Overview

This article serves as a compassionate guide for mastering New Jersey state income tax payments. We understand that navigating tax obligations can be overwhelming, and our aim is to support you through this process. In this guide, we detail essential steps, requirements, and troubleshooting tips to ease your journey.

Key elements such as tax rates, filing statuses, and necessary documents are outlined to provide clarity. Additionally, we present a step-by-step online payment process designed to help you fulfill your obligations confidently and efficiently. Remember, you are not alone in this journey; we're here to help you every step of the way.

Introduction

Navigating the complexities of New Jersey's state income tax can feel overwhelming for many. We understand that the progressive tax structure and varying rates can leave you feeling daunted and unsure. This guide is here to offer a clear, step-by-step approach to mastering the NJ state income tax payment process. Our goal is to ensure that both residents and non-residents can fulfill their tax obligations with confidence.

With deadlines looming and the potential for penalties for late payments, it’s common to feel stressed about managing your tax responsibilities. However, you are not alone in this journey. Together, we can explore effective strategies to minimize stress and maximize savings. Let’s take this step by step, so you can approach your tax obligations with peace of mind.

Understand New Jersey State Income Tax Basics

New Jersey requires an nj state income tax payment from both residents and non-residents who earn revenue within the state. This tax is characterized by a progressive structure, meaning rates increase as earnings rise. Understanding nj state income tax payment can feel overwhelming, but we’re here to help you navigate it.

-

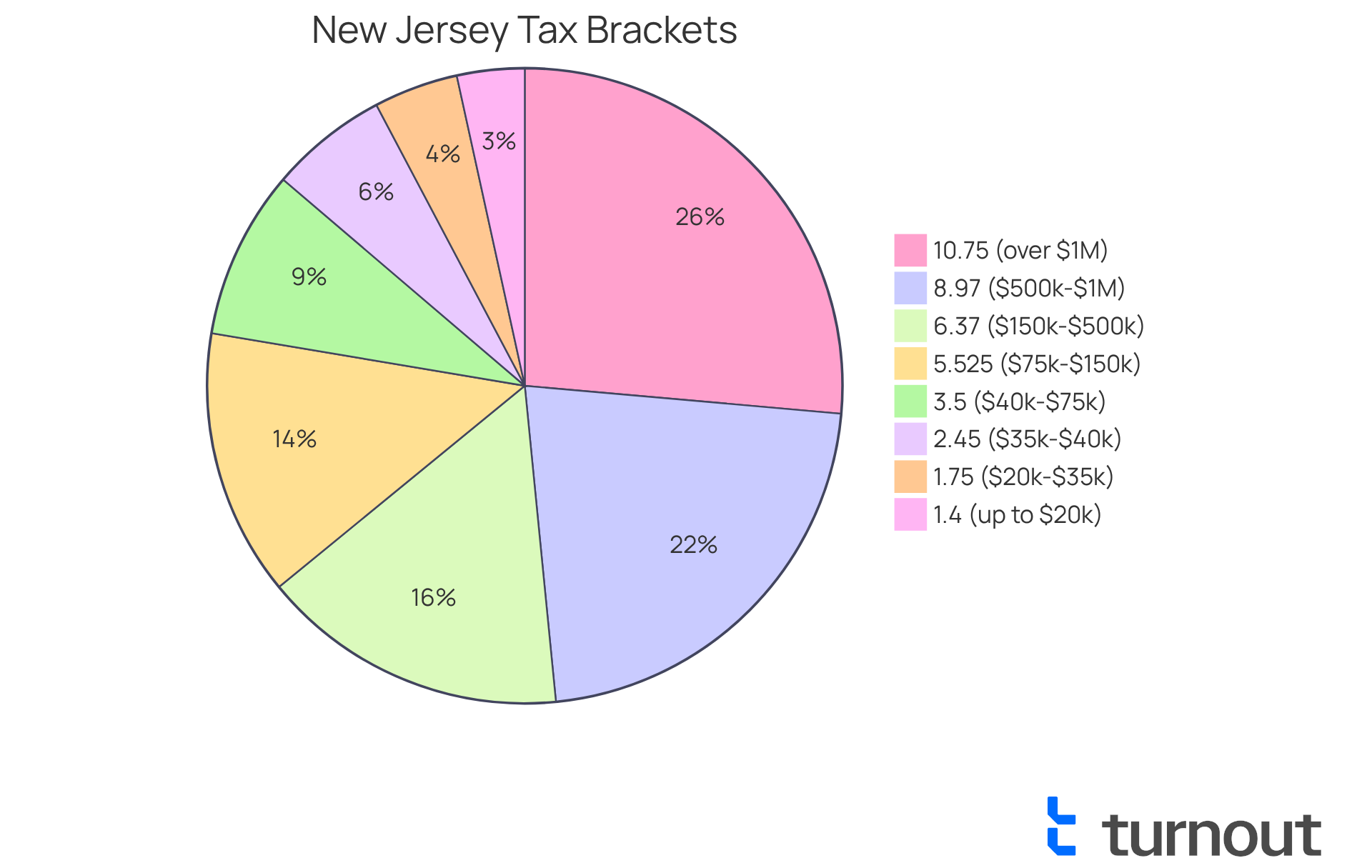

Tax Rates: New Jersey's tax brackets range from 1.4% for incomes up to $20,000 to 10.75% for incomes exceeding $1 million. For 2025, the earnings thresholds for filing taxes are set at $14,875 for single filers, $29,750 for married couples filing jointly, and slightly above $14,875 for head of household filers. Knowing where your earnings fall within these brackets is crucial for determining your nj state income tax payment.

-

Filing Status: Your filing status—whether single, married, or head of household—significantly impacts your tax rate and available deductions. For instance, the tax rate for married couples filing jointly accommodates elevated earnings thresholds, which can influence overall tax responsibilities. We understand that this can be a lot to take in.

The deadlines for the nj state income tax payment indicate that the tax year in New Jersey runs from January 1 to December 31, with returns due by April 15 of the following year. Late nj state income tax payment can result in penalties, which are typically 5% of the unpaid tax per month, up to a maximum of 25%. Additionally, the nj state income tax payment process requires that New Jersey state tax returns be e-filed alongside federal returns, ensuring a streamlined filing process. It's common to feel anxious about deadlines, but staying informed can ease that worry.

- Deductions and Credits: Familiarize yourself with available deductions and credits that can reduce your taxable earnings. New Jersey allows both standard and itemized deductions, including property levies, mortgage interest, and charitable donations. Notably, tax credits such as the Earned Income Tax Credit (EITC), Child Tax Credit, and Property Tax Relief Credit can provide significant savings for eligible taxpayers. In fact, 96% of users reported satisfaction with the IRS Direct File tool, which simplifies the filing process and helps eligible individuals automatically claim these credits.

By grasping these fundamentals, you will be better prepared to manage your nj state income tax payment responsibilities. Remember, you are not alone in this journey; understanding these aspects can help you potentially reduce your overall tax burden.

Gather Required Documents and Information

We understand that preparing for NJ state income tax payment can feel overwhelming. To make this process smoother, we encourage you to gather some essential documents and information that will help you feel more prepared:

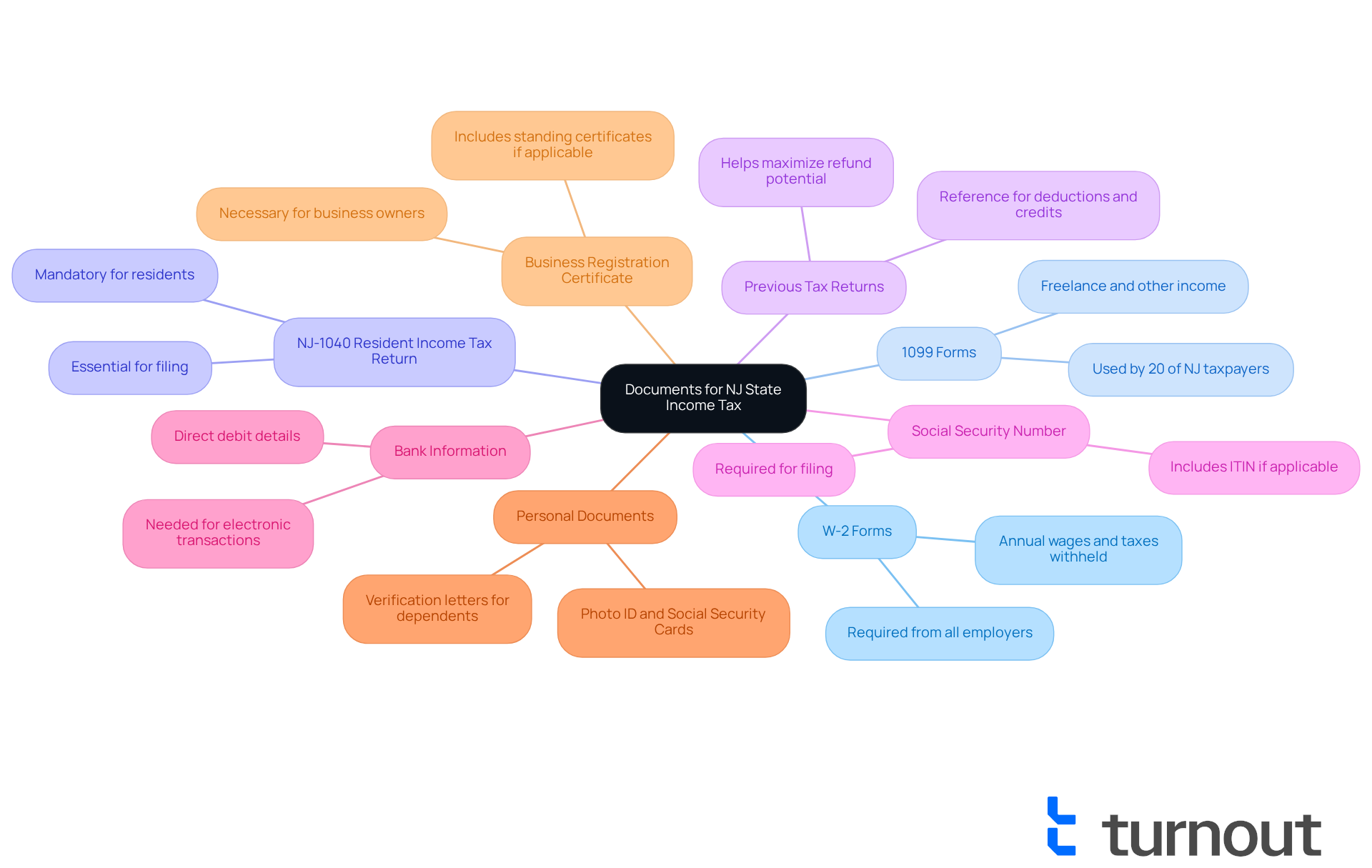

- W-2 Forms: Collect your W-2 forms from employers. These detail your annual wages and the taxes withheld, ensuring you document your earnings accurately.

- 1099 Forms: If you've earned money from freelance work or other sources, gather any 1099 forms that report these earnings. It's important to note that approximately 20% of taxpayers in New Jersey utilize 1099 forms, underscoring their significance in tax filing.

- NJ-1040 Resident Income Tax Return: This document is required for residents and must be completed for filing.

- Previous Tax Returns: Having last year's tax return handy can assist you in referencing deductions and credits you may wish to claim this year, helping you maximize your potential refund.

- Social Security Number: Ensure your Social Security number or Individual Taxpayer Identification Number (ITIN) is readily available, as it's required for filing.

- Bank Information: If you plan to make an electronic transaction, have your bank account details available for direct debit.

- Personal Documents: Bring personal documents such as a photo ID and Social Security Cards, as these are essential for tax filing.

- Business Registration Certificate and Standing Certificates: If applicable, these documents may also be necessary for your tax filing.

By organizing these documents beforehand, you can simplify the transaction process related to the NJ state income tax payment and prevent avoidable issues. Many individuals effectively managed their state tax contributions last year, and you can too. Remember, you're not alone in this journey. If you need additional support, consider exploring the Get It Back Campaign for assistance with tax credits and filing support.

Complete Your NJ State Income Tax Payment Online

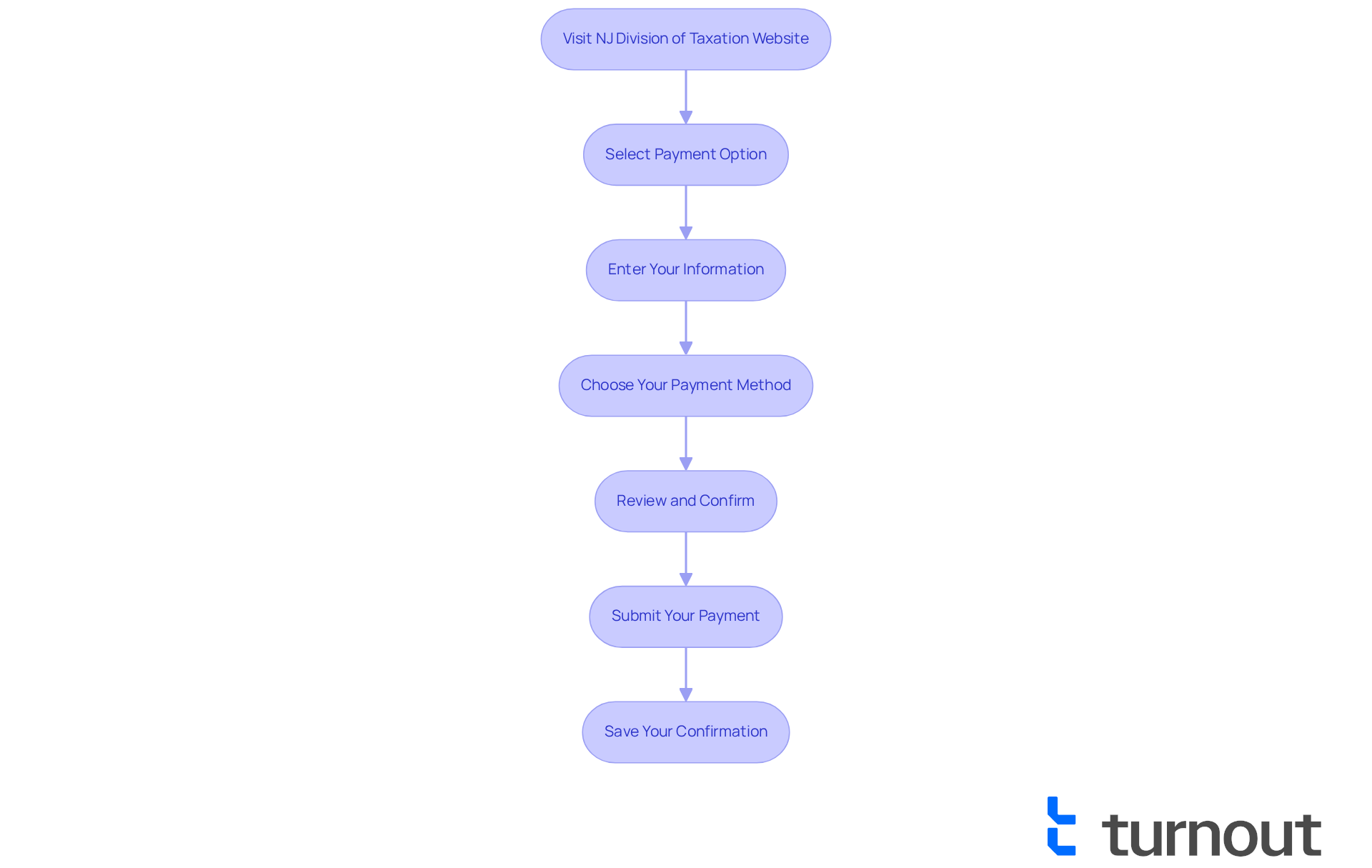

To complete your NJ state income tax payment online, we’re here to guide you through the process step by step:

- Visit the New Jersey Division of Taxation Website: Start by accessing the official site to reach the online transaction portal.

- Select the Payment Option: Look for the option labeled 'Make a Payment' or 'Pay Your Taxes.' We understand that navigating these options can be overwhelming, but we’re here to help.

- Enter Your Information: Complete the necessary fields, including your Social Security number, filing status, and the amount due. Take your time; accuracy is key.

- Choose Your Payment Method: Decide whether to pay via direct debit from your bank account or by credit/debit card. Please note that card transactions may incur additional fees, so choose what works best for you.

- Review and Confirm: Double-check all entered information for accuracy, verifying the amount and method of transaction. It’s common to feel a bit anxious at this stage, but a careful review can ease your mind.

- Submit Your Payment: Click the submit button to process your transaction. A confirmation number will be provided upon successful completion, giving you peace of mind.

- Save Your Confirmation: Keep a record of your confirmation number and any receipts for your records. This step is crucial for your future reference.

Looking ahead, it’s anticipated that in 2025, roughly 70% of New Jersey taxpayers will embrace online transaction options, reflecting a growing trend towards digital tax management. Tax professionals emphasize the importance of using the New Jersey Division of Taxation website for its user-friendly interface and efficient processing capabilities when making NJ state income tax payment. As Marita R. Sciarrotta, Director of the New Jersey Division of Taxation, states, "We do NOT initiate text messages with taxpayers," reminding us to be vigilant against scams. By following these steps, you can ensure that your transaction is processed accurately and punctually. Remember, you are not alone in this journey; we’re here to support you in making the most of the resources available through the New Jersey Division of Taxation.

Troubleshoot Common Payment Issues

If you encounter issues while making your NJ state income tax payment, we understand how frustrating that can be. Here are some troubleshooting tips to help you navigate these challenges:

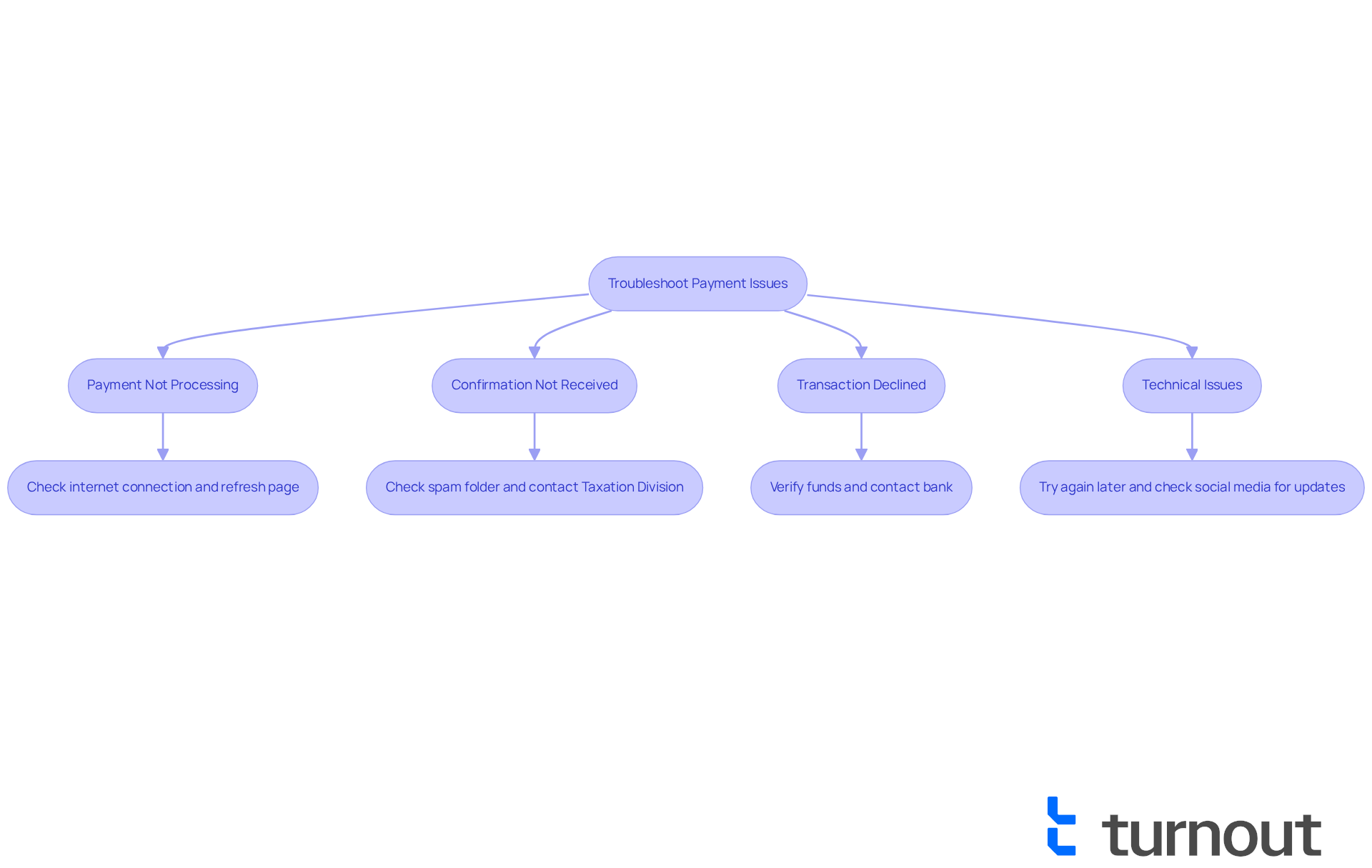

- Payment Not Processing: If your payment fails to process, please check your internet connection and ensure that all entered information is correct. Sometimes, refreshing the page or using a different browser can make a difference.

- Confirmation Not Received: If you do not receive a confirmation number, don’t forget to check your spam folder for emails from the tax authority. If it’s still missing, reach out to the New Jersey Division of Taxation for assistance.

- Transaction Declined: It’s common to feel concerned if your transaction is declined. Please verify that your bank account or card has sufficient funds. If you need further assistance, your bank is there to help.

- Technical Issues: If the website is down or experiencing technical difficulties, it’s best to try again later. You can also check the New Jersey Division of Taxation's social media for updates.

Statistics indicate that transaction processing failures can significantly delay tax refunds and create unnecessary stress for taxpayers. By being prepared for these common issues, you can navigate the transaction process with greater confidence and ease. Many taxpayers have successfully resolved processing failures by following these steps, showing that proactive troubleshooting can lead to quicker resolutions.

Furthermore, the New Jersey Tax Portal offers resources like user guides and video tutorials to assist you in managing the transaction process. If you encounter more significant issues, consider the Mediation Pilot Program, which provides a structured approach to resolving audit controversies of $5,000 or more. Lastly, please be cautious of unsolicited text messages claiming to be from the New Jersey Division of Taxation, as these are scams. Always verify communications through official channels. By following these strategies, you can effectively troubleshoot payment issues and ensure a smoother experience with your NJ state income tax payment. Remember, we're here to help you through this process.

Conclusion

Navigating the New Jersey state income tax payment process can feel overwhelming at first, but we want you to know that understanding its essential components can make this journey much easier. This guide has aimed to provide you with a comprehensive overview, from grasping the basics of tax rates and filing statuses to gathering the necessary documents and completing payments online.

We understand that the progressive nature of New Jersey's tax brackets and the importance of accurate documentation can add to your concerns. However, knowing the steps to ensure a smooth online payment experience can empower you. Additionally, being aware of potential payment issues and their solutions can help you manage your responsibilities with confidence and efficiency.

Ultimately, being informed and prepared is crucial for successfully handling NJ state income tax payments. Embracing the available resources and support systems can lead to a more manageable tax experience. Take proactive steps today to ensure compliance and potentially reduce your tax burden. Remember, you are not alone in this journey; assistance is always available should challenges arise.

Frequently Asked Questions

Who is required to pay New Jersey state income tax?

Both residents and non-residents who earn revenue within New Jersey are required to pay state income tax.

What is the structure of New Jersey's state income tax?

New Jersey's state income tax has a progressive structure, meaning that tax rates increase as earnings rise.

What are the tax rates in New Jersey?

New Jersey's tax rates range from 1.4% for incomes up to $20,000 to 10.75% for incomes exceeding $1 million.

What are the earnings thresholds for filing taxes in 2025?

The earnings thresholds for filing taxes in 2025 are $14,875 for single filers, $29,750 for married couples filing jointly, and slightly above $14,875 for head of household filers.

How does filing status affect New Jersey state income tax?

Your filing status—single, married, or head of household—significantly impacts your tax rate and available deductions, with different thresholds and rates for each status.

What is the tax year and deadline for filing New Jersey state income tax?

The tax year in New Jersey runs from January 1 to December 31, with tax returns due by April 15 of the following year.

What are the penalties for late New Jersey state income tax payment?

Late payments can result in penalties of 5% of the unpaid tax per month, up to a maximum of 25%.

What is the process for filing New Jersey state income tax returns?

New Jersey state tax returns must be e-filed alongside federal returns to ensure a streamlined filing process.

What deductions and credits are available to New Jersey taxpayers?

New Jersey allows both standard and itemized deductions, including property levies, mortgage interest, and charitable donations. Tax credits such as the Earned Income Tax Credit (EITC), Child Tax Credit, and Property Tax Relief Credit are also available.

How can the IRS Direct File tool assist taxpayers?

The IRS Direct File tool simplifies the filing process and helps eligible individuals automatically claim deductions and credits, with 96% of users reporting satisfaction with the tool.