Overview

We understand that managing estimated tax payments can feel overwhelming, especially in Maryland. This article serves as a comprehensive step-by-step guide to help you navigate this process with confidence. By highlighting the importance of accurate calculations and timely submissions, we aim to alleviate any concerns you may have about potential penalties.

It's common to feel uncertain about eligibility criteria, payment methods, and deadlines. That's why we provide detailed information on these aspects, along with the implications of recent tax regulations. Being informed is key to effective tax management, and we're here to support you on this journey toward financial peace of mind.

Remember, you are not alone in this. With the right guidance and knowledge, you can take control of your tax obligations and feel empowered in your financial decisions. Let's work together to ensure you have the tools you need for success.

Introduction

We understand that navigating estimated tax payments can feel overwhelming for many Maryland residents. This is especially true for those who are self-employed or earn income from sources where taxes are not automatically withheld. This guide is here to help you, offering a clear, step-by-step approach to calculating and managing these payments effectively.

It's common to feel uncertain about new regulations and the potential penalties for underpayment. But rest assured, you are not alone in this journey. We’re here to provide the support you need to ensure compliance while maximizing your financial well-being. Together, we can demystify this process and empower you to take control of your tax situation.

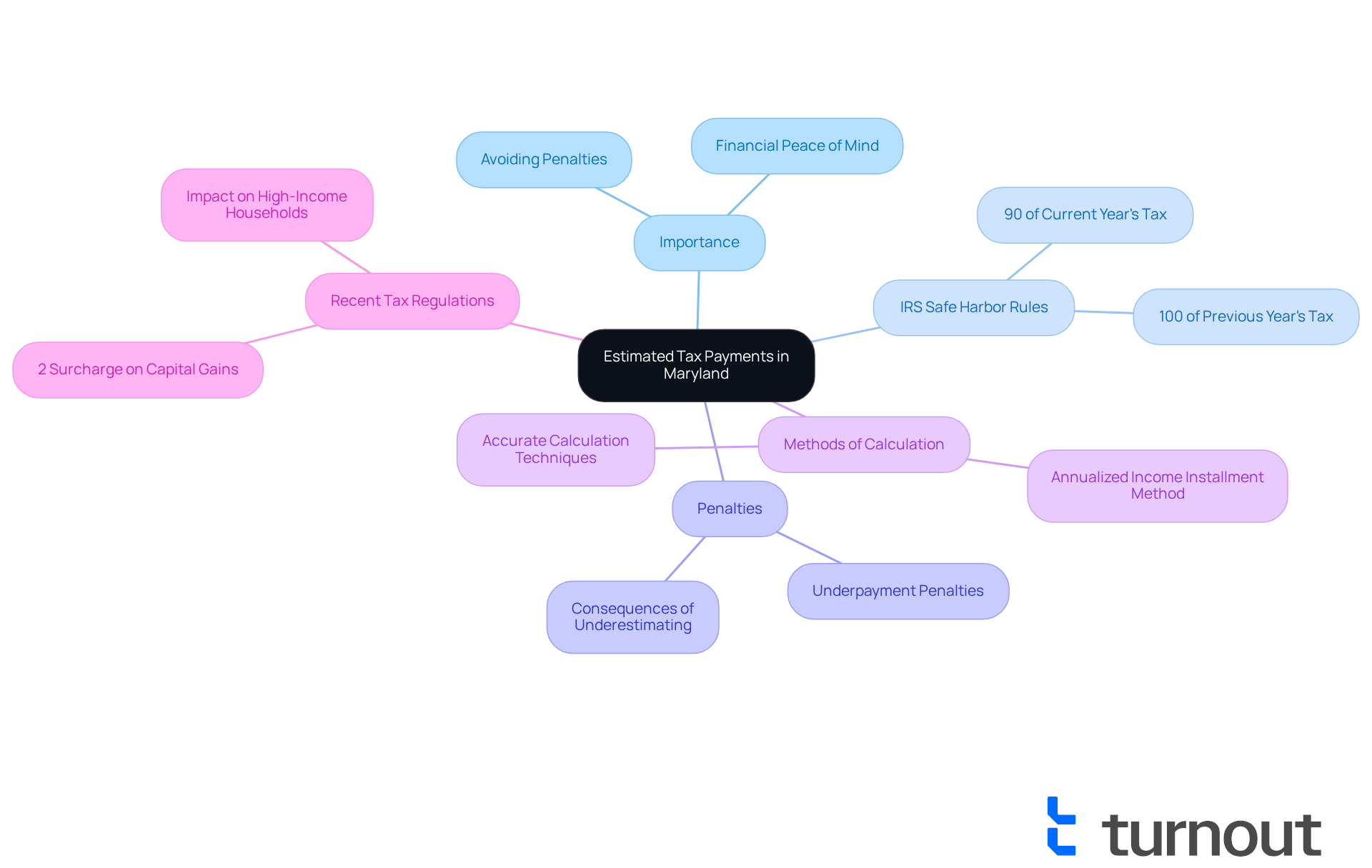

Understand Estimated Tax Payments in Maryland

Understanding projected tax contributions can feel overwhelming, especially when you anticipate owing $500 or more in state taxes after deducting withholdings and refundable credits. In Maryland, md estimated tax payments are especially crucial for self-employed individuals, freelancers, and those earning income from sources that do not withhold taxes. With around 1.5 million Maryland residents contributing annually, grasping this process is essential for financial peace of mind.

To avoid any unnecessary penalties, it's crucial to accurately calculate and plan for the md estimated tax payments. The IRS safe harbor rules are here to help you. They allow taxpayers to dodge penalties if they pay at least:

- 90% of the current year's tax owed

- 100% of the previous year's tax, as long as they owed less than $1,000 after credits and withholdings

For higher-income earners, different rules based on Adjusted Gross Income (AGI) apply. Additionally, Maryland's recent tax regulation introduces a 2% surcharge on capital gains income for households earning over $350,000, which could influence your md estimated tax payments and projected contributions.

Underestimating your projected tax contributions can lead to fines, underscoring the importance of timely and accurate calculations. Many self-employed individuals, for instance, face this challenge. They might choose the Annualized Income Installment Method, which allows them to adjust their contributions based on actual earnings throughout the year. This method can significantly reduce underpayment penalties by aligning contributions more closely with income.

It’s vital for Maryland residents to understand md estimated tax payments to manage their responsibilities effectively. As Mike O’Halloran, Maryland State Director, wisely states, "Being informed about your tax responsibilities can save you from unexpected penalties and ensure compliance with state laws." By staying proactive and educated, you can navigate your tax obligations with confidence and avoid the pitfalls of underpayment. Remember, you are not alone in this journey—we're here to help you every step of the way.

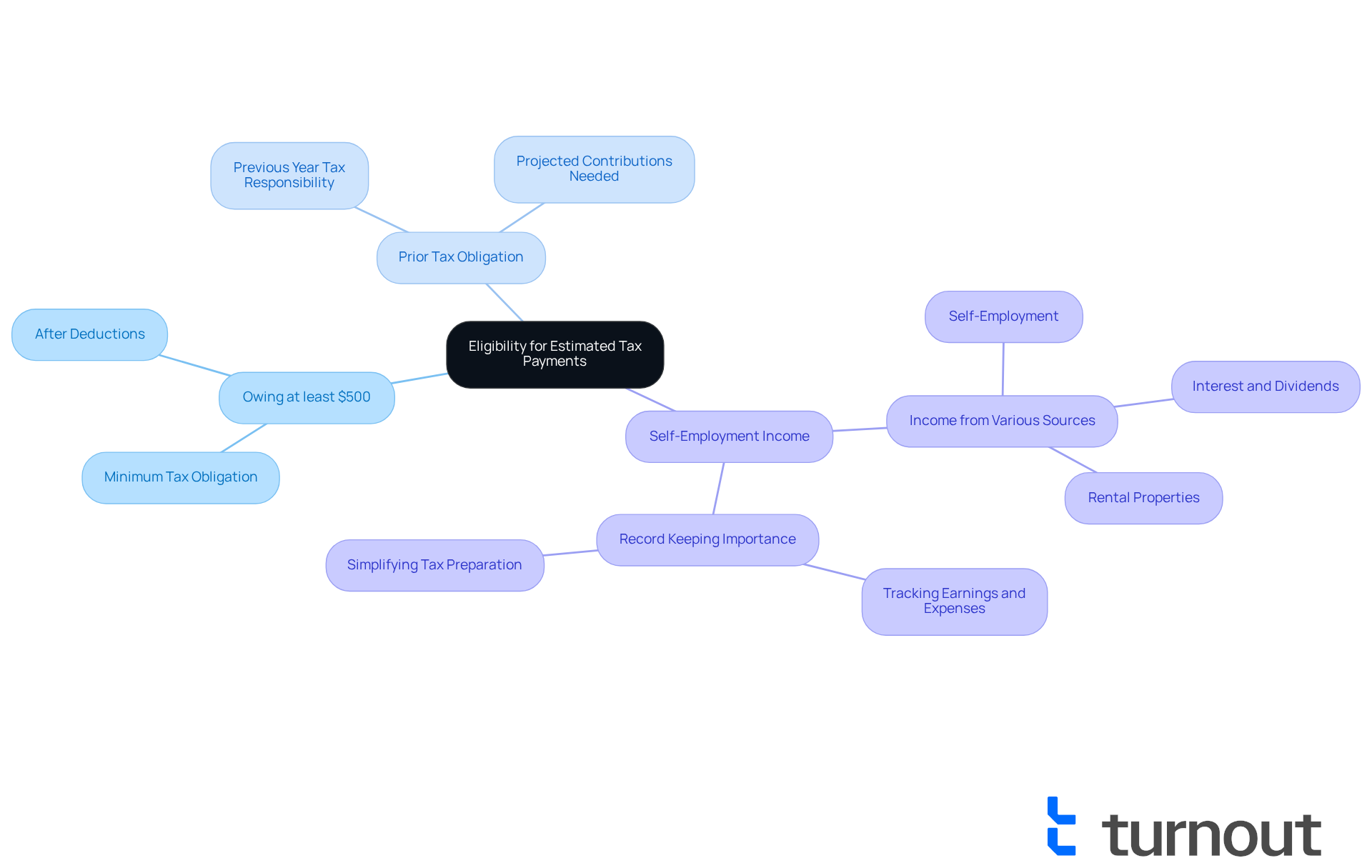

Determine Your Eligibility for Estimated Tax Payments

Are you feeling uncertain about your tax contributions in Maryland? You're not alone. To assess your qualification for anticipated tax contributions, consider these important factors:

- You must anticipate owing at least $500 in state tax after deducting withholdings and refundable credits.

- If you had a tax obligation in the prior year, you might need to make projected contributions.

- If you earn income from self-employment, interest, dividends, or rental properties, you are likely obligated to pay projected taxes.

Take a moment to review your financial situation to confirm your eligibility.

Statistics indicate that about 70% of self-employed individuals in Maryland must make estimated tax payments due to their variable revenue streams. As Brad Thibeau, Head of Growth & Partnerships at Everlance, wisely notes, "Being self-employed in Maryland comes with its own set of tax responsibilities." Consulting with a tax professional can provide you with valuable insights tailored to your specific situation, helping you navigate compliance with state tax laws.

Furthermore, keeping precise records is essential for self-employed individuals. This practice not only assists in monitoring earnings and expenses but also simplifies tax preparation and supports deductions. For instance, those who take advantage of home office deductions can significantly lower their taxable earnings by effectively documenting their business-related expenses.

Remember, we’re here to help you through this journey. You are not alone in navigating these responsibilities.

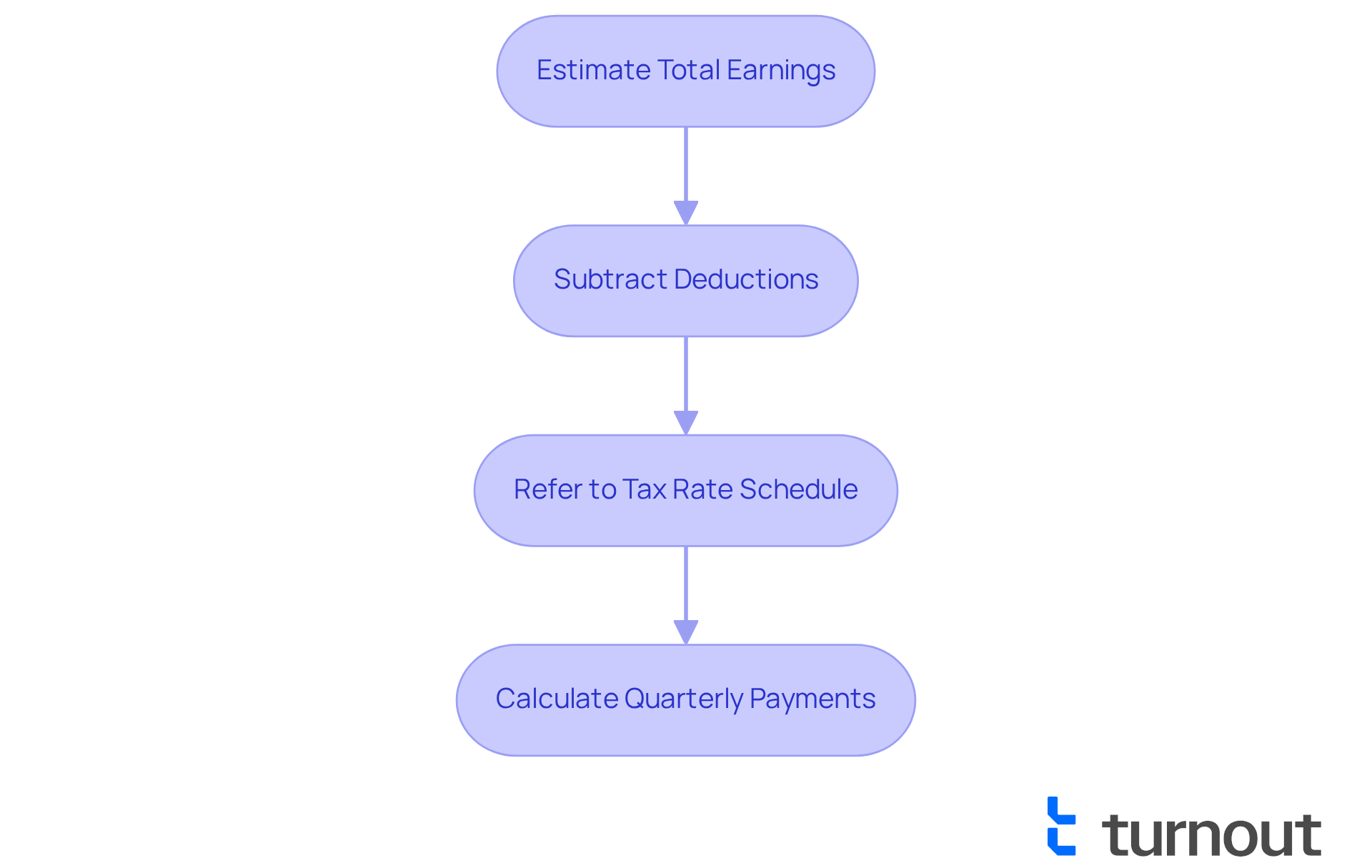

Calculate Your Estimated Tax Payment Amount

We understand that navigating tax payments can be overwhelming. To help you determine your projected tax payment amount in Maryland for 2025, let’s break it down into manageable steps:

-

First, estimate your total earnings for the year. This includes your wages, self-employment revenue, and any other sources of income.

-

Next, subtract any deductions you qualify for. These might include deductions for home office use or business expenses, which will help you determine your taxable earnings.

-

Now, refer to the updated Maryland tax rate schedule for 2025. This schedule includes new brackets and rates, such as a 2% surcharge on capital gains income for households earning over $350,000 in federal adjusted gross income. It’s also important to note that itemized deductions will phase out for households earning more than $200,000.

-

Finally, split your total projected tax obligation by four to calculate your estimated tax payments for each quarter. For example, if your projected tax obligation is $2,000, your quarterly payment would be $500. This method not only helps you stay compliant with the new tax regulations but also allows you to effectively manage your financial obligations.

Additionally, consider any potential tax credits available for renewable energy improvements. These credits could further reduce your taxable income, providing you with more financial relief. Remember, you are not alone in this journey, and we're here to help you every step of the way.

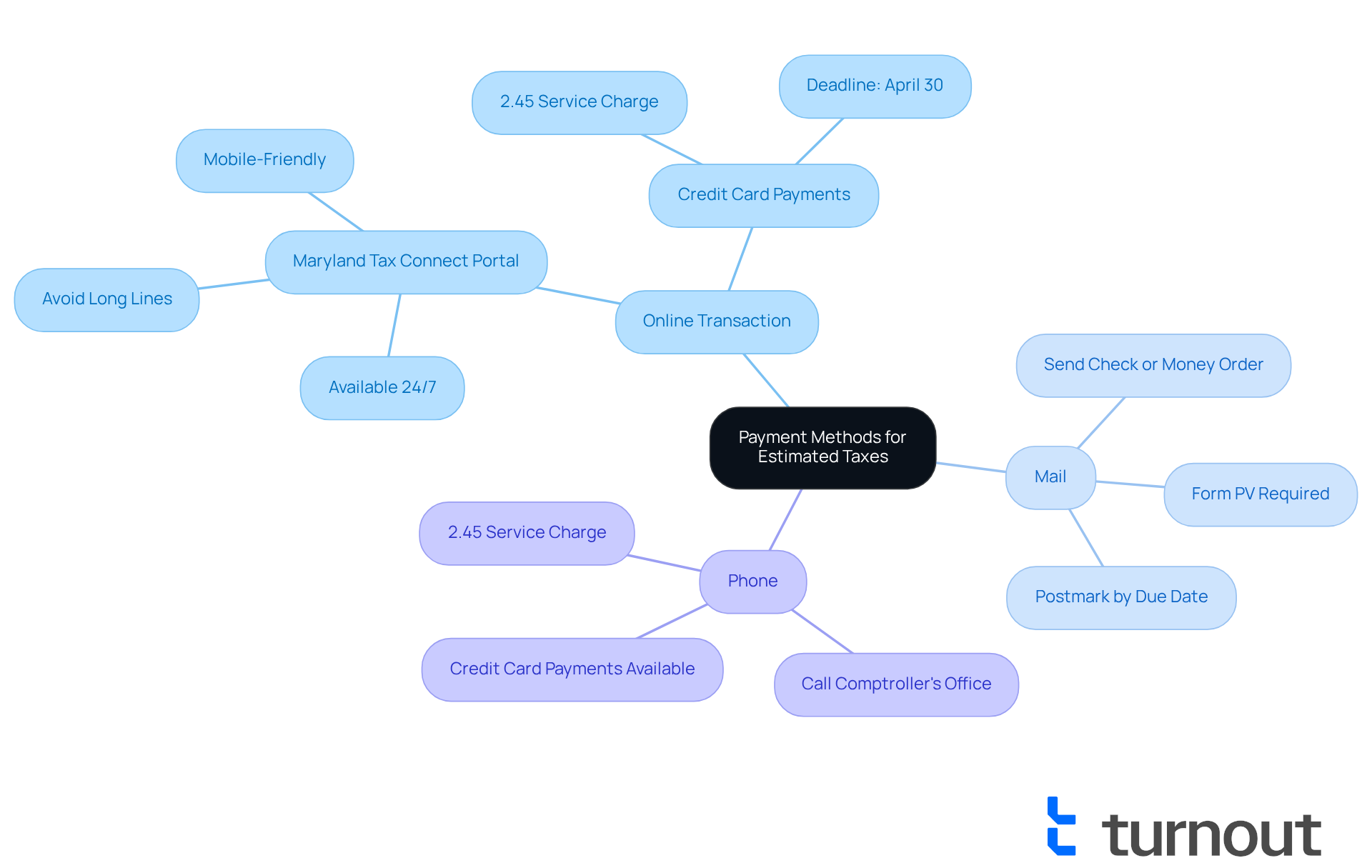

Choose Your Payment Method for Estimated Taxes

In Maryland, we understand that managing your estimated tax payments can feel overwhelming. Thankfully, you have several convenient options to make this process easier:

-

Online Transaction: You can utilize the Maryland Tax Connect portal for electronic transactions, available 24/7. This mobile-friendly service allows you to manage your tax obligations easily, helping you avoid long lines or mailing delays. The Comptroller's online transaction service simplifies the process, enabling you to handle your transactions conveniently from any device.

-

Mail: If you prefer traditional methods, you can send a check or money order along with Form PV (Payment Voucher) to the Comptroller of Maryland. Just be sure to postmark your remittance by the due date to avoid any penalties.

-

Phone: You also have the option to call the Comptroller's office to make a transaction using a credit card. Please note that a 2.45% service charge applies specifically for transactions conducted through the Comptroller of Maryland Online Tax Payments site.

Since 2011, Maryland has created almost 50 eGovernment services to improve accessibility and efficiency in tax transactions. As Comptroller Peter Franchot pointed out, these services allow you to avoid the inconvenience of standing in long queues or sending checks, simplifying tax transactions and enhancing your experience. Many Maryland residents have effectively utilized the online portal to submit their estimated tax contributions swiftly and efficiently.

Remember, if you file electronically by April 15, you have until April 30 to make credit card transactions online to avoid any penalties. We encourage you to select the approach that best meets your needs and ensure that your transactions are completed by the deadlines. You're not alone in this journey, and we're here to help you every step of the way.

Know When to Make Your Estimated Tax Payments

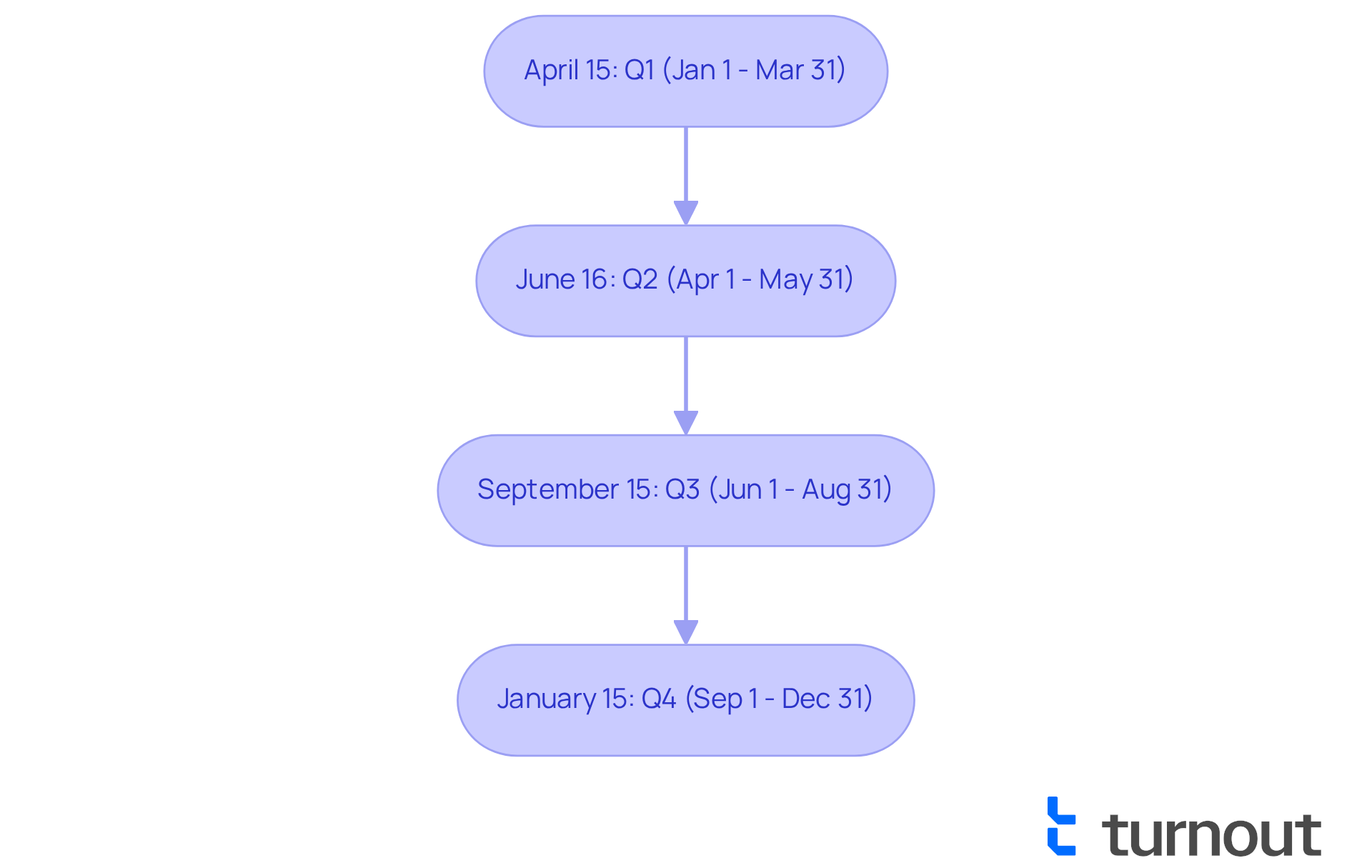

In Maryland, we understand that managing your tax responsibilities can feel overwhelming. That's why it's essential to keep track of your estimated tax contributions. These dues are required on the following dates:

- April 15: First quarter installment for earnings accrued from January 1 to March 31.

- June 16: Second quarter contribution for earnings accrued from April 1 to May 31.

- September 15: Third quarter remittance for earnings received from June 1 to August 31.

- January 15 of the following year: Fourth quarter remittance for income earned from September 1 to December 31.

Marking these dates on your calendar can help you avoid penalties and ensure compliance with tax regulations. We know that promptly calculated tax contributions can greatly lessen the chance of facing interest and fines, which can add up rapidly if deadlines are overlooked.

As Kelley R. Taylor, a Senior Tax Editor, wisely states, "Keeping track of your projected tax contributions can avoid unnecessary financial strain and guarantee a more seamless tax filing process." Individuals who consistently meet their projected tax payment deadlines often report smoother tax filing experiences and fewer financial surprises.

Remember, failing to make sufficient md estimated tax payments can lead to IRS penalties, even if you expect a refund when filing your return. Therefore, staying informed and proactive about these deadlines is key to effective tax management. You're not alone in this journey; we're here to help you navigate these responsibilities with confidence.

Conclusion

Understanding Maryland's estimated tax payments is essential for anyone who anticipates owing taxes, especially for self-employed individuals and freelancers. We understand that navigating these obligations can feel overwhelming. By grasping the rules and methods for calculating and making these payments, Maryland residents can approach their tax responsibilities with confidence, ensuring compliance and avoiding unnecessary penalties.

Throughout this guide, we've highlighted key points, including:

- Eligibility criteria for estimated tax payments

- Effective calculation methods

- Various payment options

- Crucial due dates

It's common to feel anxious about projected tax contributions and deadlines, but staying informed can significantly reduce the risk of facing fines and interest. This knowledge creates a smoother tax filing experience.

Ultimately, being proactive and educated about Maryland's estimated tax payment process is vital for your financial well-being. Whether you prefer online transactions, traditional mail, or phone payments, we encourage you to choose the method that best suits your needs. Marking important dates on your calendar can also help you stay organized. By taking these steps, you can manage your tax responsibilities effectively and avoid the pitfalls of underpayment, ensuring peace of mind as you fulfill your obligations. Remember, you are not alone in this journey; we’re here to help.

Frequently Asked Questions

What are estimated tax payments in Maryland?

Estimated tax payments in Maryland are advance payments made towards your projected tax liability for the year, necessary for individuals who expect to owe $500 or more in state taxes after deductions.

Who needs to make estimated tax payments in Maryland?

Individuals who are self-employed, freelancers, or earn income from sources that do not withhold taxes, as well as anyone anticipating owing at least $500 in state tax, need to make estimated tax payments.

What are the IRS safe harbor rules for avoiding penalties on estimated tax payments?

To avoid penalties, taxpayers must pay at least 90% of the current year’s tax owed or 100% of the previous year’s tax, provided they owed less than $1,000 after credits and withholdings.

How does Maryland's new tax regulation affect estimated tax payments?

Maryland has introduced a 2% surcharge on capital gains income for households earning over $350,000, which can impact estimated tax payments and projected contributions for higher-income earners.

What is the Annualized Income Installment Method?

The Annualized Income Installment Method allows self-employed individuals to adjust their estimated tax contributions based on actual earnings throughout the year, which can help reduce underpayment penalties.

How can self-employed individuals manage their estimated tax payments?

Self-employed individuals should keep precise records of their earnings and expenses, which aids in tax preparation and supports deductions like home office expenses, ultimately simplifying the process.

What should I do if I’m uncertain about my eligibility for estimated tax payments?

To determine eligibility, review your financial situation to see if you expect to owe at least $500 in state tax after deductions, had a tax obligation in the prior year, or earn income from self-employment or other non-withholding sources. Consulting a tax professional can also provide tailored insights.

Why is it important to understand estimated tax payments?

Understanding estimated tax payments helps Maryland residents manage their tax responsibilities effectively, avoid unexpected penalties, and ensure compliance with state laws.