. According to the Council for Disability Awareness, around 70% of high-income professionals prefer Own-Occupation plans because of the comprehensive protection they offer. This preference highlights the necessity of understanding the definitions of impairment within each type of policy, as it directly impacts your financial stability during unforeseen health challenges.

Remember, you’re not alone in this journey. We’re here to help you navigate these choices and find the coverage that best suits your needs.

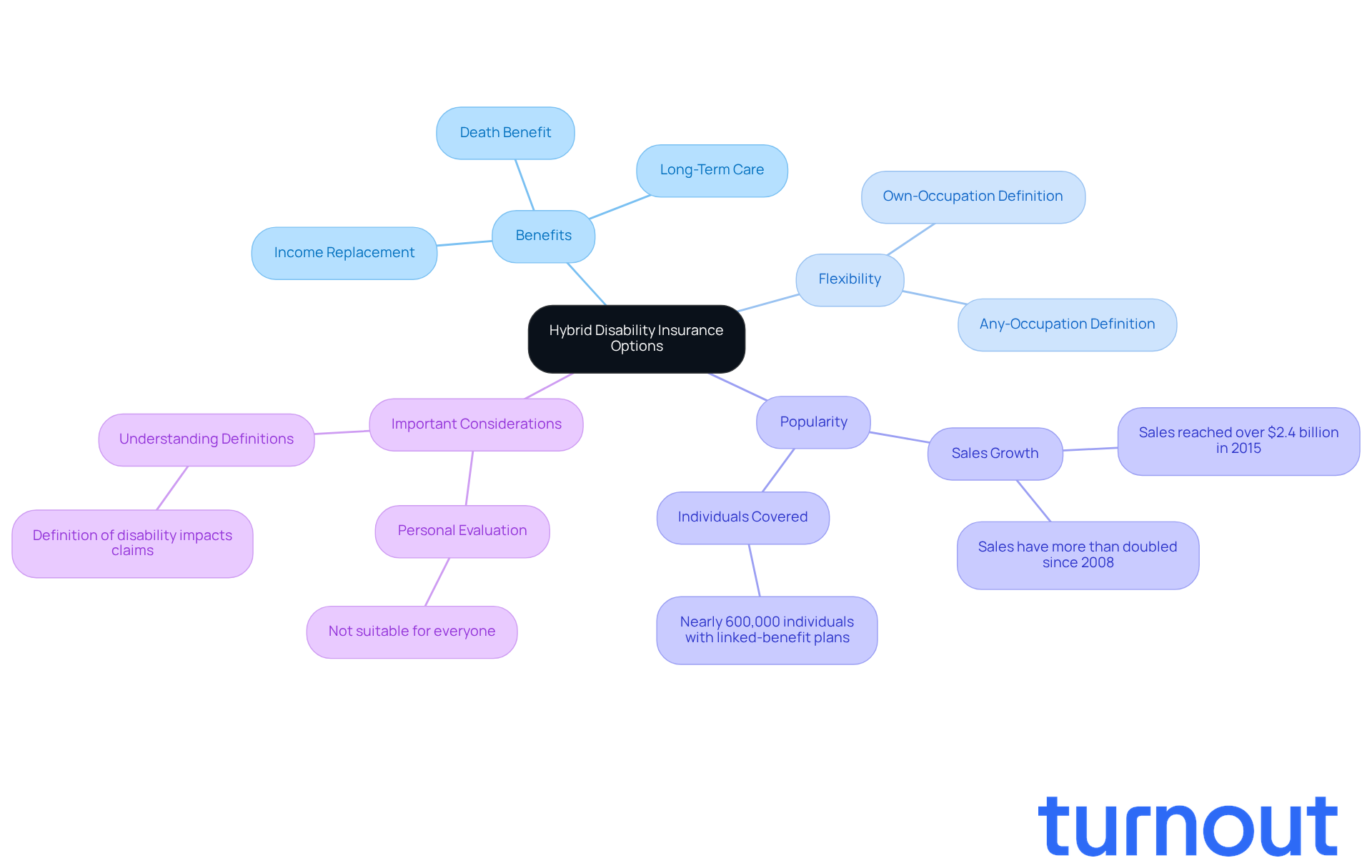

Explore Hybrid Disability Insurance Options

Hybrid impairment insurance options are becoming increasingly popular, and it’s easy to see why. They combine the benefits of traditional long-term impairment insurance with other financial products, like life insurance or critical illness coverage. This means you can enjoy a dual advantage: receiving income replacement during times of disability while also having a death benefit or long-term care element included.

Imagine a hybrid plan that starts by providing benefits under an Own-Occupation definition, then transitions to an Any-Occupation definition after a specified period. This flexibility is especially beneficial for those of you seeking comprehensive coverage that adapts to your changing needs.

As Kristi Sullivan, a certified money planner, wisely notes, hybrid plans are 'Not for everybody.' This highlights the importance of carefully evaluating your personal situation before making a decision. We understand that navigating the insurance landscape can be overwhelming, but exploring hybrid options can empower you with tailored solutions that significantly enhance your financial security.

The growing popularity of hybrid plans is evident in their sales, which have more than doubled since 2008, reaching over $2.4 billion in 2015. Additionally, nearly 600,000 individuals now have linked-benefit long-term care insurance plans, showing a strong preference for these versatile products.

It's crucial to understand the definition of disability used by your occupational disability insurance policy, as it directly impacts your claim eligibility and overall coverage. Remember, you are not alone in this journey. We're here to help you find the right solution that meets your needs.

Conclusion

Occupational disability insurance is more than just a policy; it’s a vital safety net for professionals who may face unexpected challenges due to illness or injury. We understand that when life takes an unexpected turn, financial stability can feel threatened. This type of insurance provides essential financial support during times of incapacity, allowing individuals to meet their obligations and maintain their quality of life. The importance of securing this coverage cannot be overstated, especially since many in the workforce may encounter long-term impairments that affect their ability to work.

In this guide, we’ve explored various aspects of occupational disability insurance, including:

- Its definition

- The claims process

- The differences between Own-Occupation and Any-Occupation policies

Real-life examples and statistics highlight the necessity of this coverage, showing how it can ease financial stress during tough times. Additionally, the emergence of hybrid disability insurance options reflects the changing landscape of financial protection, offering innovative solutions that blend traditional benefits with new features.

Ultimately, understanding and obtaining occupational disability insurance is crucial. As the workforce evolves, so should our strategies for financial security. Taking proactive steps to secure the right coverage tailored to your needs is essential for protecting your most valuable asset - your ability to earn an income. By prioritizing this aspect of financial planning, you can ensure peace of mind and stability when facing unforeseen challenges. Remember, you’re not alone in this journey; we’re here to help you navigate these important decisions.

Frequently Asked Questions

What is occupational disability insurance?

Occupational disability insurance is a type of insurance that provides financial support to individuals who are unable to perform their job duties due to illness or injury. It serves as a safety net by replacing a significant portion of lost income during challenging times.

Why is occupational disability insurance important?

It is important because it helps individuals meet their financial obligations and maintain their quality of life when they cannot work due to a disability. The insurance offers essential financial support, allowing individuals to focus on recovery without the stress of economic instability.

How common is long-term impairment among young adults?

More than 25% of 20-year-olds will face a long-term impairment lasting over a year before retirement, highlighting the importance of having occupational disability insurance.

What are common misconceptions about disability coverage?

Many people mistakenly believe that Social Security benefits or employer coverage will be sufficient to meet their disability needs, which can lead to underinsurance and inadequate financial protection.

How can occupational disability insurance affect recovery?

It can provide essential financial support during recovery, allowing individuals to focus on healing rather than worrying about their financial situation.