Introduction

Understanding the complexities of levy fees can feel overwhelming, especially for disabled individuals striving to maintain financial stability. These fees, often deducted from income to settle government debts, can significantly affect the resources available for everyday living expenses and healthcare.

We understand that grappling with these charges can be challenging. You might be wondering: how can you effectively navigate this landscape to ensure you receive the full benefits you deserve?

This guide is here to help. We’ll illuminate the various types of levy fees, explain the application process, and share strategies to overcome the hurdles that often accompany them. Together, we can empower you to take control of your financial future.

Define Levy Fees and Their Importance for Disabled Individuals

The complexities of income and entitlements can make levy fees feel overwhelming for those navigating them. These amounts, taken from a person's income to settle debts owed to the government, like taxes, can significantly affect financial resources. For individuals with disabilities, understanding the levy fee is crucial. When a levy fee is applied to disability assistance, it decreases the funds available for essential living costs, healthcare, and other vital needs.

Imagine living in a county where local taxes make up over 50% of your income. If ballot measures fail, it can lead to serious financial struggles for disabled residents, worsening their already vulnerable situations. We understand that grappling with these charges can be daunting, but grasping how they work enables disabled individuals to manage their finances more effectively.

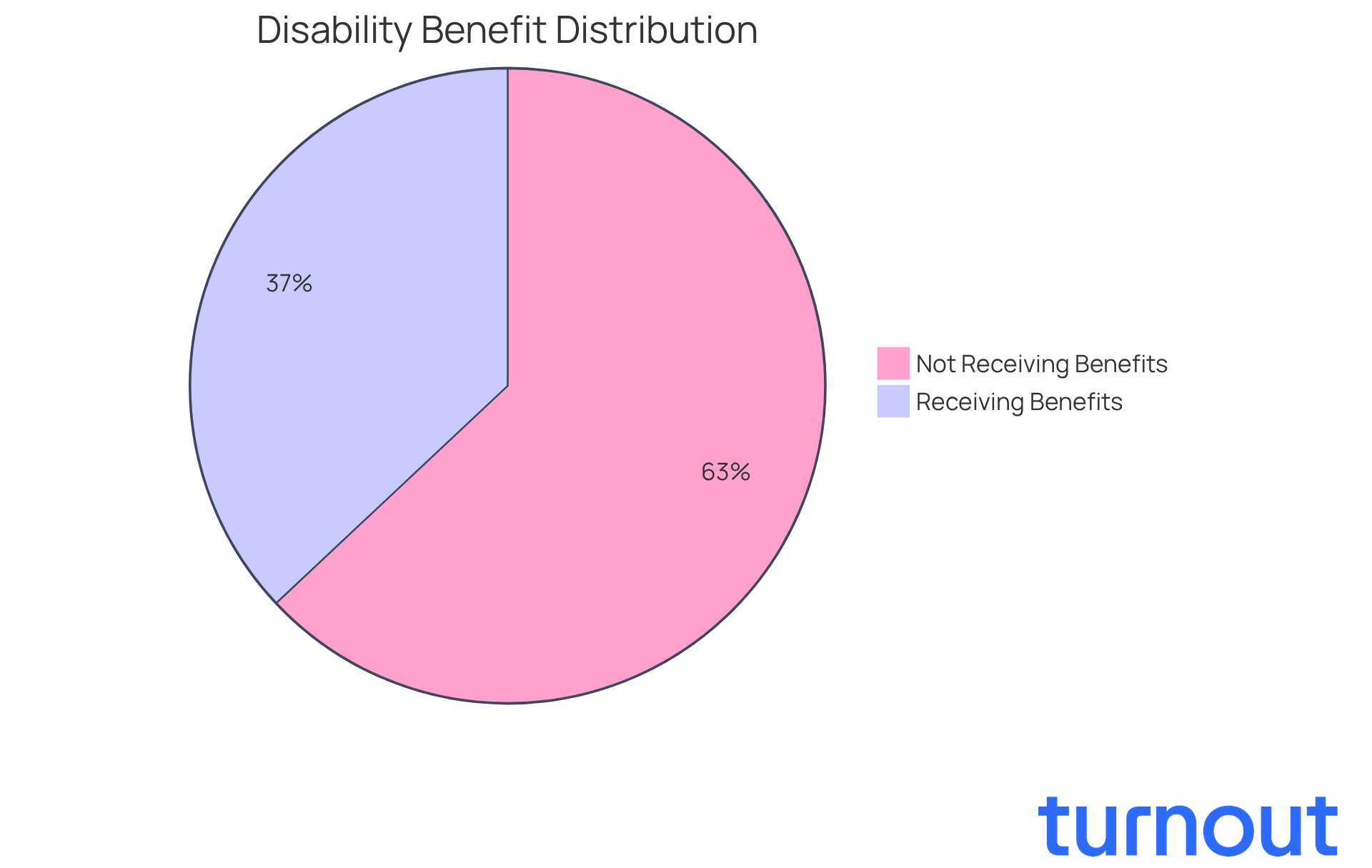

It's important to advocate for your rights and ensure you receive the full benefits you deserve. With 63% of low-income people with disabilities not receiving SSDI or SSI, understanding how fees impact your support is essential for navigating financial systems and obtaining the assistance you need. Remember, you are not alone in this journey; we're here to help you find clarity and support.

Explore Different Types of Levy Fees Relevant to Disability Benefits

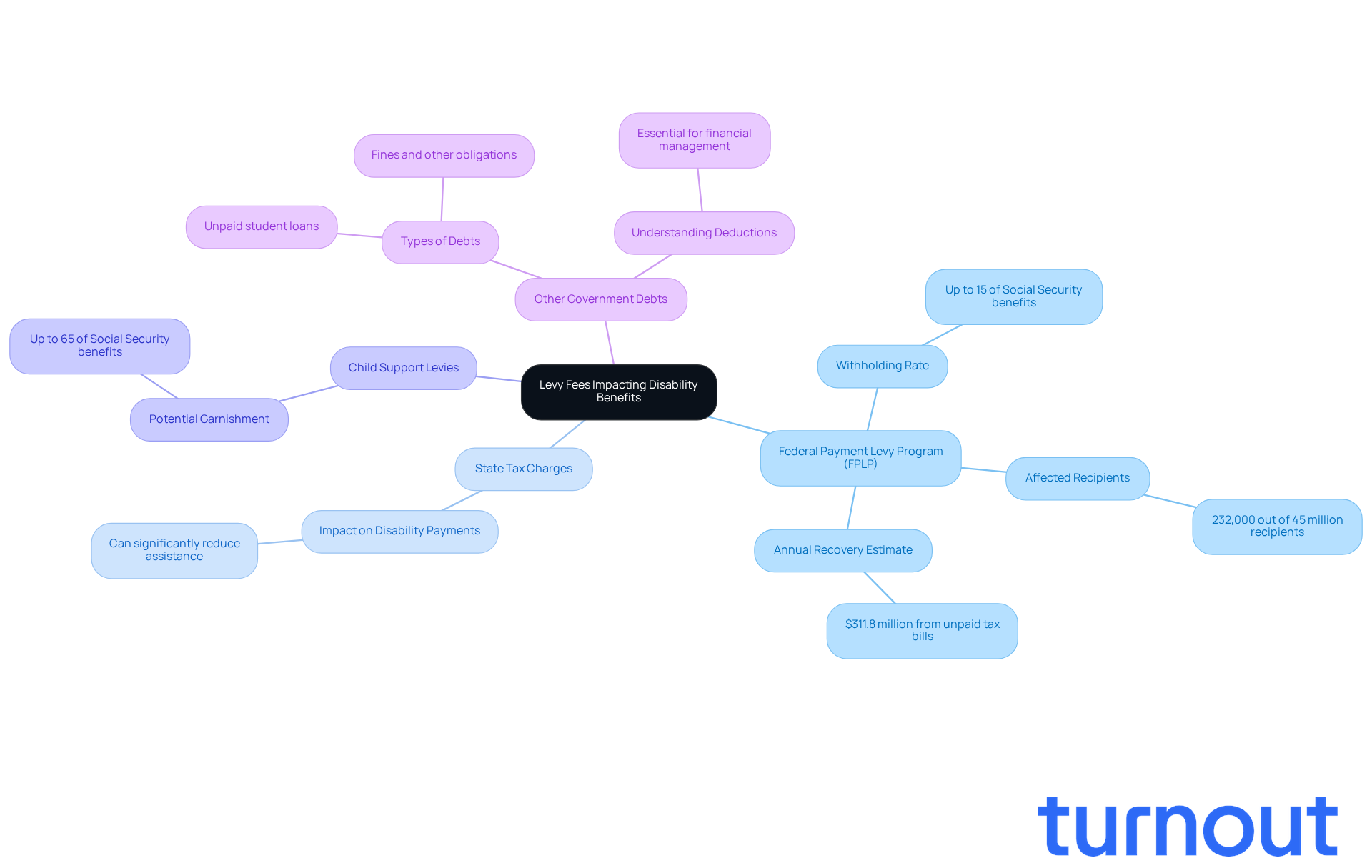

Disabled individuals often face various fees that can affect their benefits, including specific levy fees. We understand that navigating these financial challenges can be overwhelming. Here are some key types of levies to be aware of:

- Federal Payment Levy Program (FPLP): This program allows the IRS to withhold up to 15% of Social Security benefits to recover unpaid federal taxes. It’s concerning to note that about 232,000 out of 45 million Social Security recipients are identified as delinquent in their federal tax payments. This highlights the potential impact of this charge on your benefits.

- State Tax Charges: State tax authorities can impose charges on disability payments to recover outstanding state tax debts. These levies can significantly reduce the assistance you receive, making it crucial to stay informed about the levy fee related to your tax obligations.

- Child Support Levies: If you owe child support, a portion of your disability payments may be levied to meet these obligations. This can lead to significant reductions, affecting the financial stability of those who rely on these allowances.

- Other Government Debts: Levies may also be applied to recover debts owed to various government agencies, such as unpaid student loans or fines. Understanding these potential deductions, including the levy fee, is essential for effectively managing your finances and anticipating changes to your benefit amounts.

We’re here to help you navigate these complex financial situations. It’s important to remember that this organization is not a law firm and does not provide legal advice or representation. By employing skilled nonlawyer advocates for SSD claims and IRS-licensed enrolled agents for tax debt relief, we assist clients in understanding their rights and options regarding fees.

Additionally, VA disability payments are typically excluded from IRS seizures, providing an extra layer of financial security for veterans. By familiarizing yourself with these charge types and the assistance available through Turnout, you can better prepare for any deductions from your benefits and make informed financial decisions. Remember, you are not alone in this journey.

Navigate the Application Process for Levy Fees: A Step-by-Step Guide

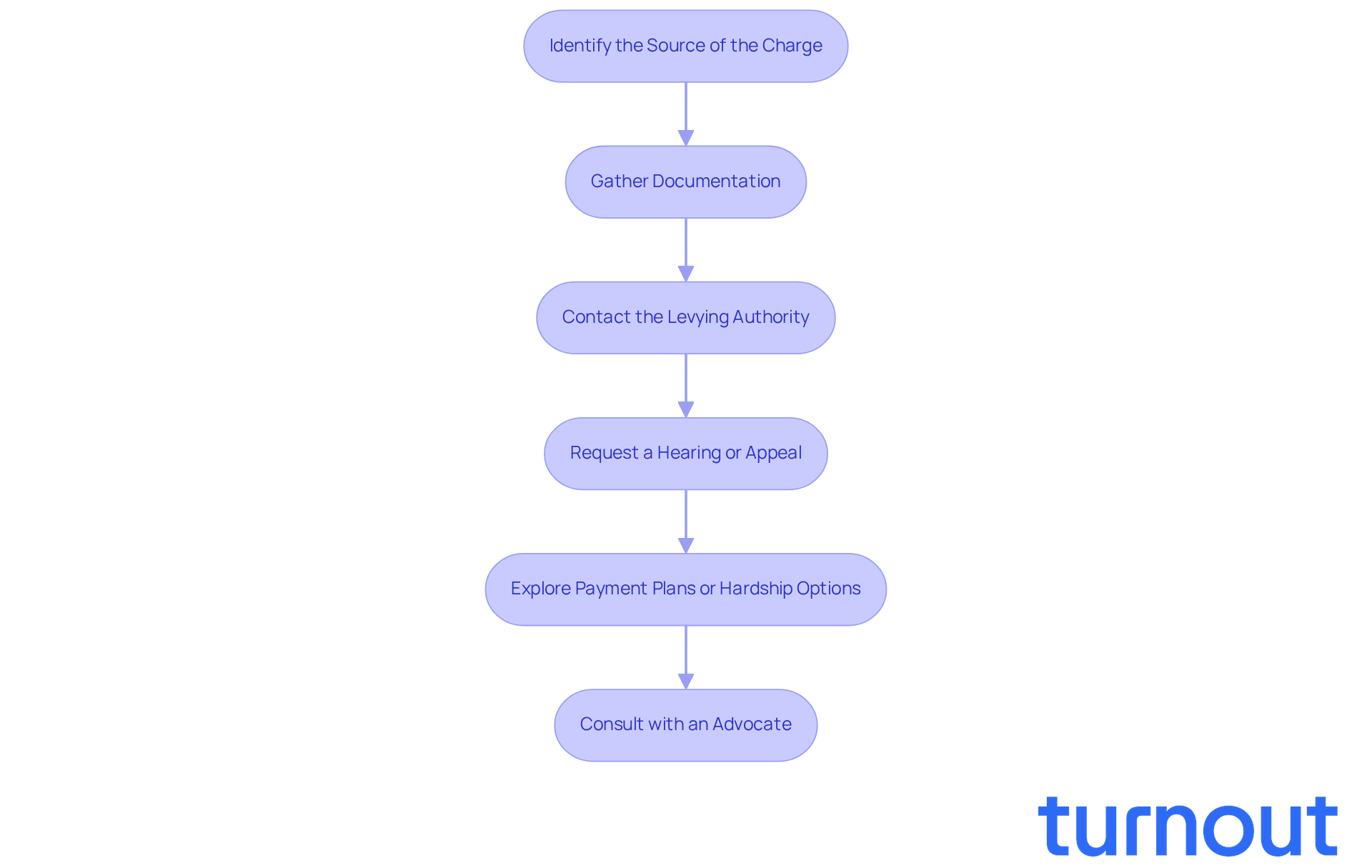

Navigating the application process for a levy fee can feel overwhelming, but you’re not alone. Here are some essential steps to guide you through:

-

Identify the Source of the Charge: Start by figuring out whether the charge comes from federal, state, or local authorities. This will help you understand your next steps.

-

Gather Documentation: Collect all relevant documents, like benefit statements, tax returns, and any notices about the charge. Having this information is crucial for your case.

-

Contact the Levying Authority: Reach out to the agency that issued the charge, whether it’s the IRS or your state tax office. Ask about the details of the charge and make sure you understand your rights.

-

Request a Hearing or Appeal: If you feel the seizure is unfair, you can request a hearing or contest the decision. Be ready to present your case with supporting documentation. Remember, many qualified claimants are denied SSD not because they aren’t disabled, but due to application issues. This highlights the importance of thorough documentation.

-

Explore Payment Plans or Hardship Options: If the charge is related to unpaid taxes, ask about payment plans or hardship options. These may help you reduce or avoid the charge altogether. The IRS typically won’t levy while a payment plan request is pending.

-

Consult with an Advocate: Consider seeking help from a disability assistance advocate, like those offered by Turnout. They can provide tailored guidance and support throughout the process. Their expertise can significantly enhance your chances of a favorable outcome. Notably, at the Administrative Law Judge (ALJ) hearing level, approval rates increase to 51%, marking a crucial turning point in the appeals process.

By following these steps, you can effectively manage the application procedure for the levy fee and safeguard your financial interests. Remember, we’re here to help you every step of the way.

Identify Challenges in Managing Levy Fees and Strategies to Overcome Them

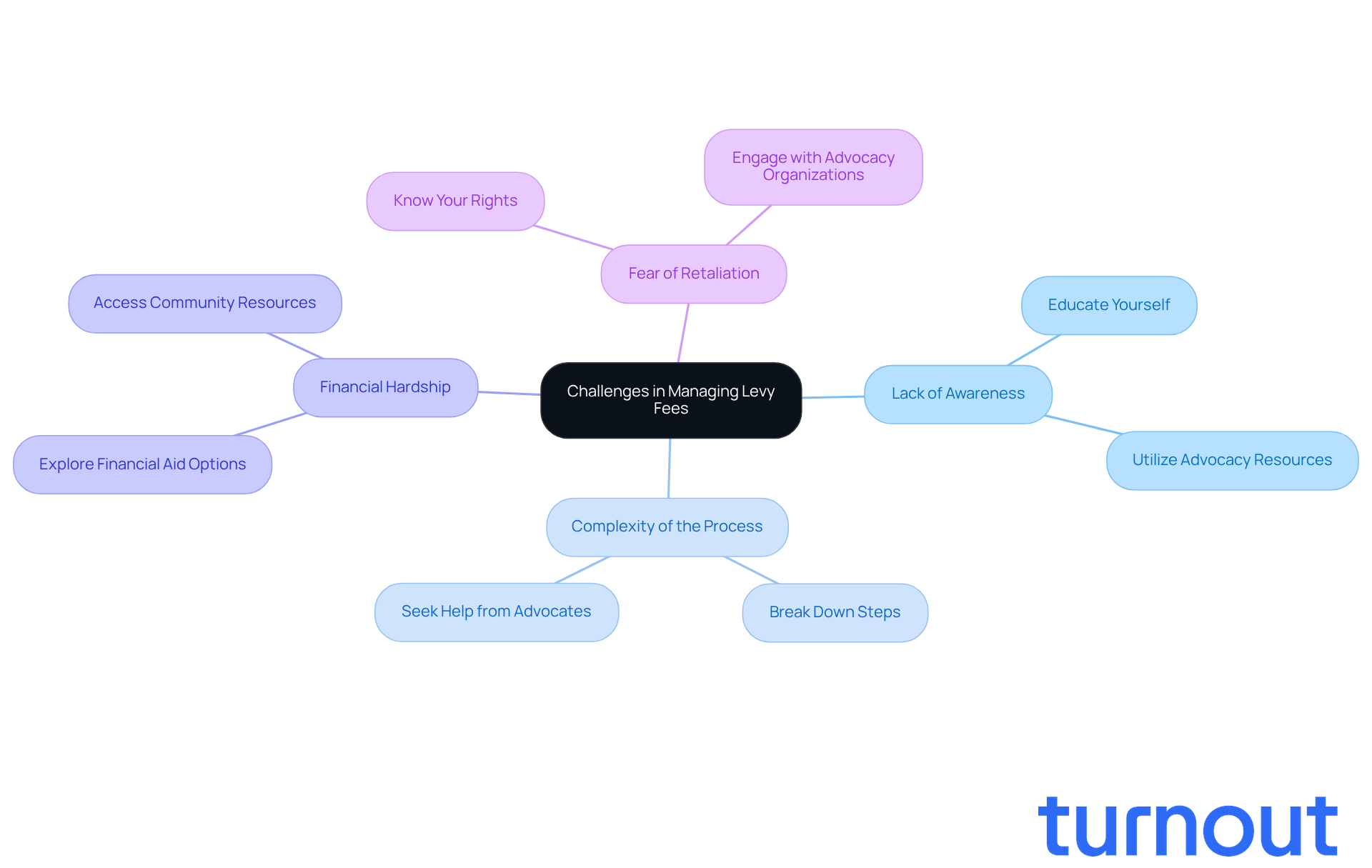

Managing levy fees can be tough for disabled individuals, and it’s important to recognize the challenges they face:

-

Lack of Awareness: Many individuals may not know their rights regarding levy fees, which can lead to unexpected deductions from their benefits. We’re here to help! Our organization offers resources and services to guide you through these complexities, ensuring you understand your rights and the types of charges that might affect your entitlements.

- Strategy: Take the time to educate yourself about your rights and the various charges that could impact your benefits. Advocacy organizations can provide valuable information, and our trained nonlawyer advocates are ready to help you navigate these processes.

-

Complexity of the Process: The application and appeal processes for contesting levies can feel overwhelming. But don’t worry! This platform simplifies the journey by offering expert guidance, helping you break down the steps needed to effectively manage your claims.

- Strategy: Simplify the process by dividing it into manageable steps. Don’t hesitate to seek help from advocates or professionals when needed. Our services are designed to support you through these challenging times, even without legal representation.

-

Financial Hardship: Financial strain can be exacerbated by the levy fee, making it difficult to cover essential living expenses. We understand how difficult this can be. Participation can help you explore options for financial aid, including government programs aimed at assisting those in need.

- Approach: Look into financial aid alternatives, such as local charities and government initiatives specifically designed to support individuals facing economic challenges. Many communities offer resources to help those dealing with rising living costs, and we can guide you in accessing these resources.

-

Fear of Retaliation: It’s common to feel hesitant about challenging a charge due to concerns about potential repercussions from government agencies. Understanding your rights is crucial, and we encourage you to advocate for yourself.

- Strategy: Remember, you have the right to challenge a levy fee, and there are legal protections for those who defend themselves. Engaging with advocacy organizations can provide you with additional support and reassurance.

By recognizing these challenges and implementing effective strategies, you can enhance your ability to manage your financial situation and protect your benefits. Remember, you’re not alone in this journey; Turnout is here to support you.

Conclusion

Understanding levy fees is crucial for disabled individuals, as these charges can greatly affect their financial stability and access to essential resources. We know that navigating this landscape can be overwhelming, but by becoming informed about how levy fees work and the types that may apply, you can take control of your financial situation and advocate for your rights. This knowledge empowers you to manage your benefits effectively and seek the full support you deserve.

In this guide, we’ve highlighted key points, including the various types of levy fees that may impact disability benefits, such as:

- federal payment levies

- state tax charges

- child support levies

We also outline a step-by-step process for applying for levy fees, emphasizing the importance of documentation and the potential for appealing unfair charges. It’s common to face challenges in managing these fees, but we provide practical strategies to help you overcome them.

Ultimately, mastering levy fees is a journey of empowerment and advocacy. By taking proactive steps to educate yourself and seek assistance, you can better secure your financial well-being. Remember, support is available, and organizations like Turnout are dedicated to helping you navigate these complexities. Embracing this knowledge not only enhances your financial management but also fosters a community of informed advocates ready to challenge unfair practices and ensure equitable access to benefits. You're not alone in this journey; together, we can make a difference.

Frequently Asked Questions

What are levy fees?

Levy fees are amounts taken from a person's income to settle debts owed to the government, such as taxes.

Why are levy fees important for disabled individuals?

Understanding levy fees is crucial for disabled individuals because these fees can decrease the funds available for essential living costs, healthcare, and other vital needs.

How can local taxes impact disabled residents?

In areas where local taxes account for over 50% of income, failing ballot measures can lead to serious financial struggles for disabled residents, worsening their vulnerable situations.

What percentage of low-income people with disabilities do not receive SSDI or SSI?

63% of low-income people with disabilities do not receive Social Security Disability Insurance (SSDI) or Supplemental Security Income (SSI).

How can understanding levy fees help disabled individuals manage their finances?

Grasping how levy fees work enables disabled individuals to manage their finances more effectively and advocate for their rights to receive the full benefits they deserve.

What support is available for individuals navigating levy fees?

There are resources and support systems available to help individuals find clarity regarding levy fees and navigate financial systems effectively.